Key Insights

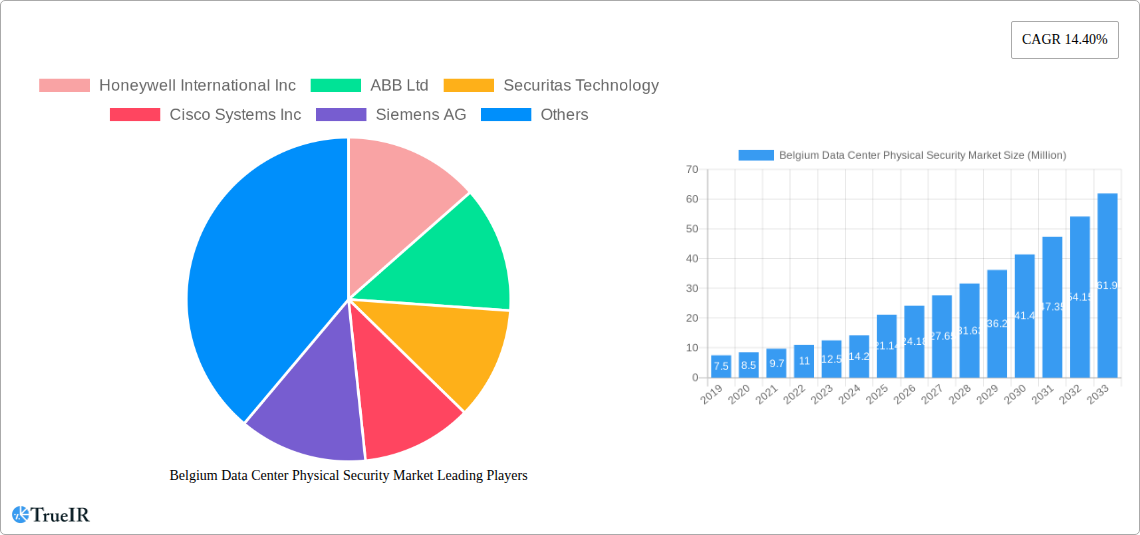

The Belgium Data Center Physical Security Market is poised for significant expansion, projected to reach a valuation of $21.14 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 14.40% expected to carry through the forecast period of 2025-2033. This strong growth is fundamentally driven by the escalating demand for secure and reliable data storage solutions. As Belgium solidifies its position as a key European digital hub, the proliferation of data centers, coupled with the increasing sophistication of cyber threats, necessitates stringent physical security measures. Key growth drivers include the expanding cloud computing sector, the rise of big data analytics, and the growing adoption of Internet of Things (IoT) devices, all of which contribute to the increased volume and sensitivity of data requiring physical protection. The market's trajectory is further propelled by ongoing technological advancements in security solutions.

Belgium Data Center Physical Security Market Market Size (In Million)

The market landscape is characterized by a dynamic interplay of solution and service types. Video surveillance and access control solutions are expected to dominate the solution segments, reflecting their critical role in monitoring and restricting entry to sensitive data center environments. System integration services, along with consulting and professional services, are anticipated to witness substantial growth as organizations seek expert guidance and seamless implementation of comprehensive security frameworks. The IT & Telecommunication, BFSI, and Government sectors are identified as major end-users, underscoring the critical nature of data protection for these industries. Emerging trends such as the integration of AI and machine learning into security systems for predictive threat detection and enhanced operational efficiency are also shaping the market's evolution, promising a more intelligent and proactive approach to data center physical security in Belgium.

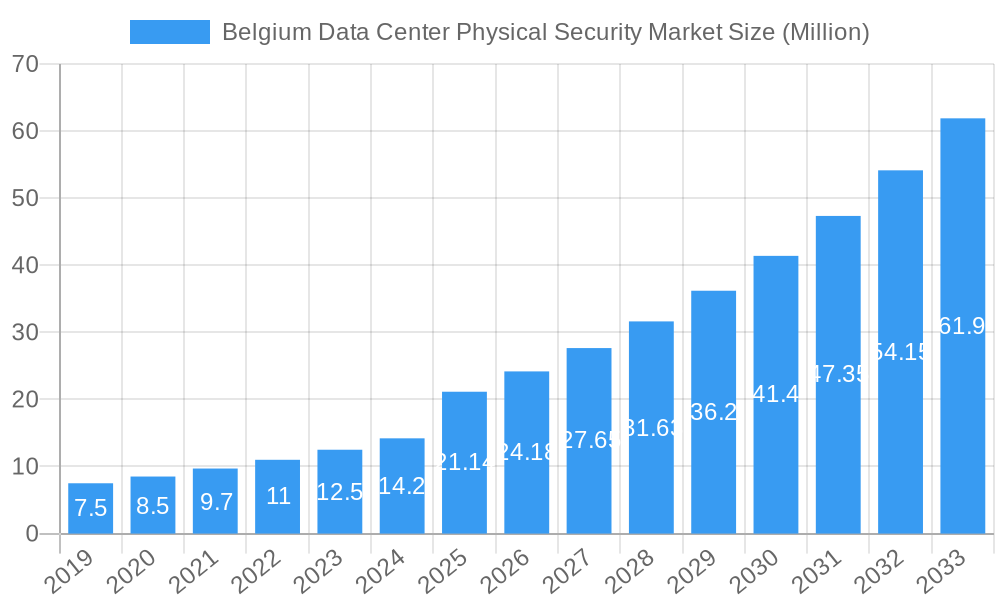

Belgium Data Center Physical Security Market Company Market Share

Belgium Data Center Physical Security Market: Comprehensive Market Analysis and Forecast (2019-2033)

This in-depth report provides a detailed analysis of the Belgium Data Center Physical Security Market, offering actionable insights and strategic guidance for stakeholders. The study covers the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending from 2025 to 2033. The market is projected to reach XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX%.

Belgium Data Center Physical Security Market Market Structure & Competitive Landscape

The Belgium data center physical security market is characterized by a moderate to high level of concentration, with leading players like Honeywell International Inc., ABB Ltd., Securitas Technology, Cisco Systems Inc., Siemens AG, Johnson Controls, Schneider Electric, Bosch Sicherheitssysteme GmbH, Axis Communications AB, AMAG Technology Inc., Dahua Technology Co Ltd, and ASSA ABLOY holding significant market share. Innovation drivers are primarily focused on the integration of AI and machine learning into surveillance systems, advanced biometrics for access control, and the development of unified security platforms. Regulatory impacts, such as GDPR and evolving data protection laws, necessitate robust security measures, influencing product development and adoption. While product substitutes exist, the highly sensitive nature of data center operations limits their widespread replacement of dedicated security solutions. End-user segmentation highlights the dominance of the IT & Telecommunication and BFSI sectors due to their critical infrastructure and stringent security requirements. Mergers and acquisitions (M&A) are observed as companies aim to expand their product portfolios, geographic reach, and technological capabilities, with approximately XX M&A deals recorded in the historical period. The market exhibits an innovation CAGR of XX% driven by continuous R&D investments.

Belgium Data Center Physical Security Market Market Trends & Opportunities

The Belgium data center physical security market is experiencing robust growth, fueled by the escalating demand for secure data storage and processing infrastructure. The market size is projected to reach XX Million by 2033, with a significant CAGR of XX% from 2025 to 2033. Technological shifts are central to this expansion, with a pronounced trend towards the adoption of advanced video analytics, AI-powered threat detection, and sophisticated access control systems. The integration of Internet of Things (IoT) devices is further enhancing the capabilities of physical security solutions, enabling real-time monitoring and proactive threat mitigation. Consumer preferences are increasingly leaning towards integrated security platforms that offer centralized management and seamless interoperability between different security components, such as video surveillance, access control, and intrusion detection systems. This shift is driven by the need for enhanced operational efficiency and a more comprehensive security posture. Competitive dynamics are intensifying as both established global security providers and specialized technology companies vie for market share. Opportunities abound for companies offering end-to-end security solutions that address the evolving needs of data center operators, including scalable systems, cloud-based security management, and advanced cybersecurity integration. The increasing adoption of hyperscale and edge data centers also presents new avenues for tailored physical security solutions. Furthermore, the growing emphasis on compliance and regulatory adherence is creating a sustained demand for certified and robust security systems, offering lucrative prospects for market players. The market penetration rate for advanced physical security solutions in data centers is estimated to be XX% in the base year and is projected to reach XX% by 2033.

Dominant Markets & Segments in Belgium Data Center Physical Security Market

The IT & Telecommunication sector is the dominant end-user segment within the Belgium data center physical security market, driven by the sheer volume of data processed and the critical nature of their operations. This segment accounts for an estimated XX% of the market share in 2025. Key growth drivers include the continuous expansion of cloud computing services, the proliferation of 5G networks, and the increasing reliance on digital infrastructure for critical business functions. Policies promoting digital transformation and data localization further bolster this demand.

Within Solution Types, Video Surveillance leads the market, representing approximately XX% of the segment in 2025. This dominance is attributed to its role in real-time monitoring, incident recording, and deterring unauthorized access. Advancements in AI-powered video analytics, such as facial recognition and anomaly detection, are further enhancing its appeal.

In terms of Service Types, System Integration Services holds a substantial market share, estimated at XX% in 2025. The complexity of modern data center security ecosystems necessitates expert integration to ensure seamless operation and interoperability of various security components. This includes the setup and configuration of advanced systems, ongoing maintenance, and system upgrades.

Geographically, within Belgium, the Flanders region is expected to represent the largest market for data center physical security solutions, accounting for an estimated XX% of the Belgian market. This is due to the concentration of major data center facilities and the presence of key players in the IT and telecommunications industries. Government initiatives supporting the development of digital infrastructure also play a crucial role.

BFSI is the second-largest end-user segment, with an estimated market share of XX% in 2025. Stringent regulatory requirements and the highly sensitive nature of financial data necessitate robust physical security measures to prevent breaches and ensure business continuity.

Government and Healthcare sectors also contribute significantly to the market, driven by national security concerns and the need to protect sensitive citizen data, respectively. These segments collectively account for approximately XX% of the market.

Belgium Data Center Physical Security Market Product Analysis

The Belgium data center physical security market is witnessing rapid product innovation focused on intelligent and integrated solutions. Video surveillance systems are increasingly incorporating AI-powered analytics for real-time threat detection, object recognition, and behavioral analysis, offering proactive security rather than reactive responses. Access control solutions are moving beyond traditional key cards to advanced biometrics, including facial recognition, fingerprint scanning, and iris recognition, providing higher levels of authentication and security. The trend towards IoT integration is creating smart security ecosystems where devices communicate and collaborate to enhance situational awareness and response times. Competitive advantages are being gained by vendors offering unified platforms that consolidate management of diverse security technologies, thereby improving operational efficiency and reducing complexity for data center operators. The market fit for these advanced solutions is strong, driven by increasing security threats and the demand for robust, scalable, and intelligent physical security.

Key Drivers, Barriers & Challenges in Belgium Data Center Physical Security Market

Key Drivers:

- Increasing Data Volume and Cloud Adoption: The exponential growth of data and the widespread adoption of cloud computing services are driving the expansion of data center infrastructure, consequently increasing the demand for robust physical security solutions.

- Stringent Regulatory Compliance: Regulations such as GDPR and evolving data protection mandates necessitate advanced security measures to safeguard sensitive information, pushing investments in physical security technologies.

- Technological Advancements: The integration of AI, machine learning, and IoT into physical security systems offers enhanced threat detection, automation, and efficiency, driving market adoption.

- Growing Cybersecurity Threats: The escalating sophistication and frequency of cyber-attacks necessitate complementary robust physical security to prevent unauthorized access to critical infrastructure.

Barriers & Challenges:

- High Initial Investment Costs: The implementation of advanced physical security systems can involve significant upfront capital expenditure, posing a challenge for smaller data center operators.

- Integration Complexity: Integrating diverse security systems and ensuring seamless interoperability can be complex and time-consuming, requiring specialized expertise.

- Skilled Workforce Shortage: The demand for skilled professionals in installing, maintaining, and operating advanced security systems can lead to talent gaps.

- Rapid Technological Obsolescence: The fast pace of technological evolution can lead to rapid obsolescence of existing security systems, requiring continuous upgrades and investments. Supply chain disruptions can also impact the timely delivery and availability of components, with an estimated impact of XX% on project timelines in the historical period.

Growth Drivers in the Belgium Data Center Physical Security Market Market

The Belgium data center physical security market is propelled by several key growth drivers. Technologically, the relentless innovation in artificial intelligence and machine learning is revolutionizing surveillance with predictive analytics and behavioral anomaly detection, significantly enhancing threat prevention. Economically, the surge in digital transformation initiatives across various industries, coupled with the increasing adoption of hybrid and multi-cloud strategies, is necessitating the expansion and upgrading of data center facilities, thereby driving demand for sophisticated physical security. Regulatory frameworks, such as those mandating data sovereignty and enhanced data protection, are compelling data center operators to invest in state-of-the-art security measures, ensuring compliance and safeguarding sensitive information. The ongoing digital economy growth in Belgium, fostering new businesses and services reliant on robust data infrastructure, also acts as a significant catalyst for market expansion.

Challenges Impacting Belgium Data Center Physical Security Market Growth

Despite the growth prospects, the Belgium data center physical security market faces several significant challenges. Regulatory complexities, while driving demand, also present hurdles related to compliance interpretation and implementation across different jurisdictions and evolving standards. Supply chain issues, exacerbated by geopolitical factors and component shortages, can lead to project delays and increased costs, impacting the timely deployment of security solutions. For instance, a projected impact of XX% on project completion timelines due to component shortages has been observed. Competitive pressures from a fragmented market with numerous vendors offering overlapping solutions can lead to price wars and affect profitability. Furthermore, the rapid pace of technological advancement necessitates continuous investment in upgrades and retraining, creating a financial burden and a challenge in keeping pace with the latest innovations. The need for specialized skilled labor to manage and maintain complex security systems also poses a continuous challenge.

Key Players Shaping the Belgium Data Center Physical Security Market Market

- Honeywell International Inc

- ABB Ltd

- Securitas Technology

- Cisco Systems Inc

- Siemens AG

- Johnson Controls

- Schneider Electric

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

- AMAG Technology Inc

- Dahua Technology Co Ltd

- ASSA ABLOY

Significant Belgium Data Center Physical Security Market Industry Milestones

- 2021/03: Launch of new AI-powered video analytics platform by Honeywell International Inc., enhancing threat detection capabilities.

- 2022/07: Securitas Technology acquires a leading access control provider, expanding its integrated security offering.

- 2023/01: Siemens AG announces strategic partnership with a cloud security provider to offer enhanced hybrid security solutions.

- 2023/09: Johnson Controls introduces advanced biometric access control solutions for high-security data centers.

- 2024/02: Schneider Electric expands its portfolio with integrated physical and cybersecurity management solutions for data centers.

Future Outlook for Belgium Data Center Physical Security Market Market

The future outlook for the Belgium data center physical security market remains exceptionally positive, driven by the relentless digitalization of society and the increasing demand for secure data infrastructure. Growth catalysts include the continued expansion of hyperscale and edge data centers, which will require increasingly sophisticated and scalable physical security solutions. The integration of advanced technologies such as AI, machine learning, and quantum-resistant encryption in physical security systems will further enhance their effectiveness and appeal. Strategic opportunities lie in the development of comprehensive, end-to-end security platforms that seamlessly integrate physical and cybersecurity measures. The growing emphasis on sustainability and energy efficiency in data center operations will also influence security solution design, with a focus on energy-efficient hardware and intelligent power management within security systems. The market is poised for sustained growth, with an estimated market size of XX Million by 2033, driven by innovation, evolving threats, and the fundamental need for secure data environments.

Belgium Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Others

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Others (System Integration Services)

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End Users

Belgium Data Center Physical Security Market Segmentation By Geography

- 1. Belgium

Belgium Data Center Physical Security Market Regional Market Share

Geographic Coverage of Belgium Data Center Physical Security Market

Belgium Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Clolud Computing Capabilities Drives the Market Growth; Increase Security Concerns in the Market Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. The High Costs Associated with Physical Security Infrastructure

- 3.4. Market Trends

- 3.4.1. Video Surveillance is Anticipated to be the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Data Center Physical Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Others (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Securitas Technology

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson Controls

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch Sicherheitssysteme GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Axis Communications AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AMAG Technology Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dahua Technology Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ASSA ABLOY

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Belgium Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Belgium Data Center Physical Security Market Share (%) by Company 2025

List of Tables

- Table 1: Belgium Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 2: Belgium Data Center Physical Security Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Belgium Data Center Physical Security Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Belgium Data Center Physical Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Belgium Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2020 & 2033

- Table 6: Belgium Data Center Physical Security Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Belgium Data Center Physical Security Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Belgium Data Center Physical Security Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Data Center Physical Security Market?

The projected CAGR is approximately 14.40%.

2. Which companies are prominent players in the Belgium Data Center Physical Security Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Securitas Technology, Cisco Systems Inc, Siemens AG, Johnson Controls, Schneider Electric, Bosch Sicherheitssysteme GmbH, Axis Communications AB, AMAG Technology Inc, Dahua Technology Co Ltd, ASSA ABLOY.

3. What are the main segments of the Belgium Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Clolud Computing Capabilities Drives the Market Growth; Increase Security Concerns in the Market Drives the Market Growth.

6. What are the notable trends driving market growth?

Video Surveillance is Anticipated to be the Largest Segment.

7. Are there any restraints impacting market growth?

The High Costs Associated with Physical Security Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the Belgium Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence