Key Insights

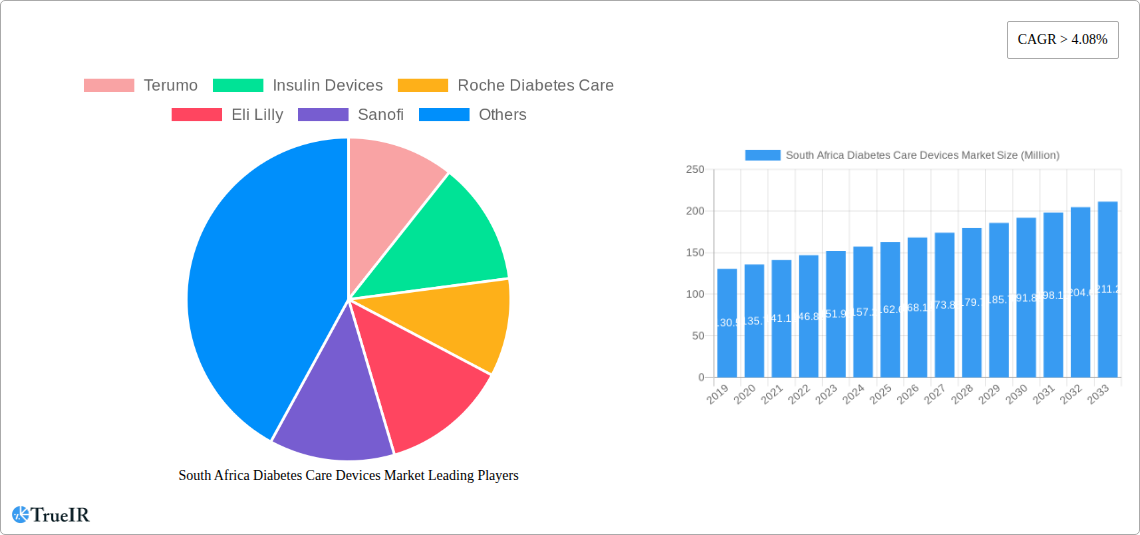

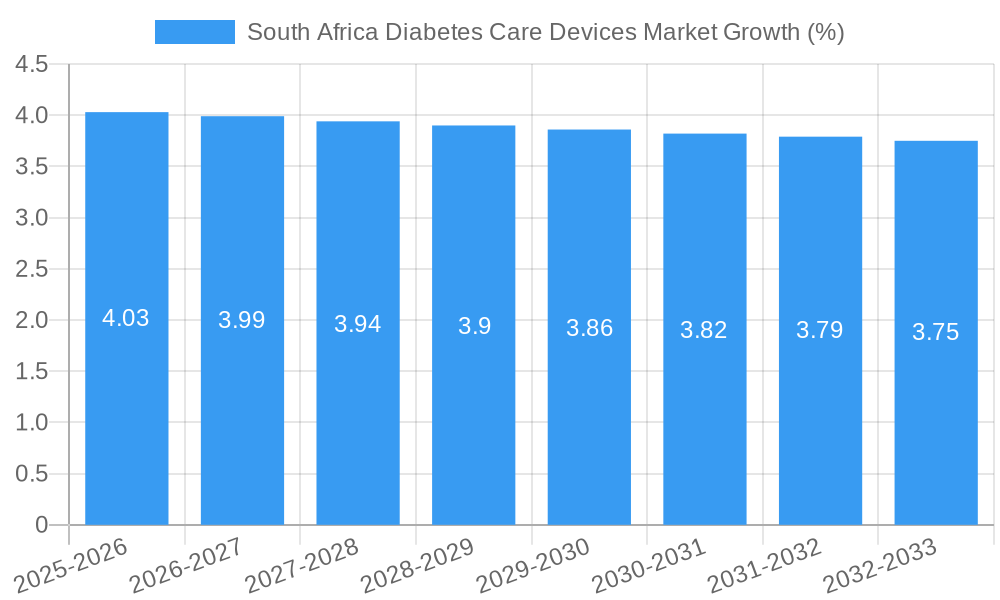

The South African diabetes care devices market is poised for substantial growth, projected to reach an estimated USD 172.45 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) exceeding 4.08% through 2033. This expansion is primarily fueled by the increasing prevalence of diabetes within the nation, driven by evolving lifestyles, sedentary habits, and dietary changes. A growing awareness among patients regarding proactive diabetes management, coupled with advancements in medical technology offering more accurate and convenient monitoring and delivery solutions, further underpins this positive market trajectory. The demand for innovative insulin delivery systems, such as insulin pumps and advanced insulin pens, is on the rise, offering improved glycemic control and enhanced quality of life for individuals living with diabetes. Similarly, the burgeoning adoption of continuous glucose monitoring (CGM) systems, providing real-time insights into blood glucose levels, is significantly contributing to market expansion, empowering patients and healthcare providers with better decision-making capabilities.

The market segmentation reveals a dynamic landscape. Within management devices, insulin pumps, encompassing both tethered and tubeless technologies, are witnessing increased uptake, driven by their potential for automated insulin delivery and improved personalization. Insulin pens, including both reusable and disposable options, also hold a significant market share, offering convenience and ease of use. Insulin syringes continue to be a staple, particularly in certain demographics, while jet injectors offer an alternative needle-free delivery method. On the monitoring front, self-monitoring blood glucose devices, including glucometers and their associated test strips and lancets, remain foundational. However, the rapid evolution and increasing accessibility of Continuous Glucose Monitoring (CGM) devices, comprising sensors, receivers, and transmitters, are set to revolutionize diabetes management. The competitive landscape features key global players such as Terumo, Roche Diabetes Care, Eli Lilly, Sanofi, Abbott Diabetes Care, Becton Dickinson, Medtronic, LifeScan (Johnson & Johnson), Novo Nordisk A/S, and Arkray, all vying to capture market share through innovation and strategic partnerships.

South Africa Diabetes Care Devices Market: Comprehensive Analysis and Forecast (2019–2033)

This report offers an in-depth analysis of the South African diabetes care devices market, providing critical insights for stakeholders, investors, and industry professionals. Leveraging high-volume SEO keywords, this report is optimized for maximum discoverability by audiences seeking comprehensive data on diabetes management solutions in South Africa.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

South Africa Diabetes Care Devices Market Market Structure & Competitive Landscape

The South African diabetes care devices market exhibits a moderately concentrated structure, characterized by the presence of global leaders alongside emerging local players. Innovation drivers are primarily focused on enhancing accuracy, user-friendliness, and affordability of both management and monitoring devices. Regulatory impacts, while present, are generally supportive of market growth, with a growing emphasis on accessible diabetes care solutions. Product substitutes exist, particularly in the realm of traditional methods, but advancements in technology are rapidly diminishing their relevance. End-user segmentation reveals distinct needs across Type 1 and Type 2 diabetes patients, as well as varying adoption rates based on socioeconomic factors. Mergers and acquisitions (M&A) are infrequent but strategic, aimed at expanding product portfolios and market reach. For instance, the market concentration is estimated to be around 65% by the top five players in 2025. While specific M&A volumes are not publicly disclosed, industry sentiment suggests a potential for consolidation in the coming years as companies seek to leverage economies of scale. The competitive landscape is dynamic, with companies continuously investing in R&D to gain a competitive edge.

South Africa Diabetes Care Devices Market Market Trends & Opportunities

The South African diabetes care devices market is on a significant growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033, reaching an estimated market size of over $XXX million by 2033. This robust growth is fueled by a confluence of factors, including the escalating prevalence of diabetes within the population, a heightened awareness regarding proactive diabetes management, and an increasing demand for advanced, user-friendly devices. Technological shifts are playing a pivotal role, with a pronounced movement towards continuous glucose monitoring (CGM) systems and smart insulin pens. These innovations offer real-time data, improved insights into glycemic control, and enhanced convenience for patients, thereby driving adoption. Consumer preferences are increasingly leaning towards personalized and integrated diabetes care solutions, where devices seamlessly connect with mobile applications and healthcare providers, facilitating better treatment adherence and outcomes. The competitive dynamics are intensifying, with key players investing heavily in research and development to introduce next-generation products that address unmet clinical needs and offer superior value propositions. The growing focus on preventative healthcare and the rising burden of diabetes-related complications are further bolstering the market. Opportunities abound for companies that can deliver cost-effective and accessible solutions, particularly for lower-income segments of the population. Furthermore, strategic partnerships between device manufacturers, healthcare providers, and government initiatives are crucial for expanding market penetration and ensuring equitable access to diabetes care technologies across the nation. The market penetration rate for advanced monitoring devices is expected to rise from 15% in 2025 to over 30% by 2033, indicating a significant shift in consumer behavior and technological adoption.

Dominant Markets & Segments in South Africa Diabetes Care Devices Market

The South African diabetes care devices market is dominated by Monitoring Devices, particularly those related to Self-monitoring Blood Glucose (SMBG). Within SMBG, Blood Glucose Test Strips hold a substantial market share due to their widespread use and established familiarity among patients and healthcare professionals. The market for Glucometer Devices also remains strong, driven by the continuous need for home-based blood glucose measurement. However, the fastest-growing segment is Continuous Glucose Monitoring (CGM), which includes Sensors and Durables (Receivers and Transmitters). This surge is attributed to their ability to provide a more comprehensive glycemic picture, enabling proactive management and reducing the risk of severe hypo- and hyperglycemia.

- Key Growth Drivers for Monitoring Devices:

- Rising Diabetes Prevalence: South Africa faces a significant and increasing burden of diabetes, driving demand for effective monitoring solutions.

- Technological Advancements: Innovations in sensor accuracy, data connectivity, and ease of use are making CGMs more attractive.

- Increased Health Awareness: Growing patient awareness about the benefits of continuous monitoring for better diabetes management.

- Government and NGO Initiatives: Programs aimed at improving diabetes care access, including potential subsidies for monitoring devices.

- Insurance Coverage: Gradual expansion of insurance coverage for advanced diabetes technologies.

Among Management Devices, Insulin Pens are a dominant segment, with strong demand for both Cartridges in Reusable Pens and Insulin Disposable Pens. These offer a more convenient and accurate alternative to traditional insulin syringes. While Insulin Syringes still hold a significant share due to their affordability, their market share is gradually declining. Insulin Pumps, particularly Tethered Insulin Pumps (though Tubeless Insulin Pump technology is gaining traction), represent a niche but high-value segment, catering to individuals requiring more sophisticated insulin delivery. The Infusion Set component of insulin pumps is also a key revenue generator.

- Key Growth Drivers for Management Devices:

- Improved Insulin Delivery: Insulin pens offer better precision and ease of use compared to syringes.

- Patient Convenience: Disposable pens and smart pen technology enhance user experience.

- Growing Adoption of Insulin Pump Therapy: For individuals with Type 1 diabetes and some Type 2 diabetes patients requiring intensive insulin therapy.

- Focus on Glycemic Control: Advanced delivery systems contribute to better blood sugar management.

South Africa Diabetes Care Devices Market Product Analysis

The South African diabetes care devices market is characterized by continuous product innovation aimed at improving accuracy, usability, and connectivity. Innovations in Self-monitoring Blood Glucose (SMBG) include smaller, faster-testing glucometers and test strips with enhanced accuracy. In Continuous Glucose Monitoring (CGM), the focus is on longer-wear sensors, seamless data transmission to smartphones, and integrated algorithms for predictive alerts. For Insulin Pens, advancements include pre-filled disposable pens, pens with dose memory, and connectivity features for tracking insulin usage. Insulin Pumps are evolving towards smaller, more discreet designs, improved infusion set technology for comfort, and advanced algorithms for automated insulin delivery. The competitive advantage lies with products offering comprehensive data insights, user-friendly interfaces, and integration into digital health ecosystems, thereby empowering patients and healthcare providers for more effective diabetes management.

Key Drivers, Barriers & Challenges in South Africa Diabetes Care Devices Market

Key Drivers:

- Technological Advancements: Continuous innovation in SMBG, CGM, and insulin delivery systems offering improved accuracy and user experience.

- Increasing Diabetes Prevalence: A growing patient population in South Africa necessitates a greater demand for diabetes management and monitoring solutions.

- Growing Health Awareness: Increased understanding among individuals about the importance of proactive diabetes management and early detection.

- Government and Healthcare Initiatives: Supportive policies and programs aimed at improving diabetes care access and affordability.

- Economic Growth: Rising disposable incomes in certain segments of the population can lead to higher adoption of advanced devices.

Key Barriers & Challenges:

- High Cost of Advanced Devices: The significant price point of CGMs and insulin pumps can be a major deterrent for many patients, particularly in lower-income brackets.

- Limited Reimbursement and Insurance Coverage: Inadequate or inconsistent insurance coverage for advanced diabetes technologies restricts accessibility.

- Infrastructure and Access Issues: Uneven distribution of healthcare facilities and trained professionals across different regions can limit access to devices and support.

- Regulatory Hurdles: Stringent approval processes for new medical devices can lead to delays in market entry.

- Lack of Technical Expertise and Training: Insufficient availability of healthcare professionals trained in the use and troubleshooting of advanced diabetes devices.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and affordability of essential diabetes care products.

Growth Drivers in the South Africa Diabetes Care Devices Market Market

The South African diabetes care devices market is propelled by several key growth drivers. Foremost is the ever-increasing prevalence of diabetes across all age groups, creating a sustained demand for effective management and monitoring solutions. Technological innovations continue to be a major catalyst, with advancements in continuous glucose monitoring (CGM) offering real-time data and predictive insights, and smarter insulin delivery systems enhancing patient convenience and control. Rising health consciousness among the South African population, coupled with greater awareness of the long-term complications of uncontrolled diabetes, is driving proactive engagement with health management tools. Furthermore, government and non-governmental organization (NGO) initiatives aimed at improving diabetes care accessibility, though still evolving, are contributing to market expansion. The gradual increase in disposable incomes within certain segments of the population also supports the adoption of more advanced and often pricier diabetes care devices.

Challenges Impacting South Africa Diabetes Care Devices Market Growth

Despite the positive growth outlook, several challenges impact the South African diabetes care devices market. The high cost of advanced technologies, such as continuous glucose monitors and insulin pumps, remains a significant barrier to widespread adoption, particularly for a large portion of the population facing economic constraints. Limited and inconsistent reimbursement policies from medical aid providers further exacerbate this issue, restricting access to these crucial devices. Uneven healthcare infrastructure across urban and rural areas means that access to devices, as well as the necessary training and support for their use, is not uniformly available. Regulatory complexities and the time taken for device approvals can also slow down the introduction of innovative products. Finally, competition from lower-cost, less technologically advanced alternatives continues to exist, though the superior benefits of modern devices are gradually shifting preferences.

Key Players Shaping the South Africa Diabetes Care Devices Market Market

- Terumo

- Roche Diabetes Care

- Eli Lilly

- Sanofi

- Abbott Diabetes Care

- Becton Dickinson

- Medtronic

- LifeScan (Johnson & Johnson)

- Novo Nordisk A/S

- Arkray

Significant South Africa Diabetes Care Devices Market Industry Milestones

- December 2022: FIND, the global alliance for diagnostics, received USD3.5 million from the Leona M. and Harry B. Helmsley Charitable Trust for a 3-year period. This grant aims to enhance the availability of continuous glucose monitoring devices (CGMs) in Kenya and South Africa, supporting the ACCEDE initiative for improved diabetes management in low- and middle-income countries (LMICs).

- September 2022: Abbott announced new data from the Real-World Evidence of the FreeStyle Libre study, demonstrating that using their continuous glucose monitoring system significantly reduced hospitalizations due to acute diabetes events for individuals with Type 2 diabetes on once-daily basal insulin therapy.

Future Outlook for South Africa Diabetes Care Devices Market Market

The future outlook for the South African diabetes care devices market is promising, driven by a robust pipeline of technological advancements and a growing recognition of the importance of proactive diabetes management. The increasing adoption of continuous glucose monitoring (CGM) systems and the continued innovation in smart insulin delivery devices are expected to be significant growth catalysts. Opportunities exist for companies that can address the market's price sensitivity through innovative pricing models, strategic partnerships for wider distribution, and by focusing on products that offer demonstrable improvements in patient outcomes and quality of life. The market is poised for growth as awareness of diabetes' impact intensifies and as healthcare systems increasingly embrace digital health solutions to manage chronic diseases more effectively, ultimately leading to better health equity and reduced long-term healthcare costs.

South Africa Diabetes Care Devices Market Segmentation

-

1. Management Devices

-

1.1. Insulin Pump

-

1.1.1. Technology

- 1.1.1.1. Tethered Insulin Pump

- 1.1.1.2. Tubeless Insulin Pump

-

1.1.2. Component

- 1.1.2.1. Insulin Pump Device

- 1.1.2.2. Insulin Pump Reservoir

- 1.1.2.3. Infusion Set

-

1.1.1. Technology

-

1.2. Insulin pens

- 1.2.1. Cartridges in Reusable Pens

- 1.2.2. Insulin Disposable Pens

- 1.3. Insulin Syringes

- 1.4. Jet Injectors

-

1.1. Insulin Pump

-

2. Monitoring Devices

-

2.1. Self-monitoring Blood Glucose

- 2.1.1. Glucometer Devices

- 2.1.2. Blood Glucose Test Strips

- 2.1.3. Lancets

-

2.2. Continuous Glucose Monitoring

- 2.2.1. Sensors

- 2.2.2. Durables (Receivers and Transmitters)

-

2.1. Self-monitoring Blood Glucose

South Africa Diabetes Care Devices Market Segmentation By Geography

- 1. South Africa

South Africa Diabetes Care Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.08% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Increasing Diabetes Prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Diabetes Care Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Management Devices

- 5.1.1. Insulin Pump

- 5.1.1.1. Technology

- 5.1.1.1.1. Tethered Insulin Pump

- 5.1.1.1.2. Tubeless Insulin Pump

- 5.1.1.2. Component

- 5.1.1.2.1. Insulin Pump Device

- 5.1.1.2.2. Insulin Pump Reservoir

- 5.1.1.2.3. Infusion Set

- 5.1.1.1. Technology

- 5.1.2. Insulin pens

- 5.1.2.1. Cartridges in Reusable Pens

- 5.1.2.2. Insulin Disposable Pens

- 5.1.3. Insulin Syringes

- 5.1.4. Jet Injectors

- 5.1.1. Insulin Pump

- 5.2. Market Analysis, Insights and Forecast - by Monitoring Devices

- 5.2.1. Self-monitoring Blood Glucose

- 5.2.1.1. Glucometer Devices

- 5.2.1.2. Blood Glucose Test Strips

- 5.2.1.3. Lancets

- 5.2.2. Continuous Glucose Monitoring

- 5.2.2.1. Sensors

- 5.2.2.2. Durables (Receivers and Transmitters)

- 5.2.1. Self-monitoring Blood Glucose

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Management Devices

- 6. South Africa South Africa Diabetes Care Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Diabetes Care Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Diabetes Care Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Diabetes Care Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Diabetes Care Devices Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Diabetes Care Devices Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Terumo

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Insulin Devices

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Roche Diabetes Care

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Eli Lilly

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Sanofi

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Abbott Diabetes Care

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Becton Dickinson

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Medtronic

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 LifeScan (Johnson & Johnson)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Novo Nordisk A/S

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Arkray

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Terumo

List of Figures

- Figure 1: South Africa Diabetes Care Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Diabetes Care Devices Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Diabetes Care Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Diabetes Care Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: South Africa Diabetes Care Devices Market Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 4: South Africa Diabetes Care Devices Market Volume K Unit Forecast, by Management Devices 2019 & 2032

- Table 5: South Africa Diabetes Care Devices Market Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 6: South Africa Diabetes Care Devices Market Volume K Unit Forecast, by Monitoring Devices 2019 & 2032

- Table 7: South Africa Diabetes Care Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South Africa Diabetes Care Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: South Africa Diabetes Care Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South Africa Diabetes Care Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: South Africa South Africa Diabetes Care Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa South Africa Diabetes Care Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Sudan South Africa Diabetes Care Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan South Africa Diabetes Care Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Uganda South Africa Diabetes Care Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda South Africa Diabetes Care Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Tanzania South Africa Diabetes Care Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania South Africa Diabetes Care Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Kenya South Africa Diabetes Care Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya South Africa Diabetes Care Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa South Africa Diabetes Care Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa South Africa Diabetes Care Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: South Africa Diabetes Care Devices Market Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 24: South Africa Diabetes Care Devices Market Volume K Unit Forecast, by Management Devices 2019 & 2032

- Table 25: South Africa Diabetes Care Devices Market Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 26: South Africa Diabetes Care Devices Market Volume K Unit Forecast, by Monitoring Devices 2019 & 2032

- Table 27: South Africa Diabetes Care Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: South Africa Diabetes Care Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Diabetes Care Devices Market?

The projected CAGR is approximately > 4.08%.

2. Which companies are prominent players in the South Africa Diabetes Care Devices Market?

Key companies in the market include Terumo, Insulin Devices, Roche Diabetes Care, Eli Lilly, Sanofi, Abbott Diabetes Care, Becton Dickinson, Medtronic, LifeScan (Johnson & Johnson), Novo Nordisk A/S, Arkray.

3. What are the main segments of the South Africa Diabetes Care Devices Market?

The market segments include Management Devices, Monitoring Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Increasing Diabetes Prevalence.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

December 2022: IND, the global alliance for diagnostics, and the Leona M. and Harry B. Helmsley Charitable Trust have jointly announced that FIND has been granted USD3.5 million by Helmsley for a period of 3 years. This grant aims to enhance the availability of continuous glucose monitoring devices (CGMs) in Kenya and South Africa, thereby improving the management of diabetes. The initiative, known as ACCEDE (ACcess to CGMs for Equity in Diabetes management), encompasses various interventions such as enhancing the affordability of CGMs, strengthening capacity in diabetes management, and generating supportive evidence for the utilization of CGMs in low- and middle-income countries (LMICs).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Diabetes Care Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Diabetes Care Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Diabetes Care Devices Market?

To stay informed about further developments, trends, and reports in the South Africa Diabetes Care Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence