Key Insights

The Nordic rigid plastic packaging market, projected for a CAGR of 3.6%, offers significant investment potential. Demand is primarily driven by the region's strong pharmaceutical and food & beverage industries. E-commerce expansion and the need for secure product delivery are further accelerating growth. Increasing environmental consciousness is spurring the adoption of recyclable and lightweight packaging solutions, influencing material selection and design. While raw material price volatility presents a challenge, advancements in plastic production and recycling technologies are fostering cost optimization and sustainable practices. Key market participants, including Muovi-Heljanko Oy and Berry Global Inc., are investing in innovation and product portfolio expansion to meet evolving consumer demands and regulatory mandates. Intense competition necessitates a focus on differentiation through superior sustainability, product innovation, and streamlined supply chains.

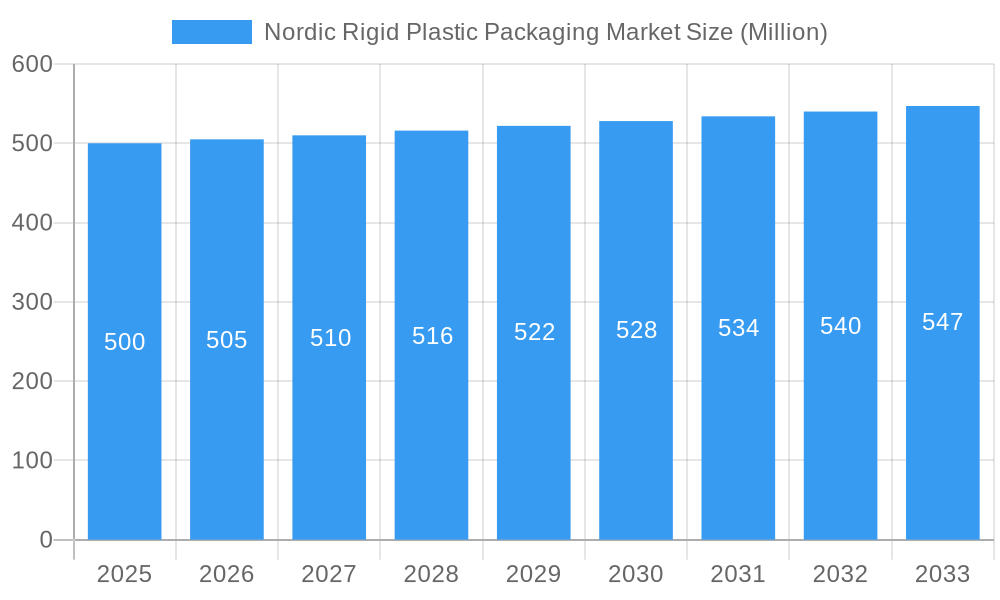

Nordic Rigid Plastic Packaging Market Market Size (In Billion)

Understanding market segmentation is vital for strategic planning. Key segments likely include packaging types (bottles, containers, tubs), end-use industries (food & beverage, pharmaceuticals, consumer goods, industrial goods), and material types (PET, HDPE, PP). Analyzing these segments will uncover niche growth opportunities. The region's emphasis on sustainability will likely propel the growth of eco-friendly and recyclable packaging segments. The forecast period, from 2025 to 2033, is expected to witness market consolidation as larger companies acquire smaller ones to achieve economies of scale and increase market share. This trend is amplified by the market's consistent growth trajectory. The market size is estimated at 220.2 billion by the base year 2025.

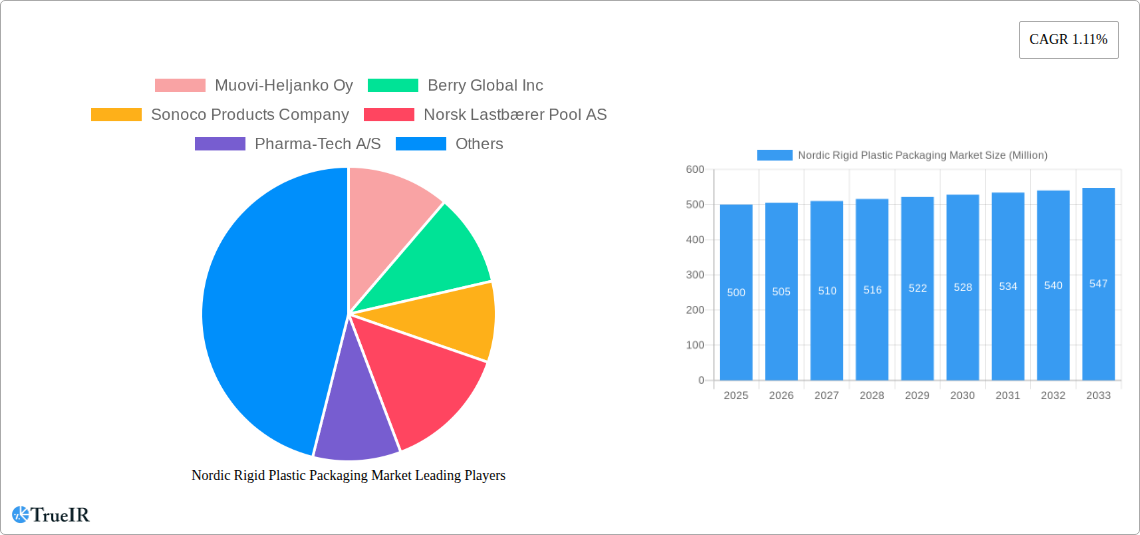

Nordic Rigid Plastic Packaging Market Company Market Share

Nordic Rigid Plastic Packaging Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Nordic rigid plastic packaging market, offering invaluable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this study meticulously examines market dynamics, competitive landscapes, and future growth potential. Leveraging extensive data analysis and expert insights, this report is a must-have resource for navigating the complexities of this dynamic sector.

Nordic Rigid Plastic Packaging Market Structure & Competitive Landscape

The Nordic rigid plastic packaging market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market. Innovation is a key driver, with companies constantly developing sustainable and efficient packaging solutions. Stringent environmental regulations across the Nordic region significantly impact the industry, pushing companies towards eco-friendly materials and production processes. Product substitution, primarily from biodegradable and compostable alternatives, poses a growing challenge. The market is segmented by end-user industries, including food & beverage, pharmaceuticals, consumer goods, and industrial applications. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on expanding product portfolios and geographical reach.

- Market Concentration: Moderately concentrated, HHI estimated at xx.

- Innovation Drivers: Sustainable materials, efficient production processes, enhanced recyclability.

- Regulatory Impacts: Stringent environmental regulations driving adoption of sustainable practices.

- Product Substitutes: Biodegradable and compostable packaging materials posing a competitive threat.

- End-User Segmentation: Food & beverage, pharmaceuticals, consumer goods, and industrial applications.

- M&A Trends: Moderate activity, focused on portfolio expansion and geographical reach (xx deals, 2019-2024).

Nordic Rigid Plastic Packaging Market Trends & Opportunities

The Nordic rigid plastic packaging market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market size is estimated at xx Million in 2025, driven by factors such as increasing consumer demand, growth in e-commerce, and rising adoption of advanced packaging technologies. Technological shifts towards lightweighting, improved barrier properties, and enhanced recyclability are shaping market trends. Consumer preferences for sustainable and convenient packaging influence product innovation. Competitive dynamics are characterized by both established players and emerging companies vying for market share through product differentiation, pricing strategies, and strategic partnerships. Market penetration rates for sustainable packaging options are steadily increasing, reaching an estimated xx% in 2025.

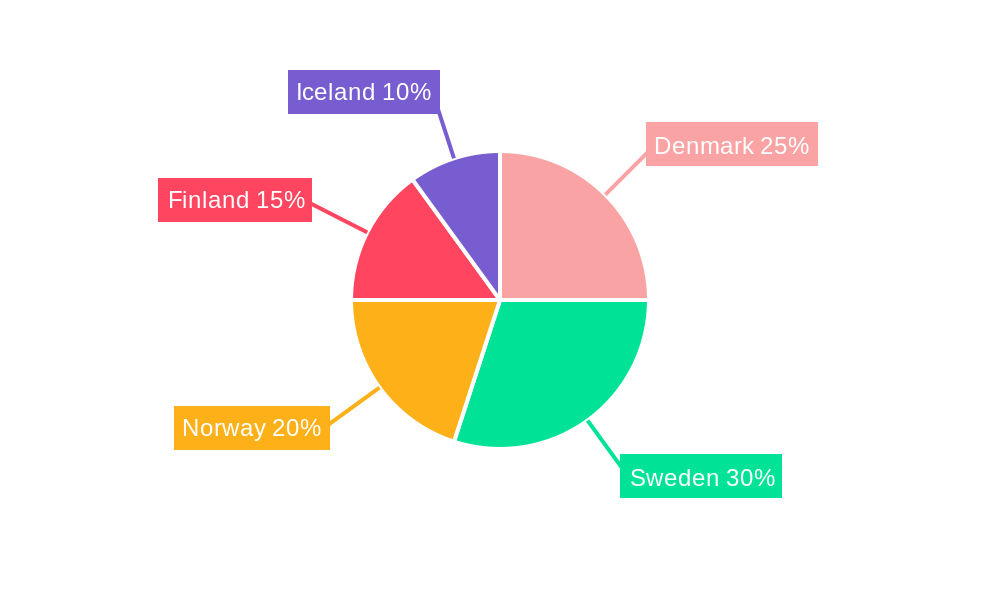

Dominant Markets & Segments in Nordic Rigid Plastic Packaging Market

The dominant segment within the Nordic rigid plastic packaging market is xx, primarily driven by strong consumer demand and robust growth within the xx industry. Sweden and Norway are the leading countries in terms of market size and growth, largely due to factors like strong economic conditions, supportive government policies, and advanced infrastructure.

- Key Growth Drivers (Sweden & Norway):

- Strong economic growth.

- Supportive government policies promoting sustainable packaging.

- Well-developed infrastructure and logistics networks.

- High consumer disposable income.

- Focus on food safety and hygiene.

Nordic Rigid Plastic Packaging Market Product Analysis

Product innovations in the Nordic rigid plastic packaging market are heavily focused on sustainability, including the use of recycled content (rPET), bio-based plastics, and lightweight designs. Applications range from food and beverage containers to pharmaceutical packaging and industrial components. Competitive advantages are derived from superior material properties, improved barrier protection, enhanced recyclability, and innovative design features. Technological advancements are driving the development of lighter, stronger, and more environmentally friendly packaging solutions tailored to specific end-user needs.

Key Drivers, Barriers & Challenges in Nordic Rigid Plastic Packaging Market

Key Drivers:

- Growing demand from the food and beverage sector.

- E-commerce expansion requiring efficient packaging solutions.

- Technological advancements in material science and packaging design.

- Government incentives for sustainable packaging options.

Challenges:

- Fluctuating raw material prices impacting production costs.

- Stringent environmental regulations and compliance requirements.

- Increased competition from alternative packaging materials.

- Supply chain disruptions causing delays and increased costs (estimated impact of xx Million annually).

Growth Drivers in the Nordic Rigid Plastic Packaging Market

The market is primarily driven by rising consumer demand, e-commerce growth, and technological advancements fostering innovation in sustainable packaging. Government regulations promoting eco-friendly materials and recycling also significantly contribute to market expansion. The increasing adoption of advanced recycling technologies, as seen in recent partnerships like Plast Nordic and Norner's alkaline hydrolysis initiative, further fuels market growth by increasing the availability of recycled materials.

Challenges Impacting Nordic Rigid Plastic Packaging Market Growth

Significant challenges include fluctuations in raw material prices, stringent environmental regulations requiring substantial investments in compliance, and intensified competition from alternative packaging solutions. Supply chain disruptions and geopolitical instability also contribute to uncertainty and increased production costs, hindering market growth.

Key Players Shaping the Nordic Rigid Plastic Packaging Market

- Muovi-Heljanko Oy

- Berry Global Inc

- Sonoco Products Company

- Norsk Lastbærer Pool AS

- Pharma-Tech A/S

- Creopack AB

- Maro Fabriken AB

- Berling Packaging

- Europak Oy

Significant Nordic Rigid Plastic Packaging Market Industry Milestones

- July 2024: Plast Nordic and Norner partner to implement alkaline hydrolysis for 97% PET waste recycling in the Nordics, creating virgin-quality rPET resin for packaging and other industries. This significantly boosts recycled material availability and reduces transportation needs.

- June 2024: Nordic Plast SIA (LTD) invests EUR 1.7 Million (USD 1.83 Million) to increase recycled pellet production capacity, driving demand for rigid plastic packaging.

Future Outlook for Nordic Rigid Plastic Packaging Market

The Nordic rigid plastic packaging market is poised for continued growth, driven by sustained consumer demand, technological innovations focused on sustainability, and supportive government policies. Strategic partnerships and investments in advanced recycling technologies will play a crucial role in shaping the future market landscape. Opportunities exist for companies to develop and commercialize innovative, eco-friendly packaging solutions tailored to the specific needs of the Nordic region. The market's future is bright, characterized by a strong focus on sustainability and circular economy principles.

Nordic Rigid Plastic Packaging Market Segmentation

-

1. Product Type

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Product Types

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE & LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene Terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 2.5. Polyvinyl chloride (PVC)

- 2.6. Other Rigid Plastic Packaging Materials

-

2.1. Polyethylene (PE)

-

3. End-Use Industries

-

3.1. Food**

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice**

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Other Foodservice End-uses

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other En

-

3.1. Food**

Nordic Rigid Plastic Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nordic Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of Nordic Rigid Plastic Packaging Market

Nordic Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient and Ease of Use Packaging; Consumer Demand for Single-Serve Packaging Options

- 3.3. Market Restrains

- 3.3.1. Demand for Convenient and Ease of Use Packaging; Consumer Demand for Single-Serve Packaging Options

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) To Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE & LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene Terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 5.2.5. Polyvinyl chloride (PVC)

- 5.2.6. Other Rigid Plastic Packaging Materials

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 5.3.1. Food**

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice**

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Other Foodservice End-uses

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other En

- 5.3.1. Food**

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Bottles and Jars

- 6.1.2. Trays and Containers

- 6.1.3. Caps and Closures

- 6.1.4. Intermediate Bulk Containers (IBCs)

- 6.1.5. Drums

- 6.1.6. Pallets

- 6.1.7. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Polyethylene (PE)

- 6.2.1.1. LDPE & LLDPE

- 6.2.1.2. HDPE

- 6.2.2. Polyethylene Terephthalate (PET)

- 6.2.3. Polypropylene (PP)

- 6.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 6.2.5. Polyvinyl chloride (PVC)

- 6.2.6. Other Rigid Plastic Packaging Materials

- 6.2.1. Polyethylene (PE)

- 6.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 6.3.1. Food**

- 6.3.1.1. Candy & Confectionery

- 6.3.1.2. Frozen Foods

- 6.3.1.3. Fresh Produce

- 6.3.1.4. Dairy Products

- 6.3.1.5. Dry Foods

- 6.3.1.6. Meat, Poultry, And Seafood

- 6.3.1.7. Pet Food

- 6.3.1.8. Other Food Products

- 6.3.2. Foodservice**

- 6.3.2.1. Quick Service Restaurants (QSRs)

- 6.3.2.2. Full-Service Restaurants (FSRs)

- 6.3.2.3. Coffee and Snack Outlets

- 6.3.2.4. Retail Establishments

- 6.3.2.5. Institutional

- 6.3.2.6. Hospitality

- 6.3.2.7. Other Foodservice End-uses

- 6.3.3. Beverage

- 6.3.4. Healthcare

- 6.3.5. Cosmetics and Personal Care

- 6.3.6. Industrial

- 6.3.7. Building and Construction

- 6.3.8. Automotive

- 6.3.9. Other En

- 6.3.1. Food**

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Bottles and Jars

- 7.1.2. Trays and Containers

- 7.1.3. Caps and Closures

- 7.1.4. Intermediate Bulk Containers (IBCs)

- 7.1.5. Drums

- 7.1.6. Pallets

- 7.1.7. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Polyethylene (PE)

- 7.2.1.1. LDPE & LLDPE

- 7.2.1.2. HDPE

- 7.2.2. Polyethylene Terephthalate (PET)

- 7.2.3. Polypropylene (PP)

- 7.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 7.2.5. Polyvinyl chloride (PVC)

- 7.2.6. Other Rigid Plastic Packaging Materials

- 7.2.1. Polyethylene (PE)

- 7.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 7.3.1. Food**

- 7.3.1.1. Candy & Confectionery

- 7.3.1.2. Frozen Foods

- 7.3.1.3. Fresh Produce

- 7.3.1.4. Dairy Products

- 7.3.1.5. Dry Foods

- 7.3.1.6. Meat, Poultry, And Seafood

- 7.3.1.7. Pet Food

- 7.3.1.8. Other Food Products

- 7.3.2. Foodservice**

- 7.3.2.1. Quick Service Restaurants (QSRs)

- 7.3.2.2. Full-Service Restaurants (FSRs)

- 7.3.2.3. Coffee and Snack Outlets

- 7.3.2.4. Retail Establishments

- 7.3.2.5. Institutional

- 7.3.2.6. Hospitality

- 7.3.2.7. Other Foodservice End-uses

- 7.3.3. Beverage

- 7.3.4. Healthcare

- 7.3.5. Cosmetics and Personal Care

- 7.3.6. Industrial

- 7.3.7. Building and Construction

- 7.3.8. Automotive

- 7.3.9. Other En

- 7.3.1. Food**

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Bottles and Jars

- 8.1.2. Trays and Containers

- 8.1.3. Caps and Closures

- 8.1.4. Intermediate Bulk Containers (IBCs)

- 8.1.5. Drums

- 8.1.6. Pallets

- 8.1.7. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Polyethylene (PE)

- 8.2.1.1. LDPE & LLDPE

- 8.2.1.2. HDPE

- 8.2.2. Polyethylene Terephthalate (PET)

- 8.2.3. Polypropylene (PP)

- 8.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 8.2.5. Polyvinyl chloride (PVC)

- 8.2.6. Other Rigid Plastic Packaging Materials

- 8.2.1. Polyethylene (PE)

- 8.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 8.3.1. Food**

- 8.3.1.1. Candy & Confectionery

- 8.3.1.2. Frozen Foods

- 8.3.1.3. Fresh Produce

- 8.3.1.4. Dairy Products

- 8.3.1.5. Dry Foods

- 8.3.1.6. Meat, Poultry, And Seafood

- 8.3.1.7. Pet Food

- 8.3.1.8. Other Food Products

- 8.3.2. Foodservice**

- 8.3.2.1. Quick Service Restaurants (QSRs)

- 8.3.2.2. Full-Service Restaurants (FSRs)

- 8.3.2.3. Coffee and Snack Outlets

- 8.3.2.4. Retail Establishments

- 8.3.2.5. Institutional

- 8.3.2.6. Hospitality

- 8.3.2.7. Other Foodservice End-uses

- 8.3.3. Beverage

- 8.3.4. Healthcare

- 8.3.5. Cosmetics and Personal Care

- 8.3.6. Industrial

- 8.3.7. Building and Construction

- 8.3.8. Automotive

- 8.3.9. Other En

- 8.3.1. Food**

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Bottles and Jars

- 9.1.2. Trays and Containers

- 9.1.3. Caps and Closures

- 9.1.4. Intermediate Bulk Containers (IBCs)

- 9.1.5. Drums

- 9.1.6. Pallets

- 9.1.7. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Polyethylene (PE)

- 9.2.1.1. LDPE & LLDPE

- 9.2.1.2. HDPE

- 9.2.2. Polyethylene Terephthalate (PET)

- 9.2.3. Polypropylene (PP)

- 9.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 9.2.5. Polyvinyl chloride (PVC)

- 9.2.6. Other Rigid Plastic Packaging Materials

- 9.2.1. Polyethylene (PE)

- 9.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 9.3.1. Food**

- 9.3.1.1. Candy & Confectionery

- 9.3.1.2. Frozen Foods

- 9.3.1.3. Fresh Produce

- 9.3.1.4. Dairy Products

- 9.3.1.5. Dry Foods

- 9.3.1.6. Meat, Poultry, And Seafood

- 9.3.1.7. Pet Food

- 9.3.1.8. Other Food Products

- 9.3.2. Foodservice**

- 9.3.2.1. Quick Service Restaurants (QSRs)

- 9.3.2.2. Full-Service Restaurants (FSRs)

- 9.3.2.3. Coffee and Snack Outlets

- 9.3.2.4. Retail Establishments

- 9.3.2.5. Institutional

- 9.3.2.6. Hospitality

- 9.3.2.7. Other Foodservice End-uses

- 9.3.3. Beverage

- 9.3.4. Healthcare

- 9.3.5. Cosmetics and Personal Care

- 9.3.6. Industrial

- 9.3.7. Building and Construction

- 9.3.8. Automotive

- 9.3.9. Other En

- 9.3.1. Food**

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Bottles and Jars

- 10.1.2. Trays and Containers

- 10.1.3. Caps and Closures

- 10.1.4. Intermediate Bulk Containers (IBCs)

- 10.1.5. Drums

- 10.1.6. Pallets

- 10.1.7. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Polyethylene (PE)

- 10.2.1.1. LDPE & LLDPE

- 10.2.1.2. HDPE

- 10.2.2. Polyethylene Terephthalate (PET)

- 10.2.3. Polypropylene (PP)

- 10.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 10.2.5. Polyvinyl chloride (PVC)

- 10.2.6. Other Rigid Plastic Packaging Materials

- 10.2.1. Polyethylene (PE)

- 10.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 10.3.1. Food**

- 10.3.1.1. Candy & Confectionery

- 10.3.1.2. Frozen Foods

- 10.3.1.3. Fresh Produce

- 10.3.1.4. Dairy Products

- 10.3.1.5. Dry Foods

- 10.3.1.6. Meat, Poultry, And Seafood

- 10.3.1.7. Pet Food

- 10.3.1.8. Other Food Products

- 10.3.2. Foodservice**

- 10.3.2.1. Quick Service Restaurants (QSRs)

- 10.3.2.2. Full-Service Restaurants (FSRs)

- 10.3.2.3. Coffee and Snack Outlets

- 10.3.2.4. Retail Establishments

- 10.3.2.5. Institutional

- 10.3.2.6. Hospitality

- 10.3.2.7. Other Foodservice End-uses

- 10.3.3. Beverage

- 10.3.4. Healthcare

- 10.3.5. Cosmetics and Personal Care

- 10.3.6. Industrial

- 10.3.7. Building and Construction

- 10.3.8. Automotive

- 10.3.9. Other En

- 10.3.1. Food**

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Muovi-Heljanko Oy

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Berry Global Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sonoco Products Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Norsk Lastbærer Pool AS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pharma-Tech A/S

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Creopack AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Maro Fabriken AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Berling Packaging

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Europak Oy8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Muovi-Heljanko Oy

List of Figures

- Figure 1: Global Nordic Rigid Plastic Packaging Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 5: North America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 6: North America Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 7: North America Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 8: North America Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 13: South America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 14: South America Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 15: South America Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 16: South America Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Europe Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 21: Europe Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: Europe Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 23: Europe Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 24: Europe Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 29: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 30: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 31: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 32: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 37: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 38: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 39: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 40: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 4: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 8: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 14: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 15: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 21: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 22: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 34: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 35: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 43: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 44: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 45: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nordic Rigid Plastic Packaging Market?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Nordic Rigid Plastic Packaging Market?

Key companies in the market include Muovi-Heljanko Oy, Berry Global Inc, Sonoco Products Company, Norsk Lastbærer Pool AS, Pharma-Tech A/S, Creopack AB, Maro Fabriken AB, Berling Packaging, Europak Oy8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Nordic Rigid Plastic Packaging Market?

The market segments include Product Type, Material, End-Use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 220.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient and Ease of Use Packaging; Consumer Demand for Single-Serve Packaging Options.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) To Witness Growth.

7. Are there any restraints impacting market growth?

Demand for Convenient and Ease of Use Packaging; Consumer Demand for Single-Serve Packaging Options.

8. Can you provide examples of recent developments in the market?

July 2024 - Plast Nordic and Norner partnered to implement alkaline hydrolysis to recycle 97% of PET waste in the Nordics back into raw materials. Their target markets for the 'virgin-quality' rPET resin are the packaging and other industries. The partners are set to recycle around 97% of this waste into raw materials. It believes advanced recycling is the 'only' technology that can achieve circularity without compromising the quality of the recyclate. This initiative is poised to enhance access to recycled materials, reduce transportation needs, and generate new employment opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nordic Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nordic Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nordic Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Nordic Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence