Key Insights

The global Search and Rescue Helicopter market is poised for significant expansion, projected to reach a market size of $22.56 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 3.4%. This growth is driven by increasing global security concerns, a rise in natural disasters, and the persistent demand for rapid emergency response. Technological advancements in helicopter capabilities, including extended range, enhanced speed, and sophisticated sensor and communication systems, are critical enablers for effective mission execution across diverse environments. The growing demand for specialized rescue helicopters in both offshore and onshore applications, encompassing maritime rescue, disaster relief, and medical evacuation, further fuels the market's upward trajectory. The market is segmented into Fixed Wing and Rotary Wing aircraft, with Rotary Wing helicopters dominating due to their superior maneuverability and vertical takeoff and landing capabilities, essential for accessing remote and challenging terrains.

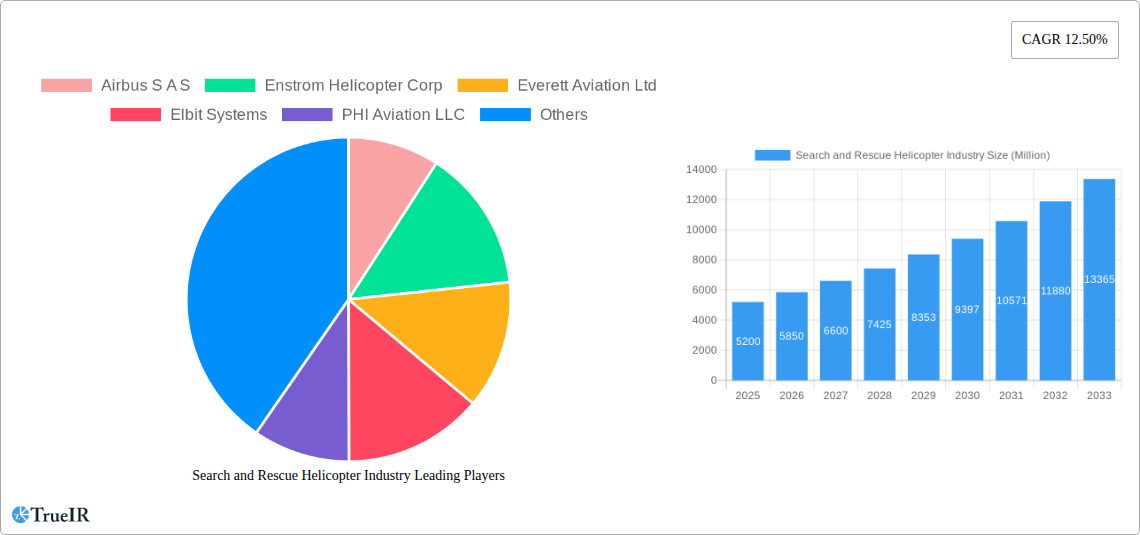

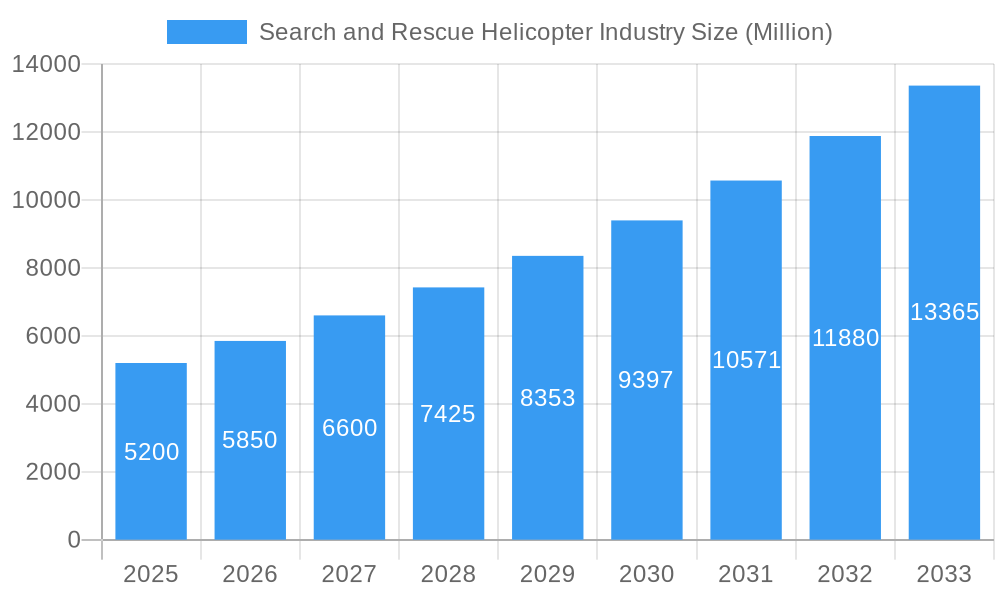

Search and Rescue Helicopter Industry Market Size (In Billion)

Leading companies such as Airbus S.A.S., Bell Textron, and Lockheed Martin Corp. are investing in research and development to introduce next-generation SAR helicopters with improved performance and sustainability. This competitive landscape, coupled with increased government investment in defense and emergency services, is a key growth stimulant. However, high acquisition and maintenance costs for advanced helicopters, along with stringent regulatory compliances, present market restraints. Despite these challenges, the growing adoption of advanced SAR protocols and the heightened global emphasis on civilian safety and disaster preparedness are expected to sustain the market's growth. The Asia Pacific and North America regions are anticipated to be major contributors to this expansion, owing to their robust economies and proactive public safety initiatives.

Search and Rescue Helicopter Industry Company Market Share

Search and Rescue Helicopter Market Analysis: Trends, Opportunities, and Forecast (2024-2033)

Global Search and Rescue Helicopter Industry Overview: Trends, Opportunities, and Future Outlook (2024-2033)

Gain critical insights into the expanding Search and Rescue (SAR) helicopter market. This comprehensive report analyzes global SAR helicopter industry dynamics, key players, technological advancements, and future projections. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is essential for stakeholders in this vital sector. We examine market concentration, innovation drivers, regulatory impacts, and M&A activities, alongside detailed product and segment analyses. Understand market leadership, challenges, opportunities, and the future trajectory of SAR helicopter operations globally.

Search and Rescue Helicopter Industry Market Structure & Competitive Landscape

The global Search and Rescue (SAR) helicopter market exhibits a moderately concentrated structure, with a few dominant players controlling a significant market share. Key companies like Airbus S.A.S., Bell Textron, and Lockheed Martin Corp are at the forefront, driving innovation and market expansion. Innovation is a primary driver, fueled by the continuous need for enhanced capabilities in challenging environments. Technological advancements in areas like advanced sensor integration, longer endurance, and improved navigation systems are critical differentiators. Regulatory frameworks, while crucial for safety and operational standards, can also present barriers to entry. The substitution threat from fixed-wing aircraft for certain long-range reconnaissance missions exists, but the unique vertical takeoff and landing (VTOL) capabilities of helicopters ensure their indispensability for immediate and localized SAR operations. End-user segmentation is diverse, encompassing military, coast guard, air ambulance, and disaster relief organizations. Merger and acquisition (M&A) activity, while not at an extreme level, has been observed as companies seek to expand their portfolios and geographic reach. For instance, significant M&A volumes, estimated to be around 3-5 transactions annually between 2019-2024, have reshaped the competitive landscape, consolidating expertise and resources. Concentration ratios, particularly for advanced SAR helicopter platforms, are estimated to be in the XX% range, highlighting the influence of major manufacturers.

Search and Rescue Helicopter Industry Market Trends & Opportunities

The Search and Rescue Helicopter Industry is experiencing a period of sustained growth and transformation, driven by increasing global demand for emergency response services and advancements in aviation technology. The market size for SAR helicopters is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033, reaching an estimated value of over XX Million by the end of the forecast period. This expansion is underpinned by a confluence of factors, including the rising frequency of natural disasters, the expansion of offshore energy exploration requiring robust safety protocols, and the growing emphasis on public safety and emergency medical services (EMS) worldwide. Technological shifts are playing a pivotal role, with a significant trend towards the integration of artificial intelligence (AI) and advanced sensor technologies such as infrared imaging, high-resolution cameras, and real-time data transmission capabilities. These advancements enhance situational awareness, improve target detection, and enable faster, more effective rescue missions. Consumer preferences, in this context, translate to a demand for helicopters offering greater endurance, higher payload capacity, enhanced survivability in extreme weather conditions, and reduced operational costs. The competitive dynamics are intensifying, with established manufacturers like Airbus S.A.S., Bell Textron, and Lockheed Martin Corp continuously investing in research and development to introduce next-generation SAR platforms. New entrants and specialized aviation service providers, such as Bristow Group Inc. and PHI Aviation LLC, are also carving out niches by offering tailored solutions and operational expertise. The market penetration rate for advanced SAR helicopter technologies is steadily increasing, driven by government procurements and the modernization of existing fleets. Opportunities abound in the development of specialized SAR configurations, including those equipped for maritime operations, mountain rescue, and medical evacuation, catering to the diverse needs of end-users. Furthermore, the growing adoption of unmanned aerial vehicles (UAVs) in supplementary SAR roles presents a complementary opportunity, allowing for wider aerial surveillance and initial reconnaissance, thereby optimizing the deployment of manned helicopters. The increasing focus on sustainability and reduced emissions is also driving innovation in rotorcraft design, with a growing interest in hybrid-electric powertrains and more fuel-efficient engine technologies. The global demand for increased operational range and endurance is also a significant trend, pushing manufacturers to develop platforms capable of extended flight times and operations in remote or inaccessible regions. The evolving threat landscape, including terrorism and piracy, also necessitates enhanced SAR capabilities for maritime and coastal security, further bolstering market demand. The integration of advanced communication systems and secure data links is crucial for seamless coordination between SAR assets and ground control, a trend that is expected to accelerate over the forecast period. The increasing emphasis on crew safety and comfort in SAR operations is also driving the development of more ergonomic cabin designs and advanced life support systems. The global SAR helicopter market is poised for robust growth, fueled by technological advancements, expanding operational needs, and a persistent commitment to saving lives.

Dominant Markets & Segments in Search and Rescue Helicopter Industry

The Search and Rescue Helicopter Industry is characterized by distinct regional dominance and segment preferences, driven by a complex interplay of geopolitical factors, environmental conditions, and governmental policies. Rotary Wing aircraft remain the dominant type within the SAR helicopter market, accounting for an estimated XX% of the total market share. Their inherent ability for vertical takeoff and landing (VTOL), hovering capabilities, and precision maneuverability make them indispensable for a wide range of SAR operations, particularly in confined spaces, urban environments, and over water.

Dominant Regions and Countries:

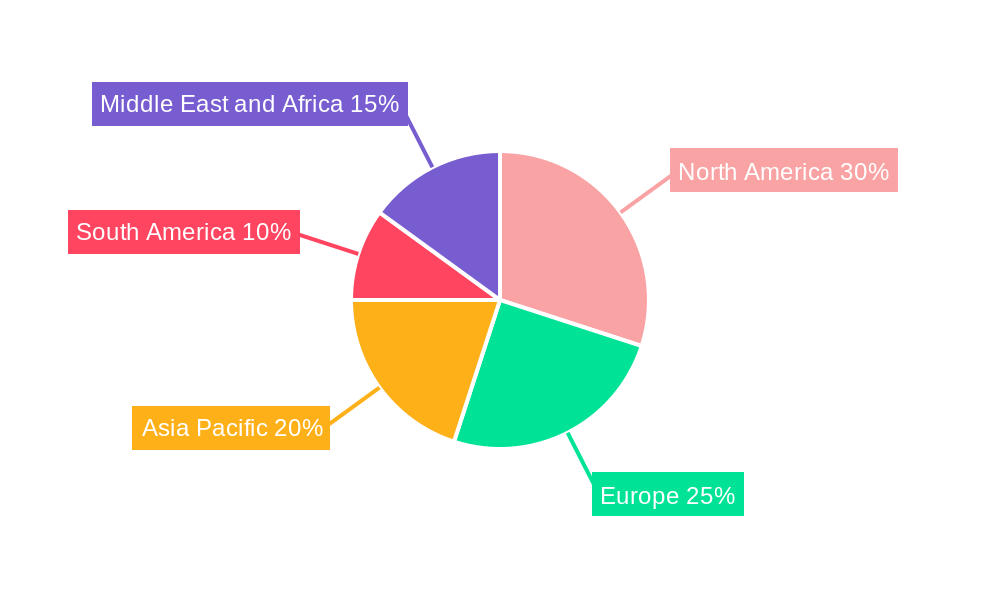

- North America currently holds the largest market share, driven by substantial government investments in defense and homeland security, a high density of offshore energy activities, and a robust network of emergency medical services. The United States, in particular, with its vast geographical expanse and susceptibility to natural disasters, is a key driver of demand for advanced SAR helicopters.

- Europe follows closely, with nations like the United Kingdom, Norway, and France heavily investing in maritime SAR capabilities due to their extensive coastlines and significant offshore oil and gas operations. Government mandates for civilian helicopter emergency medical services (HEMS) also contribute significantly to market growth.

- Asia-Pacific is emerging as a high-growth region, fueled by rapid economic development, increasing offshore exploration in countries like China and India, and a growing awareness and preparedness for natural calamities such as typhoons and earthquakes. Government initiatives to modernize military and disaster response fleets are spurring demand.

Dominant Segments:

- Onshore Rescue applications represent the largest segment, accounting for approximately XX% of the market. This encompasses a broad spectrum of operations, including mountain rescue, wilderness search, urban emergency response, disaster relief (e.g., after floods or earthquakes), and medical evacuations from remote areas. The increasing global population and human encroachment into challenging terrains contribute to the sustained demand in this segment. Key growth drivers include infrastructure development in remote areas, which necessitates improved accessibility for emergency services, and government policies prioritizing public safety and disaster preparedness.

- Offshore Rescue operations, while a smaller segment at around XX%, are critically important and experiencing robust growth. This is largely driven by the expansion of the offshore oil and gas industry in regions like the North Sea, the Gulf of Mexico, and the Asia-Pacific. The inherent dangers of offshore work necessitate highly capable helicopters for personnel recovery, emergency medical evacuations, and pollution response. Growth in this segment is intrinsically linked to energy exploration and production activities, with stringent safety regulations mandating the presence of reliable SAR capabilities.

The overall market dominance is therefore a function of both the inherent advantages of rotary-wing aircraft and the specific operational demands dictated by geography, industry, and government mandates. The continuous need to respond to emergencies and ensure public safety in diverse environments ensures the sustained relevance and growth of the SAR helicopter industry across all its segments.

Search and Rescue Helicopter Industry Product Analysis

The Search and Rescue (SAR) helicopter industry is characterized by continuous product innovation aimed at enhancing mission effectiveness, safety, and operational efficiency. Key advancements include the integration of sophisticated avionics suites, offering improved navigation, communication, and situational awareness for crews. Advanced sensor technologies, such as forward-looking infrared (FLIR) and high-resolution electro-optical/infrared (EO/IR) cameras, significantly improve target detection in challenging conditions like low light or adverse weather. Many modern SAR helicopters boast increased endurance and range, enabling them to cover larger search areas and operate in more remote locations. Competitive advantages are derived from robust airframes designed for survivability, powerful engines for performance in demanding environments, and modular interiors that can be rapidly reconfigured for various mission profiles, from casualty evacuation to search and combat SAR. Examples of leading platforms include the Airbus H145, Bell 429, and Sikorsky S-92, each offering distinct capabilities tailored to specific operational requirements.

Key Drivers, Barriers & Challenges in Search and Rescue Helicopter Industry

Key Drivers:

- Increasing Frequency of Natural Disasters: A surge in extreme weather events globally necessitates rapid and effective emergency response, driving demand for SAR helicopters.

- Technological Advancements: Integration of AI, advanced sensors, and enhanced communication systems significantly boosts operational capabilities, making modern helicopters more effective.

- Governmental Investments: Growing defense budgets and homeland security initiatives in numerous countries lead to fleet modernization and new procurement.

- Expansion of Offshore Industries: The continued growth of offshore oil and gas exploration and renewable energy installations requires robust SAR support.

- Aging Fleets: Many existing SAR helicopter fleets are reaching their end-of-life, prompting replacement and upgrades.

Barriers & Challenges:

- High Acquisition and Maintenance Costs: SAR helicopters represent a significant capital investment, and ongoing maintenance is expensive, posing financial hurdles for some operators.

- Stringent Regulatory Compliance: Meeting complex and evolving aviation safety regulations requires substantial investment and rigorous adherence.

- Shortage of Skilled Personnel: A global deficit in experienced helicopter pilots, maintenance technicians, and SAR specialists can hinder operational capacity.

- Infrastructure Limitations: Lack of adequate helipads, maintenance facilities, and communication networks in remote or disaster-stricken areas can impede operations.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability of critical components and spare parts, leading to extended downtime. The estimated impact of such disruptions on delivery timelines can be as high as XX%, affecting operational readiness.

Growth Drivers in the Search and Rescue Helicopter Industry Market

The Search and Rescue Helicopter Industry is propelled by a combination of technological innovation, evolving operational needs, and supportive governmental policies. Key growth drivers include the increasing demand for advanced onshore rescue capabilities, fueled by a rising global population and greater human presence in remote and challenging terrains. Technological advancements, such as the integration of AI-powered search algorithms, enhanced sensor suites (e.g., LiDAR, advanced thermal imaging), and longer-endurance rotorcraft, significantly improve mission effectiveness and expand operational envelopes. Furthermore, the continuous expansion of offshore energy exploration and the burgeoning renewable energy sector (e.g., offshore wind farms) necessitate sophisticated offshore rescue capabilities, creating substantial market opportunities. Governmental investments in homeland security, disaster response modernization, and maritime surveillance are also pivotal, leading to fleet upgrades and new procurements by military, coast guard, and emergency service agencies. The aging existing helicopter fleets in many regions create a natural replacement cycle, further stimulating demand for newer, more capable platforms.

Challenges Impacting Search and Rescue Helicopter Industry Growth

Despite robust growth prospects, the Search and Rescue Helicopter Industry faces several significant challenges. The high upfront acquisition cost of advanced SAR helicopters, often running into tens of millions of dollars per unit, presents a considerable financial barrier for many operators. Stringent and evolving regulatory frameworks for aviation safety, certification, and operational procedures require substantial compliance efforts and can lead to delays in new technology adoption. Supply chain disruptions, exacerbated by geopolitical events and global logistical complexities, can lead to extended lead times for critical components and spare parts, impacting fleet availability and maintenance schedules. The shortage of skilled pilots and maintenance technicians is a persistent issue, threatening to limit operational capacity and increase labor costs. Intense competitive pressures among manufacturers and service providers can also affect pricing and profit margins. Furthermore, the need for specialized infrastructure, such as dedicated helipads and advanced communication networks, can be a limiting factor in remote or rapidly developing regions. The estimated impact of supply chain issues on project timelines can be as high as XX%, requiring strategic mitigation efforts.

Key Players Shaping the Search and Rescue Helicopter Industry Market

- Airbus S.A.S

- Bell Textron

- Lockheed Martin Corp

- Enstrom Helicopter Corp

- Everett Aviation Ltd

- Elbit Systems

- PHI Aviation LLC

- Babcock International

- Bristow Group Inc

- MD Helicopters Inc

Significant Search and Rescue Helicopter Industry Industry Milestones

- 2019: Introduction of advanced sensor integration technologies, enhancing SAR capabilities in low visibility conditions.

- 2020: Increased government funding for disaster relief and emergency response in North America and Europe, driving demand for new helicopter procurements.

- 2021: Significant advancements in unmanned aerial system (UAS) integration for SAR support, offering complementary surveillance capabilities.

- 2022: Major manufacturers unveiled new rotorcraft models with extended range and endurance, specifically targeting the SAR market.

- 2023: Growing emphasis on sustainable aviation fuels and electric hybrid technologies for future SAR helicopter development.

- 2024: Increased focus on cybersecurity for SAR helicopter avionics and communication systems.

Future Outlook for Search and Rescue Helicopter Industry Market

The future outlook for the Search and Rescue Helicopter Industry is exceptionally promising, driven by an anticipated surge in demand and continuous technological innovation. Key growth catalysts include the escalating need for rapid disaster response, expansion of offshore energy operations, and a global imperative for enhanced public safety. The industry is poised for significant expansion, with projected market growth exceeding XX Million by 2033. Strategic opportunities lie in the development of autonomous or semi-autonomous SAR platforms, advanced AI-driven mission management systems, and the widespread adoption of sustainable aviation technologies. The market potential is further amplified by ongoing fleet modernization programs and increasing governmental commitment to robust emergency response infrastructure.

Search and Rescue Helicopter Industry Segmentation

-

1. Type

- 1.1. Fixed Wing

- 1.2. Rotary Wing

-

2. Application

- 2.1. Offshore Rescue

- 2.2. Onshore Rescue

Search and Rescue Helicopter Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Search and Rescue Helicopter Industry Regional Market Share

Geographic Coverage of Search and Rescue Helicopter Industry

Search and Rescue Helicopter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rotary Wing Segment Is Expected To Lead The Market During The Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Search and Rescue Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Wing

- 5.1.2. Rotary Wing

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Offshore Rescue

- 5.2.2. Onshore Rescue

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Search and Rescue Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed Wing

- 6.1.2. Rotary Wing

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Offshore Rescue

- 6.2.2. Onshore Rescue

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Search and Rescue Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed Wing

- 7.1.2. Rotary Wing

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Offshore Rescue

- 7.2.2. Onshore Rescue

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Search and Rescue Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed Wing

- 8.1.2. Rotary Wing

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Offshore Rescue

- 8.2.2. Onshore Rescue

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Search and Rescue Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fixed Wing

- 9.1.2. Rotary Wing

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Offshore Rescue

- 9.2.2. Onshore Rescue

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Search and Rescue Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fixed Wing

- 10.1.2. Rotary Wing

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Offshore Rescue

- 10.2.2. Onshore Rescue

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Airbus S A S

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Enstrom Helicopter Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Everett Aviation Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Elbit Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PHI Aviation LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bell Textron

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lockheed Martin Corp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Babcock International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bristow Group Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MD Helicopters Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Airbus S A S

List of Figures

- Figure 1: Global Search and Rescue Helicopter Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Search and Rescue Helicopter Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Search and Rescue Helicopter Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Search and Rescue Helicopter Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Search and Rescue Helicopter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Search and Rescue Helicopter Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Search and Rescue Helicopter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Search and Rescue Helicopter Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Search and Rescue Helicopter Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Search and Rescue Helicopter Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Search and Rescue Helicopter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Search and Rescue Helicopter Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Search and Rescue Helicopter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Search and Rescue Helicopter Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Search and Rescue Helicopter Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Search and Rescue Helicopter Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Search and Rescue Helicopter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Search and Rescue Helicopter Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Search and Rescue Helicopter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Search and Rescue Helicopter Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Search and Rescue Helicopter Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Search and Rescue Helicopter Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Search and Rescue Helicopter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Search and Rescue Helicopter Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Search and Rescue Helicopter Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Search and Rescue Helicopter Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Search and Rescue Helicopter Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Search and Rescue Helicopter Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Search and Rescue Helicopter Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Search and Rescue Helicopter Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Search and Rescue Helicopter Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Germany Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Russia Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Spain Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 21: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: India Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: China Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Brazil Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Argentina Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Search and Rescue Helicopter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 35: United Arab Emirates Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Saudi Arabia Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Search and Rescue Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Search and Rescue Helicopter Industry?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Search and Rescue Helicopter Industry?

Key companies in the market include Airbus S A S, Enstrom Helicopter Corp, Everett Aviation Ltd, Elbit Systems, PHI Aviation LLC, Bell Textron, Lockheed Martin Corp, Babcock International, Bristow Group Inc, MD Helicopters Inc.

3. What are the main segments of the Search and Rescue Helicopter Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.56 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rotary Wing Segment Is Expected To Lead The Market During The Forecast Period..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Search and Rescue Helicopter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Search and Rescue Helicopter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Search and Rescue Helicopter Industry?

To stay informed about further developments, trends, and reports in the Search and Rescue Helicopter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence