Key Insights

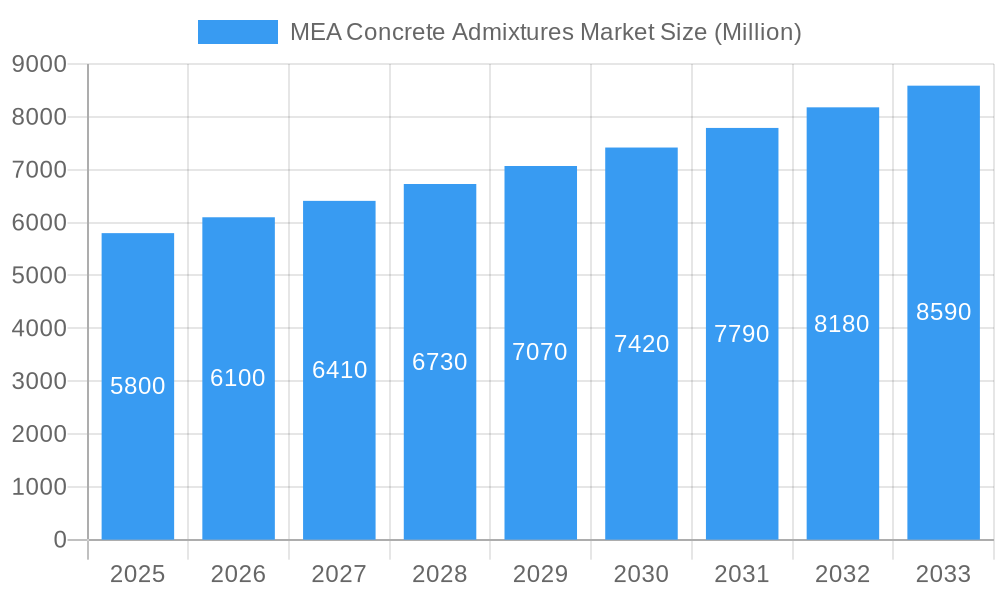

The Middle East & Africa (MEA) concrete admixtures market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 5.00% and reaching a substantial market size of approximately USD 5,800 million by 2025. This upward trajectory is significantly propelled by burgeoning infrastructure development across the region, driven by government investments in housing projects, transportation networks, and urban regeneration. Key market drivers include the increasing demand for enhanced concrete performance, such as improved workability, durability, and strength, which concrete admixtures effectively provide. The construction sector's expansion, particularly in countries like Saudi Arabia, UAE, and South Africa, is a primary catalyst. Furthermore, the growing awareness of sustainable construction practices, which concrete admixtures can facilitate by reducing cement content and improving material efficiency, is also contributing to market expansion. The trend towards the use of high-performance concrete in complex architectural designs and demanding environmental conditions further fuels the adoption of advanced admixture solutions.

MEA Concrete Admixtures Market Market Size (In Billion)

While the market exhibits strong growth potential, certain restraints need consideration. Fluctuations in raw material prices, particularly for key components like crude oil derivatives used in the production of plasticizers and superplasticizers, can impact profitability and market pricing. Economic uncertainties and political instability in some parts of the MEA region can also temporarily slow down construction activities, thereby affecting demand for concrete admixtures. However, the sustained focus on infrastructure modernization and the inherent benefits of concrete admixtures in addressing specific construction challenges are expected to outweigh these limitations. The market is segmented by function, with water reducers (plasticizers) and high-range water reducers (superplasticizers) dominating due to their widespread application in improving concrete properties. The construction sector segmentation sees commercial and infrastructure projects contributing significantly to demand.

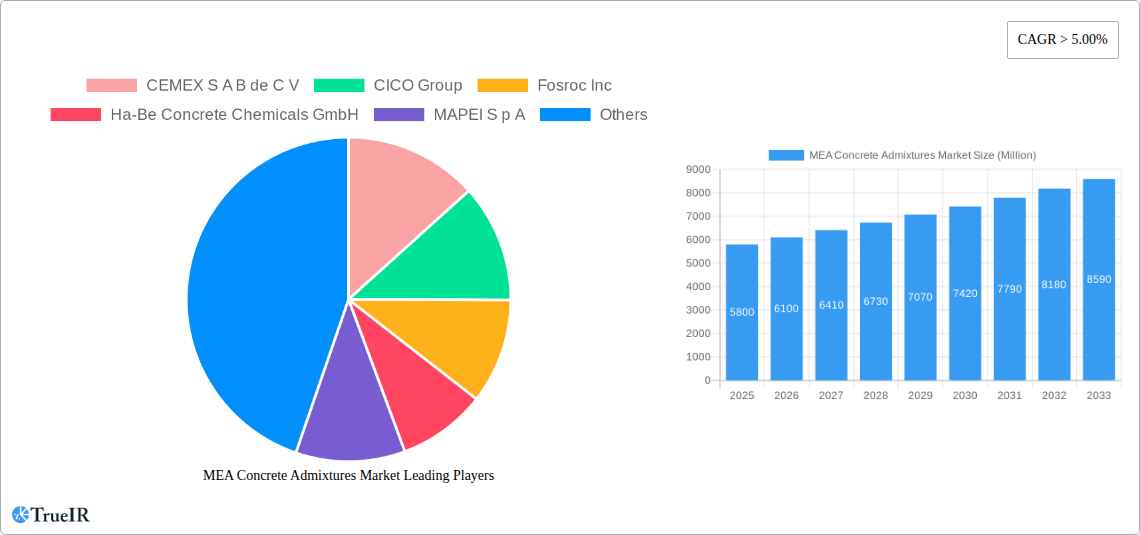

MEA Concrete Admixtures Market Company Market Share

This in-depth market research report provides a definitive analysis of the Middle East and Africa (MEA) Concrete Admixtures Market, projecting significant growth and highlighting key strategic opportunities. Covering the Study Period 2019–2033, with a Base Year of 2025 and Forecast Period of 2025–2033, this report delves into market dynamics, competitive landscape, technological innovations, and evolving end-user demands. Gain critical insights into drivers, challenges, and dominant segments that will shape the future of this vital construction chemicals sector.

MEA Concrete Admixtures Market Market Structure & Competitive Landscape

The MEA Concrete Admixtures Market is characterized by a moderately consolidated structure, with several global players and regional specialists vying for market share. Innovation remains a key driver, fueled by the increasing demand for high-performance concrete solutions that enhance durability, workability, and sustainability. Regulatory landscapes across various MEA countries are evolving, with a growing emphasis on environmental compliance and building codes that favor the adoption of advanced admixture technologies. Product substitutes, such as pre-mixed concrete with inherent performance enhancements, pose a minor threat, but the versatility and cost-effectiveness of admixtures for on-site customization maintain their strong market position. End-user segmentation reveals a significant reliance on infrastructure projects, followed by commercial and residential construction. Mergers and acquisitions are notable trends; for instance, the September 2022 acquisition of GCP Applied Technologies by Saint-Gobain for approximately USD 2.3 billion underscores consolidation efforts. The market is estimated to have witnessed over USD 500 Million in M&A activities within the historical period, indicating strategic realignments to expand product portfolios and geographical reach.

MEA Concrete Admixtures Market Market Trends & Opportunities

The MEA Concrete Admixtures Market is poised for robust expansion, driven by a confluence of megatrends and evolving construction practices. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period. This growth is underpinned by a significant increase in construction activities across the region, fueled by government investments in infrastructure development, urbanization initiatives, and a rising demand for modern residential and commercial spaces. Technological shifts are playing a pivotal role, with a growing preference for admixtures that offer enhanced properties such as reduced water content, improved strength, increased durability, and better resistance to harsh environmental conditions prevalent in many MEA regions. The adoption of high-range water reducers (superplasticizers) is particularly on the rise, enabling the production of high-strength, self-compacting concrete, thereby optimizing construction efficiency and reducing labor costs. Consumer preferences are increasingly leaning towards sustainable construction materials and practices. Concrete admixtures that contribute to reducing the carbon footprint of concrete, such as those that allow for lower cement content or improve the longevity of structures, are gaining traction. This aligns with global sustainability goals and local environmental regulations. Competitive dynamics are intensifying, with manufacturers focusing on product differentiation, technological innovation, and strategic partnerships to capture market share. The expanding construction sectors in countries like Saudi Arabia, UAE, Egypt, and South Africa are creating substantial demand. The market penetration rate for specialized admixtures is expected to rise significantly as awareness of their benefits grows. Opportunities abound for suppliers of advanced admixtures that cater to specific project requirements, including those for extreme temperature conditions, marine environments, and high-rise buildings. The potential for market growth is further amplified by the increasing use of admixtures in repair and rehabilitation projects, extending the lifespan of existing infrastructure.

Dominant Markets & Segments in MEA Concrete Admixtures Market

The MEA Concrete Admixtures Market exhibits distinct patterns of dominance across various regions and segments.

Leading Region and Country:

- Dominant Region: Middle East, particularly the Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE, Qatar), is anticipated to be the largest and fastest-growing sub-region due to extensive infrastructure projects and ambitious urban development plans.

- Key Countries: Saudi Arabia, driven by its Vision 2030 initiatives, and the UAE, with its ongoing mega-projects, will continue to lead consumption. Egypt and South Africa are also significant markets with substantial growth potential.

Dominant Segments:

- Function:

- Water Reducer (Plasticizers) and High-range Water Reducer (Superplasticizer): These categories hold the largest market share due to their widespread application in improving concrete workability, reducing water content, and enhancing strength. They are crucial for modern construction techniques demanding high-performance concrete.

- Retarders and Accelerators: These remain important for controlling concrete setting times in varying climatic conditions and for specific construction needs, like rapid construction or preventing premature setting in hot weather.

- Air-Entraining Admixtures: Their demand is growing, particularly in regions susceptible to freeze-thaw cycles or for enhancing concrete durability in corrosive environments.

- Construction Sector:

- Infrastructure: This is the most significant driver, encompassing roads, bridges, tunnels, airports, and water management systems. Government spending on infrastructure development across the MEA region is a primary catalyst.

- Commercial Construction: Includes the development of office buildings, retail spaces, hotels, and mixed-use developments, which consistently require concrete admixtures for structural integrity and aesthetic finishes.

- Residential Construction: While significant, its growth is often tied to the overall economic health and urbanization trends in the region, requiring admixtures for both large-scale housing projects and individual homes.

- Industrial and Institutional: This segment includes factories, power plants, hospitals, and educational institutions, often requiring specialized concrete admixtures for specific performance requirements and long-term durability.

Key Growth Drivers:

- Massive Infrastructure Investment: Government-led initiatives like Saudi Vision 2030, Dubai's ongoing development, and Egypt's infrastructure push are fueling unprecedented demand for construction materials, including concrete admixtures. The estimated investment in infrastructure across the MEA is projected to exceed USD 2 Trillion within the forecast period, directly translating to admixture consumption.

- Urbanization and Population Growth: Rapid population expansion necessitates continuous development of residential, commercial, and social infrastructure, driving demand for concrete and its associated admixtures.

- Technological Advancements: The adoption of advanced construction techniques like high-strength concrete, self-compacting concrete, and precast concrete elements significantly boosts the demand for sophisticated admixtures.

- Focus on Durability and Sustainability: Growing awareness and regulatory pressure for durable and sustainable construction are increasing the preference for admixtures that enhance concrete longevity, reduce material consumption, and lower carbon emissions.

- Favorable Economic Conditions and FDI: Several MEA countries are attracting foreign direct investment in the construction sector, leading to increased project pipelines and demand for high-quality construction chemicals.

MEA Concrete Admixtures Market Product Analysis

The MEA Concrete Admixtures Market is witnessing continuous product innovation focused on enhancing concrete performance and sustainability. Key advancements include the development of advanced polycarboxylate ether (PCE)-based superplasticizers offering superior water reduction and slump retention, enabling high-strength and self-consolidating concrete. Innovations also extend to admixtures that improve durability in aggressive environments, such as those resistant to sulfates and chlorides, crucial for the region's coastal infrastructure and arid climates. Developments in shrinkage-reducing admixtures are gaining prominence to mitigate cracking in large concrete structures. The competitive advantage lies in manufacturers offering tailored solutions that address specific regional challenges like extreme temperatures and the need for extended setting times. The market is seeing a rise in eco-friendly admixtures with lower volatile organic compound (VOC) content.

Key Drivers, Barriers & Challenges in MEA Concrete Admixtures Market

Key Drivers:

- Infrastructure Development Boom: Sustained government investment in large-scale infrastructure projects across the MEA region, including transportation networks, energy facilities, and urban regeneration, is the primary growth catalyst, creating consistent demand for concrete admixtures.

- Urbanization and Population Growth: The burgeoning urban populations in key MEA countries necessitate continuous expansion of residential, commercial, and public infrastructure, driving aggregate demand for construction chemicals.

- Technological Advancements: The adoption of advanced construction methods like high-strength concrete, self-compacting concrete, and precast elements, all of which rely heavily on sophisticated admixture formulations to achieve desired properties, propels market growth.

- Demand for Sustainable and Durable Construction: Increasing environmental consciousness and stringent building codes are fostering the use of admixtures that improve concrete durability, reduce cement content, and enhance overall sustainability, contributing to a stronger market presence.

Barriers & Challenges:

- Volatile Raw Material Prices: Fluctuations in the prices of key raw materials like petroleum derivatives and cement can impact manufacturing costs and profit margins for admixture producers.

- Stringent Regulatory Frameworks: Navigating diverse and evolving regulatory requirements across different MEA countries can be complex, impacting product approvals and market entry strategies.

- Supply Chain Disruptions: Geopolitical instability, logistical challenges, and limited local production capacity in some sub-regions can lead to supply chain disruptions, affecting timely delivery and project execution.

- Skilled Labor Shortage: The availability of skilled labor to properly handle and apply advanced concrete admixture technologies can sometimes be a constraint, impacting the full realization of product benefits.

- Price Sensitivity: In some segments, particularly for standard construction projects, price sensitivity can limit the adoption of higher-performing, premium admixtures.

Growth Drivers in the MEA Concrete Admixtures Market Market

The MEA Concrete Admixtures Market is propelled by several significant growth drivers. Massive infrastructure spending across countries like Saudi Arabia, the UAE, and Egypt, driven by economic diversification and urban development visions, is creating a sustained demand for construction materials. Rapid urbanization and a growing population in the region necessitate constant development of residential, commercial, and public facilities, further bolstering the need for concrete and its enhancers. Technological advancements in construction, such as the increasing use of high-strength and self-compacting concrete, directly translate to higher demand for sophisticated admixtures. Furthermore, a growing emphasis on durability and sustainability in construction is favoring admixtures that enhance concrete's lifespan and reduce its environmental impact, aligning with global trends and local regulations. The estimated market growth is approximately 6.5% CAGR.

Challenges Impacting MEA Concrete Admixtures Market Growth

Several challenges can impact the growth trajectory of the MEA Concrete Admixtures Market. Navigating complex and varied regulatory landscapes across different countries can pose hurdles for market entry and product standardization. Supply chain vulnerabilities, including logistical complexities and potential disruptions due to geopolitical factors or infrastructure limitations in certain areas, can affect product availability and timely project completion. Intense competition from both global giants and local players, coupled with price sensitivity in certain market segments, can put pressure on profit margins. Additionally, fluctuations in raw material prices and economic uncertainties in some parts of the region can create an unpredictable operating environment for manufacturers. The estimated impact of these challenges could lead to a potential slowdown of 0.5% to 1.0% in projected growth rates if not effectively managed.

Key Players Shaping the MEA Concrete Admixtures Market Market

- CEMEX S A B de C V

- CICO Group

- Fosroc Inc

- Ha-Be Concrete Chemicals GmbH

- MAPEI S p A

- Pidilite Industries Ltd

- RPM International Inc

- Saint-Gobain

- Sika AG

(List Not Exhaustive)

Significant MEA Concrete Admixtures Market Industry Milestones

- September 2022: Saint Gobain announced the acquisition of GCP Applied Technologies, a leading global provider of construction products. Saint-Gobain has acquired all of the outstanding shares of GCP Applied Technologies for USD 32.00 per share, in cash, in a transaction valued at approximately USD 2.3 billion. This strategic move enhances Saint-Gobain's presence and product portfolio in the construction chemicals sector.

- April 2021: Sika announced expansion of concrete admixture production capacity at its Doha admixture plant. The Company's goal is to position itself as a supplier of high-performance product technologies that are now produced locally and close to consumers. This expansion signifies a commitment to meeting regional demand and improving supply chain efficiency.

Future Outlook for MEA Concrete Admixtures Market Market

The future outlook for the MEA Concrete Admixtures Market is exceptionally bright, driven by sustained infrastructure development, rapid urbanization, and an increasing focus on sustainable construction practices. Strategic opportunities lie in the development and marketing of advanced admixtures that offer enhanced performance, durability, and environmental benefits. The predicted market size in 2033 is projected to exceed USD 4 Billion, with a CAGR of around 6.5% from 2025. Key growth catalysts include the ongoing mega-projects in the GCC, significant investments in affordable housing, and the growing demand for green building solutions. Manufacturers that can innovate with eco-friendly formulations, tailor products to specific regional climatic challenges, and establish robust distribution networks will be well-positioned to capitalize on this expanding market. The increasing adoption of smart construction technologies will also create demand for admixtures that enable precision and efficiency.

MEA Concrete Admixtures Market Segmentation

-

1. Function

- 1.1. Water Reducer (plasticizers)

- 1.2. Retarder

- 1.3. Accelerator

- 1.4. Air-Entraining Admixture

- 1.5. Viscosity Modifier

- 1.6. Shrinkage-reducing Admixture

- 1.7. High-range Water Reducer (superplasticizer)

- 1.8. Other Functions

-

2. Construction Sector

- 2.1. Commercial

- 2.2. Residential

- 2.3. Infrastructure

- 2.4. Industrial and Institutional

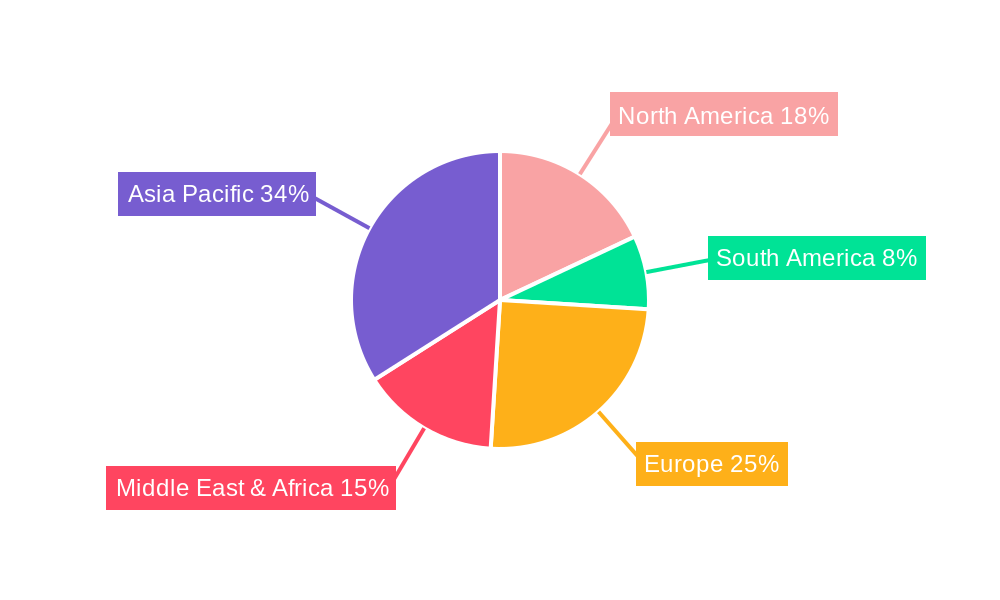

MEA Concrete Admixtures Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEA Concrete Admixtures Market Regional Market Share

Geographic Coverage of MEA Concrete Admixtures Market

MEA Concrete Admixtures Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing residential construction activities in Saudi Arabia; Strong demand for concrete admixture in residential sector

- 3.3. Market Restrains

- 3.3.1. Growing residential construction activities in Saudi Arabia; Strong demand for concrete admixture in residential sector

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Concrete Admixture in Residential Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Concrete Admixtures Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Water Reducer (plasticizers)

- 5.1.2. Retarder

- 5.1.3. Accelerator

- 5.1.4. Air-Entraining Admixture

- 5.1.5. Viscosity Modifier

- 5.1.6. Shrinkage-reducing Admixture

- 5.1.7. High-range Water Reducer (superplasticizer)

- 5.1.8. Other Functions

- 5.2. Market Analysis, Insights and Forecast - by Construction Sector

- 5.2.1. Commercial

- 5.2.2. Residential

- 5.2.3. Infrastructure

- 5.2.4. Industrial and Institutional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. North America MEA Concrete Admixtures Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Water Reducer (plasticizers)

- 6.1.2. Retarder

- 6.1.3. Accelerator

- 6.1.4. Air-Entraining Admixture

- 6.1.5. Viscosity Modifier

- 6.1.6. Shrinkage-reducing Admixture

- 6.1.7. High-range Water Reducer (superplasticizer)

- 6.1.8. Other Functions

- 6.2. Market Analysis, Insights and Forecast - by Construction Sector

- 6.2.1. Commercial

- 6.2.2. Residential

- 6.2.3. Infrastructure

- 6.2.4. Industrial and Institutional

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. South America MEA Concrete Admixtures Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Water Reducer (plasticizers)

- 7.1.2. Retarder

- 7.1.3. Accelerator

- 7.1.4. Air-Entraining Admixture

- 7.1.5. Viscosity Modifier

- 7.1.6. Shrinkage-reducing Admixture

- 7.1.7. High-range Water Reducer (superplasticizer)

- 7.1.8. Other Functions

- 7.2. Market Analysis, Insights and Forecast - by Construction Sector

- 7.2.1. Commercial

- 7.2.2. Residential

- 7.2.3. Infrastructure

- 7.2.4. Industrial and Institutional

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Europe MEA Concrete Admixtures Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Water Reducer (plasticizers)

- 8.1.2. Retarder

- 8.1.3. Accelerator

- 8.1.4. Air-Entraining Admixture

- 8.1.5. Viscosity Modifier

- 8.1.6. Shrinkage-reducing Admixture

- 8.1.7. High-range Water Reducer (superplasticizer)

- 8.1.8. Other Functions

- 8.2. Market Analysis, Insights and Forecast - by Construction Sector

- 8.2.1. Commercial

- 8.2.2. Residential

- 8.2.3. Infrastructure

- 8.2.4. Industrial and Institutional

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Middle East & Africa MEA Concrete Admixtures Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Water Reducer (plasticizers)

- 9.1.2. Retarder

- 9.1.3. Accelerator

- 9.1.4. Air-Entraining Admixture

- 9.1.5. Viscosity Modifier

- 9.1.6. Shrinkage-reducing Admixture

- 9.1.7. High-range Water Reducer (superplasticizer)

- 9.1.8. Other Functions

- 9.2. Market Analysis, Insights and Forecast - by Construction Sector

- 9.2.1. Commercial

- 9.2.2. Residential

- 9.2.3. Infrastructure

- 9.2.4. Industrial and Institutional

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Asia Pacific MEA Concrete Admixtures Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Water Reducer (plasticizers)

- 10.1.2. Retarder

- 10.1.3. Accelerator

- 10.1.4. Air-Entraining Admixture

- 10.1.5. Viscosity Modifier

- 10.1.6. Shrinkage-reducing Admixture

- 10.1.7. High-range Water Reducer (superplasticizer)

- 10.1.8. Other Functions

- 10.2. Market Analysis, Insights and Forecast - by Construction Sector

- 10.2.1. Commercial

- 10.2.2. Residential

- 10.2.3. Infrastructure

- 10.2.4. Industrial and Institutional

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CEMEX S A B de C V

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CICO Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fosroc Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ha-Be Concrete Chemicals GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MAPEI S p A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pidilite Industries Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RPM International Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Saint-Gobain

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sika AG*List Not Exhaustive 6 5 **List not Exhaustiv

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 CEMEX S A B de C V

List of Figures

- Figure 1: Global MEA Concrete Admixtures Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America MEA Concrete Admixtures Market Revenue (undefined), by Function 2025 & 2033

- Figure 3: North America MEA Concrete Admixtures Market Revenue Share (%), by Function 2025 & 2033

- Figure 4: North America MEA Concrete Admixtures Market Revenue (undefined), by Construction Sector 2025 & 2033

- Figure 5: North America MEA Concrete Admixtures Market Revenue Share (%), by Construction Sector 2025 & 2033

- Figure 6: North America MEA Concrete Admixtures Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America MEA Concrete Admixtures Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America MEA Concrete Admixtures Market Revenue (undefined), by Function 2025 & 2033

- Figure 9: South America MEA Concrete Admixtures Market Revenue Share (%), by Function 2025 & 2033

- Figure 10: South America MEA Concrete Admixtures Market Revenue (undefined), by Construction Sector 2025 & 2033

- Figure 11: South America MEA Concrete Admixtures Market Revenue Share (%), by Construction Sector 2025 & 2033

- Figure 12: South America MEA Concrete Admixtures Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America MEA Concrete Admixtures Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe MEA Concrete Admixtures Market Revenue (undefined), by Function 2025 & 2033

- Figure 15: Europe MEA Concrete Admixtures Market Revenue Share (%), by Function 2025 & 2033

- Figure 16: Europe MEA Concrete Admixtures Market Revenue (undefined), by Construction Sector 2025 & 2033

- Figure 17: Europe MEA Concrete Admixtures Market Revenue Share (%), by Construction Sector 2025 & 2033

- Figure 18: Europe MEA Concrete Admixtures Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe MEA Concrete Admixtures Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa MEA Concrete Admixtures Market Revenue (undefined), by Function 2025 & 2033

- Figure 21: Middle East & Africa MEA Concrete Admixtures Market Revenue Share (%), by Function 2025 & 2033

- Figure 22: Middle East & Africa MEA Concrete Admixtures Market Revenue (undefined), by Construction Sector 2025 & 2033

- Figure 23: Middle East & Africa MEA Concrete Admixtures Market Revenue Share (%), by Construction Sector 2025 & 2033

- Figure 24: Middle East & Africa MEA Concrete Admixtures Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa MEA Concrete Admixtures Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific MEA Concrete Admixtures Market Revenue (undefined), by Function 2025 & 2033

- Figure 27: Asia Pacific MEA Concrete Admixtures Market Revenue Share (%), by Function 2025 & 2033

- Figure 28: Asia Pacific MEA Concrete Admixtures Market Revenue (undefined), by Construction Sector 2025 & 2033

- Figure 29: Asia Pacific MEA Concrete Admixtures Market Revenue Share (%), by Construction Sector 2025 & 2033

- Figure 30: Asia Pacific MEA Concrete Admixtures Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific MEA Concrete Admixtures Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 2: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Construction Sector 2020 & 2033

- Table 3: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 5: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Construction Sector 2020 & 2033

- Table 6: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 11: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Construction Sector 2020 & 2033

- Table 12: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 17: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Construction Sector 2020 & 2033

- Table 18: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 29: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Construction Sector 2020 & 2033

- Table 30: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Function 2020 & 2033

- Table 38: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Construction Sector 2020 & 2033

- Table 39: Global MEA Concrete Admixtures Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific MEA Concrete Admixtures Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Concrete Admixtures Market?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the MEA Concrete Admixtures Market?

Key companies in the market include CEMEX S A B de C V, CICO Group, Fosroc Inc, Ha-Be Concrete Chemicals GmbH, MAPEI S p A, Pidilite Industries Ltd, RPM International Inc, Saint-Gobain, Sika AG*List Not Exhaustive 6 5 **List not Exhaustiv.

3. What are the main segments of the MEA Concrete Admixtures Market?

The market segments include Function, Construction Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing residential construction activities in Saudi Arabia; Strong demand for concrete admixture in residential sector.

6. What are the notable trends driving market growth?

Increasing Demand for Concrete Admixture in Residential Construction.

7. Are there any restraints impacting market growth?

Growing residential construction activities in Saudi Arabia; Strong demand for concrete admixture in residential sector.

8. Can you provide examples of recent developments in the market?

September 2022: Saint Gobain announced the acquisition of GCP Applied Technologies, a leading global provider of construction products. Saint-Gobain has acquired all of the outstanding shares of GCP Applied Technologies for USD 32.00 per share, in cash, in a transaction valued at approximately USD 2.3 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Concrete Admixtures Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Concrete Admixtures Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Concrete Admixtures Market?

To stay informed about further developments, trends, and reports in the MEA Concrete Admixtures Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence