Key Insights

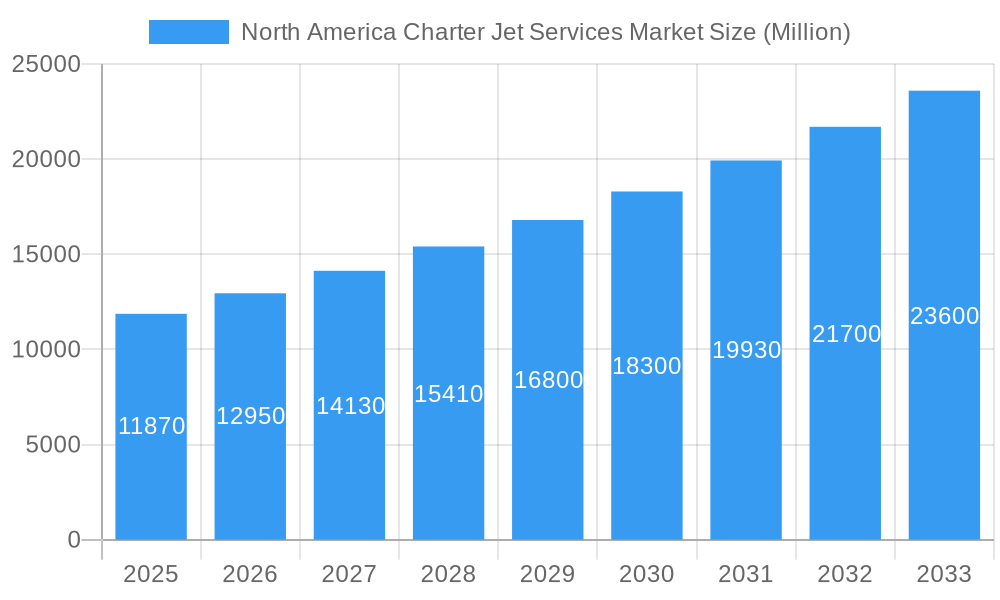

The North America Charter Jet Services Market is poised for robust expansion, projected to reach a substantial valuation by 2033. With a significant market size of approximately $11.87 billion in the base year of 2025, the sector is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 9.10% through 2033. This impressive growth trajectory is primarily fueled by increasing demand for private aviation among high-net-worth individuals and corporations seeking convenience, flexibility, and time efficiency. The inherent desire for personalized travel experiences, coupled with a growing emphasis on safety and privacy, continues to drive charter jet utilization. Furthermore, advancements in aircraft technology and the expanding network of charter operators are making private jet travel more accessible and competitive. The market's segmentation by aircraft size highlights a balanced demand across light, mid-size, and large jets, catering to diverse travel needs, from short-haul executive trips to international long-haul journeys.

North America Charter Jet Services Market Market Size (In Billion)

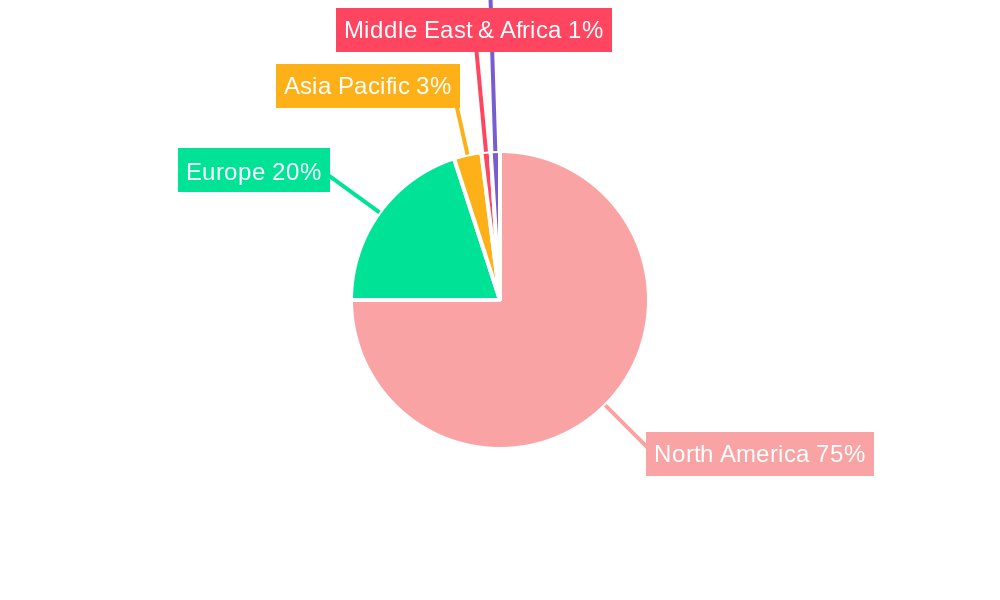

Geographically, the United States and Canada represent the dominant markets for charter jet services in North America. The United States, with its vast economic landscape and a concentrated population of affluent individuals and businesses, leads the demand. Canada, while smaller, presents a significant and growing market due to its resource-rich industries and increasing adoption of private aviation solutions. Key market drivers include the burgeoning corporate travel sector, a strong leisure travel segment, and the growing preference for on-demand services. While the market exhibits strong growth potential, certain restraints, such as high operational costs and regulatory complexities, need to be navigated by industry players. Nonetheless, the ongoing innovation in service offerings and the sustained demand for unparalleled travel experiences position the North America Charter Jet Services Market for continued success and significant value creation.

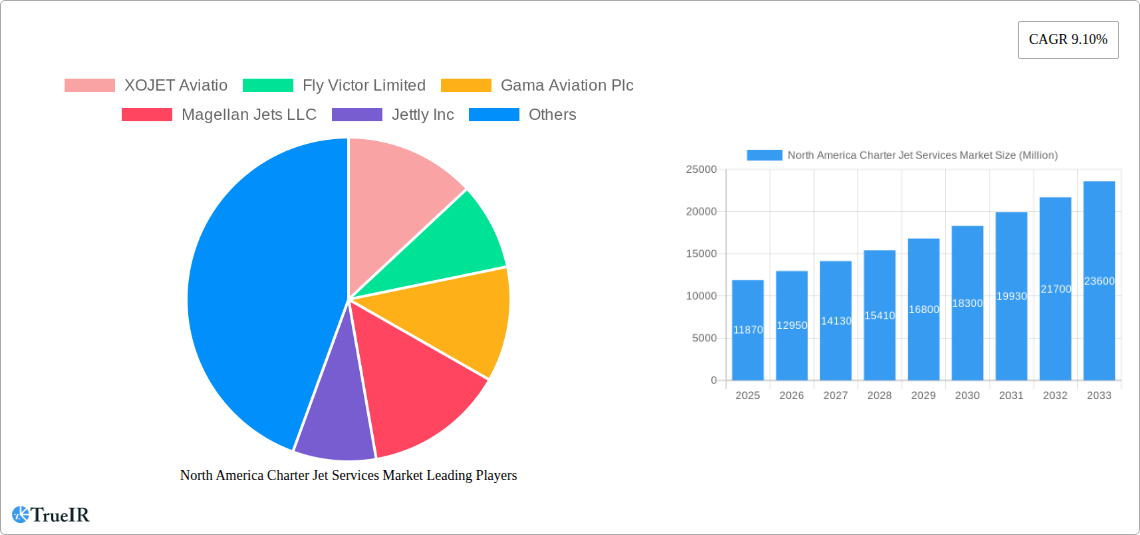

North America Charter Jet Services Market Company Market Share

North America Charter Jet Services Market: Comprehensive Market Insights and Growth Projections (2019–2033)

This in-depth market report offers a panoramic view of the North America Charter Jet Services Market, meticulously analyzing its structure, trends, and future trajectory. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report provides actionable insights for industry stakeholders, investors, and decision-makers. We leverage high-volume SEO keywords such as "private jet charter," "business aviation," "executive air travel," "on-demand jets," and "charter flight services" to ensure maximum discoverability and engagement with our target audience.

North America Charter Jet Services Market Market Structure & Competitive Landscape

The North America Charter Jet Services Market is characterized by a moderately concentrated structure, with a few dominant players alongside a substantial number of regional and niche operators. Innovation drivers are primarily focused on enhancing user experience through digital platforms, seamless booking processes, and personalized service offerings. Technological advancements in aircraft efficiency and safety protocols also play a crucial role. Regulatory impacts, while generally supportive of business aviation, involve stringent safety certifications and operational compliance, influencing market entry barriers. Product substitutes include commercial first-class travel, high-speed rail for shorter distances, and fractional ownership models, though charter jets offer unparalleled flexibility and time savings. End-user segmentation reveals a strong reliance on corporate clients, high-net-worth individuals, and government entities, with a growing segment of leisure travelers seeking bespoke experiences. Mergers and acquisitions (M&A) trends indicate a consolidation drive among larger players to expand their fleet, service offerings, and geographical reach, aiming to capture a larger market share. For instance, recent M&A activities have seen the acquisition of smaller charter operators by larger entities seeking to bolster their service capabilities. The concentration ratio (CR4) is estimated to be around 60%, indicating significant market power held by the top four companies. M&A volumes in the past two years have totaled an estimated $1,500 Million, signaling robust consolidation efforts.

North America Charter Jet Services Market Market Trends & Opportunities

The North America Charter Jet Services Market is poised for significant expansion, driven by a confluence of factors that are reshaping the business aviation landscape. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033, reaching an estimated $35,000 Million by the end of the forecast period. This robust growth is fueled by evolving consumer preferences that increasingly prioritize privacy, flexibility, and time efficiency, key differentiators of private jet charter services. The surge in demand from high-net-worth individuals (HNWIs) and a growing affluent demographic seeking exclusive travel experiences continues to be a primary market driver. Technological shifts are also playing a pivotal role, with advancements in digital booking platforms and AI-powered itinerary optimization enhancing the customer journey and operational efficiency. The integration of advanced avionics and sustainable aviation fuels are also becoming more prominent, appealing to environmentally conscious travelers and corporate sustainability goals. Competitive dynamics are intensifying, with established players investing heavily in fleet modernization, service diversification, and strategic partnerships to maintain and expand their market share. New entrants, often leveraging innovative digital models, are challenging traditional operators by offering more accessible charter solutions. The increasing acceptance of charter services for both business and leisure travel, often referred to as "flex-jetting" or "on-demand private travel," is a significant trend. Opportunities lie in expanding into underserved secondary markets, developing specialized charter services (e.g., medical transport, group charters), and further integrating technology to personalize offerings and streamline operations. The market penetration rate for charter jet services among target demographics is estimated to be around 18% in 2025, indicating substantial room for growth as awareness and accessibility increase. The shift towards a more "do-it-yourself" booking experience through intuitive mobile applications is also a notable trend, catering to a younger, tech-savvy demographic. Furthermore, the increasing adoption of smaller, more fuel-efficient aircraft within the light and mid-size segments is opening up new market segments and driving cost-effectiveness for a wider range of users. The resilience of the charter jet market, even during economic uncertainties, highlights its indispensable role for businesses and individuals who value time and productivity.

Dominant Markets & Segments in North America Charter Jet Services Market

The United States unequivocally dominates the North America Charter Jet Services Market, accounting for an estimated 85% of the total market revenue. This dominance is attributable to several interwoven factors, including a robust economy, a large concentration of high-net-worth individuals and multinational corporations, and a well-established infrastructure for business aviation. The sheer volume of business travel and the strong culture of utilizing private aviation for efficiency and productivity solidify the US's position. Key growth drivers in the United States include:

- Extensive Airport Network: A vast number of general aviation airports cater to private jets, offering unparalleled access to various business and leisure destinations.

- Favorable Regulatory Environment: While safety regulations are stringent, the overall framework in the US supports business aviation operations.

- High Disposable Income: The presence of a significant affluent population fuels demand for luxury and personalized travel services.

- Corporate Culture: Many US corporations regularly utilize charter services for executive travel, team offsites, and client meetings, viewing it as a strategic investment in productivity.

In terms of Aircraft Size, the Mid-size segment is currently the largest and fastest-growing segment within the North America Charter Jet Services Market. This segment offers a compelling balance of range, cabin comfort, and operational cost-effectiveness, making it ideal for a wide array of business and leisure travel needs. Key growth drivers for the Mid-size segment include:

- Versatility: Mid-size jets can efficiently serve a broad spectrum of missions, from cross-country business trips to international leisure travel.

- Cost-Effectiveness: Compared to large cabin jets, mid-size aircraft generally offer lower operating costs, making them more accessible to a broader customer base.

- Technological Advancements: Modern mid-size jets are equipped with sophisticated avionics and comfortable interiors, rivaling the amenities of larger aircraft.

- Growing Demand for Medium-Haul Flights: As businesses expand their reach and leisure travel patterns evolve, the demand for aircraft capable of handling medium-haul routes increases.

The Light Jet segment also represents a significant and growing portion of the market, particularly for shorter regional trips and for clients seeking cost-effective private travel solutions. Its agility and ability to access smaller airports make it a convenient option for specific itineraries. The Large Jet segment, while commanding higher charter fees, remains crucial for intercontinental travel and for accommodating larger groups, catering to the highest echelons of corporate and VVIP travel.

Canada, while a smaller market compared to the United States, represents a stable and growing sector for charter jet services. Its demand is primarily driven by corporate travel in industries such as mining, oil and gas, and natural resources, which often require access to remote locations. Key growth drivers in Canada include:

- Resource-Based Industries: These industries necessitate travel to remote areas with limited commercial aviation infrastructure.

- Corporate Expansion: Growing Canadian businesses require efficient travel solutions for national and international operations.

- Increasing HNWI Population: A rising number of affluent individuals are opting for the convenience and privacy of private jet charters.

The United States is projected to maintain its dominant position throughout the forecast period, with the Mid-size aircraft segment expected to continue its robust growth trajectory, outpacing the other size categories due to its inherent versatility and increasing operational efficiencies.

North America Charter Jet Services Market Product Analysis

The North America Charter Jet Services Market is witnessing continuous product innovation focused on enhancing passenger experience, operational efficiency, and sustainability. Key advancements include the integration of state-of-the-art cabin interiors offering enhanced comfort, connectivity, and productivity features, such as high-speed Wi-Fi and advanced entertainment systems. Aircraft manufacturers are also prioritizing fuel-efficient designs and the exploration of sustainable aviation fuels (SAFs) to align with environmental consciousness among clients. The development of sophisticated digital platforms for seamless booking, flight tracking, and personalized service management provides a significant competitive advantage. The application of these innovations ranges from executive commuting and corporate roadshows to luxury leisure travel and urgent logistical needs, showcasing the adaptability and broad market fit of modern charter jet services.

Key Drivers, Barriers & Challenges in North America Charter Jet Services Market

The North America Charter Jet Services Market is propelled by several key drivers. Technological advancements in aircraft design, avionics, and digital booking platforms are enhancing safety, efficiency, and user experience. The growing disposable income of high-net-worth individuals and the increasing need for time-saving travel solutions for businesses are significant economic drivers. Favorable regulatory frameworks that support private aviation operations also contribute to market growth.

However, the market faces several barriers and challenges. High operational costs, including fuel, maintenance, and crew expenses, can be a restraint for some potential users. Strict regulatory compliance and certification requirements can pose hurdles for new entrants. Supply chain disruptions for aircraft parts and maintenance services can impact fleet availability. Intensifying competition among charter operators, coupled with evolving customer expectations for premium services, also presents a continuous challenge. Economic downturns can lead to reduced corporate spending, impacting charter demand.

Growth Drivers in the North America Charter Jet Services Market Market

Key growth drivers in the North America Charter Jet Services Market are multifaceted. Technological innovations, such as advanced cabin connectivity and efficient aircraft designs, are enhancing passenger experience and operational economics. The increasing demand for time-saving travel solutions from corporate executives and affluent individuals remains a primary economic driver. Furthermore, a growing awareness and appreciation for the flexibility and privacy offered by charter services are expanding the customer base beyond traditional corporate users. Favorable regulatory environments in key North American markets continue to support the growth of business aviation by providing clear operational guidelines and safety standards. The trend towards personalized travel experiences is also a significant growth catalyst, as charter services can be tailored to meet specific itinerary and amenity requirements.

Challenges Impacting North America Charter Jet Services Market Growth

Several challenges are impacting the North America Charter Jet Services Market growth. High upfront investment and ongoing operational expenses for aircraft ownership and operation present a significant financial barrier. Stringent safety and regulatory compliance demands, while crucial for passenger safety, can increase operational complexity and costs. Global supply chain volatility, affecting the availability of spare parts and specialized maintenance, can lead to operational delays and increased costs. Intensified competition among a wide array of charter providers, from large fleet operators to smaller niche players, often leads to pricing pressures. Additionally, macroeconomic uncertainties and potential recessions can lead to a reduction in discretionary spending by corporations and individuals, impacting charter demand.

Key Players Shaping the North America Charter Jet Services Market Market

- XOJET Aviation

- Fly Victor Limited

- Gama Aviation Plc

- Magellan Jets LLC

- Jettly Inc

- VistaJet Group Holding Limited

- Executive Jet Management Inc

- PrivateFly LLC

- Stratos Jet Charters Inc

- Delta Airlines Inc

- NetJets IP LLC

Significant North America Charter Jet Services Market Industry Milestones

- 2019: Increased investment in digital booking platforms by major charter operators to enhance customer accessibility.

- 2020: Impact of global pandemic leads to a surge in demand for private travel due to health and safety concerns.

- 2021: Growing focus on sustainable aviation fuels (SAFs) by charter companies to meet environmental goals.

- 2022: Consolidation activities increase as larger players acquire smaller operators to expand fleet and service offerings.

- 2023: Introduction of enhanced in-flight connectivity and entertainment options in new and refurbished aircraft.

Future Outlook for North America Charter Jet Services Market Market

The future outlook for the North America Charter Jet Services Market is exceptionally promising, driven by sustained demand for personalized, efficient, and safe air travel. Strategic opportunities lie in further leveraging digital technologies to streamline operations and enhance customer engagement, as well as expanding service offerings to cater to niche markets such as medical transport and specialized group charters. The growing emphasis on sustainability will also drive innovation in greener aircraft technologies and operational practices. The market is expected to witness continued growth, fueled by an expanding base of affluent individuals and corporations prioritizing flexibility and time optimization. Projected growth is estimated to maintain a strong CAGR of approximately 7.5% through 2033.

North America Charter Jet Services Market Segmentation

-

1. Aircraft Size

- 1.1. Light

- 1.2. Mid-size

- 1.3. Large

-

2. Geography

- 2.1. United States

- 2.2. Canada

North America Charter Jet Services Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Charter Jet Services Market Regional Market Share

Geographic Coverage of North America Charter Jet Services Market

North America Charter Jet Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Large Jet Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Charter Jet Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 5.1.1. Light

- 5.1.2. Mid-size

- 5.1.3. Large

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 6. United States North America Charter Jet Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 6.1.1. Light

- 6.1.2. Mid-size

- 6.1.3. Large

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 7. Canada North America Charter Jet Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 7.1.1. Light

- 7.1.2. Mid-size

- 7.1.3. Large

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 XOJET Aviatio

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Fly Victor Limited

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Gama Aviation Plc

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Magellan Jets LLC

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Jettly Inc

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 VistaJet Group Holding Limited

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Executive Jet Management Inc

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 PrivateFly LLC

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Stratos Jet Charters Inc

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Delta Airlines Inc

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 NetJets IP LLC

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.1 XOJET Aviatio

List of Figures

- Figure 1: North America Charter Jet Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Charter Jet Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Charter Jet Services Market Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 2: North America Charter Jet Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: North America Charter Jet Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Charter Jet Services Market Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 5: North America Charter Jet Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: North America Charter Jet Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: North America Charter Jet Services Market Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 8: North America Charter Jet Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: North America Charter Jet Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Charter Jet Services Market?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the North America Charter Jet Services Market?

Key companies in the market include XOJET Aviatio, Fly Victor Limited, Gama Aviation Plc, Magellan Jets LLC, Jettly Inc, VistaJet Group Holding Limited, Executive Jet Management Inc, PrivateFly LLC, Stratos Jet Charters Inc, Delta Airlines Inc, NetJets IP LLC.

3. What are the main segments of the North America Charter Jet Services Market?

The market segments include Aircraft Size, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.87 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Large Jet Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Charter Jet Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Charter Jet Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Charter Jet Services Market?

To stay informed about further developments, trends, and reports in the North America Charter Jet Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence