Key Insights

The Business Aviation Maintenance, Repair, and Overhaul (MRO) market is projected for significant expansion, propelled by an increasing global fleet of business jets and the rising demand for specialized, high-quality maintenance solutions. The market, valued at $90.85 billion in 2024, is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 4.75% between 2024 and 2033. Key growth drivers include the aging aircraft fleet requiring proactive maintenance, technological advancements demanding sophisticated MRO capabilities (e.g., engine upgrades, advanced diagnostics), and stringent regulatory compliance mandating adherence to safety standards. The MRO market is segmented by service type, including engine, component, interior, airframe, and line maintenance. Engine MRO currently represents a dominant segment due to the inherent complexity and cost of engine servicing. Leading industry players such as Rolls-Royce, Pratt & Whitney, and Lufthansa Technik are instrumental in market evolution through innovation and strategic alliances. North America currently leads the market, attributed to its substantial base of business jet operators and MRO infrastructure. However, the Asia-Pacific region is poised for substantial growth, driven by increasing disposable incomes and expanding business aviation sectors in emerging economies.

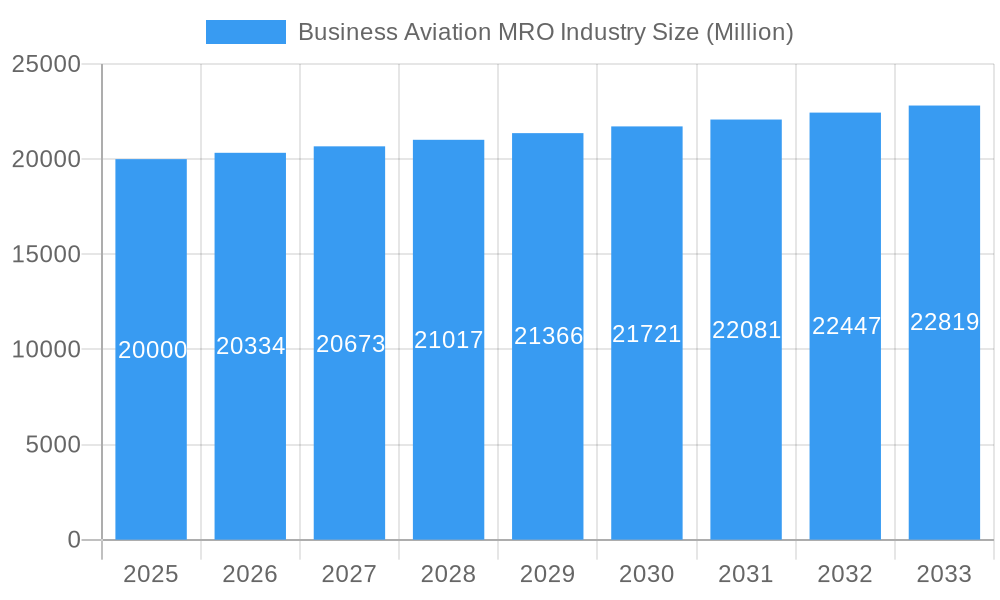

Business Aviation MRO Industry Market Size (In Billion)

The business aviation MRO sector faces challenges including volatile fuel costs, economic uncertainties impacting capital expenditure on maintenance, and potential shortages of skilled aviation technicians. Intense competition necessitates continuous enhancement of operational efficiency and service portfolios. The integration of emerging technologies, such as predictive maintenance and digital twin solutions, presents both opportunities and requires significant investment in training and infrastructure upgrades. Strategic acquisitions, innovation in service delivery, and an unwavering commitment to customer satisfaction are critical for MRO providers to thrive in this dynamic and competitive landscape.

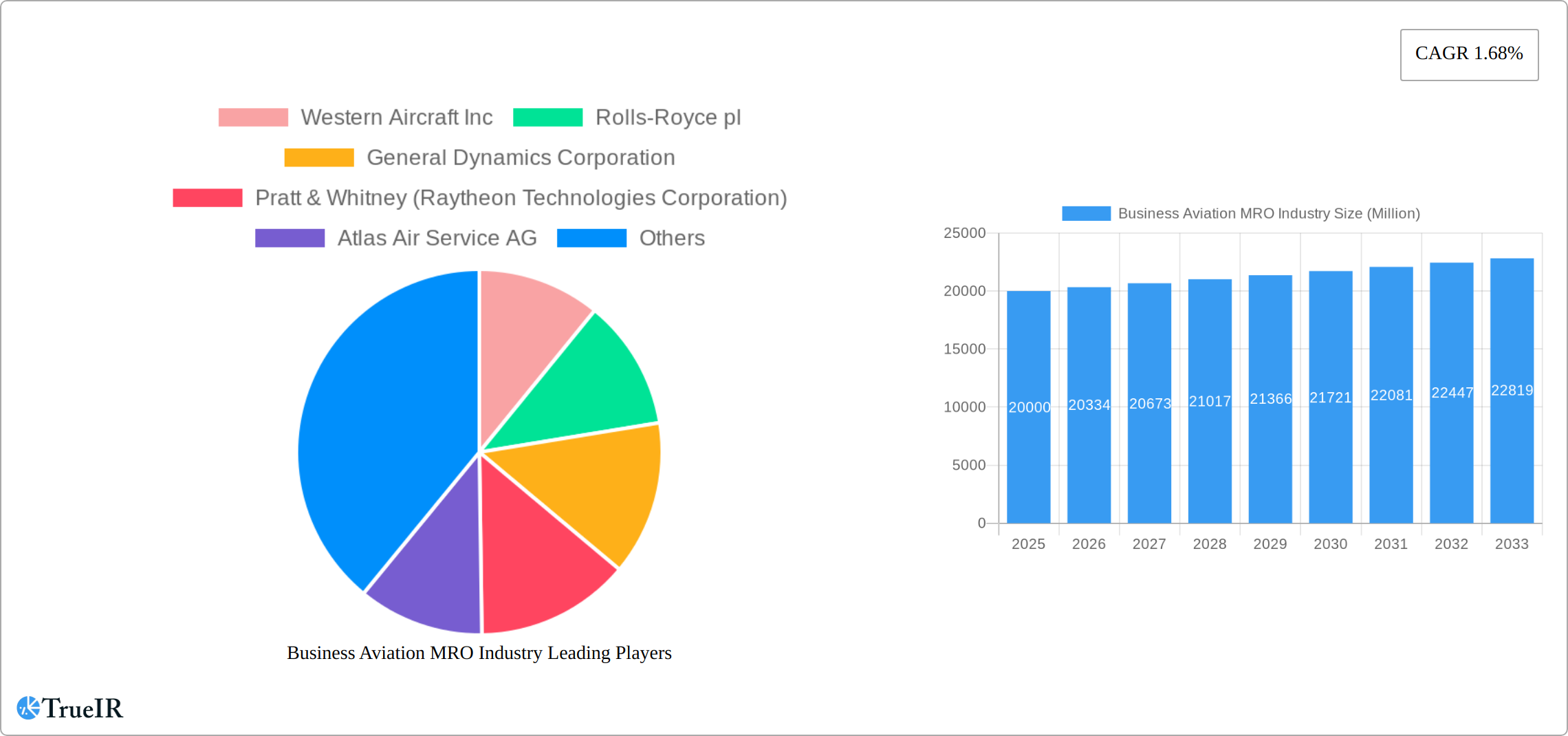

Business Aviation MRO Industry Company Market Share

Business Aviation MRO Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Business Aviation MRO (Maintenance, Repair, and Overhaul) industry, covering market size, segmentation, competitive landscape, key players, and future growth prospects from 2019 to 2033. With a focus on key industry trends and developments, this report is an invaluable resource for investors, industry professionals, and anyone seeking to understand this dynamic market. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects through the forecast period (2025-2033). The total market size is expected to reach xx Million by 2033.

Business Aviation MRO Industry Market Structure & Competitive Landscape

The Business Aviation MRO market is characterized by a dynamic and evolving structure, reflecting a blend of established global providers and a robust network of specialized, agile independent operators. While a few dominant players command significant market share, the landscape is increasingly enriched by niche service providers excelling in specific aircraft types, components, or specialized technical expertise. The Herfindahl-Hirschman Index (HHI) for the industry in 2024 is estimated at xx, signifying a moderately competitive environment with room for both large-scale operations and targeted specialization. Innovation is a paramount force, propelled by continuous advancements in aircraft technology, a growing imperative for highly efficient and cost-effective maintenance solutions, and the accelerating integration of digital technologies across the MRO lifecycle. These include AI-powered diagnostics, augmented reality for technicians, and comprehensive digital twins of aircraft. Regulatory frameworks, particularly those concerning aviation safety and environmental sustainability, are significant shapers of industry practices, driving higher standards and demanding greater transparency. Product and service substitutes, such as the leasing of newer, more technologically advanced aircraft that may require less immediate heavy maintenance, also exert competitive pressure, pushing MRO providers to enhance their value propositions. The end-user segment is predominantly comprised of discerning business jet operators, fractional ownership programs prioritizing fleet availability, and private aircraft owners seeking bespoke, reliable service.

- Market Concentration: HHI of xx in 2024, indicating a moderately competitive market with significant opportunities for both large integrators and specialized independent providers.

- Innovation Drivers: Proliferation of advanced materials in aircraft design, sophisticated digital maintenance technologies (e.g., AI, IoT, AR/VR), and the strategic implementation of predictive analytics for proactive issue resolution.

- Regulatory Impacts: Stringent adherence to evolving FAA regulations, EASA directives, and international environmental standards, which mandate higher operational efficiency and sustainable practices.

- M&A Trends: Recorded xx Million in M&A volume in 2024, with a projected xx% increase in activity by 2030. This surge is attributed to consolidation among smaller, specialized players seeking economies of scale and expanded service portfolios, as well as larger entities acquiring complementary capabilities and market access.

- End-User Segmentation: Business jet operators (estimated 60%), Fractional ownership programs (estimated 25%), and Private aircraft owners (estimated 15%).

Business Aviation MRO Industry Market Trends & Opportunities

The global business aviation MRO market is experiencing a period of sustained and robust growth, fueled by a confluence of strategic factors. The market size is projected to expand at an impressive Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, with an anticipated market valuation of xx Million by the conclusion of the forecast period. This significant expansion is primarily driven by the continuously increasing global fleet of business jets in operation, coupled with a discernible trend towards more frequent and comprehensive maintenance cycles, often mandated by increasingly stringent regulatory requirements. Furthermore, the accelerating adoption of cutting-edge maintenance technologies, such as advanced predictive maintenance algorithms and integrated digital solutions, is revolutionizing service delivery. The current market penetration rate for these advanced technologies remains relatively nascent, presenting substantial untapped potential for early adopters and innovative service providers. Moreover, evolving consumer preferences, emphasizing higher levels of aircraft availability and a critical reduction in operational downtime, are intensifying the demand for highly efficient, reliable, and proactive MRO services. The competitive dynamics within the market are becoming increasingly intense, marked by the strategic maneuvers of both established industry titans and agile new entrants. This competitive fervor is driving a pronounced focus on differentiation through the development of highly specialized service offerings, the cultivation of superior technological capabilities, and an unwavering commitment to customer service excellence.

Dominant Markets & Segments in Business Aviation MRO Industry

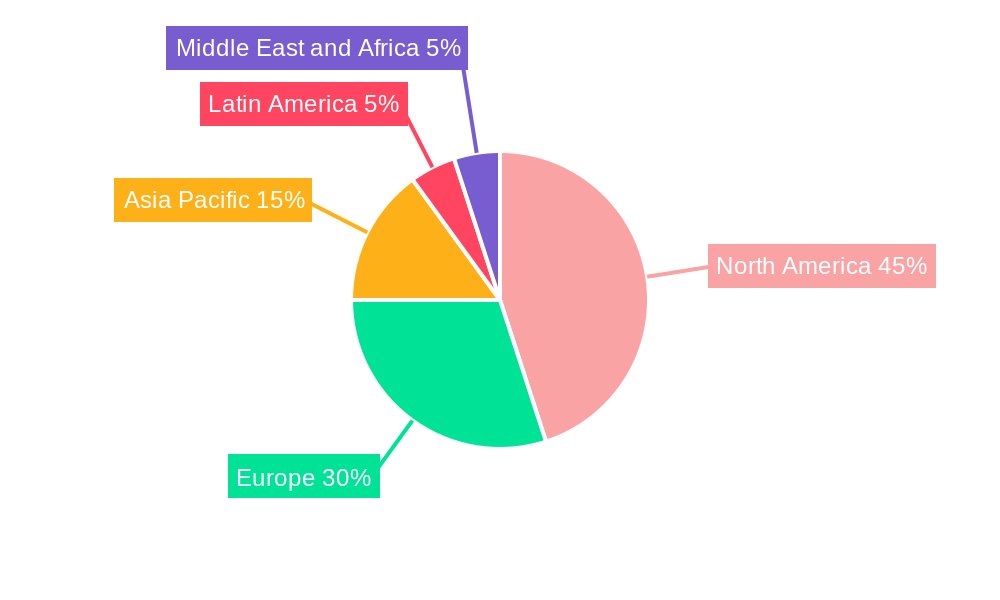

The North American region holds the largest market share within the business aviation MRO sector, fueled by a high concentration of business jet operators, strong economic growth, and developed infrastructure. Within MRO types, Engine MRO represents the largest segment, driven by the complexity and cost of engine maintenance.

- Leading Region: North America

- Leading Segment: Engine MRO

- Key Growth Drivers for North America:

- Well-established business aviation infrastructure.

- Stringent safety regulations driving higher MRO expenditure.

- High concentration of business jet operators and manufacturers.

- Key Growth Drivers for Engine MRO:

- High engine repair costs and complex maintenance procedures.

- Increasing engine technology complexity demanding specialized skills.

- Stricter environmental regulations impacting engine maintenance cycles.

- Other MRO Segments: Component MRO, Interior MRO, Airframe MRO, Field Maintenance each show varying growth rates depending on aircraft age, technology adoption and regulatory landscape. Specific regional growth rates are detailed within the full report.

Business Aviation MRO Industry Product Analysis

The Business Aviation MRO industry is witnessing significant innovation in maintenance technologies, with a shift towards predictive maintenance, digital solutions, and advanced materials. This leads to reduced downtime, improved operational efficiency, and optimized maintenance costs. The market fit for these advanced technologies is strong as operators prioritize minimizing disruptions and maximizing aircraft availability. The integration of data analytics, IoT sensors, and AI-powered diagnostic tools significantly enhances maintenance accuracy and efficiency.

Key Drivers, Barriers & Challenges in Business Aviation MRO Industry

Key Drivers:

- Continuous technological advancements, with a particular emphasis on the transformative potential of predictive maintenance, AI-driven diagnostics, and integrated digital solutions that enhance operational efficiency and reduce turnaround times.

- A growing global business aviation fleet, accompanied by an increase in average flight hours per aircraft, directly correlating to higher demand for MRO services.

- Stringent and evolving safety regulations across various jurisdictions, which necessitate higher levels of maintenance expenditure and adherence to best practices.

- An escalating demand for highly efficient maintenance strategies aimed at minimizing aircraft downtime, thereby maximizing asset utilization and operator revenue.

- The increasing complexity and sophistication of modern business aircraft, requiring specialized knowledge and advanced tooling that only experienced MRO providers can offer.

Key Challenges:

- Persistent supply chain disruptions, which significantly impact the availability of critical spare parts and the timely deployment of skilled labor, leading to project delays and increased costs. This resulted in an estimated xx% increase in MRO costs in 2022 alone.

- Navigating a complex and often fragmented global regulatory landscape, with evolving compliance requirements that add operational burdens, increase administrative overhead, and necessitate continuous investment in training and certification.

- Intense competition among a diverse range of MRO providers, from large OEMs and MRO networks to independent shops and specialized component repair facilities, which exerts downward pressure on pricing and impacts overall profitability. Market share competition is estimated to reduce profit margins by approximately xx% by 2030 if cost-saving efficiencies are not aggressively pursued.

- The ongoing shortage of highly skilled and experienced aviation maintenance technicians, particularly those with expertise in the latest aircraft technologies and digital systems.

Growth Drivers in the Business Aviation MRO Industry Market

The primary catalysts for growth in the Business Aviation MRO industry are intrinsically linked to the expanding global fleet of business jets and the increasing average flight hours these sophisticated aircraft accumulate. Technological advancements, particularly the strategic implementation of predictive maintenance methodologies and comprehensive digital solutions, are revolutionizing efficiency and drastically reducing costly aircraft downtime. Furthermore, the unwavering commitment to aviation safety, underscored by increasingly stringent regulatory mandates across different regions, directly translates into a higher frequency and scope of required maintenance activities. The growing demand originating from dynamic fractional ownership programs, which prioritize fleet availability and operational continuity, also significantly contributes to market expansion. Moreover, the continuous pursuit of enhanced operational efficiency by aircraft operators, driven by the need to optimize costs and maximize asset utilization, further fuels the demand for specialized and high-quality MRO services.

Challenges Impacting Business Aviation MRO Industry Growth

Supply chain constraints lead to part shortages and higher costs. Regulatory complexities and compliance requirements increase operational burdens. Intense competition from established players and new entrants puts downward pressure on prices. Skilled labor shortages limit capacity and operational efficiency.

Key Players Shaping the Business Aviation MRO Industry Market

- Western Aircraft Inc

- Rolls-Royce plc

- General Dynamics Corporation

- Pratt & Whitney (Raytheon Technologies Corporation)

- Atlas Air Service AG

- ExecuJet Aviation Group AG

- Lufthansa Technik AG

- DC Aviation GmbH

- Bombardier Inc

- Flying Colours Corp

- Constant Aviation LLC

- Comlux Aviation Services LLC

Significant Business Aviation MRO Industry Milestones

- December 2022: Embraer-X partners with Pulse Aviation for Beacon platform implementation, enhancing maintenance coordination.

- March 2022: Embraer signs service agreement with Avantto, leveraging the Embraer Executive Care Program.

- December 2021: ExecuJet MRO Services Malaysia announces construction of a new MRO facility in Kuala Lumpur.

Future Outlook for Business Aviation MRO Industry Market

The Business Aviation MRO market is poised for sustained growth, driven by technological innovation, fleet expansion, and regulatory compliance. Strategic opportunities lie in leveraging digital technologies for predictive maintenance and enhancing operational efficiency. The market's potential is substantial, with continued expansion expected across various segments and regions. The shift towards sustainable aviation fuels and the adoption of green technologies within MRO operations will present both opportunities and challenges in the coming decade.

Business Aviation MRO Industry Segmentation

-

1. MRO Type

- 1.1. Engine MRO

- 1.2. Component MRO

- 1.3. Interior MRO

- 1.4. Airframe MRO

- 1.5. Field Maintenance

Business Aviation MRO Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Business Aviation MRO Industry Regional Market Share

Geographic Coverage of Business Aviation MRO Industry

Business Aviation MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Components MRO Segment of the Market is Expected to Witness Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Engine MRO

- 5.1.2. Component MRO

- 5.1.3. Interior MRO

- 5.1.4. Airframe MRO

- 5.1.5. Field Maintenance

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. North America Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 6.1.1. Engine MRO

- 6.1.2. Component MRO

- 6.1.3. Interior MRO

- 6.1.4. Airframe MRO

- 6.1.5. Field Maintenance

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 7. Europe Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 7.1.1. Engine MRO

- 7.1.2. Component MRO

- 7.1.3. Interior MRO

- 7.1.4. Airframe MRO

- 7.1.5. Field Maintenance

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 8. Asia Pacific Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 8.1.1. Engine MRO

- 8.1.2. Component MRO

- 8.1.3. Interior MRO

- 8.1.4. Airframe MRO

- 8.1.5. Field Maintenance

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 9. Latin America Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 9.1.1. Engine MRO

- 9.1.2. Component MRO

- 9.1.3. Interior MRO

- 9.1.4. Airframe MRO

- 9.1.5. Field Maintenance

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 10. Middle East and Africa Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 10.1.1. Engine MRO

- 10.1.2. Component MRO

- 10.1.3. Interior MRO

- 10.1.4. Airframe MRO

- 10.1.5. Field Maintenance

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Western Aircraft Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rolls-Royce pl

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Dynamics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pratt & Whitney (Raytheon Technologies Corporation)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Atlas Air Service AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ExecuJet Aviation Group AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lufthansa Technik AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DC Aviation GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bombardier Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Flying Colours Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Constant Aviation LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Comlux Aviation Services LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Western Aircraft Inc

List of Figures

- Figure 1: Global Business Aviation MRO Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 3: North America Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 4: North America Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 7: Europe Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 8: Europe Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 11: Asia Pacific Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 12: Asia Pacific Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 15: Latin America Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 16: Latin America Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 19: Middle East and Africa Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 20: Middle East and Africa Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 2: Global Business Aviation MRO Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 4: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 6: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 8: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 10: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 12: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Aviation MRO Industry?

The projected CAGR is approximately 4.75%.

2. Which companies are prominent players in the Business Aviation MRO Industry?

Key companies in the market include Western Aircraft Inc, Rolls-Royce pl, General Dynamics Corporation, Pratt & Whitney (Raytheon Technologies Corporation), Atlas Air Service AG, ExecuJet Aviation Group AG, Lufthansa Technik AG, DC Aviation GmbH, Bombardier Inc, Flying Colours Corp, Constant Aviation LLC, Comlux Aviation Services LLC.

3. What are the main segments of the Business Aviation MRO Industry?

The market segments include MRO Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 90.85 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Components MRO Segment of the Market is Expected to Witness Highest Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Embraer-X signed a contract with Pulse Aviation for the use of Beacon, the maintenance coordination platform connecting resources and professionals for faster return-to-service aircraft. Pulse Aviation, a Florida-based business aviation company that offers MRO services, will use Beacon to improve maintenance coordination, make it easier to communicate about maintenance events involving all different types of aircraft models, foster teamwork, enhance knowledge sharing, and speed up workflows related to maintenance events.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Business Aviation MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Business Aviation MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Business Aviation MRO Industry?

To stay informed about further developments, trends, and reports in the Business Aviation MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence