Key Insights

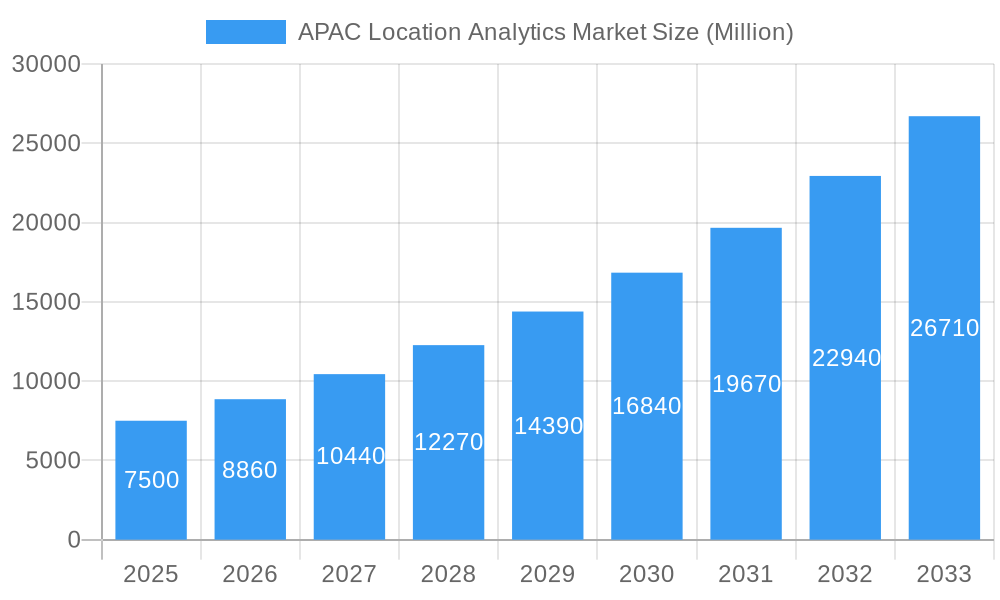

The APAC Location Analytics Market is projected for significant expansion, forecasting a rise from an estimated USD 25.92 billion in 2025 to reach USD 14.52 billion by 2033, at a robust Compound Annual Growth Rate (CAGR) of 14.52%. This growth is propelled by escalating adoption of location-based services and data analytics across industries. Key drivers include the demand for enhanced customer engagement, operational efficiency, and data-driven decision-making. Industries like retail, banking, finance, manufacturing, transportation, logistics, and healthcare are leveraging location analytics for diverse applications, from optimizing store placement and fraud detection to supply chain visibility and patient tracking.

APAC Location Analytics Market Market Size (In Billion)

Key trends influencing the APAC Location Analytics Market include the integration of AI and machine learning for advanced predictive analytics, and the increasing availability of high-resolution geospatial data and IoT devices. While data integration complexities and the need for skilled professionals present challenges, widespread digitalization and technological innovation are expected to drive sustained market expansion. The on-demand deployment model is gaining traction for its flexibility. China and India are anticipated to be major growth engines due to their large populations and dynamic digital economies.

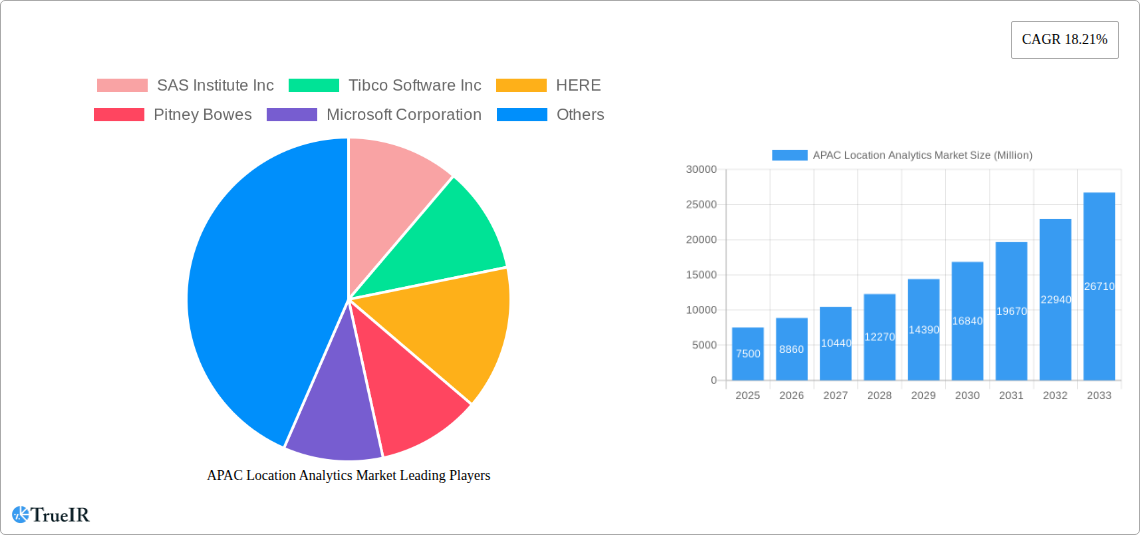

APAC Location Analytics Market Company Market Share

This comprehensive report provides an SEO-optimized analysis of the APAC Location Analytics Market, covering 2019-2033 with a base year of 2025. It examines market structure, trends, dominant segments, product analysis, key drivers, barriers, and future outlook, utilizing high-volume keywords for industry professionals.

APAC Location Analytics Market Market Structure & Competitive Landscape

The APAC Location Analytics Market is characterized by a moderately concentrated landscape, with key players like SAS Institute Inc, Tibco Software Inc, HERE, Pitney Bowes, Microsoft Corporation, Galigeo, ESRI (Environmental Systems Research Institute), Oracle Corporation, Cisco Systems, and SAP SE driving innovation and market share. Innovation is predominantly fueled by advancements in AI, IoT, and big data analytics, enabling sophisticated location-based insights. Regulatory impacts, while varying across countries, are increasingly focused on data privacy and security, influencing deployment strategies. Product substitutes, such as manual data analysis and generic GIS tools, are being rapidly superseded by advanced location intelligence platforms. End-user segmentation spans Retail, Banking, Manufacturing, Transportation, Healthcare, Government, Energy and Power, and Other Verticals, each with unique demands. Mergers and acquisitions (M&A) are a notable trend, with an estimated 15-20 M&A activities recorded between 2021 and 2024, consolidating market power and expanding service offerings. Concentration ratios for the top 5 players are estimated to be around 55-60%, indicating significant market influence.

- Key Market Dynamics:

- Increasing adoption of cloud-based solutions.

- Growing demand for real-time analytics.

- Focus on hyper-personalization and customer experience.

- Integration of location analytics with other business intelligence tools.

APAC Location Analytics Market Market Trends & Opportunities

The APAC Location Analytics Market is experiencing robust growth, projected to reach an estimated market size of $15 Billion by 2025, expanding to $28 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025–2033). This expansion is driven by the escalating need for data-driven decision-making across various industries in the region. Technological shifts are central to this growth, with the proliferation of IoT devices generating vast amounts of location-specific data, which is then processed and analyzed to derive actionable insights. Artificial intelligence and machine learning algorithms are increasingly integrated to enhance predictive capabilities and uncover complex spatial patterns. Consumer preferences are evolving towards personalized experiences, prompting businesses to leverage location analytics for targeted marketing, optimized service delivery, and improved customer engagement. For instance, retail businesses are using foot traffic analysis to optimize store layouts and promotional campaigns, while transportation companies are employing real-time tracking and route optimization to enhance efficiency and customer satisfaction. The competitive landscape is dynamic, with established players innovating and new entrants focusing on niche applications and specialized solutions. The market penetration rate for advanced location analytics solutions is estimated to be around 30% in developed APAC economies, with significant room for growth in emerging markets. The increasing adoption of 5G technology is also a significant trend, enabling faster data transmission and real-time processing, thereby unlocking new opportunities for location-based services and applications. The rise of smart cities initiatives across the APAC region further fuels the demand for sophisticated location analytics to manage urban infrastructure, optimize resource allocation, and improve public services. Opportunities abound in areas such as predictive maintenance for industrial assets, personalized healthcare delivery based on patient location, and dynamic resource management in the energy sector.

Dominant Markets & Segments in APAC Location Analytics Market

China currently stands as the dominant market within the APAC Location Analytics domain, accounting for an estimated 35% of the total market revenue. This dominance is attributed to its vast population, rapid urbanization, burgeoning e-commerce sector, and significant government investment in smart city infrastructure and digital transformation initiatives. India follows closely, driven by its large and growing economy, increasing digital adoption, and a rapidly expanding manufacturing and retail sector. Japan and Australia also represent significant markets, characterized by high technological adoption rates and mature industry verticals.

Dominant Location Segments:

- Outdoor Location Analytics: Currently holds the largest market share, estimated at 65%, driven by applications in transportation and logistics, smart city management, environmental monitoring, and asset tracking in open environments. The widespread use of GPS and mobile devices facilitates extensive data collection.

- Indoor Location Analytics: Experiencing a higher CAGR, projected at 9.2%, due to its growing importance in retail for understanding customer behavior, in manufacturing for optimizing factory floor operations, and in healthcare for patient tracking and asset management within facilities. Technologies like Wi-Fi triangulation, Bluetooth beacons, and UWB are key enablers.

Dominant Deployment Models:

- On-demand (Cloud): Dominates the market with an estimated 70% share, owing to its scalability, cost-effectiveness, and ease of deployment. Businesses are increasingly migrating their analytics workloads to the cloud to leverage its flexibility and reduce upfront infrastructure costs.

- On-premise: Holds a significant but declining share, primarily adopted by organizations with stringent data security requirements or existing robust on-premise infrastructure.

Dominant Verticals:

- Retail: Leads in adoption due to its direct impact on sales, customer experience, and inventory management. Location analytics helps in optimizing store placement, understanding foot traffic, and personalizing marketing.

- Transportation: A major consumer of location analytics for route optimization, fleet management, supply chain visibility, and intelligent traffic management systems.

- Manufacturing: Utilizes location analytics for asset tracking, supply chain optimization, and improving operational efficiency within factories.

- Government: Leverages location analytics for urban planning, public safety, disaster management, and resource allocation.

APAC Location Analytics Market Product Analysis

The APAC Location Analytics market is witnessing a surge in product innovations focused on real-time data processing, advanced spatial analytics, and AI-driven insights. Solutions are increasingly offering capabilities like predictive modeling for customer churn, dynamic route optimization for logistics, and hyper-local marketing campaigns. Competitive advantages are being built around ease of integration with existing enterprise systems, robust data visualization tools, and specialized functionalities catering to specific industry needs, such as precision agriculture or smart building management. The focus is on developing platforms that can handle massive datasets from diverse sources like IoT devices, mobile phones, and satellite imagery, providing actionable intelligence for businesses aiming to enhance operational efficiency and customer engagement.

Key Drivers, Barriers & Challenges in APAC Location Analytics Market

Key Drivers:

- Technological Advancements: The proliferation of IoT devices, 5G networks, and AI/ML is significantly boosting the demand for sophisticated location analytics.

- Big Data Growth: The exponential increase in location-based data from various sources necessitates advanced analytics to extract value.

- Digital Transformation Initiatives: Governments and enterprises across APAC are investing heavily in digital transformation, with location analytics playing a crucial role in smart city development, e-commerce optimization, and supply chain efficiency.

- Demand for Enhanced Customer Experience: Businesses are leveraging location insights to personalize offerings and improve customer interactions.

Barriers & Challenges:

- Data Privacy and Security Concerns: Stringent regulations and public apprehension regarding data privacy can hinder widespread adoption and data utilization.

- Skill Gap: A shortage of skilled professionals in data science and geospatial analytics can limit the effective implementation and utilization of location analytics solutions.

- Integration Complexity: Integrating new location analytics platforms with legacy IT systems can be a complex and costly process for many organizations.

- High Implementation Costs: While cloud solutions offer cost-effectiveness, the initial investment for comprehensive location analytics systems can still be a barrier for small and medium-sized enterprises.

Growth Drivers in the APAC Location Analytics Market Market

The APAC Location Analytics market is propelled by several critical growth drivers. Technologically, the widespread adoption of smartphones and IoT devices generates an unprecedented volume of location data, fueling the need for analytics. The rapid rollout of 5G networks enhances real-time data processing capabilities, opening new avenues for location-based services. Economically, the booming e-commerce sector and the ongoing digital transformation across industries necessitate precise location insights for logistics, customer targeting, and operational efficiency. Government initiatives promoting smart cities and digital infrastructure development further stimulate market growth. Regulatory frameworks, while sometimes posing challenges, are also evolving to support data-driven innovation, indirectly contributing to market expansion by establishing clearer guidelines for data usage.

Challenges Impacting APAC Location Analytics Market Growth

Despite its robust growth, the APAC Location Analytics market faces significant challenges. Regulatory complexities surrounding data privacy and cross-border data transfer in various APAC countries create hurdles for universal application and data integration. Supply chain issues, particularly in hardware components for IoT devices and sensors, can impact the timely deployment of location-aware infrastructure. Fierce competitive pressures from both established global players and emerging local providers necessitate continuous innovation and competitive pricing strategies. Furthermore, a persistent talent shortage in data science and geospatial analytics expertise can impede the effective utilization of advanced location intelligence tools by businesses.

Key Players Shaping the APAC Location Analytics Market Market

- SAS Institute Inc

- Tibco Software Inc

- HERE

- Pitney Bowes

- Microsoft Corporation

- Galigeo

- ESRI (Environmental Systems Research Institute)

- Oracle Corporation

- Cisco Systems

- SAP SE

Significant APAC Location Analytics Market Industry Milestones

- September 2022: HERE Technologies launched HERE SDK Navigate in Japan, offering businesses enhanced map experiences and location features for mobile applications, including advanced routing and geocoding, benefiting global and local businesses.

- October 2022: Innoviz Technology partnered with Kudan for 3D digital mapping solutions leveraging SLAM technology. This collaboration aims to generate 3D maps for autonomous mobility, robotics, geospatial mapping, and surveying across the Asia Pacific region, utilizing Innoviz LiDARs.

Future Outlook for APAC Location Analytics Market Market

The future outlook for the APAC Location Analytics Market is exceptionally promising. Continued advancements in AI, IoT, and 5G will unlock novel applications and deepen the insights derived from location data. Strategic opportunities lie in the burgeoning smart city initiatives, the growth of autonomous vehicles, and the increasing demand for hyper-personalized consumer experiences. The market is poised for sustained expansion as businesses across diverse verticals recognize the indispensable role of location intelligence in optimizing operations, enhancing customer engagement, and driving competitive advantage in the dynamic APAC landscape. The predicted market size growth indicates a significant upward trajectory for this vital segment of the technology market.

APAC Location Analytics Market Segmentation

-

1. Location

- 1.1. Indoor

- 1.2. Outdoor

-

2. Deployment Model

- 2.1. On-premise

- 2.2. On-demand

-

3. Verticals

- 3.1. Retail

- 3.2. Banking

- 3.3. Manufacturing

- 3.4. Transportation

- 3.5. Healthcare

- 3.6. Government

- 3.7. Energy and Power

- 3.8. Other Verticals

-

4. Countries

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. Australia

- 4.5. Other Countries

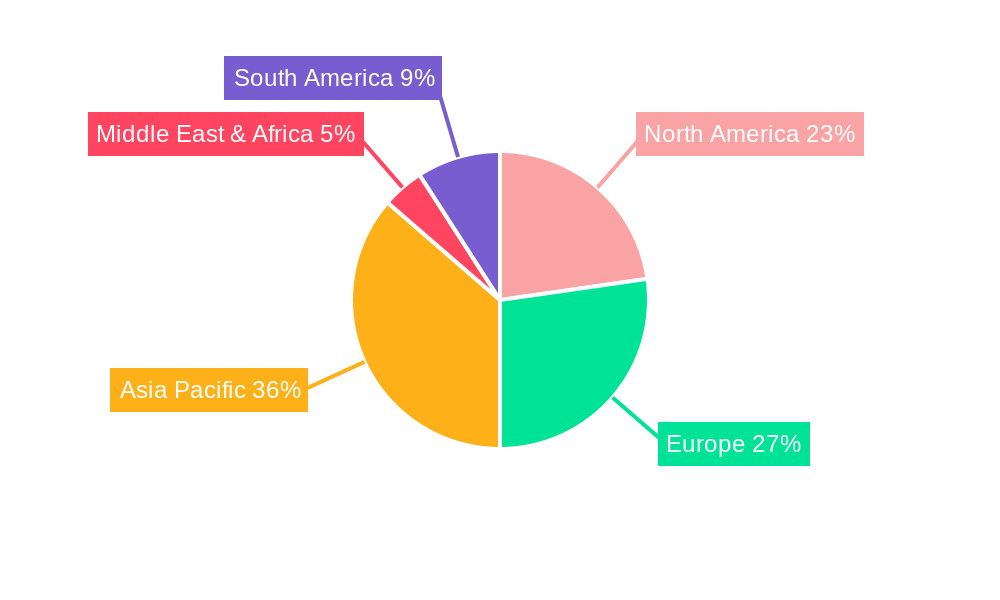

APAC Location Analytics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Location Analytics Market Regional Market Share

Geographic Coverage of APAC Location Analytics Market

APAC Location Analytics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Retail Market; Increasing adoption of analytical business intelligence and geographic information systems technology; Increasing Usage of Internet of Things

- 3.3. Market Restrains

- 3.3.1 Concerns about security and privacy; Systems are error prone In cases like incomplete business information

- 3.3.2 out-of-date information and limitation of place databases

- 3.4. Market Trends

- 3.4.1. In-vehicle connectivity is driving growth in the Automotive sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Location Analytics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Indoor

- 5.1.2. Outdoor

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. On-premise

- 5.2.2. On-demand

- 5.3. Market Analysis, Insights and Forecast - by Verticals

- 5.3.1. Retail

- 5.3.2. Banking

- 5.3.3. Manufacturing

- 5.3.4. Transportation

- 5.3.5. Healthcare

- 5.3.6. Government

- 5.3.7. Energy and Power

- 5.3.8. Other Verticals

- 5.4. Market Analysis, Insights and Forecast - by Countries

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Other Countries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. North America APAC Location Analytics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location

- 6.1.1. Indoor

- 6.1.2. Outdoor

- 6.2. Market Analysis, Insights and Forecast - by Deployment Model

- 6.2.1. On-premise

- 6.2.2. On-demand

- 6.3. Market Analysis, Insights and Forecast - by Verticals

- 6.3.1. Retail

- 6.3.2. Banking

- 6.3.3. Manufacturing

- 6.3.4. Transportation

- 6.3.5. Healthcare

- 6.3.6. Government

- 6.3.7. Energy and Power

- 6.3.8. Other Verticals

- 6.4. Market Analysis, Insights and Forecast - by Countries

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. Australia

- 6.4.5. Other Countries

- 6.1. Market Analysis, Insights and Forecast - by Location

- 7. South America APAC Location Analytics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location

- 7.1.1. Indoor

- 7.1.2. Outdoor

- 7.2. Market Analysis, Insights and Forecast - by Deployment Model

- 7.2.1. On-premise

- 7.2.2. On-demand

- 7.3. Market Analysis, Insights and Forecast - by Verticals

- 7.3.1. Retail

- 7.3.2. Banking

- 7.3.3. Manufacturing

- 7.3.4. Transportation

- 7.3.5. Healthcare

- 7.3.6. Government

- 7.3.7. Energy and Power

- 7.3.8. Other Verticals

- 7.4. Market Analysis, Insights and Forecast - by Countries

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. Australia

- 7.4.5. Other Countries

- 7.1. Market Analysis, Insights and Forecast - by Location

- 8. Europe APAC Location Analytics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location

- 8.1.1. Indoor

- 8.1.2. Outdoor

- 8.2. Market Analysis, Insights and Forecast - by Deployment Model

- 8.2.1. On-premise

- 8.2.2. On-demand

- 8.3. Market Analysis, Insights and Forecast - by Verticals

- 8.3.1. Retail

- 8.3.2. Banking

- 8.3.3. Manufacturing

- 8.3.4. Transportation

- 8.3.5. Healthcare

- 8.3.6. Government

- 8.3.7. Energy and Power

- 8.3.8. Other Verticals

- 8.4. Market Analysis, Insights and Forecast - by Countries

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Australia

- 8.4.5. Other Countries

- 8.1. Market Analysis, Insights and Forecast - by Location

- 9. Middle East & Africa APAC Location Analytics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location

- 9.1.1. Indoor

- 9.1.2. Outdoor

- 9.2. Market Analysis, Insights and Forecast - by Deployment Model

- 9.2.1. On-premise

- 9.2.2. On-demand

- 9.3. Market Analysis, Insights and Forecast - by Verticals

- 9.3.1. Retail

- 9.3.2. Banking

- 9.3.3. Manufacturing

- 9.3.4. Transportation

- 9.3.5. Healthcare

- 9.3.6. Government

- 9.3.7. Energy and Power

- 9.3.8. Other Verticals

- 9.4. Market Analysis, Insights and Forecast - by Countries

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. Australia

- 9.4.5. Other Countries

- 9.1. Market Analysis, Insights and Forecast - by Location

- 10. Asia Pacific APAC Location Analytics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location

- 10.1.1. Indoor

- 10.1.2. Outdoor

- 10.2. Market Analysis, Insights and Forecast - by Deployment Model

- 10.2.1. On-premise

- 10.2.2. On-demand

- 10.3. Market Analysis, Insights and Forecast - by Verticals

- 10.3.1. Retail

- 10.3.2. Banking

- 10.3.3. Manufacturing

- 10.3.4. Transportation

- 10.3.5. Healthcare

- 10.3.6. Government

- 10.3.7. Energy and Power

- 10.3.8. Other Verticals

- 10.4. Market Analysis, Insights and Forecast - by Countries

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Japan

- 10.4.4. Australia

- 10.4.5. Other Countries

- 10.1. Market Analysis, Insights and Forecast - by Location

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SAS Institute Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tibco Software Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HERE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pitney Bowes

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Microsoft Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Galigeo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ESRI (Environmental Systems Research Institute)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oracle Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cisco Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SAP SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global APAC Location Analytics Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America APAC Location Analytics Market Revenue (billion), by Location 2025 & 2033

- Figure 3: North America APAC Location Analytics Market Revenue Share (%), by Location 2025 & 2033

- Figure 4: North America APAC Location Analytics Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 5: North America APAC Location Analytics Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 6: North America APAC Location Analytics Market Revenue (billion), by Verticals 2025 & 2033

- Figure 7: North America APAC Location Analytics Market Revenue Share (%), by Verticals 2025 & 2033

- Figure 8: North America APAC Location Analytics Market Revenue (billion), by Countries 2025 & 2033

- Figure 9: North America APAC Location Analytics Market Revenue Share (%), by Countries 2025 & 2033

- Figure 10: North America APAC Location Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America APAC Location Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America APAC Location Analytics Market Revenue (billion), by Location 2025 & 2033

- Figure 13: South America APAC Location Analytics Market Revenue Share (%), by Location 2025 & 2033

- Figure 14: South America APAC Location Analytics Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 15: South America APAC Location Analytics Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 16: South America APAC Location Analytics Market Revenue (billion), by Verticals 2025 & 2033

- Figure 17: South America APAC Location Analytics Market Revenue Share (%), by Verticals 2025 & 2033

- Figure 18: South America APAC Location Analytics Market Revenue (billion), by Countries 2025 & 2033

- Figure 19: South America APAC Location Analytics Market Revenue Share (%), by Countries 2025 & 2033

- Figure 20: South America APAC Location Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 21: South America APAC Location Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe APAC Location Analytics Market Revenue (billion), by Location 2025 & 2033

- Figure 23: Europe APAC Location Analytics Market Revenue Share (%), by Location 2025 & 2033

- Figure 24: Europe APAC Location Analytics Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 25: Europe APAC Location Analytics Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 26: Europe APAC Location Analytics Market Revenue (billion), by Verticals 2025 & 2033

- Figure 27: Europe APAC Location Analytics Market Revenue Share (%), by Verticals 2025 & 2033

- Figure 28: Europe APAC Location Analytics Market Revenue (billion), by Countries 2025 & 2033

- Figure 29: Europe APAC Location Analytics Market Revenue Share (%), by Countries 2025 & 2033

- Figure 30: Europe APAC Location Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe APAC Location Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa APAC Location Analytics Market Revenue (billion), by Location 2025 & 2033

- Figure 33: Middle East & Africa APAC Location Analytics Market Revenue Share (%), by Location 2025 & 2033

- Figure 34: Middle East & Africa APAC Location Analytics Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 35: Middle East & Africa APAC Location Analytics Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 36: Middle East & Africa APAC Location Analytics Market Revenue (billion), by Verticals 2025 & 2033

- Figure 37: Middle East & Africa APAC Location Analytics Market Revenue Share (%), by Verticals 2025 & 2033

- Figure 38: Middle East & Africa APAC Location Analytics Market Revenue (billion), by Countries 2025 & 2033

- Figure 39: Middle East & Africa APAC Location Analytics Market Revenue Share (%), by Countries 2025 & 2033

- Figure 40: Middle East & Africa APAC Location Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa APAC Location Analytics Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific APAC Location Analytics Market Revenue (billion), by Location 2025 & 2033

- Figure 43: Asia Pacific APAC Location Analytics Market Revenue Share (%), by Location 2025 & 2033

- Figure 44: Asia Pacific APAC Location Analytics Market Revenue (billion), by Deployment Model 2025 & 2033

- Figure 45: Asia Pacific APAC Location Analytics Market Revenue Share (%), by Deployment Model 2025 & 2033

- Figure 46: Asia Pacific APAC Location Analytics Market Revenue (billion), by Verticals 2025 & 2033

- Figure 47: Asia Pacific APAC Location Analytics Market Revenue Share (%), by Verticals 2025 & 2033

- Figure 48: Asia Pacific APAC Location Analytics Market Revenue (billion), by Countries 2025 & 2033

- Figure 49: Asia Pacific APAC Location Analytics Market Revenue Share (%), by Countries 2025 & 2033

- Figure 50: Asia Pacific APAC Location Analytics Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific APAC Location Analytics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Location Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 2: Global APAC Location Analytics Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 3: Global APAC Location Analytics Market Revenue billion Forecast, by Verticals 2020 & 2033

- Table 4: Global APAC Location Analytics Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 5: Global APAC Location Analytics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global APAC Location Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 7: Global APAC Location Analytics Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 8: Global APAC Location Analytics Market Revenue billion Forecast, by Verticals 2020 & 2033

- Table 9: Global APAC Location Analytics Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 10: Global APAC Location Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global APAC Location Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 15: Global APAC Location Analytics Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 16: Global APAC Location Analytics Market Revenue billion Forecast, by Verticals 2020 & 2033

- Table 17: Global APAC Location Analytics Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 18: Global APAC Location Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global APAC Location Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 23: Global APAC Location Analytics Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 24: Global APAC Location Analytics Market Revenue billion Forecast, by Verticals 2020 & 2033

- Table 25: Global APAC Location Analytics Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 26: Global APAC Location Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global APAC Location Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 37: Global APAC Location Analytics Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 38: Global APAC Location Analytics Market Revenue billion Forecast, by Verticals 2020 & 2033

- Table 39: Global APAC Location Analytics Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 40: Global APAC Location Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global APAC Location Analytics Market Revenue billion Forecast, by Location 2020 & 2033

- Table 48: Global APAC Location Analytics Market Revenue billion Forecast, by Deployment Model 2020 & 2033

- Table 49: Global APAC Location Analytics Market Revenue billion Forecast, by Verticals 2020 & 2033

- Table 50: Global APAC Location Analytics Market Revenue billion Forecast, by Countries 2020 & 2033

- Table 51: Global APAC Location Analytics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific APAC Location Analytics Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Location Analytics Market?

The projected CAGR is approximately 14.52%.

2. Which companies are prominent players in the APAC Location Analytics Market?

Key companies in the market include SAS Institute Inc, Tibco Software Inc, HERE, Pitney Bowes, Microsoft Corporation, Galigeo, ESRI (Environmental Systems Research Institute), Oracle Corporation, Cisco Systems, SAP SE.

3. What are the main segments of the APAC Location Analytics Market?

The market segments include Location, Deployment Model, Verticals, Countries.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Retail Market; Increasing adoption of analytical business intelligence and geographic information systems technology; Increasing Usage of Internet of Things.

6. What are the notable trends driving market growth?

In-vehicle connectivity is driving growth in the Automotive sector.

7. Are there any restraints impacting market growth?

Concerns about security and privacy; Systems are error prone In cases like incomplete business information. out-of-date information and limitation of place databases.

8. Can you provide examples of recent developments in the market?

September 2022: HERE Technologies launched HERE SDK Navigate (Software Development Kit) in Japan. That provides businesses access to a smooth map experience and a rich portfolio of location features, such as multiple map view instances, 3D camera control, and an integrated toolchain for map customization, including car and truck turn-by-turn (TBT) navigation, advanced routing, geocoding, and search, that will benefit global and local businesses to improve their mobile application user experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Location Analytics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Location Analytics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Location Analytics Market?

To stay informed about further developments, trends, and reports in the APAC Location Analytics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence