Key Insights

The Amorphous Polyethylene Terephthalate (APET) market is projected to experience substantial growth, with a projected Compound Annual Growth Rate (CAGR) of 8.1%. This expansion is driven by escalating demand for sustainable and versatile packaging across key industries. The Food & Beverage sector leads consumption, utilizing APET's superior barrier properties and clarity for bottles and films that enhance shelf life and product appeal. The Pharmaceutical industry's need for APET in blister packaging, mandated by strict product protection and tamper-evidence regulations, further fuels market growth. Consumer preference for convenient, safe packaging, combined with advancements in APET manufacturing that improve performance and recyclability, are key growth drivers.

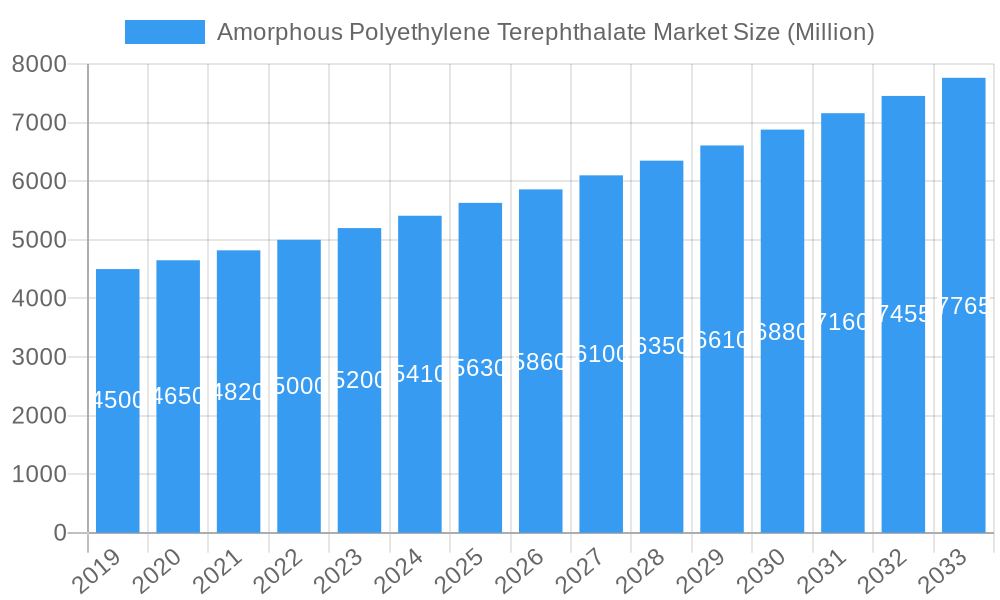

Amorphous Polyethylene Terephthalate Market Market Size (In Billion)

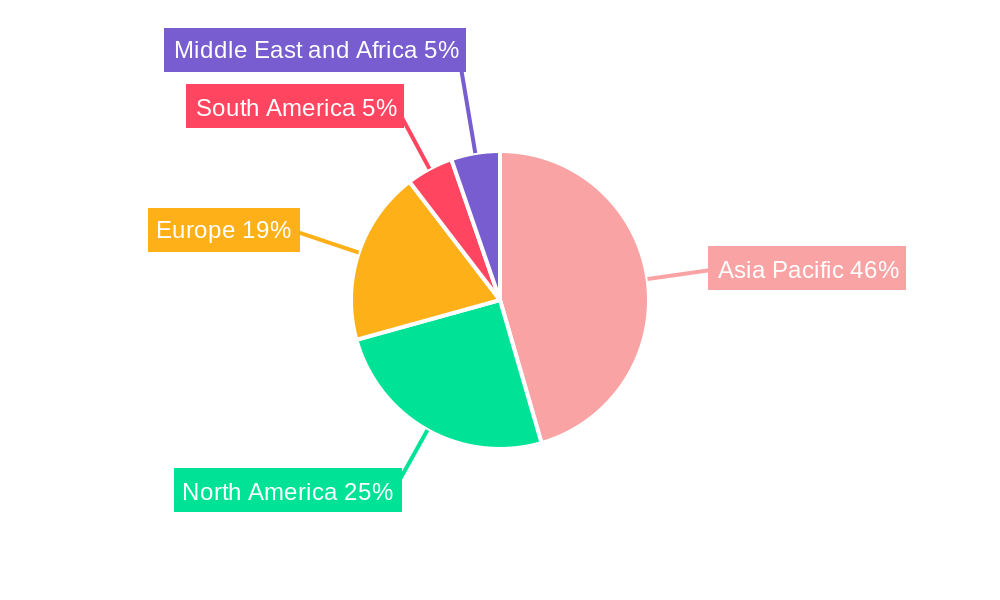

Despite robust demand, market growth may be influenced by raw material price volatility. The increasing focus on recycled content and the emergence of alternative sustainable materials present both challenges and opportunities for APET. Investment in R&D is crucial for enhancing APET's recyclability and exploring novel applications to maintain competitiveness. Geographically, the Asia Pacific region, particularly China and India, is anticipated to lead market share due to its burgeoning industrial base, growing middle class, and increased consumption of packaged goods. North America and Europe remain significant markets, driven by developed economies and a strong emphasis on regulatory compliance and sustainability in their packaging sectors.

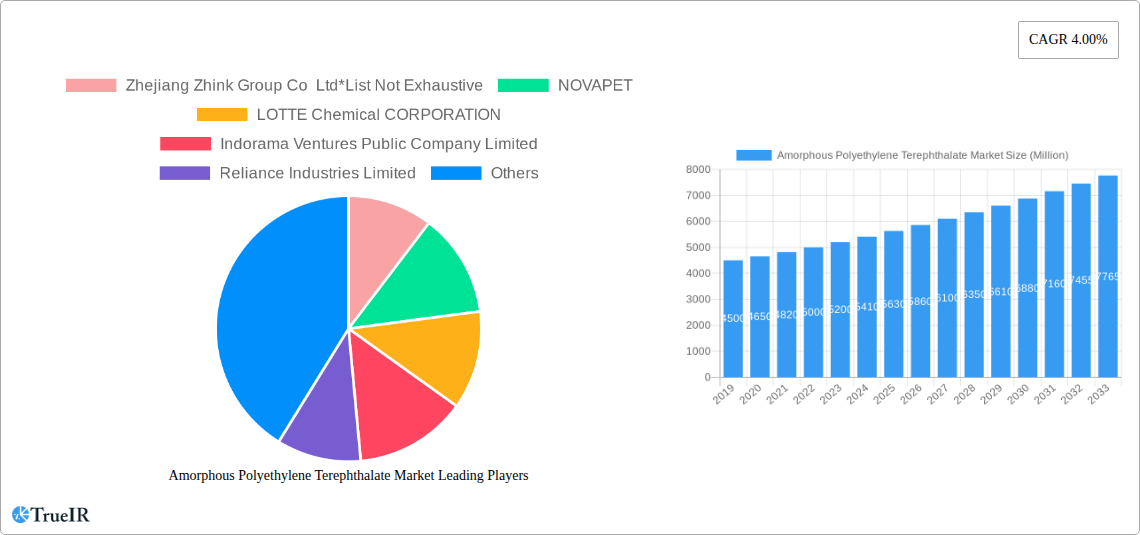

Amorphous Polyethylene Terephthalate Market Company Market Share

The global APET market size is estimated at 54.22 billion in the base year 2025.

Amorphous Polyethylene Terephthalate Market: Comprehensive Industry Analysis and Forecast (2019-2033)

This in-depth report provides a holistic view of the Amorphous Polyethylene Terephthalate (A-PET) market, meticulously analyzing its structure, trends, dominant segments, and future trajectory. Spanning the historical period from 2019 to 2024, with a base and estimated year of 2025, and a comprehensive forecast extending to 2033, this research leverages high-volume SEO keywords to empower industry stakeholders with actionable insights for strategic decision-making.

Amorphous Polyethylene Terephthalate Market Market Structure & Competitive Landscape

The Amorphous Polyethylene Terephthalate (A-PET) market exhibits a moderately concentrated structure, with a few key players holding significant market share. Innovation remains a crucial differentiator, driven by the continuous demand for enhanced material properties such as improved clarity, barrier performance, and recyclability. Regulatory impacts, particularly concerning single-use plastics and sustainability initiatives, are increasingly shaping market dynamics, pushing for the adoption of recycled A-PET (r-APET) and bio-based alternatives. Product substitutes, including crystalline PET (C-PET) and other polymers like polypropylene (PP) and high-density polyethylene (HDPE), present ongoing competition, especially in cost-sensitive applications.

End-user segmentation reveals the dominance of the Food & Beverage and Pharmaceutical sectors, which collectively account for over 70% of A-PET consumption. Mergers and acquisitions (M&A) activity, while not as pronounced as in some other chemical sectors, is present, with larger integrated players acquiring smaller specialized manufacturers to expand their product portfolios and geographical reach. For instance, significant M&A volumes are projected to reach approximately $500 Million in the forecast period. The Herfindahl-Hirschman Index (HHI) for the A-PET market is estimated to be around 0.25, indicating moderate concentration. Key competitive advantages in the market are derived from economies of scale, advanced manufacturing technologies, and robust supply chain networks.

Amorphous Polyethylene Terephthalate Market Market Trends & Opportunities

The Amorphous Polyethylene Terephthalate (A-PET) market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033. This expansion is fueled by a confluence of evolving consumer preferences, significant technological advancements, and increasing global demand for sustainable packaging solutions. The market size is expected to grow from an estimated $18,000 Million in 2025 to over $28,500 Million by 2033.

Technological shifts are playing a pivotal role, with ongoing research and development focused on enhancing the properties of A-PET. This includes the development of advanced barrier coatings, improved thermal stability for hot-fill applications, and innovations in chemical recycling processes that enable a higher proportion of post-consumer recycled content in A-PET products. These advancements are crucial for addressing the environmental concerns associated with conventional plastics and meeting the stringent requirements of various end-user industries.

Consumer preferences are increasingly leaning towards eco-friendly and sustainable packaging options. The demand for lightweight, durable, and transparent packaging that can effectively preserve product integrity and extend shelf life continues to drive the adoption of A-PET. Furthermore, consumer awareness regarding plastic waste and the circular economy is influencing purchasing decisions, creating a favorable environment for products packaged in recyclable materials like A-PET.

Competitive dynamics within the A-PET market are characterized by intense competition among established chemical manufacturers and emerging players. Companies are focusing on developing high-performance A-PET grades tailored to specific applications, optimizing production processes for cost efficiency, and expanding their global distribution networks. The market penetration rate for A-PET in the packaging sector is currently estimated at around 65%, with significant room for growth in emerging economies and new application areas. The increasing adoption of A-PET for applications beyond traditional bottles, such as films, sheets, and specialized industrial components, presents new avenues for market expansion. The push for lightweighting in automotive and electronics sectors also offers latent opportunities for A-PET, provided its mechanical and thermal properties can be further enhanced. The growing emphasis on food safety and extended shelf life in the food and beverage industry, coupled with the demand for tamper-evident and child-resistant pharmaceutical packaging, directly correlates with the demand for A-PET's versatile properties. The increasing disposable incomes in developing nations are also contributing to a rise in packaged goods consumption, thereby boosting the A-PET market.

Dominant Markets & Segments in Amorphous Polyethylene Terephthalate Market

The Amorphous Polyethylene Terephthalate (A-PET) market's dominance is clearly established within the Asia Pacific region, particularly in China and India, driven by robust industrial growth, expanding manufacturing capabilities, and a rapidly growing consumer base. This region is expected to account for approximately 40% of the global A-PET market share by 2033. Key growth drivers in this region include substantial government investments in infrastructure development, supportive industrial policies promoting domestic manufacturing, and a burgeoning middle class with increasing purchasing power for packaged goods. The presence of a well-established petrochemical industry also provides a competitive advantage in terms of raw material availability and cost-effectiveness.

The Bottles segment, under the Application category, remains the most dominant, commanding an estimated 55% of the A-PET market. This is intrinsically linked to the overwhelming demand from the Food & Beverage industry, which represents the largest end-user segment, accounting for over 50% of A-PET consumption. The clarity, inertness, and excellent barrier properties of A-PET make it the material of choice for packaging a wide range of beverages, including water, soft drinks, juices, and edible oils.

Films/Sheets represent the second-largest application segment, estimated to hold around 20% of the market. This segment is significantly driven by the Consumer Goods and Pharmaceutical end-user industries. A-PET films are widely used for food packaging, creating thermoformed trays and lids, and for producing blister packaging for consumer electronics and household items. In the pharmaceutical sector, A-PET films are essential for blister packs, providing a reliable barrier against moisture and oxygen, thus ensuring drug efficacy and stability.

The Clam Shell Packaging segment, though smaller, is experiencing robust growth, estimated at around 10% of the market. This is particularly driven by the retail sector for packaging electronics, toys, and personal care products, offering product visibility and protection. Pharmaceutical Blister Packaging, while a subset of films, is a critical and high-value application, projected to contribute approximately 10% to the total market by 2033, driven by stringent regulatory requirements and the need for secure, dose-specific packaging. The "Others" category, encompassing industrial applications, automotive components, and textiles, is expected to grow at a higher CAGR, albeit from a smaller base.

The Pharmaceutical end-user industry, beyond blister packaging, is also seeing increased A-PET adoption for vials, syringes, and other primary packaging components due to its chemical resistance and clarity. Government initiatives promoting healthcare access and the growth of the generic drug market further bolster this segment. The Consumer Goods sector, encompassing home appliances, electronics, and personal care items, contributes significantly to the A-PET demand through its use in protective packaging and product displays.

Amorphous Polyethylene Terephthalate Market Product Analysis

Amorphous Polyethylene Terephthalate (A-PET) is a thermoplastic polymer widely recognized for its excellent transparency, impact resistance, and good barrier properties against gases and moisture. Product innovations in the A-PET market are focused on enhancing its performance characteristics and expanding its application range. Advancements in polymerization techniques and additive technologies have led to the development of A-PET grades with improved thermal stability, enabling their use in hot-fill applications and microwaveable packaging. Furthermore, the integration of recycled PET (r-PET) into virgin A-PET formulations is a significant innovation, driven by sustainability demands and regulatory mandates. This circular approach not only reduces the environmental footprint but also offers cost advantages. Competitive advantages are derived from A-PET's recyclability, its ability to be processed using conventional methods like injection molding and extrusion, and its cost-effectiveness compared to some high-performance engineering plastics. Its application in food and beverage packaging, pharmaceutical blister packs, and consumer goods packaging highlights its market fit and versatility.

Key Drivers, Barriers & Challenges in Amorphous Polyethylene Terephthalate Market

Key Drivers:

- Growing Demand for Sustainable Packaging: Increasing consumer and regulatory pressure for eco-friendly solutions is driving the adoption of A-PET, especially recycled A-PET (r-APET).

- Expansion of Food & Beverage and Pharmaceutical Industries: These sectors, major consumers of A-PET, are experiencing consistent growth globally, fueled by population increase and rising disposable incomes.

- Technological Advancements in Recycling: Innovations in chemical and mechanical recycling are improving the quality and availability of r-APET, making it a more viable option.

- Lightweighting Initiatives: A-PET's inherent lightweight properties contribute to reduced transportation costs and lower carbon emissions in supply chains.

- Excellent Material Properties: Its transparency, clarity, impact strength, and barrier properties make it ideal for various packaging applications.

Key Barriers & Challenges:

- Environmental Concerns and Plastic Waste Management: Negative perceptions surrounding plastic waste and single-use plastics can impact demand and lead to stricter regulations.

- Competition from Alternative Materials: Other polymers like polypropylene (PP), polyethylene terephthalate glycol (PETG), and bio-based plastics offer competing solutions, especially in specific niche applications.

- Volatility in Raw Material Prices: Fluctuations in the prices of crude oil and its derivatives can impact the production cost of A-PET.

- Regulatory Landscape: Evolving regulations concerning plastic usage, recycled content mandates, and extended producer responsibility can create compliance challenges.

- Supply Chain Disruptions: Geopolitical events, natural disasters, and logistical issues can disrupt the supply chain for raw materials and finished A-PET products.

Growth Drivers in the Amorphous Polyethylene Terephthalate Market Market

The amorphous polyethylene terephthalate (A-PET) market is primarily propelled by the escalating global demand for sustainable and high-performance packaging solutions. The intensifying consumer awareness regarding environmental issues and the subsequent drive towards a circular economy are significant growth catalysts. Regulatory bodies worldwide are increasingly implementing policies that favor the use of recycled materials and discourage single-use plastics, thereby boosting the demand for r-APET. Technological advancements in recycling processes, such as enhanced chemical recycling methods, are making it more feasible to produce high-quality recycled A-PET that can meet the stringent requirements of food-grade and pharmaceutical applications. Furthermore, the expanding food and beverage sector, particularly in emerging economies, driven by population growth and urbanization, directly translates to increased demand for A-PET bottles and packaging. The pharmaceutical industry's continuous need for safe, sterile, and reliable packaging solutions, such as blister packs, also contributes significantly to market growth.

Challenges Impacting Amorphous Polyethylene Terephthalate Market Growth

Despite its growth prospects, the Amorphous Polyethylene Terephthalate (A-PET) market faces several significant challenges. The pervasive negative public perception surrounding plastic waste and its environmental impact can lead to boycotts and stricter governmental regulations, potentially hindering market expansion. Competition from alternative packaging materials, including paper-based composites and biodegradable plastics, poses a constant threat, especially in applications where sustainability is the primary purchasing driver. Furthermore, the volatility in the prices of petrochemical feedstocks, the primary raw materials for A-PET production, can significantly impact manufacturing costs and profitability, creating price uncertainty for end-users. Supply chain complexities, amplified by global trade tensions and logistical bottlenecks, can also lead to material shortages and increased lead times. Navigating the diverse and evolving regulatory landscape across different regions, including varying mandates on recycled content and end-of-life management, presents a continuous challenge for manufacturers and suppliers.

Key Players Shaping the Amorphous Polyethylene Terephthalate Market Market

- Zhejiang Zhink Group Co Ltd

- NOVAPET

- LOTTE Chemical CORPORATION

- Indorama Ventures Public Company Limited

- Reliance Industries Limited

- MPI Polyester Industries

- PolyQuest

- NEO GROUP

- AVI Global Plast

- OCTAL

- Shahid Tondgooyan Petrochemical Co

Significant Amorphous Polyethylene Terephthalate Market Industry Milestones

- 2021: Indorama Ventures announces a significant investment in advanced chemical recycling technologies to boost r-APET production.

- 2022: LOTTE Chemical Corporation expands its A-PET production capacity in Southeast Asia to meet growing regional demand.

- 2022: European Union introduces stricter regulations on single-use plastics, increasing the demand for A-PET with higher recycled content.

- 2023: NOVAPET develops a new grade of A-PET with enhanced barrier properties for extended shelf-life food packaging.

- 2023: The industry witnesses a surge in partnerships between A-PET manufacturers and waste management companies to secure reliable sources of post-consumer plastic for recycling.

- 2024: Reliance Industries Limited invests in R&D to develop bio-based A-PET alternatives.

Future Outlook for Amorphous Polyethylene Terephthalate Market Market

The future outlook for the Amorphous Polyethylene Terephthalate (A-PET) market is exceptionally promising, driven by an unwavering global commitment to sustainability and the increasing demand for versatile and efficient packaging solutions. The continuous advancements in recycling technologies, particularly chemical recycling, will be instrumental in bolstering the supply and quality of recycled A-PET, meeting stringent regulatory requirements and consumer expectations for circularity. Strategic opportunities lie in expanding the application of A-PET in emerging markets, where the growth of the food & beverage and pharmaceutical sectors is particularly robust. Further innovation in developing A-PET grades with enhanced properties, such as improved heat resistance and biodegradability, will unlock new market segments and applications. The market potential is immense as industries globally seek to balance performance, cost-effectiveness, and environmental responsibility, positioning A-PET as a key material in the transition towards a more sustainable future.

Amorphous Polyethylene Terephthalate Market Segmentation

-

1. Application

- 1.1. Bottles

- 1.2. Films/Sheets

- 1.3. Clam Shell Packaging

- 1.4. Pharmaceutical Blister Packaging

- 1.5. Others

-

2. End-user Industry

- 2.1. Food & Beverage

- 2.2. Pharmaceutical

- 2.3. Consumer Goods

- 2.4. Others

Amorphous Polyethylene Terephthalate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Amorphous Polyethylene Terephthalate Market Regional Market Share

Geographic Coverage of Amorphous Polyethylene Terephthalate Market

Amorphous Polyethylene Terephthalate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Application in Food & Beverage Industry; Growing Application Owing to its Wide Range of Applications

- 3.3. Market Restrains

- 3.3.1. ; Stringent Environmental Regulations; Negative Impact of COVID-19 Outbreak on the Market

- 3.4. Market Trends

- 3.4.1. Increasing Application in Food & Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Amorphous Polyethylene Terephthalate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Bottles

- 5.1.2. Films/Sheets

- 5.1.3. Clam Shell Packaging

- 5.1.4. Pharmaceutical Blister Packaging

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food & Beverage

- 5.2.2. Pharmaceutical

- 5.2.3. Consumer Goods

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Amorphous Polyethylene Terephthalate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Bottles

- 6.1.2. Films/Sheets

- 6.1.3. Clam Shell Packaging

- 6.1.4. Pharmaceutical Blister Packaging

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food & Beverage

- 6.2.2. Pharmaceutical

- 6.2.3. Consumer Goods

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Amorphous Polyethylene Terephthalate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Bottles

- 7.1.2. Films/Sheets

- 7.1.3. Clam Shell Packaging

- 7.1.4. Pharmaceutical Blister Packaging

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food & Beverage

- 7.2.2. Pharmaceutical

- 7.2.3. Consumer Goods

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Amorphous Polyethylene Terephthalate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Bottles

- 8.1.2. Films/Sheets

- 8.1.3. Clam Shell Packaging

- 8.1.4. Pharmaceutical Blister Packaging

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food & Beverage

- 8.2.2. Pharmaceutical

- 8.2.3. Consumer Goods

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Amorphous Polyethylene Terephthalate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Bottles

- 9.1.2. Films/Sheets

- 9.1.3. Clam Shell Packaging

- 9.1.4. Pharmaceutical Blister Packaging

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food & Beverage

- 9.2.2. Pharmaceutical

- 9.2.3. Consumer Goods

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Amorphous Polyethylene Terephthalate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Bottles

- 10.1.2. Films/Sheets

- 10.1.3. Clam Shell Packaging

- 10.1.4. Pharmaceutical Blister Packaging

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food & Beverage

- 10.2.2. Pharmaceutical

- 10.2.3. Consumer Goods

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zhejiang Zhink Group Co Ltd*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NOVAPET

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LOTTE Chemical CORPORATION

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Indorama Ventures Public Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Reliance Industries Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MPI Polyester Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PolyQuest

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NEO GROUP

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AVI Global Plast

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 OCTAL

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shahid Tondgooyan Petrochemical Co

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Zhejiang Zhink Group Co Ltd*List Not Exhaustive

List of Figures

- Figure 1: Global Amorphous Polyethylene Terephthalate Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Amorphous Polyethylene Terephthalate Market Revenue (billion), by Application 2025 & 2033

- Figure 3: Asia Pacific Amorphous Polyethylene Terephthalate Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Amorphous Polyethylene Terephthalate Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Amorphous Polyethylene Terephthalate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Amorphous Polyethylene Terephthalate Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Amorphous Polyethylene Terephthalate Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Amorphous Polyethylene Terephthalate Market Revenue (billion), by Application 2025 & 2033

- Figure 9: North America Amorphous Polyethylene Terephthalate Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Amorphous Polyethylene Terephthalate Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America Amorphous Polyethylene Terephthalate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Amorphous Polyethylene Terephthalate Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Amorphous Polyethylene Terephthalate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Amorphous Polyethylene Terephthalate Market Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Amorphous Polyethylene Terephthalate Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Amorphous Polyethylene Terephthalate Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe Amorphous Polyethylene Terephthalate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Amorphous Polyethylene Terephthalate Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Amorphous Polyethylene Terephthalate Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Amorphous Polyethylene Terephthalate Market Revenue (billion), by Application 2025 & 2033

- Figure 21: South America Amorphous Polyethylene Terephthalate Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: South America Amorphous Polyethylene Terephthalate Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Amorphous Polyethylene Terephthalate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Amorphous Polyethylene Terephthalate Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Amorphous Polyethylene Terephthalate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Amorphous Polyethylene Terephthalate Market Revenue (billion), by Application 2025 & 2033

- Figure 27: Middle East and Africa Amorphous Polyethylene Terephthalate Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Amorphous Polyethylene Terephthalate Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Amorphous Polyethylene Terephthalate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Amorphous Polyethylene Terephthalate Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Amorphous Polyethylene Terephthalate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Germany Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: France Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Argentina Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 33: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Amorphous Polyethylene Terephthalate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Amorphous Polyethylene Terephthalate Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Amorphous Polyethylene Terephthalate Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Amorphous Polyethylene Terephthalate Market?

Key companies in the market include Zhejiang Zhink Group Co Ltd*List Not Exhaustive, NOVAPET, LOTTE Chemical CORPORATION, Indorama Ventures Public Company Limited, Reliance Industries Limited, MPI Polyester Industries, PolyQuest, NEO GROUP, AVI Global Plast, OCTAL, Shahid Tondgooyan Petrochemical Co.

3. What are the main segments of the Amorphous Polyethylene Terephthalate Market?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.22 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Application in Food & Beverage Industry; Growing Application Owing to its Wide Range of Applications.

6. What are the notable trends driving market growth?

Increasing Application in Food & Beverage Industry.

7. Are there any restraints impacting market growth?

; Stringent Environmental Regulations; Negative Impact of COVID-19 Outbreak on the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Amorphous Polyethylene Terephthalate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Amorphous Polyethylene Terephthalate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Amorphous Polyethylene Terephthalate Market?

To stay informed about further developments, trends, and reports in the Amorphous Polyethylene Terephthalate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence