Key Insights

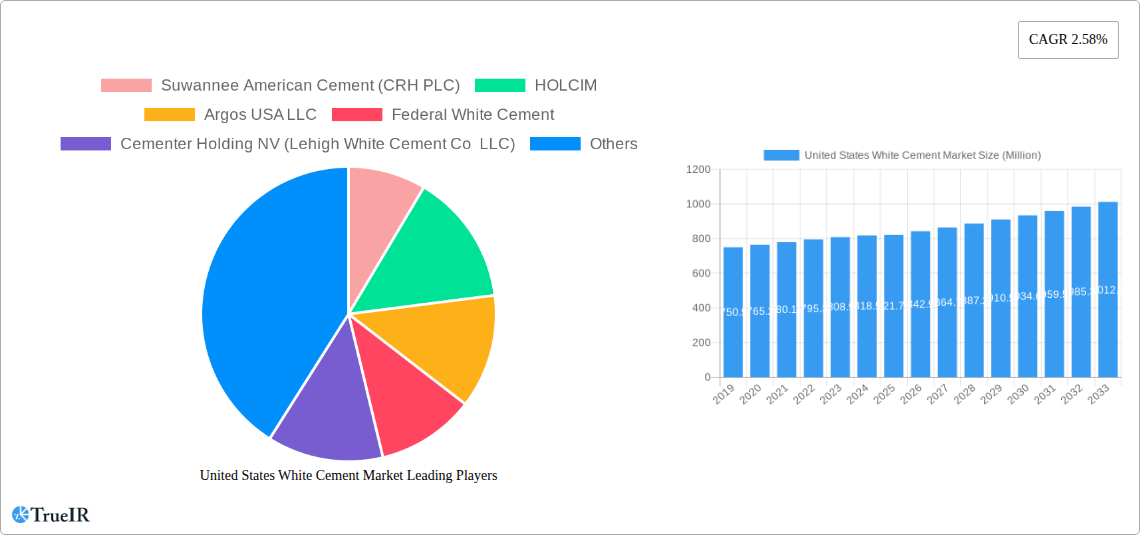

The United States White Cement Market is poised for steady growth, with a projected market size of approximately $821.79 million in 2025. This expansion is driven by an estimated Compound Annual Growth Rate (CAGR) of 2.58% throughout the forecast period of 2025-2033. The demand for white cement is significantly influenced by its aesthetic appeal and versatility, making it a preferred choice for a wide array of applications. Key drivers include the burgeoning residential construction sector, where white cement is favored for decorative elements, façade finishes, and interior design applications. Furthermore, the ongoing investments in infrastructure development, particularly in projects requiring visually appealing and durable materials, will continue to fuel market demand. Commercial and industrial sectors also contribute to this growth, utilizing white cement for specialized applications like precast elements, architectural concrete, and decorative paving. The market's trajectory indicates a sustained demand, reflecting the material's ability to meet both functional and aesthetic requirements in diverse construction projects across the nation.

United States White Cement Market Market Size (In Million)

The market landscape for white cement in the United States is characterized by a strong presence of leading global and domestic players, fostering a competitive environment that encourages innovation and product development. While the overall market demonstrates a positive growth trend, certain factors could influence its pace. Potential restraints might include the fluctuating raw material costs, particularly for the specialized clinker and gypsum required for white cement production, and the availability of skilled labor for precise application. However, these challenges are likely to be mitigated by advancements in manufacturing technologies and an increasing focus on sustainable building practices. The segmentation of the market by product type, including Type I and Type III cements, caters to specific performance needs, while the broad application segments of residential, infrastructure, commercial, industrial, and institutional sectors underscore the material's widespread utility. The United States, as a singular region with a robust construction industry, represents the primary focus for this market analysis, highlighting its critical role in shaping the overall demand and supply dynamics of white cement.

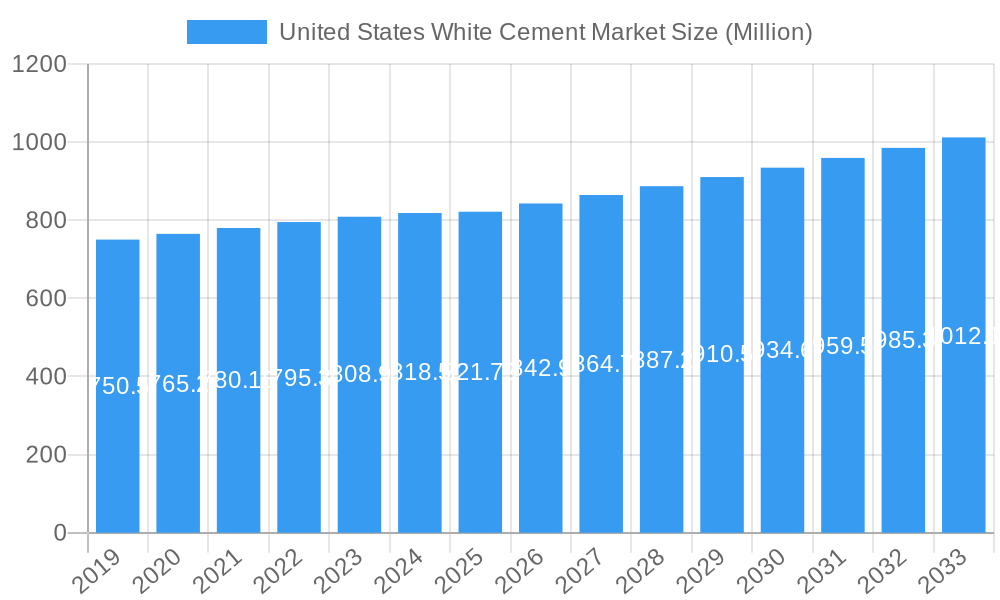

United States White Cement Market Company Market Share

United States White Cement Market: Comprehensive Analysis and Forecast (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the United States White Cement Market. Leveraging high-volume keywords and detailed insights, it offers a comprehensive understanding for industry stakeholders. The report covers the market structure, trends, opportunities, dominant segments, product analysis, key drivers, challenges, leading players, significant industry milestones, and future outlook. All monetary values are presented in Millions of USD.

United States White Cement Market Market Structure & Competitive Landscape

The United States White Cement Market exhibits a moderately concentrated competitive landscape, characterized by the presence of a few dominant global players and a number of regional manufacturers. Innovation drivers are primarily focused on product quality, sustainability initiatives, and specialized applications. Regulatory impacts, particularly concerning environmental standards and building codes, play a crucial role in shaping market entry and product development. Product substitutes, while present, are often niche, with white cement offering unique aesthetic and performance advantages. The end-user segmentation is diverse, spanning residential, infrastructure, commercial, and industrial sectors, each with distinct demands. Mergers and Acquisitions (M&A) trends are observed as key players seek to consolidate market share, expand geographical reach, and integrate vertically. For instance, CRH PLC's acquisition strategies have consistently bolstered its market position. Industry analysts estimate the current market concentration ratio to be around 60% among the top five players. M&A activity, while cyclical, has seen an average of 2-3 significant transactions annually over the past five years, often involving capacity expansion or diversification of product portfolios. The ongoing pursuit of sustainable building materials and the increasing demand for visually appealing construction solutions are pushing companies to invest in R&D for advanced white cement formulations. The regulatory environment, while a barrier for some, also fosters innovation as companies strive to meet stringent environmental compliance and energy efficiency standards.

United States White Cement Market Market Trends & Opportunities

The United States White Cement Market is poised for robust growth, driven by a confluence of economic, technological, and societal factors. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.2% from the base year of 2025 through 2033, reaching an estimated value of $4,500 Million by the end of the forecast period. This expansion is underpinned by a surge in construction activities across various sectors, particularly in residential and commercial development. Technological shifts are central to this growth, with manufacturers increasingly focusing on developing eco-friendly white cement formulations and optimizing production processes to reduce carbon footprints. The adoption of advanced grinding technologies and the utilization of supplementary cementitious materials (SCMs) are gaining traction, aligning with the growing emphasis on sustainability. Consumer preferences are also evolving, with a rising demand for aesthetically pleasing architectural designs that white cement can readily facilitate. The premium finish and versatility of white cement in creating decorative elements, facades, and interior finishes are key differentiators. This trend is particularly evident in urban renewal projects and the construction of high-end residential and commercial properties.

The competitive dynamics within the market are intensifying, compelling companies to differentiate themselves through product innovation, customer service, and sustainable practices. Market penetration rates for specialized white cement applications are expected to climb as awareness and acceptance grow among architects, designers, and contractors. Opportunities abound in catering to niche applications such as precast concrete elements, decorative mortars, and specialized grouts. The increasing investment in infrastructure development, including roads, bridges, and public buildings, also presents a significant avenue for growth, as white cement's durability and aesthetic appeal are highly valued in these projects. Furthermore, the growing adoption of energy-efficient building standards and green building certifications is creating a favorable environment for white cement, especially when produced with reduced environmental impact. The circular economy principles are also influencing the market, with a growing interest in recycled materials and sustainable sourcing of raw materials for cement production. Companies that can effectively integrate these trends into their product offerings and operational strategies will be well-positioned for success in the evolving United States White Cement Market. The demand for high-performance white cement with enhanced durability and specific aesthetic properties is a key opportunity that manufacturers are actively pursuing.

Dominant Markets & Segments in United States White Cement Market

The United States White Cement Market is characterized by distinct regional dominance and segment leadership, driven by varied economic activities, construction trends, and regulatory landscapes.

Product Type Dominance:

- Type I Cement: This foundational product type consistently holds the largest market share, accounting for an estimated 65% of the total white cement market value in 2025. Its versatility and widespread application across residential, commercial, and infrastructure projects make it the workhorse of the white cement industry. Key growth drivers for Type I cement include the steady demand for general construction, renovation projects, and its use in precast concrete elements that require a uniform white appearance.

- Type III Cement: While smaller in market share, Type III cement is experiencing significant growth, particularly in applications demanding rapid strength development. This includes precast concrete manufacturing, tunnel construction, and emergency repair work. The increasing pace of construction projects and the need for faster project completion times are fueling the demand for Type III cement. Its ability to achieve high early strength allows for quicker formwork removal and accelerated project timelines, making it an attractive option for contractors facing tight schedules. The estimated market share for Type III cement stands at approximately 25% in 2025.

- Other Product Types: This category encompasses specialized white cements, such as those with enhanced water resistance, specific color additives, or tailored performance characteristics for niche applications like decorative overlays, architectural finishes, and specialty mortars. While comprising a smaller portion of the overall market (estimated at 10% in 2025), these products are crucial for value-added applications and are expected to witness a higher growth rate due to their specialized nature and premium pricing.

Application Dominance:

- Residential: The residential sector remains a dominant end-user, driven by new home construction, remodeling, and renovation activities. The aesthetic appeal of white cement in modern home designs, from facades and interior walls to decorative concrete features, contributes significantly to its demand. Favorable housing market conditions and increasing disposable incomes further bolster this segment. The estimated share for residential applications is around 35% in 2025.

- Commercial: This segment, encompassing office buildings, retail spaces, hotels, and mixed-use developments, represents another substantial portion of the white cement market. The demand here is fueled by the need for visually appealing and durable building materials that convey professionalism and sophistication. Architects and developers are increasingly opting for white cement to create distinctive architectural statements. Commercial construction, especially in rapidly growing urban centers, is a key driver. The commercial segment is estimated to account for 30% of the market share in 2025.

- Infrastructure: While not as prominent as residential or commercial in terms of sheer volume, the infrastructure sector is a critical and growing consumer of white cement. Applications include decorative bridge elements, street furniture, public plazas, and architectural concrete in transportation hubs. Government investments in public works and urban beautification projects are significant growth catalysts. The durability and aesthetic versatility of white cement make it suitable for these high-visibility public projects. The infrastructure segment is projected to hold approximately 20% of the market share in 2025.

- Industrial and Institutional: This segment includes the construction of factories, warehouses, hospitals, schools, and other institutional facilities. While functional requirements often take precedence, white cement is utilized for specific aesthetic elements, durable flooring, and in precast components where a clean and bright appearance is desired. The growth in this segment is tied to overall economic expansion and government spending on public facilities. This segment represents an estimated 15% of the market share in 2025.

The dominance of Type I cement and the residential and commercial applications are projected to continue in the coming years. However, the growing emphasis on sustainable infrastructure and the demand for specialized aesthetic solutions in all segments will drive increased adoption of Type III and other specialized white cement products.

United States White Cement Market Product Analysis

United States White Cement Market is witnessing significant product innovations driven by the demand for enhanced aesthetics and improved sustainability. Manufacturers are focusing on developing high-performance white cements with superior whiteness, finer particle size, and improved workability for decorative applications. Key product innovations include the development of low-carbon white cement formulations utilizing supplementary cementitious materials and optimized clinker compositions. These advancements not only meet growing environmental regulations but also offer competitive advantages by reducing the embodied carbon of construction projects. The competitive advantage of white cement lies in its unparalleled ability to provide a bright, uniform, and visually appealing finish, enabling architects and designers to realize a wide range of creative possibilities in facade treatments, interior finishes, and precast concrete elements.

Key Drivers, Barriers & Challenges in United States White Cement Market

Key Drivers, Barriers & Challenges in United States White Cement Market

The United States White Cement Market is propelled by several key drivers. The escalating demand for aesthetically pleasing and durable construction materials, particularly in the booming residential and commercial sectors, is a primary catalyst. Urbanization and infrastructure development projects further fuel this demand, with white cement being favored for its visual appeal in public spaces and architectural elements. Technological advancements in production processes, leading to improved quality, consistency, and reduced environmental impact, are also significant drivers. Moreover, the growing preference for green building practices and certifications incentivizes the use of sustainable cement alternatives, including those with lower carbon footprints.

However, the market faces several barriers and challenges. High production costs associated with achieving the specific purity and whiteness of white cement can make it more expensive than grey cement, limiting its widespread adoption in cost-sensitive projects. Stringent regulatory hurdles, particularly concerning environmental emissions and energy consumption during production, add to operational complexities and costs. Supply chain disruptions and the availability of raw materials can also pose challenges. Intense competitive pressure from grey cement manufacturers and alternative building materials necessitates continuous innovation and marketing efforts to highlight the unique value proposition of white cement. The perception of white cement as a niche or premium product can also be a barrier to broader market penetration, requiring educational initiatives for specifiers and end-users.

Growth Drivers in the United States White Cement Market Market

The United States White Cement Market is experiencing robust growth driven by several influential factors. Economic expansion and a strong housing market are fundamental, leading to increased residential construction and renovation activities where the aesthetic appeal of white cement is highly valued. Furthermore, significant government investments in infrastructure development, including public spaces, transportation hubs, and urban beautification projects, create substantial demand for durable and visually attractive materials like white cement. Technological advancements in cement production are enabling the development of eco-friendly white cement formulations with reduced carbon footprints, aligning with the growing demand for sustainable building materials and green certifications. The increasing adoption of architectural innovation and modern design trends that emphasize clean lines, bright aesthetics, and customized finishes directly benefits the white cement market.

Challenges Impacting United States White Cement Market Growth

The United States White Cement Market faces several significant challenges that can impede its growth trajectory. The higher production costs compared to traditional grey cement can limit its adoption in price-sensitive projects, posing a significant barrier to entry for wider market penetration. Strict environmental regulations concerning emissions and energy consumption during the manufacturing process necessitate substantial investments in compliance and cleaner technologies, adding to operational expenses. Supply chain vulnerabilities, including the availability and transportation of specialized raw materials required for white cement production, can lead to delays and increased costs. Furthermore, intense competition from established grey cement producers and emerging alternative building materials requires continuous innovation and effective market positioning. The perceived complexity of specifying and using white cement for certain applications can also be a restraint, requiring ongoing educational efforts to promote its benefits and ease of use.

Key Players Shaping the United States White Cement Market Market

- Suwannee American Cement (CRH PLC)

- HOLCIM

- Argos USA LLC

- Federal White Cement

- Cementer Holding NV (Lehigh White Cement Co LLC)

- CEMEX SAB De CV

- Almaty's Gmbh (OYAK)

- Royal El Minya Cement (SESCO Cement Corp )

- Royal White Cement Inc.

- Titan America LLC

- Heidelberg Materials

- CIMSA

Significant United States White Cement Market Industry Milestones

- August 2023: Royal White Cement Inc. announced its plans to build a new cement terminal in Houston, Texas, to produce slag, grey cement, and white cement. The company has strengthened its market presence by expanding its footprint in Houston.

- March 2023: Argos USA LLC has been awarded the Energy Star certification from the US Environmental Protection Agency (EPA). The company has strengthened its market presence by reducing the electricity use and CO2 emissions from its manufacturing process.

Future Outlook for United States White Cement Market Market

The future outlook for the United States White Cement Market is exceptionally bright, driven by sustained demand from key sectors and evolving industry trends. The ongoing urbanization and the continuous need for modern infrastructure development will remain primary growth catalysts, creating consistent demand for high-quality, aesthetically pleasing building materials. The increasing emphasis on sustainable construction practices and green building initiatives will further propel the adoption of eco-friendly white cement variants, presenting significant opportunities for manufacturers investing in low-carbon technologies and circular economy principles. The market is also expected to witness innovation in specialized white cement products tailored for niche applications, offering enhanced performance and unique aesthetic qualities. Strategic opportunities lie in expanding production capacity to meet rising demand, forging partnerships for enhanced distribution networks, and investing in research and development to stay ahead of technological advancements and evolving consumer preferences.

United States White Cement Market Segmentation

-

1. Product Type

- 1.1. Type I Cement

- 1.2. Type III Cement

- 1.3. Other Product Types

-

2. Application

- 2.1. Residential

- 2.2. Infrastructure

- 2.3. Commercial

- 2.4. Industrial and Institutional

United States White Cement Market Segmentation By Geography

- 1. United States

United States White Cement Market Regional Market Share

Geographic Coverage of United States White Cement Market

United States White Cement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Residential Construction in the Country; Increasing Investments in the Infrastructure Sector

- 3.3. Market Restrains

- 3.3.1. High Production Costs

- 3.4. Market Trends

- 3.4.1. Type I Cement to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States White Cement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Type I Cement

- 5.1.2. Type III Cement

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Infrastructure

- 5.2.3. Commercial

- 5.2.4. Industrial and Institutional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Suwannee American Cement (CRH PLC)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HOLCIM

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Argos USA LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Federal White Cement

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cementer Holding NV (Lehigh White Cement Co LLC)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEMEX SAB De CV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Almaty's Gmbh (OYAK)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Royal El Minya Cement (SESCO Cement Corp )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Royal White Cement Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Titan America LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Heidelberg Materials

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CIMSA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Suwannee American Cement (CRH PLC)

List of Figures

- Figure 1: United States White Cement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States White Cement Market Share (%) by Company 2025

List of Tables

- Table 1: United States White Cement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States White Cement Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: United States White Cement Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: United States White Cement Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: United States White Cement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States White Cement Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: United States White Cement Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: United States White Cement Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: United States White Cement Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: United States White Cement Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: United States White Cement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States White Cement Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States White Cement Market?

The projected CAGR is approximately 2.58%.

2. Which companies are prominent players in the United States White Cement Market?

Key companies in the market include Suwannee American Cement (CRH PLC), HOLCIM, Argos USA LLC, Federal White Cement, Cementer Holding NV (Lehigh White Cement Co LLC), CEMEX SAB De CV, Almaty's Gmbh (OYAK), Royal El Minya Cement (SESCO Cement Corp ), Royal White Cement Inc, Titan America LLC, Heidelberg Materials, CIMSA.

3. What are the main segments of the United States White Cement Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 821.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Residential Construction in the Country; Increasing Investments in the Infrastructure Sector.

6. What are the notable trends driving market growth?

Type I Cement to Dominate the Market.

7. Are there any restraints impacting market growth?

High Production Costs.

8. Can you provide examples of recent developments in the market?

August 2023: Royal White Cement Inc. announced its plans to build a new cement terminal in Houston, Texas, to produce slag, grey cement, and white cement. The company has strengthened its market presence by expanding its footprint in Houston.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States White Cement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States White Cement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States White Cement Market?

To stay informed about further developments, trends, and reports in the United States White Cement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence