Key Insights

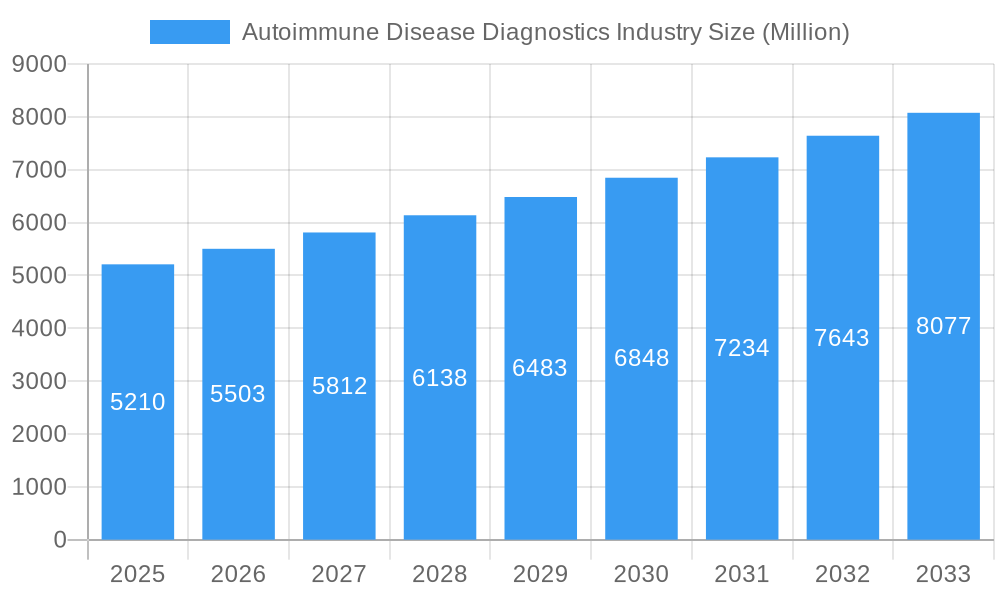

The global Autoimmune Disease Diagnostics market is poised for significant expansion, with an estimated market size of $5.21 billion in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 5.60% through 2033. This growth trajectory is primarily fueled by an increasing global prevalence of autoimmune disorders, driven by a confluence of genetic predispositions, environmental triggers, and evolving lifestyle factors. Enhanced awareness among both patients and healthcare professionals regarding early detection and management of these chronic conditions is a critical driver. Furthermore, advancements in diagnostic technologies, including the development of more sensitive and specific autoantibody tests and multiplex assays, are enabling earlier and more accurate diagnoses, thereby expanding the addressable market. The increasing focus on personalized medicine and the growing demand for targeted therapies further bolster the need for precise diagnostic tools.

Autoimmune Disease Diagnostics Industry Market Size (In Billion)

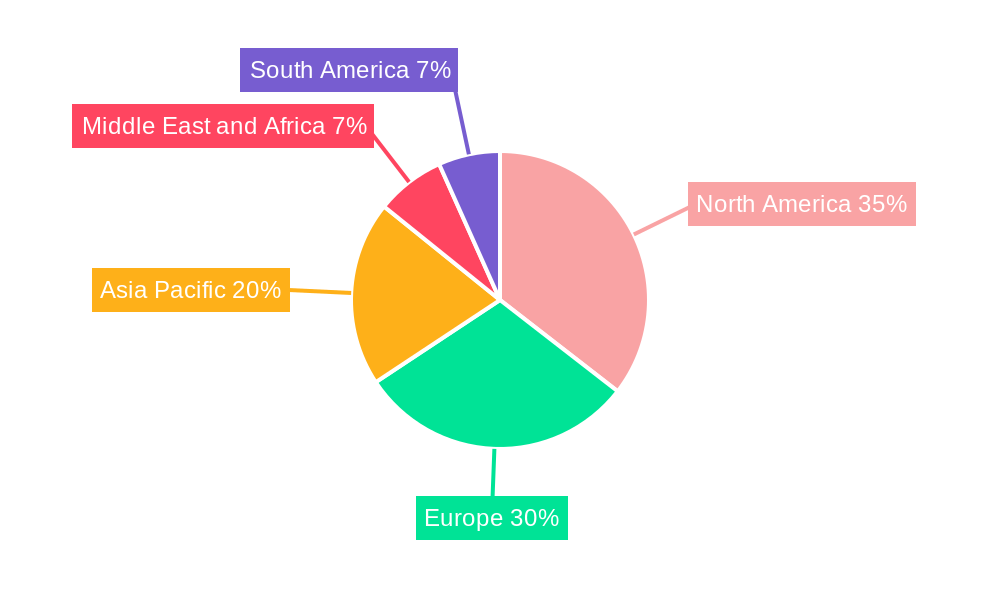

The market segmentation reveals a dynamic landscape. Systemic autoimmune diseases, such as Rheumatoid Arthritis, Psoriasis, and Systemic Lupus Erythematosus (SLE), represent a substantial segment due to their widespread impact. Similarly, localized autoimmune diseases like Inflammatory Bowel Disease and Type 1 Diabetes also contribute significantly to market demand. Within diagnostic methods, Antinuclear Antibody (ANA) tests and other autoantibody tests are foundational, while Complete Blood Count (CBC) and C-reactive Protein (CRP) assays play crucial roles in monitoring inflammation and disease activity. North America is anticipated to maintain a leading position in market share, owing to its well-established healthcare infrastructure, high R&D investments, and a greater incidence of autoimmune diseases. However, the Asia Pacific region is expected to witness the fastest growth, driven by a burgeoning patient population, improving healthcare access, and increasing adoption of advanced diagnostic techniques.

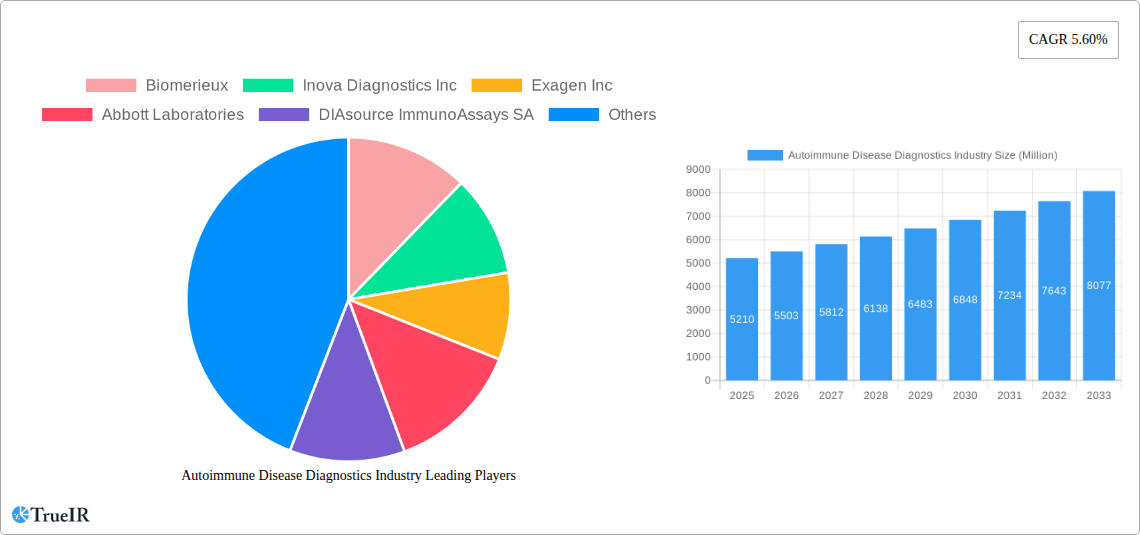

Autoimmune Disease Diagnostics Industry Company Market Share

This comprehensive report delves into the dynamic Autoimmune Disease Diagnostics market, providing an in-depth analysis of its current landscape, future trajectory, and key growth drivers. With a study period spanning from 2019 to 2033, and a base year of 2025, this report offers actionable insights for stakeholders navigating this rapidly evolving sector. The global autoimmune disease diagnostics market is projected to reach $XX Million by 2033, exhibiting a robust CAGR of XX% during the forecast period (2025–2033).

Autoimmune Disease Diagnostics Industry Market Structure & Competitive Landscape

The Autoimmune Disease Diagnostics industry is characterized by a moderately concentrated market structure, with a blend of large, established players and emerging innovators. Key innovation drivers include advancements in molecular diagnostics, biomarker discovery, and the increasing adoption of automated testing platforms. Regulatory frameworks, while crucial for ensuring patient safety and diagnostic accuracy, also present a significant influence on market entry and product development. The availability of interchangeable product substitutes, particularly for broadly indicative tests, necessitates a focus on assay specificity and sensitivity for differentiated offerings. End-user segmentation primarily involves hospitals, diagnostic laboratories, and research institutions, each with distinct purchasing patterns and technological adoption rates. Mergers and acquisitions (M&A) are active trends, with companies strategically acquiring complementary technologies and expanding their geographical reach. Over the historical period (2019–2024), there have been approximately XX M&A deals valued at over $XX Million. Concentration ratios, particularly among top-tier diagnostic companies, stand at approximately XX% for the top five players, highlighting the competitive intensity.

Autoimmune Disease Diagnostics Industry Market Trends & Opportunities

The autoimmune disease diagnostics market is experiencing sustained growth, propelled by an increasing prevalence of autoimmune conditions globally, coupled with rising awareness and improved diagnostic capabilities. Market size is projected to expand significantly, driven by an estimated XX% annual growth rate in the demand for advanced diagnostic solutions. Technological shifts are a cornerstone of this expansion, with a pronounced trend towards the development and adoption of highly specific and sensitive immunoassay techniques, multiplex assays, and next-generation sequencing for genetic predisposition identification. The integration of artificial intelligence (AI) and machine learning (ML) in diagnostic algorithms promises to enhance diagnostic accuracy and personalize treatment pathways. Consumer preferences are increasingly leaning towards non-invasive and minimally invasive diagnostic methods, along with faster turnaround times and more accessible testing options, especially in point-of-care settings. Competitive dynamics are intensifying, with companies investing heavily in R&D to develop novel biomarkers and refine existing diagnostic platforms. The market penetration rate for advanced autoimmune diagnostic tests is currently estimated at XX%, with substantial room for growth as awareness and accessibility increase.

Dominant Markets & Segments in Autoimmune Disease Diagnostics Industry

Systemic Autoimmune Disease dominates the autoimmune disease diagnostics market, driven by the high incidence and complex nature of conditions like Rheumatoid Arthritis, Psoriasis, Systemic Lupus Erythematosus (SLE), and Multiple Sclerosis.

- Rheumatoid Arthritis: The substantial patient population and the need for early and accurate diagnosis to prevent joint damage make Rheumatoid Arthritis a key market driver. Advancements in serological markers and imaging techniques are crucial.

- Psoriasis: The growing understanding of the immune system's role in Psoriasis and the development of targeted therapies necessitate precise diagnostic tools to monitor disease activity and treatment response.

- Systemic Lupus Erythematosus (SLE): The multi-organ involvement and fluctuating nature of SLE require comprehensive diagnostic panels and sophisticated monitoring techniques.

- Multiple Sclerosis: Early detection and disease progression monitoring in MS are heavily reliant on advanced neurological and immunological diagnostics, including cerebrospinal fluid analysis and MRI compatibility.

Within Localized Autoimmune Diseases, Thyroid-related autoimmune disorders, including Hashimoto's thyroiditis and Graves' disease, represent a significant segment due to their widespread prevalence. Inflammatory Bowel Disease (IBD) and Type 1 Diabetes also contribute to market growth, with increasing diagnostic sophistication enhancing patient outcomes.

In terms of diagnostic methods, Autoantibody Tests are the most significant segment, forming the backbone of autoimmune disease diagnosis.

- Antinuclear Antibody (ANA) Tests: As a primary screening tool for a broad spectrum of autoimmune diseases, ANA testing holds substantial market share.

- Autoantibody Tests (Specific): The development of highly specific autoantibody assays targeting individual autoimmune diseases (e.g., anti-CCP for RA, anti-dsDNA for SLE) is critical for differential diagnosis and disease subtyping.

- Complete Blood Count (CBC), C-reactive Protein (CRP), and Urinalysis: These are crucial complementary tests that aid in assessing inflammation and organ involvement, contributing to a holistic diagnostic approach.

North America currently holds the largest market share, estimated at XX% of the global market, owing to a well-established healthcare infrastructure, high disposable incomes, and a strong focus on research and development.

Autoimmune Disease Diagnostics Industry Product Analysis

The autoimmune disease diagnostics product landscape is defined by continuous innovation aimed at improving sensitivity, specificity, and speed. Current product offerings include a wide array of immunoassay kits, molecular diagnostic platforms, and automated analyzers. Technological advancements are leading to the development of multiplex assay panels that can simultaneously detect multiple autoantibodies, significantly reducing testing time and cost while increasing diagnostic efficiency. Applications range from early disease detection and differential diagnosis to monitoring treatment efficacy and predicting disease prognosis. The competitive advantage lies in products that offer superior analytical performance, user-friendly interfaces, and seamless integration into existing laboratory workflows.

Key Drivers, Barriers & Challenges in Autoimmune Disease Diagnostics Industry

Key Drivers:

- Increasing Prevalence of Autoimmune Diseases: A growing global population and improved diagnostic capabilities are leading to a higher reported incidence of autoimmune disorders.

- Technological Advancements: Innovations in immunoassay technologies, molecular diagnostics, and bioinformatics are enhancing diagnostic accuracy and expanding the scope of detectable biomarkers.

- Growing Healthcare Expenditure: Increased investment in healthcare infrastructure and diagnostic services globally supports market growth.

- Demand for Early and Precise Diagnosis: The need for timely intervention to manage chronic autoimmune conditions drives demand for sophisticated diagnostic solutions.

Barriers & Challenges:

- High Cost of Advanced Diagnostic Technologies: The significant investment required for sophisticated equipment and specialized reagents can be a barrier for some healthcare providers.

- Complex Regulatory Landscape: Navigating stringent regulatory approvals for new diagnostic tests can be time-consuming and costly.

- Reimbursement Policies: Inconsistent or inadequate reimbursement policies for certain autoimmune diagnostic tests can impact market adoption.

- Skilled Workforce Shortage: A lack of trained professionals to operate and interpret advanced diagnostic platforms poses a challenge.

- Supply Chain Disruptions: Geopolitical events and global health crises can lead to interruptions in the supply of essential reagents and consumables, impacting diagnostic workflow.

Growth Drivers in the Autoimmune Disease Diagnostics Industry Market

Key growth drivers for the autoimmune disease diagnostics market include the relentless pursuit of technological innovation, leading to more accurate and efficient diagnostic tools. Economically, increasing healthcare expenditure and rising disposable incomes in emerging economies are fueling demand for advanced diagnostics. Policy-driven factors, such as government initiatives promoting early disease detection and improved patient outcomes, also play a crucial role. For instance, the focus on precision medicine is encouraging the development of targeted diagnostic panels for personalized treatment strategies in autoimmune diseases.

Challenges Impacting Autoimmune Disease Diagnostics Industry Growth

Regulatory complexities, particularly the stringent approval processes for novel diagnostic assays, present a significant barrier. Supply chain issues, as witnessed during recent global events, can disrupt the availability of critical reagents and consumables, impacting diagnostic capabilities. Competitive pressures, with a growing number of players vying for market share, also necessitate continuous innovation and cost-efficiency. For example, the development of rapid point-of-care tests for autoimmune markers faces challenges related to maintaining analytical performance while ensuring affordability and accessibility.

Key Players Shaping the Autoimmune Disease Diagnostics Industry Market

- Biomerieux

- Inova Diagnostics Inc

- Exagen Inc

- Abbott Laboratories

- DIAsource ImmunoAssays SA

- Euroimmun AG

- Siemens Healthineers Inc

- Grifols S A

- Bio-rad Laboratories

- Myriad Genetics

- R-Biopharm AG

- F Hoffmann-la Roche

- Thermo Fisher Scientific

- Trinity Biotech

Significant Autoimmune Disease Diagnostics Industry Industry Milestones

- August 2022: KSL Beutner Laboratories (Beutner) launched a blood test to detect an antigen linked with the autoimmune blistering disease mucous membrane pemphigoid (MMP), which often causes painful lesions in the oral cavity. This launch addresses a critical unmet need in the diagnosis of rare autoimmune dermatological conditions.

- May 2022: The new Phadia 2500+ series of instruments by Thermo Fisher Scientific became available for autoimmune testing in the United States. This series offers reliable and unparalleled high throughput for both allergy diagnostics and autoimmune testing, enhancing laboratory efficiency and capacity.

Future Outlook for Autoimmune Disease Diagnostics Industry Market

The future outlook for the autoimmune disease diagnostics market is exceptionally bright, characterized by sustained growth driven by several key catalysts. The ongoing expansion of personalized medicine initiatives will further propel the demand for highly specific and prognostically valuable diagnostic tests. Strategic opportunities lie in the development of novel, less invasive diagnostic modalities, such as liquid biopsies, and the integration of advanced AI-powered analytical platforms to interpret complex data sets. Market potential will be realized through increased accessibility of diagnostic services in underserved regions and the development of cost-effective solutions for a wider patient demographic. The focus will continue to be on early detection, precise subtyping of autoimmune diseases, and improved monitoring for better patient management and outcomes.

Autoimmune Disease Diagnostics Industry Segmentation

-

1. Disease Type

-

1.1. Systemic Autoimmune Disease

- 1.1.1. Rheumatoid Arthritis

- 1.1.2. Psoriasis

- 1.1.3. Systemic Lupus Erythematosus (SLE)

- 1.1.4. Multiple Sclerosis

- 1.1.5. Other Systemic Autoimmune Diseases

-

1.2. Localized Autoimmune Disease

- 1.2.1. Inflammatory Bowel Disease

- 1.2.2. Type 1 Diabetes

- 1.2.3. Thyroid

- 1.2.4. Other Localized Autoimmune Diseases

-

1.1. Systemic Autoimmune Disease

-

2. Diagnosis

- 2.1. Antinuclear Antibody Tests

- 2.2. Autoantibody Tests

- 2.3. Complete Blood Count (CBC)

- 2.4. C-reactive Protein (CRP)

- 2.5. Urinalysis

- 2.6. Others tests

Autoimmune Disease Diagnostics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Autoimmune Disease Diagnostics Industry Regional Market Share

Geographic Coverage of Autoimmune Disease Diagnostics Industry

Autoimmune Disease Diagnostics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Autoimmune Diseases and Rising Public Awareness; Technological Advancements and Improved Laboratory Automation

- 3.3. Market Restrains

- 3.3.1. Slow Turnaround Time of Results and Need for Multiple Diagnostic Tests; High Cost and Reimbursement Issues Coupled with Regulatory Uncertainties

- 3.4. Market Trends

- 3.4.1. Rheumatoid Arthritis Segment is Expected to Hold a Major Market Share in the Autoimmune Disease Diagnostics Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autoimmune Disease Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 5.1.1. Systemic Autoimmune Disease

- 5.1.1.1. Rheumatoid Arthritis

- 5.1.1.2. Psoriasis

- 5.1.1.3. Systemic Lupus Erythematosus (SLE)

- 5.1.1.4. Multiple Sclerosis

- 5.1.1.5. Other Systemic Autoimmune Diseases

- 5.1.2. Localized Autoimmune Disease

- 5.1.2.1. Inflammatory Bowel Disease

- 5.1.2.2. Type 1 Diabetes

- 5.1.2.3. Thyroid

- 5.1.2.4. Other Localized Autoimmune Diseases

- 5.1.1. Systemic Autoimmune Disease

- 5.2. Market Analysis, Insights and Forecast - by Diagnosis

- 5.2.1. Antinuclear Antibody Tests

- 5.2.2. Autoantibody Tests

- 5.2.3. Complete Blood Count (CBC)

- 5.2.4. C-reactive Protein (CRP)

- 5.2.5. Urinalysis

- 5.2.6. Others tests

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 6. North America Autoimmune Disease Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 6.1.1. Systemic Autoimmune Disease

- 6.1.1.1. Rheumatoid Arthritis

- 6.1.1.2. Psoriasis

- 6.1.1.3. Systemic Lupus Erythematosus (SLE)

- 6.1.1.4. Multiple Sclerosis

- 6.1.1.5. Other Systemic Autoimmune Diseases

- 6.1.2. Localized Autoimmune Disease

- 6.1.2.1. Inflammatory Bowel Disease

- 6.1.2.2. Type 1 Diabetes

- 6.1.2.3. Thyroid

- 6.1.2.4. Other Localized Autoimmune Diseases

- 6.1.1. Systemic Autoimmune Disease

- 6.2. Market Analysis, Insights and Forecast - by Diagnosis

- 6.2.1. Antinuclear Antibody Tests

- 6.2.2. Autoantibody Tests

- 6.2.3. Complete Blood Count (CBC)

- 6.2.4. C-reactive Protein (CRP)

- 6.2.5. Urinalysis

- 6.2.6. Others tests

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 7. Europe Autoimmune Disease Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 7.1.1. Systemic Autoimmune Disease

- 7.1.1.1. Rheumatoid Arthritis

- 7.1.1.2. Psoriasis

- 7.1.1.3. Systemic Lupus Erythematosus (SLE)

- 7.1.1.4. Multiple Sclerosis

- 7.1.1.5. Other Systemic Autoimmune Diseases

- 7.1.2. Localized Autoimmune Disease

- 7.1.2.1. Inflammatory Bowel Disease

- 7.1.2.2. Type 1 Diabetes

- 7.1.2.3. Thyroid

- 7.1.2.4. Other Localized Autoimmune Diseases

- 7.1.1. Systemic Autoimmune Disease

- 7.2. Market Analysis, Insights and Forecast - by Diagnosis

- 7.2.1. Antinuclear Antibody Tests

- 7.2.2. Autoantibody Tests

- 7.2.3. Complete Blood Count (CBC)

- 7.2.4. C-reactive Protein (CRP)

- 7.2.5. Urinalysis

- 7.2.6. Others tests

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 8. Asia Pacific Autoimmune Disease Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 8.1.1. Systemic Autoimmune Disease

- 8.1.1.1. Rheumatoid Arthritis

- 8.1.1.2. Psoriasis

- 8.1.1.3. Systemic Lupus Erythematosus (SLE)

- 8.1.1.4. Multiple Sclerosis

- 8.1.1.5. Other Systemic Autoimmune Diseases

- 8.1.2. Localized Autoimmune Disease

- 8.1.2.1. Inflammatory Bowel Disease

- 8.1.2.2. Type 1 Diabetes

- 8.1.2.3. Thyroid

- 8.1.2.4. Other Localized Autoimmune Diseases

- 8.1.1. Systemic Autoimmune Disease

- 8.2. Market Analysis, Insights and Forecast - by Diagnosis

- 8.2.1. Antinuclear Antibody Tests

- 8.2.2. Autoantibody Tests

- 8.2.3. Complete Blood Count (CBC)

- 8.2.4. C-reactive Protein (CRP)

- 8.2.5. Urinalysis

- 8.2.6. Others tests

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 9. Middle East and Africa Autoimmune Disease Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Disease Type

- 9.1.1. Systemic Autoimmune Disease

- 9.1.1.1. Rheumatoid Arthritis

- 9.1.1.2. Psoriasis

- 9.1.1.3. Systemic Lupus Erythematosus (SLE)

- 9.1.1.4. Multiple Sclerosis

- 9.1.1.5. Other Systemic Autoimmune Diseases

- 9.1.2. Localized Autoimmune Disease

- 9.1.2.1. Inflammatory Bowel Disease

- 9.1.2.2. Type 1 Diabetes

- 9.1.2.3. Thyroid

- 9.1.2.4. Other Localized Autoimmune Diseases

- 9.1.1. Systemic Autoimmune Disease

- 9.2. Market Analysis, Insights and Forecast - by Diagnosis

- 9.2.1. Antinuclear Antibody Tests

- 9.2.2. Autoantibody Tests

- 9.2.3. Complete Blood Count (CBC)

- 9.2.4. C-reactive Protein (CRP)

- 9.2.5. Urinalysis

- 9.2.6. Others tests

- 9.1. Market Analysis, Insights and Forecast - by Disease Type

- 10. South America Autoimmune Disease Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Disease Type

- 10.1.1. Systemic Autoimmune Disease

- 10.1.1.1. Rheumatoid Arthritis

- 10.1.1.2. Psoriasis

- 10.1.1.3. Systemic Lupus Erythematosus (SLE)

- 10.1.1.4. Multiple Sclerosis

- 10.1.1.5. Other Systemic Autoimmune Diseases

- 10.1.2. Localized Autoimmune Disease

- 10.1.2.1. Inflammatory Bowel Disease

- 10.1.2.2. Type 1 Diabetes

- 10.1.2.3. Thyroid

- 10.1.2.4. Other Localized Autoimmune Diseases

- 10.1.1. Systemic Autoimmune Disease

- 10.2. Market Analysis, Insights and Forecast - by Diagnosis

- 10.2.1. Antinuclear Antibody Tests

- 10.2.2. Autoantibody Tests

- 10.2.3. Complete Blood Count (CBC)

- 10.2.4. C-reactive Protein (CRP)

- 10.2.5. Urinalysis

- 10.2.6. Others tests

- 10.1. Market Analysis, Insights and Forecast - by Disease Type

- 11. North America Autoimmune Disease Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Autoimmune Disease Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Nordics

- 12.1.7 BeNeLux

- 12.1.8 Rest of Europe

- 13. Asia Pacific Autoimmune Disease Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Autoimmune Disease Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Autoimmune Disease Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 Biomerieux

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Inova Diagnostics Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Exagen Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Abbott Laboratories

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 DIAsource ImmunoAssays SA

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Euroimmun AG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Siemens Healthineers Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Grifols S A

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Bio-rad Laboratories

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Myriad Genetics

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 R-Biopharm AG

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 F Hoffmann-la Roche

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Thermo Fisher Scientific

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Trinity Biotech

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 Biomerieux

List of Figures

- Figure 1: Global Autoimmune Disease Diagnostics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Autoimmune Disease Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 3: North America Autoimmune Disease Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Autoimmune Disease Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe Autoimmune Disease Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Autoimmune Disease Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Autoimmune Disease Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Middle East and Africa Autoimmune Disease Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Middle East and Africa Autoimmune Disease Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Autoimmune Disease Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: South America Autoimmune Disease Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: North America Autoimmune Disease Diagnostics Industry Revenue (Million), by Disease Type 2025 & 2033

- Figure 13: North America Autoimmune Disease Diagnostics Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 14: North America Autoimmune Disease Diagnostics Industry Revenue (Million), by Diagnosis 2025 & 2033

- Figure 15: North America Autoimmune Disease Diagnostics Industry Revenue Share (%), by Diagnosis 2025 & 2033

- Figure 16: North America Autoimmune Disease Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Autoimmune Disease Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Autoimmune Disease Diagnostics Industry Revenue (Million), by Disease Type 2025 & 2033

- Figure 19: Europe Autoimmune Disease Diagnostics Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 20: Europe Autoimmune Disease Diagnostics Industry Revenue (Million), by Diagnosis 2025 & 2033

- Figure 21: Europe Autoimmune Disease Diagnostics Industry Revenue Share (%), by Diagnosis 2025 & 2033

- Figure 22: Europe Autoimmune Disease Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 23: Europe Autoimmune Disease Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 24: Asia Pacific Autoimmune Disease Diagnostics Industry Revenue (Million), by Disease Type 2025 & 2033

- Figure 25: Asia Pacific Autoimmune Disease Diagnostics Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 26: Asia Pacific Autoimmune Disease Diagnostics Industry Revenue (Million), by Diagnosis 2025 & 2033

- Figure 27: Asia Pacific Autoimmune Disease Diagnostics Industry Revenue Share (%), by Diagnosis 2025 & 2033

- Figure 28: Asia Pacific Autoimmune Disease Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 29: Asia Pacific Autoimmune Disease Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 30: Middle East and Africa Autoimmune Disease Diagnostics Industry Revenue (Million), by Disease Type 2025 & 2033

- Figure 31: Middle East and Africa Autoimmune Disease Diagnostics Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 32: Middle East and Africa Autoimmune Disease Diagnostics Industry Revenue (Million), by Diagnosis 2025 & 2033

- Figure 33: Middle East and Africa Autoimmune Disease Diagnostics Industry Revenue Share (%), by Diagnosis 2025 & 2033

- Figure 34: Middle East and Africa Autoimmune Disease Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 35: Middle East and Africa Autoimmune Disease Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 36: South America Autoimmune Disease Diagnostics Industry Revenue (Million), by Disease Type 2025 & 2033

- Figure 37: South America Autoimmune Disease Diagnostics Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 38: South America Autoimmune Disease Diagnostics Industry Revenue (Million), by Diagnosis 2025 & 2033

- Figure 39: South America Autoimmune Disease Diagnostics Industry Revenue Share (%), by Diagnosis 2025 & 2033

- Figure 40: South America Autoimmune Disease Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Autoimmune Disease Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 3: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Diagnosis 2020 & 2033

- Table 4: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 6: United States Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Canada Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Mexico Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Italy Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Nordics Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: BeNeLux Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: GCC Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Africa Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Middle East and Africa Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 34: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Diagnosis 2020 & 2033

- Table 35: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: United States Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Canada Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Mexico Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 40: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Diagnosis 2020 & 2033

- Table 41: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Germany Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: France Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Italy Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 49: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Diagnosis 2020 & 2033

- Table 50: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 51: China Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Japan Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: India Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Australia Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: South Korea Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia Pacific Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 58: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Diagnosis 2020 & 2033

- Table 59: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: GCC Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Africa Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East and Africa Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Disease Type 2020 & 2033

- Table 64: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Diagnosis 2020 & 2033

- Table 65: Global Autoimmune Disease Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Brazil Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 67: Argentina Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of South America Autoimmune Disease Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autoimmune Disease Diagnostics Industry?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Autoimmune Disease Diagnostics Industry?

Key companies in the market include Biomerieux, Inova Diagnostics Inc, Exagen Inc, Abbott Laboratories, DIAsource ImmunoAssays SA, Euroimmun AG, Siemens Healthineers Inc, Grifols S A, Bio-rad Laboratories, Myriad Genetics, R-Biopharm AG, F Hoffmann-la Roche, Thermo Fisher Scientific, Trinity Biotech.

3. What are the main segments of the Autoimmune Disease Diagnostics Industry?

The market segments include Disease Type, Diagnosis.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Autoimmune Diseases and Rising Public Awareness; Technological Advancements and Improved Laboratory Automation.

6. What are the notable trends driving market growth?

Rheumatoid Arthritis Segment is Expected to Hold a Major Market Share in the Autoimmune Disease Diagnostics Market.

7. Are there any restraints impacting market growth?

Slow Turnaround Time of Results and Need for Multiple Diagnostic Tests; High Cost and Reimbursement Issues Coupled with Regulatory Uncertainties.

8. Can you provide examples of recent developments in the market?

In August 2022, KSL Beutner Laboratories (Beutner) launched a blood test to detect an antigen linked with the autoimmune blistering disease mucous membrane pemphigoid (MMP), which often causes painful lesions in the oral cavity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autoimmune Disease Diagnostics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autoimmune Disease Diagnostics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autoimmune Disease Diagnostics Industry?

To stay informed about further developments, trends, and reports in the Autoimmune Disease Diagnostics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence