Key Insights

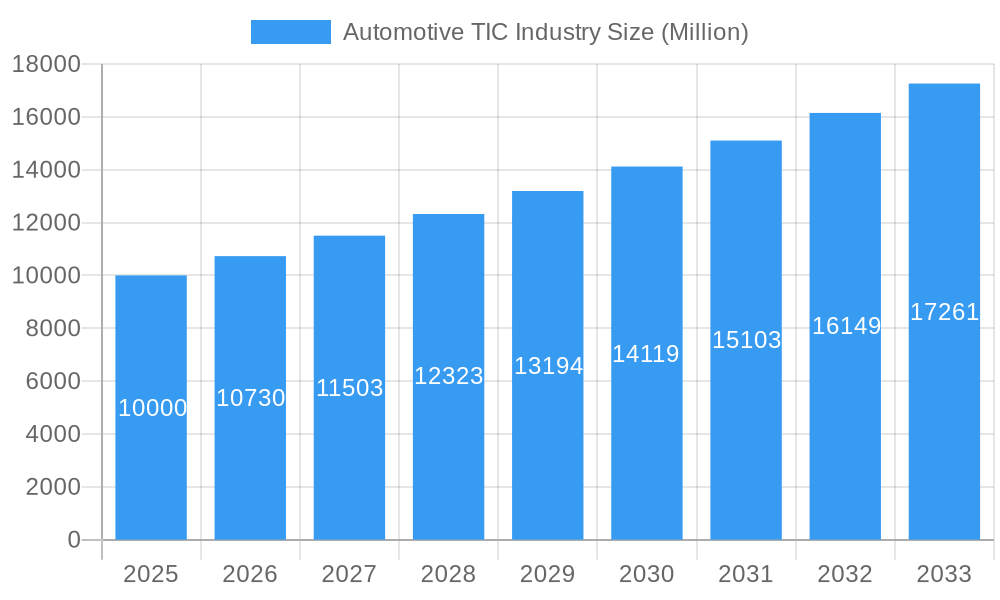

The global Automotive Testing, Inspection, and Certification (TIC) market is poised for significant expansion, driven by escalating vehicle safety standards and stringent environmental regulations worldwide. The market is currently valued at $20.31 billion in the base year 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.84% from 2025 to 2033. This growth is propelled by several critical factors, including the increasing complexity of automotive technologies like Advanced Driver-Assistance Systems (ADAS) and Electric Vehicles (EVs), which mandate comprehensive testing and certification. Moreover, heightened consumer emphasis on vehicle safety and eco-friendliness is spurring governments to implement more rigorous regulations, thereby boosting demand for TIC services.

Automotive TIC Industry Market Size (In Billion)

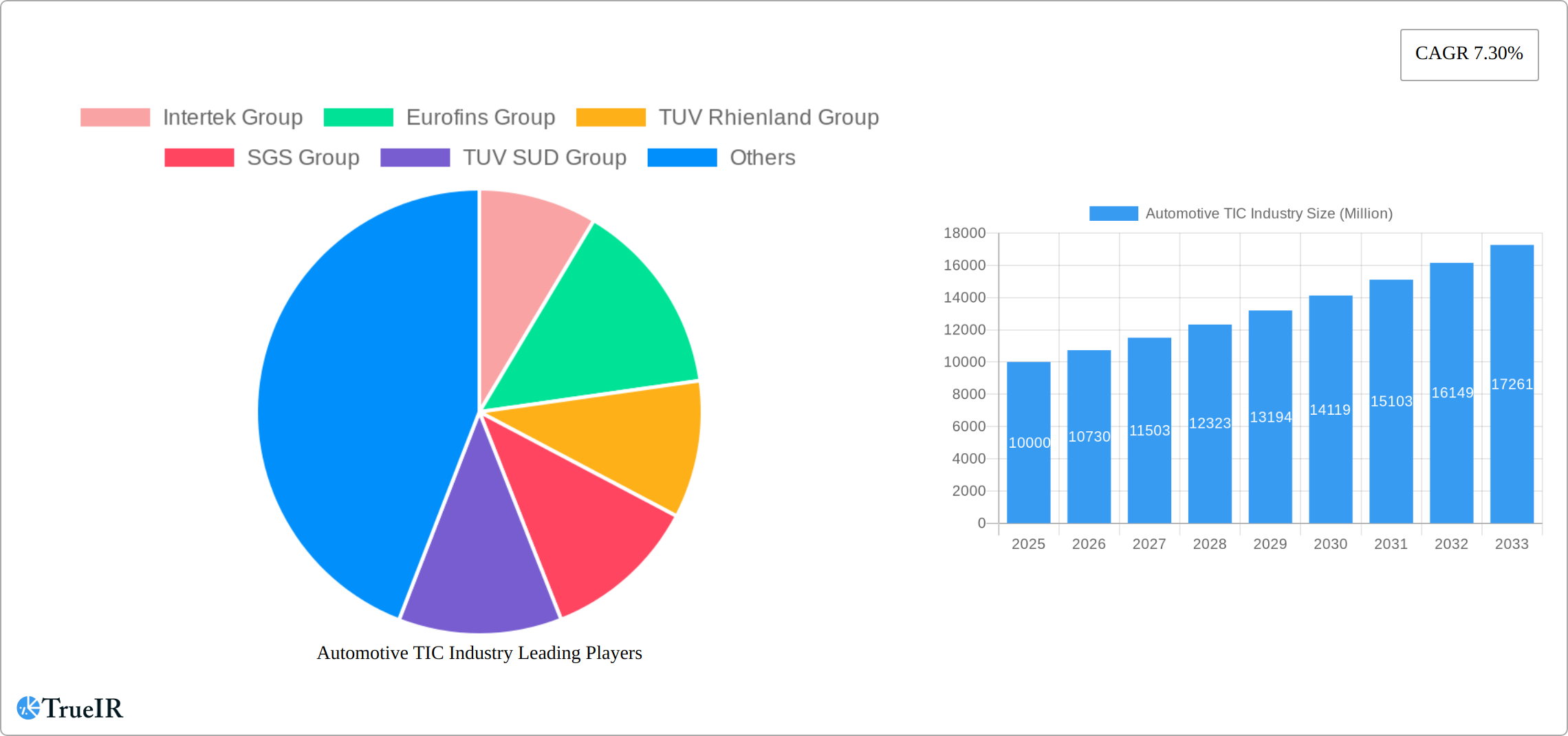

The market is segmented by service type, encompassing testing & inspection, certification, and other services such as auditing, consulting, and training. Vehicle type segmentation includes passenger and commercial vehicles, with the passenger vehicle segment expected to exhibit slightly higher growth due to higher production volumes and wider adoption of advanced technologies. Leading industry players, including Intertek, Eurofins, TÜV Rheinland, SGS, TÜV SÜD, Dekra, Applus, TÜV Nord, and Bureau Veritas, are strategically expanding their service portfolios and global presence to leverage this market opportunity.

Automotive TIC Industry Company Market Share

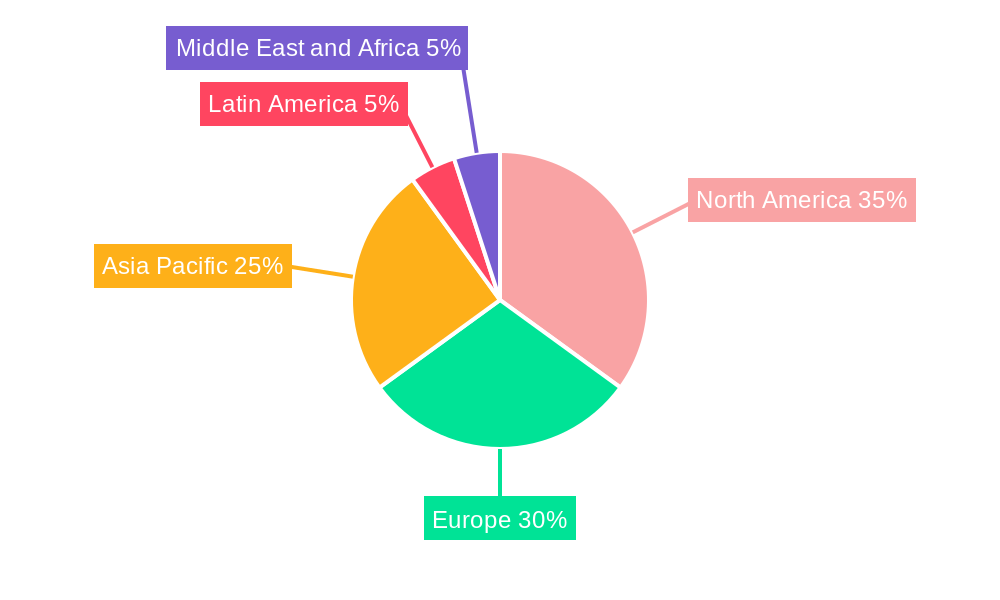

Geographical expansion is a defining trend in the Automotive TIC industry. While North America and Europe currently dominate market share, the Asia-Pacific region is anticipated to experience the most rapid growth, attributed to rising automotive production and the implementation of stricter emission norms in key economies such as China and India. The competitive landscape is characterized by established players vying on service quality, geographic reach, and technological prowess. However, the industry faces challenges such as substantial upfront investments in advanced testing infrastructure and the necessity for skilled professionals. Despite these constraints, the long-term outlook for the Automotive TIC market remains robust, underpinned by continuous innovation in automotive technology and an unwavering commitment to safety and environmental sustainability. Growth in consulting and training segments is also expected as manufacturers and suppliers seek specialized expertise to navigate evolving regulatory landscapes and technological advancements.

Automotive TIC Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Automotive Testing, Inspection, and Certification (TIC) industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report analyzes a market valued at $XX Million in 2025, projected to reach $XX Million by 2033, exhibiting a CAGR of XX%.

Automotive TIC Industry Market Structure & Competitive Landscape

The Automotive TIC industry is characterized by a moderately concentrated market structure, with several multinational giants dominating the landscape. Key players like Intertek Group, Eurofins Group, TÜV Rheinland Group, SGS Group, TÜV SÜD Group, DEKRA SE, Applus Group, TÜV Nord, and Bureau Veritas hold significant market share. The Herfindahl-Hirschman Index (HHI) for this market is estimated at XX, indicating a moderately concentrated market.

- Market Concentration: The top 5 players account for approximately XX% of the global market revenue.

- Innovation Drivers: Stringent safety and emission regulations, increasing vehicle electrification and automation, and growing demand for connected car technologies drive innovation in testing and certification services.

- Regulatory Impacts: Government regulations regarding vehicle safety, emissions, and cybersecurity significantly impact market growth and necessitate continuous adaptation by TIC providers.

- Product Substitutes: The absence of readily available substitutes for professional TIC services ensures stable demand. However, internal testing capabilities of some large automotive manufacturers could marginally impact market growth.

- End-User Segmentation: The industry caters to Original Equipment Manufacturers (OEMs), Tier-1 suppliers, and independent aftermarket players, with OEMs representing the largest segment.

- M&A Trends: The industry has witnessed significant M&A activity in recent years, with companies aiming to expand their service portfolios and geographical reach. The total value of M&A deals in the Automotive TIC industry between 2019 and 2024 is estimated at $XX Million. This includes strategic acquisitions aimed at enhancing technological capabilities and market penetration.

Automotive TIC Industry Market Trends & Opportunities

The Automotive TIC market is experiencing robust growth, fueled by the convergence of several key factors. The escalating complexity of modern vehicles, coupled with increasingly stringent regulatory compliance requirements, is driving significant demand. The rapid rise of electric vehicles (EVs) and autonomous driving technologies presents a particularly lucrative segment, demanding specialized testing and certification capabilities. Market penetration rates for various TIC services are accelerating, notably in emerging markets characterized by rapid automotive sector expansion. Technological advancements, such as AI-powered testing solutions and the comprehensive digitalization of testing processes, are enhancing efficiency, accelerating turnaround times, and reducing operational costs. This market exhibits considerable growth potential, driven by increasing global vehicle production, particularly in developing economies, and the pervasive adoption of advanced driver-assistance systems (ADAS) and autonomous vehicles. The evolving regulatory landscape presents significant opportunities for businesses offering specialized services in areas like cybersecurity testing, battery performance validation, and functional safety verification. The global adoption of stricter environmental regulations further fuels the market's expansion. Consumer preference for safer, more reliable, and environmentally friendly vehicles consistently increases demand for comprehensive TIC solutions. Competitive dynamics remain intense, with ongoing investments in technological innovation, strategic acquisitions, and the development of new testing methodologies shaping the market landscape.

Dominant Markets & Segments in Automotive TIC Industry

Leading Region: Europe and North America currently dominate the market, driven by robust automotive manufacturing sectors and stringent regulatory environments. However, Asia-Pacific is projected to show the highest growth rate due to increasing vehicle production and rising adoption of advanced automotive technologies.

Leading Segment (By Service Type): Testing & Inspection services constitute the largest segment, driven by the continuous need for rigorous quality control and compliance assessments throughout the vehicle lifecycle. Certification services are expected to experience strong growth, fuelled by stricter regulatory requirements.

Leading Segment (By Vehicle Type): The passenger vehicle segment currently holds a larger market share compared to the commercial vehicle segment, though the latter exhibits significant growth potential, particularly in emerging economies experiencing rapid infrastructure development and expansion of logistics services.

Key Growth Drivers:

- Stringent Government Regulations: Increased emphasis on vehicle safety and emission standards drives the demand for compliance testing.

- Technological Advancements: The introduction of autonomous driving systems and EVs necessitates sophisticated testing capabilities.

- Infrastructure Development: Expansive road networks and growing logistics sectors boost demand in the commercial vehicle segment.

Automotive TIC Industry Product Analysis

The Automotive TIC industry encompasses a diverse portfolio of products and services, including comprehensive testing and inspection across various critical aspects: safety, emissions, performance, durability, and cybersecurity. Advanced technologies, such as automated testing systems, AI-powered data analytics, and sophisticated simulation tools, are increasingly integrated to enhance efficiency, accuracy, and the overall depth of analysis. These advancements allow for faster testing cycles and earlier identification of potential issues. A competitive advantage in this sector is defined by specialized expertise, technological leadership, a robust global reach, and the ability to provide customized solutions tailored to specific client needs. The industry's dynamic nature necessitates continuous adaptation to the evolving needs of the automotive sector, with a strong focus on providing innovative, cost-effective, and data-driven solutions.

Key Drivers, Barriers & Challenges in Automotive TIC Industry

Key Drivers:

Technological advancements (e.g., automated testing, AI, machine learning), increasingly stringent regulations (e.g., emissions standards, safety norms, cybersecurity mandates), and the exponential increase in vehicle complexity are the primary catalysts propelling market growth. The shift towards electric and autonomous vehicles further fuels demand for specialized testing expertise.

Challenges:

- Regulatory Complexity and Fragmentation: Keeping pace with evolving global and regional regulations, often differing significantly across jurisdictions, presents substantial challenges for TIC providers, requiring significant investment in compliance and expertise.

- Supply Chain Disruptions and Talent Acquisition: Disruptions in the supply chain can impact the availability of specialized testing equipment and skilled personnel, potentially leading to delays and increased costs. Attracting and retaining highly skilled engineers and technicians is a crucial challenge.

- Intense Competition and Price Pressure: Intense competition from established players and emerging technology companies necessitates continuous innovation, cost optimization, and differentiation through specialized services to maintain profitability and market share. The total estimated impact of these challenges on market growth is approximately $XX Million annually.

Growth Drivers in the Automotive TIC Industry Market

The robust growth trajectory of the automotive TIC industry is fueled by a confluence of factors. Stringent regulations governing vehicle safety and emissions are paramount drivers, demanding comprehensive testing and rigorous certification processes. Technological advancements, particularly in autonomous driving and electric vehicle technologies, necessitate specialized testing procedures and create substantial new service opportunities requiring advanced skillsets and equipment. The ongoing expansion of the global automotive industry, particularly in rapidly developing economies, contributes significantly to market expansion, creating new demand centers.

Challenges Impacting Automotive TIC Industry Growth

Significant barriers continue to impact the Automotive TIC market's growth trajectory. Regulatory complexities and the variation of standards across different regions create challenges in achieving global compliance and necessitate substantial investment in adaptation. Supply chain vulnerabilities, particularly regarding the availability of specialized equipment and the acquisition of skilled labor, can disrupt services and increase operational costs. Intense competition among established players and new entrants necessitates consistent innovation, a commitment to cost-effective solutions, and a relentless pursuit of operational efficiency to maintain market share and ensure profitability.

Key Players Shaping the Automotive TIC Industry Market

Significant Automotive TIC Industry Milestones

- May 2021: Applus acquired IMA Dresden, expanding its European testing capabilities in various sectors, including automotive.

- April 2021: DEKRA became an MFi Authorized Test Laboratory, offering CarPlay certification services, signifying its entry into the rapidly expanding connected car market.

Future Outlook for Automotive TIC Industry Market

The Automotive TIC industry is poised for sustained growth, driven by technological advancements in electric vehicles, autonomous driving, and connected car technologies. Strategic partnerships and acquisitions are likely to continue shaping the competitive landscape, while increased focus on digitalization and data analytics will enhance testing efficiency. Emerging markets will present significant growth opportunities, requiring TIC providers to adapt their offerings to local regulatory requirements. The market is expected to witness a period of robust growth and diversification, driven by evolving industry trends.

Automotive TIC Industry Segmentation

-

1. Service Type

- 1.1. Testing & Inspection

- 1.2. Certification

- 1.3. Others

-

2. Vehicle Type

- 2.1. Passenger

- 2.2. Commercial

Automotive TIC Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Automotive TIC Industry Regional Market Share

Geographic Coverage of Automotive TIC Industry

Automotive TIC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Integration of Electronic Components in Automobiles; Trend Toward Digitization

- 3.3. Market Restrains

- 3.3.1. Lack of International Accepted Standards

- 3.4. Market Trends

- 3.4.1. Testing is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Testing & Inspection

- 5.1.2. Certification

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Testing & Inspection

- 6.1.2. Certification

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger

- 6.2.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Testing & Inspection

- 7.1.2. Certification

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger

- 7.2.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Testing & Inspection

- 8.1.2. Certification

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger

- 8.2.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Testing & Inspection

- 9.1.2. Certification

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger

- 9.2.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Automotive TIC Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Testing & Inspection

- 10.1.2. Certification

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Passenger

- 10.2.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Intertek Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eurofins Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TUV Rhienland Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SGS Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TUV SUD Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dekra SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Applus Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TUV Nord

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bureau Veritas

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Intertek Group

List of Figures

- Figure 1: Global Automotive TIC Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 3: North America Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 9: Europe Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 15: Asia Pacific Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Pacific Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 17: Asia Pacific Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 18: Asia Pacific Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 21: Latin America Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Latin America Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 23: Latin America Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Latin America Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Automotive TIC Industry Revenue (billion), by Service Type 2025 & 2033

- Figure 27: Middle East and Africa Automotive TIC Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Middle East and Africa Automotive TIC Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 29: Middle East and Africa Automotive TIC Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Middle East and Africa Automotive TIC Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Automotive TIC Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive TIC Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 5: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 8: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 9: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 11: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 12: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 14: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Automotive TIC Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 17: Global Automotive TIC Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global Automotive TIC Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive TIC Industry?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the Automotive TIC Industry?

Key companies in the market include Intertek Group, Eurofins Group, TUV Rhienland Group, SGS Group, TUV SUD Group, Dekra SE, Applus Group, TUV Nord, Bureau Veritas.

3. What are the main segments of the Automotive TIC Industry?

The market segments include Service Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.31 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Integration of Electronic Components in Automobiles; Trend Toward Digitization.

6. What are the notable trends driving market growth?

Testing is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of International Accepted Standards.

8. Can you provide examples of recent developments in the market?

May 2021 - Applus acquired IMA Dresden, a leading testing laboratory in Europe which is a well-diversified structural and materials testing laboratory, with a good reputation for excellence and a European leader in most of its key markets of railway, aerospace & defense, wind power, building products, medical devices and automotive.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive TIC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive TIC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive TIC Industry?

To stay informed about further developments, trends, and reports in the Automotive TIC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence