Key Insights

Kazakhstan's mining sector is set for substantial growth, projected to reach an estimated USD 29.52 billion by 2024, expanding at a Compound Annual Growth Rate (CAGR) of 11.5% through 2032. This expansion is propelled by the nation's abundant natural resources, including coal, ferrous metals, and non-ferrous metals. Escalating global demand for raw materials, vital for industrialization, infrastructure, and the green energy transition (e.g., copper and critical minerals), will drive this growth. Supportive government initiatives focused on foreign investment, operational modernization, and technological advancement further bolster the market's positive outlook. Innovations in extraction, automation, and sustainable practices are anticipated to boost efficiency and minimize environmental impact, ensuring long-term market viability.

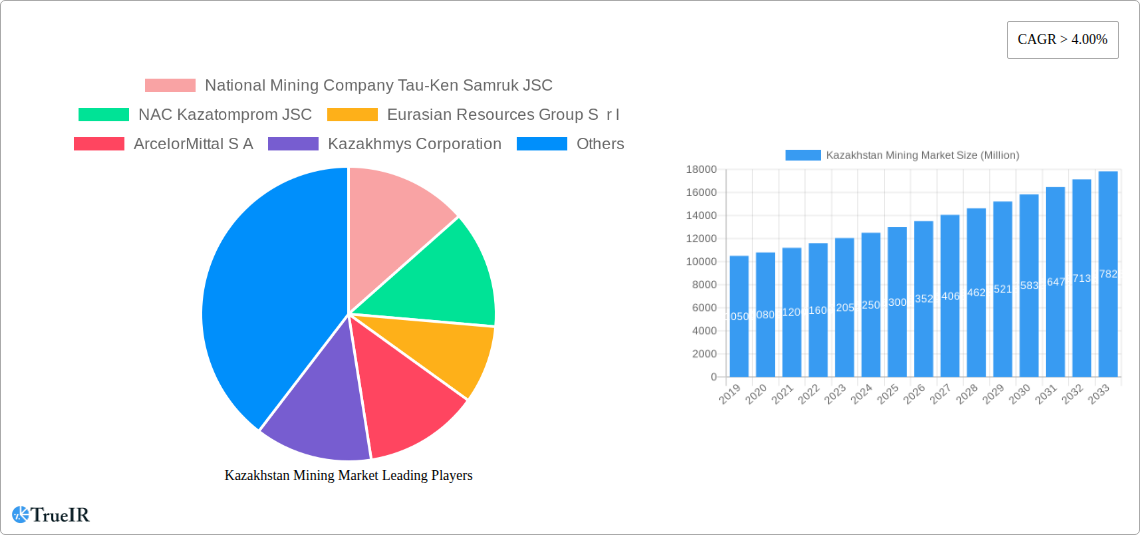

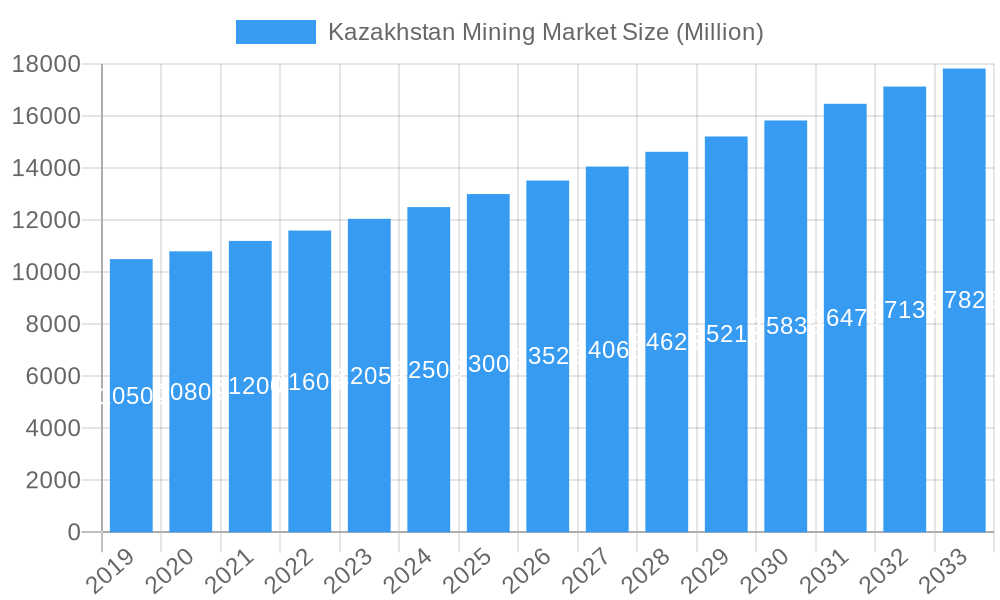

Kazakhstan Mining Market Market Size (In Billion)

Key players such as National Mining Company Tau-Ken Samruk JSC, NAC Kazatomprom JSC, Eurasian Resources Group S.A.R.L., ArcelorMittal S.A., Kazakhmys Corporation, KAZ Minerals PLC, and KAZZINC JSC are instrumental in exploring, extracting, and processing diverse minerals, significantly contributing to Kazakhstan's export revenue and economic development. While strong drivers exist, potential challenges like volatile commodity prices, rigorous environmental regulations, and the imperative for continuous investment in advanced technologies necessitate strategic management. However, the market's inherent resource wealth, coupled with ongoing efforts towards operational excellence and strategic collaborations, positions Kazakhstan as a significant player in the global mining arena.

Kazakhstan Mining Market Company Market Share

Kazakhstan Mining Market: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock unparalleled insights into Kazakhstan's dynamic mining sector with this in-depth market report. Covering historical data from 2019-2024, a base and estimated year of 2025, and a robust forecast period extending to 2033, this report provides a detailed examination of market structure, trends, dominant segments, product analysis, key drivers, challenges, and the competitive landscape.

Leveraging high-volume keywords like "Kazakhstan mining," "coal exports," "ferrous metals," "non-ferrous metals," and "mining investment," this report is meticulously designed for SEO optimization, ensuring maximum visibility for industry stakeholders, investors, and policymakers seeking comprehensive data and strategic guidance.

Kazakhstan Mining Market Market Structure & Competitive Landscape

The Kazakhstan mining market exhibits a moderately concentrated structure, with a few dominant players controlling significant market share, particularly in high-value mineral extraction. However, the presence of numerous smaller enterprises in niche segments contributes to a degree of market fragmentation. Innovation within the sector is largely driven by the adoption of advanced extraction technologies, beneficiation processes, and a growing emphasis on sustainable mining practices, aimed at reducing environmental impact and improving resource efficiency. Regulatory frameworks, while evolving, play a crucial role in shaping the competitive landscape, with government policies influencing investment incentives, environmental standards, and export regulations. The identification and development of new mineral deposits, alongside the efficient exploitation of existing ones, are key innovation drivers. Product substitutes are limited for many core commodities like coal and metals, but advancements in material science and recycling technologies could present long-term challenges. End-user segmentation is diverse, spanning energy (coal), construction (iron ore, cement materials), manufacturing (various metals), and agriculture (fertilizer components). Mergers and acquisitions (M&A) activity, while not at peak levels historically, remains a strategic tool for consolidation, market expansion, and access to new technologies or reserves. For instance, M&A volumes have fluctuated, with an estimated USD 1.5 Billion in transactions observed in the historical period. Concentration ratios in key segments like coal production are estimated to be around 60%, indicating substantial market control by the top few entities.

Kazakhstan Mining Market Market Trends & Opportunities

The Kazakhstan mining market is poised for significant expansion, driven by robust global demand for key commodities and the nation's rich mineral endowment. Over the study period (2019-2033), the market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.2%. This growth is underpinned by several converging trends. Firstly, the increasing global need for energy resources, particularly coal for power generation, continues to fuel demand, with Kazakhstan strategically positioned to supply key markets. Secondly, the burgeoning demand for non-ferrous metals, such as copper and zinc, driven by the electrification of transportation and renewable energy infrastructure, presents substantial opportunities. Ferrous metals, vital for construction and industrial development, will also maintain a steady growth trajectory. Technological shifts are a defining characteristic of the modern mining landscape. Kazakhstan is increasingly adopting advanced exploration techniques, including AI-driven geological mapping and remote sensing, to identify new reserves and optimize extraction. Furthermore, the implementation of automation in mining operations and the utilization of sophisticated data analytics are enhancing operational efficiency and safety. Consumer preferences are indirectly influencing the market through global demand patterns for end-products. For example, the growing preference for electric vehicles directly boosts demand for copper and lithium. Competitive dynamics are intensifying, with both domestic and international players vying for market share. Opportunities abound for companies investing in green mining technologies, advanced processing techniques, and vertical integration to capture more value. The strategic location of Kazakhstan, facilitating access to both Asian and European markets, further enhances its export potential. Market penetration rates for specialized mining equipment and services are expected to rise as companies invest in modernizing their operations. The shift towards digitalization and smart mining technologies is also a significant trend, promising improved resource management and reduced operational costs.

Dominant Markets & Segments in Kazakhstan Mining Market

The Coal segment stands as a cornerstone of the Kazakhstan mining market, demonstrating consistent dominance due to the nation's vast reserves and significant export capabilities. In July 2022, Kazakhstan exported 2.85 million tons of coal and coke to the European Union (EU) countries since the beginning of the year, a substantial increase compared to the average of 0.81 million tons exported to EU nations in the previous year. This surge highlights the growing demand for Kazakh coal, particularly its suitability for European power plants. From January to June 2022, coal production reached 57.4 million tons, marking a 5.9% increase year-on-year, generating a profit of 271 billion tenges (USD 564 million). Key growth drivers for the coal segment include:

- Strong Export Demand: Favorable geopolitical factors and energy security concerns in importing regions continue to bolster demand.

- Infrastructure Development: Investments in rail and port facilities are crucial for efficient export logistics.

- Government Support: Policies aimed at optimizing coal production and export contribute to market stability.

The Non-Ferrous Metals segment, encompassing minerals like copper, zinc, lead, and gold, is another powerhouse within the Kazakhstan mining landscape. Driven by global trends in electrification and technological advancements, this segment is experiencing robust growth. Copper, in particular, is in high demand for electric vehicle batteries, renewable energy infrastructure, and construction. Kazakhstan's significant copper reserves and increasing production capacity make it a key global supplier. Zinc and lead are also vital for industrial applications, and their demand is closely tied to global manufacturing output. Gold production, while subject to market price volatility, remains a significant contributor to the nation's mineral wealth. Key growth drivers for non-ferrous metals include:

- Global Electrification Trends: The transition to electric vehicles and renewable energy sources is a primary demand catalyst.

- Technological Advancements: Innovations in extraction and processing technologies are enabling more efficient recovery of valuable metals.

- Foreign Direct Investment: Attracting international capital for exploration and mine development is crucial.

The Ferrous Metals segment, primarily iron ore, plays a vital role in supporting industrial development, both domestically and internationally. While not exhibiting the same rapid growth as some non-ferrous metals, the demand for iron ore remains stable, driven by the construction and manufacturing sectors. Kazakhstan's significant iron ore reserves ensure its continued relevance. Key growth drivers for ferrous metals include:

- Infrastructure Projects: Global investments in infrastructure, particularly in developing economies, underpin demand.

- Steel Production Capacity: Expansion or maintenance of domestic and international steel production facilities directly influences iron ore consumption.

- Exploration for High-Grade Ores: Continued exploration for high-quality iron ore deposits is essential for competitive advantage.

Kazakhstan Mining Market Product Analysis

The Kazakhstan mining market is characterized by the production and export of a diverse range of essential raw materials. Innovations focus on enhancing extraction efficiency, improving ore beneficiation processes, and developing value-added products. Technological advancements in mineral processing are enabling the recovery of a wider array of metals and minerals, increasing yields, and reducing waste. For example, advanced hydrometallurgical and pyrometallurgical techniques are being employed to extract precious and base metals with greater precision. The competitive advantage for Kazakh mining companies lies in their access to vast, high-grade mineral deposits and their ability to leverage modern technologies to optimize production. Applications range from powering global energy grids with coal to supplying the building blocks for advanced manufacturing and electronics with non-ferrous metals. The continuous pursuit of higher purity grades and tailored product specifications for specific industrial needs is a key market differentiator.

Key Drivers, Barriers & Challenges in Kazakhstan Mining Market

Key Drivers:

- Abundant Mineral Resources: Kazakhstan possesses extensive reserves of coal, copper, gold, zinc, uranium, and various other valuable minerals, providing a fundamental advantage.

- Global Commodity Demand: Strong international demand for energy and industrial metals, particularly from emerging economies, fuels market growth.

- Strategic Geographic Location: Kazakhstan's position as a transit hub offers advantageous access to major Asian and European markets.

- Government Support & Investment Incentives: Favorable policies, tax exemptions, and infrastructure development initiatives encourage foreign and domestic investment.

- Technological Advancements: Adoption of new exploration, extraction, and processing technologies enhances efficiency and reduces costs.

Barriers & Challenges:

- Infrastructure Deficiencies: Inadequate transportation networks, particularly in remote mining regions, can hinder efficient logistics and increase operational costs.

- Regulatory Complexities & Bureaucracy: Navigating evolving environmental regulations, permitting processes, and tax regimes can pose challenges.

- Environmental Concerns & Sustainability Pressures: Increasing global focus on ESG (Environmental, Social, and Governance) factors necessitates significant investment in sustainable practices and pollution control.

- Geopolitical Instability & Global Economic Slowdowns: External factors can impact commodity prices, investment flows, and export market access.

- Skilled Labor Shortages: A demand for specialized mining expertise can create challenges in workforce recruitment and retention.

Growth Drivers in the Kazakhstan Mining Market Market

The Kazakhstan mining market's growth is propelled by a confluence of technological, economic, and policy-driven factors. Economically, the sustained global demand for key commodities, such as coal for energy generation and metals for industrial applications and the green transition, provides a powerful impetus. Technologically, the ongoing integration of advanced exploration tools, including AI-driven geological surveys and remote sensing, is unlocking new reserves and optimizing extraction strategies. Furthermore, the adoption of automation and data analytics in mining operations is significantly boosting efficiency and safety. From a policy perspective, the Kazakh government's commitment to attracting foreign direct investment through favorable regulatory frameworks and tax incentives plays a critical role in fostering expansion. Investments in infrastructure, such as rail and port upgrades, are crucial for enhancing export competitiveness.

Challenges Impacting Kazakhstan Mining Market Growth

Several significant barriers and restraints are impacting the growth trajectory of the Kazakhstan mining market. Regulatory complexities and bureaucratic hurdles can sometimes slow down project approvals and operational expansions. Supply chain issues, particularly concerning the availability of specialized equipment and spare parts, along with logistical challenges in vast, remote territories, can lead to delays and increased costs. Competitive pressures are also intensifying, both from other resource-rich nations and from the increasing global focus on sustainable and ethical sourcing, which can necessitate substantial investments in environmental compliance and social responsibility initiatives. Furthermore, fluctuations in global commodity prices, driven by geopolitical events and economic cycles, present inherent risks to profitability and investment decisions.

Key Players Shaping the Kazakhstan Mining Market Market

- National Mining Company Tau-Ken Samruk JSC

- NAC Kazatomprom JSC

- Eurasian Resources Group S r l

- ArcelorMittal S A

- Kazakhmys Corporation

- KAZ Minerals PLC

- KAZZINC JSC

Significant Kazakhstan Mining Market Industry Milestones

- July 2022: Kazakhstan exported 2.85 million tons of coal and coke to the European Union (EU) countries since the beginning of the year, a notable increase attributed to their suitability for EU power plants.

- 2022 (January-June): Kazakhstan produced 57.4 million tons of coal, a 5.9% increase compared to the previous year, generating profits of 271 billion tenges (USD 564 million).

- 2021: Kazakhstan exported an average of 0.81 million tons of coal to EU nations, providing a baseline for the significant increase observed in 2022.

- 2019-2024 (Historical Period): Significant investments in new mine development and modernization of existing facilities, contributing to increased production capacity across various mineral segments.

- 2023 (Estimated): Continued focus on attracting foreign investment for large-scale projects, particularly in the non-ferrous metals sector, driven by global demand.

Future Outlook for Kazakhstan Mining Market Market

The future outlook for the Kazakhstan mining market is exceptionally bright, fueled by sustained global demand for essential commodities and the nation's rich resource base. Strategic opportunities lie in the further development of its non-ferrous metal reserves, particularly copper, to meet the burgeoning needs of the electric vehicle and renewable energy sectors. Investments in advanced processing technologies and value-added product development will be crucial for enhancing profitability and market competitiveness. The government's commitment to attracting foreign direct investment, coupled with ongoing infrastructure improvements, will further solidify Kazakhstan's position as a key global mining player. Embracing sustainable mining practices and digital transformation will be paramount for long-term success and environmental stewardship, positioning the market for robust growth throughout the forecast period.

Kazakhstan Mining Market Segmentation

- 1. Coal

- 2. Ferrous Metals

- 3. Non Ferrous Metals

Kazakhstan Mining Market Segmentation By Geography

- 1. Kazakhstan

Kazakhstan Mining Market Regional Market Share

Geographic Coverage of Kazakhstan Mining Market

Kazakhstan Mining Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Coal Mining to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kazakhstan Mining Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coal

- 5.2. Market Analysis, Insights and Forecast - by Ferrous Metals

- 5.3. Market Analysis, Insights and Forecast - by Non Ferrous Metals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kazakhstan

- 5.1. Market Analysis, Insights and Forecast - by Coal

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 National Mining Company Tau-Ken Samruk JSC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NAC Kazatomprom JSC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Eurasian Resources Group S r l

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ArcelorMittal S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kazakhmys Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KAZ Minerals PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KAZZINC JSC*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 National Mining Company Tau-Ken Samruk JSC

List of Figures

- Figure 1: Kazakhstan Mining Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Kazakhstan Mining Market Share (%) by Company 2025

List of Tables

- Table 1: Kazakhstan Mining Market Revenue billion Forecast, by Coal 2020 & 2033

- Table 2: Kazakhstan Mining Market Revenue billion Forecast, by Ferrous Metals 2020 & 2033

- Table 3: Kazakhstan Mining Market Revenue billion Forecast, by Non Ferrous Metals 2020 & 2033

- Table 4: Kazakhstan Mining Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Kazakhstan Mining Market Revenue billion Forecast, by Coal 2020 & 2033

- Table 6: Kazakhstan Mining Market Revenue billion Forecast, by Ferrous Metals 2020 & 2033

- Table 7: Kazakhstan Mining Market Revenue billion Forecast, by Non Ferrous Metals 2020 & 2033

- Table 8: Kazakhstan Mining Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kazakhstan Mining Market?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Kazakhstan Mining Market?

Key companies in the market include National Mining Company Tau-Ken Samruk JSC, NAC Kazatomprom JSC, Eurasian Resources Group S r l, ArcelorMittal S A, Kazakhmys Corporation, KAZ Minerals PLC, KAZZINC JSC*List Not Exhaustive.

3. What are the main segments of the Kazakhstan Mining Market?

The market segments include Coal, Ferrous Metals, Non Ferrous Metals.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.52 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Coal Mining to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In July 2022, Kazakhstan exported 2.85 million tons of coal and coke to the European Union (EU) countries since the beginning of this year, as its coal is suitable for their power plants. Kazakhstan exported an average of 0.81 million tons of coal to EU nations in the previous year. From January to June 2022, Kazakhstan produced 57.4 million tons of coal, 5.9% more than a year earlier, with a profit of 271 billion tenges (USD 564 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kazakhstan Mining Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kazakhstan Mining Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kazakhstan Mining Market?

To stay informed about further developments, trends, and reports in the Kazakhstan Mining Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence