Key Insights

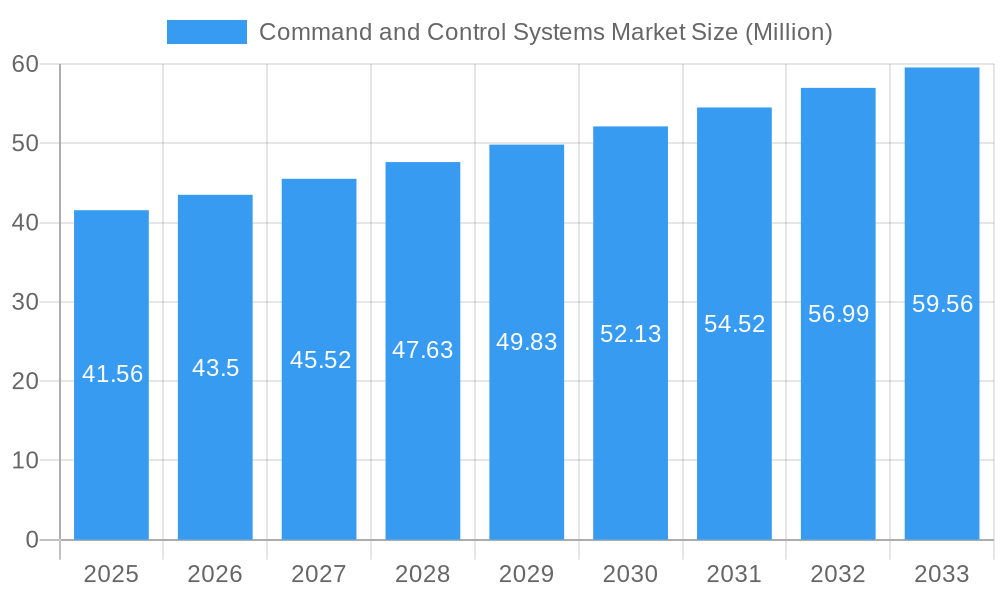

The global Command and Control Systems Market is poised for significant expansion, with a current market size valued at approximately USD 41.56 billion in 2025. This robust growth is projected to continue at a Compound Annual Growth Rate (CAGR) of 4.66% through 2033, indicating a sustained demand for advanced C2 solutions. This upward trajectory is primarily fueled by escalating geopolitical tensions, the increasing sophistication of warfare, and the growing need for integrated battlefield management across defense, aerospace, and public safety sectors. The drive towards digital transformation and the adoption of cutting-edge technologies like AI, IoT, and cloud computing in military operations are further bolstering market expansion. These advancements enable enhanced situational awareness, faster decision-making, and more efficient resource allocation, making robust C2 systems indispensable. The market's expansion is also influenced by government investments in modernizing defense infrastructure and the development of networked warfare capabilities.

Command and Control Systems Market Market Size (In Million)

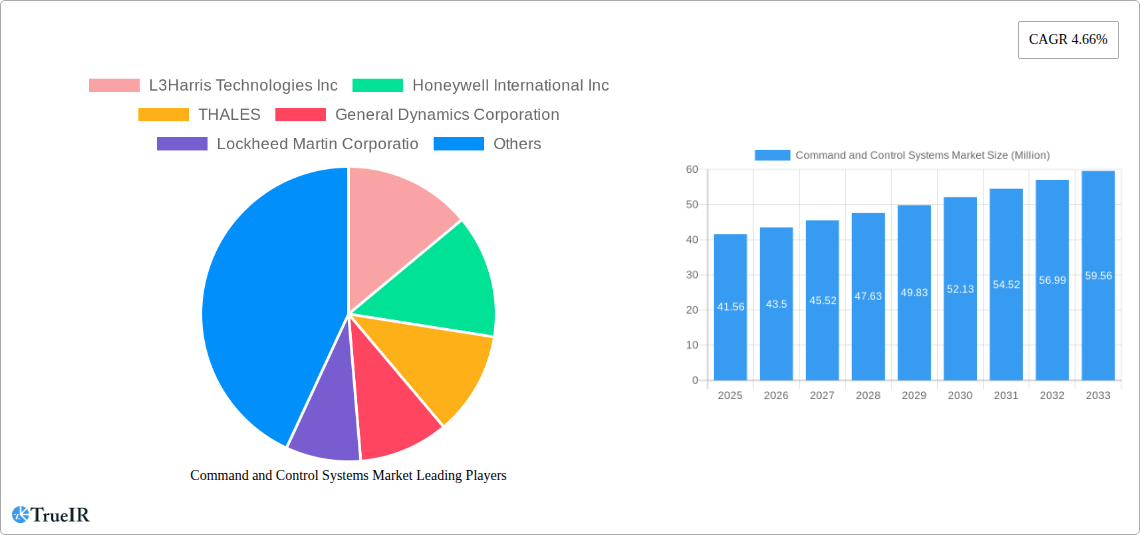

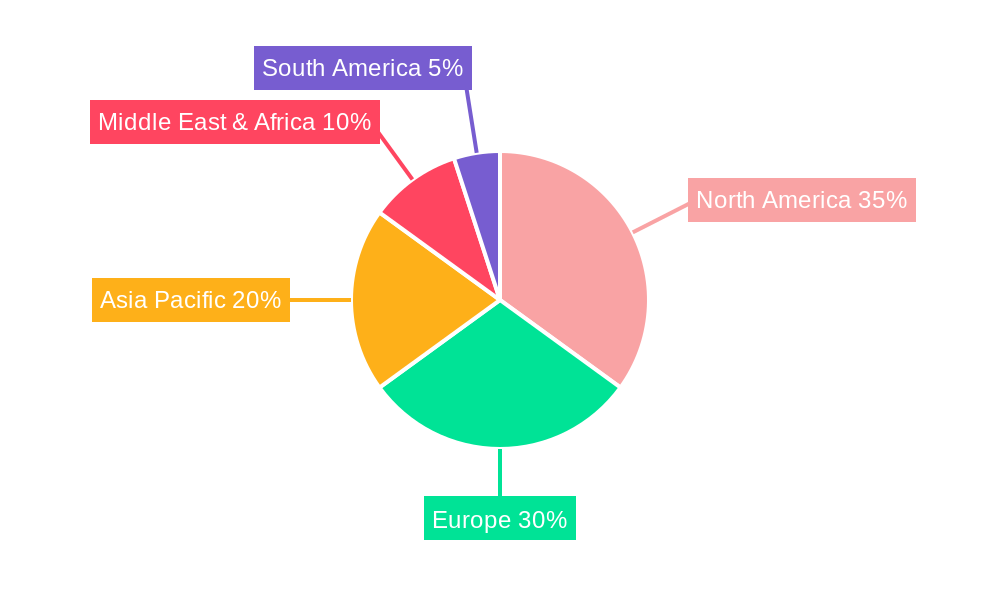

Key segments contributing to market growth include production and consumption, with a notable emphasis on import and export markets as nations seek to bolster their defense capabilities through technology acquisition and collaboration. Price trends are expected to be influenced by the complexity of integrated systems, the cost of technological innovation, and economies of scale in production. Major players such as L3Harris Technologies Inc., Honeywell International Inc., THALES, General Dynamics Corporation, Lockheed Martin Corporation, RTX Corporation, Kratos Defense & Security Solutions Inc., Leonardo S.p.A., CACI International Inc., BAE Systems plc, and Saab AB are actively investing in research and development to deliver sophisticated C2 solutions. These companies are instrumental in driving innovation and meeting the evolving demands of global defense and security agencies. North America and Europe currently lead the market due to substantial defense spending and established technological infrastructure, while the Asia Pacific region presents a rapidly growing opportunity driven by its own defense modernization initiatives.

Command and Control Systems Market Company Market Share

This comprehensive Command and Control Systems Market report delves into the intricate dynamics of the global market, offering an in-depth analysis of its structure, trends, opportunities, and future outlook. Spanning the study period from 2019 to 2033, with a base year of 2025, this report provides critical insights for stakeholders navigating the evolving landscape of defense, aerospace, and critical infrastructure command and control solutions. Leveraging high-volume keywords such as "command and control systems," "C2 systems," "defense technology," "military command," "intelligence systems," "surveillance systems," and "network-centric warfare," this report aims to enhance search rankings and engage industry professionals.

The global Command and Control Systems Market is projected to experience significant growth, driven by increasing geopolitical tensions, the imperative for enhanced national security, and the rapid advancement of digital transformation in defense sectors worldwide. This report meticulously dissects market segments, regional dominance, technological innovations, and key player strategies, providing actionable intelligence for strategic decision-making.

Command and Control Systems Market Market Structure & Competitive Landscape

The Command and Control Systems Market exhibits a moderately concentrated structure, characterized by a mix of large, established defense contractors and specialized technology providers. Innovation drivers are primarily fueled by the continuous need for superior situational awareness, real-time decision-making capabilities, and interoperability across diverse platforms. Regulatory impacts, particularly stringent government procurement processes and cybersecurity mandates, significantly shape market entry and product development. Product substitutes, while limited in core C2 functionalities, can emerge in the form of advanced analytics platforms and specialized communication solutions that augment existing C2 architectures.

End-user segmentation is crucial, with military and defense applications dominating, followed by critical infrastructure, homeland security, and emergency response. Mergers and acquisitions (M&A) are key strategic maneuvers for market players seeking to consolidate market share, acquire cutting-edge technologies, and expand their geographical reach. Over the historical period (2019-2024), an estimated volume of over 50 significant M&A activities have been recorded, reflecting the strategic importance of this sector. Concentration ratios, particularly among the top five players, are estimated to be in the range of 60-70%, indicating substantial market influence.

Command and Control Systems Market Market Trends & Opportunities

The global Command and Control Systems Market is experiencing a transformative phase, driven by a confluence of technological advancements, evolving geopolitical landscapes, and increasing demand for sophisticated defense and security solutions. The market size is projected to escalate from an estimated USD 40,000 Million in 2025 to over USD 60,000 Million by 2033, registering a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period. This robust growth is propelled by the relentless pursuit of network-centric warfare capabilities, emphasizing seamless information flow and decentralized command structures.

Technological shifts are central to this evolution. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing C2 systems, enabling predictive analytics, automated decision support, and enhanced threat detection. The proliferation of the Internet of Military Things (IoMT) further fuels this trend, connecting a vast array of sensors, platforms, and personnel to provide unprecedented real-time data for command centers. Cloud computing and edge computing are also playing pivotal roles, offering scalable infrastructure and enabling faster processing of critical data closer to the source.

Consumer preferences, dictated by defense ministries and governmental agencies, are increasingly leaning towards modular, open-architecture C2 systems that allow for rapid upgrades and integration of new technologies. This reduces vendor lock-in and promotes interoperability. Furthermore, there is a growing emphasis on cybersecurity within C2 systems, as adversarial cyber threats become more sophisticated. Resilience, survivability, and the ability to operate in contested electromagnetic environments are paramount.

Competitive dynamics are intensifying, with established defense giants fiercely competing with agile technology startups. Opportunities abound in areas such as advanced simulation and training environments, multi-domain command and control (MDC2) solutions, and the development of secure communication networks. The increasing global defense spending, particularly in emerging economies and regions facing significant security challenges, presents substantial growth prospects. Market penetration rates for advanced C2 technologies are steadily increasing, indicating a growing adoption curve as nations prioritize modernizing their defense infrastructure.

Dominant Markets & Segments in Command and Control Systems Market

The Command and Control Systems Market is characterized by distinct regional dominance and segment leadership, driven by a complex interplay of geopolitical factors, defense spending, and technological adoption.

Production Analysis: North America, particularly the United States, stands as the leading region in the production of advanced command and control systems. This dominance is attributed to substantial government investment in defense research and development, a highly skilled workforce, and the presence of major defense contractors. The production volume is estimated to reach over USD 15,000 Million in 2025. Key growth drivers include ongoing modernization programs for existing military assets and the development of next-generation C2 architectures to counter evolving threats. Asia-Pacific is emerging as a significant production hub, driven by increasing defense budgets and indigenous development capabilities in countries like China and India.

Consumption Analysis: Similarly, North America accounts for the largest share of global consumption, reflecting its extensive military operations and significant investment in C2 technologies. The consumption analysis indicates a market value of over USD 18,000 Million for 2025. Consumption is further boosted by the need to integrate disparate systems and enhance interoperability across allied forces. Europe also represents a substantial consumption market, driven by NATO commitments and the need for coordinated defense efforts among member states. Emerging markets in the Middle East and Africa are showing accelerated consumption growth due to increasing security concerns and military modernization initiatives.

Import Market Analysis (Value & Volume): The import market is crucial for countries seeking to acquire cutting-edge C2 capabilities that may not be available through domestic production. The import market value is projected to be around USD 8,000 Million in 2025. Key import drivers include the demand for specialized software, advanced sensor integration, and secure communication modules. Countries in the Middle East and Southeast Asia are significant importers, seeking to bolster their defense capabilities. The volume of imports is driven by the need for system upgrades and the expansion of command and control networks.

Export Market Analysis (Value & Volume): The export market is dominated by a few key players from technologically advanced nations. The export market value is estimated to be over USD 7,000 Million in 2025. Major exporting nations include the United States, the United Kingdom, France, and Israel, capitalizing on their technological prowess and established defense relationships. The volume of exports is influenced by international defense agreements and the demand for interoperable C2 systems that can integrate with allied forces.

Price Trend Analysis: Price trends in the Command and Control Systems Market are largely influenced by the complexity of the technology, the level of customization required, and the scale of deployment. High-value, specialized systems for strategic command can command premium pricing. Conversely, solutions for tactical C2 or for smaller force units may be more cost-effective. The ongoing trend towards modularity and open architectures could, over the long term, lead to some price stabilization or even reduction as competition increases and economies of scale are achieved. However, the continuous evolution of technology and the need for advanced cybersecurity measures are expected to maintain upward price pressures for cutting-edge solutions. The average unit price for a sophisticated C2 system can range from USD 5 Million to over USD 50 Million, depending on its capabilities and application.

Command and Control Systems Market Product Analysis

Command and Control (C2) systems are evolving rapidly, with product innovations focused on enhancing situational awareness, decision-making speed, and interoperability across diverse operational environments. Key advancements include the integration of AI-powered analytics for real-time threat assessment and predictive intelligence, enabling faster and more informed command decisions. Open architecture platforms are becoming prevalent, allowing for seamless integration of new sensors, software modules, and communication technologies, thus reducing vendor lock-in and promoting adaptability. Edge computing solutions are also gaining traction, enabling distributed processing of critical data closer to the source, thereby reducing latency and enhancing operational resilience. These innovations are crucial for developing robust and agile C2 capabilities that can operate effectively in complex, multi-domain environments, providing a significant competitive advantage to systems that offer superior data fusion, secure communication, and user-friendly interfaces.

Key Drivers, Barriers & Challenges in Command and Control Systems Market

Key Drivers:

- Geopolitical Tensions & National Security Imperatives: The rising global security threats and the need for enhanced national defense capabilities are the primary drivers for the demand for advanced Command and Control (C2) systems.

- Technological Advancements: The integration of AI, ML, IoT, and advanced networking technologies is creating more sophisticated and effective C2 solutions.

- Modernization of Military Forces: Nations worldwide are investing in upgrading their legacy defense systems, leading to increased adoption of modern C2 platforms.

- Network-Centric Warfare Concepts: The push towards integrated and interconnected military operations necessitates robust C2 systems for seamless information sharing and coordination.

- Increasing Defense Budgets: Sustained growth in global defense spending directly translates to higher investment in C2 technologies.

Barriers & Challenges:

- High Development & Implementation Costs: The intricate nature of C2 systems leads to substantial research, development, and deployment expenses, posing a financial challenge for some end-users.

- Interoperability Issues: Integrating new C2 systems with existing legacy infrastructure can be complex and costly, requiring significant standardization efforts.

- Cybersecurity Threats: The increasing sophistication of cyberattacks poses a continuous threat to the integrity and security of C2 systems, demanding constant vigilance and advanced protective measures.

- Complex Procurement Processes: Government procurement cycles for defense systems are often lengthy and highly regulated, leading to extended sales cycles.

- Skilled Workforce Shortage: The demand for highly skilled personnel to design, operate, and maintain advanced C2 systems outstrips supply, creating a talent gap.

- Regulatory Hurdles: Stringent regulations concerning data privacy, export controls, and national security compliances can impact market access and product development.

Growth Drivers in the Command and Control Systems Market Market

Key growth drivers in the Command and Control Systems Market are multifaceted. Technologically, the rapid integration of Artificial Intelligence (AI) and Machine Learning (ML) is enhancing situational awareness and automating decision-making processes, leading to more effective command operations. Economically, sustained increases in global defense spending, particularly in regions experiencing geopolitical instability, are fueling demand for advanced C2 capabilities. Regulatory factors, such as government mandates for modernized defense infrastructure and the emphasis on interoperability among allied forces, also play a crucial role. For instance, ongoing military modernization programs in the Asia-Pacific and Middle East regions are significant growth catalysts, driving investment in sophisticated C2 platforms. The push towards network-centric warfare further necessitates robust C2 systems that can facilitate seamless information exchange and coordination across diverse military branches and allied nations, representing a substantial opportunity for market expansion.

Challenges Impacting Command and Control Systems Market Growth

Several challenges significantly impact the growth of the Command and Control Systems Market. Regulatory complexities, including stringent export control laws and data localization requirements, can hinder market access and increase compliance costs for international players. Supply chain issues, exacerbated by global disruptions, can lead to delays in component procurement and production, impacting delivery timelines. Competitive pressures are intense, with established players facing competition from agile technology firms offering innovative solutions, leading to pricing pressures. Furthermore, the significant upfront investment required for developing and deploying advanced C2 systems, coupled with the need for continuous upgrades to counter evolving threats, presents a substantial financial barrier for many potential clients. The cybersecurity landscape, with its ever-increasing sophistication of threats, demands continuous investment in protective measures, adding to the overall cost and complexity.

Key Players Shaping the Command and Control Systems Market Market

- L3Harris Technologies Inc

- Honeywell International Inc

- THALES

- General Dynamics Corporation

- Lockheed Martin Corporation

- RTX Corporation

- Kratos Defense & Security Solutions Inc

- Leonardo S p A

- CACI International Inc

- BAE Systems plc

- Saab AB

Significant Command and Control Systems Market Industry Milestones

- February 2024: The Defense Information Systems Agency awarded Data Computer Corporation of America a five-year contract with a maximum value of USD 37 million. This contract is to provide a variety of support services, including systems and software engineering and cybersecurity, for DISA’s command and control portfolio capabilities, underscoring the ongoing investment in C2 infrastructure and services.

- January 2022: THALES was awarded a 10-year contract to provide logistics support to the French military's national air command and control system (SCCOA). Under the contract, the company will ensure that the main components of the air surveillance system are sustained to meet the needs of the French armed forces, highlighting the critical importance of long-term support and maintenance for C2 systems.

Future Outlook for Command and Control Systems Market Market

The future outlook for the Command and Control Systems Market is exceptionally promising, driven by the continued evolution of warfare and security paradigms. The increasing adoption of multi-domain command and control (MDC2) capabilities, which integrate land, air, sea, space, and cyber domains, will be a significant growth catalyst. Furthermore, the pervasive integration of AI and ML for enhanced decision support and predictive analytics will redefine operational effectiveness. The market is poised for substantial expansion as nations prioritize the modernization of their defense infrastructure and invest in resilient, secure, and interoperable C2 solutions to address complex global security challenges. Strategic opportunities lie in developing advanced simulation and training environments, secure cloud-based C2 platforms, and edge computing solutions that enable faster response times in dynamic operational settings.

Command and Control Systems Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Command and Control Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Command and Control Systems Market Regional Market Share

Geographic Coverage of Command and Control Systems Market

Command and Control Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Land Based Platform Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Command and Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Command and Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Command and Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Command and Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Command and Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Command and Control Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 THALES

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Dynamics Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lockheed Martin Corporatio

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RTX Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kratos Defense & Security Solutions Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Leonardo S p A

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CACI International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BAE Systems plc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Saab AB

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Command and Control Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Command and Control Systems Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Command and Control Systems Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Command and Control Systems Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Command and Control Systems Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Command and Control Systems Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Command and Control Systems Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Command and Control Systems Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Command and Control Systems Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Command and Control Systems Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Command and Control Systems Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Command and Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Command and Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Command and Control Systems Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Command and Control Systems Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Command and Control Systems Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Command and Control Systems Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Command and Control Systems Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Command and Control Systems Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Command and Control Systems Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Command and Control Systems Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Command and Control Systems Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Command and Control Systems Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Command and Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Command and Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Command and Control Systems Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Command and Control Systems Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Command and Control Systems Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Command and Control Systems Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Command and Control Systems Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Command and Control Systems Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Command and Control Systems Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Command and Control Systems Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Command and Control Systems Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Command and Control Systems Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Command and Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Command and Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Command and Control Systems Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Command and Control Systems Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Command and Control Systems Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Command and Control Systems Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Command and Control Systems Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Command and Control Systems Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Command and Control Systems Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Command and Control Systems Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Command and Control Systems Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Command and Control Systems Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Command and Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Command and Control Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Command and Control Systems Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Command and Control Systems Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Command and Control Systems Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Command and Control Systems Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Command and Control Systems Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Command and Control Systems Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Command and Control Systems Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Command and Control Systems Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Command and Control Systems Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Command and Control Systems Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Command and Control Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Command and Control Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Command and Control Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Command and Control Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Command and Control Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Command and Control Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Command and Control Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Command and Control Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Command and Control Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Command and Control Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Command and Control Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Command and Control Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Command and Control Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Command and Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Command and Control Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Command and Control Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Command and Control Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Command and Control Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Command and Control Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Command and Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Command and Control Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Command and Control Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Command and Control Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Command and Control Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Command and Control Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Command and Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Command and Control Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Command and Control Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Command and Control Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Command and Control Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Command and Control Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Command and Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Command and Control Systems Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Command and Control Systems Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Command and Control Systems Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Command and Control Systems Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Command and Control Systems Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Command and Control Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Command and Control Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Command and Control Systems Market?

The projected CAGR is approximately 4.66%.

2. Which companies are prominent players in the Command and Control Systems Market?

Key companies in the market include L3Harris Technologies Inc, Honeywell International Inc, THALES, General Dynamics Corporation, Lockheed Martin Corporatio, RTX Corporation, Kratos Defense & Security Solutions Inc, Leonardo S p A, CACI International Inc, BAE Systems plc, Saab AB.

3. What are the main segments of the Command and Control Systems Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.56 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Land Based Platform Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

February 2024: The Defense Information Systems Agency awarded Data Computer Corporation of America a five-year contract with a maximum value of USD 37 million. It is to provide a variety of support services like systems and software engineering and cybersecurity for DISA’s command and control portfolio capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Command and Control Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Command and Control Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Command and Control Systems Market?

To stay informed about further developments, trends, and reports in the Command and Control Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence