Key Insights

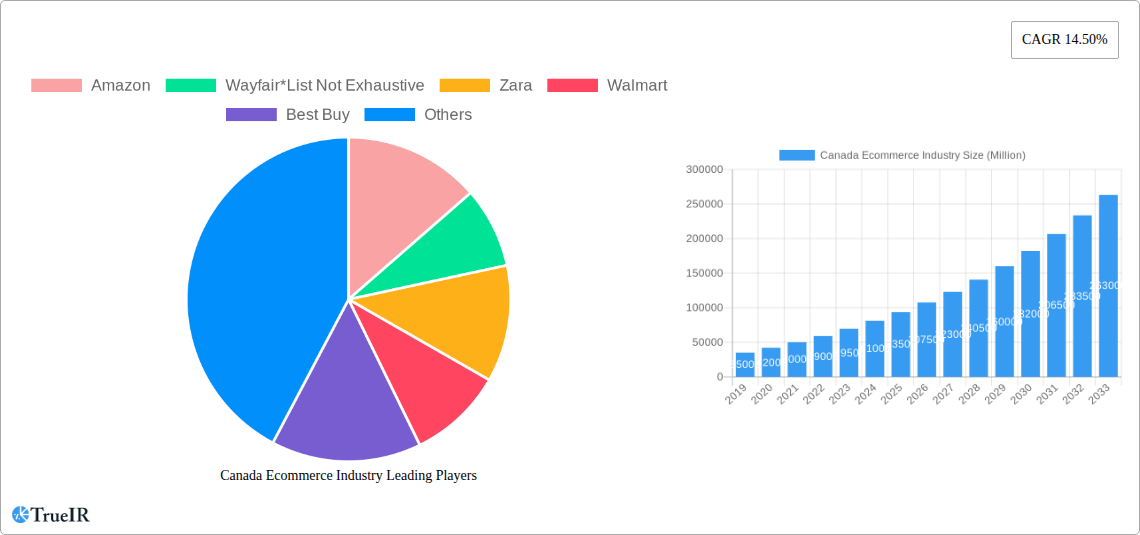

The Canadian e-commerce market is projected to experience substantial growth, expanding from $41.79 billion in 2025 to an estimated $120.5 billion by 2033. This robust expansion is underpinned by a Compound Annual Growth Rate (CAGR) of 9.86%. The Business-to-Consumer (B2C) segment remains the primary driver, fueled by increasing digital adoption, enhanced internet accessibility, widespread mobile device usage, and growing consumer confidence in online payment systems. Digital transformation initiatives and strategic investments in online retail infrastructure are further catalyzing this upward trajectory.

Canada Ecommerce Industry Market Size (In Billion)

Key market participants, including Amazon, Walmart, and Apple, are actively innovating to secure market dominance. The industry is witnessing a pronounced shift towards personalized customer experiences, emphasizing seamless online interactions, efficient logistics, and curated product assortments. Emerging trends such as social commerce, AI-driven personalization, and the growth of sustainable e-commerce practices are reshaping the market landscape. Potential challenges include evolving data privacy regulations and the imperative for continuous investment in cybersecurity. The market's segmentation across diverse sectors, including Beauty & Personal Care, Consumer Electronics, and Fashion & Apparel, reflects its broad appeal and diverse consumer base, contributing to its impressive market size and projected growth in Canada.

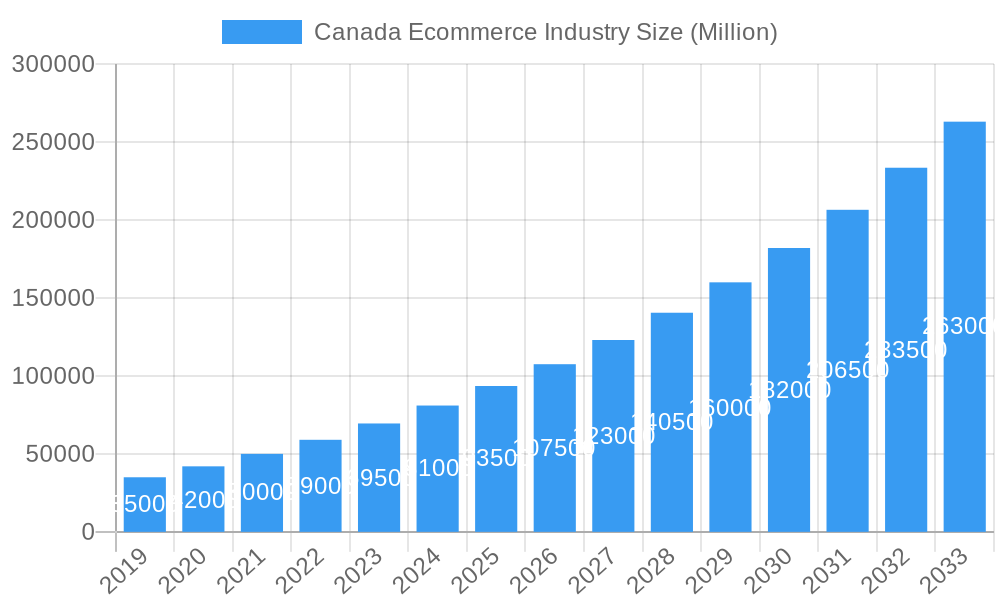

Canada Ecommerce Industry Company Market Share

Canada E-commerce Industry Report Description: Market Dynamics, Trends, and Future Outlook (2019-2033)

Unlock comprehensive insights into the burgeoning Canadian e-commerce landscape with this in-depth report. Covering the historical period of 2019-2024, the base and estimated year of 2025, and an extensive forecast period through 2033, this analysis provides critical data on market size, segmentation, key players, and emerging trends. Leveraging high-volume keywords such as "Canada e-commerce," "online retail Canada," "Canadian e-commerce market size," "B2C e-commerce Canada," and "B2B e-commerce Canada," this report is meticulously optimized for search engines and designed to captivate industry professionals, investors, and market strategists.

This report meticulously examines the evolving dynamics of the Canadian e-commerce market, offering granular analysis of both Business-to-Consumer (B2C) and Business-to-Business (B2B) segments. With detailed projections and historical data, stakeholders can confidently navigate the competitive environment, identify lucrative opportunities, and anticipate future market shifts.

Canada Ecommerce Industry Market Structure & Competitive Landscape

The Canadian e-commerce market exhibits a dynamic structure characterized by increasing competition, significant innovation drivers, and evolving regulatory landscapes. Market concentration remains a key area of analysis, with a few dominant players such as Amazon, Walmart, and Best Buy holding substantial market share, yet a growing number of agile startups and specialized retailers are challenging their positions. Innovation is largely driven by advancements in artificial intelligence for personalized shopping experiences, improved logistics and supply chain management, and the adoption of sustainable e-commerce practices. Regulatory impacts, though less pronounced than in some global markets, are beginning to shape data privacy, consumer protection, and cross-border trade policies, influencing operational strategies for companies. The threat of product substitutes is moderate, as the convenience and selection offered by online channels often outweigh traditional retail alternatives, though the experiential aspect of brick-and-mortar remains a differentiating factor. End-user segmentation highlights the diverse needs of Canadian consumers, ranging from rapid delivery expectations for groceries to specialized requirements for consumer electronics and fashion. Mergers and acquisitions (M&A) activity, while not at the fever pitch of other markets, is steadily increasing as larger players seek to acquire technological capabilities, expand market reach, or consolidate specific niche segments. For instance, the acquisition of niche online retailers by larger platforms reflects a strategic approach to diversification and market penetration. Concentration ratios in key sub-segments are closely monitored to understand market power and potential barriers to entry for new entrants.

Canada Ecommerce Industry Market Trends & Opportunities

The Canadian e-commerce market is poised for substantial growth, projected to expand significantly throughout the forecast period. This expansion is fueled by a confluence of technological advancements, shifting consumer preferences towards convenience and value, and intensifying competitive dynamics. The overall market size, encompassing both B2C and B2B transactions, is expected to witness a robust Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. Technological shifts are central to this growth trajectory, with the widespread adoption of mobile commerce, the integration of augmented reality (AR) for virtual try-ons, and the implementation of AI-powered chatbots for enhanced customer service revolutionizing the online shopping experience. The increasing penetration of high-speed internet across urban and rural areas further underpins this digital transformation. Consumer preferences are increasingly leaning towards personalized shopping journeys, sustainable product offerings, and seamless omnichannel experiences that blend online and offline touchpoints. This has created significant opportunities for retailers who can effectively leverage data analytics to understand individual customer needs and tailor their offerings accordingly. Competitive dynamics are characterized by both intense price competition and a growing emphasis on unique value propositions, brand loyalty, and exceptional customer service. The rise of direct-to-consumer (DTC) brands is also a notable trend, enabling businesses to bypass traditional retail channels and build direct relationships with their customer base, fostering stronger brand affinity and higher profit margins. The Canadian government's ongoing support for digital innovation and infrastructure development further bolsters the market's potential, creating a favorable environment for e-commerce businesses to thrive and capitalize on emerging opportunities.

Dominant Markets & Segments in Canada Ecommerce Industry

Within the Canadian e-commerce industry, the Business-to-Consumer (B2C) segment continues to dominate in terms of Gross Merchandise Volume (GMV), consistently outperforming its Business-to-Business (B2B) counterpart. The B2C market is projected to reach a GMV of approximately XX Million by 2027. This dominance is driven by a diverse range of applications, with Fashion & Apparel and Consumer Electronics consistently leading the pack.

- Market Size (GMV) for the period of 2017-2027: The historical data shows a consistent upward trend, with projections indicating continued robust growth for the B2C e-commerce market in Canada. The forecast for 2027 anticipates a GMV of XX Million.

- Market Segmentation - by Application:

- Beauty & Personal Care: This segment has shown steady growth, with a projected GMV of XX Million by 2027, driven by an increasing consumer focus on wellness and self-care.

- Consumer Electronics: Consistently a top performer, this segment is expected to reach XX Million in GMV by 2027, fueled by demand for the latest gadgets and smart home devices.

- Fashion & Apparel: The largest segment, Fashion & Apparel is projected to achieve a GMV of XX Million by 2027, reflecting evolving fashion trends and the convenience of online shopping for clothing and accessories.

- Food & Beverage: This segment has witnessed significant acceleration, particularly post-pandemic, with an anticipated GMV of XX Million by 2027, driven by grocery delivery services and meal kit subscriptions.

- Furniture & Home: Experiencing substantial growth, Furniture & Home is expected to reach XX Million in GMV by 2027, as consumers increasingly purchase larger items online.

- Others (Toys, DIY, Media, etc.): This diverse category is projected to contribute XX Million in GMV by 2027, showcasing the broad reach of e-commerce across various consumer needs.

The B2B e-commerce market, while smaller in comparison to B2C, is also on a significant growth trajectory, with a projected market size of XX Million for the period of 2017-2027. Key growth drivers for the B2B segment include the digitalization of procurement processes, the demand for specialized industrial goods, and the increasing adoption of online marketplaces for business transactions. Infrastructure development and favorable government policies aimed at supporting business digitalization are crucial factors bolstering market dominance in both segments.

Canada Ecommerce Industry Product Analysis

Canadian e-commerce is characterized by a surge in product innovations aimed at enhancing customer experience and operational efficiency. From smart home devices and personalized beauty products to sustainable fashion and ready-to-eat meal kits, the diversity of online offerings continues to expand. Competitive advantages are increasingly derived from seamless integration of online and offline channels, user-friendly mobile applications, and the adoption of advanced technologies like AI for personalized recommendations and AR for virtual try-ons. The focus on fast and reliable delivery, coupled with robust customer support, further solidifies market position for leading companies.

Key Drivers, Barriers & Challenges in Canada Ecommerce Industry

Key Drivers:

- Technological Advancements: Widespread internet penetration, mobile-first strategies, and the adoption of AI and AR technologies are propelling market growth.

- Shifting Consumer Behavior: Increasing preference for convenience, wider product selection, and competitive pricing available online.

- Government Initiatives: Support for digital infrastructure and e-commerce adoption through various policies.

- Growing Middle Class: Increased disposable income leading to higher online spending.

Key Barriers & Challenges:

- Supply Chain and Logistics: Managing efficient last-mile delivery, especially in vast geographical areas, remains a significant hurdle.

- Regulatory Complexity: Navigating diverse provincial regulations, data privacy laws, and taxation can be challenging.

- Competitive Pressures: Intense competition from both domestic and international players, leading to price wars and margin erosion.

- Consumer Trust and Security Concerns: Building and maintaining customer trust regarding online transactions and data security is crucial.

Growth Drivers in the Canada Ecommerce Industry Market

The growth of the Canadian e-commerce market is primarily propelled by increasing internet and smartphone penetration, making online shopping more accessible than ever before. Technological innovations, such as the widespread adoption of mobile payment solutions and the integration of AI for personalized customer experiences, are significantly enhancing the convenience and appeal of online retail. Furthermore, government initiatives aimed at fostering digital adoption and improving digital infrastructure provide a supportive ecosystem for e-commerce businesses to flourish. Economic factors, including rising disposable incomes and a growing middle class, also contribute to increased consumer spending power online.

Challenges Impacting Canada Ecommerce Industry Growth

Despite robust growth, the Canadian e-commerce industry faces several challenges. Regulatory complexities, particularly concerning data privacy and consumer protection across different provinces, can create operational hurdles. Supply chain issues, including the costs and logistical complexities of last-mile delivery in Canada's vast geography, remain a persistent concern. Intense competitive pressures from established global giants and emerging local players often lead to price wars, impacting profit margins for smaller businesses. Additionally, building and maintaining consumer trust regarding online security and the reliability of product quality continues to be a crucial aspect for sustained growth.

Key Players Shaping the Canada Ecommerce Industry Market

- Amazon

- Wayfair

- Zara

- Walmart

- Best Buy

- Home Depot

- Kroger

- Costco

- Target

- Apple

Significant Canada Ecommerce Industry Industry Milestones

- May 2022: Amazon's advanced robotics facility, its most technologically advanced supply chain in Canada, opened in April 2022. The company also announced plans to open three more Ontario facilities in 2023.

- April 2022: The Home Depot Canada Foundation committed an additional $125 million to combat youth homelessness by 2030. Over recent months, the foundation has distributed over $5 million across Canadian communities through various initiatives.

- April 2022: Walmart Canada partnered with Stingray Retail Media Network, appointing Stingray as the exclusive sales representative for its in-store digital audio ad campaigns across the national retail footprint.

Future Outlook for Canada Ecommerce Industry Market

The future outlook for the Canadian e-commerce industry is exceptionally promising, driven by continued technological innovation and evolving consumer habits. Strategic opportunities lie in expanding personalized shopping experiences through AI and AR, optimizing omnichannel strategies to seamlessly integrate online and offline retail, and further investing in sustainable e-commerce practices. The growing adoption of mobile commerce and the increasing demand for same-day delivery services will also shape market dynamics. As the digital infrastructure continues to improve and consumer confidence in online transactions solidifies, the Canadian e-commerce market is set to experience sustained and significant growth, presenting lucrative prospects for businesses that can adapt to these trends.

Canada Ecommerce Industry Segmentation

-

1. B2C E-commerce

- 1.1. Market size (GMV) for the period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty & Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion & Apparel

- 1.2.4. Food & Beverage

- 1.2.5. Furniture & Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market size (GMV) for the period of 2017-2027

-

3. Application

- 3.1. Beauty & Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion & Apparel

- 3.4. Food & Beverage

- 3.5. Furniture & Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty & Personal Care

- 5. Consumer Electronics

- 6. Fashion & Apparel

- 7. Food & Beverage

- 8. Furniture & Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B E-commerce

- 10.1. Market size for the period of 2017-2027

Canada Ecommerce Industry Segmentation By Geography

- 1. Canada

Canada Ecommerce Industry Regional Market Share

Geographic Coverage of Canada Ecommerce Industry

Canada Ecommerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Contactless Forms of Payment; Rise in Cross-Border Online Shopping; Penetration of Internet and Smartphone Usage

- 3.3. Market Restrains

- 3.3.1. Operational Compatibility Due to Growing Brand Value

- 3.4. Market Trends

- 3.4.1. Increasing internet users in Canada

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Ecommerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Market size (GMV) for the period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty & Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion & Apparel

- 5.1.2.4. Food & Beverage

- 5.1.2.5. Furniture & Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market size (GMV) for the period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty & Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion & Apparel

- 5.3.4. Food & Beverage

- 5.3.5. Furniture & Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty & Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion & Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food & Beverage

- 5.8. Market Analysis, Insights and Forecast - by Furniture & Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10.1. Market size for the period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wayfair*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zara

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Walmart

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Best Buy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Home Depot

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kroger

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Costco

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Target

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apple

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: Canada Ecommerce Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Ecommerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Ecommerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 2: Canada Ecommerce Industry Revenue billion Forecast, by Market size (GMV) for the period of 2017-2027 2020 & 2033

- Table 3: Canada Ecommerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Canada Ecommerce Industry Revenue billion Forecast, by Beauty & Personal Care 2020 & 2033

- Table 5: Canada Ecommerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 6: Canada Ecommerce Industry Revenue billion Forecast, by Fashion & Apparel 2020 & 2033

- Table 7: Canada Ecommerce Industry Revenue billion Forecast, by Food & Beverage 2020 & 2033

- Table 8: Canada Ecommerce Industry Revenue billion Forecast, by Furniture & Home 2020 & 2033

- Table 9: Canada Ecommerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 10: Canada Ecommerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 11: Canada Ecommerce Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Canada Ecommerce Industry Revenue billion Forecast, by B2C E-commerce 2020 & 2033

- Table 13: Canada Ecommerce Industry Revenue billion Forecast, by Market size (GMV) for the period of 2017-2027 2020 & 2033

- Table 14: Canada Ecommerce Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Canada Ecommerce Industry Revenue billion Forecast, by Beauty & Personal Care 2020 & 2033

- Table 16: Canada Ecommerce Industry Revenue billion Forecast, by Consumer Electronics 2020 & 2033

- Table 17: Canada Ecommerce Industry Revenue billion Forecast, by Fashion & Apparel 2020 & 2033

- Table 18: Canada Ecommerce Industry Revenue billion Forecast, by Food & Beverage 2020 & 2033

- Table 19: Canada Ecommerce Industry Revenue billion Forecast, by Furniture & Home 2020 & 2033

- Table 20: Canada Ecommerce Industry Revenue billion Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 21: Canada Ecommerce Industry Revenue billion Forecast, by B2B E-commerce 2020 & 2033

- Table 22: Canada Ecommerce Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Ecommerce Industry?

The projected CAGR is approximately 9.86%.

2. Which companies are prominent players in the Canada Ecommerce Industry?

Key companies in the market include Amazon, Wayfair*List Not Exhaustive, Zara, Walmart, Best Buy, Home Depot, Kroger, Costco, Target, Apple.

3. What are the main segments of the Canada Ecommerce Industry?

The market segments include B2C E-commerce, Market size (GMV) for the period of 2017-2027, Application, Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home, Others (Toys, DIY, Media, etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.79 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Contactless Forms of Payment; Rise in Cross-Border Online Shopping; Penetration of Internet and Smartphone Usage.

6. What are the notable trends driving market growth?

Increasing internet users in Canada.

7. Are there any restraints impacting market growth?

Operational Compatibility Due to Growing Brand Value.

8. Can you provide examples of recent developments in the market?

May 2022- The robotics facility, which Amazon called (new window) its most advanced technological supply chain in Canada, opened in April 2022. In April, the company announced its plans to open three more Ontario facilities in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Ecommerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Ecommerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Ecommerce Industry?

To stay informed about further developments, trends, and reports in the Canada Ecommerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence