Key Insights

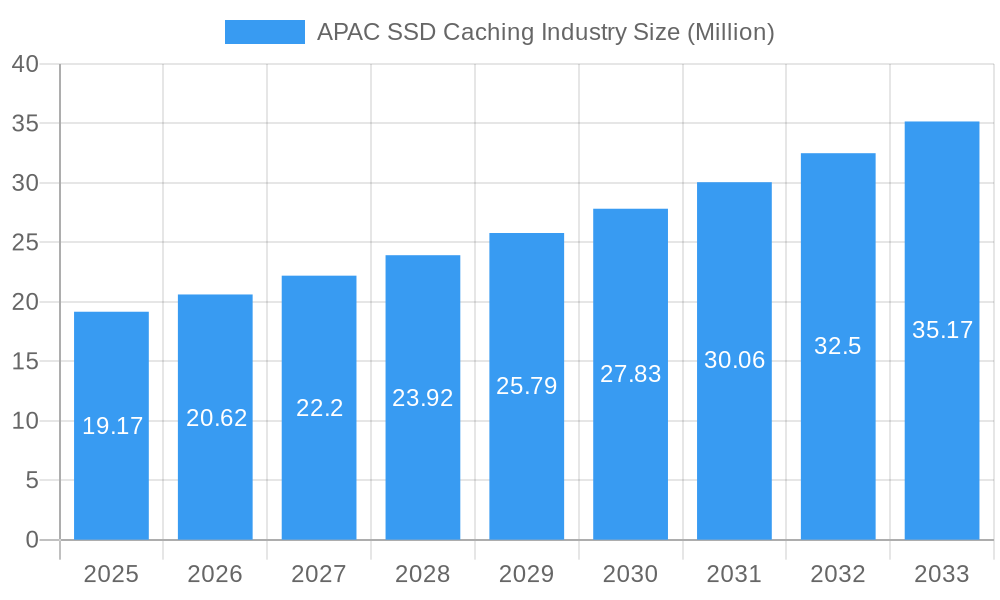

The APAC SSD Caching market is poised for significant expansion, demonstrating robust growth driven by the increasing demand for faster data access and improved application performance across enterprise and personal storage segments. With a current market size estimated at USD 19.17 million in the base year 2025 and a projected Compound Annual Growth Rate (CAGR) of 7.50%, the market is expected to witness substantial value accretion throughout the forecast period of 2025-2033. Key drivers underpinning this growth include the proliferation of data-intensive applications, the growing adoption of Solid State Drives (SSDs) for their superior speed and reliability compared to traditional Hard Disk Drives (HDDs), and the ongoing digital transformation initiatives across various industries in the region. The increasing affordability and enhanced capabilities of SSD caching solutions further contribute to their widespread adoption.

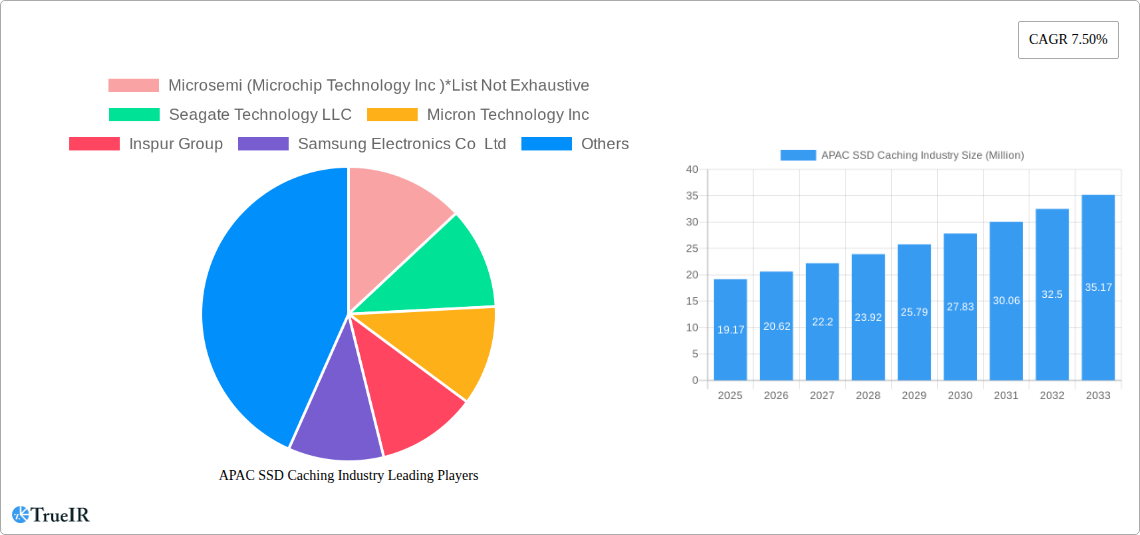

APAC SSD Caching Industry Market Size (In Million)

The competitive landscape features a dynamic interplay of established global players and emerging regional innovators, including technology giants like Samsung Electronics, Western Digital, Micron Technology, and SK Hynix, alongside specialized providers such as QNAP Systems and ADATA Technology. These companies are actively engaged in research and development to offer advanced SSD caching solutions with higher capacities, improved endurance, and sophisticated management software. Trends such as the integration of NVMe SSDs, the rise of hybrid storage architectures, and the increasing use of SSD caching in cloud computing and edge computing environments are shaping market dynamics. While opportunities for growth are abundant, potential restraints might include the initial cost of implementation for smaller enterprises and the need for robust technical expertise to optimize SSD caching performance.

APAC SSD Caching Industry Company Market Share

APAC SSD Caching Industry: Market Analysis, Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the dynamic APAC SSD Caching industry. Leveraging high-volume keywords such as "SSD caching APAC," "enterprise storage solutions," "personal storage innovations," and "data acceleration technology," this report is meticulously crafted for optimal SEO performance and maximum industry engagement. It covers the historical period from 2019 to 2024, the base and estimated year of 2025, and a detailed forecast period spanning 2025 to 2033. Uncover critical insights into market structure, competitive landscape, evolving trends, dominant segments, product innovations, key drivers, barriers, and the future trajectory of this rapidly expanding market.

APAC SSD Caching Industry Market Structure & Competitive Landscape

The APAC SSD Caching industry exhibits a moderately concentrated market structure, with key players actively engaged in innovation and strategic partnerships. The proliferation of high-performance computing demands and the increasing adoption of data-intensive applications are primary innovation drivers. Regulatory frameworks concerning data privacy and security, while evolving, are influencing product development and deployment strategies. Product substitutes, primarily other forms of storage acceleration like RAM caching or high-performance HDD arrays, are present but face limitations in terms of latency and endurance compared to SSD caching. End-user segmentation is predominantly driven by Enterprise Storage, accounting for an estimated XX% of the market share, followed by Personal Storage at XX%. Mergers and acquisitions (M&A) activity, while not exhaustive, aims to consolidate market presence and expand technological portfolios, with an estimated volume of XX deals in the historical period. Concentration ratios, particularly within enterprise solutions, indicate a strong presence of leading vendors, yet opportunities exist for niche players focusing on specialized applications or emerging markets.

APAC SSD Caching Industry Market Trends & Opportunities

The APAC SSD Caching industry is poised for significant growth, driven by an insatiable demand for faster data access and improved application performance across diverse sectors. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period, escalating from an estimated XX Million in the base year 2025 to an anticipated XX Million by 2033. Technological shifts are characterized by the increasing integration of NVMe SSDs for caching, offering significantly lower latency and higher throughput than their SATA predecessors. This trend is further amplified by the growing adoption of hybrid cloud environments and the explosion of data generated by IoT devices and big data analytics, necessitating sophisticated data acceleration solutions. Consumer preferences are leaning towards solutions that offer a balance of performance, cost-effectiveness, and scalability. Enterprise Storage, a dominant segment, is experiencing rapid expansion due to the need for improved database performance, virtual machine efficiency, and faster analytics processing. Personal Storage, though a smaller segment, is seeing growth with the demand for faster gaming experiences, video editing workflows, and overall system responsiveness. Competitive dynamics are characterized by intense innovation, with companies vying to offer higher capacities, lower power consumption, and more intelligent caching algorithms. Opportunities abound in developing advanced AI-driven caching software, optimizing solutions for edge computing deployments, and catering to the specific needs of rapidly digitizing economies within the APAC region. Market penetration rates are expected to rise steadily, as the tangible benefits of SSD caching become increasingly apparent to a wider range of businesses and individual users.

Dominant Markets & Segments in APAC SSD Caching Industry

Within the APAC region, Enterprise Storage emerges as the dominant market segment for SSD caching solutions, driven by a confluence of critical growth factors. The burgeoning digital transformation initiatives across various industries, coupled with the exponential increase in data generation from Big Data analytics, AI, and IoT applications, are compelling enterprises to invest heavily in high-performance storage infrastructure. Government policies promoting digitalization and smart city development in countries like China, South Korea, and Japan further fuel this demand by mandating robust IT frameworks. For instance, the widespread adoption of cloud computing and the growing need for faster data processing in sectors like finance, healthcare, and e-commerce are directly translating into significant investments in SSD caching technology to enhance application responsiveness and reduce latency. The infrastructure requirements for these sectors necessitate solutions that can handle massive transaction volumes and provide near real-time data access, making SSD caching an indispensable component of modern data centers.

In contrast, Personal Storage represents a growing, albeit smaller, segment. The increasing affordability of SSDs and the rising disposable incomes across many APAC nations are driving consumer demand for faster personal computing experiences. This includes enhanced gaming performance, quicker boot times, smoother video editing, and overall system responsiveness for everyday tasks. The proliferation of high-definition content and the growing popularity of demanding applications are creating a tangible need for faster data access, which SSD caching directly addresses. While the scale of investment per user is considerably lower than in the enterprise segment, the sheer volume of individual consumers in the APAC region presents a substantial market opportunity.

APAC SSD Caching Industry Product Analysis

Product innovations in the APAC SSD Caching industry are heavily focused on enhancing performance, efficiency, and integration. The advent of NVMe-based SSD caches is a significant technological advancement, offering vastly superior read and write speeds compared to traditional SATA SSDs, thereby accelerating read-centric workloads and improving overall system responsiveness. These products provide competitive advantages through reduced latency, increased IOPS (Input/Output Operations Per Second), and improved endurance, making them ideal for demanding enterprise applications such as databases, virtualized environments, and high-performance computing. Innovations also encompass intelligent caching algorithms that optimize data placement and retrieval, further maximizing performance gains. Integration capabilities with existing storage architectures, including hybrid HDD/SSD configurations and cloud environments, are key market differentiators, ensuring seamless deployment and scalability for a wide range of applications.

Key Drivers, Barriers & Challenges in APAC SSD Caching Industry

Key Drivers:

- Growing demand for high-performance computing: The increasing complexity and data-intensiveness of modern applications necessitate faster data access, a primary driver for SSD caching adoption.

- Digital transformation initiatives: Widespread digital transformation across industries in APAC is fueling investment in advanced IT infrastructure, including SSD caching.

- Proliferation of Big Data and AI: The exponential growth of data requires efficient processing and access, making SSD caching crucial for analytics and AI workloads.

- Advancements in SSD technology: Continuous improvements in SSD speed, capacity, and cost-effectiveness are making caching solutions more accessible and powerful.

Barriers & Challenges:

- Initial Cost of Implementation: While prices are decreasing, the upfront investment for enterprise-grade SSD caching solutions can still be a barrier for some smaller businesses.

- Complexity of Integration and Management: Implementing and managing advanced caching solutions can require specialized IT expertise, posing a challenge for organizations with limited resources.

- Data Durability and Reliability Concerns: Although SSD technology has matured, concerns regarding data durability and the lifespan of flash memory can still influence purchasing decisions for critical data.

- Supply Chain Disruptions: Geopolitical factors and global supply chain vulnerabilities can impact the availability and pricing of SSD components, affecting market stability.

Growth Drivers in the APAC SSD Caching Industry Market

The APAC SSD Caching industry is propelled by a trifecta of powerful growth drivers. Technologically, the relentless evolution of SSD technology, particularly the widespread adoption of NVMe interfaces, offers unprecedented speed and latency improvements, directly enhancing data access performance. Economically, the rapid digitalization across sectors like finance, healthcare, and e-commerce in APAC fuels a burgeoning demand for robust and responsive IT infrastructure, where SSD caching plays a pivotal role in optimizing application performance and user experience. Furthermore, government initiatives aimed at fostering innovation and digital economies, coupled with increasing enterprise IT budgets, create a conducive environment for market expansion. For example, smart city projects in countries like Singapore and South Korea necessitate high-speed data processing capabilities that SSD caching directly addresses.

Challenges Impacting APAC SSD Caching Industry Growth

Despite its promising growth trajectory, the APAC SSD Caching industry faces several significant challenges. Regulatory complexities surrounding data sovereignty and privacy in certain APAC nations can create hurdles for seamless deployment and data management across borders. Supply chain issues, exacerbated by global component shortages and geopolitical tensions, can lead to price volatility and availability constraints for SSDs and related hardware, impacting market predictability. Competitive pressures from established players and emerging solution providers also necessitate continuous innovation and aggressive pricing strategies. Moreover, the initial capital expenditure required for high-capacity enterprise caching solutions, while diminishing, remains a consideration for some organizations, particularly small and medium-sized enterprises (SMEs).

Key Players Shaping the APAC SSD Caching Industry Market

- Microchip Technology Inc

- Seagate Technology LLC

- Micron Technology Inc

- Inspur Group

- Samsung Electronics Co Ltd

- Transcend Information Inc

- Kioxia Corporation

- ADATA Technology Co Ltd

- Western Digital Corporation

- SK Hynix Inc

- NetApp Inc

- Intel Corporation

- QNAP Systems Inc

Significant APAC SSD Caching Industry Industry Milestones

- July 2023: Lenovo updated its ThinkSystem DM5000H, offering scalability up to 1.96 PB of raw storage. A cluster can expand to 23.5 PB for NAS or 11.7 PB for SAN environments. The DM5000H supports unified file and block storage with 1 GbE/10 GbE NAS, iSCSI, and 8 Gb/16 Gb Fibre Channel protocols, accelerating read-centric workloads with onboard NVMe SSD caching.

- January 2023: QNAP Systems, Inc. introduced the high-capacity TS-1655 2.5GbE NAS, accommodating twelve 3.5-inch HDDs and four 2.5-inch SSDs. This model integrates 8-core computing, 2.5GbE networking, and PCIe expansion for enhanced business efficiency in file sharing, collaboration, backup, and virtualization. Its hybrid storage architecture balances performance and cost, supporting RAID 50/60 for increased data security and optimal storage space utilization.

Future Outlook for APAC SSD Caching Industry Market

The future outlook for the APAC SSD Caching industry is exceptionally bright, driven by ongoing technological advancements and a deepening reliance on data-intensive operations. Strategic opportunities lie in the expansion of caching solutions into emerging applications such as edge computing, autonomous systems, and advanced AI deployments. The market will likely witness increased demand for intelligent, software-defined caching solutions that can dynamically adapt to changing workloads and optimize resource utilization. Furthermore, the growing adoption of hybrid cloud strategies will spur the development of integrated caching technologies that seamlessly bridge on-premises and cloud storage environments. As SSD costs continue to decline and performance metrics improve, SSD caching is poised to become an even more integral component of IT infrastructure across the APAC region, unlocking new levels of efficiency and innovation for businesses and consumers alike.

APAC SSD Caching Industry Segmentation

-

1. Application

- 1.1. Enterprise Storage

- 1.2. Personal Storage

APAC SSD Caching Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

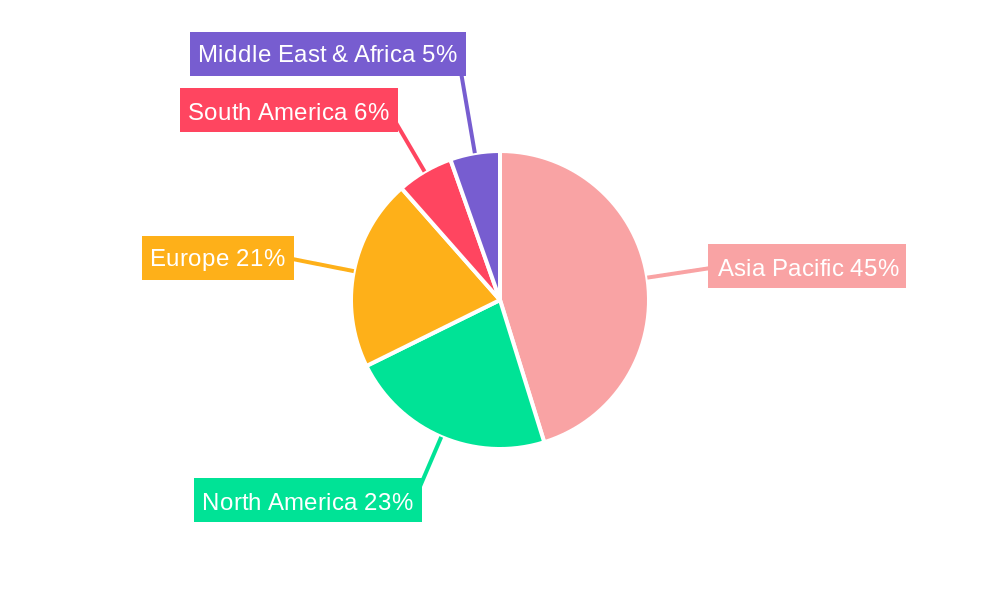

APAC SSD Caching Industry Regional Market Share

Geographic Coverage of APAC SSD Caching Industry

APAC SSD Caching Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improvements Offered by SSDs Over Conventional HDDs

- 3.3. Market Restrains

- 3.3.1. Slow Pace in Development of Applications Despite Heavy investments in R&D; Commplexities in Hardware Designing

- 3.4. Market Trends

- 3.4.1. Enterprise Storage Application Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC SSD Caching Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Enterprise Storage

- 5.1.2. Personal Storage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America APAC SSD Caching Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Enterprise Storage

- 6.1.2. Personal Storage

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America APAC SSD Caching Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Enterprise Storage

- 7.1.2. Personal Storage

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe APAC SSD Caching Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Enterprise Storage

- 8.1.2. Personal Storage

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa APAC SSD Caching Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Enterprise Storage

- 9.1.2. Personal Storage

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific APAC SSD Caching Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Enterprise Storage

- 10.1.2. Personal Storage

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Microsemi (Microchip Technology Inc )*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Seagate Technology LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Micron Technology Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inspur Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung Electronics Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Transcend Information Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kioxia (Toshiba Memory Corporation)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ADATA Technology Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Western Digital Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SK Hynix Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NetApp Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Intel Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 QNAP Systems Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Microsemi (Microchip Technology Inc )*List Not Exhaustive

List of Figures

- Figure 1: Global APAC SSD Caching Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC SSD Caching Industry Revenue (Million), by Application 2025 & 2033

- Figure 3: North America APAC SSD Caching Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America APAC SSD Caching Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America APAC SSD Caching Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America APAC SSD Caching Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: South America APAC SSD Caching Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: South America APAC SSD Caching Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America APAC SSD Caching Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe APAC SSD Caching Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe APAC SSD Caching Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe APAC SSD Caching Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe APAC SSD Caching Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa APAC SSD Caching Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Middle East & Africa APAC SSD Caching Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Middle East & Africa APAC SSD Caching Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa APAC SSD Caching Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific APAC SSD Caching Industry Revenue (Million), by Application 2025 & 2033

- Figure 19: Asia Pacific APAC SSD Caching Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: Asia Pacific APAC SSD Caching Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific APAC SSD Caching Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC SSD Caching Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global APAC SSD Caching Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global APAC SSD Caching Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global APAC SSD Caching Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global APAC SSD Caching Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global APAC SSD Caching Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global APAC SSD Caching Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global APAC SSD Caching Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global APAC SSD Caching Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global APAC SSD Caching Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global APAC SSD Caching Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global APAC SSD Caching Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific APAC SSD Caching Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC SSD Caching Industry?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the APAC SSD Caching Industry?

Key companies in the market include Microsemi (Microchip Technology Inc )*List Not Exhaustive, Seagate Technology LLC, Micron Technology Inc, Inspur Group, Samsung Electronics Co Ltd, Transcend Information Inc, Kioxia (Toshiba Memory Corporation), ADATA Technology Co Ltd, Western Digital Corporation, SK Hynix Inc, NetApp Inc, Intel Corporation, QNAP Systems Inc.

3. What are the main segments of the APAC SSD Caching Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Improvements Offered by SSDs Over Conventional HDDs.

6. What are the notable trends driving market growth?

Enterprise Storage Application Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Slow Pace in Development of Applications Despite Heavy investments in R&D; Commplexities in Hardware Designing.

8. Can you provide examples of recent developments in the market?

July 2023: Lenovo updated ThinkSystem DM5000H can scale up to 1.96 PB of raw storage capacity. A cluster of the DM5000H storage systems can scale up to 23.5 PB for NAS or up to 11.7 PB for SAN environments. The ThinkSystem DM5000H offers unified file and block storage connectivity with support for 1 GbE or 10 GbE NAS and iSCSI and 8 Gb or 16 Gb Fibre Channel protocols simultaneously. Acceleration of read-centric workloads with the high-speed, low-latency onboard NVMe SSD caching.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC SSD Caching Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC SSD Caching Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC SSD Caching Industry?

To stay informed about further developments, trends, and reports in the APAC SSD Caching Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence