Key Insights

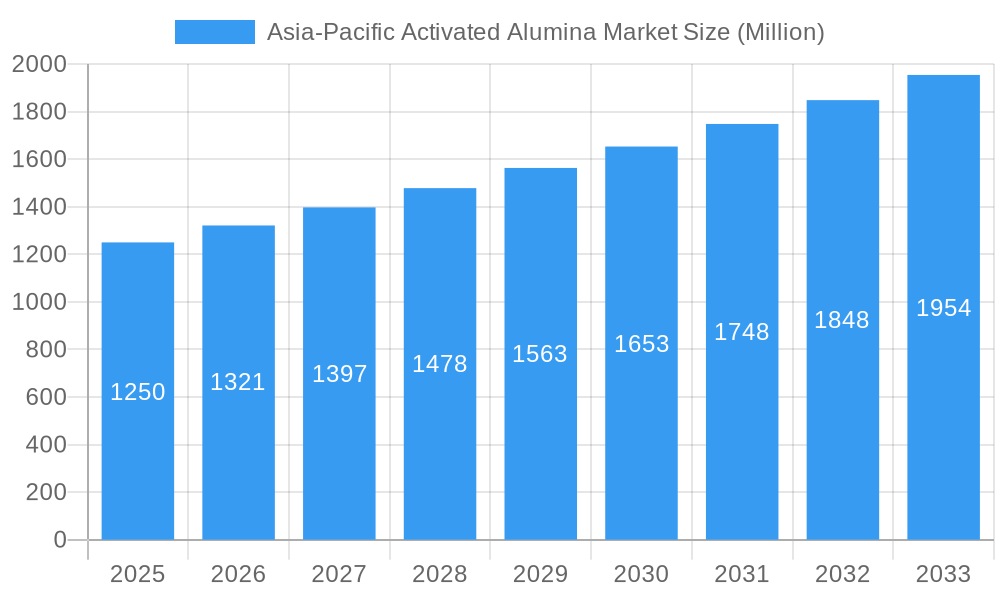

The Asia-Pacific Activated Alumina market is projected for significant expansion, forecasted to reach $2.21 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6% through 2033. This growth is propelled by escalating demand in key applications such as petrochemical and chemical catalysis, industrial desiccation, and purification adsorbents. The region's dynamic industrial growth, characterized by rapid urbanization, enhanced manufacturing, and a commitment to environmental sustainability, is a primary growth catalyst. This includes increasing chemical and polymer production, the critical need for effective water treatment, and advancements in healthcare requiring high-purity materials.

Asia-Pacific Activated Alumina Market Market Size (In Billion)

Key market trends fueling growth include the adoption of activated alumina in advanced catalytic processes for enhanced efficiency and reduced environmental impact. Stringent environmental regulations for water quality and emissions further drive demand for activated alumina as a superior adsorbent and purifying agent. Potential restraints may arise from raw material price volatility and the emergence of alternative technologies. However, the established dominance of catalyst and desiccant applications, alongside the growing importance of water treatment and healthcare, solidifies a positive growth trajectory for the Asia-Pacific Activated Alumina market. Leading companies such as Axens, Honeywell International Inc., Sumitomo Chemical Co Ltd, and BASF SE are instrumental in driving innovation and supply chain development.

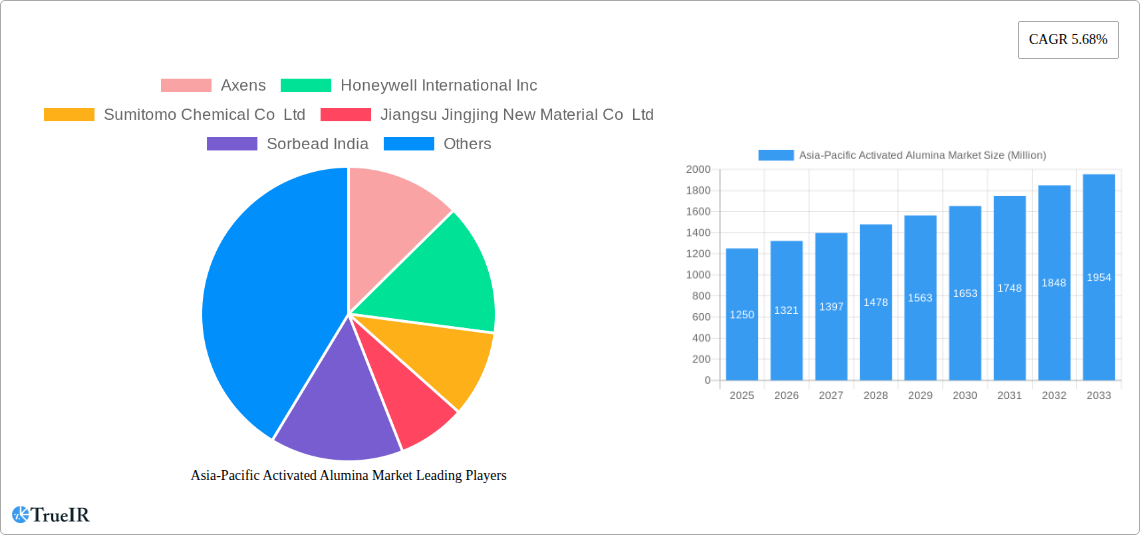

Asia-Pacific Activated Alumina Market Company Market Share

This SEO-optimized report provides a comprehensive overview of the Asia-Pacific Activated Alumina Market, covering market size, growth dynamics, and future forecasts.

Asia-Pacific Activated Alumina Market Market Structure & Competitive Landscape

The Asia-Pacific Activated Alumina Market is characterized by a moderately concentrated structure, with key players actively driving innovation and market expansion. The competitive landscape is shaped by continuous technological advancements in purification and separation processes, increasing demand for high-performance desiccants, and the stringent regulatory environment governing industrial emissions and water quality across the region. Key innovation drivers include the development of customized activated alumina grades for specific catalytic applications in petrochemical refining and the growing adoption of advanced adsorbent materials for environmental remediation. Regulatory impacts, such as stricter environmental protection policies in China and increasing water scarcity concerns in India, are significantly influencing product development and market growth. Product substitutes, while present in some lower-tier applications, are often outpaced by the superior adsorption capacity and thermal stability of activated alumina. End-user segmentation analysis reveals the dominance of the Oil and Gas and Water Treatment sectors, followed by the Chemical and Healthcare industries. Mergers and acquisitions (M&A) activity, while not exceptionally high in volume, indicates strategic consolidation and capacity expansion by leading manufacturers to enhance market reach and product portfolios. Concentration ratios are estimated to be around 45-55% for the top five players, reflecting a blend of established global entities and rapidly growing regional manufacturers. The pursuit of sustainable manufacturing practices and the development of eco-friendly activated alumina variants are emerging as critical M&A targets.

Asia-Pacific Activated Alumina Market Market Trends & Opportunities

The Asia-Pacific Activated Alumina Market is poised for robust growth, with an estimated market size projected to reach USD 750.5 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.8% from 2025. This expansion is fueled by a confluence of evolving technological shifts, dynamic consumer preferences within end-user industries, and intensifying competitive dynamics. The growing demand for cleaner fuels and more efficient chemical synthesis processes is a primary market trend, driving the uptake of activated alumina as a superior catalyst support and adsorbent. Technological shifts are evident in the development of novel activated alumina formulations with enhanced surface areas and pore structures, leading to improved adsorption kinetics and selectivity for a wider range of contaminants. This innovation is critical for meeting the increasingly stringent purity requirements in industries like pharmaceuticals and electronics. Consumer preferences are leaning towards sustainable and environmentally friendly solutions. This translates into a demand for activated alumina that can effectively remove pollutants from air and water, thereby supporting the region's ambitious environmental targets. The automotive industry's shift towards electric vehicles, while potentially impacting traditional fuel-related applications, is also creating new opportunities for activated alumina in battery manufacturing and thermal management systems. Competitive dynamics are characterized by intense price competition, particularly in high-volume applications like desiccation, alongside a growing emphasis on product differentiation through specialized formulations and technical support. Market penetration rates for activated alumina in emerging applications such as industrial gas drying and hydrogen purification are steadily increasing. Strategic investments in R&D are crucial for companies to stay ahead of the curve and capitalize on opportunities arising from the development of specialized activated alumina grades tailored for niche applications. The expansion of petrochemical complexes across Southeast Asia and the continuous need for water purification in densely populated urban centers are significant market drivers. Furthermore, the increasing focus on healthcare infrastructure development in countries like India and Vietnam is creating a growing demand for high-purity activated alumina used in pharmaceutical manufacturing and medical device sterilization. The market is also witnessing a trend towards localized production to reduce logistics costs and improve responsiveness to regional demand fluctuations.

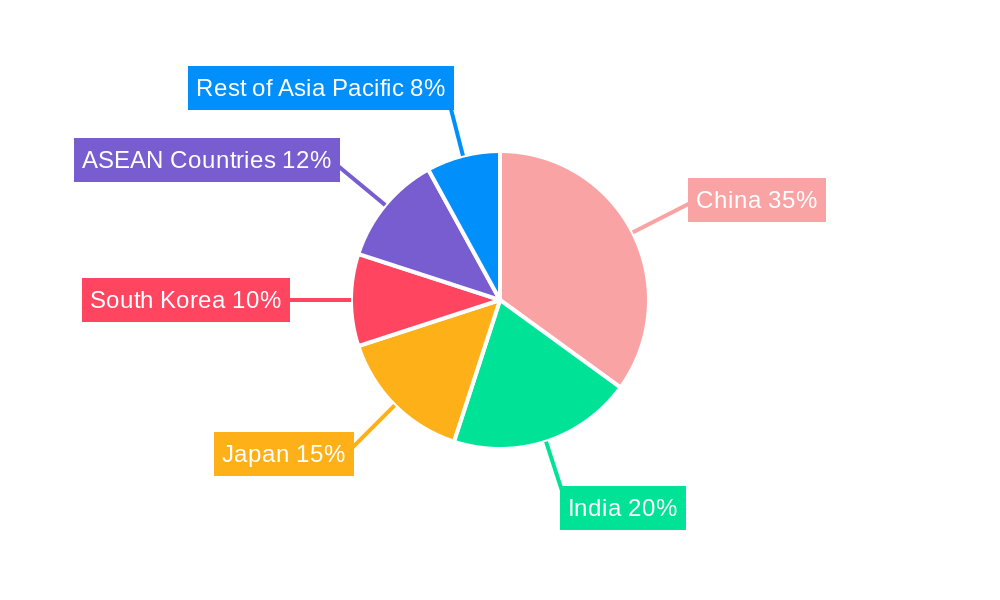

Dominant Markets & Segments in Asia-Pacific Activated Alumina Market

The Asia-Pacific Activated Alumina Market demonstrates significant dominance within specific regions and application segments, driven by distinct industrial and economic factors. China, with its vast industrial base and substantial investments in petrochemicals, water treatment, and chemical manufacturing, stands as the leading country market. Its influence is further amplified by proactive government policies aimed at environmental protection and industrial upgrading. India follows as a rapidly growing market, propelled by increasing investments in infrastructure, a burgeoning pharmaceutical sector, and a critical need for effective water purification solutions. Southeast Asian nations like Indonesia, Thailand, and Vietnam are also emerging as significant markets, fueled by rapid industrialization and the expansion of manufacturing facilities.

Within the Application segment:

- Desiccant applications represent a substantial market share, driven by the widespread need for moisture control in packaging, pharmaceuticals, electronics, and compressed air drying across various industries. The demand for highly efficient desiccants to preserve product integrity and prevent equipment damage is a key growth factor.

- Catalyst applications are another major driver, particularly in the oil and gas industry for refining processes like hydrotreating and cracking, and in the chemical industry for synthesis reactions. The increasing complexity of refining processes and the demand for cleaner fuels necessitate advanced catalytic materials.

- Adsorbent applications are experiencing robust growth, especially in water treatment for removing fluoride, arsenic, and other contaminants, and in air purification for capturing pollutants. Environmental regulations and public health concerns are directly fueling this segment.

- Other Applications, including its use in chromatography, dental materials, and as a polishing agent, contribute to the overall market, though with a smaller share.

Within the End-User Industry segment:

- Oil and Gas remains a dominant sector, leveraging activated alumina for purification, drying of natural gas, and as a catalyst in refining operations. The region's extensive oil and gas infrastructure and ongoing exploration activities ensure sustained demand.

- Water Treatment is a rapidly expanding sector, driven by urbanization, industrial wastewater management, and the increasing scarcity of potable water. Activated alumina's efficacy in removing a wide range of impurities makes it indispensable for municipal and industrial water treatment plants.

- Chemical industries utilize activated alumina extensively as a catalyst, catalyst support, and adsorbent in various synthesis and purification processes. The growth of the specialty chemicals sector in the region is a significant contributor.

- Healthcare is a growing end-user, with activated alumina finding applications in pharmaceutical manufacturing, drug delivery systems, and as a component in medical devices. The rising healthcare expenditure and focus on drug purity are key drivers.

- Other End-Users, encompassing industries such as power generation, food and beverage, and electronics, also contribute to market demand, albeit to a lesser extent.

Asia-Pacific Activated Alumina Market Product Analysis

Activated alumina products in the Asia-Pacific region are defined by their high surface area, porous structure, and exceptional thermal stability, making them ideal for demanding adsorption and catalytic applications. Innovations focus on tailoring pore size distribution and surface chemistry to enhance selectivity for specific molecules, such as in the removal of impurities from industrial gases and the catalysis of complex chemical reactions. Key product advantages include their regenerative capabilities, leading to cost-effectiveness in continuous industrial processes, and their resistance to harsh chemical environments. The market sees a range of grades, from standard spherical beads for general desiccation to highly specialized extrudates and powders for advanced catalytic functions.

Key Drivers, Barriers & Challenges in Asia-Pacific Activated Alumina Market

The Asia-Pacific Activated Alumina Market is propelled by significant growth drivers, including the burgeoning demand from the oil and gas industry for efficient refining and purification processes, and the critical need for advanced water treatment solutions driven by increasing pollution and water scarcity. Technological advancements in developing activated alumina with enhanced adsorption capacities and catalytic efficiencies further bolster market expansion. The chemical industry's continuous requirement for effective catalysts and adsorbents, alongside the growing healthcare sector's demand for high-purity materials, also plays a crucial role.

However, the market faces several key challenges and restraints. Fluctuations in raw material prices, particularly alumina, can impact production costs and profit margins. Intense competition, especially from lower-cost alternatives in less demanding applications, exerts downward pressure on pricing. Stringent environmental regulations, while driving demand, also impose compliance costs on manufacturers for production processes and waste management. Supply chain disruptions, as witnessed in recent global events, can affect the availability and timely delivery of essential raw materials and finished products, impacting operational efficiency and customer satisfaction. Furthermore, the development of alternative separation and purification technologies poses a long-term threat to market share.

Growth Drivers in the Asia-Pacific Activated Alumina Market Market

Key growth drivers in the Asia-Pacific Activated Alumina Market include the expanding oil and gas industry across countries like China and Southeast Asia, necessitating advanced activated alumina for refining and purification. The escalating need for effective water treatment solutions due to rising pollution levels and growing populations in India and China is another significant catalyst. Technological advancements in developing customized activated alumina grades with superior adsorption and catalytic properties are creating new market opportunities. The robust growth of the chemical manufacturing sector, driven by increasing demand for industrial chemicals and specialty products, further fuels the demand for activated alumina as catalysts and adsorbents.

Challenges Impacting Asia-Pacific Activated Alumina Market Growth

Challenges impacting Asia-Pacific Activated Alumina Market growth include price volatility of key raw materials like bauxite and aluminum derivatives, which directly affects manufacturing costs. Intense competition from both domestic and international players, particularly in price-sensitive segments, can limit profit margins. Stringent environmental regulations and the associated compliance costs for manufacturing processes and waste disposal present ongoing hurdles for producers. Supply chain vulnerabilities, including transportation disruptions and availability of specialized inputs, can lead to production delays and increased operational expenses. Furthermore, the development and adoption of alternative technologies for adsorption and catalysis, though currently nascent, pose a potential long-term competitive threat.

Key Players Shaping the Asia-Pacific Activated Alumina Market Market

- Axens

- Honeywell International Inc

- Sumitomo Chemical Co Ltd

- Jiangsu Jingjing New Material Co Ltd

- Sorbead India

- BASF SE

- Zibo XiangRun Environment Engineering Co Ltd

- Jiangsu Sanji Industrial Co Ltd

- CHALCO Shandong Co Ltd

- Huber Engineered Materials

- KIN Filter Engineering Co Limited

Significant Asia-Pacific Activated Alumina Market Industry Milestones

- 2019: Jiangsu Jingjing New Material Co Ltd announces significant capacity expansion for high-purity activated alumina to meet growing demand in China's petrochemical sector.

- 2020: Honeywell International Inc launches an advanced activated alumina desiccant with enhanced moisture adsorption capacity, targeting the electronics and pharmaceutical industries in Asia.

- 2021: BASF SE invests in research and development for novel activated alumina formulations to improve catalytic efficiency in sustainable chemical processes.

- 2022: Sorbead India expands its distribution network across Southeast Asia to capitalize on the region's increasing demand for desiccants and adsorbents.

- 2023: Sumitomo Chemical Co Ltd reports strong sales growth for its activated alumina products used in air purification and water treatment applications.

- 2024: Axens introduces new activated alumina grades optimized for challenging hydrotreating applications in oil refineries across the Asia-Pacific region.

Future Outlook for Asia-Pacific Activated Alumina Market Market

The future outlook for the Asia-Pacific Activated Alumina Market is exceptionally positive, driven by continued industrial expansion, stringent environmental regulations, and ongoing technological advancements. Strategic opportunities lie in the development of advanced, high-performance activated alumina for niche applications in areas such as hydrogen purification, carbon capture, and advanced battery technologies. The increasing focus on sustainable manufacturing and circular economy principles will also favor producers who can offer regenerable and eco-friendly activated alumina solutions. The market is expected to witness further consolidation and strategic partnerships as key players aim to enhance their product portfolios and geographical reach to cater to the dynamic needs of the Asia-Pacific industrial landscape.

Asia-Pacific Activated Alumina Market Segmentation

-

1. Application

- 1.1. Catalyst

- 1.2. Desiccant

- 1.3. Adsorbent

- 1.4. Other Ap

-

2. End-User Industry

- 2.1. Oil and Gas

- 2.2. Water Treatment

- 2.3. Chemical

- 2.4. Healthcare

- 2.5. Other En

Asia-Pacific Activated Alumina Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

Asia-Pacific Activated Alumina Market Regional Market Share

Geographic Coverage of Asia-Pacific Activated Alumina Market

Asia-Pacific Activated Alumina Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Oil and Gas Sector; Increasing Investments in Water Treatment Facilities; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Oil and Gas Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Catalyst

- 5.1.2. Desiccant

- 5.1.3. Adsorbent

- 5.1.4. Other Ap

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Oil and Gas

- 5.2.2. Water Treatment

- 5.2.3. Chemical

- 5.2.4. Healthcare

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. China Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Catalyst

- 6.1.2. Desiccant

- 6.1.3. Adsorbent

- 6.1.4. Other Ap

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Oil and Gas

- 6.2.2. Water Treatment

- 6.2.3. Chemical

- 6.2.4. Healthcare

- 6.2.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. India Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Catalyst

- 7.1.2. Desiccant

- 7.1.3. Adsorbent

- 7.1.4. Other Ap

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Oil and Gas

- 7.2.2. Water Treatment

- 7.2.3. Chemical

- 7.2.4. Healthcare

- 7.2.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Japan Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Catalyst

- 8.1.2. Desiccant

- 8.1.3. Adsorbent

- 8.1.4. Other Ap

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Oil and Gas

- 8.2.2. Water Treatment

- 8.2.3. Chemical

- 8.2.4. Healthcare

- 8.2.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South Korea Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Catalyst

- 9.1.2. Desiccant

- 9.1.3. Adsorbent

- 9.1.4. Other Ap

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Oil and Gas

- 9.2.2. Water Treatment

- 9.2.3. Chemical

- 9.2.4. Healthcare

- 9.2.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. ASEAN Countries Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Catalyst

- 10.1.2. Desiccant

- 10.1.3. Adsorbent

- 10.1.4. Other Ap

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Oil and Gas

- 10.2.2. Water Treatment

- 10.2.3. Chemical

- 10.2.4. Healthcare

- 10.2.5. Other En

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Rest of Asia Pacific Asia-Pacific Activated Alumina Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Catalyst

- 11.1.2. Desiccant

- 11.1.3. Adsorbent

- 11.1.4. Other Ap

- 11.2. Market Analysis, Insights and Forecast - by End-User Industry

- 11.2.1. Oil and Gas

- 11.2.2. Water Treatment

- 11.2.3. Chemical

- 11.2.4. Healthcare

- 11.2.5. Other En

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Axens

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Honeywell International Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Sumitomo Chemical Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Jiangsu Jingjing New Material Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Sorbead India

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 BASF SE

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Zibo XiangRun Environment Engineering Co Ltd *List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Jiangsu Sanji Industrial Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 CHALCO Shandong Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Huber Engineered Materials

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 KIN Filter Engineering Co Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Axens

List of Figures

- Figure 1: Asia-Pacific Activated Alumina Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Activated Alumina Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 5: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 9: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 10: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 11: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 16: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 17: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 21: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 22: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 23: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 27: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 28: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 29: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 33: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 34: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 35: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 39: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 40: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by End-User Industry 2020 & 2033

- Table 41: Asia-Pacific Activated Alumina Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Asia-Pacific Activated Alumina Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Activated Alumina Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Asia-Pacific Activated Alumina Market?

Key companies in the market include Axens, Honeywell International Inc, Sumitomo Chemical Co Ltd, Jiangsu Jingjing New Material Co Ltd, Sorbead India, BASF SE, Zibo XiangRun Environment Engineering Co Ltd *List Not Exhaustive, Jiangsu Sanji Industrial Co Ltd, CHALCO Shandong Co Ltd, Huber Engineered Materials, KIN Filter Engineering Co Limited.

3. What are the main segments of the Asia-Pacific Activated Alumina Market?

The market segments include Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.21 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Oil and Gas Sector; Increasing Investments in Water Treatment Facilities; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand from the Oil and Gas Sector.

7. Are there any restraints impacting market growth?

Availability of Substitutes; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Activated Alumina Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Activated Alumina Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Activated Alumina Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Activated Alumina Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence