Key Insights

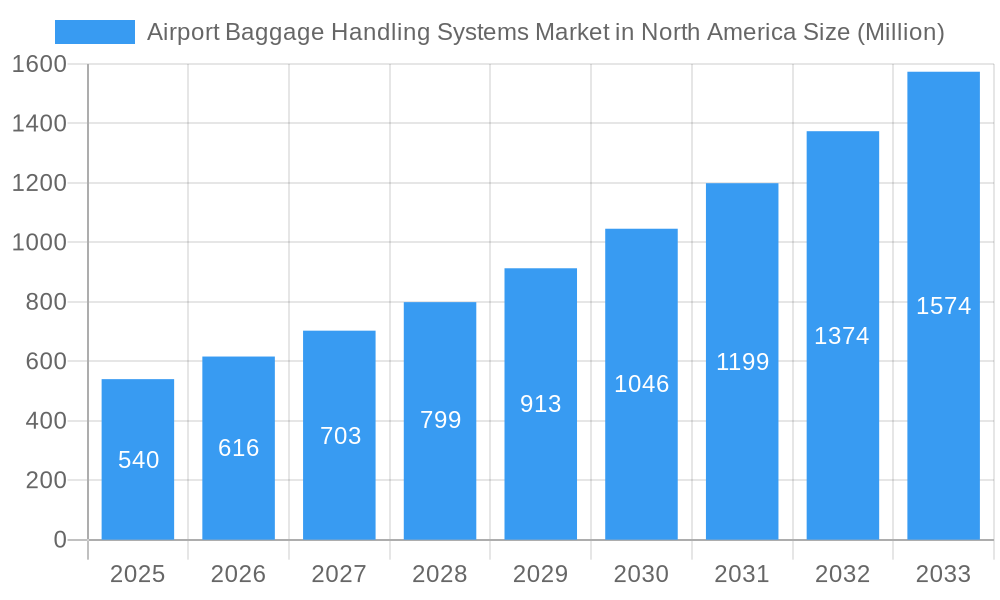

The North American airport baggage handling systems market, valued at $540 million in 2025, is projected to experience robust growth, driven by increasing passenger traffic at major airports and the ongoing modernization of existing infrastructure. A Compound Annual Growth Rate (CAGR) of 14.08% is anticipated from 2025 to 2033, indicating a significant expansion of the market. Key drivers include the rising demand for efficient and automated baggage handling solutions to minimize delays and enhance passenger experience. The increasing adoption of advanced technologies such as automated guided vehicles (AGVs), robotics, and advanced tracking systems contributes to this growth. Furthermore, stringent security regulations and the need for improved baggage security are pushing the market forward. Segmentation reveals that airports with capacities exceeding 40 million passengers annually represent a significant market share, primarily concentrated in the United States. This segment is expected to witness the most significant growth due to high passenger volume and the consequent need for high-throughput baggage handling systems. Canada also presents a substantial market, although smaller than the US, driven by similar factors, including airport expansion and modernization initiatives. Competitive rivalry among established players like Vanderlande Industries, Daifuku, and Siemens Logistics, as well as emerging technology providers, is intensifying innovation and driving down costs, making these systems accessible to a broader range of airports.

Airport Baggage Handling Systems Market in North America Market Size (In Million)

The market's growth is, however, subject to certain restraints, primarily the high initial investment costs associated with installing and maintaining these sophisticated systems. Economic downturns or unforeseen disruptions in the aviation industry could also impact investment decisions. Despite these challenges, the long-term outlook remains positive, fueled by the continuous expansion of air travel and the need for reliable, efficient baggage handling to maintain the smooth operation of airports. The market's growth will likely be uneven across different airport capacity segments, with larger airports leading the charge in adopting the latest technology and expanding their baggage handling capacity. Specific regional variations within North America will be influenced by factors such as government regulations, airport expansion plans, and economic conditions in each country. The focus on improving passenger experience and ensuring efficient operations will continue to be paramount, driving further investment and innovation within the North American airport baggage handling systems market.

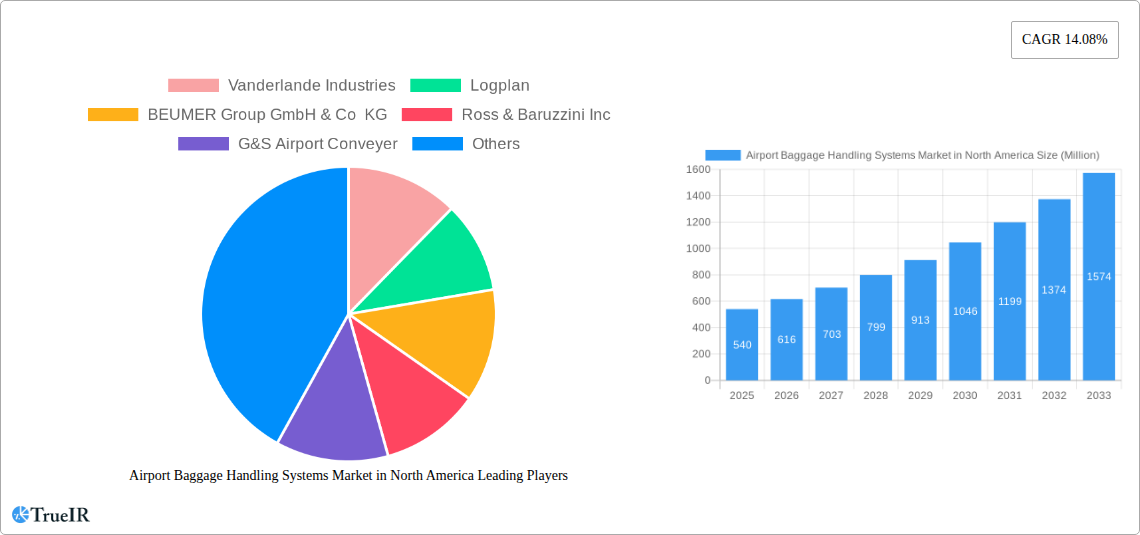

Airport Baggage Handling Systems Market in North America Company Market Share

This in-depth report provides a comprehensive analysis of the North American Airport Baggage Handling Systems market, covering the period from 2019 to 2033. It delves into market structure, competitive dynamics, key trends, growth drivers, and challenges, offering valuable insights for industry stakeholders. The report leverages extensive data analysis and qualitative research to provide a clear and concise understanding of this dynamic market. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Airport Baggage Handling Systems Market in North America Market Structure & Competitive Landscape

The North American airport baggage handling systems market exhibits a moderately concentrated structure, with key players such as Vanderlande Industries, BEUMER Group, and Siemens Logistics holding significant market share. The market's concentration ratio (CR4) is estimated at xx%, indicating the presence of several large players alongside a substantial number of smaller, specialized companies. Innovation is a key driver, with continuous advancements in automated systems, AI-powered solutions, and improved tracking technologies shaping the competitive landscape. Stringent safety and security regulations imposed by aviation authorities significantly impact market dynamics, influencing system design and operational procedures. The market also witnesses the emergence of product substitutes, such as improved manual handling practices and specialized third-party logistics services, though these often lack the efficiency and scalability of automated systems. End-user segmentation comprises airports categorized by passenger capacity (up to 15 million, 15-25 million, 25-40 million, and more than 40 million annually), creating distinct demand patterns. M&A activity has been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024, driven by strategic expansion and technology integration initiatives. Future M&A activity is expected to accelerate, driven by the need for enhanced scalability and technological synergy.

Airport Baggage Handling Systems Market in North America Market Trends & Opportunities

The North American airport baggage handling systems market is experiencing robust growth, fueled by increasing passenger traffic, the demand for enhanced operational efficiency, and the adoption of advanced technologies. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033, representing a significant expansion. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%. Technological advancements, particularly the integration of Artificial Intelligence (AI), Internet of Things (IoT), and advanced analytics, are transforming the market, enabling real-time baggage tracking, predictive maintenance, and optimized resource allocation. Passenger expectations for seamless and efficient travel experiences drive demand for reliable and technologically advanced baggage handling systems. The competitive landscape is dynamic, with established players constantly innovating and new entrants emerging, creating opportunities for collaboration and consolidation. Market penetration rates are highest in larger airports with high passenger volumes, exceeding xx% in airports handling more than 40 million passengers annually, and lower in smaller airports due to cost considerations.

Dominant Markets & Segments in Airport Baggage Handling Systems Market in North America

The United States constitutes the dominant market within North America, accounting for approximately xx% of the total market value in 2024. This is driven by high passenger volumes at major airports, significant infrastructure investments, and a favorable regulatory environment. Canada exhibits strong growth potential, driven by modernization initiatives at key airports and increasing passenger numbers.

Key Growth Drivers in the United States:

- Extensive airport modernization programs.

- High passenger traffic at major hubs.

- Robust investment in airport infrastructure.

- Favorable regulatory frameworks supporting technological advancements.

Key Growth Drivers in Canada:

- Government initiatives to upgrade airport infrastructure.

- Rising passenger numbers at key airports.

- Investments in advanced baggage handling technologies.

Segment-wise, the segment with a capacity of "More than 40 million" passengers annually displays the most significant growth, driven by the need for highly efficient and automated baggage handling solutions at large, international airports. This segment is projected to hold xx% of the market share by 2033.

Airport Baggage Handling Systems Market in North America Product Analysis

The market offers a wide range of products, from conventional conveyor systems to sophisticated automated systems integrating AI and IoT technologies. These advancements lead to enhanced efficiency, improved baggage tracking, and reduced operational costs. The adoption of individual carrier systems (ICS) is increasing, offering flexibility and scalability, while the integration of advanced software solutions, like Siemens Logistics’ Baggage 360, provides real-time visibility and optimization capabilities. The market fit of these products is strongly linked to airport size and passenger volume, with larger airports adopting more complex and integrated systems.

Key Drivers, Barriers & Challenges in Airport Baggage Handling Systems Market in North America

Key Drivers: The market is propelled by rising passenger traffic, the need for improved operational efficiency and security, and the integration of advanced technologies such as AI and IoT. Government investments in airport infrastructure modernization also play a significant role.

Challenges: Supply chain disruptions, increasing material costs, and regulatory complexities pose significant challenges. Competition among established and new market players also exerts pressure on pricing and margins. These factors collectively contribute to potential delays and cost overruns in airport infrastructure projects. The impact of these challenges is estimated to lead to a xx% reduction in market growth in the short term (2025-2027).

Growth Drivers in the Airport Baggage Handling Systems Market in North America Market

Technological advancements, increased passenger volumes at major airports, government investments in infrastructure upgrades, and the increasing demand for improved efficiency and passenger experience are key drivers. The growing adoption of AI and IoT-enabled solutions is accelerating growth. Stringent security regulations also drive the adoption of advanced baggage screening systems.

Challenges Impacting Airport Baggage Handling Systems Market in North America Growth

High initial investment costs, complex integration processes, potential supply chain disruptions, and the need for skilled workforce are significant barriers. Regulatory compliance and cybersecurity concerns also pose challenges. The impact of these challenges is estimated to cause a delay of xx% in the overall market growth in the long term.

Key Players Shaping the Airport Baggage Handling Systems Market in North America Market

- Vanderlande Industries

- Logplan

- BEUMER Group GmbH & Co KG

- Ross & Baruzzini Inc

- G&S Airport Conveyer

- Glidepath Limite

- Grenzebach Maschinenbau GmbH

- Daifuku Co Ltd

- SITA

- Siemens Logistics GmbH

Significant Airport Baggage Handling Systems Market in North America Industry Milestones

- May 2021: Vanderlande delivered an individual carrier system (ICS) to Los Angeles International Airport. This highlighted the growing trend towards advanced, automated systems in major airports.

- June 2022: Siemens Logistics unveiled Baggage 360, showcasing the increasing role of software and AI in optimizing baggage handling operations. This marked a significant step towards real-time baggage tracking and efficient resource management.

Future Outlook for Airport Baggage Handling Systems Market in North America Market

The market is poised for continued growth, driven by ongoing airport expansion projects, increasing passenger traffic, and the continuous adoption of innovative technologies. Strategic partnerships and acquisitions among key players are expected to shape the market landscape. The focus on improving passenger experience through streamlined baggage handling processes will further drive demand. The market presents significant opportunities for companies offering advanced, integrated solutions that address efficiency, security, and sustainability concerns.

Airport Baggage Handling Systems Market in North America Segmentation

-

1. Airport Capacity

- 1.1. Up to 15 million

- 1.2. 15-25 million

- 1.3. 25-40 million

- 1.4. More than 40 million

Airport Baggage Handling Systems Market in North America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

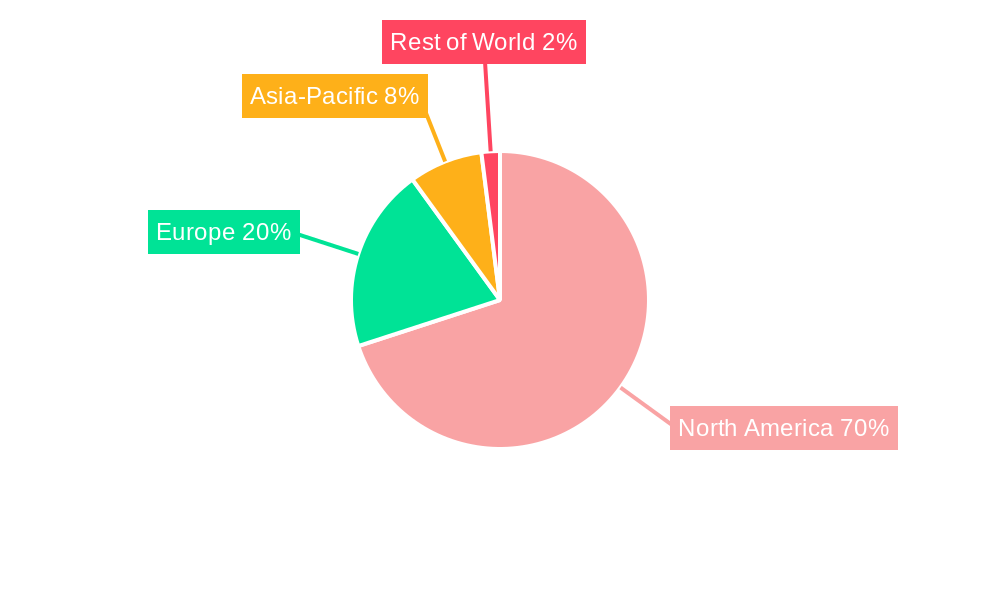

Airport Baggage Handling Systems Market in North America Regional Market Share

Geographic Coverage of Airport Baggage Handling Systems Market in North America

Airport Baggage Handling Systems Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The More Than 40 Million Airport Capacity segment is expected to lead the market during the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airport Baggage Handling Systems Market in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 5.1.1. Up to 15 million

- 5.1.2. 15-25 million

- 5.1.3. 25-40 million

- 5.1.4. More than 40 million

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6. North America Airport Baggage Handling Systems Market in North America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6.1.1. Up to 15 million

- 6.1.2. 15-25 million

- 6.1.3. 25-40 million

- 6.1.4. More than 40 million

- 6.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 7. South America Airport Baggage Handling Systems Market in North America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 7.1.1. Up to 15 million

- 7.1.2. 15-25 million

- 7.1.3. 25-40 million

- 7.1.4. More than 40 million

- 7.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 8. Europe Airport Baggage Handling Systems Market in North America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 8.1.1. Up to 15 million

- 8.1.2. 15-25 million

- 8.1.3. 25-40 million

- 8.1.4. More than 40 million

- 8.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 9. Middle East & Africa Airport Baggage Handling Systems Market in North America Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 9.1.1. Up to 15 million

- 9.1.2. 15-25 million

- 9.1.3. 25-40 million

- 9.1.4. More than 40 million

- 9.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 10. Asia Pacific Airport Baggage Handling Systems Market in North America Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 10.1.1. Up to 15 million

- 10.1.2. 15-25 million

- 10.1.3. 25-40 million

- 10.1.4. More than 40 million

- 10.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vanderlande Industries

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Logplan

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BEUMER Group GmbH & Co KG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ross & Baruzzini Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 G&S Airport Conveyer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Glidepath Limite

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Grenzebach Maschinenbau GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Daifuku Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SITA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Siemens Logistics GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Vanderlande Industries

List of Figures

- Figure 1: Global Airport Baggage Handling Systems Market in North America Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Airport Baggage Handling Systems Market in North America Revenue (Million), by Airport Capacity 2025 & 2033

- Figure 3: North America Airport Baggage Handling Systems Market in North America Revenue Share (%), by Airport Capacity 2025 & 2033

- Figure 4: North America Airport Baggage Handling Systems Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Airport Baggage Handling Systems Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Airport Baggage Handling Systems Market in North America Revenue (Million), by Airport Capacity 2025 & 2033

- Figure 7: South America Airport Baggage Handling Systems Market in North America Revenue Share (%), by Airport Capacity 2025 & 2033

- Figure 8: South America Airport Baggage Handling Systems Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Airport Baggage Handling Systems Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Airport Baggage Handling Systems Market in North America Revenue (Million), by Airport Capacity 2025 & 2033

- Figure 11: Europe Airport Baggage Handling Systems Market in North America Revenue Share (%), by Airport Capacity 2025 & 2033

- Figure 12: Europe Airport Baggage Handling Systems Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Airport Baggage Handling Systems Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Airport Baggage Handling Systems Market in North America Revenue (Million), by Airport Capacity 2025 & 2033

- Figure 15: Middle East & Africa Airport Baggage Handling Systems Market in North America Revenue Share (%), by Airport Capacity 2025 & 2033

- Figure 16: Middle East & Africa Airport Baggage Handling Systems Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Airport Baggage Handling Systems Market in North America Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Airport Baggage Handling Systems Market in North America Revenue (Million), by Airport Capacity 2025 & 2033

- Figure 19: Asia Pacific Airport Baggage Handling Systems Market in North America Revenue Share (%), by Airport Capacity 2025 & 2033

- Figure 20: Asia Pacific Airport Baggage Handling Systems Market in North America Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Airport Baggage Handling Systems Market in North America Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Airport Baggage Handling Systems Market in North America Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 2: Global Airport Baggage Handling Systems Market in North America Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Airport Baggage Handling Systems Market in North America Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 4: Global Airport Baggage Handling Systems Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Airport Baggage Handling Systems Market in North America Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 9: Global Airport Baggage Handling Systems Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Airport Baggage Handling Systems Market in North America Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 14: Global Airport Baggage Handling Systems Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Airport Baggage Handling Systems Market in North America Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 25: Global Airport Baggage Handling Systems Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Airport Baggage Handling Systems Market in North America Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 33: Global Airport Baggage Handling Systems Market in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Airport Baggage Handling Systems Market in North America Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Baggage Handling Systems Market in North America?

The projected CAGR is approximately 14.08%.

2. Which companies are prominent players in the Airport Baggage Handling Systems Market in North America?

Key companies in the market include Vanderlande Industries, Logplan, BEUMER Group GmbH & Co KG, Ross & Baruzzini Inc, G&S Airport Conveyer, Glidepath Limite, Grenzebach Maschinenbau GmbH, Daifuku Co Ltd, SITA, Siemens Logistics GmbH.

3. What are the main segments of the Airport Baggage Handling Systems Market in North America?

The market segments include Airport Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.54 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The More Than 40 Million Airport Capacity segment is expected to lead the market during the forecast period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In June 2022, Siemens Logistics unveiled the Baggage 360, the versatile airport operations software that features real-time forecasting of baggage flows. Baggage 360 also enables ground handlers to plan their fixed, mobile, and personnel resources with maximum efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Baggage Handling Systems Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Baggage Handling Systems Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Baggage Handling Systems Market in North America?

To stay informed about further developments, trends, and reports in the Airport Baggage Handling Systems Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence