Key Insights

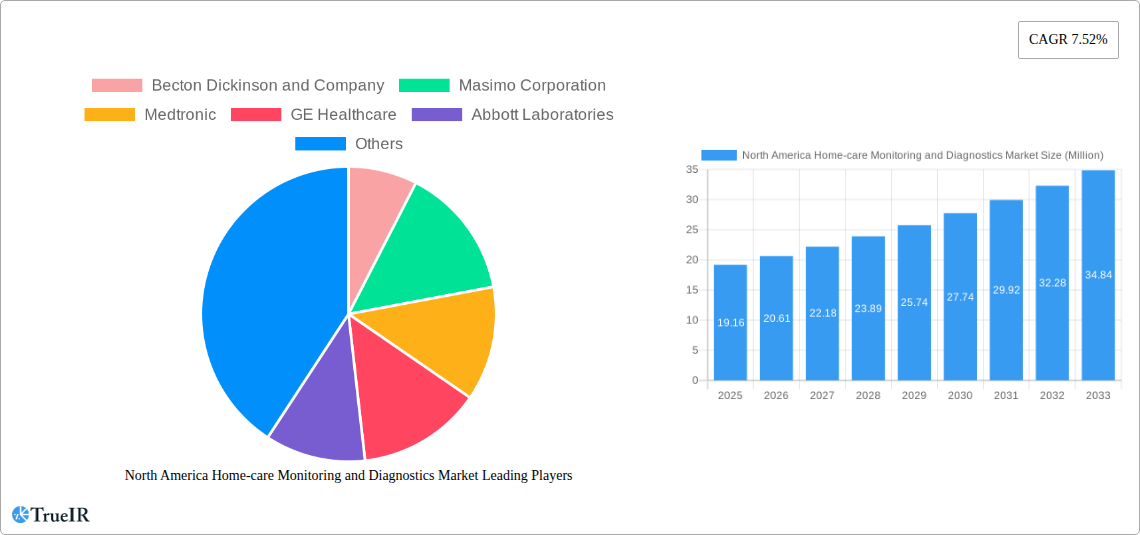

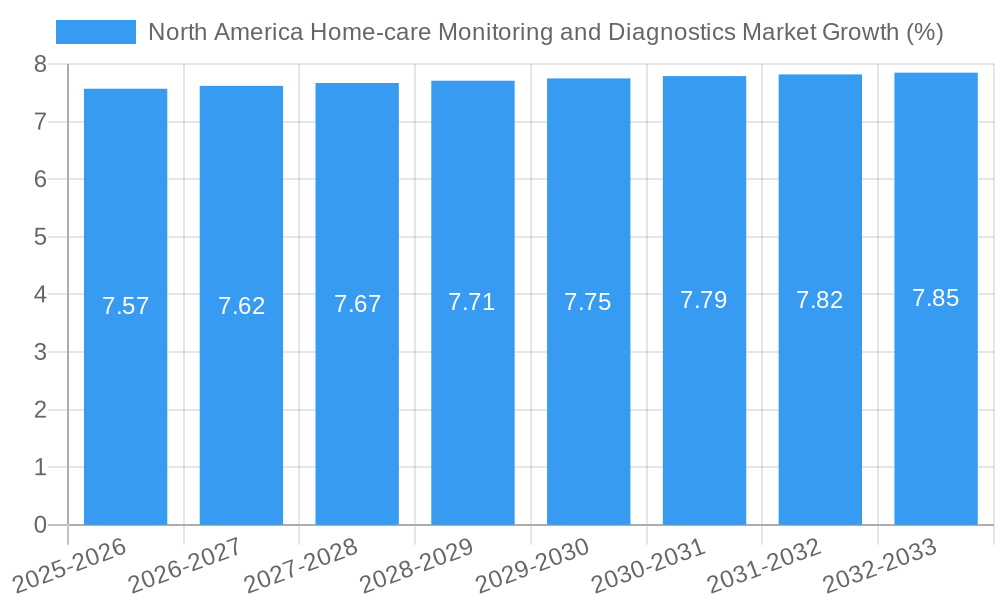

The North America Home-care Monitoring and Diagnostics Market is poised for significant expansion, projected to reach USD 19.16 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.52% anticipated through 2033. This dynamic growth is propelled by a confluence of factors, chief among them being the increasing prevalence of chronic diseases, a growing aging population, and a pronounced shift towards patient-centric care models. Advancements in technology are democratizing access to sophisticated diagnostic tools, enabling individuals to monitor their health proactively from the comfort of their homes. This transition is further fueled by supportive government initiatives and reimbursement policies that encourage the adoption of home-based healthcare solutions. The market is witnessing a surge in demand for connected devices that facilitate seamless data transmission to healthcare providers, fostering timely interventions and personalized treatment plans. Key therapeutic areas driving this growth include cardiology, neurology, and respiratory care, where continuous monitoring can significantly improve patient outcomes and reduce hospital readmissions. The ongoing technological innovation in areas like AI-powered diagnostics and miniaturized wearable sensors are also instrumental in shaping the market's trajectory.

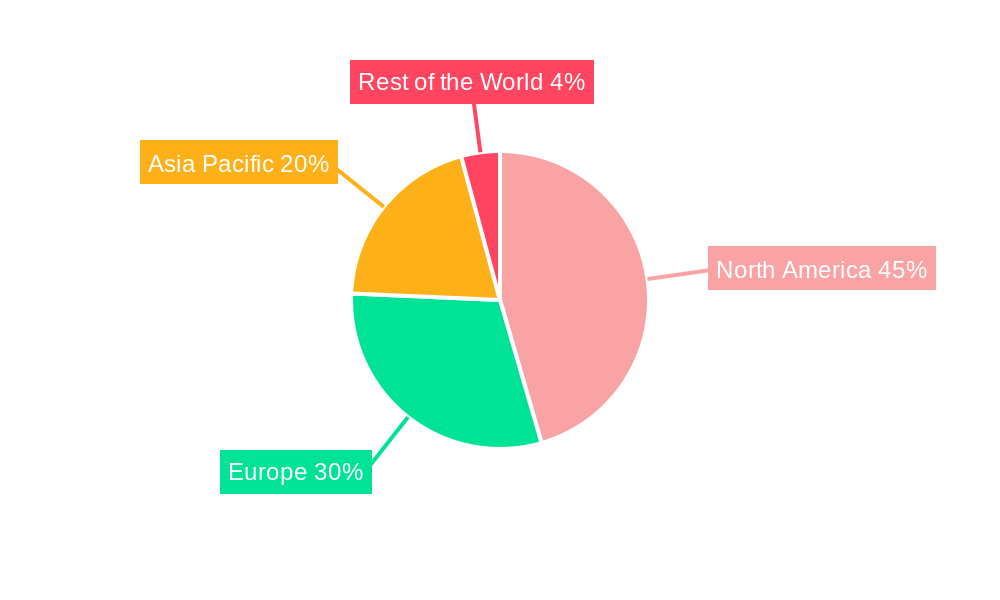

The market's expansion is primarily driven by the increasing adoption of hemodynamic monitoring devices, cardiac monitoring devices, and remote patient monitoring devices, catering to the growing needs in cardiology and remote monitoring applications. While the market exhibits strong growth potential, it faces certain restraints, including data security and privacy concerns, the need for robust regulatory frameworks, and the initial cost of some advanced monitoring systems. However, the enduring trend towards preventative healthcare, coupled with rising health consciousness among consumers, is expected to outweigh these challenges. Home healthcare settings are emerging as a significant end-user segment, benefiting from the convenience and cost-effectiveness offered by these monitoring solutions. Hospitals and clinics are also integrating these technologies to extend care beyond their physical premises, thereby enhancing patient engagement and managing chronic conditions more effectively. The North American region, encompassing the United States, Canada, and Mexico, is expected to maintain its leadership position due to its advanced healthcare infrastructure, high adoption rates of technology, and significant investments in healthcare innovation.

This comprehensive report delves into the dynamic North America Home-care Monitoring and Diagnostics Market, forecasting robust growth from 2025 through 2033, building upon historical data from 2019–2024. The base year of 2025 serves as a crucial benchmark for our estimations. We meticulously analyze key market segments including Hemodynamic Monitoring Devices, Neuro-Monitoring Devices, Cardiac-Monitoring Devices, Multi-parameters Monitors, Respiratory Monitoring Devices, Remote Patient Monitoring Devices, and Other Devices. Furthermore, we explore the market's application landscape across Cardiology, Neurology, Respiratory, Fetal & Neonatal, Remote Monitoring, and Weight Management & Fitness Monitoring, while also dissecting the end-user segments comprising Home Healthcare, Hospitals & Clinics, and Other End Users. Geographically, the report zeroes in on North America, specifically the United States, Canada, and Mexico. This report is engineered for industry professionals seeking in-depth insights into market dynamics, competitive strategies, and future growth trajectories.

North America Home-care Monitoring and Diagnostics Market Market Structure & Competitive Landscape

The North America Home-care Monitoring and Diagnostics Market exhibits a moderately consolidated structure, characterized by the presence of both global giants and specialized innovators. Key players like Becton Dickinson and Company, Masimo Corporation, Medtronic, GE Healthcare, Abbott Laboratories, Omron Corporation, Johnson & Johnson, Boston Scientific Corporation, and Baxter International Inc are actively engaged in driving innovation and expanding market reach. The competitive landscape is shaped by relentless product development, strategic partnerships, and a keen focus on addressing the increasing demand for convenient and effective remote healthcare solutions. Innovation drivers are primarily centered on miniaturization of devices, enhanced data accuracy, seamless connectivity, and the integration of artificial intelligence for predictive diagnostics. Regulatory impacts, though stringent, are also fostering innovation by mandating higher safety and efficacy standards. Product substitutes are emerging, particularly in the form of wearable consumer-grade devices, though their clinical validation remains a key differentiator for established players. End-user segmentation reveals a strong preference for home healthcare solutions driven by an aging population and the growing prevalence of chronic diseases. Mergers and acquisitions (M&A) trends are anticipated to continue as larger companies seek to acquire innovative technologies and expand their portfolios, further consolidating the market. The concentration ratio is estimated to be around 0.65, indicating a significant market share held by the top five players. M&A volumes in the historical period (2019-2024) averaged 5 significant deals per year.

North America Home-care Monitoring and Diagnostics Market Market Trends & Opportunities

The North America Home-care Monitoring and Diagnostics Market is poised for substantial expansion, driven by a confluence of favorable trends and emerging opportunities. The market size is projected to witness a compound annual growth rate (CAGR) of approximately 9.5% during the forecast period 2025–2033, reaching an estimated value of USD 25,000 Million by 2033. This robust growth trajectory is underpinned by a significant increase in the adoption of remote patient monitoring (RPM) devices. Technological shifts are central to this expansion, with advancements in wireless connectivity, miniaturization of sensors, and sophisticated data analytics enabling more accurate and accessible healthcare outside traditional clinical settings. The proliferation of smartphones and other connected devices has further facilitated the integration of home-care monitoring solutions into daily life, enhancing patient engagement and compliance. Consumer preferences are increasingly leaning towards proactive health management and early disease detection, creating a strong demand for user-friendly and integrated diagnostic tools. The growing awareness of the benefits of home-based care, including reduced healthcare costs, improved patient comfort, and better management of chronic conditions like cardiovascular diseases and diabetes, is a significant opportunity for market players. The surge in telehealth services, accelerated by global health events, has normalized the use of remote monitoring technologies and created a receptive environment for these solutions. Furthermore, the increasing prevalence of an aging population in North America, coupled with a rising burden of chronic diseases, necessitates continuous monitoring and timely interventions, making home-care monitoring and diagnostics indispensable. The development of AI-powered diagnostic algorithms and predictive analytics presents a compelling opportunity to offer personalized healthcare insights, moving beyond mere data collection to actionable recommendations. The market penetration rate for remote patient monitoring devices in households with chronic conditions is estimated to grow from 30% in 2025 to over 55% by 2033. Competitive dynamics are intensifying, with companies focusing on developing integrated platforms that offer a seamless patient and provider experience, encompassing data acquisition, analysis, and intervention. The opportunity lies in creating ecosystems that connect various monitoring devices, electronic health records (EHRs), and telehealth platforms, thereby fostering a holistic approach to patient care. Strategic collaborations between technology providers, healthcare institutions, and pharmaceutical companies are also crucial for unlocking new market segments and enhancing the value proposition. The market is also witnessing an increasing focus on specialized monitoring devices for niche applications, such as neurological disorders and respiratory conditions, presenting further avenues for growth and innovation. The integration of genomics and personalized medicine into home-care diagnostics is another frontier offering significant potential.

Dominant Markets & Segments in North America Home-care Monitoring and Diagnostics Market

The North America Home-care Monitoring and Diagnostics Market is characterized by the clear dominance of certain segments and geographies. Within North America, the United States stands out as the largest and most influential market, driven by its advanced healthcare infrastructure, high disposable incomes, and a strong emphasis on technological adoption in healthcare. Canada and Mexico, while smaller, represent significant growth opportunities due to their expanding healthcare sectors and increasing investment in digital health solutions.

Analyzing the Type of Devices, Remote Patient Monitoring Devices are exhibiting the most substantial growth and are projected to lead the market in the coming years. This surge is attributed to their versatility in managing a wide range of chronic conditions and their ability to facilitate continuous patient oversight outside clinical settings. Cardiac-Monitoring Devices and Multi-parameters Monitors also hold significant market share due to the high prevalence of cardiovascular diseases and the need for comprehensive physiological assessment. The growth drivers for Remote Patient Monitoring Devices include:

- Increasing prevalence of chronic diseases: Conditions such as heart failure, hypertension, and diabetes necessitate continuous tracking.

- Technological advancements: Miniaturized sensors, improved connectivity, and AI integration are enhancing their efficacy and user-friendliness.

- Government initiatives and reimbursement policies: Favorable policies encouraging the adoption of telehealth and remote care solutions.

- Patient preference for home-based care: Desire for comfort, convenience, and reduced hospitalizations.

In terms of Application, Cardiology remains a dominant segment, reflecting the high incidence of heart-related ailments and the critical need for ongoing monitoring. Remote Monitoring as an application is rapidly gaining traction, intrinsically linked to the rise of RPM devices and telehealth. Respiratory and Neurology applications are also significant growth areas, driven by the increasing incidence of conditions like COPD, asthma, and neurodegenerative diseases. The key growth drivers for the Cardiology segment include:

- High burden of cardiovascular diseases: Leading cause of death and disability in North America.

- Advancements in implantable and wearable cardiac monitoring: ECG monitors, pacemakers with remote monitoring capabilities.

- Post-operative care and chronic disease management: Enabling early detection of complications and adherence to treatment.

Regarding End User, Home Healthcare agencies and direct-to-consumer sales are experiencing exponential growth. This is directly correlated with the increasing preference for aging-in-place and managing chronic conditions at home. Hospitals & Clinics also remain crucial end-users, integrating home-care monitoring solutions into their patient management protocols for continuous care and reduced readmission rates. The primary growth drivers for the Home Healthcare segment are:

- Demographic shifts: Aging population requiring ongoing care and monitoring.

- Cost-effectiveness: Home care is generally more affordable than hospital stays.

- Improved quality of life: Allowing patients to remain in familiar surroundings.

The combination of these dominant segments, particularly the ascendancy of Remote Patient Monitoring Devices and the strong demand from Home Healthcare providers in the United States, paints a clear picture of where the market's momentum is focused.

North America Home-care Monitoring and Diagnostics Market Product Analysis

The North America Home-care Monitoring and Diagnostics Market is witnessing a wave of innovative product development, characterized by enhanced miniaturization, improved accuracy, and seamless connectivity. These advancements are critical for ensuring the efficacy and user-friendliness of home-based healthcare solutions. Key product innovations include the development of wearable biosensors that can continuously track vital signs such as heart rate, blood pressure, and oxygen saturation with unprecedented precision. The integration of artificial intelligence and machine learning algorithms into diagnostic devices is enabling predictive analytics, allowing for early detection of potential health issues before they become critical. Furthermore, the focus on user-centric design is leading to the creation of intuitive interfaces and simplified data interpretation for patients and caregivers. These technological leaps are not only improving patient outcomes but also driving broader market adoption, solidifying the competitive advantage of companies that can deliver advanced, reliable, and accessible monitoring and diagnostic tools for home use.

Key Drivers, Barriers & Challenges in North America Home-care Monitoring and Diagnostics Market

Key Drivers: The North America Home-care Monitoring and Diagnostics Market is propelled by several powerful forces. Technological advancements, including the miniaturization of sensors, enhanced wireless connectivity (e.g., 5G), and AI-driven analytics, are making sophisticated monitoring accessible at home. The increasing prevalence of chronic diseases like cardiovascular ailments, diabetes, and respiratory conditions necessitates continuous patient oversight. Government initiatives and favorable reimbursement policies for telehealth and remote patient monitoring are significantly boosting adoption. The growing aging population and a preference for aging-in-place are also crucial demand drivers. Furthermore, a heightened consumer awareness of health and wellness, coupled with a desire for proactive disease management, fuels the demand for home-based diagnostic tools.

Barriers & Challenges: Despite the promising outlook, the market faces several hurdles. Stringent regulatory frameworks for medical devices, while ensuring safety, can lead to lengthy approval processes and increased development costs. Data privacy and security concerns are paramount, as the collection of sensitive health information requires robust cybersecurity measures. Interoperability issues between different devices and Electronic Health Record (EHR) systems can hinder seamless data integration. High initial costs for some advanced devices can be a barrier for certain segments of the population, despite their long-term cost-saving potential. User adoption and digital literacy among the elderly population can also pose a challenge. Supply chain disruptions, though less prominent in recent times, remain a potential vulnerability impacting product availability. Competitive pressures can lead to price wars, impacting profit margins for manufacturers.

Growth Drivers in the North America Home-care Monitoring and Diagnostics Market Market

The North America Home-care Monitoring and Diagnostics Market is propelled by significant growth drivers, predominantly technological innovation and a shifting healthcare paradigm. The increasing prevalence of chronic diseases, such as cardiovascular diseases and diabetes, necessitates continuous patient monitoring, creating a robust demand for these solutions. Advancements in miniaturization and wireless technology have made sophisticated monitoring devices more accessible and user-friendly for home use. Furthermore, favorable government policies and reimbursement schemes for telehealth and remote patient monitoring are incentivizing both providers and patients to adopt these technologies. The growing aging population, coupled with a strong preference for aging-in-place, further amplifies the need for reliable home-care monitoring.

Challenges Impacting North America Home-care Monitoring and Diagnostics Market Growth

The growth of the North America Home-care Monitoring and Diagnostics Market is not without its challenges. Regulatory complexities and the need for stringent compliance with healthcare standards can lead to extended product development cycles and increased costs. Concerns surrounding data privacy and security are significant, requiring robust cybersecurity measures to protect sensitive patient information. Interoperability issues between various devices and Electronic Health Record (EHR) systems can hinder seamless data integration and create workflow inefficiencies. The initial cost of some advanced monitoring devices can also be a barrier to widespread adoption, particularly for individuals with limited financial resources. Finally, ensuring adequate digital literacy and user comfort with technology among all patient demographics remains a crucial aspect to address for sustained market penetration.

Key Players Shaping the North America Home-care Monitoring and Diagnostics Market Market

- Becton Dickinson and Company

- Masimo Corporation

- Medtronic

- GE Healthcare

- Abbott Laboratories

- Omron Corporation

- Johnson & Johnson

- Boston Scientific Corporation

- Baxter International Inc

Significant North America Home-care Monitoring and Diagnostics Market Industry Milestones

- 2023 (Q4): FDA approval of a new generation of wearable ECG monitors with enhanced battery life and real-time data transmission capabilities.

- 2023 (Q3): Masimo Corporation's strategic acquisition of a leading AI-powered diagnostic analytics company to bolster its predictive capabilities.

- 2022 (Q2): Abbott Laboratories launched an integrated platform combining continuous glucose monitoring with telehealth services for diabetes management.

- 2022 (Q1): Medtronic announced significant expansion of its remote patient monitoring services for post-surgical cardiac patients.

- 2021 (Q4): GE Healthcare introduced a new multi-parameter monitor designed for seamless integration into home healthcare settings, offering improved portability and user interface.

- 2021 (Q3): Johnson & Johnson invested in a startup specializing in at-home neurological diagnostic tools.

- 2020 (Q2): The COVID-19 pandemic significantly accelerated the adoption and regulatory pathways for remote patient monitoring devices.

- 2019 (Q1): Boston Scientific Corporation received regulatory clearance for a novel implantable cardiac monitor with advanced remote data retrieval features.

Future Outlook for North America Home-care Monitoring and Diagnostics Market Market

The future outlook for the North America Home-care Monitoring and Diagnostics Market is exceptionally bright, driven by sustained technological innovation and a deepening integration of healthcare into daily life. The continued miniaturization of devices, coupled with the advancement of AI and machine learning, will lead to more predictive and personalized diagnostic capabilities. The growing acceptance of telehealth and remote care models by both patients and healthcare providers will further fuel market expansion. Strategic partnerships and potential consolidation through mergers and acquisitions are expected to shape the competitive landscape, fostering integrated ecosystems of care. The increasing focus on preventative healthcare and chronic disease management presents a significant long-term growth catalyst, positioning home-care monitoring and diagnostics as an indispensable component of modern healthcare delivery. The market is poised to witness a substantial increase in penetration across various age groups and socioeconomic strata, transforming how healthcare is accessed and managed.

North America Home-care Monitoring and Diagnostics Market Segmentation

-

1. Type of Devices

- 1.1. Hemodynamic Monitoring Devices

- 1.2. Neuro-Monitoring Devices

- 1.3. Cardiac-Monitoring Devices

- 1.4. Multi-parameters Monitors

- 1.5. Respiratory Monitoring Devices

- 1.6. Remote Patient Monitoring Devices

- 1.7. Other Devices

-

2. Application

- 2.1. Cardiology

- 2.2. Neurology

- 2.3. Respiratory

- 2.4. Fetal & Neonatal

- 2.5. Remote Monitoring

- 2.6. Weight Management & Fitness Monitoring

-

3. End User

- 3.1. Home Healthcare

- 3.2. Hospitals & Clinics

- 3.3. Other End Users

-

4. Geography

-

4.1. North America

- 4.1.1. United States

- 4.1.2. Canada

- 4.1.3. Mexico

-

4.1. North America

North America Home-care Monitoring and Diagnostics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Home-care Monitoring and Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Burden of Chronic Diseases due to Lifestyle Changes; Growing Preference for Home and Remote Monitoring

- 3.3. Market Restrains

- 3.3.1. ; Resistance from Healthcare Industry Professionals Toward the Adoption of Patient Monitoring Systems; High Cost of Technology

- 3.4. Market Trends

- 3.4.1. Weight Management & Fitness Monitoring is expected to Show a Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Home-care Monitoring and Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Devices

- 5.1.1. Hemodynamic Monitoring Devices

- 5.1.2. Neuro-Monitoring Devices

- 5.1.3. Cardiac-Monitoring Devices

- 5.1.4. Multi-parameters Monitors

- 5.1.5. Respiratory Monitoring Devices

- 5.1.6. Remote Patient Monitoring Devices

- 5.1.7. Other Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Neurology

- 5.2.3. Respiratory

- 5.2.4. Fetal & Neonatal

- 5.2.5. Remote Monitoring

- 5.2.6. Weight Management & Fitness Monitoring

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Home Healthcare

- 5.3.2. Hospitals & Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. North America

- 5.4.1.1. United States

- 5.4.1.2. Canada

- 5.4.1.3. Mexico

- 5.4.1. North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Devices

- 6. United States North America Home-care Monitoring and Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Home-care Monitoring and Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Home-care Monitoring and Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Home-care Monitoring and Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Becton Dickinson and Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Masimo Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Medtronic

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GE Healthcare

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Abbott Laboratories

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Omron Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Johnson & Johnson

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Boston Scientific Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Baxter International Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: North America Home-care Monitoring and Diagnostics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Home-care Monitoring and Diagnostics Market Share (%) by Company 2024

List of Tables

- Table 1: North America Home-care Monitoring and Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Home-care Monitoring and Diagnostics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Home-care Monitoring and Diagnostics Market Revenue Million Forecast, by Type of Devices 2019 & 2032

- Table 4: North America Home-care Monitoring and Diagnostics Market Volume K Unit Forecast, by Type of Devices 2019 & 2032

- Table 5: North America Home-care Monitoring and Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: North America Home-care Monitoring and Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: North America Home-care Monitoring and Diagnostics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: North America Home-care Monitoring and Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: North America Home-care Monitoring and Diagnostics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: North America Home-care Monitoring and Diagnostics Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 11: North America Home-care Monitoring and Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: North America Home-care Monitoring and Diagnostics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: North America Home-care Monitoring and Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: North America Home-care Monitoring and Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: United States North America Home-care Monitoring and Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States North America Home-care Monitoring and Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Canada North America Home-care Monitoring and Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada North America Home-care Monitoring and Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Mexico North America Home-care Monitoring and Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico North America Home-care Monitoring and Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of North America North America Home-care Monitoring and Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of North America North America Home-care Monitoring and Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: North America Home-care Monitoring and Diagnostics Market Revenue Million Forecast, by Type of Devices 2019 & 2032

- Table 24: North America Home-care Monitoring and Diagnostics Market Volume K Unit Forecast, by Type of Devices 2019 & 2032

- Table 25: North America Home-care Monitoring and Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: North America Home-care Monitoring and Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 27: North America Home-care Monitoring and Diagnostics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 28: North America Home-care Monitoring and Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 29: North America Home-care Monitoring and Diagnostics Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: North America Home-care Monitoring and Diagnostics Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 31: North America Home-care Monitoring and Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: North America Home-care Monitoring and Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: United States North America Home-care Monitoring and Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: United States North America Home-care Monitoring and Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Canada North America Home-care Monitoring and Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Canada North America Home-care Monitoring and Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Mexico North America Home-care Monitoring and Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico North America Home-care Monitoring and Diagnostics Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Home-care Monitoring and Diagnostics Market?

The projected CAGR is approximately 7.52%.

2. Which companies are prominent players in the North America Home-care Monitoring and Diagnostics Market?

Key companies in the market include Becton Dickinson and Company, Masimo Corporation, Medtronic, GE Healthcare, Abbott Laboratories, Omron Corporation, Johnson & Johnson, Boston Scientific Corporation, Baxter International Inc.

3. What are the main segments of the North America Home-care Monitoring and Diagnostics Market?

The market segments include Type of Devices, Application, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.16 Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Burden of Chronic Diseases due to Lifestyle Changes; Growing Preference for Home and Remote Monitoring.

6. What are the notable trends driving market growth?

Weight Management & Fitness Monitoring is expected to Show a Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

; Resistance from Healthcare Industry Professionals Toward the Adoption of Patient Monitoring Systems; High Cost of Technology.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Home-care Monitoring and Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Home-care Monitoring and Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Home-care Monitoring and Diagnostics Market?

To stay informed about further developments, trends, and reports in the North America Home-care Monitoring and Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence