Key Insights

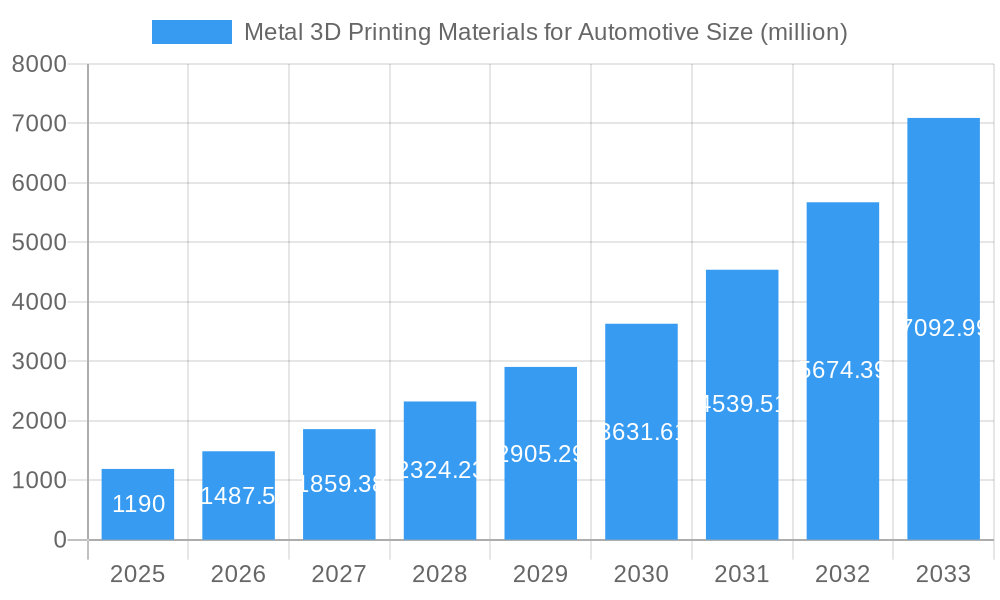

The Metal 3D Printing Materials for Automotive market is poised for significant expansion, projected to reach an estimated $1.19 billion in 2025. This robust growth is underpinned by an impressive Compound Annual Growth Rate (CAGR) of 25% throughout the forecast period of 2025-2033. The automotive industry's increasing adoption of additive manufacturing for prototyping, tooling, and the production of complex, lightweight components is a primary driver. Innovations in material science, particularly in the development of advanced metal powders like high-strength steels, titanium alloys, and aluminum alloys, are enabling the creation of parts with superior performance characteristics, improved fuel efficiency, and enhanced safety. The demand for customized and on-demand production, along with the need to reduce lead times and supply chain complexities, further fuels the adoption of metal 3D printing.

Metal 3D Printing Materials for Automotive Market Size (In Billion)

Key trends shaping this market include the growing application of metal additive manufacturing in electric vehicles (EVs) for battery components, motor housings, and lightweight structural elements. The increasing focus on sustainability and the potential for material waste reduction through additive processes also contribute to market momentum. While the market exhibits strong growth, it faces certain restraints. High initial investment costs for industrial-grade 3D printers and specialized materials can be a barrier for some manufacturers. Furthermore, the need for rigorous quality control and standardization for critical automotive components, along with the availability of skilled labor for operating and maintaining additive manufacturing systems, present ongoing challenges that the industry is actively addressing. The market is segmented across various applications, with passenger cars and commercial vehicles being dominant segments, and material types encompassing iron-based alloys, titanium, nickel, and aluminum, each offering unique benefits for specific automotive applications.

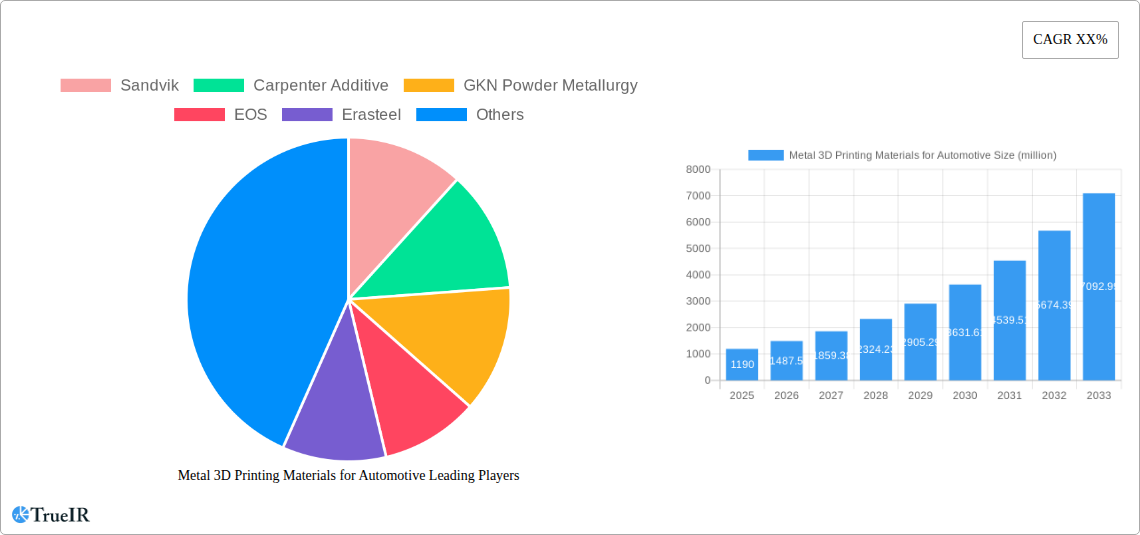

Metal 3D Printing Materials for Automotive Company Market Share

This in-depth report delves into the dynamic Metal 3D Printing Materials for Automotive market, forecasting significant growth and evolution from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this analysis leverages a study period spanning 2019-2033 to provide unparalleled insights into market dynamics, technological advancements, and key industry players. We project the global metal additive manufacturing materials for automotive market to reach $45 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 22% during the forecast period. This report is essential for automotive manufacturers, material suppliers, technology providers, and investors seeking to understand the present landscape and future trajectory of 3D printed automotive parts, metal powders for additive manufacturing, and advanced materials for vehicle production.

Metal 3D Printing Materials for Automotive Market Structure & Competitive Landscape

The metal 3D printing materials for automotive market exhibits a moderately concentrated structure, with leading players investing heavily in research and development to drive innovation. Key innovation drivers include the demand for lightweighting, customization, and complex geometries that traditional manufacturing methods cannot achieve. Regulatory impacts, particularly those focused on emission reduction and safety standards, are indirectly influencing the adoption of advanced materials. Product substitutes, while present in some applications, are increasingly being outperformed by the superior performance characteristics offered by 3D printed metal components. End-user segmentation is crucial, with passenger cars and commercial vehicles representing distinct market segments with varying material requirements. Mergers and acquisitions (M&A) are a significant trend, with major companies acquiring specialized material providers to bolster their additive manufacturing capabilities. For instance, in the historical period, there were over 15 significant M&A deals valued at approximately $3 billion, indicating a consolidation drive to secure intellectual property and market share. Concentration ratios for key material types like iron-based and titanium powders are estimated to be around 60% held by the top five players.

Metal 3D Printing Materials for Automotive Market Trends & Opportunities

The metal 3D printing materials for automotive market is witnessing exponential growth, driven by a confluence of technological advancements, evolving consumer preferences, and strategic industry developments. The market size is projected to expand from $25 billion in 2023 to an impressive $45 billion by 2025, and is expected to surpass $100 billion by 2033. Technological shifts are paramount, with advancements in powder metallurgy, binder jetting, and direct energy deposition (DED) enabling the use of a wider array of metal powders for additive manufacturing. Consumer preferences are increasingly leaning towards personalized vehicle designs, enhanced performance, and improved fuel efficiency, all of which can be realized through additive manufacturing. The competitive dynamics are intensifying, with established material suppliers and automotive OEMs vying for leadership. Opportunities abound in developing novel high-performance alloys for critical automotive components, such as engine parts, chassis structures, and interior fixtures. The penetration rate of 3D printed automotive parts is expected to rise from approximately 5% in 2023 to over 20% by 2033. The increasing adoption of electric vehicles (EVs) also presents a substantial opportunity, as additive manufacturing can enable lighter, more efficient battery components and powertrain parts, contributing to extended range and reduced charging times. Furthermore, the development of sustainable and recyclable metal 3D printing materials is becoming a key trend, aligning with the automotive industry's broader environmental goals. The integration of AI and machine learning in material design and process optimization is further accelerating innovation, leading to customized material properties for specific applications. The growth of the aftermarket for replacement parts for vehicles through additive manufacturing also represents a significant untapped potential.

Dominant Markets & Segments in Metal 3D Printing Materials for Automotive

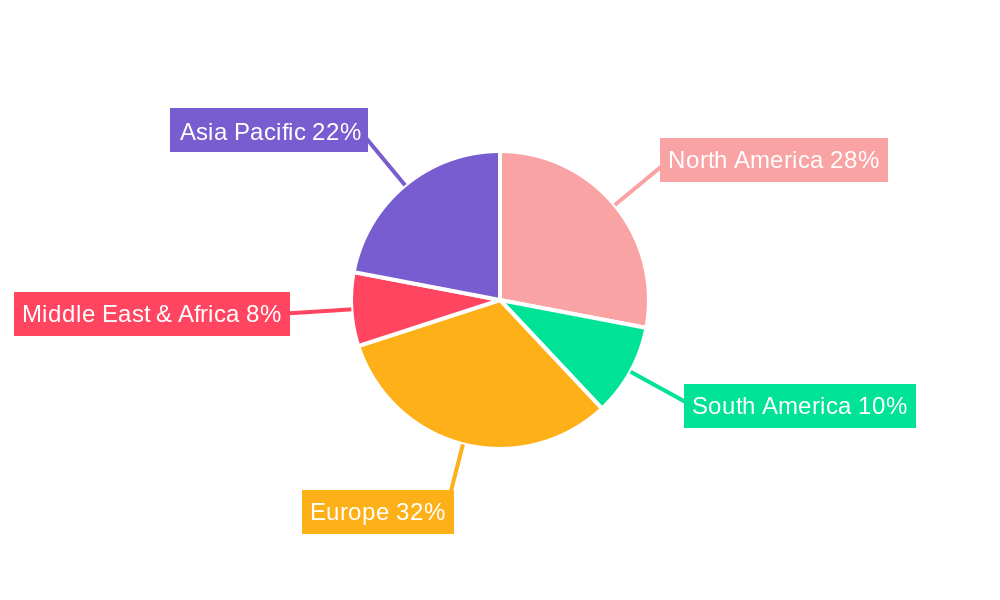

The metal 3D printing materials for automotive market is experiencing robust growth across various applications and material types. Within the Application segment, Passenger Cars currently represent the largest market share, accounting for an estimated 65% of the total market value in 2025, driven by the demand for lightweighting, performance enhancement, and customization in the high-volume automotive sector. However, Commercial Vehicles are projected to exhibit the highest CAGR, estimated at 25%, due to the increasing need for durable, high-strength components and the potential for on-demand spare parts manufacturing. In terms of Types, Iron-based materials dominate the market, holding approximately 40% of the share in 2025, owing to their cost-effectiveness and widespread use in structural components. Titanium alloys are witnessing significant growth, particularly in high-performance applications where strength-to-weight ratio is critical, with an estimated CAGR of 28%. Nickel-based alloys are crucial for high-temperature applications and corrosion resistance, showing a steady growth trajectory. Aluminum alloys are gaining traction for their lightweight properties, especially in EV battery enclosures and structural components, with an anticipated CAGR of 26%. The Others category, encompassing specialized alloys and composites, is expected to grow at a CAGR of 30%, fueled by ongoing R&D and niche applications. Leading regions like North America and Europe are spearheading the adoption of these materials, supported by strong automotive manufacturing bases and proactive government initiatives promoting advanced manufacturing technologies. Asia Pacific is emerging as a fast-growing market, driven by increasing automotive production and a burgeoning demand for customized and high-performance vehicles. Key growth drivers in these dominant markets include government policies supporting advanced manufacturing, substantial investments in R&D by automotive OEMs and material suppliers, and the increasing adoption of additive manufacturing for prototyping and serial production.

Metal 3D Printing Materials for Automotive Product Analysis

The metal 3D printing materials for automotive landscape is characterized by continuous product innovation, offering enhanced performance and expanded application possibilities. Innovations focus on developing high-strength, lightweight alloys with improved fatigue resistance and superior corrosion properties, enabling the production of critical automotive components like engine parts, chassis elements, and suspension systems. The ability to create complex geometries and consolidated part designs through additive manufacturing provides significant competitive advantages, leading to reduced assembly times and enhanced structural integrity. For example, Nickel-based superalloys are being tailored for exhaust system components, offering exceptional thermal stability and durability. Similarly, advancements in aluminum alloys are enabling the production of lighter and more energy-efficient EV battery casings.

Key Drivers, Barriers & Challenges in Metal 3D Printing Materials for Automotive

The metal 3D printing materials for automotive market is propelled by several key drivers, including the relentless pursuit of vehicle lightweighting for improved fuel efficiency and reduced emissions, the growing demand for highly customized and personalized vehicle components, and the ability to produce complex geometries unattainable with traditional manufacturing methods. Technological advancements in metal powder production and printing processes are also significant drivers, expanding the range of feasible applications. For instance, the development of fine-grain titanium powders has enabled the printing of high-precision aerospace-grade components for automotive applications.

Conversely, the market faces several barriers and challenges. High material costs, particularly for specialized alloys like nickel and titanium, remain a significant restraint, impacting the cost-effectiveness of mass production. Regulatory hurdles related to material certification and part validation for safety-critical automotive applications are also a concern, with estimated delays of 6-12 months for new material approvals. Supply chain complexities for raw materials and the need for specialized manufacturing infrastructure pose further challenges. Competitive pressures from established, lower-cost traditional manufacturing methods also necessitate continued innovation and cost reduction in additive manufacturing. The estimated impact of these challenges on market penetration can be a delay of 15-20% in widespread adoption for certain components.

Growth Drivers in the Metal 3D Printing Materials for Automotive Market

Key growth drivers in the metal 3D printing materials for automotive market are fundamentally tied to the automotive industry's evolution. Lightweighting initiatives to improve fuel economy and reduce CO2 emissions are paramount, making aluminum and titanium alloys increasingly attractive. The burgeoning electric vehicle (EV) market presents a significant opportunity, with additive manufacturing enabling the production of lighter, more efficient battery enclosures, motor components, and thermal management systems. Furthermore, the demand for customization and personalization in vehicles fuels the adoption of 3D printing for unique interior and exterior components. Technological advancements in printing processes and material science are also crucial, leading to the development of novel high-performance alloys with enhanced properties like superior strength, fatigue resistance, and thermal stability. Government incentives and supportive policies promoting advanced manufacturing technologies also play a vital role in accelerating market growth.

Challenges Impacting Metal 3D Printing Materials for Automotive Growth

Despite its promising trajectory, the metal 3D printing materials for automotive market faces notable challenges. The high cost of metal powders for additive manufacturing, especially for advanced alloys, remains a significant barrier to widespread adoption, impacting the overall cost-effectiveness of 3D printed parts compared to traditionally manufactured components. Regulatory complexities and standardization issues for safety-critical automotive parts are also a concern, requiring rigorous validation and certification processes that can be time-consuming and costly. Supply chain vulnerabilities for certain raw materials and the need for specialized infrastructure for printing and post-processing can also hinder growth. Scalability and production speed for mass production applications continue to be areas of development, with current technologies sometimes struggling to match the throughput of traditional methods. The estimated economic impact of these challenges can lead to a 10-15% slower adoption rate for certain applications.

Key Players Shaping the Metal 3D Printing Materials for Automotive Market

The metal 3D printing materials for automotive market is actively shaped by a diverse group of innovative companies. These include:

- Sandvik

- Carpenter Additive

- GKN Powder Metallurgy

- EOS

- Erasteel

- GE Additive

- Hoganas

- HC Starck

- AMC Powders

- Jingye Group

Significant Metal 3D Printing Materials for Automotive Industry Milestones

- 2019: Sandvik launches a new range of high-performance metal powders for additive manufacturing, including stainless steels and titanium alloys specifically for automotive applications.

- 2020: GE Additive collaborates with automotive OEMs to develop 3D printed components for next-generation vehicle designs, focusing on lightweighting and performance.

- 2021: GKN Powder Metallurgy expands its additive manufacturing capabilities, investing in new facilities to meet the growing demand for 3D printed automotive parts.

- 2022: Carpenter Additive introduces novel alloy powders designed for high-volume production of critical automotive components, emphasizing cost-effectiveness and material performance.

- 2023: EOS partners with leading automotive tier-1 suppliers to integrate metal additive manufacturing into their production lines for series production of complex parts.

- 2024: Erasteel announces advancements in iron-based powders for automotive applications, offering improved mechanical properties and cost-efficiency.

- 2025 (Estimated): Significant breakthroughs in binder jetting technology for metal printing are expected, leading to faster and more cost-effective production of automotive parts.

- 2027 (Estimated): Increased adoption of metal 3D printing for full vehicle architectures and complex integrated components is anticipated.

- 2030 (Estimated): Widespread use of recycled metal powders for automotive 3D printing becomes a commercial reality, driven by sustainability initiatives.

- 2033 (Estimated): Metal additive manufacturing is projected to be a standard production method for a significant portion of specialized and high-performance automotive components.

Future Outlook for Metal 3D Printing Materials for Automotive Market

The future outlook for the metal 3D printing materials for automotive market is exceptionally bright, characterized by sustained innovation and expanding adoption. Key growth catalysts include the ongoing drive for electrification, the relentless pursuit of lightweighting, and the increasing demand for personalized vehicle experiences. Strategic opportunities lie in the development of advanced, multi-material printing capabilities, the integration of artificial intelligence for material design and process optimization, and the establishment of robust, localized supply chains. The market potential is immense, with additive manufacturing poised to revolutionize automotive design, engineering, and production, enabling the creation of safer, more efficient, and sustainable vehicles. The projected market size reaching over $100 billion by 2033 underscores the transformative impact of this technology on the automotive industry.

Metal 3D Printing Materials for Automotive Segmentation

-

1. Application

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Types

- 2.1. Iron-based

- 2.2. Titanium

- 2.3. Nickel

- 2.4. Aluminum

- 2.5. Others

Metal 3D Printing Materials for Automotive Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Metal 3D Printing Materials for Automotive Regional Market Share

Geographic Coverage of Metal 3D Printing Materials for Automotive

Metal 3D Printing Materials for Automotive REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metal 3D Printing Materials for Automotive Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Iron-based

- 5.2.2. Titanium

- 5.2.3. Nickel

- 5.2.4. Aluminum

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Metal 3D Printing Materials for Automotive Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Iron-based

- 6.2.2. Titanium

- 6.2.3. Nickel

- 6.2.4. Aluminum

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Metal 3D Printing Materials for Automotive Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Iron-based

- 7.2.2. Titanium

- 7.2.3. Nickel

- 7.2.4. Aluminum

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Metal 3D Printing Materials for Automotive Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Iron-based

- 8.2.2. Titanium

- 8.2.3. Nickel

- 8.2.4. Aluminum

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Metal 3D Printing Materials for Automotive Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Iron-based

- 9.2.2. Titanium

- 9.2.3. Nickel

- 9.2.4. Aluminum

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Metal 3D Printing Materials for Automotive Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Cars

- 10.1.2. Commercial Vehicles

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Iron-based

- 10.2.2. Titanium

- 10.2.3. Nickel

- 10.2.4. Aluminum

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Sandvik

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carpenter Additive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GKN Powder Metallurgy

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EOS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Erasteel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GE Additive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hoganas

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HC Starck

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AMC Powders

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Jingye Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Sandvik

List of Figures

- Figure 1: Global Metal 3D Printing Materials for Automotive Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Metal 3D Printing Materials for Automotive Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Metal 3D Printing Materials for Automotive Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Metal 3D Printing Materials for Automotive Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Metal 3D Printing Materials for Automotive Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Metal 3D Printing Materials for Automotive Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Metal 3D Printing Materials for Automotive Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Metal 3D Printing Materials for Automotive Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Metal 3D Printing Materials for Automotive Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Metal 3D Printing Materials for Automotive Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Metal 3D Printing Materials for Automotive Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Metal 3D Printing Materials for Automotive Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Metal 3D Printing Materials for Automotive Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Metal 3D Printing Materials for Automotive Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Metal 3D Printing Materials for Automotive Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Metal 3D Printing Materials for Automotive Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Metal 3D Printing Materials for Automotive Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Metal 3D Printing Materials for Automotive Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Metal 3D Printing Materials for Automotive Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Metal 3D Printing Materials for Automotive Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Metal 3D Printing Materials for Automotive Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Metal 3D Printing Materials for Automotive Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Metal 3D Printing Materials for Automotive Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Metal 3D Printing Materials for Automotive Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Metal 3D Printing Materials for Automotive Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Metal 3D Printing Materials for Automotive Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Metal 3D Printing Materials for Automotive Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Metal 3D Printing Materials for Automotive Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Metal 3D Printing Materials for Automotive Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Metal 3D Printing Materials for Automotive Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Metal 3D Printing Materials for Automotive Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Types 2020 & 2033

- Table 7: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Canada Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Mexico Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Types 2020 & 2033

- Table 13: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Brazil Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Argentina Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Types 2020 & 2033

- Table 19: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Germany Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Spain Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Russia Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Benelux Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Nordics Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Types 2020 & 2033

- Table 31: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Turkey Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Israel Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: GCC Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: North Africa Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Types 2020 & 2033

- Table 40: Global Metal 3D Printing Materials for Automotive Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: China Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: India Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Japan Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Oceania Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Metal 3D Printing Materials for Automotive Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal 3D Printing Materials for Automotive?

The projected CAGR is approximately 25%.

2. Which companies are prominent players in the Metal 3D Printing Materials for Automotive?

Key companies in the market include Sandvik, Carpenter Additive, GKN Powder Metallurgy, EOS, Erasteel, GE Additive, Hoganas, HC Starck, AMC Powders, Jingye Group.

3. What are the main segments of the Metal 3D Printing Materials for Automotive?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metal 3D Printing Materials for Automotive," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metal 3D Printing Materials for Automotive report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metal 3D Printing Materials for Automotive?

To stay informed about further developments, trends, and reports in the Metal 3D Printing Materials for Automotive, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence