Key Insights

The Asia-Pacific small satellite industry is experiencing robust growth, driven by increasing demand for cost-effective Earth observation, communication, and navigation solutions. The region's burgeoning technological advancements, coupled with supportive government policies and a rising number of private sector players, are fueling this expansion. A Compound Annual Growth Rate (CAGR) of 5.18% from 2019 to 2024 suggests a significant market trajectory. While precise market size figures for 2025 are unavailable, extrapolation from the historical data and considering the current CAGR suggests a market value in the hundreds of millions of USD for the Asia-Pacific region in 2025. Key application segments driving this growth include Earth observation for environmental monitoring, precision agriculture, and disaster management; communication for internet of things (IoT) applications and remote connectivity; and navigation for autonomous systems and location-based services. The preference for smaller, more adaptable satellites is propelled by reduced launch costs and faster deployment capabilities. Furthermore, innovations in electric propulsion technology are enhancing the operational efficiency and longevity of these satellites, thereby improving their cost-effectiveness. However, challenges remain, including regulatory hurdles and the need for continued technological advancements to improve satellite performance and reliability.

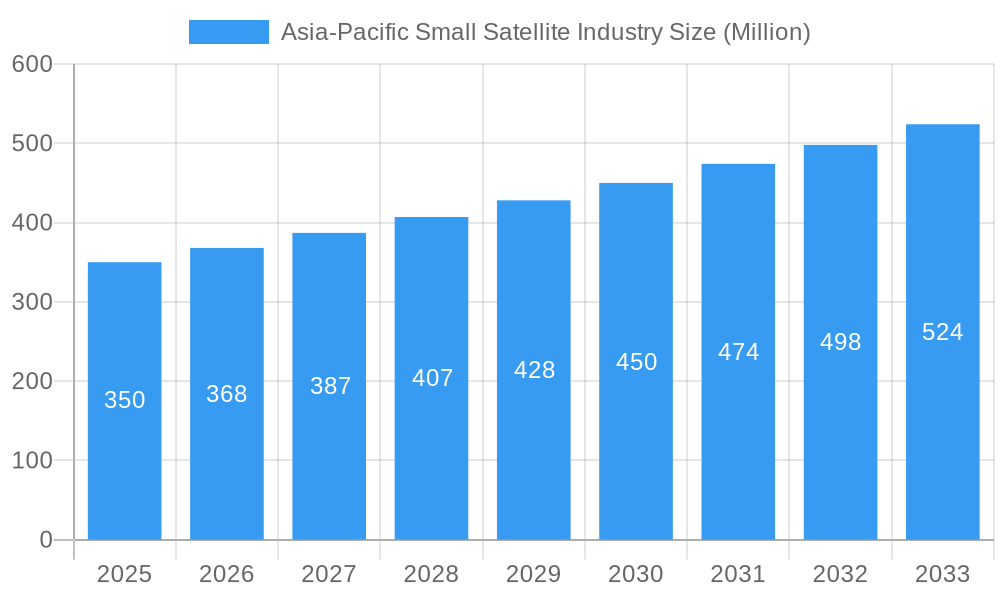

Asia-Pacific Small Satellite Industry Market Size (In Million)

The competitive landscape is characterized by a mix of established players like CASC and emerging companies like MinoSpace Technology and Axelspace Corporation, highlighting a dynamic and innovative market environment. Growth is particularly strong in countries such as China, Japan, India, and South Korea, where significant investments in space technology and a focus on indigenous capabilities are bolstering the industry. The diverse range of orbit classes utilized (GEO, LEO, MEO) underscores the versatility and adaptability of small satellites to cater to varied applications and geographical requirements. Looking ahead, the forecast period (2025-2033) is poised for continued expansion, driven by increasing private investment, technological breakthroughs in miniaturization and propulsion, and the growing adoption of small satellites across diverse sectors. Further market segmentation analysis, factoring in different propulsion technologies (electric, gas-based, liquid fuel) and end-user segments (commercial, military & government), would provide a more comprehensive understanding of market dynamics and opportunities.

Asia-Pacific Small Satellite Industry Company Market Share

Asia-Pacific Small Satellite Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the dynamic Asia-Pacific small satellite industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report delves into market size, segmentation, key players, technological advancements, and future growth projections. The report leverages extensive data analysis to offer a precise and actionable understanding of this rapidly evolving sector. Expect detailed breakdowns across key segments including LEO, GEO, and MEO orbits, focusing on applications like earth observation, communication, and navigation. The report is expected to show a market valuation of xx Million in 2025, projected to reach xx Million by 2033, representing a significant CAGR.

Asia-Pacific Small Satellite Industry Market Structure & Competitive Landscape

The Asia-Pacific small satellite industry presents a dynamic market structure, evolving from a moderately concentrated landscape to one increasingly characterized by diverse players. While established entities like the China Aerospace Science and Technology Corporation (CASC) maintain significant market share, a vibrant ecosystem of innovative startups and SMEs, including MinoSpace Technology and Axelspace Corporation, are rapidly gaining traction. This competitive landscape is further fueled by the proliferation of new entrants and niche players specializing in specific technologies or applications. While a precise Concentration Ratio (CR4) is difficult to definitively state due to the rapidly changing nature of the market, the industry exhibits a blend of established powerhouses and agile newcomers. Innovation is driven by several key factors: the decreasing cost of launch services (including rideshare opportunities), the ongoing miniaturization of satellite components and payloads, and the increasing accessibility of advanced technologies. Regulatory frameworks vary significantly across the region, but a general trend toward encouraging small satellite development, particularly in nations with ambitious space exploration goals, can be observed. While alternative technologies such as drone technologies exist, their capabilities are currently limited compared to space-based solutions, restricting their ability to serve as substantial substitutes.

End-user segmentation reveals a robust commercial sector, accounting for a significant majority (estimated at approximately [Insert updated percentage]%) of the market. Government and military applications follow, representing approximately [Insert updated percentage]%, with the remaining [Insert updated percentage]% attributed to other sectors, such as research and education. Mergers and acquisitions (M&A) activity has played, and will continue to play, a significant role in shaping this market. While precise figures for the 2019-2024 period are [Insert updated figures], a notable increase in M&A activity is anticipated during the forecast period, driven primarily by the consolidation of smaller companies by larger corporations seeking to expand their capabilities and market reach. Strategic partnerships and collaborations are also prominent, fostering technological advancements and market expansion. This collaborative environment further distinguishes the Asia-Pacific small satellite industry from some of its global counterparts.

- Market Concentration: [Insert updated CR4 or qualitative description, e.g., "Increasingly diverse with both large and small players"]

- M&A Activity (2019-2024): [Insert updated figures and value in appropriate currency]

- Key Innovation Drivers: Miniaturization, reduced launch costs, increased accessibility, technological advancements in propulsion and power systems, and growing availability of software-defined radios

- End-User Segmentation: Commercial ([Insert updated percentage]% ), Military & Government ([Insert updated percentage]% ), Other ([Insert updated percentage]%)

Asia-Pacific Small Satellite Industry Market Trends & Opportunities

The Asia-Pacific small satellite market is experiencing rapid growth, driven by increasing demand for high-resolution imagery, faster data transmission, and cost-effective space-based solutions. The market size is witnessing an impressive expansion, with a CAGR of xx% projected during the forecast period (2025-2033). This robust growth is fueled by several key trends: a significant shift toward miniaturized and standardized satellite platforms, reducing development time and cost; a surge in demand for earth observation data across various sectors, including agriculture, urban planning, and disaster management; and the increasing adoption of electric propulsion technologies, improving satellite lifespan and operational efficiency. Growing consumer preferences for high-quality data and real-time insights are driving the demand for sophisticated sensors and advanced data analytics capabilities. The competitive dynamics are characterized by intense innovation, with companies focusing on developing unique value propositions to stand out in a crowded market. Market penetration rates are increasing across different applications, fueled by both government initiatives and private investment. This surge in the adoption of small satellite technology across a range of sectors points towards a highly promising trajectory for the Asia-Pacific region. The report will offer a detailed breakdown of growth drivers, market segmentation, and competitive analysis across each segment, providing actionable strategic insights.

Dominant Markets & Segments in Asia-Pacific Small Satellite Industry

China holds a dominant position within the Asia-Pacific small satellite market, driven by substantial government investment in space exploration and technological innovation. India, Japan, and South Korea are also emerging as significant players. Within the application segments, Earth Observation currently leads, fueled by increased demand for data across various sectors. However, the Communication segment is expected to experience rapid growth.

- Leading Region/Country: China

- Dominant Application Segment: Earth Observation

- Fastest-Growing Application Segment: Communication

- Key Growth Drivers (China): Government funding, technological advancements, strong domestic industry

Growth Drivers by Segment:

- Earth Observation: Demand for high-resolution imagery across agriculture, urban planning, and disaster management. Rapid development in sensor technologies.

- Communication: Increased demand for broadband services, particularly in remote areas. The development of constellations for improved coverage.

- Navigation: Growing use of GNSS for precise location services and autonomous vehicles.

Asia-Pacific Small Satellite Industry Product Analysis

The Asia-Pacific small satellite industry showcases continuous product innovation, with a shift toward smaller, more modular designs. This modularity enhances flexibility, reduces development costs, and allows for quicker integration of advanced technologies like improved sensors and more efficient communication systems. The key competitive advantage lies in the ability to offer customized solutions for specific applications, including tailored payload configurations and data processing capabilities. These innovative approaches are directly impacting the market’s ability to meet the diverse and ever-growing demands of various sectors.

Key Drivers, Barriers & Challenges in Asia-Pacific Small Satellite Industry

Key Drivers:

- Technological advancements in miniaturization and propulsion systems, leading to lower costs and improved performance, including CubeSats and other standardized platforms.

- Growing demand for high-resolution Earth observation data for various commercial and governmental applications, such as precision agriculture, disaster response, and urban planning.

- Government initiatives and funding programs supporting space exploration and technological development, fostering a robust innovation ecosystem.

- Increased private sector investment and participation, driving innovation and commercial applications.

Challenges:

- Regulatory complexities and licensing requirements hindering market entry and expansion, especially for international collaborations.

- Supply chain disruptions causing delays in the production and launch of satellites, highlighting the need for resilient and diversified supply chains.

- Intense competition among industry players leading to price pressures and margin squeezes. The cost of launching satellites, while decreasing, remains a significant hurdle for many smaller companies.

- Securing skilled workforce and talent to support the rapid growth of the industry.

- Space debris mitigation and orbital management considerations.

Growth Drivers in the Asia-Pacific Small Satellite Industry Market

The Asia-Pacific small satellite industry's growth is propelled by a confluence of factors. Sustained government support, manifested in substantial funding for space programs and supportive regulatory frameworks, plays a crucial role. This is amplified by advancements in miniaturization and related technologies, which reduce costs and unlock new application possibilities. The increasing private sector involvement and commercialization of space technology are also significant accelerators of market expansion. The region's burgeoning tech sector and its established manufacturing capabilities are crucial supporting elements. The growing demand for data-driven services across various sectors further fuels this growth trajectory.

Challenges Impacting Asia-Pacific Small Satellite Industry Growth

The industry faces challenges related to supply chain vulnerabilities, particularly regarding critical components. Regulatory inconsistencies across different nations and the high cost of launch services can also stifle growth. Increased competition among numerous players poses significant pricing pressures and margin challenges.

Key Players Shaping the Asia-Pacific Small Satellite Industry Market

- MinoSpace Technology

- Axelspace Corporation

- Zhuhai Orbita Control Engineering

- China Aerospace Science and Technology Corporation (CASC)

- Chang Guang Satellite Technology Co Ltd

- Spacety Aerospace Co

- Guodian Gaoke

Significant Asia-Pacific Small Satellite Industry Industry Milestones

- February 2022: CASC launched 89 Jilin-1 optical imaging satellites (30-45 kg each). This mass launch demonstrated significant advancements in manufacturing and launch capabilities.

- March 2022: CASC successfully launched the Tiankun-2 satellites via the Long March 6A rocket. This marked a significant milestone for a new launch vehicle.

- March 2022: Guodian Gaoke's Tianqi 19 commercial data relay satellite launched using the Long March 8 rocket, furthering the commercialization of space technology.

Future Outlook for Asia-Pacific Small Satellite Industry Market

The Asia-Pacific small satellite market is poised for sustained robust growth, driven by a multitude of interconnected factors. Technological innovation, particularly in areas such as AI-powered image processing and advanced data analytics, will continue to be a primary growth engine. The increasing demand for data-driven services across various sectors – from agriculture and environmental monitoring to urban planning and disaster management – will create significant market opportunities. Supportive government policies and increased private sector investment will further fuel this expansion. The emergence of mega-constellations, while presenting both opportunities and challenges, will represent a major driver of future growth. Strategic partnerships and international collaborations will play an increasingly important role in shaping the industry landscape, fostering innovation and market expansion. The overall outlook remains overwhelmingly positive, with significant potential for both established players and new entrants.

Asia-Pacific Small Satellite Industry Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. End User

- 3.1. Commercial

- 3.2. Military & Government

- 3.3. Other

-

4. Propulsion Tech

- 4.1. Electric

- 4.2. Gas based

- 4.3. Liquid Fuel

Asia-Pacific Small Satellite Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Small Satellite Industry Regional Market Share

Geographic Coverage of Asia-Pacific Small Satellite Industry

Asia-Pacific Small Satellite Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Satellites that are being launched into LEO is driving the market demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Small Satellite Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Military & Government

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.4.1. Electric

- 5.4.2. Gas based

- 5.4.3. Liquid Fuel

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. China Asia-Pacific Small Satellite Industry Analysis, Insights and Forecast, 2020-2032

- 7. Japan Asia-Pacific Small Satellite Industry Analysis, Insights and Forecast, 2020-2032

- 8. India Asia-Pacific Small Satellite Industry Analysis, Insights and Forecast, 2020-2032

- 9. South Korea Asia-Pacific Small Satellite Industry Analysis, Insights and Forecast, 2020-2032

- 10. Taiwan Asia-Pacific Small Satellite Industry Analysis, Insights and Forecast, 2020-2032

- 11. Australia Asia-Pacific Small Satellite Industry Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Asia-Pacific Asia-Pacific Small Satellite Industry Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 MinoSpace Technology

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Axelspace Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Zhuhai Orbita Control Engineerin

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 China Aerospace Science and Technology Corporation (CASC)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Chang Guang Satellite Technology Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Spacety Aerospace Co

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Guodian Gaoke

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 MinoSpace Technology

List of Figures

- Figure 1: Asia-Pacific Small Satellite Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Small Satellite Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Small Satellite Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Asia-Pacific Small Satellite Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Small Satellite Industry Revenue Million Forecast, by Orbit Class 2020 & 2033

- Table 4: Asia-Pacific Small Satellite Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 5: Asia-Pacific Small Satellite Industry Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 6: Asia-Pacific Small Satellite Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Small Satellite Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: China Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Taiwan Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Asia-Pacific Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Small Satellite Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Asia-Pacific Small Satellite Industry Revenue Million Forecast, by Orbit Class 2020 & 2033

- Table 17: Asia-Pacific Small Satellite Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Asia-Pacific Small Satellite Industry Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 19: Asia-Pacific Small Satellite Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Australia Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: New Zealand Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Singapore Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Thailand Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Vietnam Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Philippines Asia-Pacific Small Satellite Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Small Satellite Industry?

The projected CAGR is approximately 5.18%.

2. Which companies are prominent players in the Asia-Pacific Small Satellite Industry?

Key companies in the market include MinoSpace Technology, Axelspace Corporation, Zhuhai Orbita Control Engineerin, China Aerospace Science and Technology Corporation (CASC), Chang Guang Satellite Technology Co Ltd, Spacety Aerospace Co, Guodian Gaoke.

3. What are the main segments of the Asia-Pacific Small Satellite Industry?

The market segments include Application, Orbit Class, End User, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Satellites that are being launched into LEO is driving the market demand.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2022: The China Aerospace Science and Technology Corporation successfully launched the Tiankun-2 satellites into a low-Earth polar orbit on the debut launch of the Long March 6A.March 2022: Guodian Gaoke's Tianqi 19 commercial data relay satellite was launched from the Long March 8 rocket.February 2022: A total of 89 Jilin-1 optical imaging satellites manufactured by CASC each weighing 30-45 kg were launched into orbit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Small Satellite Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Small Satellite Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Small Satellite Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Small Satellite Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence