Key Insights

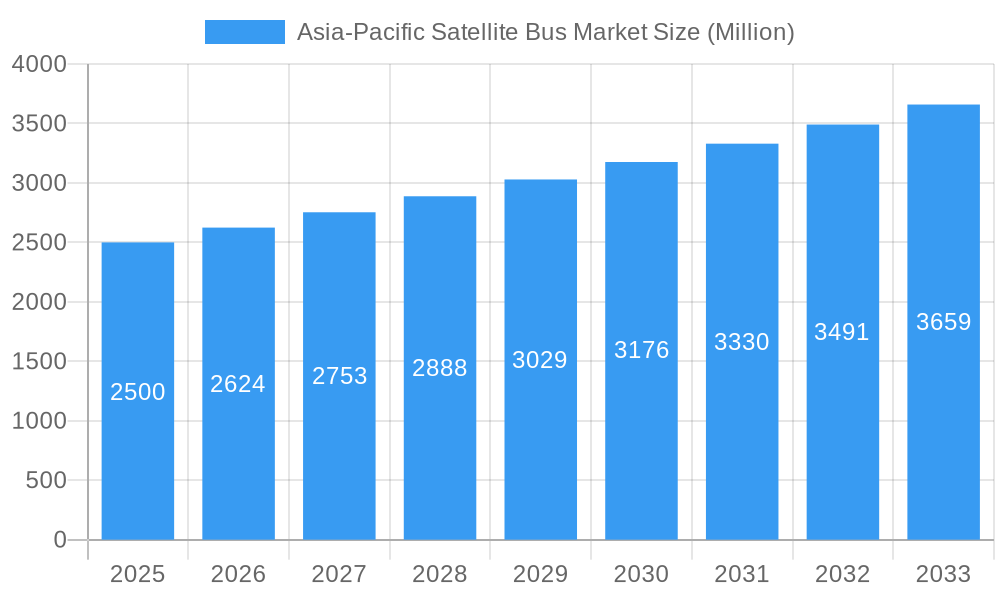

The Asia-Pacific satellite bus market is experiencing robust growth, driven by increasing demand for satellite-based communication, navigation, and earth observation services across the region. A burgeoning space industry, coupled with significant government investment in space exploration and technological advancements, fuels this expansion. The market's Compound Annual Growth Rate (CAGR) of 4.96% from 2019 to 2024 suggests a consistently positive trajectory. This growth is largely attributed to the rising adoption of small satellites (below 100kg), fueled by reduced launch costs and the emergence of NewSpace companies. The segments experiencing the most significant growth are LEO (Low Earth Orbit) satellite buses, catering to the increasing need for high-bandwidth, low-latency communication applications, and the commercial sector, leveraging satellite technology for various applications such as broadband internet access, environmental monitoring, and disaster management. Major players like NEC, Honeywell, Lockheed Martin, and Airbus are actively involved, contributing significantly to market value. Countries like China, Japan, India, and South Korea, owing to substantial investments in their space programs and a growing demand for advanced technologies, are key contributors to regional market expansion. The market size is expected to increase with the growing demand and it shows a steady growth over the years.

Asia-Pacific Satellite Bus Market Market Size (In Billion)

The increasing adoption of advanced technologies like AI and machine learning in satellite operations further enhances the efficiency and functionality of satellite buses, driving market expansion. Though regulatory hurdles and the high initial investment costs for satellite development pose challenges, the overall market outlook remains positive. The diverse application segments—communication, earth observation, navigation, and space observation—ensure sustained market growth. The market segmentation by satellite mass, orbit class, and end-user provides valuable insights into specific market dynamics and helps in identifying lucrative investment opportunities. Continued advancements in miniaturization and reduced launch costs are expected to further stimulate the adoption of satellite buses across various sectors, maintaining a healthy growth trajectory for the foreseeable future.

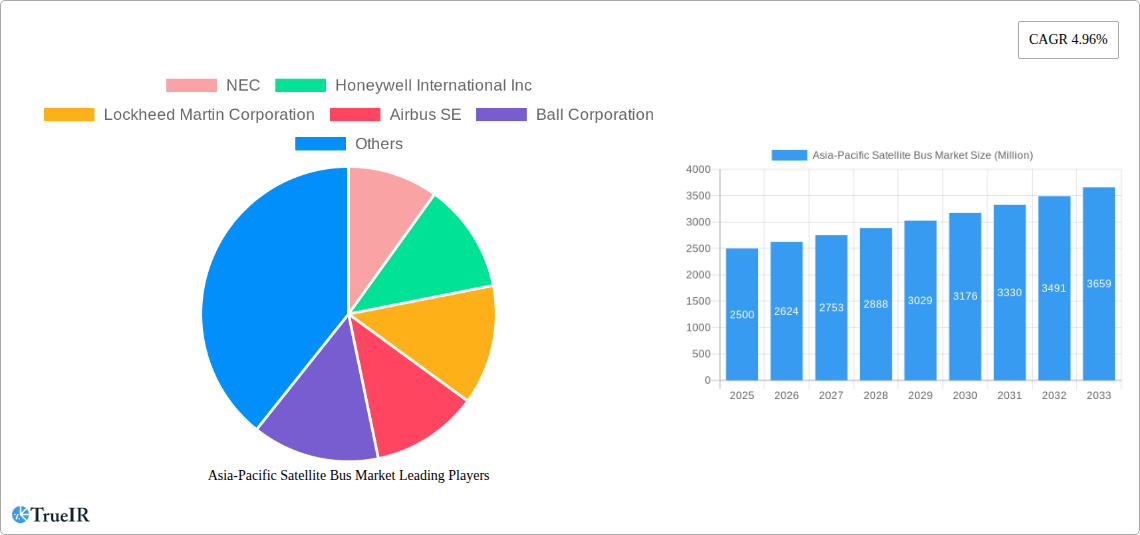

Asia-Pacific Satellite Bus Market Company Market Share

Asia-Pacific Satellite Bus Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific satellite bus market, offering invaluable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market size, growth drivers, competitive landscape, and future outlook. The market is segmented by application, satellite mass, orbit class, and end-user, providing a granular understanding of its diverse components. Key players such as NEC, Honeywell International Inc, Lockheed Martin Corporation, and others are profiled, highlighting their strategies and contributions to market evolution. This report is crucial for navigating the complexities of this rapidly evolving sector and making informed business decisions. The market is projected to reach xx Million by 2033.

Asia-Pacific Satellite Bus Market Market Structure & Competitive Landscape

The Asia-Pacific satellite bus market is characterized by a dynamic and evolving competitive landscape. While a few established players command a significant market share, the market is increasingly vibrant due to the emergence of innovative startups and substantial investment from government agencies. This blend of mature and emerging entities fosters a competitive environment driven by rapid technological advancements, evolving regulatory frameworks, and the strategic consideration of alternative technologies. Mergers and acquisitions (M&A) remain a crucial strategy for companies seeking to consolidate market position, acquire critical technological expertise, and expand their regional and global reach.

- Market Concentration: The market exhibits a moderately concentrated structure. While specific data points like the Herfindahl-Hirschman Index (HHI) are subject to continuous change, the presence of a few dominant players alongside a growing number of smaller, specialized firms indicates this moderate concentration.

- Innovation Drivers: Key innovations revolve around the miniaturization of satellite components for more cost-effective launches, the development of highly efficient and versatile propulsion systems, and the integration of advanced communication technologies to support higher data throughput and connectivity.

- Regulatory Impacts: Stringent government policies and regulations, particularly concerning spectrum allocation for satellite communications and the increasing emphasis on space debris mitigation, play a pivotal role in shaping market growth and dictating operational strategies.

- Product Substitutes: While satellite technology offers unique advantages, emerging alternatives such as high-altitude platforms (HAPs) and advanced terrestrial communication networks are being monitored as potential substitutes for certain applications, driving a need for continuous innovation in satellite bus capabilities.

- End-User Segmentation: The market is broadly segmented into commercial, military & government, and other end-users. The commercial segment currently holds the largest share, driven by the burgeoning demand for satellite-based services across various industries.

- M&A Trends: The past few years have seen a notable trend of strategic M&A activities. These deals are primarily motivated by the acquisition of specialized technological capabilities, securing intellectual property, and expanding market penetration. The average deal size reflects the significant strategic and financial investments being made in this sector.

Asia-Pacific Satellite Bus Market Market Trends & Opportunities

The Asia-Pacific satellite bus market is experiencing a period of robust and sustained growth, fueled by the escalating demand for essential services such as advanced communication, precise navigation, and comprehensive earth observation. The market, which was estimated to be valued at [Insert Market Size Value] Million in 2025, is projected to reach [Insert Projected Market Size Value] Million by 2033, demonstrating a compelling Compound Annual Growth Rate (CAGR) of [Insert CAGR Value]%. Technological breakthroughs, particularly the widespread adoption of smaller, lighter, and significantly more efficient satellite buses, are acting as powerful catalysts for this expansion. The proliferation of Internet of Things (IoT) devices and the persistent need for enhanced global connectivity further amplify these growth drivers. Consumer and enterprise preferences are increasingly leaning towards cost-effective, reliable, and scalable satellite-based solutions. The competitive environment is characterized by an accelerated pace of innovation and the formation of strategic partnerships aimed at leveraging complementary strengths. Market penetration rates are steadily rising across various application segments, with communication and earth observation applications showing particularly strong upward trajectories.

Dominant Markets & Segments in Asia-Pacific Satellite Bus Market

Within the expansive Asia-Pacific region, [Country Name] currently stands as the leading market for satellite buses. This dominance is largely attributable to substantial government investment in ambitious space exploration programs and significant advancements in indigenous space-related infrastructure. From an application perspective, the communication segment continues to be the largest contributor, followed closely by the growing demand for earth observation services.

- Leading Region: [Country Name]

- Key Growth Drivers in Leading Region:

- Substantial and sustained investments in pioneering space exploration initiatives and cutting-edge research.

- Proactive government initiatives designed to foster and accelerate the development of the domestic space sector.

- Continuous development and deployment of advanced communication infrastructure that leverages satellite technology.

- A rapidly increasing demand for versatile satellite-based services that cater to a wide array of industries and applications.

- Dominant Segments:

- Application: Communication, projected to account for [Insert Communication Application Value] Million in 2025, highlighting its critical role in regional connectivity.

- Satellite Mass: The 100-500kg segment remains dominant due to its optimal balance of payload capacity, cost-effectiveness, and suitability for a diverse range of applications, from earth observation to telecommunications.

- Orbit Class: Both Low Earth Orbit (LEO) and Geostationary Orbit (GEO) continue to be the primary orbit classes, owing to their distinct but wide-ranging applicability for global coverage and specialized services.

- End User: The commercial segment represents a significant [Insert Commercial Segment Percentage]% of the market share, driven by the increasing adoption of satellite solutions for business and consumer needs.

Asia-Pacific Satellite Bus Market Product Analysis

Satellite bus technology is constantly evolving, with a focus on miniaturization, increased payload capacity, and improved reliability. The market offers a variety of bus platforms tailored to different mission requirements, ranging from small, low-cost platforms for CubeSats to large, sophisticated buses for high-capacity communication satellites. These advancements have facilitated greater accessibility and cost-effectiveness, driving market expansion. The competitive advantage lies in offering innovative solutions tailored to specific customer needs and providing robust, reliable, and cost-effective satellite buses.

Key Drivers, Barriers & Challenges in Asia-Pacific Satellite Bus Market

Key Drivers: The market is driven by the growing demand for satellite-based services, technological advancements in satellite miniaturization and propulsion systems, supportive government policies, and the increasing adoption of IoT devices. For example, the Indian Space Research Organisation's (ISRO) focus on developing low-cost launch vehicles has created opportunities for smaller satellite buses.

Challenges: Key challenges include the high cost of development and launch, stringent regulatory requirements for satellite operation, and the intense competition from established players and emerging startups. Supply chain disruptions and geopolitical factors further complicate market dynamics, potentially leading to delays and increased costs.

Growth Drivers in the Asia-Pacific Satellite Bus Market Market

The Asia-Pacific satellite bus market's growth trajectory is propelled by several interconnected factors. Foremost among these are continuous technological advancements, particularly in the areas of miniaturization, which allows for more efficient and cost-effective satellite launches, and the development of more advanced and versatile propulsion systems. Complementing these technological strides, strong government support for the space industry across numerous Asia-Pacific nations, coupled with burgeoning private sector investments, creates a fertile ground for market expansion. The ever-increasing demand for sophisticated satellite-based services, spanning critical sectors like telecommunications, navigation, surveillance, and environmental monitoring, further fuels this growth momentum.

Challenges Impacting Asia-Pacific Satellite Bus Market Growth

The high initial investment costs and complexities associated with satellite development and launch pose considerable challenges. Stringent regulatory frameworks and potential supply chain disruptions can impede growth. Intense competition among established and emerging players further adds to the market complexities.

Key Players Shaping the Asia-Pacific Satellite Bus Market Market

- NEC

- Honeywell International Inc

- Lockheed Martin Corporation

- Airbus SE

- Ball Corporation

- Nano Avionics

- Thale

- Northrop Grumman Corporation

- Indian Space Research Organisation (ISRO)

Significant Asia-Pacific Satellite Bus Market Industry Milestones

- June 2020: NanoAvionics received a contract from Thales Alenia Space to build satellite buses for Omnispace's IoT infrastructure. This highlights the growing demand for small satellite buses in the IoT sector.

- July 2020: Thales Alenia Space secured a contract with SES to build SES-22 and SES-23 communication satellites, demonstrating continued demand for larger, high-capacity satellite platforms.

- October 2020: NanoAvionics expanded its UK operations, signifying the strategic importance of the region and the growing global demand for satellite bus manufacturing and testing capabilities.

Future Outlook for Asia-Pacific Satellite Bus Market Market

The future outlook for the Asia-Pacific satellite bus market is exceptionally promising, with projections indicating continued and robust growth. This expansion will be primarily driven by ongoing technological innovations, a sustained and escalating demand for a wide spectrum of satellite-based services, and the implementation of supportive government policies and regulatory frameworks. Strategic alliances and collaborative ventures among diverse stakeholders, including satellite manufacturers, launch providers, service operators, and end-users, are expected to play a crucial role in accelerating market development. The market presents significant opportunities for forward-thinking companies that can offer innovative, highly reliable, and cost-effective satellite bus solutions. Furthermore, the progressive integration of artificial intelligence (AI) and machine learning (ML) into satellite design, operations, and data analysis promises to unlock entirely new avenues for market growth and enhance the capabilities of future satellite constellations.

Asia-Pacific Satellite Bus Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. GEO

- 3.2. LEO

- 3.3. MEO

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

Asia-Pacific Satellite Bus Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

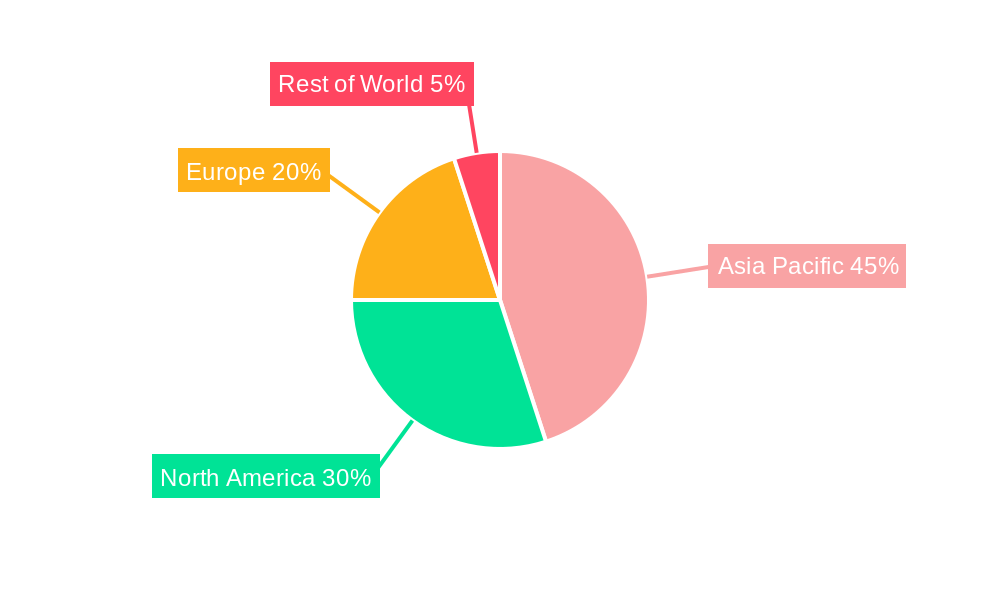

Asia-Pacific Satellite Bus Market Regional Market Share

Geographic Coverage of Asia-Pacific Satellite Bus Market

Asia-Pacific Satellite Bus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Satellite Bus Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. GEO

- 5.3.2. LEO

- 5.3.3. MEO

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NEC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Airbus SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ball Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nano Avionics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thale

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Northrop Grumman Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Indian Space Research Organisation (ISRO)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 NEC

List of Figures

- Figure 1: Asia-Pacific Satellite Bus Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Satellite Bus Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Satellite Bus Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Satellite Bus Market Revenue Million Forecast, by Satellite Mass 2020 & 2033

- Table 3: Asia-Pacific Satellite Bus Market Revenue Million Forecast, by Orbit Class 2020 & 2033

- Table 4: Asia-Pacific Satellite Bus Market Revenue Million Forecast, by End User 2020 & 2033

- Table 5: Asia-Pacific Satellite Bus Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Satellite Bus Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Satellite Bus Market Revenue Million Forecast, by Satellite Mass 2020 & 2033

- Table 8: Asia-Pacific Satellite Bus Market Revenue Million Forecast, by Orbit Class 2020 & 2033

- Table 9: Asia-Pacific Satellite Bus Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Asia-Pacific Satellite Bus Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Satellite Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Satellite Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Satellite Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Satellite Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Satellite Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Satellite Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Satellite Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Satellite Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Satellite Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Satellite Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Satellite Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Satellite Bus Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Satellite Bus Market?

The projected CAGR is approximately 4.96%.

2. Which companies are prominent players in the Asia-Pacific Satellite Bus Market?

Key companies in the market include NEC, Honeywell International Inc, Lockheed Martin Corporation, Airbus SE, Ball Corporation, Nano Avionics, Thale, Northrop Grumman Corporation, Indian Space Research Organisation (ISRO).

3. What are the main segments of the Asia-Pacific Satellite Bus Market?

The market segments include Application, Satellite Mass, Orbit Class, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2020: NanoAvionics expanded its presence in the United Kingdom by beginning operations at its new facility in Basingstoke for satellite assembly, integration, and testing (AIT), as well as sales, technical support, and R&D activities.July 2020: Thales Alenia Space signed a contract with SES to build SES-22 and SES-23, geostationary communications satellites. SES-22 and SES-23 are based on the proven Spacebus 4000 B2 platform and are 3.5-ton class satellites. These satellites are the 11th and 12th satellites based on the Spacebus 4000 B2 platform to be built by Thales Alenia Space.June 2020: NanoAvionics received a contract from Thales Alenia Space to build the initial two satellite buses for the satellite-based Internet of Things (IoT) infrastructure of Omnispace. The company will develop satellites based on M12P satellite buses for IoT and machine-to-machine (M2M) communications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Satellite Bus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Satellite Bus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Satellite Bus Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Satellite Bus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence