Key Insights

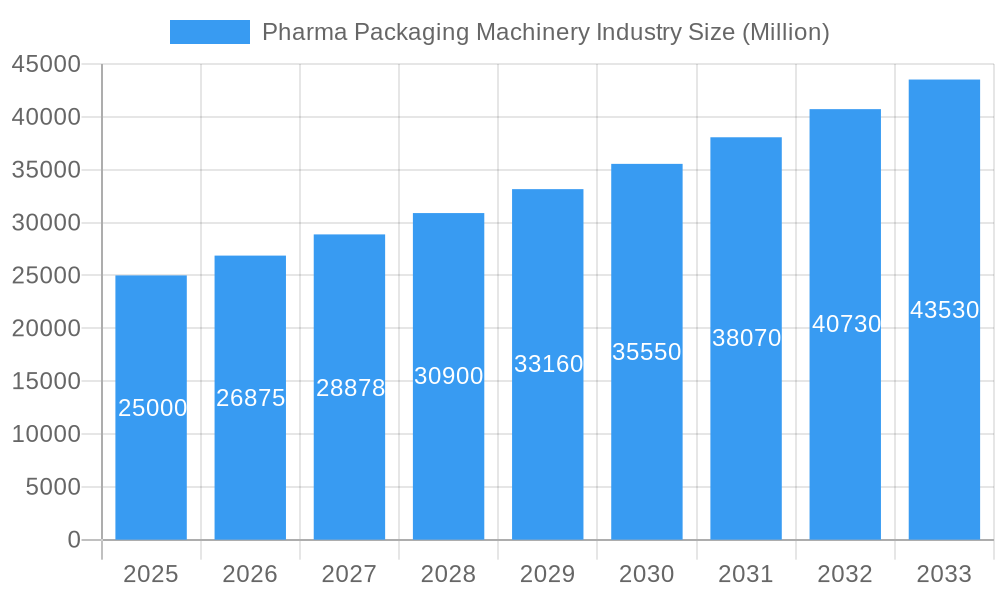

The pharmaceutical packaging machinery market is projected for significant expansion, driven by escalating global pharmaceutical demand and stringent regulatory mandates for product safety and traceability. This sector anticipates a Compound Annual Growth Rate (CAGR) of 7.74%, leading to a market size of 6.62 billion by 2033, with 2025 as the base year. Advancements in automation, serialization, and smart packaging are key growth catalysts, enhancing supply chain visibility and mitigating counterfeiting risks. The increasing incidence of chronic diseases and an aging global population further contribute to this market's upward trajectory, with North America and Europe leading demand due to their established pharmaceutical industries and rigorous regulatory environments.

Pharma Packaging Machinery Industry Market Size (In Billion)

Primary packaging machinery dominates market segments, followed by secondary packaging, labeling, and serialization solutions. Leading manufacturers are investing in R&D to address evolving industry needs and maintain a competitive edge. High initial capital investment for advanced machinery and economic volatility pose potential challenges, but the long-term outlook remains strong. Consistent growth in the pharmaceutical sector and the persistent need for enhanced packaging efficiency and security, particularly in the burgeoning Asia-Pacific market, will fuel future market penetration.

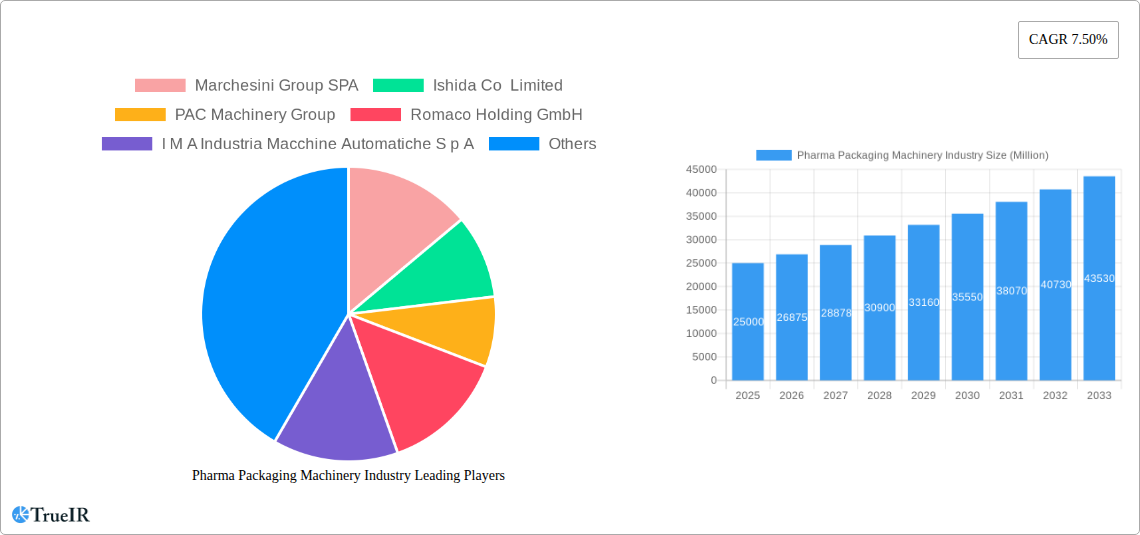

Pharma Packaging Machinery Industry Company Market Share

Pharma Packaging Machinery Market Analysis: Trends, Opportunities, and Forecasts (2019-2033)

This comprehensive report delivers critical insights into the global Pharma Packaging Machinery industry, essential for stakeholders navigating this dynamic market. The analysis covers the period 2019-2033, utilizing 2025 as the base and estimated year. The forecast period is 2025-2033, with historical data from 2019-2024. Extensive research provides a robust understanding of market size, growth trends, competitive landscapes, and future potential, supporting informed strategic decisions. The market, valued at 6.62 billion in the base year 2025, is projected to reach substantial figures by 2033, exhibiting a CAGR of 7.74%.

Pharma Packaging Machinery Industry Market Structure & Competitive Landscape

The global pharma packaging machinery market exhibits a moderately concentrated structure, with several key players commanding significant market share. The top ten companies—including Marchesini Group SPA, Ishida Co Limited, PAC Machinery Group, Romaco Holding GmbH, I M A Industria Macchine Automatiche S p A, Uhlmann Group, MG2 s r l, Syntegon Technology GmbH (Robert Bosch GmbH), MULTIVAC Group, and Accutek Packaging Equipment Companies Inc—account for approximately XX% of the global market in 2025. The market concentration ratio (CR4) is estimated at XX%, indicating a moderately consolidated landscape.

Several factors drive innovation within the industry, including the increasing demand for advanced packaging solutions, stringent regulatory requirements, and the growing need for enhanced product traceability and security. Mergers and acquisitions (M&A) activities are frequent, with XX major deals recorded between 2019 and 2024, driven by the desire for market consolidation, technological integration, and geographic expansion. The regulatory environment significantly impacts the industry, with evolving guidelines related to drug safety, serialization, and counterfeiting prevention influencing product development and market access. Product substitution is limited due to the specialized nature of the equipment, although increasing automation and integration are impacting the competitive landscape. End-user segmentation comprises pharmaceutical manufacturers of varying sizes, ranging from large multinational corporations to smaller specialized firms.

Pharma Packaging Machinery Industry Market Trends & Opportunities

The pharma packaging machinery market is experiencing robust growth, driven by several key factors. The increasing global demand for pharmaceutical products, particularly in emerging markets, fuels the need for efficient and sophisticated packaging solutions. Technological advancements, including the integration of automation, robotics, and artificial intelligence (AI), are enhancing packaging speed, accuracy, and efficiency. Consumer preferences for convenience, safety, and sustainability are also influencing packaging design and material selection. These trends are creating significant opportunities for companies offering innovative and customized solutions. The market size is projected to grow from $XX Million in 2025 to $XX Million in 2033, reflecting a strong CAGR of XX%. This growth is further fueled by a rising preference for advanced packaging technologies, particularly in the primary and secondary packaging segments. Market penetration rates are increasing across regions, driven by growing investments in pharmaceutical manufacturing capacity and improving healthcare infrastructure. Competitive dynamics are characterized by both innovation and consolidation, with established players expanding their product portfolios and smaller firms focusing on niche applications.

Dominant Markets & Segments in Pharma Packaging Machinery Industry

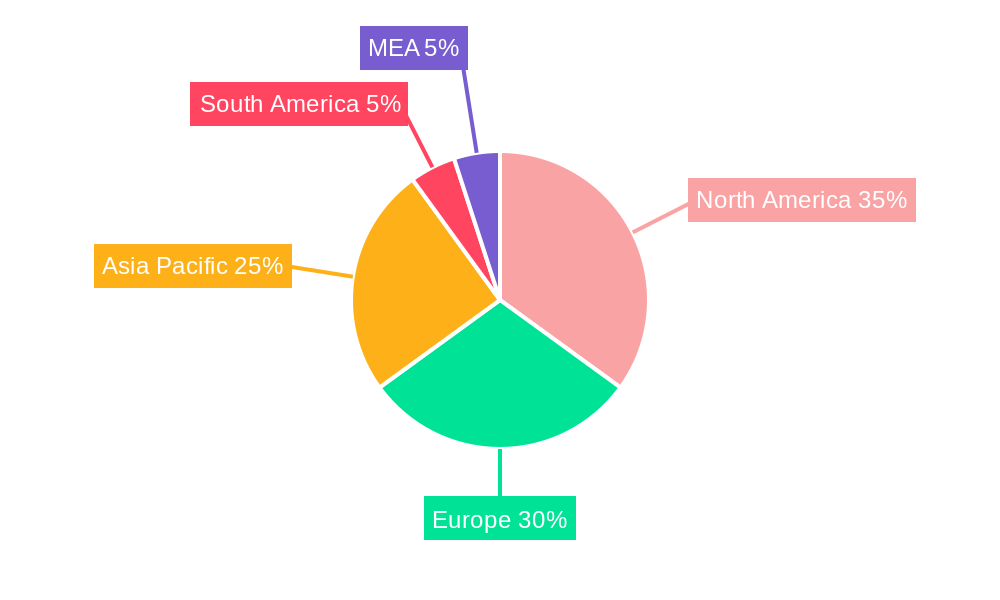

The North American and European regions currently dominate the pharma packaging machinery market, accounting for approximately XX% of the global market in 2025. However, Asia-Pacific is emerging as a key growth region, fueled by the rapid expansion of the pharmaceutical industry in countries like China and India.

By Machinery Type:

- Primary Packaging: This segment holds the largest market share, driven by the rising demand for blister packs, bottles, vials, and syringes. The high growth is attributed to the increase in pharmaceutical product launches and the need for robust primary packaging to ensure drug efficacy and safety.

- Secondary Packaging: This segment is experiencing substantial growth, driven by the increasing demand for cartons, cases, and other secondary packaging solutions for product protection, transportation, and marketing.

- Labelling and Serialization: This is the fastest-growing segment, propelled by stringent regulatory requirements for drug traceability and anti-counterfeiting measures.

Key Growth Drivers:

- Favorable government regulations promoting pharmaceutical manufacturing: Government initiatives and policies aimed at strengthening healthcare infrastructure and pharmaceutical manufacturing capabilities are bolstering market growth.

- Increasing investments in research and development of advanced packaging technologies: Significant investments are being made in developing advanced packaging solutions that enhance drug safety, efficacy, and convenience.

- Rising demand for customized packaging solutions: The growing demand for tailored packaging solutions to meet specific product and market requirements.

Pharma Packaging Machinery Industry Product Analysis

The pharma packaging machinery industry is characterized by continuous innovation, resulting in a diverse range of products. Technological advancements are focused on improving machine speed, accuracy, and efficiency, incorporating automation, robotics, and advanced sensors. These innovations enhance production output, reduce waste, and improve overall quality control. The market is witnessing a shift towards integrated packaging lines that seamlessly combine multiple packaging processes, optimizing operational efficiency and reducing costs. Competitive advantages are derived from product innovation, superior quality, reliability, after-sales service, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Pharma Packaging Machinery Industry

Key Drivers:

The pharma packaging machinery market is propelled by factors such as the rising demand for pharmaceutical products globally, stringent regulatory compliance needs necessitating advanced packaging solutions, the increasing adoption of automation and digitization within pharmaceutical manufacturing, and a focus on enhancing supply chain efficiency and security.

Key Challenges and Restraints:

The industry faces challenges such as high initial investment costs for advanced equipment, the complexity of regulatory compliance across diverse markets, supply chain disruptions affecting the availability of critical components, and intense competition leading to price pressures. These factors can impede market growth and profitability.

Growth Drivers in the Pharma Packaging Machinery Industry Market

Growth in the pharma packaging machinery market is significantly driven by technological advancements, including automation and AI-powered solutions, which increase production efficiency and reduce operational costs. Furthermore, stringent regulatory requirements worldwide, mandating advanced packaging technologies for serialization and track-and-trace capabilities, act as a major catalyst for market expansion. Finally, increased investments in pharmaceutical R&D and a growing global demand for pharmaceuticals further boost the need for reliable and sophisticated packaging machinery.

Challenges Impacting Pharma Packaging Machinery Industry Growth

Several challenges hinder the growth of the pharma packaging machinery industry. High capital expenditure for advanced equipment restricts entry for smaller firms. Navigating complex and evolving regulatory landscapes globally creates significant hurdles. Supply chain vulnerabilities and disruptions negatively impact production and delivery timelines. Furthermore, intense competition among existing players puts pressure on pricing and profit margins.

Key Players Shaping the Pharma Packaging Machinery Industry Market

- Marchesini Group SPA

- Ishida Co Limited

- PAC Machinery Group

- Romaco Holding GmbH

- I M A Industria Macchine Automatiche S p A

- Uhlmann Group

- MG2 s r l

- Syntegon Technology GmbH (Robert Bosch GmbH)

- MULTIVAC Group

- Accutek Packaging Equipment Companies Inc

- Mesoblast Limited

- Vanguard Pharmaceutical Machinery Inc

- Optima Packaging Group GmbH

Significant Pharma Packaging Machinery Industry Industry Milestones

- 2020: Syntegon Technology launched a new high-speed cartoning machine.

- 2021: Marchesini Group acquired a smaller packaging company specializing in blister packaging.

- 2022: New regulations regarding serialization were implemented in several key markets.

- 2023: Several major players announced investments in R&D for AI-powered packaging solutions.

- 2024: A significant merger between two mid-sized packaging machinery companies took place.

Future Outlook for Pharma Packaging Machinery Industry Market

The future of the pharma packaging machinery market appears bright, driven by sustained growth in the pharmaceutical sector, ongoing technological advancements, and evolving regulatory landscapes. Strategic opportunities lie in developing sustainable packaging solutions, integrating digital technologies for enhanced traceability and efficiency, and expanding into emerging markets. The market is poised for considerable expansion, with significant potential for innovation and growth in the coming decade.

Pharma Packaging Machinery Industry Segmentation

-

1. Machinery Type

-

1.1. Primary Packaging

- 1.1.1. Aseptic Filling and Sealing Equipmen

- 1.1.2. Bottle Filling and Capping Equipment

- 1.1.3. Blister Packaging Equipment

- 1.1.4. Others

-

1.2. Secondary Packaging

- 1.2.1. Cartoning Equipment

- 1.2.2. Case Packaging Equipment

- 1.2.3. Wrapping Equipment

- 1.2.4. Tray Packing Equipment

-

1.3. Labelling and Serialization

- 1.3.1. Bottle a

- 1.3.2. Carton Labelling and Serialization Equipment

-

1.1. Primary Packaging

Pharma Packaging Machinery Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Pharma Packaging Machinery Industry Regional Market Share

Geographic Coverage of Pharma Packaging Machinery Industry

Pharma Packaging Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; High Demand in Key End-user Markets; Ongoing Technological Developments; Impact of Safety Standards & Regulations in the Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. ; High Costs and Import Duties Pose a Challenge for New Customers; Capital Intensive Manufacturing Process

- 3.4. Market Trends

- 3.4.1. The Presence of Safety Standards & Regulations in the Pharmaceutical Industry Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Primary Packaging

- 5.1.1.1. Aseptic Filling and Sealing Equipmen

- 5.1.1.2. Bottle Filling and Capping Equipment

- 5.1.1.3. Blister Packaging Equipment

- 5.1.1.4. Others

- 5.1.2. Secondary Packaging

- 5.1.2.1. Cartoning Equipment

- 5.1.2.2. Case Packaging Equipment

- 5.1.2.3. Wrapping Equipment

- 5.1.2.4. Tray Packing Equipment

- 5.1.3. Labelling and Serialization

- 5.1.3.1. Bottle a

- 5.1.3.2. Carton Labelling and Serialization Equipment

- 5.1.1. Primary Packaging

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. North America Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6.1.1. Primary Packaging

- 6.1.1.1. Aseptic Filling and Sealing Equipmen

- 6.1.1.2. Bottle Filling and Capping Equipment

- 6.1.1.3. Blister Packaging Equipment

- 6.1.1.4. Others

- 6.1.2. Secondary Packaging

- 6.1.2.1. Cartoning Equipment

- 6.1.2.2. Case Packaging Equipment

- 6.1.2.3. Wrapping Equipment

- 6.1.2.4. Tray Packing Equipment

- 6.1.3. Labelling and Serialization

- 6.1.3.1. Bottle a

- 6.1.3.2. Carton Labelling and Serialization Equipment

- 6.1.1. Primary Packaging

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7. Europe Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7.1.1. Primary Packaging

- 7.1.1.1. Aseptic Filling and Sealing Equipmen

- 7.1.1.2. Bottle Filling and Capping Equipment

- 7.1.1.3. Blister Packaging Equipment

- 7.1.1.4. Others

- 7.1.2. Secondary Packaging

- 7.1.2.1. Cartoning Equipment

- 7.1.2.2. Case Packaging Equipment

- 7.1.2.3. Wrapping Equipment

- 7.1.2.4. Tray Packing Equipment

- 7.1.3. Labelling and Serialization

- 7.1.3.1. Bottle a

- 7.1.3.2. Carton Labelling and Serialization Equipment

- 7.1.1. Primary Packaging

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8. Asia Pacific Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8.1.1. Primary Packaging

- 8.1.1.1. Aseptic Filling and Sealing Equipmen

- 8.1.1.2. Bottle Filling and Capping Equipment

- 8.1.1.3. Blister Packaging Equipment

- 8.1.1.4. Others

- 8.1.2. Secondary Packaging

- 8.1.2.1. Cartoning Equipment

- 8.1.2.2. Case Packaging Equipment

- 8.1.2.3. Wrapping Equipment

- 8.1.2.4. Tray Packing Equipment

- 8.1.3. Labelling and Serialization

- 8.1.3.1. Bottle a

- 8.1.3.2. Carton Labelling and Serialization Equipment

- 8.1.1. Primary Packaging

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9. Latin America Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9.1.1. Primary Packaging

- 9.1.1.1. Aseptic Filling and Sealing Equipmen

- 9.1.1.2. Bottle Filling and Capping Equipment

- 9.1.1.3. Blister Packaging Equipment

- 9.1.1.4. Others

- 9.1.2. Secondary Packaging

- 9.1.2.1. Cartoning Equipment

- 9.1.2.2. Case Packaging Equipment

- 9.1.2.3. Wrapping Equipment

- 9.1.2.4. Tray Packing Equipment

- 9.1.3. Labelling and Serialization

- 9.1.3.1. Bottle a

- 9.1.3.2. Carton Labelling and Serialization Equipment

- 9.1.1. Primary Packaging

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10. Middle East Pharma Packaging Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10.1.1. Primary Packaging

- 10.1.1.1. Aseptic Filling and Sealing Equipmen

- 10.1.1.2. Bottle Filling and Capping Equipment

- 10.1.1.3. Blister Packaging Equipment

- 10.1.1.4. Others

- 10.1.2. Secondary Packaging

- 10.1.2.1. Cartoning Equipment

- 10.1.2.2. Case Packaging Equipment

- 10.1.2.3. Wrapping Equipment

- 10.1.2.4. Tray Packing Equipment

- 10.1.3. Labelling and Serialization

- 10.1.3.1. Bottle a

- 10.1.3.2. Carton Labelling and Serialization Equipment

- 10.1.1. Primary Packaging

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Marchesini Group SPA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ishida Co Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PAC Machinery Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Romaco Holding GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 I M A Industria Macchine Automatiche S p A

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Uhlmann Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MG2 s r l *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Syntegon Technology GmbH (Robert Bosch GmbH)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MULTIVAC Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accutek Packaging Equipment Companies Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mesoblast Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Vanguard Pharmaceutical Machinery Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Optima Packaging Group GmbH

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Marchesini Group SPA

List of Figures

- Figure 1: Global Pharma Packaging Machinery Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 3: North America Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 4: North America Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 7: Europe Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 8: Europe Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 11: Asia Pacific Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 12: Asia Pacific Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 15: Latin America Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 16: Latin America Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Pharma Packaging Machinery Industry Revenue (billion), by Machinery Type 2025 & 2033

- Figure 19: Middle East Pharma Packaging Machinery Industry Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 20: Middle East Pharma Packaging Machinery Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East Pharma Packaging Machinery Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 2: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 4: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 6: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 8: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 10: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 12: Global Pharma Packaging Machinery Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharma Packaging Machinery Industry?

The projected CAGR is approximately 7.74%.

2. Which companies are prominent players in the Pharma Packaging Machinery Industry?

Key companies in the market include Marchesini Group SPA, Ishida Co Limited, PAC Machinery Group, Romaco Holding GmbH, I M A Industria Macchine Automatiche S p A, Uhlmann Group, MG2 s r l *List Not Exhaustive, Syntegon Technology GmbH (Robert Bosch GmbH), MULTIVAC Group, Accutek Packaging Equipment Companies Inc, Mesoblast Limited, Vanguard Pharmaceutical Machinery Inc, Optima Packaging Group GmbH.

3. What are the main segments of the Pharma Packaging Machinery Industry?

The market segments include Machinery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.62 billion as of 2022.

5. What are some drivers contributing to market growth?

; High Demand in Key End-user Markets; Ongoing Technological Developments; Impact of Safety Standards & Regulations in the Pharmaceutical Industry.

6. What are the notable trends driving market growth?

The Presence of Safety Standards & Regulations in the Pharmaceutical Industry Expected to Drive the Market.

7. Are there any restraints impacting market growth?

; High Costs and Import Duties Pose a Challenge for New Customers; Capital Intensive Manufacturing Process.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharma Packaging Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharma Packaging Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharma Packaging Machinery Industry?

To stay informed about further developments, trends, and reports in the Pharma Packaging Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence