Key Insights

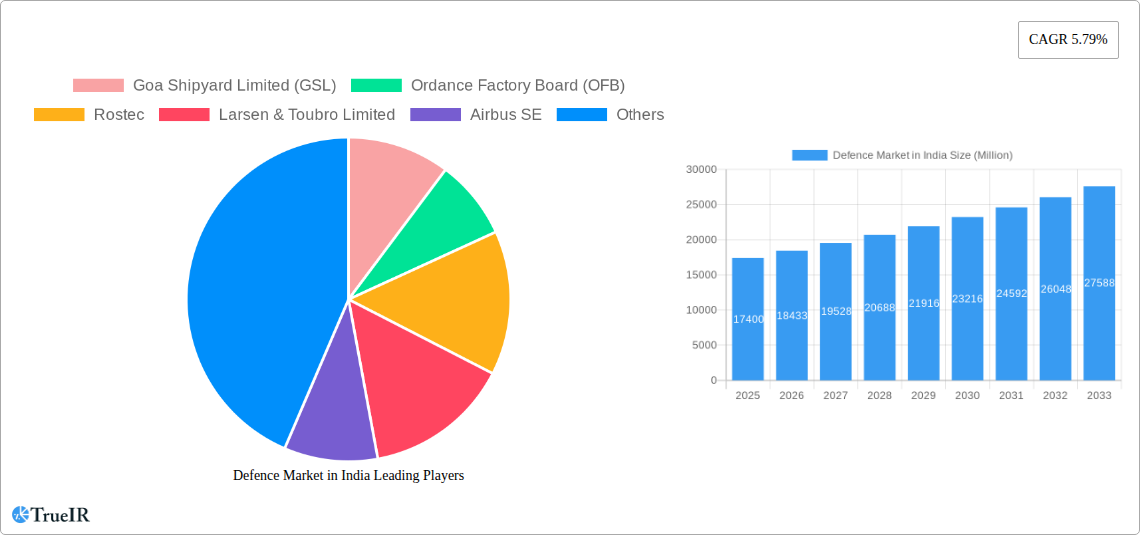

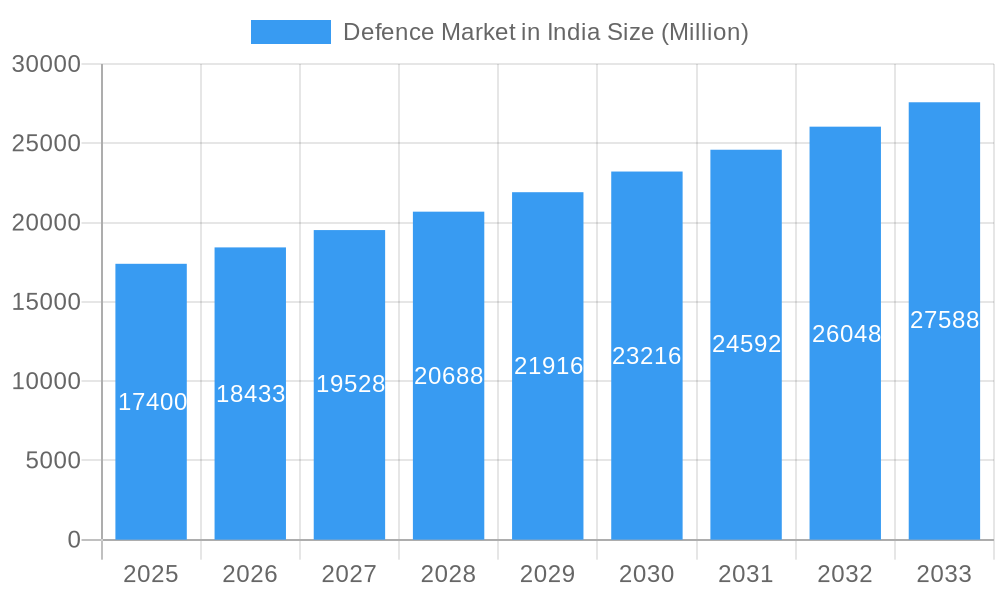

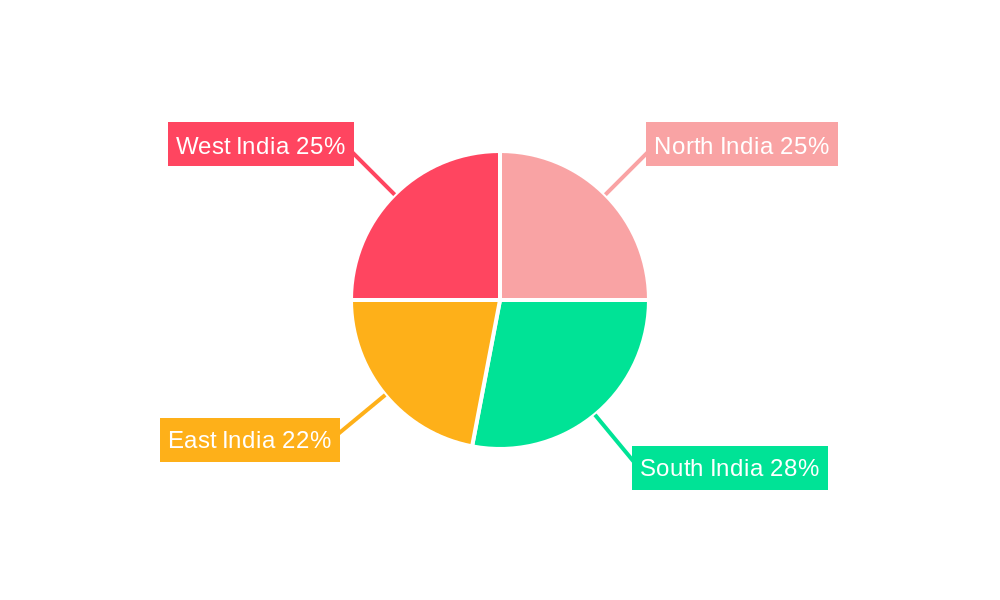

The Indian defense market, valued at $17.4 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.79% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, escalating geopolitical tensions in the region necessitate increased defense spending to modernize and strengthen national security. Secondly, the government's focus on indigenization of defense equipment, through initiatives like "Make in India," is stimulating domestic manufacturing and attracting substantial foreign investment. Thirdly, a growing demand for advanced technologies, including unmanned systems, C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance), and sophisticated weaponry, contributes significantly to market growth. While challenges exist, such as bureaucratic hurdles and the complexities of integrating new technologies, the overall outlook remains positive. The market is segmented by armed forces (Army, Navy, Air Force), equipment type (fixed-wing aircraft, rotorcraft, ground vehicles, naval vessels, C4ISR, weapons & ammunition, protection & training equipment, unmanned systems), and geographical regions (North, South, East, and West India). The presence of numerous domestic players like Hindustan Aeronautics Limited (HAL), Bharat Electronics Limited (BEL), and Ordnance Factory Board (OFB), alongside global giants such as Boeing, Airbus, and Rafael Advanced Defense Systems, indicates a dynamic and competitive landscape. The substantial investments in R&D by organizations like DRDO (Defense Research and Development Organisation) further contribute to the market's future growth trajectory.

Defence Market in India Market Size (In Billion)

The significant players in the Indian defense market actively participate in both domestic and international collaborations, seeking to capitalize on the nation's strategic location and the growing demand for advanced defense solutions. The strategic partnerships and joint ventures are expected to increase significantly, furthering innovation and technology transfer. The competitive landscape is further intensified by the entry of new private sector participants alongside established government-owned entities. The government's continued emphasis on modernization and indigenous development is expected to lead to further market expansion, as the demand for advanced technologies outpaces supply, thereby creating numerous opportunities for domestic and international companies alike. The regional variations in demand are largely influenced by geopolitical considerations and the specific security needs of each region within India.

Defence Market in India Company Market Share

Defence Market in India: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Indian defence market, offering invaluable insights for stakeholders across the industry. With a detailed study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report leverages high-volume keywords to ensure maximum searchability and engagement. The report meticulously analyzes market trends, competitive dynamics, key players, and future growth potential, making it an indispensable resource for informed decision-making.

Defence Market in India Market Structure & Competitive Landscape

The Indian defence market is characterized by a complex interplay of government policies, technological advancements, and intense competition amongst both domestic and international players. While the public sector remains dominant, a gradual increase in private sector participation is observed. The market concentration is moderate, with a few large players holding significant market share, particularly in specific segments. The Herfindahl-Hirschman Index (HHI) for the overall market is estimated at xx in 2025, indicating a moderately concentrated landscape. Innovation drivers include the increasing need for advanced technologies, modernization of armed forces, and indigenization initiatives. Stringent regulatory frameworks, particularly concerning technology transfer and security clearances, significantly impact market dynamics. Substitutes are limited, especially in critical defence systems, though alternative solutions are emerging in some areas like unmanned systems. The end-user segmentation is primarily driven by the three armed forces: Army, Navy, and Air Force, each with unique procurement priorities. M&A activity in the Indian defence sector has been steadily increasing, with xx Million in total deal value recorded between 2019 and 2024. This reflects consolidation amongst players and increased strategic partnerships.

- Market Concentration: Moderate, with HHI estimated at xx in 2025.

- Innovation Drivers: Technological advancements, modernization, indigenization.

- Regulatory Impacts: Stringent regulations on technology transfer and security clearances.

- Product Substitutes: Limited, except in some niche areas.

- End-User Segmentation: Dominated by Army, Navy, and Air Force.

- M&A Trends: Increasing activity, reflecting consolidation and strategic partnerships.

Defence Market in India Market Trends & Opportunities

The Indian defence market is experiencing robust growth, driven by increasing geopolitical tensions, modernization efforts by the armed forces, and a commitment to self-reliance in defence manufacturing. The market size is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by significant investments in new platforms and technologies, notably in areas such as fixed-wing aircraft, unmanned aerial vehicles (UAVs), and advanced weaponry. Technological shifts, particularly in areas like artificial intelligence (AI), big data analytics, and cyber warfare, are shaping market demand. The government's "Make in India" initiative is incentivizing domestic manufacturing, promoting technological self-reliance and attracting private sector participation. The Indian defence market presents significant opportunities for players capable of providing cutting-edge technologies and meeting the stringent requirements of the armed forces. Market penetration rates vary across segments, with higher penetration in certain established segments like weapons and ammunition, and lower rates for emerging areas like unmanned systems. The competitive landscape is becoming increasingly dynamic, with a mix of domestic and international players vying for market share.

Dominant Markets & Segments in Defence Market in India

The Indian defence market is diverse, with varying growth dynamics across segments. While all three armed forces (Army, Navy, and Air Force) contribute significantly, the Army segment currently holds the largest market share. Within product types, Weapons and Ammunition remains a dominant segment due to consistent demand for replenishment and modernization. However, significant growth is projected in segments such as Unmanned Systems and C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) driven by technological advancements and strategic imperatives.

Key Growth Drivers:

- Army: Modernization drive, border infrastructure development.

- Navy: Acquisition of new naval vessels and upgrades of existing fleets.

- Air Force: Upgradation of fighter jets and acquisition of advanced aircraft.

- Weapons & Ammunition: Consistent demand for replenishment and modernization.

- Unmanned Systems: Technological advancements, strategic importance.

- C4ISR: Increasing need for integrated and advanced systems.

Market Dominance: The Army currently holds the largest market share, followed by the Air Force and Navy. Weapons and ammunition represent the largest product segment, followed by Ground Vehicles.

Defence Market in India Product Analysis

The Indian defence market displays a diverse range of products, including fixed-wing aircraft, rotorcraft, ground vehicles, naval vessels, C4ISR systems, weapons and ammunition, protection and training equipment, and unmanned systems. Technological advancements are driving innovation across all segments, with a growing focus on AI, autonomous systems, and cyber security. The competitive advantage lies in the ability to offer cutting-edge technology, cost-effectiveness, and adherence to strict quality standards and security protocols. The market is increasingly demanding indigenous solutions, aligning with the government's 'Make in India' initiative.

Key Drivers, Barriers & Challenges in Defence Market in India

Key Drivers: The primary drivers for growth include the modernization of the armed forces, increasing geopolitical tensions, and the government's focus on indigenous defence manufacturing through initiatives like 'Make in India' and 'Atmanirbhar Bharat'. These factors are creating significant demand for advanced defence technologies and systems. Economic growth and budgetary allocations for defence also significantly contribute.

Challenges: Key challenges include stringent regulatory hurdles, complex procurement procedures, supply chain constraints, and technological dependence on foreign vendors for certain critical components. These issues lead to delays in project implementation and increase costs. Intense competition from both domestic and international players also poses a challenge.

Growth Drivers in the Defence Market in India Market

The Indian defence market's growth is fuelled by several factors: increasing defence budgets, a modernization drive across the three armed forces, the government's push for indigenous defence manufacturing (Make in India), and growing geopolitical concerns. Technological advancements, particularly in areas like AI, cyber warfare, and unmanned systems, further accelerate growth.

Challenges Impacting Defence Market in India Growth

The growth of India's defence market faces several hurdles. Complex bureaucratic processes and lengthy procurement cycles often delay projects. Supply chain disruptions, particularly for imported components, can hamper production. Competition from established global defence players requires domestic companies to enhance their competitiveness and technological capabilities. The need for substantial investment in R&D to maintain technological parity also presents a challenge.

Key Players Shaping the Defence Market in India Market

- Goa Shipyard Limited (GSL)

- Ordnance Factory Board (OFB)

- Rostec

- Larsen & Toubro Limited

- Airbus SE

- Kalyani Group

- The Boeing Company

- Tata Sons Private Limited

- Rafael Advanced Defense Systems Ltd

- Hindustan Aeronautics Limited (HAL)

- Hinduja Group

- Defence Research and Development Organisation (DRDO)

- IAI Group

- Mahindra & Mahindra Ltd

- Reliance Group

- Bharat Electronics Limited (BEL)

Significant Defence Market in India Industry Milestones

- 2020: Launch of several indigenous defence products by DRDO.

- 2021: Significant increase in defence budget allocation.

- 2022: Several strategic partnerships formed between Indian and foreign defence companies.

- 2023: Successful test-firing of indigenous missile systems.

- 2024: Launch of a major indigenously developed fighter aircraft.

Future Outlook for Defence Market in India Market

The Indian defence market is poised for substantial growth in the coming years. Continued modernization of the armed forces, increasing geopolitical tensions, and a strong emphasis on indigenous defence manufacturing will drive this growth. The market presents significant opportunities for both domestic and international players. Strategic partnerships and investments in R&D will be crucial for success in this dynamic and competitive landscape. The focus on advanced technologies like AI, unmanned systems, and cyber security will define future market trends.

Defence Market in India Segmentation

-

1. Armed Forces

- 1.1. Army

- 1.2. Navy

- 1.3. Air Force

-

2. Type

- 2.1. Fixed-wing Aircraft

- 2.2. Rotorcraft

- 2.3. Ground Vehicles

- 2.4. Naval Vessels

- 2.5. C4ISR

- 2.6. Weapons and Ammunition

- 2.7. Protection and Training Equipment

- 2.8. Unmanned Systems

Defence Market in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Defence Market in India Regional Market Share

Geographic Coverage of Defence Market in India

Defence Market in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Air Force Segment is Expected to Hold the Highest Shares in the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Defence Market in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 5.1.1. Army

- 5.1.2. Navy

- 5.1.3. Air Force

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fixed-wing Aircraft

- 5.2.2. Rotorcraft

- 5.2.3. Ground Vehicles

- 5.2.4. Naval Vessels

- 5.2.5. C4ISR

- 5.2.6. Weapons and Ammunition

- 5.2.7. Protection and Training Equipment

- 5.2.8. Unmanned Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6. North America Defence Market in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6.1.1. Army

- 6.1.2. Navy

- 6.1.3. Air Force

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fixed-wing Aircraft

- 6.2.2. Rotorcraft

- 6.2.3. Ground Vehicles

- 6.2.4. Naval Vessels

- 6.2.5. C4ISR

- 6.2.6. Weapons and Ammunition

- 6.2.7. Protection and Training Equipment

- 6.2.8. Unmanned Systems

- 6.1. Market Analysis, Insights and Forecast - by Armed Forces

- 7. South America Defence Market in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Armed Forces

- 7.1.1. Army

- 7.1.2. Navy

- 7.1.3. Air Force

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fixed-wing Aircraft

- 7.2.2. Rotorcraft

- 7.2.3. Ground Vehicles

- 7.2.4. Naval Vessels

- 7.2.5. C4ISR

- 7.2.6. Weapons and Ammunition

- 7.2.7. Protection and Training Equipment

- 7.2.8. Unmanned Systems

- 7.1. Market Analysis, Insights and Forecast - by Armed Forces

- 8. Europe Defence Market in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Armed Forces

- 8.1.1. Army

- 8.1.2. Navy

- 8.1.3. Air Force

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fixed-wing Aircraft

- 8.2.2. Rotorcraft

- 8.2.3. Ground Vehicles

- 8.2.4. Naval Vessels

- 8.2.5. C4ISR

- 8.2.6. Weapons and Ammunition

- 8.2.7. Protection and Training Equipment

- 8.2.8. Unmanned Systems

- 8.1. Market Analysis, Insights and Forecast - by Armed Forces

- 9. Middle East & Africa Defence Market in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Armed Forces

- 9.1.1. Army

- 9.1.2. Navy

- 9.1.3. Air Force

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fixed-wing Aircraft

- 9.2.2. Rotorcraft

- 9.2.3. Ground Vehicles

- 9.2.4. Naval Vessels

- 9.2.5. C4ISR

- 9.2.6. Weapons and Ammunition

- 9.2.7. Protection and Training Equipment

- 9.2.8. Unmanned Systems

- 9.1. Market Analysis, Insights and Forecast - by Armed Forces

- 10. Asia Pacific Defence Market in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Armed Forces

- 10.1.1. Army

- 10.1.2. Navy

- 10.1.3. Air Force

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fixed-wing Aircraft

- 10.2.2. Rotorcraft

- 10.2.3. Ground Vehicles

- 10.2.4. Naval Vessels

- 10.2.5. C4ISR

- 10.2.6. Weapons and Ammunition

- 10.2.7. Protection and Training Equipment

- 10.2.8. Unmanned Systems

- 10.1. Market Analysis, Insights and Forecast - by Armed Forces

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Goa Shipyard Limited (GSL)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ordance Factory Board (OFB)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rostec

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Larsen & Toubro Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kalyani Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Boeing Compan

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tata Sons Private Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rafael Advanced Defense Systems Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hindustan Aeronautics Limited (HAL)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hinduja Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Defense Research and Development Organisation (DRDO)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 IAI Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Mahindra & Mahindra Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Reliance Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Bharat Electronics Limited (BEL)

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Goa Shipyard Limited (GSL)

List of Figures

- Figure 1: Global Defence Market in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Defence Market in India Revenue (Million), by Armed Forces 2025 & 2033

- Figure 3: North America Defence Market in India Revenue Share (%), by Armed Forces 2025 & 2033

- Figure 4: North America Defence Market in India Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Defence Market in India Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Defence Market in India Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Defence Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Defence Market in India Revenue (Million), by Armed Forces 2025 & 2033

- Figure 9: South America Defence Market in India Revenue Share (%), by Armed Forces 2025 & 2033

- Figure 10: South America Defence Market in India Revenue (Million), by Type 2025 & 2033

- Figure 11: South America Defence Market in India Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Defence Market in India Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Defence Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Defence Market in India Revenue (Million), by Armed Forces 2025 & 2033

- Figure 15: Europe Defence Market in India Revenue Share (%), by Armed Forces 2025 & 2033

- Figure 16: Europe Defence Market in India Revenue (Million), by Type 2025 & 2033

- Figure 17: Europe Defence Market in India Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Defence Market in India Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Defence Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Defence Market in India Revenue (Million), by Armed Forces 2025 & 2033

- Figure 21: Middle East & Africa Defence Market in India Revenue Share (%), by Armed Forces 2025 & 2033

- Figure 22: Middle East & Africa Defence Market in India Revenue (Million), by Type 2025 & 2033

- Figure 23: Middle East & Africa Defence Market in India Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Defence Market in India Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Defence Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Defence Market in India Revenue (Million), by Armed Forces 2025 & 2033

- Figure 27: Asia Pacific Defence Market in India Revenue Share (%), by Armed Forces 2025 & 2033

- Figure 28: Asia Pacific Defence Market in India Revenue (Million), by Type 2025 & 2033

- Figure 29: Asia Pacific Defence Market in India Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Defence Market in India Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Defence Market in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2020 & 2033

- Table 2: Global Defence Market in India Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Defence Market in India Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2020 & 2033

- Table 5: Global Defence Market in India Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Defence Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2020 & 2033

- Table 11: Global Defence Market in India Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Defence Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2020 & 2033

- Table 17: Global Defence Market in India Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Defence Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2020 & 2033

- Table 29: Global Defence Market in India Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Defence Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2020 & 2033

- Table 38: Global Defence Market in India Revenue Million Forecast, by Type 2020 & 2033

- Table 39: Global Defence Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Defence Market in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Defence Market in India?

The projected CAGR is approximately 5.79%.

2. Which companies are prominent players in the Defence Market in India?

Key companies in the market include Goa Shipyard Limited (GSL), Ordance Factory Board (OFB), Rostec, Larsen & Toubro Limited, Airbus SE, Kalyani Group, The Boeing Compan, Tata Sons Private Limited, Rafael Advanced Defense Systems Ltd, Hindustan Aeronautics Limited (HAL), Hinduja Group, Defense Research and Development Organisation (DRDO), IAI Group, Mahindra & Mahindra Ltd, Reliance Group, Bharat Electronics Limited (BEL).

3. What are the main segments of the Defence Market in India?

The market segments include Armed Forces, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.40 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Air Force Segment is Expected to Hold the Highest Shares in the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Defence Market in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Defence Market in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Defence Market in India?

To stay informed about further developments, trends, and reports in the Defence Market in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence