Key Insights

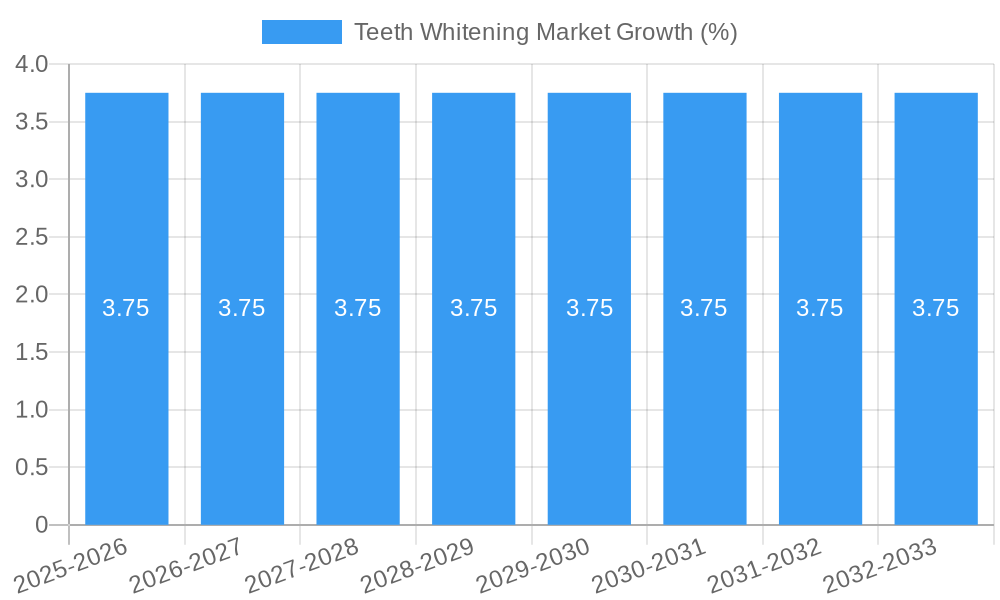

The global Teeth Whitening Market is poised for steady expansion, projected to reach a substantial USD 7.44 billion in 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 3.75%, indicating sustained consumer interest and market development through 2033. The market is driven by a confluence of factors, including increasing consumer awareness of oral aesthetics, a growing demand for cosmetic dental procedures, and the rising disposable incomes in key emerging economies. The desire for a brighter smile, fueled by social media trends and celebrity endorsements, is a significant motivator for individuals seeking professional and at-home teeth whitening solutions. Advancements in product formulations, offering enhanced efficacy and user-friendliness, coupled with innovative delivery systems like LED light-activated treatments, are further propelling market penetration. The expanding reach of e-commerce platforms is also democratizing access to these products, making them more accessible to a wider consumer base.

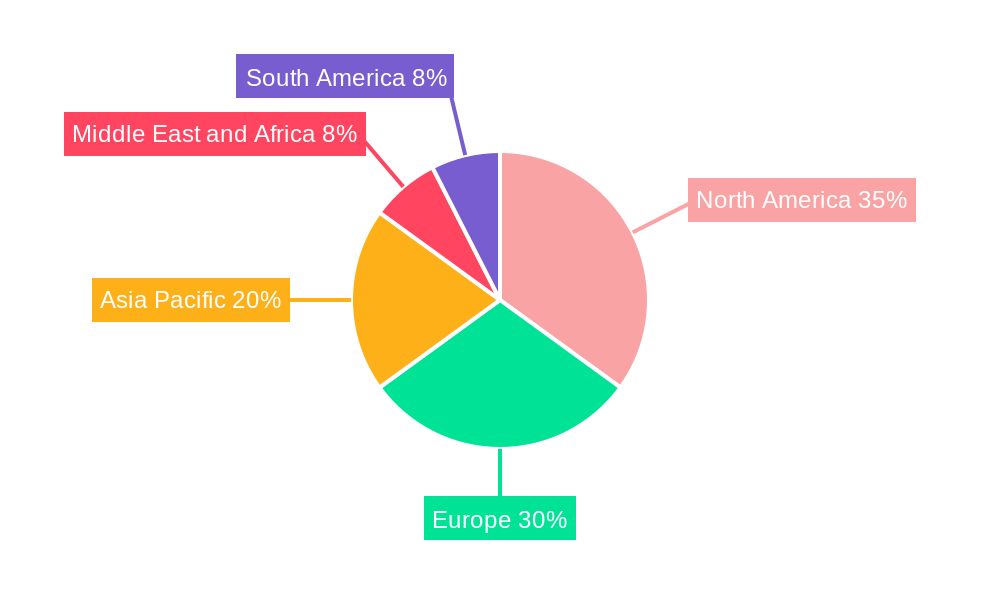

The market landscape is characterized by a diverse range of product offerings, segmented into Whitening Toothpastes, Whitening Gels and Strips, White Light Teeth Whitening Devices, and Other Product Types. Distribution channels are similarly bifurcated between Offline Sales and Online Sales, with the latter experiencing remarkable growth due to convenience and competitive pricing. Key players such as Proctor & Gamble, Colgate-Palmolive Company, and Unilever are actively investing in research and development to introduce novel and improved whitening solutions, while smaller, specialized companies are carving out niches with innovative technologies. Geographically, North America and Europe currently lead the market, driven by high consumer spending and established dental care infrastructure. However, the Asia Pacific region is emerging as a high-growth area, with increasing disposable incomes, a burgeoning middle class, and a growing emphasis on personal grooming and appearance. Challenges such as the potential for tooth sensitivity and gum irritation associated with some whitening products, alongside the cost of professional treatments, represent the primary restraints, though ongoing product innovation aims to mitigate these concerns.

This comprehensive report delves into the dynamic global Teeth Whitening Market, offering in-depth analysis of market structure, competitive landscape, key trends, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025, this report leverages high-volume keywords to provide actionable insights for industry stakeholders. Explore market segmentation by product type and distribution channel, identify dominant regions and countries, and understand the pivotal role of key players in shaping this multi-million dollar industry.

Teeth Whitening Market Market Structure & Competitive Landscape

The global teeth whitening market exhibits a moderately concentrated structure, with a mix of large multinational corporations and specialized niche players. Innovation serves as a key driver, fueled by increasing consumer demand for aesthetic dental solutions and advancements in at-home whitening technologies. Regulatory impacts are significant, with varying guidelines across regions influencing product development and marketing strategies. Product substitutes, such as professional dental treatments and cosmetic dentistry procedures, present a competitive pressure, yet the convenience and affordability of over-the-counter teeth whitening products continue to drive market growth. End-user segmentation reveals a broad consumer base, from individuals seeking simple aesthetic improvements to those undergoing more intensive dental care. Mergers and acquisitions (M&A) activity, though not consistently high, plays a role in market consolidation and strategic expansion for key players. The market is projected to reach a valuation of over $7,000 Million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period. The top five companies are estimated to hold around 40% of the market share in 2025.

Teeth Whitening Market Market Trends & Opportunities

The teeth whitening market is experiencing robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and increased disposable incomes. Market size is projected to surge from an estimated $6,500 Million in 2024 to over $7,000 Million by 2025, with a projected CAGR of 6.5% through 2033. This expansion is propelled by the growing emphasis on personal grooming and aesthetics, where a bright smile is increasingly perceived as a vital component of overall attractiveness and confidence. Technological shifts are paramount, with a notable trend towards developing more effective, faster-acting, and gentler teeth whitening solutions. Innovations in at-home kits, including advanced LED light-activated devices and peroxide-free formulations, are democratizing access to professional-grade whitening. Consumer preferences are leaning towards convenience and affordability, fueling the demand for teeth whitening gels and strips and whitening toothpastes. The rise of e-commerce further amplifies these trends, providing consumers with easy access to a wider array of products and detailed information, thereby increasing market penetration rates. Digital marketing and social media influencers are also playing a crucial role in educating consumers and creating demand. The competitive dynamics are intensifying, with established players investing heavily in research and development to maintain their market share and new entrants focusing on disruptive innovations. Opportunities abound in emerging markets where awareness of dental aesthetics is on the rise, coupled with growing economic prosperity. Furthermore, the increasing integration of smart technologies in white light teeth whitening devices presents a significant growth avenue. The market penetration rate for at-home whitening products is expected to reach 60% globally by 2033.

Dominant Markets & Segments in Teeth Whitening Market

The teeth whitening market exhibits regional dominance, with North America and Europe currently leading in terms of market value and consumer adoption. However, the Asia-Pacific region is poised for significant growth, driven by increasing disposable incomes, rising awareness of dental aesthetics, and the growing influence of Western beauty standards. Within product types, Whitening Gels and Strips currently hold the largest market share, accounting for approximately 45% of the global market in 2025. This dominance is attributed to their perceived efficacy, ease of use, and relatively affordable price points. Whitening Toothpastes, representing around 30% of the market, continue to be a popular choice for daily oral hygiene with added whitening benefits. White Light Teeth Whitening Devices, while a smaller segment at approximately 15%, are experiencing rapid growth due to technological advancements and their promise of faster results. Other product types, including trays and mouthwashes, collectively make up the remaining 10%.

In terms of distribution channels, Offline Sales continue to hold a significant share, driven by pharmacies, supermarkets, and dental clinics. However, Online Sales are exhibiting exceptional growth, projected to capture over 40% of the market by 2028. This surge is facilitated by the convenience of e-commerce platforms, wider product availability, competitive pricing, and the ability for consumers to research and compare products extensively.

Key growth drivers for regional dominance include:

- North America: High consumer awareness, disposable income, and a strong prevalence of dental care practices.

- Europe: Growing demand for aesthetic dental solutions and a well-established retail infrastructure for oral care products.

- Asia-Pacific: Rapidly expanding middle class, increasing disposable incomes, and a growing emphasis on appearance.

- Latin America: Emerging market with increasing awareness and affordability driving adoption.

The continuous innovation in formulations and delivery systems for whitening gels and strips is a major factor in their sustained market leadership. Simultaneously, the accessibility and convenience of whitening toothpastes ensure their consistent demand. The burgeoning e-commerce sector is crucial for expanding the reach of all product segments, especially in developing regions.

Teeth Whitening Market Product Analysis

Product innovations in the teeth whitening market are largely centered on enhancing efficacy, reducing sensitivity, and improving user experience. Formulations are evolving to incorporate gentler yet effective bleaching agents, such as carbamide peroxide and hydrogen peroxide in optimized concentrations, alongside natural ingredients for added oral health benefits. The development of specialized white light teeth whitening devices with multiple LED settings and ergonomic designs offers faster and more comfortable treatment cycles. Competitive advantages are being gained through user-friendly application methods, extended shelf life, and packaging designed for convenience and portability. Market fit is strong for products that address specific consumer concerns like enamel sensitivity and staining from coffee, tea, and smoking.

Key Drivers, Barriers & Challenges in Teeth Whitening Market

Key Drivers: The teeth whitening market is propelled by a growing global emphasis on aesthetic appeal and personal grooming. Rising disposable incomes, particularly in emerging economies, enable consumers to invest in cosmetic dental solutions. Technological advancements in at-home whitening kits, offering convenience and affordability, significantly drive adoption. Increasing social media influence and celebrity endorsements further fuel demand. Barriers & Challenges: Regulatory hurdles concerning the concentration of bleaching agents can impact product development and market entry in different regions. Supply chain disruptions and fluctuations in raw material costs can affect production and pricing. Intense competition from established brands and the availability of low-cost counterfeit products pose significant challenges. Consumer concerns regarding potential enamel damage and tooth sensitivity, despite advancements in gentler formulations, can act as a restraint.

Growth Drivers in the Teeth Whitening Market Market

The teeth whitening market is experiencing significant growth primarily due to technological advancements in at-home whitening products, making them more accessible and effective. A burgeoning global focus on personal appearance and a desire for a brighter smile are powerful psychological drivers. Increasing disposable incomes, especially in developing nations, allow consumers to allocate more funds towards cosmetic enhancements. Furthermore, the widespread influence of social media and celebrity endorsements plays a crucial role in popularizing teeth whitening treatments and raising consumer awareness.

Challenges Impacting Teeth Whitening Market Growth

Despite the promising growth, the teeth whitening market faces several challenges. Stringent regulatory frameworks in various countries regarding the permissible concentration of bleaching agents can limit product innovation and market expansion. Fluctuations in the availability and cost of key raw materials, such as hydrogen peroxide and specialized polymers for strips, can disrupt supply chains and impact profitability. Intense competition from both global brands and smaller, localized players, coupled with the prevalence of lower-priced, often less regulated, products, exerts considerable pricing pressure. Consumer apprehension regarding potential tooth sensitivity and enamel erosion, even with improved formulations, remains a significant barrier to wider adoption.

Key Players Shaping the Teeth Whitening Market Market

- Proctor & Gamble

- Henkel AG & Co KGaA

- Unilever

- Church & Dwight Co Inc

- Dr Fresh LLC

- Ultradent Products Inc

- Colgate-Palmolive Company

- GoSmile LLC

- Creightons plc

- GLO Science

- Johnson & Johnson

- GlaxoSmithKline PLC

Significant Teeth Whitening Market Industry Milestones

- April 2022: GSK Consumer Healthcare launched Sensodyne Nourish, a toothpaste enriched with bioactive minerals to nourish and strengthen teeth for a healthy mouth and protect them from sensitivity.

- January 2022: Colgate-Palmolive Company and 3Shape partnered to introduce the Colgate Illuminator, a tailored-to-patient teeth whitening tool for catering the dental clinics across the United States.

Future Outlook for Teeth Whitening Market Market

- April 2022: GSK Consumer Healthcare launched Sensodyne Nourish, a toothpaste enriched with bioactive minerals to nourish and strengthen teeth for a healthy mouth and protect them from sensitivity.

- January 2022: Colgate-Palmolive Company and 3Shape partnered to introduce the Colgate Illuminator, a tailored-to-patient teeth whitening tool for catering the dental clinics across the United States.

Future Outlook for Teeth Whitening Market Market

The future outlook for the teeth whitening market is exceptionally positive, driven by sustained consumer interest in aesthetic dental care and continuous product innovation. Strategic opportunities lie in the development of advanced, personalized whitening solutions that minimize sensitivity and offer faster results. Emerging markets present significant untapped potential, requiring localized marketing strategies and product offerings. The integration of digital technologies, such as AI-powered diagnostics for personalized whitening plans and teledentistry consultations, is expected to further enhance accessibility and convenience, driving substantial market growth in the coming years. The market is projected to maintain a robust CAGR, exceeding $10,000 Million by 2033.

Teeth Whitening Market Segmentation

-

1. Product Type

- 1.1. Whitening Toothpastes

- 1.2. Whitening Gels and Strips

- 1.3. White Light Teeth Whitening Devices

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Offline Sales

- 2.2. Online Sales

Teeth Whitening Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Teeth Whitening Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Awareness of Oral Hygiene; Easy Availability of Teeth Whitening OTC Products; Stigma Associated with Discoloration of Teeth

- 3.3. Market Restrains

- 3.3.1. Low Awareness in Rural Areas; Side Effects Associated with Teeth Whitening Products

- 3.4. Market Trends

- 3.4.1. The Whitening Toothpaste Segment is Expected to Account for the Largest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Teeth Whitening Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whitening Toothpastes

- 5.1.2. Whitening Gels and Strips

- 5.1.3. White Light Teeth Whitening Devices

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Sales

- 5.2.2. Online Sales

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Teeth Whitening Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Whitening Toothpastes

- 6.1.2. Whitening Gels and Strips

- 6.1.3. White Light Teeth Whitening Devices

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Sales

- 6.2.2. Online Sales

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Teeth Whitening Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Whitening Toothpastes

- 7.1.2. Whitening Gels and Strips

- 7.1.3. White Light Teeth Whitening Devices

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Sales

- 7.2.2. Online Sales

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Teeth Whitening Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Whitening Toothpastes

- 8.1.2. Whitening Gels and Strips

- 8.1.3. White Light Teeth Whitening Devices

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Sales

- 8.2.2. Online Sales

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Teeth Whitening Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Whitening Toothpastes

- 9.1.2. Whitening Gels and Strips

- 9.1.3. White Light Teeth Whitening Devices

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Sales

- 9.2.2. Online Sales

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Teeth Whitening Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Whitening Toothpastes

- 10.1.2. Whitening Gels and Strips

- 10.1.3. White Light Teeth Whitening Devices

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Sales

- 10.2.2. Online Sales

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Teeth Whitening Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Teeth Whitening Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Teeth Whitening Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Teeth Whitening Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Teeth Whitening Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Proctor & Gamble

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Henkel AG & Co KGaA

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Unilever

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Church & Dwight Co Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Dr Fresh LLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Ultradent Products Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Colgate-Palmolive Company

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 GoSmile LLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Creightons plc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 GLO Science

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Johnson & Johnson

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 GlaxoSmithKline PLC

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Proctor & Gamble

List of Figures

- Figure 1: Global Teeth Whitening Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Teeth Whitening Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Teeth Whitening Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Teeth Whitening Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Teeth Whitening Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Teeth Whitening Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Teeth Whitening Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Teeth Whitening Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Teeth Whitening Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Teeth Whitening Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Teeth Whitening Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Teeth Whitening Market Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Teeth Whitening Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Teeth Whitening Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 15: North America Teeth Whitening Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 16: North America Teeth Whitening Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Teeth Whitening Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Teeth Whitening Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe Teeth Whitening Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Teeth Whitening Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: Europe Teeth Whitening Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: Europe Teeth Whitening Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Teeth Whitening Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Teeth Whitening Market Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia Pacific Teeth Whitening Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia Pacific Teeth Whitening Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 27: Asia Pacific Teeth Whitening Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 28: Asia Pacific Teeth Whitening Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Teeth Whitening Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Teeth Whitening Market Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Middle East and Africa Teeth Whitening Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Middle East and Africa Teeth Whitening Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Middle East and Africa Teeth Whitening Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Middle East and Africa Teeth Whitening Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East and Africa Teeth Whitening Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Teeth Whitening Market Revenue (Million), by Product Type 2024 & 2032

- Figure 37: South America Teeth Whitening Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: South America Teeth Whitening Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 39: South America Teeth Whitening Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 40: South America Teeth Whitening Market Revenue (Million), by Country 2024 & 2032

- Figure 41: South America Teeth Whitening Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Teeth Whitening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Teeth Whitening Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Teeth Whitening Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Teeth Whitening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Teeth Whitening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Teeth Whitening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Teeth Whitening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Teeth Whitening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Teeth Whitening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Teeth Whitening Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 32: Global Teeth Whitening Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: Global Teeth Whitening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Teeth Whitening Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: Global Teeth Whitening Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 39: Global Teeth Whitening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Teeth Whitening Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 47: Global Teeth Whitening Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: Global Teeth Whitening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: India Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Australia Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Teeth Whitening Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 56: Global Teeth Whitening Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 57: Global Teeth Whitening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: GCC Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Teeth Whitening Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 62: Global Teeth Whitening Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 63: Global Teeth Whitening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Brazil Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Argentina Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Teeth Whitening Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Teeth Whitening Market?

The projected CAGR is approximately 3.75%.

2. Which companies are prominent players in the Teeth Whitening Market?

Key companies in the market include Proctor & Gamble, Henkel AG & Co KGaA, Unilever, Church & Dwight Co Inc, Dr Fresh LLC, Ultradent Products Inc, Colgate-Palmolive Company, GoSmile LLC, Creightons plc, GLO Science, Johnson & Johnson, GlaxoSmithKline PLC.

3. What are the main segments of the Teeth Whitening Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Awareness of Oral Hygiene; Easy Availability of Teeth Whitening OTC Products; Stigma Associated with Discoloration of Teeth.

6. What are the notable trends driving market growth?

The Whitening Toothpaste Segment is Expected to Account for the Largest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Low Awareness in Rural Areas; Side Effects Associated with Teeth Whitening Products.

8. Can you provide examples of recent developments in the market?

In April 2022, GSK Consumer Healthcare launched Sensodyne Nourish, a toothpaste enriched with bioactive minerals to nourish and strengthen teeth for a healthy mouth and protect them from sensitivity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Teeth Whitening Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Teeth Whitening Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Teeth Whitening Market?

To stay informed about further developments, trends, and reports in the Teeth Whitening Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence