Key Insights

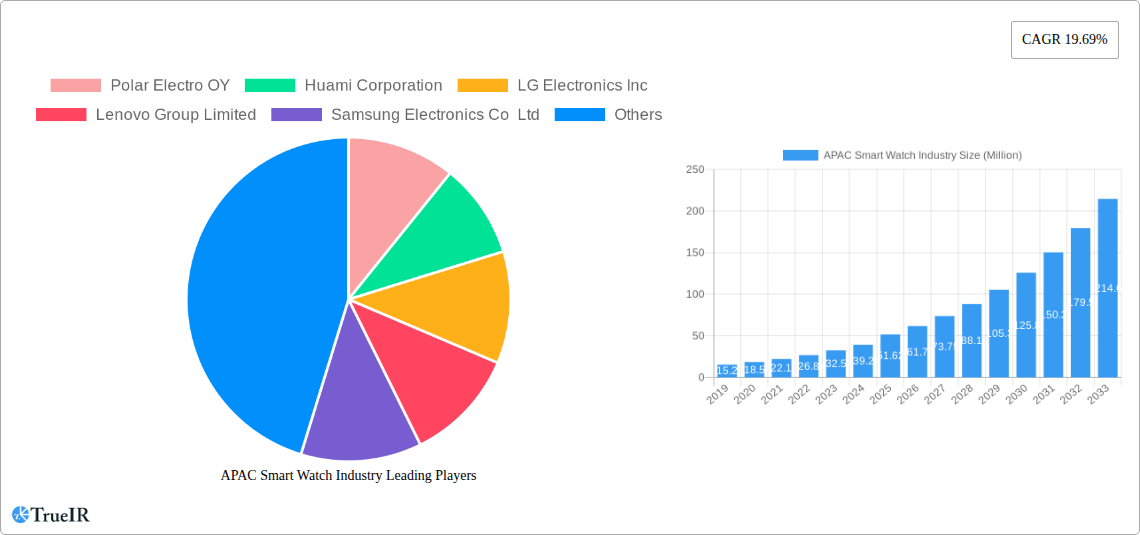

The APAC Smartwatch Industry is poised for explosive growth, projected to reach a significant market size of USD 51.62 billion by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 19.69% from 2025 to 2033. This rapid expansion is primarily fueled by the burgeoning demand for advanced wearable technology, driven by increasing consumer awareness of health and fitness tracking capabilities, the proliferation of smart devices, and the growing disposable incomes across key Asian markets. The region's tech-savvy population, coupled with a strong emphasis on preventive healthcare and an active lifestyle, acts as a powerful catalyst for smartwatch adoption. Furthermore, the increasing integration of smartwatches with personal assistance features, seamless connectivity options, and innovative medical monitoring functionalities is expanding their appeal beyond basic timekeeping and fitness tracking, making them indispensable personal devices.

APAC Smart Watch Industry Market Size (In Million)

The market's robust trajectory is further bolstered by significant trends such as the miniaturization of technology, enhanced battery life, and the development of sophisticated sensors for more accurate health metrics like ECG, blood oxygen levels, and stress monitoring. This is particularly evident in the strong adoption of AMOLED and PMOLED display types, offering superior visual experiences. While the market is dominated by major players like Apple, Samsung, Huawei, and Xiaomi, intense competition is driving innovation and leading to more feature-rich and competitively priced devices. The dominant segments within the APAC smartwatch market include applications for personal assistance and medical use, underscoring the shift towards smartwatches as comprehensive wellness companions. However, challenges such as concerns over data privacy and security, alongside the premium pricing of some high-end models, could present moderate headwinds, although the overall growth outlook remains exceptionally strong.

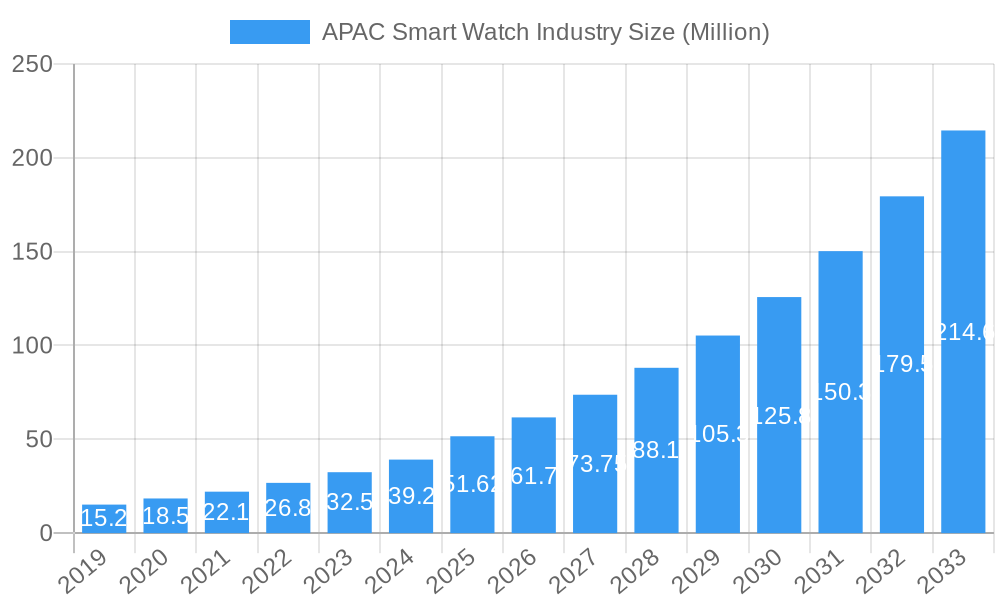

APAC Smart Watch Industry Company Market Share

Gain unparalleled insights into the dynamic APAC Smartwatch industry with this comprehensive report. Covering the forecast period from 2025 to 2033, with a base year of 2025 and historical data from 2019-2024, this analysis dives deep into market size, trends, opportunities, and competitive strategies. Leverage high-volume keywords like "APAC smartwatch market," "wearable technology Asia," "smartwatch market growth," "smartwatch applications," and "smartwatch manufacturers Asia" to enhance your understanding and strategic decision-making. This report is essential for stakeholders seeking to capitalize on the burgeoning demand for advanced wearable devices across the Asia-Pacific region.

APAC Smart Watch Industry Market Structure & Competitive Landscape

The APAC smartwatch market is characterized by a moderately concentrated structure, driven by rapid technological innovation and intense competition among a mix of global tech giants and agile local players. The APAC smartwatch market value is projected to reach several Million by 2025, with significant growth anticipated. Key innovation drivers include advancements in sensor technology, battery efficiency, AI integration for personalized health insights, and seamless ecosystem connectivity. Regulatory impacts are generally supportive, fostering innovation, though data privacy concerns and evolving e-commerce regulations present ongoing considerations. Product substitutes, such as advanced fitness trackers and smartphones with limited wearable functionalities, exist but are increasingly differentiated by the comprehensive features and integrated experiences offered by smartwatches. End-user segmentation is diverse, spanning health-conscious individuals, fitness enthusiasts, tech-savvy consumers, and enterprise users. Mergers and acquisitions (M&A) trends in the APAC smartwatch sector are expected to accelerate as larger companies seek to acquire niche technologies or expand their market reach. Approximately 10-15% of market players are involved in M&A activities annually, aiming to consolidate market share and drive synergistic growth. This dynamic landscape necessitates a deep understanding of competitive advantages, from superior user experience to specialized application offerings.

APAC Smart Watch Industry Market Trends & Opportunities

The APAC smartwatch market is on an unprecedented growth trajectory, poised for a significant expansion driven by a confluence of technological advancements, evolving consumer preferences, and increasing disposable incomes. The global smartwatch market continues to be a dominant force, with APAC emerging as a pivotal region for growth. By 2025, the market is anticipated to surpass XX Million in value, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This robust growth is fueled by a shift in consumer perception, with smartwatches evolving from mere gadgets to essential lifestyle companions that offer advanced health monitoring, personal assistance, and seamless connectivity. The smartwatch market size in APAC is expanding rapidly, driven by increasing smartphone penetration and the desire for integrated digital experiences.

Technological shifts are central to this expansion. The adoption of next-generation display technologies like AMOLED and PMOLED is enhancing user experience through vibrant visuals and improved battery life. Furthermore, the integration of sophisticated sensors for health tracking, including ECG, blood oxygen, and stress monitoring, is transforming smartwatches into indispensable personal health devices. This trend is particularly evident in the medical smartwatch application segment, where devices are increasingly being used for remote patient monitoring and early disease detection.

Consumer preferences are also evolving. There's a growing demand for smartwatches that offer personalized insights and proactive health management. Features like sleep tracking, activity monitoring, and guided wellness programs are becoming standard expectations. The smartwatch market trends indicate a strong preference for devices that seamlessly integrate with existing digital ecosystems, offering convenience and enhanced productivity.

The competitive dynamics are characterized by fierce innovation and strategic product launches. Companies are investing heavily in research and development to introduce devices with longer battery life, enhanced durability, and advanced functionalities. The APAC wearable technology market is witnessing a surge in demand for smartwatches that cater to niche segments, such as advanced sports tracking for professional athletes or specialized medical monitoring for chronic conditions.

Opportunities abound in this dynamic market. The burgeoning middle class in countries like India and Southeast Asian nations represents a significant untapped market. The development of affordable yet feature-rich smartwatches can unlock substantial growth potential. Furthermore, partnerships between smartwatch manufacturers and healthcare providers or insurance companies can create innovative service offerings, further driving market penetration. The increasing focus on personalized wellness and preventative healthcare positions smartwatches as key enablers of a healthier future for millions across the APAC region. The smartwatch market forecast for APAC remains exceptionally optimistic, pointing towards sustained innovation and market expansion.

Dominant Markets & Segments in APAC Smart Watch Industry

The APAC smartwatch industry's dominance is fragmented across several key regions and segments, each exhibiting unique growth drivers and market penetration rates. Leading the charge is the China smartwatch market, driven by its massive consumer base, rapid adoption of new technologies, and a strong presence of domestic manufacturers like Xiaomi and Huawei. Following closely are South Korea and Japan, markets known for their early adoption of advanced electronics and a high demand for premium, feature-rich devices. Emerging markets such as India and select Southeast Asian nations present significant growth opportunities due to increasing disposable incomes and a rising awareness of health and wellness.

Within the smartwatch operating systems segment, Android/Wear OS commands a substantial share, owing to its open-source nature and broad compatibility with a vast array of smartphones. However, Apple's Watch OS maintains a strong hold in the premium segment, particularly in markets with high Apple device penetration. The "Other Operating Systems" category, though smaller, is crucial as it encompasses proprietary operating systems developed by manufacturers like Huawei and Fitbit, often tailored for specific device ecosystems and user experiences. The growth of these proprietary systems is often tied to the brand's overall device strategy and its ability to create a compelling user experience within its own ecosystem.

In terms of smartwatch display types, AMOLED technology is increasingly dominating the market. Its superior color reproduction, deeper blacks, and energy efficiency contribute to a better user experience, driving its adoption in mid-range to high-end smartwatches. While PMOLED offers cost-effectiveness for simpler displays, and TFT LCD remains a viable option for entry-level devices, AMOLED’s advanced capabilities are aligning with the evolving consumer expectations for visually appealing and power-efficient wearables. The smartwatch display market is thus witnessing a clear trend towards AMOLED integration.

The smartwatch application landscape is a crucial determinant of market dominance. The "Personal Assistance" segment, encompassing notifications, voice commands, and mobile payments, remains a primary driver of adoption. However, the "Medical" application segment is experiencing exponential growth, fueled by rising health consciousness and advancements in sensor technology for monitoring vital signs like heart rate, blood oxygen, and ECG. This has led to a significant increase in the use of smartwatches for managing chronic conditions and promoting preventative healthcare. The "Sports" application segment continues to be a strong performer, with dedicated features for various athletic activities and performance tracking appealing to fitness enthusiasts. "Other Applications," including smart home control and productivity tools, also contribute to the overall utility and appeal of smartwatches. The synergy between these applications is key to fostering deeper market penetration and user engagement across the diverse APAC landscape.

APAC Smart Watch Industry Product Analysis

The APAC smartwatch industry is defined by relentless product innovation and a sharp focus on competitive advantages. Manufacturers are consistently pushing the boundaries of technological advancement, integrating sophisticated sensors for comprehensive health and fitness tracking, including ECG, blood oxygen, and advanced sleep monitoring. Innovations in battery technology are addressing a key consumer pain point, offering longer usage times between charges. Furthermore, the seamless integration of smartwatches with smartphone ecosystems, including advanced notification systems, contactless payments, and voice assistants, enhances their utility and market appeal. Companies are also differentiating through unique design elements, durable materials, and specialized software features catering to niche applications like medical monitoring or extreme sports. These product advancements are crucial for capturing market share and building brand loyalty in this highly competitive environment.

Key Drivers, Barriers & Challenges in APAC Smart Watch Industry

Key Drivers: The primary forces propelling the APAC smartwatch industry include rapid technological advancements in sensor technology, AI integration for personalized health insights, and enhanced battery life, making devices more appealing and functional. The increasing health consciousness among consumers, driven by a desire for proactive health management and preventative care, is a significant economic and policy-driven factor. Growing disposable incomes across the region also contribute to higher consumer spending on premium wearable devices. Furthermore, government initiatives promoting digital health and wellness infrastructure indirectly support market growth.

Barriers & Challenges: Supply chain disruptions, particularly for critical components like microchips, pose a significant challenge, impacting production volumes and lead times. Evolving regulatory hurdles related to data privacy and health device certifications in different APAC countries can create complexities for manufacturers. The intense competitive pressure from established global brands and emerging local players leads to price wars and necessitates continuous innovation to maintain market share. The high cost of advanced components can also make premium smartwatches unaffordable for a segment of the population, acting as a restraint on market penetration in price-sensitive markets.

Growth Drivers in the APAC Smart Watch Industry Market

The growth of the APAC smartwatch industry is significantly propelled by technological innovation, particularly in areas like advanced health sensors (ECG, SpO2, stress monitoring) and improved battery efficiency. Economic factors, such as rising disposable incomes and a growing middle class across countries like India and Southeast Asia, are creating a larger addressable market for wearable devices. Policy-driven factors, including government initiatives promoting digital health and wellness adoption, also play a crucial role. For instance, the increasing focus on remote patient monitoring and preventative healthcare is creating new avenues for smartwatch integration. The expanding smartphone user base also acts as a natural catalyst, as smartwatches offer a complementary and integrated user experience.

Challenges Impacting APAC Smart Watch Industry Growth

Several regulatory complexities in data privacy and medical device certification across different APAC nations present a significant hurdle for manufacturers, requiring extensive compliance efforts. Supply chain issues, particularly concerning the availability and cost of essential components like advanced semiconductors, can lead to production delays and increased manufacturing costs. Intense competitive pressures from both established global brands and agile local players force companies to constantly innovate and potentially engage in price wars, impacting profit margins. Furthermore, the high price point of advanced smartwatches can limit market penetration in price-sensitive emerging economies. Addressing these challenges is critical for sustained growth in the APAC smartwatch market.

Key Players Shaping the APAC Smart Watch Industry Market

- Apple Inc

- Samsung Electronics Co Ltd

- Huawei Technologies Co Ltd

- Xiaomi Corporation

- Fitbit Inc

- Garmin Ltd

- Sony Corporation

- LG Electronics Inc

- Huami Corporation

- Fossil Group Inc

- Polar Electro OY

- Lenovo Group Limited

Significant APAC Smart Watch Industry Industry Milestones

- November 2022: Xiaomi announced the launch of its new watch S2 in China alongside the flagship Xiaomi 13 series, Buds 4, and a couple of new products. After the launch in China, the company could also aim to launch the watch in the global market.

- August 2022: Fitbit launched its Sense 2 and Versa 4 smartwatches. The Sense 2 offers extra heart monitoring and stress management capabilities in design and features. Fitbit Sense 2 features offer a Multi-path optical heart rate sensor; body response monitoring cEDA sensor; multipurpose ECG/EDA sensors; red and IR SpO2 sensors; gyroscope; altimeter; 3-axis accelerometer; skin temperature sensor; and ambient light sensor.

Future Outlook for APAC Smart Watch Industry Market

The future outlook for the APAC smartwatch industry is exceptionally bright, poised for continued robust growth driven by ongoing technological advancements and increasing consumer adoption. Strategic opportunities lie in the development of more specialized smartwatches catering to the burgeoning medical and wellness sectors, leveraging AI for personalized health insights and remote patient monitoring. The expansion into emerging markets with affordable yet feature-rich devices will be a key growth catalyst. Furthermore, the integration of smartwatches into broader IoT ecosystems and the development of advanced contactless payment and communication features will further enhance their value proposition, ensuring sustained market penetration and a significant contribution to the global wearable technology landscape. The market is expected to see increased innovation in battery technology and display efficiency, addressing key consumer concerns and driving further demand.

APAC Smart Watch Industry Segmentation

-

1. Operating Systems

- 1.1. Watch OS

- 1.2. Android/Wear OS

- 1.3. Other Operating Systems

-

2. Display Type

- 2.1. AMOLED

- 2.2. PMOLED

- 2.3. TFT LCD

-

3. Application

- 3.1. Personal Assistance

- 3.2. Medical

- 3.3. Sports

- 3.4. Other Applications

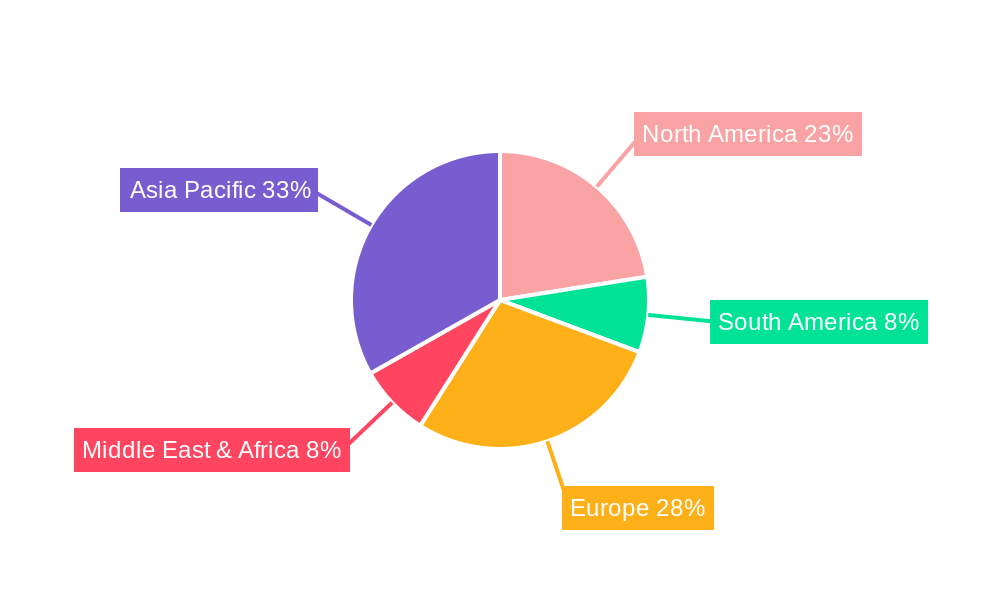

APAC Smart Watch Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Smart Watch Industry Regional Market Share

Geographic Coverage of APAC Smart Watch Industry

APAC Smart Watch Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumer

- 3.3. Market Restrains

- 3.3.1 Growing Complexity of Wearable Devices and Limited Use of Features

- 3.3.2 Augmented With Security Risks

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration in the Asia Pacific is Expected to Drive the Studied Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Smart Watch Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 5.1.1. Watch OS

- 5.1.2. Android/Wear OS

- 5.1.3. Other Operating Systems

- 5.2. Market Analysis, Insights and Forecast - by Display Type

- 5.2.1. AMOLED

- 5.2.2. PMOLED

- 5.2.3. TFT LCD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal Assistance

- 5.3.2. Medical

- 5.3.3. Sports

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 6. North America APAC Smart Watch Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Operating Systems

- 6.1.1. Watch OS

- 6.1.2. Android/Wear OS

- 6.1.3. Other Operating Systems

- 6.2. Market Analysis, Insights and Forecast - by Display Type

- 6.2.1. AMOLED

- 6.2.2. PMOLED

- 6.2.3. TFT LCD

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Personal Assistance

- 6.3.2. Medical

- 6.3.3. Sports

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Operating Systems

- 7. South America APAC Smart Watch Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Operating Systems

- 7.1.1. Watch OS

- 7.1.2. Android/Wear OS

- 7.1.3. Other Operating Systems

- 7.2. Market Analysis, Insights and Forecast - by Display Type

- 7.2.1. AMOLED

- 7.2.2. PMOLED

- 7.2.3. TFT LCD

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Personal Assistance

- 7.3.2. Medical

- 7.3.3. Sports

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Operating Systems

- 8. Europe APAC Smart Watch Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Operating Systems

- 8.1.1. Watch OS

- 8.1.2. Android/Wear OS

- 8.1.3. Other Operating Systems

- 8.2. Market Analysis, Insights and Forecast - by Display Type

- 8.2.1. AMOLED

- 8.2.2. PMOLED

- 8.2.3. TFT LCD

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Personal Assistance

- 8.3.2. Medical

- 8.3.3. Sports

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Operating Systems

- 9. Middle East & Africa APAC Smart Watch Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Operating Systems

- 9.1.1. Watch OS

- 9.1.2. Android/Wear OS

- 9.1.3. Other Operating Systems

- 9.2. Market Analysis, Insights and Forecast - by Display Type

- 9.2.1. AMOLED

- 9.2.2. PMOLED

- 9.2.3. TFT LCD

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Personal Assistance

- 9.3.2. Medical

- 9.3.3. Sports

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Operating Systems

- 10. Asia Pacific APAC Smart Watch Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Operating Systems

- 10.1.1. Watch OS

- 10.1.2. Android/Wear OS

- 10.1.3. Other Operating Systems

- 10.2. Market Analysis, Insights and Forecast - by Display Type

- 10.2.1. AMOLED

- 10.2.2. PMOLED

- 10.2.3. TFT LCD

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Personal Assistance

- 10.3.2. Medical

- 10.3.3. Sports

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Operating Systems

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Polar Electro OY

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Huami Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LG Electronics Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lenovo Group Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung Electronics Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Garmin Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fitbit Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Huawei Technologies Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Xiaomi Corporatio

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fossil Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Apple Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sony Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Polar Electro OY

List of Figures

- Figure 1: Global APAC Smart Watch Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Smart Watch Industry Revenue (Million), by Operating Systems 2025 & 2033

- Figure 3: North America APAC Smart Watch Industry Revenue Share (%), by Operating Systems 2025 & 2033

- Figure 4: North America APAC Smart Watch Industry Revenue (Million), by Display Type 2025 & 2033

- Figure 5: North America APAC Smart Watch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 6: North America APAC Smart Watch Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America APAC Smart Watch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America APAC Smart Watch Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America APAC Smart Watch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America APAC Smart Watch Industry Revenue (Million), by Operating Systems 2025 & 2033

- Figure 11: South America APAC Smart Watch Industry Revenue Share (%), by Operating Systems 2025 & 2033

- Figure 12: South America APAC Smart Watch Industry Revenue (Million), by Display Type 2025 & 2033

- Figure 13: South America APAC Smart Watch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 14: South America APAC Smart Watch Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: South America APAC Smart Watch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America APAC Smart Watch Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America APAC Smart Watch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe APAC Smart Watch Industry Revenue (Million), by Operating Systems 2025 & 2033

- Figure 19: Europe APAC Smart Watch Industry Revenue Share (%), by Operating Systems 2025 & 2033

- Figure 20: Europe APAC Smart Watch Industry Revenue (Million), by Display Type 2025 & 2033

- Figure 21: Europe APAC Smart Watch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 22: Europe APAC Smart Watch Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe APAC Smart Watch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe APAC Smart Watch Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe APAC Smart Watch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa APAC Smart Watch Industry Revenue (Million), by Operating Systems 2025 & 2033

- Figure 27: Middle East & Africa APAC Smart Watch Industry Revenue Share (%), by Operating Systems 2025 & 2033

- Figure 28: Middle East & Africa APAC Smart Watch Industry Revenue (Million), by Display Type 2025 & 2033

- Figure 29: Middle East & Africa APAC Smart Watch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 30: Middle East & Africa APAC Smart Watch Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: Middle East & Africa APAC Smart Watch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East & Africa APAC Smart Watch Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa APAC Smart Watch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific APAC Smart Watch Industry Revenue (Million), by Operating Systems 2025 & 2033

- Figure 35: Asia Pacific APAC Smart Watch Industry Revenue Share (%), by Operating Systems 2025 & 2033

- Figure 36: Asia Pacific APAC Smart Watch Industry Revenue (Million), by Display Type 2025 & 2033

- Figure 37: Asia Pacific APAC Smart Watch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 38: Asia Pacific APAC Smart Watch Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Asia Pacific APAC Smart Watch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Asia Pacific APAC Smart Watch Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific APAC Smart Watch Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Smart Watch Industry Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 2: Global APAC Smart Watch Industry Revenue Million Forecast, by Display Type 2020 & 2033

- Table 3: Global APAC Smart Watch Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global APAC Smart Watch Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global APAC Smart Watch Industry Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 6: Global APAC Smart Watch Industry Revenue Million Forecast, by Display Type 2020 & 2033

- Table 7: Global APAC Smart Watch Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global APAC Smart Watch Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global APAC Smart Watch Industry Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 13: Global APAC Smart Watch Industry Revenue Million Forecast, by Display Type 2020 & 2033

- Table 14: Global APAC Smart Watch Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global APAC Smart Watch Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global APAC Smart Watch Industry Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 20: Global APAC Smart Watch Industry Revenue Million Forecast, by Display Type 2020 & 2033

- Table 21: Global APAC Smart Watch Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global APAC Smart Watch Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Smart Watch Industry Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 33: Global APAC Smart Watch Industry Revenue Million Forecast, by Display Type 2020 & 2033

- Table 34: Global APAC Smart Watch Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global APAC Smart Watch Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global APAC Smart Watch Industry Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 43: Global APAC Smart Watch Industry Revenue Million Forecast, by Display Type 2020 & 2033

- Table 44: Global APAC Smart Watch Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 45: Global APAC Smart Watch Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Smart Watch Industry?

The projected CAGR is approximately 19.69%.

2. Which companies are prominent players in the APAC Smart Watch Industry?

Key companies in the market include Polar Electro OY, Huami Corporation, LG Electronics Inc, Lenovo Group Limited, Samsung Electronics Co Ltd, Garmin Ltd, Fitbit Inc, Huawei Technologies Co Ltd, Xiaomi Corporatio, Fossil Group Inc, Apple Inc, Sony Corporation.

3. What are the main segments of the APAC Smart Watch Industry?

The market segments include Operating Systems, Display Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumer.

6. What are the notable trends driving market growth?

Increasing Internet Penetration in the Asia Pacific is Expected to Drive the Studied Market.

7. Are there any restraints impacting market growth?

Growing Complexity of Wearable Devices and Limited Use of Features. Augmented With Security Risks.

8. Can you provide examples of recent developments in the market?

November 2022 - Xiaomi announced the launch of its new watch S2 in China alongside the flagship Xiaomi 13 series, Buds 4, and a couple of new products. After the launch in China, the company could also aim to launch the watch in the global market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Smart Watch Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Smart Watch Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Smart Watch Industry?

To stay informed about further developments, trends, and reports in the APAC Smart Watch Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence