Key Insights

The global Veterinary Biomarkers Market is projected for substantial expansion, forecasted to reach a market size of $0.91 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.1% during the 2025-2033 period. This growth is driven by a rising global pet population, increased pet owner awareness of animal health, and a surge in demand for advanced diagnostic solutions. The escalating prevalence of animal diseases, including inflammatory, infectious, cardiovascular, skeletal muscle, and tumor-related conditions, necessitates accurate and timely diagnosis through veterinary biomarkers. Advancements in diagnostic technologies and sophisticated biomarker assays are also fueling market growth. The market is segmented by product type, with Kits & Reagents expected to lead due to widespread adoption in diagnostic laboratories and veterinary clinics. Companion animals, particularly dogs and cats, represent a significant segment, reflecting growing pet healthcare expenditure.

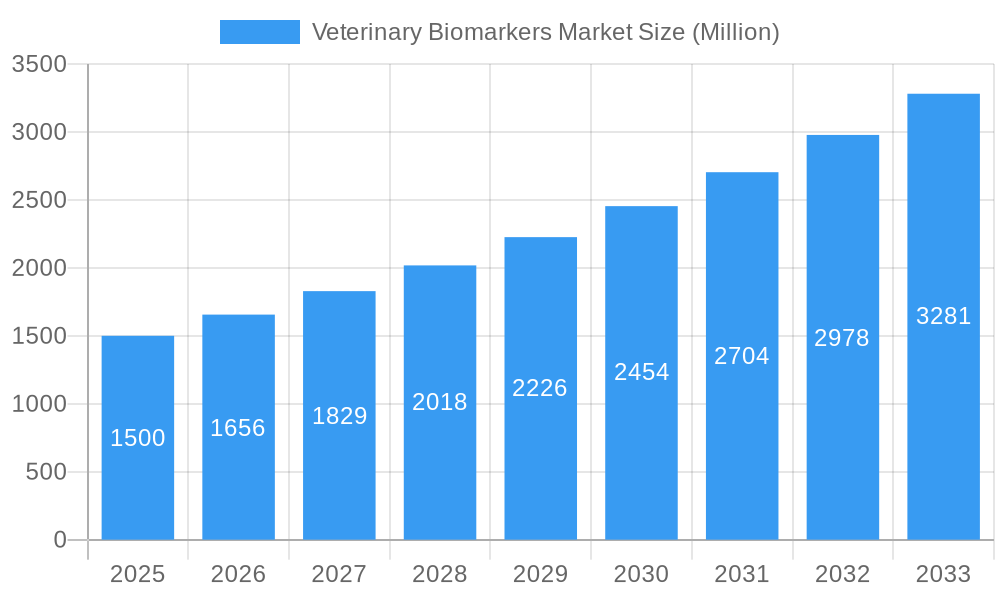

Veterinary Biomarkers Market Market Size (In Million)

Market expansion is further supported by significant investments in preclinical research for novel drug development and a growing emphasis on proactive animal health management. Key market players are actively pursuing R&D, strategic collaborations, and product launches. Geographically, North America and Europe are expected to dominate due to established veterinary healthcare infrastructure, high disposable incomes, and strong pet ownership cultures. The Asia Pacific region is anticipated to experience the fastest growth, driven by a burgeoning pet population, increasing pet humanization, and improving veterinary healthcare accessibility. While challenges like the high cost of advanced diagnostic equipment and the need for specialized veterinary expertise may present moderate restraints, the overall market outlook is optimistic, with continuous innovation and expanding applications promising sustained growth and lucrative opportunities.

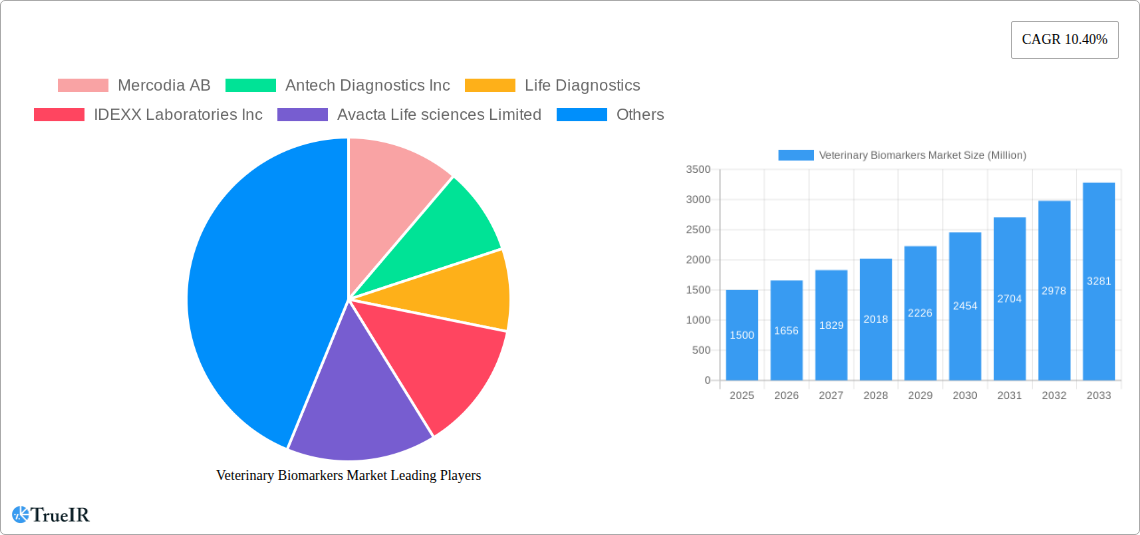

Veterinary Biomarkers Market Company Market Share

Unleashing Precision Animal Health: Veterinary Biomarkers Market Report (2019–2033)

This comprehensive report provides an in-depth analysis of the Veterinary Biomarkers Market, a rapidly evolving sector poised for substantial growth. Driven by increasing pet ownership, rising demand for advanced animal healthcare, and significant technological advancements, the market is witnessing unprecedented innovation. This report leverages high-volume keywords such as "veterinary diagnostics," "animal health biomarkers," "pet disease detection," and "precision veterinary medicine" to enhance SEO rankings and deliver actionable insights for industry stakeholders.

Our analysis covers the Study Period: 2019–2033, with the Base Year: 2025, Estimated Year: 2025, and a detailed Forecast Period: 2025–2033. The Historical Period: 2019–2024 provides crucial context for understanding market evolution.

Veterinary Biomarkers Market Market Structure & Competitive Landscape

The veterinary biomarkers market is characterized by a dynamic and evolving competitive landscape, with a moderate to high degree of concentration in certain segments. Key innovation drivers include advancements in molecular diagnostics, genetic sequencing, and proteomics, enabling the identification of novel biomarkers for a wider range of animal diseases. Regulatory impacts, while generally supportive of innovation, can also present hurdles in terms of approval timelines for new diagnostic tests. Product substitutes, such as traditional diagnostic methods, are gradually being augmented and, in some cases, replaced by more precise biomarker-based solutions. End-user segmentation is crucial, with distinct needs arising from companion animal owners, livestock producers, and veterinary research institutions. Mergers and acquisitions (M&A) are playing a significant role in consolidating market share and expanding product portfolios. For instance, the acquisition of Basepaws by Zoetis signifies a strategic move to bolster capabilities in precision animal health and pet genetics. M&A volumes have seen a steady increase as companies seek to gain a competitive edge and access new technologies. The market is witnessing a growing number of partnerships and collaborations aimed at accelerating research and development and expanding market reach.

Veterinary Biomarkers Market Market Trends & Opportunities

The veterinary biomarkers market is experiencing robust growth, projected to reach an estimated value of XX Billion USD by 2033, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is fueled by a confluence of escalating pet humanization trends, a heightened awareness among pet owners regarding animal welfare and longevity, and a growing demand for early and accurate disease detection in both companion and production animals. Technological shifts are profoundly reshaping the market, with innovations in next-generation sequencing (NGS), microfluidics, and artificial intelligence (AI) enabling the development of highly sensitive and specific biomarker assays. These advancements are facilitating the transition from reactive treatment to proactive health management and preventive care in veterinary medicine.

Consumer preferences are increasingly leaning towards non-invasive diagnostic methods and personalized treatment plans for pets, aligning perfectly with the capabilities offered by biomarker-based diagnostics. The ability to detect diseases at their nascent stages, monitor treatment efficacy, and predict disease predisposition is becoming a significant value proposition for veterinary professionals and pet owners alike. The competitive dynamics are intensifying, with established players and emerging startups vying for market dominance. This competition is spurring further innovation and driving down costs, making advanced diagnostics more accessible. Opportunities abound in the development of multiplex biomarker panels for complex diseases, the creation of point-of-care diagnostic devices, and the integration of biomarker data with other health information for comprehensive animal wellness profiles. The growing focus on zoonotic disease surveillance also presents a significant opportunity, as biomarkers can play a crucial role in identifying and monitoring diseases transmissible between animals and humans. Furthermore, the expansion of veterinary services in emerging economies and the increasing investment in animal research are further contributing to the market's upward trajectory. The integration of digital health platforms and telemedicine in veterinary care is creating new avenues for the delivery and utilization of biomarker data, enhancing patient monitoring and client engagement.

Dominant Markets & Segments in Veterinary Biomarkers Market

The Veterinary Biomarkers Market is segmented across various categories, each exhibiting distinct growth trajectories and market dominance.

Dominant Product Type:

- Biomarkers, Kits & Reagents: This segment holds the largest market share, driven by the foundational role of biomarkers and the widespread adoption of diagnostic kits and reagents for routine testing. The increasing number of available biomarkers for various animal diseases fuels continuous demand.

- Biomarker Readers: While a smaller segment, it is expected to witness significant growth due to the increasing sophistication of diagnostic platforms and the demand for automated, high-throughput analysis.

Dominant Animal Type:

- Companion Animals (Dogs, Cats, Others): This segment is the primary revenue generator and growth driver. The escalating humanization of pets, coupled with owners' willingness to invest in advanced healthcare for their beloved companions, underpins this dominance. The rising prevalence of age-related diseases and chronic conditions in pets further boosts the demand for diagnostic solutions.

- Dogs: Represent the largest sub-segment within companion animals, owing to their high prevalence and the availability of a wide range of diagnostic tests tailored to their specific health needs.

- Cats: Showing rapid growth, driven by increasing awareness of feline-specific diseases and the development of specialized diagnostic tools.

- Production Animals (Cows, Pigs): This segment, while historically driven by food safety and disease outbreak prevention, is experiencing a resurgence with the application of biomarkers for optimizing herd health, improving production efficiency, and early detection of economically significant diseases.

Dominant Disease Type:

- Inflammatory & Infectious Diseases: This segment consistently commands a significant market share due to the high incidence of these diseases in both companion and production animals. Rapid and accurate diagnosis is crucial for timely treatment and preventing outbreaks.

- Tumor: The growing incidence of cancer in animals, particularly in aging companion animals, is a major driver for this segment. The development of early detection and monitoring biomarkers for various cancer types is a key focus.

- Cardiovascular Diseases: With lifestyle-related factors influencing animal health, cardiovascular diseases are becoming more prevalent, leading to increased demand for specialized biomarkers.

Dominant Application:

- Disease Diagnostics: This remains the most significant application. The ability of biomarkers to provide early, accurate, and non-invasive diagnoses is a critical factor driving their adoption.

- Preclinical Research: Biomarkers play an indispensable role in drug discovery and development, efficacy testing, and safety assessments in preclinical animal models, contributing substantially to market growth.

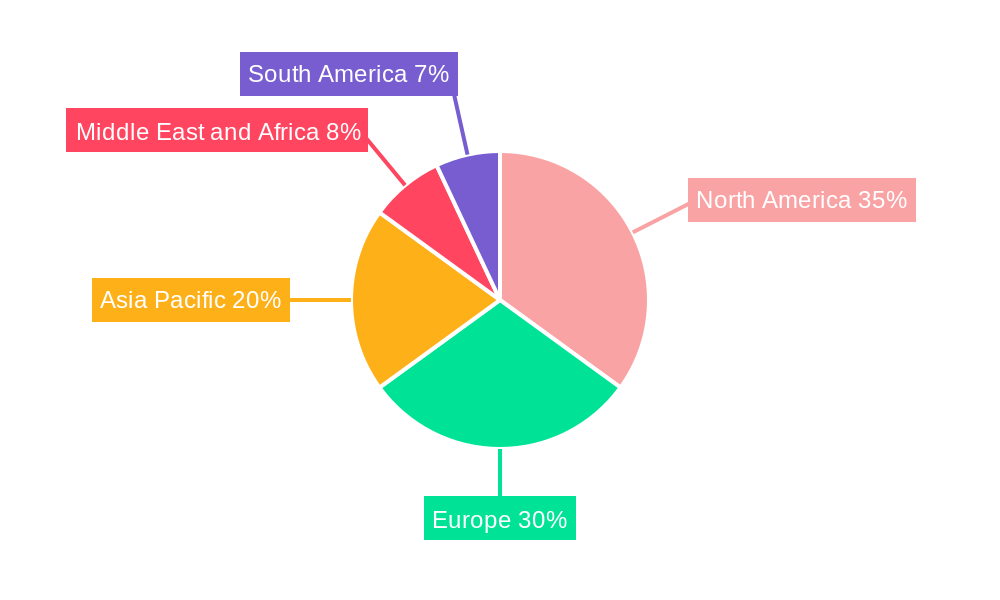

Dominant Region:

- North America: Leads the market owing to high pet ownership rates, advanced veterinary infrastructure, significant R&D investments, and a strong emphasis on pet healthcare. The presence of key market players and a supportive regulatory environment further bolsters its dominance.

- Europe: A strong second-largest market, driven by similar factors to North America, including a high standard of animal welfare and increasing adoption of advanced veterinary technologies.

Veterinary Biomarkers Market Product Analysis

The veterinary biomarkers market is witnessing a surge in product innovations focused on enhancing diagnostic accuracy, speed, and accessibility. Novel protein-based biomarkers for early cancer detection, such as those utilized in the Nu. Q Vet cancer screening test, exemplify the trend towards non-invasive and sensitive diagnostic tools. Advancements in assay development for inflammatory markers and infectious agents are crucial for combating prevalent animal diseases. Furthermore, the integration of genomics and transcriptomics is unlocking new biomarker discovery pathways, leading to personalized medicine approaches for animals. The competitive advantage lies in developing multiplex panels capable of detecting multiple conditions simultaneously, improving efficiency for veterinarians. The market fit for these products is amplified by their ability to provide actionable insights for disease management, treatment monitoring, and preventative healthcare, thereby enhancing the overall quality of life for animals.

Key Drivers, Barriers & Challenges in Veterinary Biomarkers Market

Key Drivers:

- Rising Pet Ownership and Humanization: The growing trend of treating pets as family members drives increased spending on advanced veterinary care, including diagnostics.

- Technological Advancements: Innovations in molecular diagnostics, genomics, and proteomics enable the discovery and validation of novel, more accurate biomarkers.

- Increasing Demand for Early Disease Detection: The desire for proactive health management and prevention of severe diseases fuels the adoption of biomarker-based diagnostics for early intervention.

- Growing Awareness of Animal Welfare: Heightened awareness among pet owners and livestock producers about animal health and well-being necessitates better diagnostic tools.

- Government Initiatives and Research Funding: Support from regulatory bodies and increased funding for animal health research accelerate the development and adoption of new technologies.

Key Barriers & Challenges:

- High Cost of Development and Validation: Developing and validating new biomarker assays can be expensive and time-consuming, posing a barrier to entry for smaller companies.

- Regulatory Hurdles: Navigating the regulatory approval processes for new diagnostic tests can be complex and lengthy, impacting market entry timelines.

- Limited Awareness and Adoption in Certain Regions: In some developing regions, awareness of advanced veterinary diagnostics and their benefits may be limited, hindering market penetration.

- Standardization and Interoperability Issues: Lack of standardized protocols and interoperability between different diagnostic platforms can create challenges for widespread adoption and data comparison.

- Availability of Skilled Personnel: A shortage of trained veterinary professionals proficient in interpreting and utilizing complex biomarker data can impede market growth.

Growth Drivers in the Veterinary Biomarkers Market Market

The veterinary biomarkers market is experiencing significant growth, primarily driven by the escalating pet humanization trend, which translates into increased expenditure on advanced animal healthcare. Technological innovations, particularly in genomic sequencing and proteomics, are continuously expanding the repertoire of identifiable biomarkers, enabling earlier and more precise disease detection. The growing awareness among pet owners and livestock farmers regarding animal welfare and disease prevention further fuels the demand for sophisticated diagnostic solutions. Moreover, favorable government initiatives and increased research funding in animal health research are accelerating the development and commercialization of novel biomarker assays. The economic development in emerging economies is also contributing, with a rising middle class more inclined to invest in pet healthcare.

Challenges Impacting Veterinary Biomarkers Market Growth

Despite its promising outlook, the veterinary biomarkers market faces several challenges. The high cost associated with the research, development, and validation of new biomarker assays can be a significant barrier, particularly for smaller companies. Regulatory complexities and the lengthy approval processes for novel diagnostic tests can also hinder market entry and product commercialization. Furthermore, the adoption of advanced biomarker technologies can be uneven across different geographic regions, with some markets lagging due to limited awareness, infrastructure, or affordability. Competitive pressures from established diagnostic providers and the continuous need for innovation to stay ahead of the curve also present challenges. Supply chain disruptions for specialized reagents or components can also impact production and availability.

Key Players Shaping the Veterinary Biomarkers Market Market

- Mercodia AB

- Antech Diagnostics Inc

- Life Diagnostics

- IDEXX Laboratories Inc

- Avacta Life sciences Limited

- Merck & Co Inc

- Zoetis

- MI:RNA Diagnostics Ltd

- Virbac

- Acuvet Biotech

Significant Veterinary Biomarkers Market Industry Milestones

- June 2022: The Zoetis pharmaceutical company made an agreement to acquire Basepaws pet genetics, which offers individualized breed and health reports that can identify traits, biomarkers, and potential hereditary conditions in pets. The acquisition will advance Zoetis' portfolio in the precision animal health space and will inform and shape its future pipeline of pet care innovations.

- November 2022: VolitionRx Limited collaborated with Heska and launched the Nu. Q Vet cancer screening test for veterinary early cancer detection. It is an accurate, affordable, and non-invasive diagnostic for cancer screening and monitoring in dogs.

Future Outlook for Veterinary Biomarkers Market Market

The future outlook for the veterinary biomarkers market is exceptionally bright, propelled by the relentless pursuit of precision animal health. Strategic opportunities lie in the development of integrated diagnostic platforms that combine biomarker data with imaging and clinical information, offering a holistic approach to animal wellness. The expansion into novel disease areas, such as neurological disorders and metabolic syndromes, presents significant untapped potential. Furthermore, the increasing use of AI and machine learning in biomarker discovery and data analysis will unlock new insights and accelerate diagnostic capabilities. The growing emphasis on preventative veterinary care and the desire for longer, healthier lives for companion animals will continue to be key growth catalysts. The market is poised for continued innovation, with a focus on user-friendly, cost-effective, and highly accurate diagnostic solutions that empower veterinarians and pet owners alike.

Veterinary Biomarkers Market Segmentation

-

1. Product Type

- 1.1. Biomarkers, Kits & Reagents

- 1.2. Biomarker Readers

-

2. Animal Type

-

2.1. Companion Animals

- 2.1.1. Dogs

- 2.1.2. Cats

- 2.1.3. Others

-

2.2. Production Animals

- 2.2.1. Cows

- 2.2.2. Pigs

-

2.1. Companion Animals

-

3. Disease Type

- 3.1. Inflammatory & Infectious Diseases

- 3.2. Cardiovascular Diseases

- 3.3. Skeletal Muscle Diseases

- 3.4. Tumor

- 3.5. Other Disease Types

-

4. Application

- 4.1. Disease Diagnostics

- 4.2. Preclinical Research

- 4.3. Other Applications

Veterinary Biomarkers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Veterinary Biomarkers Market Regional Market Share

Geographic Coverage of Veterinary Biomarkers Market

Veterinary Biomarkers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Chronic Conditions Such as Cancer and Cardiovascular Diseases in Animals; Growing R & D Activities by Key Market Players; Growing Companion Animal Population and Pet Adoption Rates

- 3.3. Market Restrains

- 3.3.1. Cost Effectiveness and Anticipation of Biomarkers Availability

- 3.4. Market Trends

- 3.4.1 The Biomarkers

- 3.4.2 Kits & Reagents Segment is Expected to Witness Growth Over the Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Biomarkers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Biomarkers, Kits & Reagents

- 5.1.2. Biomarker Readers

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Companion Animals

- 5.2.1.1. Dogs

- 5.2.1.2. Cats

- 5.2.1.3. Others

- 5.2.2. Production Animals

- 5.2.2.1. Cows

- 5.2.2.2. Pigs

- 5.2.1. Companion Animals

- 5.3. Market Analysis, Insights and Forecast - by Disease Type

- 5.3.1. Inflammatory & Infectious Diseases

- 5.3.2. Cardiovascular Diseases

- 5.3.3. Skeletal Muscle Diseases

- 5.3.4. Tumor

- 5.3.5. Other Disease Types

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Disease Diagnostics

- 5.4.2. Preclinical Research

- 5.4.3. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Veterinary Biomarkers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Biomarkers, Kits & Reagents

- 6.1.2. Biomarker Readers

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Companion Animals

- 6.2.1.1. Dogs

- 6.2.1.2. Cats

- 6.2.1.3. Others

- 6.2.2. Production Animals

- 6.2.2.1. Cows

- 6.2.2.2. Pigs

- 6.2.1. Companion Animals

- 6.3. Market Analysis, Insights and Forecast - by Disease Type

- 6.3.1. Inflammatory & Infectious Diseases

- 6.3.2. Cardiovascular Diseases

- 6.3.3. Skeletal Muscle Diseases

- 6.3.4. Tumor

- 6.3.5. Other Disease Types

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Disease Diagnostics

- 6.4.2. Preclinical Research

- 6.4.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Veterinary Biomarkers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Biomarkers, Kits & Reagents

- 7.1.2. Biomarker Readers

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Companion Animals

- 7.2.1.1. Dogs

- 7.2.1.2. Cats

- 7.2.1.3. Others

- 7.2.2. Production Animals

- 7.2.2.1. Cows

- 7.2.2.2. Pigs

- 7.2.1. Companion Animals

- 7.3. Market Analysis, Insights and Forecast - by Disease Type

- 7.3.1. Inflammatory & Infectious Diseases

- 7.3.2. Cardiovascular Diseases

- 7.3.3. Skeletal Muscle Diseases

- 7.3.4. Tumor

- 7.3.5. Other Disease Types

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Disease Diagnostics

- 7.4.2. Preclinical Research

- 7.4.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Veterinary Biomarkers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Biomarkers, Kits & Reagents

- 8.1.2. Biomarker Readers

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Companion Animals

- 8.2.1.1. Dogs

- 8.2.1.2. Cats

- 8.2.1.3. Others

- 8.2.2. Production Animals

- 8.2.2.1. Cows

- 8.2.2.2. Pigs

- 8.2.1. Companion Animals

- 8.3. Market Analysis, Insights and Forecast - by Disease Type

- 8.3.1. Inflammatory & Infectious Diseases

- 8.3.2. Cardiovascular Diseases

- 8.3.3. Skeletal Muscle Diseases

- 8.3.4. Tumor

- 8.3.5. Other Disease Types

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Disease Diagnostics

- 8.4.2. Preclinical Research

- 8.4.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Veterinary Biomarkers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Biomarkers, Kits & Reagents

- 9.1.2. Biomarker Readers

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Companion Animals

- 9.2.1.1. Dogs

- 9.2.1.2. Cats

- 9.2.1.3. Others

- 9.2.2. Production Animals

- 9.2.2.1. Cows

- 9.2.2.2. Pigs

- 9.2.1. Companion Animals

- 9.3. Market Analysis, Insights and Forecast - by Disease Type

- 9.3.1. Inflammatory & Infectious Diseases

- 9.3.2. Cardiovascular Diseases

- 9.3.3. Skeletal Muscle Diseases

- 9.3.4. Tumor

- 9.3.5. Other Disease Types

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Disease Diagnostics

- 9.4.2. Preclinical Research

- 9.4.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Veterinary Biomarkers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Biomarkers, Kits & Reagents

- 10.1.2. Biomarker Readers

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Companion Animals

- 10.2.1.1. Dogs

- 10.2.1.2. Cats

- 10.2.1.3. Others

- 10.2.2. Production Animals

- 10.2.2.1. Cows

- 10.2.2.2. Pigs

- 10.2.1. Companion Animals

- 10.3. Market Analysis, Insights and Forecast - by Disease Type

- 10.3.1. Inflammatory & Infectious Diseases

- 10.3.2. Cardiovascular Diseases

- 10.3.3. Skeletal Muscle Diseases

- 10.3.4. Tumor

- 10.3.5. Other Disease Types

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Disease Diagnostics

- 10.4.2. Preclinical Research

- 10.4.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mercodia AB

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Antech Diagnostics Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Life Diagnostics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IDEXX Laboratories Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Avacta Life sciences Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Merck & Co Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zoetis

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MI

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Mercodia AB

List of Figures

- Figure 1: Global Veterinary Biomarkers Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Veterinary Biomarkers Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Veterinary Biomarkers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Veterinary Biomarkers Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 5: North America Veterinary Biomarkers Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 6: North America Veterinary Biomarkers Market Revenue (billion), by Disease Type 2025 & 2033

- Figure 7: North America Veterinary Biomarkers Market Revenue Share (%), by Disease Type 2025 & 2033

- Figure 8: North America Veterinary Biomarkers Market Revenue (billion), by Application 2025 & 2033

- Figure 9: North America Veterinary Biomarkers Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Veterinary Biomarkers Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Veterinary Biomarkers Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Veterinary Biomarkers Market Revenue (billion), by Product Type 2025 & 2033

- Figure 13: Europe Veterinary Biomarkers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Veterinary Biomarkers Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 15: Europe Veterinary Biomarkers Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: Europe Veterinary Biomarkers Market Revenue (billion), by Disease Type 2025 & 2033

- Figure 17: Europe Veterinary Biomarkers Market Revenue Share (%), by Disease Type 2025 & 2033

- Figure 18: Europe Veterinary Biomarkers Market Revenue (billion), by Application 2025 & 2033

- Figure 19: Europe Veterinary Biomarkers Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Veterinary Biomarkers Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Veterinary Biomarkers Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Veterinary Biomarkers Market Revenue (billion), by Product Type 2025 & 2033

- Figure 23: Asia Pacific Veterinary Biomarkers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Asia Pacific Veterinary Biomarkers Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 25: Asia Pacific Veterinary Biomarkers Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 26: Asia Pacific Veterinary Biomarkers Market Revenue (billion), by Disease Type 2025 & 2033

- Figure 27: Asia Pacific Veterinary Biomarkers Market Revenue Share (%), by Disease Type 2025 & 2033

- Figure 28: Asia Pacific Veterinary Biomarkers Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Asia Pacific Veterinary Biomarkers Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Veterinary Biomarkers Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Veterinary Biomarkers Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Veterinary Biomarkers Market Revenue (billion), by Product Type 2025 & 2033

- Figure 33: Middle East and Africa Veterinary Biomarkers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Middle East and Africa Veterinary Biomarkers Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 35: Middle East and Africa Veterinary Biomarkers Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 36: Middle East and Africa Veterinary Biomarkers Market Revenue (billion), by Disease Type 2025 & 2033

- Figure 37: Middle East and Africa Veterinary Biomarkers Market Revenue Share (%), by Disease Type 2025 & 2033

- Figure 38: Middle East and Africa Veterinary Biomarkers Market Revenue (billion), by Application 2025 & 2033

- Figure 39: Middle East and Africa Veterinary Biomarkers Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Veterinary Biomarkers Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Veterinary Biomarkers Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Veterinary Biomarkers Market Revenue (billion), by Product Type 2025 & 2033

- Figure 43: South America Veterinary Biomarkers Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: South America Veterinary Biomarkers Market Revenue (billion), by Animal Type 2025 & 2033

- Figure 45: South America Veterinary Biomarkers Market Revenue Share (%), by Animal Type 2025 & 2033

- Figure 46: South America Veterinary Biomarkers Market Revenue (billion), by Disease Type 2025 & 2033

- Figure 47: South America Veterinary Biomarkers Market Revenue Share (%), by Disease Type 2025 & 2033

- Figure 48: South America Veterinary Biomarkers Market Revenue (billion), by Application 2025 & 2033

- Figure 49: South America Veterinary Biomarkers Market Revenue Share (%), by Application 2025 & 2033

- Figure 50: South America Veterinary Biomarkers Market Revenue (billion), by Country 2025 & 2033

- Figure 51: South America Veterinary Biomarkers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Veterinary Biomarkers Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Veterinary Biomarkers Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 3: Global Veterinary Biomarkers Market Revenue billion Forecast, by Disease Type 2020 & 2033

- Table 4: Global Veterinary Biomarkers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Veterinary Biomarkers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Veterinary Biomarkers Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Global Veterinary Biomarkers Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 8: Global Veterinary Biomarkers Market Revenue billion Forecast, by Disease Type 2020 & 2033

- Table 9: Global Veterinary Biomarkers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Veterinary Biomarkers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Veterinary Biomarkers Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 15: Global Veterinary Biomarkers Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 16: Global Veterinary Biomarkers Market Revenue billion Forecast, by Disease Type 2020 & 2033

- Table 17: Global Veterinary Biomarkers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Veterinary Biomarkers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Germany Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Veterinary Biomarkers Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Global Veterinary Biomarkers Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 27: Global Veterinary Biomarkers Market Revenue billion Forecast, by Disease Type 2020 & 2033

- Table 28: Global Veterinary Biomarkers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Veterinary Biomarkers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: China Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Japan Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: India Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Australia Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: South Korea Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Asia Pacific Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Veterinary Biomarkers Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 37: Global Veterinary Biomarkers Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 38: Global Veterinary Biomarkers Market Revenue billion Forecast, by Disease Type 2020 & 2033

- Table 39: Global Veterinary Biomarkers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 40: Global Veterinary Biomarkers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: GCC Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: South Africa Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Global Veterinary Biomarkers Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 45: Global Veterinary Biomarkers Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 46: Global Veterinary Biomarkers Market Revenue billion Forecast, by Disease Type 2020 & 2033

- Table 47: Global Veterinary Biomarkers Market Revenue billion Forecast, by Application 2020 & 2033

- Table 48: Global Veterinary Biomarkers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 49: Brazil Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Argentina Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Rest of South America Veterinary Biomarkers Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Biomarkers Market?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the Veterinary Biomarkers Market?

Key companies in the market include Mercodia AB, Antech Diagnostics Inc, Life Diagnostics, IDEXX Laboratories Inc, Avacta Life sciences Limited, Merck & Co Inc, Zoetis, MI:RNA Diagnostics Ltd, Virbac, Acuvet Biotech.

3. What are the main segments of the Veterinary Biomarkers Market?

The market segments include Product Type, Animal Type, Disease Type, Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 0.91 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Chronic Conditions Such as Cancer and Cardiovascular Diseases in Animals; Growing R & D Activities by Key Market Players; Growing Companion Animal Population and Pet Adoption Rates.

6. What are the notable trends driving market growth?

The Biomarkers. Kits & Reagents Segment is Expected to Witness Growth Over the Forecast Period..

7. Are there any restraints impacting market growth?

Cost Effectiveness and Anticipation of Biomarkers Availability.

8. Can you provide examples of recent developments in the market?

June 2022: The Zoetis pharmaceutical company made an agreement to acquire Basepaws pet genetics, which offers individualized breed and health reports that can identify traits, biomarkers, and potential hereditary conditions in pets. The acquisition will advance Zoetis' portfolio in the precision animal health space and will inform and shape its future pipeline of pet care innovations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Biomarkers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Biomarkers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Biomarkers Market?

To stay informed about further developments, trends, and reports in the Veterinary Biomarkers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence