Key Insights

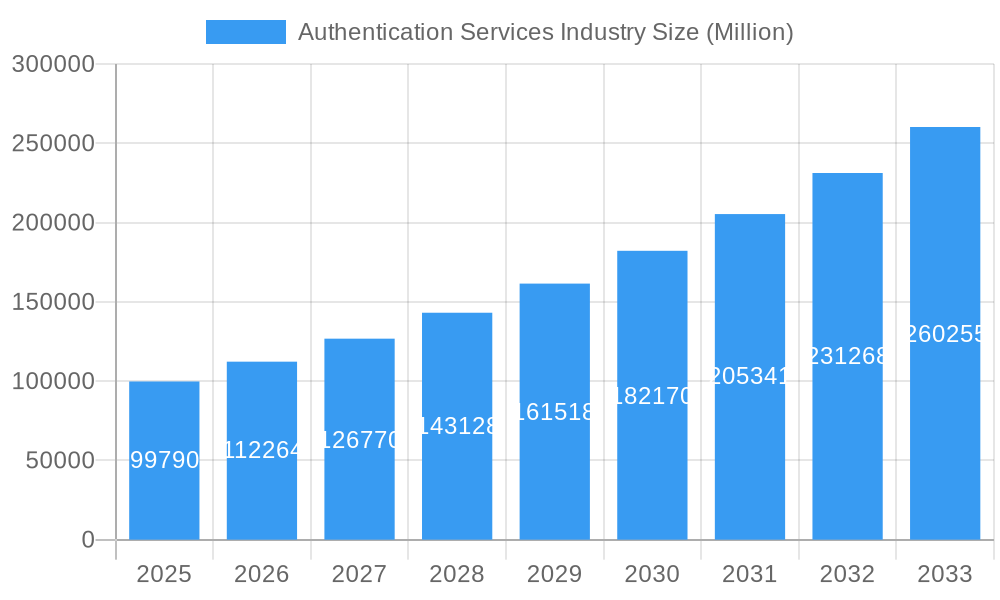

The global Authentication Services market is poised for substantial growth, projected to reach USD 99.79 billion by 2025, driven by a robust CAGR of 12.5% throughout the forecast period. This significant expansion is primarily fueled by the escalating need for robust cybersecurity measures across diverse industries. The increasing sophistication of cyber threats, coupled with the growing adoption of digital transformation initiatives, mandates advanced authentication solutions to protect sensitive data and ensure regulatory compliance. Key drivers include the rising prevalence of data breaches, stringent data privacy regulations such as GDPR and CCPA, and the growing demand for secure remote access solutions, especially in the wake of widespread remote work trends. The IT and Telecommunications, BFSI, and Government & Defense sectors are leading the charge in adopting these services, recognizing the critical role of secure authentication in maintaining operational integrity and customer trust.

Authentication Services Industry Market Size (In Billion)

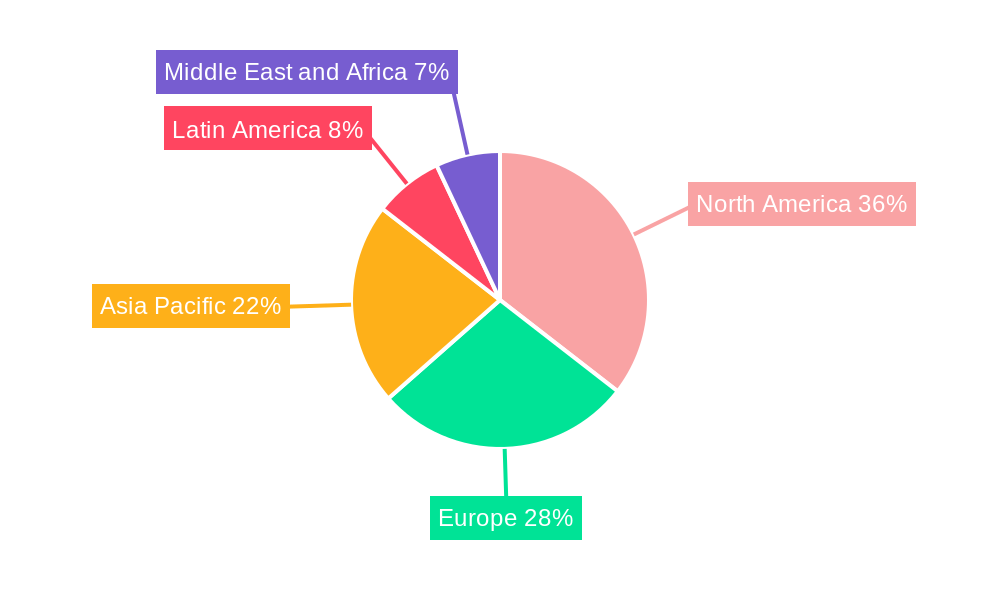

The market is segmented by Authentication Type, with Multi-Factor Authentication (MFA) emerging as a dominant segment due to its enhanced security capabilities compared to Single-Factor Authentication. In terms of Service Type, Compliance Management and Managed Public Key Infrastructure (PKI) are gaining significant traction as organizations grapple with complex regulatory landscapes and the need for secure digital identity management. While the market presents immense opportunities, certain restraints such as the high cost of implementation for some advanced solutions and the perceived complexity of integration may pose challenges. However, ongoing technological advancements and the increasing availability of cloud-based, cost-effective solutions are expected to mitigate these restraints. Geographically, North America and Europe are currently leading the market, but the Asia Pacific region is anticipated to witness the fastest growth due to its rapidly expanding digital economy and increasing cybersecurity awareness.

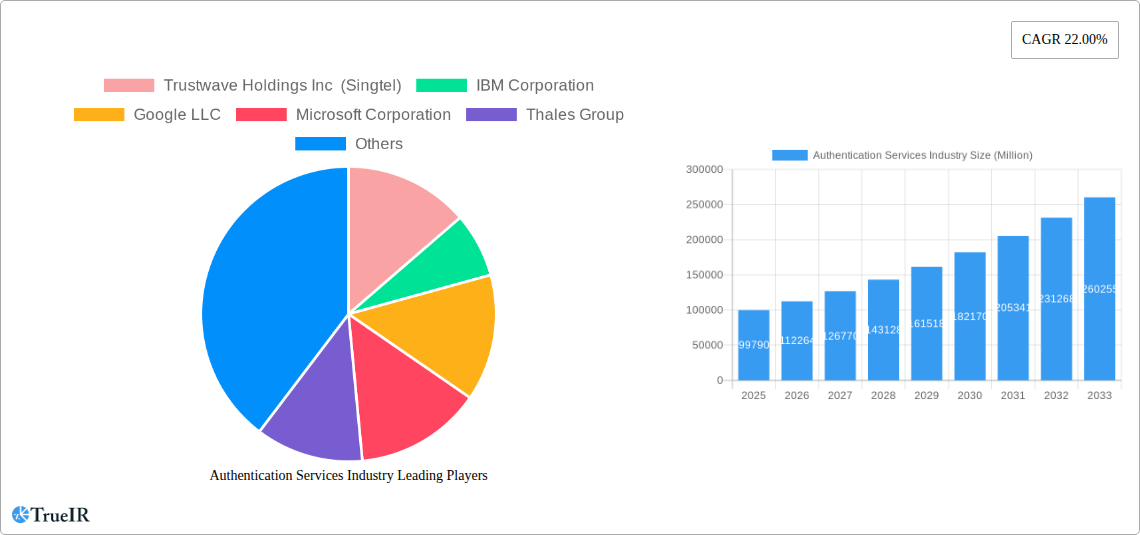

Authentication Services Industry Company Market Share

Here's the SEO-optimized report description for the Authentication Services Industry, incorporating all your requirements:

This comprehensive report offers an in-depth analysis of the global Authentication Services market, providing critical insights into its structure, trends, opportunities, and future outlook. Covering the historical period from 2019 to 2024, the base year of 2025, and an extensive forecast period up to 2033, this study is an indispensable resource for stakeholders seeking to understand the dynamics of this rapidly evolving sector. With an estimated market size projected to reach billions, the report delves into the intricate factors influencing growth, competitive strategies, and emerging innovations.

Authentication Services Industry Market Structure & Competitive Landscape

The Authentication Services industry is characterized by a moderate to high market concentration, with leading players like IBM Corporation, Google LLC, Microsoft Corporation, and Okta Inc. driving innovation and market share. The study period of 2019–2033 reveals a dynamic competitive landscape shaped by technological advancements and an increasing demand for robust security solutions. Innovation drivers include the escalating threat landscape, the growing adoption of cloud-based services, and the need for seamless user experiences. Regulatory impacts, such as data privacy laws and compliance mandates, are also significant influencers, compelling organizations to invest in advanced authentication mechanisms. Product substitutes, while present in the form of basic password systems, are increasingly being superseded by more sophisticated solutions. End-user segmentation highlights the dominance of the IT and Telecommunications sector, followed closely by BFSI and Government & Defense, underscoring the criticality of secure authentication across industries. Mergers and acquisitions (M&A) trends are notable, with companies like Trustwave Holdings Inc (Singtel) and CA Technology Inc (Broadcom Inc) actively participating in consolidation to expand their service portfolios and market reach. M&A volumes are projected to remain substantial throughout the forecast period as companies seek strategic advantages and economies of scale.

Authentication Services Industry Market Trends & Opportunities

The global Authentication Services market is poised for substantial growth, with an anticipated Compound Annual Growth Rate (CAGR) that will propel its valuation into the billions by 2033. This expansion is fueled by a confluence of evolving technological landscapes and shifting consumer preferences towards secure and convenient digital interactions. The proliferation of cloud computing, the rise of the Internet of Things (IoT), and the increasing adoption of remote work models are fundamental drivers, necessitating robust identity and access management solutions. Multi-Factor Authentication (MFA) is no longer a niche offering but a critical requirement, experiencing exponential adoption rates across all end-user industries. Single Factor Authentication, while still prevalent in legacy systems, is progressively being phased out in favor of more secure alternatives.

Consumer preferences are increasingly leaning towards seamless, passwordless authentication experiences, driving innovation in biometrics, behavioral analytics, and secure hardware tokens. This shift presents significant opportunities for service providers who can deliver user-friendly yet highly secure authentication solutions. The competitive dynamics are intensifying, with established technology giants, specialized identity and access management (IAM) vendors, and emerging startups vying for market share. Strategic partnerships and acquisitions are becoming increasingly common as companies aim to broaden their technological capabilities and customer bases.

Furthermore, the growing emphasis on data privacy and regulatory compliance, such as GDPR and CCPA, mandates stringent authentication protocols, creating a continuous demand for advanced services like Compliance Management and Managed Public Key Infrastructure (PKI). The "Other Service Types" segment, encompassing areas like subscription key management and identity governance, is also witnessing significant development and uptake. The IT and Telecommunications sector continues to lead in adoption, followed by the BFSI, Government & Defense, and Healthcare industries, each with unique authentication requirements and security challenges. The "Other End-user Industries" are also beginning to recognize the indispensable role of secure authentication in their digital transformation journeys.

Dominant Markets & Segments in Authentication Services Industry

The Authentication Services industry exhibits a clear dominance in Multi Factor Authentication (MFA), a segment projected to witness the highest growth and market penetration throughout the forecast period (2025–2033). This dominance is driven by the escalating sophistication of cyber threats and the imperative for organizations to implement layered security measures beyond basic password protection. The IT and Telecommunications end-user industry stands as the leading market for authentication services, owing to the inherent digital nature of its operations and the vast amounts of sensitive data it handles. High growth drivers within this segment include the pervasive adoption of cloud infrastructure, the rapid expansion of 5G networks, and the increasing reliance on remote access for IT professionals.

Within service types, Compliance Management and Managed Public Key Infrastructure (PKI) are critical growth areas, particularly within the BFSI and Government & Defense sectors. Stringent regulatory frameworks and the need for secure transaction processing and national security necessitate robust PKI solutions and comprehensive compliance adherence. For BFSI, key growth drivers include the need to secure online banking, protect financial transactions, and meet evolving KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. In Government & Defense, the focus is on securing critical infrastructure, protecting classified information, and ensuring the authenticity of digital identities for national security purposes.

The Healthcare industry is also emerging as a significant growth market, driven by the digitization of patient records (Electronic Health Records - EHRs) and the increasing demand for secure remote patient monitoring and telehealth services. Key growth drivers here include HIPAA compliance, the need to protect sensitive patient data, and the adoption of IoT devices for healthcare applications. The "Other End-user Industries," encompassing retail, education, and manufacturing, are also increasingly investing in authentication services as they undergo digital transformation and face similar security threats. Overall, the global adoption of advanced authentication solutions is propelled by overarching policies emphasizing cybersecurity, economic incentives for digital innovation, and the continuous evolution of threat landscapes.

Authentication Services Industry Product Analysis

Product innovations in the Authentication Services industry are heavily focused on enhancing security, improving user experience, and enabling seamless integration across diverse digital platforms. Advancements in biometric technologies, including facial recognition, fingerprint scanning, and behavioral biometrics, are offering more secure and convenient alternatives to traditional passwords. Passwordless authentication solutions, leveraging FIDO standards and secure element technologies, are gaining significant traction, reducing the risk of credential theft and phishing attacks. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) into authentication platforms allows for real-time risk assessment and anomaly detection, providing a dynamic layer of security. Competitive advantages are derived from the ability to offer a unified identity management framework, support for a wide range of authentication factors, and robust compliance features.

Key Drivers, Barriers & Challenges in Authentication Services Industry

Key Drivers: The primary forces propelling the Authentication Services market are the ever-increasing sophistication of cyber threats and the growing global emphasis on data security and privacy. Technological advancements, such as the widespread adoption of cloud computing and mobile devices, necessitate robust identity verification. Regulatory mandates like GDPR and CCPA are compelling organizations to invest in advanced authentication solutions. Economic drivers include the need for business continuity and the protection of revenue streams against cyberattacks.

Barriers & Challenges: Supply chain issues can impact the availability of hardware-based authentication tokens. Regulatory hurdles, while driving adoption, also present complexities in implementation and ongoing compliance management. Competitive pressures are intense, with numerous vendors offering overlapping solutions, leading to price sensitivity in certain market segments. Furthermore, the challenge of effectively migrating legacy systems to modern authentication protocols and ensuring user adoption of new security measures can hinder growth.

Growth Drivers in the Authentication Services Industry Market

The Authentication Services market is propelled by several key growth drivers. Technologically, the rapid expansion of cloud adoption and the proliferation of connected devices (IoT) create an urgent need for scalable and secure identity management. Economically, the increasing frequency and financial impact of cyberattacks incentivize businesses to invest proactively in robust authentication to protect assets and maintain customer trust. Regulatory landscapes are also a significant catalyst; governments worldwide are implementing stricter data protection laws, mandating advanced authentication measures to safeguard sensitive information and ensure compliance. The growing trend towards remote work further amplifies the demand for secure remote access authentication solutions, making it a critical growth factor.

Challenges Impacting Authentication Services Industry Growth

Despite robust growth, the Authentication Services industry faces several challenges. Regulatory complexities, while driving demand, can also create significant implementation hurdles and ongoing compliance burdens for businesses operating across multiple jurisdictions. Supply chain disruptions, particularly for hardware-based authentication factors, can impact product availability and increase lead times. Intense competitive pressures from a crowded market lead to price erosion and necessitate continuous innovation to maintain differentiation. Furthermore, user resistance to adopting new authentication methods and the significant cost and effort involved in migrating from legacy systems remain considerable barriers to widespread, rapid adoption.

Key Players Shaping the Authentication Services Industry Market

- Trustwave Holdings Inc (Singtel)

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Thales Group

- Tata Communications

- OneLogin Inc

- CA Technology Inc (Broadcom Inc)

- Okta Inc

- Entrust Datacard Corporation

Significant Authentication Services Industry Industry Milestones

- 2020: Widespread adoption of Multi-Factor Authentication (MFA) surges due to increased remote work and phishing attacks.

- 2021: Rise in passwordless authentication solutions, including FIDO2 adoption and biometric advancements.

- 2022: Increased focus on Zero Trust security architectures, heavily reliant on continuous authentication.

- 2023: Growing integration of AI and Machine Learning for advanced threat detection in authentication processes.

- 2024: Key mergers and acquisitions in the identity and access management space, consolidating market players.

Future Outlook for Authentication Services Industry Market

The future outlook for the Authentication Services industry is exceptionally bright, driven by an insatiable demand for robust digital security and seamless user experiences. Emerging growth catalysts include the continued expansion of AI-powered adaptive authentication, which dynamically adjusts security based on real-time risk factors, and the widespread adoption of decentralized identity solutions. The ongoing digital transformation across all sectors will further solidify the foundational role of secure authentication. Strategic opportunities lie in developing integrated identity platforms that span the entire user lifecycle and in catering to the unique authentication needs of emerging technologies like the metaverse and advanced IoT ecosystems. The market is projected to see sustained, high-value growth, becoming an indispensable component of the global digital infrastructure.

Authentication Services Industry Segmentation

-

1. Authentication Type

- 1.1. Single Factor Authentication

- 1.2. Multi Factor Authentication

-

2. Service Type

- 2.1. Compliance Management

- 2.2. Managed Public Key Infrastructure (PKI)

- 2.3. Subscription Keys Management

- 2.4. Other Service Types

-

3. End-user Industry

- 3.1. IT and Telecommunications

- 3.2. BFSI

- 3.3. Government & Defense

- 3.4. Healthcare

- 3.5. Other End-user Industries

Authentication Services Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Authentication Services Industry Regional Market Share

Geographic Coverage of Authentication Services Industry

Authentication Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in the Number of Digital Identities; Authentication Needed for Security Compliances and Regulations; Growing Adoption of Bring Your Own Device (BYOD)

- 3.3. Market Restrains

- 3.3.1. ; High Cost Involved with Matured Authentication Methods

- 3.4. Market Trends

- 3.4.1. Multi Factor Authentication is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Authentication Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Authentication Type

- 5.1.1. Single Factor Authentication

- 5.1.2. Multi Factor Authentication

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Compliance Management

- 5.2.2. Managed Public Key Infrastructure (PKI)

- 5.2.3. Subscription Keys Management

- 5.2.4. Other Service Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Telecommunications

- 5.3.2. BFSI

- 5.3.3. Government & Defense

- 5.3.4. Healthcare

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Authentication Type

- 6. North America Authentication Services Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Authentication Type

- 6.1.1. Single Factor Authentication

- 6.1.2. Multi Factor Authentication

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Compliance Management

- 6.2.2. Managed Public Key Infrastructure (PKI)

- 6.2.3. Subscription Keys Management

- 6.2.4. Other Service Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. IT and Telecommunications

- 6.3.2. BFSI

- 6.3.3. Government & Defense

- 6.3.4. Healthcare

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Authentication Type

- 7. Europe Authentication Services Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Authentication Type

- 7.1.1. Single Factor Authentication

- 7.1.2. Multi Factor Authentication

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Compliance Management

- 7.2.2. Managed Public Key Infrastructure (PKI)

- 7.2.3. Subscription Keys Management

- 7.2.4. Other Service Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. IT and Telecommunications

- 7.3.2. BFSI

- 7.3.3. Government & Defense

- 7.3.4. Healthcare

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Authentication Type

- 8. Asia Pacific Authentication Services Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Authentication Type

- 8.1.1. Single Factor Authentication

- 8.1.2. Multi Factor Authentication

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Compliance Management

- 8.2.2. Managed Public Key Infrastructure (PKI)

- 8.2.3. Subscription Keys Management

- 8.2.4. Other Service Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. IT and Telecommunications

- 8.3.2. BFSI

- 8.3.3. Government & Defense

- 8.3.4. Healthcare

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Authentication Type

- 9. Latin America Authentication Services Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Authentication Type

- 9.1.1. Single Factor Authentication

- 9.1.2. Multi Factor Authentication

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Compliance Management

- 9.2.2. Managed Public Key Infrastructure (PKI)

- 9.2.3. Subscription Keys Management

- 9.2.4. Other Service Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. IT and Telecommunications

- 9.3.2. BFSI

- 9.3.3. Government & Defense

- 9.3.4. Healthcare

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Authentication Type

- 10. Middle East and Africa Authentication Services Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Authentication Type

- 10.1.1. Single Factor Authentication

- 10.1.2. Multi Factor Authentication

- 10.2. Market Analysis, Insights and Forecast - by Service Type

- 10.2.1. Compliance Management

- 10.2.2. Managed Public Key Infrastructure (PKI)

- 10.2.3. Subscription Keys Management

- 10.2.4. Other Service Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. IT and Telecommunications

- 10.3.2. BFSI

- 10.3.3. Government & Defense

- 10.3.4. Healthcare

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Authentication Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Trustwave Holdings Inc (Singtel)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Google LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Microsoft Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Thales Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tata Communications

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OneLogin Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CA Technology Inc (Broadcom Inc )

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Okta Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Entrust Datacard Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Trustwave Holdings Inc (Singtel)

List of Figures

- Figure 1: Global Authentication Services Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Authentication Services Industry Revenue (undefined), by Authentication Type 2025 & 2033

- Figure 3: North America Authentication Services Industry Revenue Share (%), by Authentication Type 2025 & 2033

- Figure 4: North America Authentication Services Industry Revenue (undefined), by Service Type 2025 & 2033

- Figure 5: North America Authentication Services Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Authentication Services Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: North America Authentication Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Authentication Services Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Authentication Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Authentication Services Industry Revenue (undefined), by Authentication Type 2025 & 2033

- Figure 11: Europe Authentication Services Industry Revenue Share (%), by Authentication Type 2025 & 2033

- Figure 12: Europe Authentication Services Industry Revenue (undefined), by Service Type 2025 & 2033

- Figure 13: Europe Authentication Services Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 14: Europe Authentication Services Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: Europe Authentication Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Authentication Services Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Authentication Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Authentication Services Industry Revenue (undefined), by Authentication Type 2025 & 2033

- Figure 19: Asia Pacific Authentication Services Industry Revenue Share (%), by Authentication Type 2025 & 2033

- Figure 20: Asia Pacific Authentication Services Industry Revenue (undefined), by Service Type 2025 & 2033

- Figure 21: Asia Pacific Authentication Services Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Asia Pacific Authentication Services Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Authentication Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Authentication Services Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Authentication Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Authentication Services Industry Revenue (undefined), by Authentication Type 2025 & 2033

- Figure 27: Latin America Authentication Services Industry Revenue Share (%), by Authentication Type 2025 & 2033

- Figure 28: Latin America Authentication Services Industry Revenue (undefined), by Service Type 2025 & 2033

- Figure 29: Latin America Authentication Services Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 30: Latin America Authentication Services Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: Latin America Authentication Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Authentication Services Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Authentication Services Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Authentication Services Industry Revenue (undefined), by Authentication Type 2025 & 2033

- Figure 35: Middle East and Africa Authentication Services Industry Revenue Share (%), by Authentication Type 2025 & 2033

- Figure 36: Middle East and Africa Authentication Services Industry Revenue (undefined), by Service Type 2025 & 2033

- Figure 37: Middle East and Africa Authentication Services Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 38: Middle East and Africa Authentication Services Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Authentication Services Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Authentication Services Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Authentication Services Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Authentication Services Industry Revenue undefined Forecast, by Authentication Type 2020 & 2033

- Table 2: Global Authentication Services Industry Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 3: Global Authentication Services Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Authentication Services Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Authentication Services Industry Revenue undefined Forecast, by Authentication Type 2020 & 2033

- Table 6: Global Authentication Services Industry Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 7: Global Authentication Services Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Authentication Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Authentication Services Industry Revenue undefined Forecast, by Authentication Type 2020 & 2033

- Table 10: Global Authentication Services Industry Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 11: Global Authentication Services Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Authentication Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Authentication Services Industry Revenue undefined Forecast, by Authentication Type 2020 & 2033

- Table 14: Global Authentication Services Industry Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 15: Global Authentication Services Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Authentication Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Authentication Services Industry Revenue undefined Forecast, by Authentication Type 2020 & 2033

- Table 18: Global Authentication Services Industry Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 19: Global Authentication Services Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Authentication Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Authentication Services Industry Revenue undefined Forecast, by Authentication Type 2020 & 2033

- Table 22: Global Authentication Services Industry Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 23: Global Authentication Services Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Authentication Services Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Authentication Services Industry?

The projected CAGR is approximately 12.5%.

2. Which companies are prominent players in the Authentication Services Industry?

Key companies in the market include Trustwave Holdings Inc (Singtel), IBM Corporation, Google LLC, Microsoft Corporation, Thales Group, Tata Communications, OneLogin Inc, CA Technology Inc (Broadcom Inc ), Okta Inc, Entrust Datacard Corporation.

3. What are the main segments of the Authentication Services Industry?

The market segments include Authentication Type, Service Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growth in the Number of Digital Identities; Authentication Needed for Security Compliances and Regulations; Growing Adoption of Bring Your Own Device (BYOD).

6. What are the notable trends driving market growth?

Multi Factor Authentication is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; High Cost Involved with Matured Authentication Methods.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Authentication Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Authentication Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Authentication Services Industry?

To stay informed about further developments, trends, and reports in the Authentication Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence