Key Insights

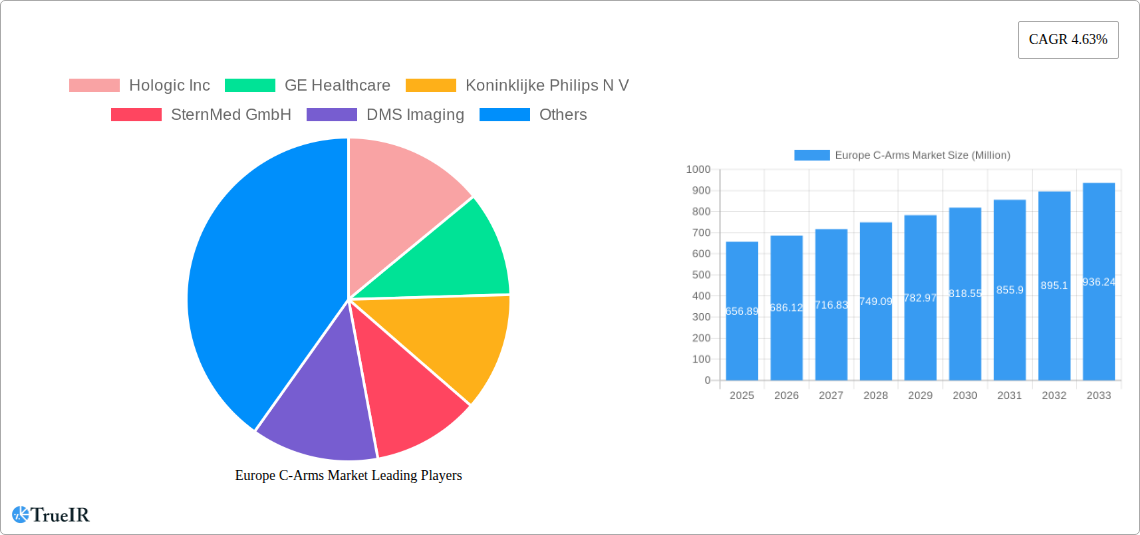

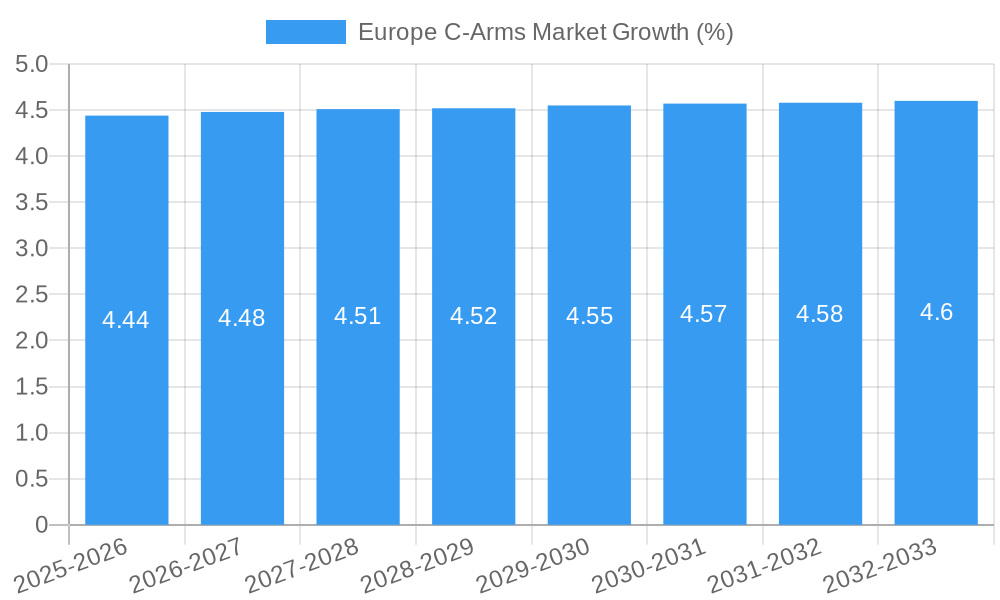

The Europe C-Arms market is projected to exhibit robust growth, reaching an estimated valuation of USD 656.89 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 4.63% through 2033. This expansion is primarily fueled by increasing demand for minimally invasive surgical procedures across cardiology, gastroenterology, neurology, and orthopedics. Advancements in C-arm technology, including the development of more compact, mobile, and higher-resolution systems, are further driving market adoption. The growing prevalence of chronic diseases and age-related conditions necessitating diagnostic and interventional imaging procedures significantly contributes to market buoyancy. Furthermore, a heightened focus on improving patient outcomes and reducing hospital stays through sophisticated imaging solutions is bolstering the uptake of C-arms in clinical settings throughout Europe.

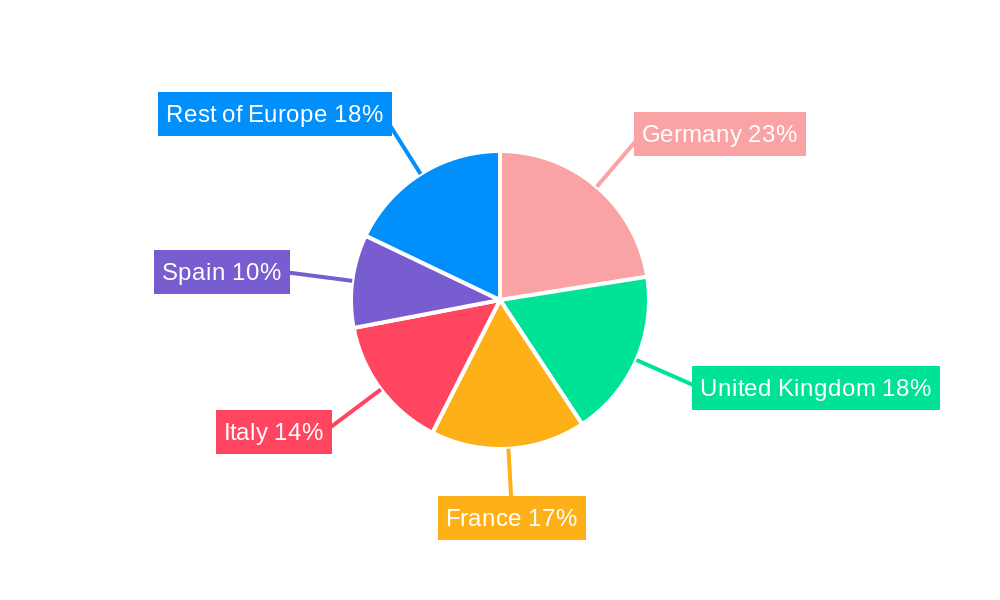

The competitive landscape of the Europe C-Arms market is characterized by the presence of several key global players, including GE Healthcare, Siemens Healthineers, and Koninklijke Philips N.V., alongside specialized manufacturers like Ziehm Imaging and Hologic Inc. The market is segmented by type into Fixed C-Arms and Mobile C-Arms, with the latter further divided into Full-Size and Mini C-Arms, catering to diverse clinical needs and space constraints. Applications span across critical medical specialties such as cardiology, gastroenterology, neurology, orthopedics and trauma, and oncology, reflecting the broad utility of C-arm technology. Regional variations in healthcare infrastructure, regulatory frameworks, and adoption rates of advanced medical technologies will influence market dynamics across Germany, the United Kingdom, France, Italy, Spain, and the Rest of Europe. The drive towards digital radiography and AI-powered imaging analysis is also expected to shape future market trends and innovation.

This in-depth report provides a granular analysis of the Europe C-Arms Market, a critical segment of the medical imaging industry. We meticulously examine market dynamics, technological advancements, and competitive strategies shaping the landscape of C-arm systems across the continent. Our research covers the historical period from 2019 to 2024, with a base year of 2025 and a comprehensive forecast extending to 2033. Dive into detailed market segmentation, including analyses of Fixed C-Arms, Mobile C-Arms (Full-Size C-Arms, Mini C-Arms), and diverse applications such as Cardiology, Gastroenterology, Neurology, Orthopedics and Trauma, and Oncology. Understand the pivotal role of innovative C-arm solutions in revolutionizing diagnostic and interventional procedures, driving demand for advanced medical imaging technologies.

Europe C-Arms Market Market Structure & Competitive Landscape

The Europe C-Arms Market exhibits a moderately concentrated structure, characterized by the presence of established global players and emerging regional manufacturers. Innovation remains a key driver, with companies continuously investing in research and development to enhance imaging quality, reduce radiation exposure, and improve workflow efficiency. Regulatory impacts, though stringent, are also fostering advancements as manufacturers strive to meet evolving safety and performance standards. Product substitutability is relatively low due to the specialized nature of C-arm systems, though advancements in other imaging modalities could present indirect competition. End-user segmentation reveals a growing demand from hospitals and surgical centers, particularly for interventional procedures. Mergers and acquisitions (M&A) activity is a notable trend, with larger players acquiring smaller innovators to expand their product portfolios and geographical reach. For instance, the recent acquisition of a niche technology provider could bolster a company's presence in the orthopedic C-arms segment. The market's competitive intensity is further shaped by the ongoing pursuit of technological leadership and strategic partnerships aimed at enhancing market penetration.

Europe C-Arms Market Market Trends & Opportunities

The Europe C-Arms Market is poised for significant growth, projected to expand at a compound annual growth rate (CAGR) of approximately 6.5% from 2025 to 2033. This robust expansion is fueled by an increasing prevalence of chronic diseases and a burgeoning geriatric population, both contributing to a higher demand for diagnostic and interventional imaging procedures. Technological advancements are at the forefront of market evolution, with a notable shift towards mobile C-arms that offer greater flexibility and portability in diverse clinical settings. This trend is particularly evident in the adoption of full-size mobile C-arms in emergency departments and hybrid operating rooms, enabling real-time imaging during complex surgical interventions. The integration of artificial intelligence (AI) and advanced visualization software is also transforming the C-arms landscape, offering enhanced image processing, reduced radiation dosage, and improved diagnostic accuracy. Consumer preferences are increasingly leaning towards solutions that offer superior patient outcomes, cost-effectiveness, and streamlined clinical workflows. Healthcare providers are actively seeking C-arm systems that can accommodate a wide range of applications, from minimally invasive surgery to interventional radiology and cardiology. This creates substantial opportunities for manufacturers to innovate and cater to these evolving demands. The growing emphasis on value-based healthcare is also pushing for C-arm solutions that demonstrate improved clinical efficacy and economic benefits. Furthermore, the ongoing digital transformation within the healthcare sector, including the adoption of Picture Archiving and Communication Systems (PACS) and Electronic Health Records (EHRs), is creating a synergistic environment for the integration of advanced C-arm imaging data. This integration enhances diagnostic capabilities and facilitates better patient management. The market penetration of advanced C-arm technologies is expected to increase as healthcare facilities across Europe invest in upgrading their existing infrastructure to meet the demands of modern medical practices. The increasing volume of orthopedic surgeries, cardiovascular interventions, and neurological procedures directly translates into a heightened demand for sophisticated C-arm systems. The market's trajectory is also influenced by the growing adoption of hybrid operating rooms, which require integrated imaging solutions like advanced C-arms for complex procedures. The continuous development of new imaging techniques and detectors is further driving innovation and expanding the application scope of C-arm technology. This creates a dynamic market environment where companies that can offer cutting-edge, user-friendly, and application-specific C-arm solutions are best positioned for success. The demand for mini C-arms is also expected to rise, particularly in specialized fields and for bedside imaging. The increasing awareness regarding radiation safety among both healthcare professionals and patients is also a key factor driving the development and adoption of C-arm systems with advanced dose reduction technologies. This trend is expected to accelerate the market's growth as manufacturers introduce more efficient and safer imaging solutions.

Dominant Markets & Segments in Europe C-Arms Market

The Mobile C-Arms segment is poised for significant dominance within the Europe C-Arms Market, driven by their inherent versatility and adaptability across various clinical settings. Within this category, Full-Size C-Arms are expected to lead, owing to their comprehensive imaging capabilities essential for complex surgical procedures. The application segment of Orthopedics and Trauma is a primary growth engine, experiencing sustained demand due to an aging population, rising sports-related injuries, and the increasing adoption of minimally invasive orthopedic surgeries. The infrastructure supporting orthopedic care, including dedicated surgical suites and trauma centers, is well-developed across major European economies, further bolstering this segment.

- Key Growth Drivers for Mobile C-Arms:

- Flexibility and Portability: Enables seamless use in operating rooms, intensive care units, and emergency departments, catering to diverse patient needs.

- Advancements in Imaging Technology: Improved resolution, reduced radiation dosage, and enhanced fluoroscopic capabilities are critical for precise surgical guidance.

- Growth in Minimally Invasive Procedures: Mobile C-arms are integral to the success of these procedures, offering real-time imaging without requiring the patient to be moved.

- Hybrid Operating Rooms: The proliferation of hybrid ORs, which combine surgical and interventional capabilities, necessitates the integration of advanced mobile C-arms.

The Cardiology application segment also demonstrates strong growth, propelled by the high prevalence of cardiovascular diseases and the increasing volume of interventional cardiology procedures such as angioplasty and stenting. The requirement for high-quality, real-time imaging during these life-saving interventions makes advanced C-arms indispensable. Countries like Germany, France, and the United Kingdom are major contributors to this segment's growth due to their advanced healthcare infrastructure and high expenditure on cardiovascular treatments.

- Key Growth Drivers for Cardiology Application:

- Prevalence of Cardiovascular Diseases: A significant and growing patient population requiring diagnostic and interventional procedures.

- Technological Advancements in Interventional Cardiology: The development of new devices and techniques necessitates sophisticated imaging support.

- Increased Number of Interventional Procedures: Rising rates of angioplasties, stent placements, and electrophysiology procedures.

- Development of Hybrid Cath Labs: Integration of C-arms within these advanced facilities to perform complex interventions.

While Fixed C-Arms will continue to hold a significant market share, particularly in dedicated radiology suites and specialized imaging centers, the agility and broader applicability of mobile solutions are driving their accelerated growth and market dominance. The Gastroenterology, Neurology, and Oncology segments also present substantial opportunities, driven by ongoing research, technological innovation, and the increasing need for advanced imaging in diagnosis and treatment planning. The market's overall trajectory points towards a sustained preference for mobile C-arm solutions across key applications in Europe.

Europe C-Arms Market Product Analysis

The Europe C-Arms Market is witnessing a wave of product innovation focused on enhancing imaging fidelity, reducing radiation exposure, and improving user experience. Companies are introducing C-arms with high-resolution detectors, advanced image processing algorithms, and intuitive user interfaces. Key product advancements include hybrid C-arms capable of both fluoroscopic and static X-ray imaging, offering greater versatility for various surgical scenarios. The integration of AI-powered software for image enhancement and automated parameter selection is also a significant trend, improving diagnostic accuracy and workflow efficiency. These innovations directly address the demand for safer, more precise, and faster diagnostic and interventional procedures, solidifying the competitive advantage of manufacturers at the forefront of technological development.

Key Drivers, Barriers & Challenges in Europe C-Arms Market

Key Drivers: The Europe C-Arms Market is propelled by several significant drivers. Technologically, the continuous advancements in imaging resolution, dose reduction technologies, and AI-powered image processing are enhancing the efficacy and safety of C-arm systems. Economically, the increasing healthcare expenditure across European nations, coupled with the rising prevalence of chronic diseases and an aging population, is driving demand for sophisticated medical imaging solutions. Policy-driven factors, such as government initiatives to improve healthcare infrastructure and promote early diagnosis, also contribute to market expansion. The growing adoption of minimally invasive surgical procedures, which rely heavily on real-time imaging from C-arms, is a substantial catalyst.

Barriers & Challenges: Despite the growth, the market faces several challenges. High acquisition costs for advanced C-arm systems can be a significant barrier for smaller healthcare facilities, impacting market penetration. Stringent regulatory approvals for medical devices in Europe, although ensuring safety and efficacy, can prolong the time-to-market for new products. Supply chain disruptions and component shortages, particularly for sophisticated electronic parts, can affect manufacturing timelines and availability. Furthermore, intense competition among established players and the emergence of new entrants necessitate continuous innovation and competitive pricing strategies, putting pressure on profit margins. The need for specialized training for healthcare professionals to operate advanced C-arm systems also presents an ongoing operational challenge for healthcare providers.

Growth Drivers in the Europe C-Arms Market Market

The Europe C-Arms Market's growth is significantly influenced by key technological, economic, and regulatory factors. Technologically, the development of lighter, more compact, and user-friendly C-arms is expanding their applicability in diverse clinical settings. AI integration for automated image acquisition and analysis is revolutionizing diagnostic speed and accuracy. Economically, the robust healthcare infrastructure in many European countries, coupled with increasing patient volumes for orthopedic, cardiovascular, and neurological procedures, is a primary growth catalyst. Government investments in healthcare modernization and the growing demand for advanced medical devices further fuel market expansion.

Challenges Impacting Europe C-Arms Market Growth

The Europe C-Arms Market faces considerable challenges that can impede its growth trajectory. Regulatory complexities, including the need to comply with evolving medical device regulations across different EU member states, can lead to extended approval processes and increased compliance costs. Supply chain vulnerabilities, exacerbated by global geopolitical events and material shortages, can disrupt production and impact the availability of crucial components. Intense competitive pressures from both global giants and emerging regional players necessitate significant investment in R&D and marketing, potentially squeezing profit margins. The high capital expenditure required for advanced C-arm systems can also be a restraint for smaller healthcare providers, limiting their adoption of the latest technologies.

Key Players Shaping the Europe C-Arms Market Market

- Hologic Inc

- GE Healthcare

- Koninklijke Philips N V

- SternMed GmbH

- DMS Imaging

- Ziehm Imaging GmbH

- Allengers Medical System Ltd

- Canon Medical Systems Corporation

- Siemens Healthineers GmbH

- Shimadzu Corporation

- Eurocolumbus SRL

Significant Europe C-Arms Market Industry Milestones

- July 2022: Fujifilm Europe launched FDR CROSS, a new hybrid C-arm and portable X-ray device designed for high-quality fluoroscopic and static X-ray imaging during surgical and medical procedures. This innovation expands the market's offerings in flexible, multi-functional imaging solutions.

- January 2022: Cydar and Philips established an exclusive partnership. As part of this collaboration, Philips will offer Cydar EV Maps alongside its Image-Guided Therapy Mobile C-arm System, Zenition. This strategic alliance aims to broaden commercial reach and integrate advanced navigation software with leading C-arm technology.

Future Outlook for Europe C-Arms Market Market

The future outlook for the Europe C-Arms Market is exceptionally promising, driven by sustained technological innovation and increasing demand for advanced medical imaging solutions. Strategic opportunities lie in the further development of AI-integrated C-arms that offer predictive analytics and enhanced diagnostic capabilities, along with solutions designed for interventional radiology and minimally invasive surgery. The growing emphasis on point-of-care diagnostics and the expansion of hybrid operating rooms will continue to fuel the demand for mobile and versatile C-arm systems. Furthermore, emerging markets within Europe and a continued focus on upgrading existing healthcare infrastructure present significant market potential for manufacturers who can offer cost-effective, high-performance, and application-specific C-arm technologies. The market is expected to witness continued growth, driven by a blend of technological sophistication and the increasing need for precise and efficient medical imaging across a wide spectrum of healthcare applications.

Europe C-Arms Market Segmentation

-

1. Type

- 1.1. Fixed C-Arms

-

1.2. Mobile C-Arms

- 1.2.1. Full-Size C-Arms

- 1.2.2. Mini C-Arms

-

2. Application

- 2.1. Cardiology

- 2.2. Gastroenterology

- 2.3. Neurology

- 2.4. Orthopedics and Trauma

- 2.5. Oncology

- 2.6. Other Applications

Europe C-Arms Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe C-Arms Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements in Maneuverability and Imaging Capabilities; Increasing Incidence of Chronic Diseases and Geriatric Population Requiring Medical Imaging; Growing Demand for Advanced Imaging Technology

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment; Low Replacement Rates of C-Arm Systems

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Show a High Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed C-Arms

- 5.1.2. Mobile C-Arms

- 5.1.2.1. Full-Size C-Arms

- 5.1.2.2. Mini C-Arms

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Gastroenterology

- 5.2.3. Neurology

- 5.2.4. Orthopedics and Trauma

- 5.2.5. Oncology

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed C-Arms

- 6.1.2. Mobile C-Arms

- 6.1.2.1. Full-Size C-Arms

- 6.1.2.2. Mini C-Arms

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cardiology

- 6.2.2. Gastroenterology

- 6.2.3. Neurology

- 6.2.4. Orthopedics and Trauma

- 6.2.5. Oncology

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed C-Arms

- 7.1.2. Mobile C-Arms

- 7.1.2.1. Full-Size C-Arms

- 7.1.2.2. Mini C-Arms

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cardiology

- 7.2.2. Gastroenterology

- 7.2.3. Neurology

- 7.2.4. Orthopedics and Trauma

- 7.2.5. Oncology

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed C-Arms

- 8.1.2. Mobile C-Arms

- 8.1.2.1. Full-Size C-Arms

- 8.1.2.2. Mini C-Arms

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cardiology

- 8.2.2. Gastroenterology

- 8.2.3. Neurology

- 8.2.4. Orthopedics and Trauma

- 8.2.5. Oncology

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fixed C-Arms

- 9.1.2. Mobile C-Arms

- 9.1.2.1. Full-Size C-Arms

- 9.1.2.2. Mini C-Arms

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Cardiology

- 9.2.2. Gastroenterology

- 9.2.3. Neurology

- 9.2.4. Orthopedics and Trauma

- 9.2.5. Oncology

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fixed C-Arms

- 10.1.2. Mobile C-Arms

- 10.1.2.1. Full-Size C-Arms

- 10.1.2.2. Mini C-Arms

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Cardiology

- 10.2.2. Gastroenterology

- 10.2.3. Neurology

- 10.2.4. Orthopedics and Trauma

- 10.2.5. Oncology

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Europe Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Fixed C-Arms

- 11.1.2. Mobile C-Arms

- 11.1.2.1. Full-Size C-Arms

- 11.1.2.2. Mini C-Arms

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Cardiology

- 11.2.2. Gastroenterology

- 11.2.3. Neurology

- 11.2.4. Orthopedics and Trauma

- 11.2.5. Oncology

- 11.2.6. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Germany Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 13. France Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe C-Arms Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Hologic Inc

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 GE Healthcare

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Koninklijke Philips N V

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 SternMed GmbH

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 DMS Imaging

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Ziehm Imaging GmbH

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Allengers Medical System Ltd

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Canon Medical Systems Corporation

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Siemens Healthineers GmbH

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Shimadzu Corporation

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Eurocolumbus SRL

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.1 Hologic Inc

List of Figures

- Figure 1: Europe C-Arms Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe C-Arms Market Share (%) by Company 2024

List of Tables

- Table 1: Europe C-Arms Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe C-Arms Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe C-Arms Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe C-Arms Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Europe C-Arms Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Europe C-Arms Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Europe C-Arms Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe C-Arms Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Europe C-Arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe C-Arms Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Germany Europe C-Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe C-Arms Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: France Europe C-Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe C-Arms Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe C-Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe C-Arms Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe C-Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe C-Arms Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe C-Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe C-Arms Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe C-Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe C-Arms Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe C-Arms Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe C-Arms Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Europe C-Arms Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Europe C-Arms Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 27: Europe C-Arms Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Europe C-Arms Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 29: Europe C-Arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe C-Arms Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: Europe C-Arms Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Europe C-Arms Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 33: Europe C-Arms Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Europe C-Arms Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 35: Europe C-Arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Europe C-Arms Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: Europe C-Arms Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Europe C-Arms Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 39: Europe C-Arms Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Europe C-Arms Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 41: Europe C-Arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe C-Arms Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Europe C-Arms Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Europe C-Arms Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 45: Europe C-Arms Market Revenue Million Forecast, by Application 2019 & 2032

- Table 46: Europe C-Arms Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 47: Europe C-Arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Europe C-Arms Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 49: Europe C-Arms Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Europe C-Arms Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 51: Europe C-Arms Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Europe C-Arms Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 53: Europe C-Arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Europe C-Arms Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 55: Europe C-Arms Market Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Europe C-Arms Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 57: Europe C-Arms Market Revenue Million Forecast, by Application 2019 & 2032

- Table 58: Europe C-Arms Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 59: Europe C-Arms Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Europe C-Arms Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe C-Arms Market?

The projected CAGR is approximately 4.63%.

2. Which companies are prominent players in the Europe C-Arms Market?

Key companies in the market include Hologic Inc, GE Healthcare, Koninklijke Philips N V, SternMed GmbH, DMS Imaging, Ziehm Imaging GmbH, Allengers Medical System Ltd, Canon Medical Systems Corporation, Siemens Healthineers GmbH, Shimadzu Corporation, Eurocolumbus SRL.

3. What are the main segments of the Europe C-Arms Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 656.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Advancements in Maneuverability and Imaging Capabilities; Increasing Incidence of Chronic Diseases and Geriatric Population Requiring Medical Imaging; Growing Demand for Advanced Imaging Technology.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Show a High Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Equipment; Low Replacement Rates of C-Arm Systems.

8. Can you provide examples of recent developments in the market?

July 2022: Fujifilm Europe launched a new hybrid C-arm and portable x-ray device. FDR CROSS is a flexible, hybrid C-arm, and portable x-ray machine designed to offer high-quality fluoroscopic and static x-ray images during surgery and other medical procedures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe C-Arms Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe C-Arms Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe C-Arms Market?

To stay informed about further developments, trends, and reports in the Europe C-Arms Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence