Key Insights

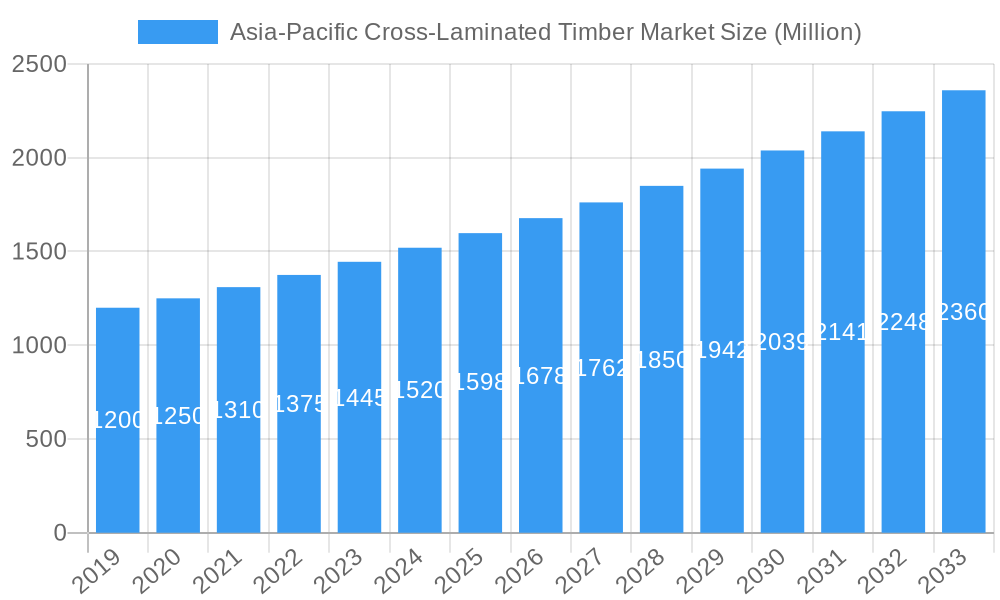

The Asia-Pacific Cross-Laminated Timber (CLT) market is poised for robust expansion, projected to reach a substantial market size by 2033. Driven by a significant CAGR of 4.56%, this growth is fueled by increasing adoption of sustainable building materials, supportive government initiatives promoting green construction, and a rising awareness of timber's environmental benefits. The region's rapid urbanization and infrastructure development, particularly in developing economies like China and India, are creating a strong demand for innovative and efficient construction solutions. CLT offers a compelling alternative to traditional materials due to its strength, durability, rapid construction times, and reduced carbon footprint, aligning perfectly with global sustainability goals. This surge in demand is further bolstered by a growing preference for aesthetically pleasing and healthy living and working environments, which CLT inherently provides.

Asia-Pacific Cross-Laminated Timber Market Market Size (In Billion)

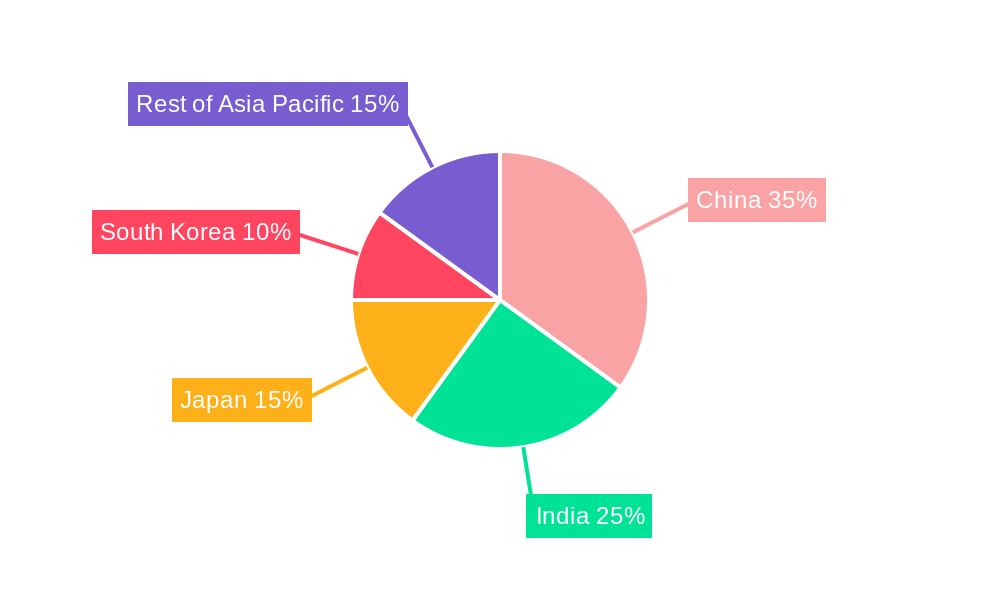

The market is segmented by type and application, with Adhesive Bonded and Mechanically Fastened both playing crucial roles, catering to diverse structural requirements. The application landscape spans Residential and Non-Residential sectors, encompassing Commercial, Industrial/Institutional, and Other Applications, reflecting the versatility of CLT in various construction projects. Geographically, China and India are expected to lead the market's growth trajectory, owing to their large populations, escalating construction activities, and increasing investments in eco-friendly building technologies. South Korea and Japan, with their established commitment to innovation and sustainable architecture, will also contribute significantly to the market's expansion. While the market benefits from strong demand drivers, potential restraints could include the availability of skilled labor for CLT installation and the initial cost perception compared to conventional materials, though these are being addressed through technological advancements and market maturation. Key players like Mercer International Inc., Stora Enso, and KLH Massivholz GmbH are actively investing in expanding their production capacities and developing innovative CLT solutions to meet the burgeoning regional demand.

Asia-Pacific Cross-Laminated Timber Market Company Market Share

This comprehensive report delves into the dynamic Asia-Pacific Cross-Laminated Timber (CLT) market, offering in-depth analysis and actionable insights for stakeholders. Spanning from 2019 to 2033, with a base year of 2025, this study covers historical trends, current market dynamics, and future projections for this rapidly evolving sector. The report provides a granular understanding of the market's structure, key trends, dominant segments, competitive landscape, and growth drivers, making it an indispensable resource for anyone seeking to capitalize on the burgeoning demand for sustainable building materials in the region.

The report analyzes the market by key segments including Type (Adhesive Bonded, Mechanically Fastened) and Application (Residential, Non-Residential - encompassing Commercial, Industrial/Institutional, and Other Applications). Geographically, it provides detailed insights into China, India, Japan, South Korea, and the Rest of Asia-Pacific.

Asia-Pacific Cross-Laminated Timber Market Market Structure & Competitive Landscape

The Asia-Pacific Cross-Laminated Timber (CLT) market is characterized by a moderately concentrated competitive landscape, with key players increasingly focusing on technological innovation and strategic partnerships to gain market share. Regulatory frameworks encouraging sustainable construction and the growing demand for mass timber solutions are significant innovation drivers. Product substitutes, while present in traditional construction materials, are losing ground to CLT's superior environmental credentials and performance attributes. End-user segmentation reveals a strong push towards both residential and non-residential applications, driven by a need for faster construction timelines and reduced carbon footprints. Mergers and acquisitions (M&A) are playing a crucial role in consolidating the market and expanding production capacities. For instance, the acquisition of a 40% stake in Egoin Wood Group by Hasslacher Holding GmbH in February 2023, significantly bolstering their global engineered wood product capacity, exemplifies this trend. The market's evolution is shaped by companies committed to sustainable forestry and advanced manufacturing processes.

Asia-Pacific Cross-Laminated Timber Market Market Trends & Opportunities

The Asia-Pacific Cross-Laminated Timber (CLT) market is poised for substantial growth, driven by a confluence of evolving consumer preferences, escalating environmental consciousness, and supportive governmental policies aimed at fostering sustainable development. This market is witnessing an unprecedented surge in demand, fueled by the inherent advantages of CLT, including its lightweight nature, exceptional strength-to-weight ratio, superior fire resistance compared to traditional timber, and its significant role in carbon sequestration. The projected market size growth is robust, with a Compound Annual Growth Rate (CAGR) estimated to be in the high single digits during the forecast period (2025-2033). Technological shifts are at the forefront, with advancements in manufacturing processes leading to increased efficiency, reduced costs, and enhanced product customization. This enables the creation of larger, more complex timber structures, opening up new architectural possibilities. Consumer preferences are increasingly leaning towards eco-friendly and healthy living spaces, with CLT offering a natural, renewable, and aesthetically pleasing alternative to conventional building materials. This shift is particularly evident in urban areas grappling with air quality concerns and a desire for biophilic design elements. Competitive dynamics are intensifying as both established timber giants and emerging players vie for market dominance. Companies are investing heavily in research and development to improve CLT performance, explore new applications, and streamline supply chains. The market penetration rate for CLT in the broader construction sector, while still nascent in some Asia-Pacific sub-regions, is rapidly expanding, driven by successful pilot projects and the growing acceptance of mass timber in mainstream construction. Opportunities abound for companies that can offer innovative, cost-effective, and sustainable CLT solutions, catering to the growing demand for low-carbon buildings and resilient infrastructure. The rising awareness of embodied carbon in construction materials is a key catalyst, positioning CLT as a frontrunner in the transition towards a circular economy. Furthermore, the increasing frequency of natural disasters is driving demand for more resilient and rapidly deployable construction methods, areas where CLT excels. The overall market outlook is exceptionally positive, promising significant returns for early adopters and strategic investors.

Dominant Markets & Segments in Asia-Pacific Cross-Laminated Timber Market

The Asia-Pacific Cross-Laminated Timber (CLT) market exhibits distinct patterns of dominance across its various segments, with China emerging as the leading geography due to its vast construction industry and proactive adoption of sustainable building practices. The country's ambitious infrastructure development projects and government initiatives promoting green construction significantly bolster CLT demand. Japan, with its long-standing tradition of timber construction and advanced engineering capabilities, also represents a substantial market, particularly for high-rise and complex wooden structures.

Geography:

- China: Dominates due to large-scale infrastructure, supportive government policies for green building, and a rapidly expanding construction sector. Massive urban development projects and a growing middle class with an inclination towards modern, sustainable housing drive demand.

- Japan: A mature market with advanced technological adoption, focusing on seismic resilience and high-rise timber construction. Strict building codes are being adapted to incorporate mass timber, opening new avenues for CLT.

- South Korea: Shows promising growth driven by government incentives for sustainable construction and a rising interest in innovative architectural designs. The increasing adoption of wood construction in mid-rise buildings is a key indicator.

- India: Represents a significant emerging market with immense potential, fueled by rapid urbanization, housing shortages, and increasing environmental awareness. Government focus on affordable housing and sustainable infrastructure development will be critical.

- Rest of Asia-Pacific: This segment encompasses diverse markets like Australia, New Zealand, and Southeast Asian nations, each with unique growth drivers. Australia and New Zealand are already established markets with robust demand for CLT in residential and commercial projects. Southeast Asian countries are gradually adopting CLT, driven by a need for faster construction and sustainability goals.

Type:

- Adhesive Bonded: This segment holds a dominant position due to its superior structural integrity and versatility in creating large-format panels, crucial for diverse construction applications. The reliability and durability offered by adhesive bonding make it the preferred choice for most significant projects.

- Mechanically Fastened: While currently holding a smaller market share, mechanically fastened CLT is gaining traction, particularly in regions or applications where on-site assembly is a key consideration or where specific design aesthetics are desired. Its ease of assembly can offer cost benefits in certain scenarios.

Application:

- Residential: This segment is experiencing substantial growth, driven by the demand for sustainable, healthy, and aesthetically pleasing housing options. The speed of construction with CLT panels is a significant advantage in addressing housing shortages.

- Non-Residential: This broad category is also a major growth driver, encompassing:

- Commercial: Offices, retail spaces, and hospitality buildings are increasingly opting for CLT to showcase sustainability commitments and achieve faster project timelines.

- Industrial/Institutional: Educational institutions, healthcare facilities, and industrial buildings are benefiting from CLT's structural efficiency, fire safety, and potential for quicker construction and reduced disruption.

- Other Applications: This includes public buildings, community centers, and specialized structures where CLT's unique properties can be leveraged.

The interplay of these segments, driven by specific regional policies and market needs, dictates the overall trajectory of the Asia-Pacific CLT market.

Asia-Pacific Cross-Laminated Timber Market Product Analysis

The Asia-Pacific Cross-Laminated Timber (CLT) market is defined by continuous product innovation and diversification. Manufacturers are focusing on developing CLT panels with enhanced structural performance, improved fire resistance, and greater thermal insulation properties. Advancements in glues and bonding technologies are yielding more durable and environmentally friendly adhesive-bonded CLT, while innovations in mechanical fastening are improving assembly efficiency. Applications are expanding beyond traditional uses to include high-rise buildings, modular construction, and even bespoke architectural elements. Competitive advantages are being forged through customization options, optimized panel sizes for logistical efficiency, and the integration of smart technologies for building performance monitoring.

Key Drivers, Barriers & Challenges in Asia-Pacific Cross-Laminated Timber Market

Key Drivers: The Asia-Pacific Cross-Laminated Timber market is propelled by several potent forces. Technologically, advancements in CLT manufacturing have led to increased production efficiency and a wider range of structural applications. Economically, the growing demand for sustainable and low-carbon building materials, coupled with the potential for reduced construction timelines and labor costs, makes CLT an attractive proposition. Policy-driven factors, such as government incentives for green building and stricter environmental regulations, are significantly boosting market adoption. The inherent sustainability of wood as a renewable resource, sequestering carbon, aligns perfectly with global climate goals.

Barriers & Challenges: Despite the positive outlook, the market faces several challenges. Regulatory hurdles, particularly the adaptation of building codes to accommodate mass timber construction in certain countries, can slow adoption. Supply chain complexities, including the availability of sustainably sourced timber and efficient logistics for large CLT panels, present logistical challenges. Competitive pressures from established construction materials, though diminishing, still exist, requiring continuous education and demonstration of CLT's benefits. The initial perception of higher upfront costs, even with long-term savings, can be a barrier for some developers.

Growth Drivers in the Asia-Pacific Cross-Laminated Timber Market Market

The Asia-Pacific Cross-Laminated Timber market is experiencing robust growth driven by a confluence of technological advancements, economic incentives, and policy support. Technological innovations in manufacturing processes are leading to more efficient and cost-effective production of high-quality CLT panels. Economically, the increasing global demand for sustainable construction solutions, coupled with the potential for faster build times and reduced labor costs, makes CLT a compelling alternative. Policy-driven factors, such as government mandates for green building standards and carbon emission reductions, are creating a favorable regulatory environment that directly fuels CLT adoption. The growing awareness of timber's role in carbon sequestration further enhances its appeal as a climate-friendly building material.

Challenges Impacting Asia-Pacific Cross-Laminated Timber Market Growth

Several factors pose challenges to the unimpeded growth of the Asia-Pacific Cross-Laminated Timber market. Regulatory complexities, including the need for updated building codes and standards to fully embrace mass timber construction in various countries, can create delays and uncertainty. Supply chain issues, such as the consistent availability of sustainably sourced timber and the logistical challenges associated with transporting large CLT panels, can impact project timelines and costs. Competitive pressures from conventional building materials, although gradually decreasing, still require ongoing efforts to educate stakeholders on CLT's long-term economic and environmental benefits. Furthermore, concerns regarding fire safety perceptions, despite advancements in CLT's fire-resistant properties, necessitate continued demonstration and certification.

Key Players Shaping the Asia-Pacific Cross-Laminated Timber Market Market

- Mercer International Inc

- SEIHOKU CORPORATION

- SCHILLIGER HOLZ AG

- XLam Australia Pty Ltd

- HASSLACHER Holding GmbH

- Timberlink Australia & New Zealand

- Stora Enso

- Holmen

- AGROP NOVA a s

- KLH Massivholz GmbH

Significant Asia-Pacific Cross-Laminated Timber Market Industry Milestones

- February 2023: Hasslacher Holding GmbH acquired a 40% stake in Egoin Wood Group. This strategic move significantly enhances Hasslacher's global engineered wood product capacity, integrating Egoin's expertise and production sites to bolster the market for CLT and glulam solutions, anticipating a substantial increase in production capacity to up to 52,000 m3 with the opening of a third CLT plant.

- October 2022: Stora Enso launched its innovative product, Sylva, a massive wood building kit. This pre-manufactured, custom-made solution delivered directly to the building site aims to meet the growing demand for sustainable and innovative construction, reinforcing Stora Enso's position in the low-carbon building sector.

Future Outlook for Asia-Pacific Cross-Laminated Timber Market Market

The future outlook for the Asia-Pacific Cross-Laminated Timber (CLT) market is exceptionally bright, driven by an intensified global focus on sustainability and climate action. The increasing adoption of green building certifications, stringent carbon emission reduction targets, and a growing consumer preference for eco-friendly living spaces will continue to propel demand. Strategic opportunities lie in further research and development to enhance CLT's performance characteristics, such as improved thermal efficiency and seismic resistance, catering to diverse regional needs. The expansion of manufacturing facilities and the streamlining of supply chains will be crucial for meeting anticipated market growth. Furthermore, the development of innovative applications, including modular construction and taller timber structures, will unlock new market segments and drive further adoption. The Asia-Pacific region, with its dynamic economies and growing environmental consciousness, presents immense potential for widespread CLT integration into the built environment.

Asia-Pacific Cross-Laminated Timber Market Segmentation

-

1. Type

- 1.1. Adhesive Bonded

- 1.2. Mechanically Fastened

-

2. Application

- 2.1. Residential

-

2.2. Non-Residential

- 2.2.1. Commercial

- 2.2.2. Industrial/Institutional

- 2.2.3. Other Applications

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia-Pacific

Asia-Pacific Cross-Laminated Timber Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Cross-Laminated Timber Market Regional Market Share

Geographic Coverage of Asia-Pacific Cross-Laminated Timber Market

Asia-Pacific Cross-Laminated Timber Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Commercial Sector in the Region; Increasing Popularity of Cross-Laminated Timber Over other Traditional Wood Materials

- 3.3. Market Restrains

- 3.3.1. Moisture Absorption Related Risks of the Material; Other Restraints

- 3.4. Market Trends

- 3.4.1. Non-Residential Application Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Cross-Laminated Timber Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Adhesive Bonded

- 5.1.2. Mechanically Fastened

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Non-Residential

- 5.2.2.1. Commercial

- 5.2.2.2. Industrial/Institutional

- 5.2.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Cross-Laminated Timber Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Adhesive Bonded

- 6.1.2. Mechanically Fastened

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Non-Residential

- 6.2.2.1. Commercial

- 6.2.2.2. Industrial/Institutional

- 6.2.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Cross-Laminated Timber Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Adhesive Bonded

- 7.1.2. Mechanically Fastened

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Non-Residential

- 7.2.2.1. Commercial

- 7.2.2.2. Industrial/Institutional

- 7.2.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Cross-Laminated Timber Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Adhesive Bonded

- 8.1.2. Mechanically Fastened

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Non-Residential

- 8.2.2.1. Commercial

- 8.2.2.2. Industrial/Institutional

- 8.2.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Asia-Pacific Cross-Laminated Timber Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Adhesive Bonded

- 9.1.2. Mechanically Fastened

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Non-Residential

- 9.2.2.1. Commercial

- 9.2.2.2. Industrial/Institutional

- 9.2.2.3. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Cross-Laminated Timber Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Adhesive Bonded

- 10.1.2. Mechanically Fastened

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Non-Residential

- 10.2.2.1. Commercial

- 10.2.2.2. Industrial/Institutional

- 10.2.2.3. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mercer International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SEIHOKU CORPORATION

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SCHILLIGER HOLZ AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 XLam Australia Pty Ltd*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HASSLACHER Holding GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Timberlink Australia & New Zealand

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stora Enso

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Holmen

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AGROP NOVA a s

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KLH Massivholz GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Mercer International Inc

List of Figures

- Figure 1: Asia-Pacific Cross-Laminated Timber Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Cross-Laminated Timber Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Type 2020 & 2033

- Table 11: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Application 2020 & 2033

- Table 13: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Type 2020 & 2033

- Table 19: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Application 2020 & 2033

- Table 21: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Type 2020 & 2033

- Table 27: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Application 2020 & 2033

- Table 29: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Type 2020 & 2033

- Table 35: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Application 2020 & 2033

- Table 37: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Type 2020 & 2033

- Table 43: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Application 2020 & 2033

- Table 45: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific Cross-Laminated Timber Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific Cross-Laminated Timber Market Volume Thousand Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Cross-Laminated Timber Market?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the Asia-Pacific Cross-Laminated Timber Market?

Key companies in the market include Mercer International Inc, SEIHOKU CORPORATION, SCHILLIGER HOLZ AG, XLam Australia Pty Ltd*List Not Exhaustive, HASSLACHER Holding GmbH, Timberlink Australia & New Zealand, Stora Enso, Holmen, AGROP NOVA a s, KLH Massivholz GmbH.

3. What are the main segments of the Asia-Pacific Cross-Laminated Timber Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Commercial Sector in the Region; Increasing Popularity of Cross-Laminated Timber Over other Traditional Wood Materials.

6. What are the notable trends driving market growth?

Non-Residential Application Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Moisture Absorption Related Risks of the Material; Other Restraints.

8. Can you provide examples of recent developments in the market?

February 2023: HasslacherHolding GmbH acquired a 40% stake in Egoin Wood Group. With production sites in Ea (Biscay) and Legutio (Araba), this globally engaged company has more than 30 years of experience in the creation of construction timber solutions. The overall production capacity for engineered wood products at Egoin Wood Group was 22,000 m3 (14,000 m3 cross-laminated timber and 8,000 m3 glulam), but that capacity was anticipated to increase to up to 52,000 m3 when the third cross-laminated timber plant in Legutio opened in mid-2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Cross-Laminated Timber Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Cross-Laminated Timber Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Cross-Laminated Timber Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Cross-Laminated Timber Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence