Key Insights

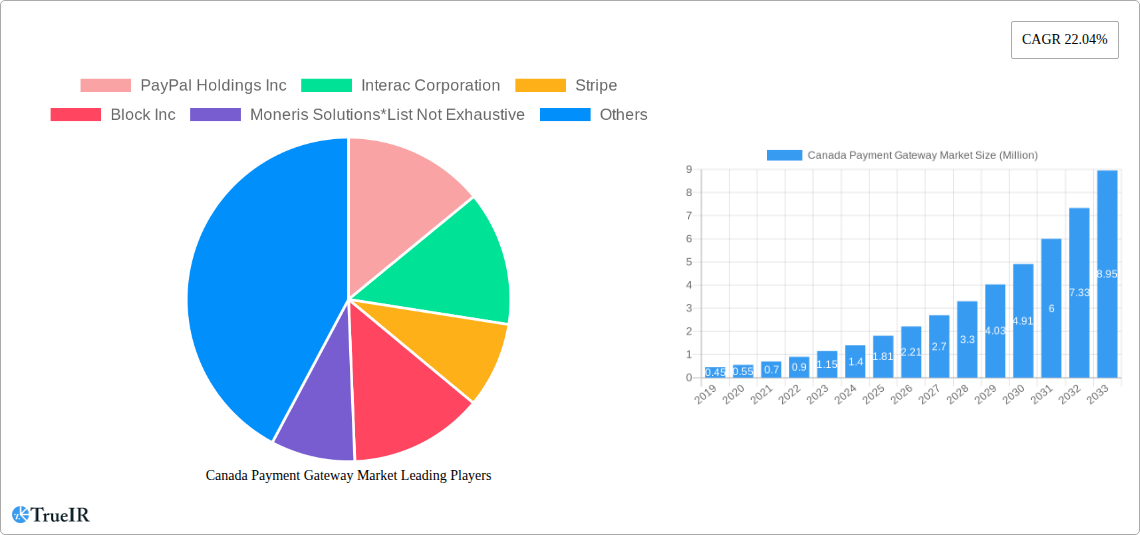

The Canadian payment gateway market is poised for significant expansion, projected to reach $1.81 million by 2025 and grow at a robust 22.04% CAGR through 2033. This rapid growth is primarily propelled by the increasing adoption of digital payment methods across various sectors, driven by evolving consumer preferences for convenience and speed. The surge in e-commerce, coupled with the ongoing digital transformation initiatives by businesses, further fuels demand for secure and efficient payment solutions. Key market drivers include the growing prevalence of mobile payments, the expanding small and medium-sized enterprise (SME) segment embracing online transactions, and the increasing need for streamlined cross-border payments. The market is segmented by type into Hosted and Non-Hosted solutions, with Hosted solutions likely dominating due to their ease of integration and lower upfront costs for businesses. Enterprise segments include Small and Medium Enterprises (SMEs) and Large Enterprises, with SMEs expected to be a significant growth area as they increasingly invest in online sales channels.

Canada Payment Gateway Market Market Size (In Million)

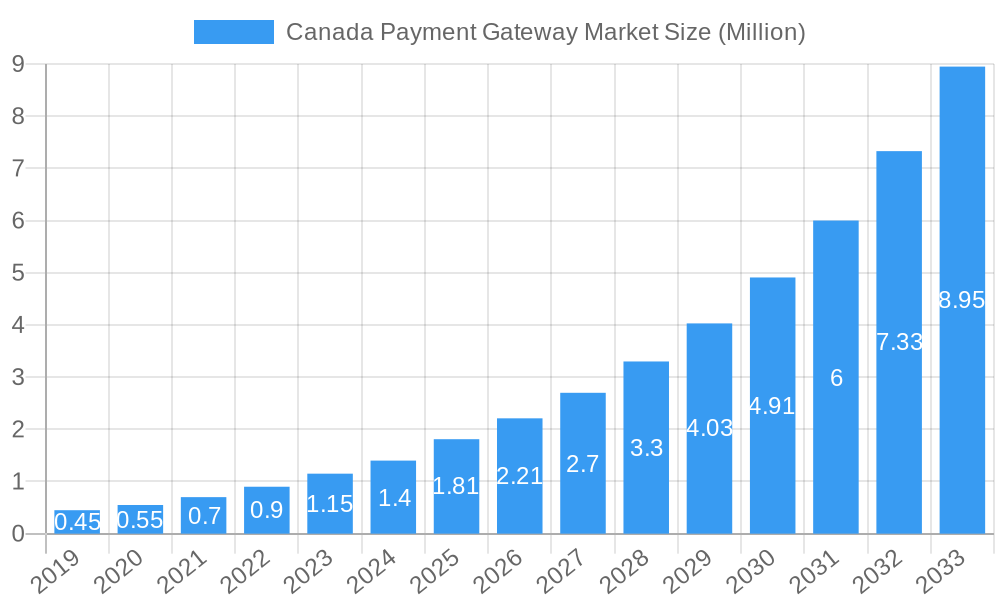

The entertainment and retail sectors are anticipated to be major end-users, alongside the burgeoning travel and BFSI industries, all leveraging payment gateways for seamless transactions. While the market is experiencing a substantial upward trajectory, potential restraints could include evolving regulatory landscapes regarding data security and privacy, and the ongoing challenge of cybersecurity threats. However, the innovation in payment technologies, such as the rise of contactless payments and advancements in fraud detection, is expected to mitigate these concerns. Major players like PayPal Holdings Inc., Interac Corporation, Stripe, Block Inc., and Moneris Solutions are actively shaping the market through continuous product development and strategic partnerships, contributing to the overall dynamic and competitive nature of the Canadian payment gateway landscape. The region is also seeing increased investment in payment infrastructure to support this growth.

Canada Payment Gateway Market Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the Canada Payment Gateway Market. Covering the study period 2019–2033, with a base year and estimated year of 2025, this research leverages high-volume keywords to enhance search rankings and engage industry audiences. Explore critical market dynamics, competitive landscapes, emerging trends, and future growth projections for Canadian payment solutions.

Canada Payment Gateway Market Market Structure & Competitive Landscape

The Canada Payment Gateway Market exhibits a moderately concentrated structure, driven by significant innovation and the increasing adoption of digital payment solutions. Key innovation drivers include the demand for seamless online transactions, enhanced security features, and the integration of emerging technologies like AI and blockchain. Regulatory impacts, while generally supportive of innovation, also shape market entry and operational strategies. Product substitutes, such as peer-to-peer payment apps and direct bank transfers, present ongoing competition, necessitating continuous improvement from payment gateway providers. The market is further segmented by end-user industries, including Travel, Retail, BFSI, and Media and Entertainment, each with distinct payment processing needs. Mergers and acquisitions (M&A) play a vital role in market consolidation and the expansion of service portfolios. In the historical period (2019-2024), an estimated XX billion Canadian dollars were involved in M&A activities, reflecting strategic consolidations and investments. The competitive intensity is high, with established players continuously vying for market share through service differentiation and technological advancements. Concentration ratios, while subject to market fluctuations, indicate a significant presence of the top five players, though emerging fintechs are steadily gaining traction.

Canada Payment Gateway Market Market Trends & Opportunities

The Canada Payment Gateway Market is experiencing robust growth, projected to reach an estimated XX billion Canadian dollars by 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period 2025–2033. This expansion is fueled by a confluence of technological shifts, evolving consumer preferences, and dynamic competitive landscapes. The increasing penetration of e-commerce across various sectors, particularly in Retail and Travel, is a primary growth catalyst. Consumers are increasingly demanding secure, convenient, and instant payment options, driving the adoption of advanced payment gateways that support multiple payment methods, including credit cards, debit cards, digital wallets, and newer contactless technologies.

Technological advancements are revolutionizing the payment gateway ecosystem. The integration of Artificial Intelligence (AI) for fraud detection and risk management, the adoption of Application Programming Interfaces (APIs) for seamless integration with business systems, and the exploration of blockchain technology for enhanced security and transparency are key trends. Cloud-based payment gateway solutions are gaining significant traction due to their scalability, flexibility, and cost-effectiveness, particularly for Small and Medium Enterprises (SMEs).

Consumer preferences are shifting towards mobile-first payment experiences, with a surge in mobile wallet usage and in-app purchases. This trend necessitates payment gateway providers to offer mobile-optimized solutions and robust security measures to protect sensitive customer data. The growing demand for cross-border e-commerce also presents a significant opportunity, as businesses look for payment gateways that can handle international transactions efficiently and compliantly.

The competitive dynamics are characterized by intense innovation and strategic partnerships. Leading players are focusing on expanding their service offerings, enhancing user experience, and ensuring compliance with evolving regulatory frameworks. Opportunities abound for players who can offer specialized solutions for niche industries, provide comprehensive data analytics, and foster ecosystem integrations. The market is ripe for disruption through innovative business models and a customer-centric approach. The estimated market penetration rate of advanced payment gateway solutions in the Canadian e-commerce sector is currently at XX% and is expected to grow significantly.

Dominant Markets & Segments in Canada Payment Gateway Market

The Canada Payment Gateway Market showcases distinct dominance across various segments, driven by specific industry needs and technological adoption patterns.

Type Segmentation:

- Hosted Payment Gateways: These solutions are widely adopted, particularly by SMEs, due to their ease of implementation and reduced PCI DSS compliance burden. The Retail and Media and Entertainment sectors show a strong preference for hosted solutions, leveraging their user-friendly interfaces and quick setup times. The market share for hosted gateways is estimated at XX% in 2025.

- Non-Hosted Payment Gateways: Large enterprises and businesses with stringent customization requirements often opt for non-hosted solutions. These offer greater control over the payment process and customer experience, making them a preferred choice for sectors like BFSI and Travel where advanced integration and security are paramount. The market share for non-hosted gateways is projected at XX% in 2025.

Enterprise Segmentation:

- Small and Medium Enterprise (SME): This segment represents a significant growth engine for the Canadian payment gateway market. SMEs are increasingly embracing e-commerce and digital payment solutions to expand their reach and improve operational efficiency. The availability of cost-effective and easy-to-integrate payment gateways makes them an attractive option for this demographic. The SME segment is expected to contribute XX% to the market revenue by 2025.

- Large Enterprise: While already significant adopters, large enterprises continue to drive innovation and demand for sophisticated payment gateway functionalities. Their focus is on scalability, robust security, fraud prevention, and seamless integration with existing enterprise resource planning (ERP) and customer relationship management (CRM) systems.

End-User Segmentation:

- Retail: This is a dominant end-user industry, accounting for a substantial portion of payment gateway transactions. The exponential growth of online shopping and the increasing demand for diversified payment options, including buy-now-pay-later (BNPL) services, fuel this segment's dominance. The Retail segment is expected to hold XX% market share by 2025.

- Travel: The travel industry, encompassing online travel agencies (OTAs), airlines, and hotels, heavily relies on secure and efficient payment gateways for bookings and transactions. The recovery and growth of the travel sector post-pandemic have further boosted the demand for these services. The Travel segment is estimated to contribute XX% to the market by 2025.

- BFSI: The Banking, Financial Services, and Insurance (BFSI) sector is a major player, both as a consumer and provider of payment gateway services. Financial institutions are increasingly integrating advanced payment solutions to offer enhanced digital banking experiences, facilitate secure online transactions, and combat financial fraud.

- Media and Entertainment: With the rise of digital content streaming, online ticketing, and in-app purchases, the media and entertainment sector presents a growing market for payment gateways.

- Other End-users: This includes various other industries like healthcare, education, and government services, all of which are increasingly adopting digital payment solutions.

Key growth drivers across these segments include robust e-commerce infrastructure, supportive government policies promoting digital payments, and the continuous need for secure and efficient transaction processing.

Canada Payment Gateway Market Product Analysis

The Canada Payment Gateway Market is characterized by a steady stream of product innovations aimed at enhancing security, user experience, and integration capabilities. Key advancements include the development of AI-powered fraud detection systems, tokenization for secure data handling, and simplified API integrations for seamless merchant onboarding. Payment gateways are increasingly offering multi-currency support and localized payment methods to cater to the growing cross-border e-commerce landscape. Competitive advantages are being gained through features like real-time transaction monitoring, robust analytics dashboards, and personalized customer journeys. The focus is on providing scalable, reliable, and compliant solutions that meet the evolving demands of diverse industries, from the fast-paced retail sector to the highly regulated BFSI domain.

Key Drivers, Barriers & Challenges in Canada Payment Gateway Market

Key Drivers:

- Growing E-commerce Penetration: The continuous expansion of online retail and digital services across Canada is a primary growth engine.

- Technological Advancements: Innovation in areas like AI, cloud computing, and mobile payments are enhancing functionality and user experience.

- Government Initiatives: Policies supporting digital transformation and financial inclusion are fostering market growth.

- Demand for Secure Transactions: Increasing consumer awareness and regulatory requirements are driving the adoption of secure payment solutions.

Barriers & Challenges:

- Regulatory Compliance: Adhering to evolving data privacy and security regulations (e.g., PCI DSS) can be complex and costly.

- Cybersecurity Threats: The constant threat of cyberattacks and data breaches necessitates continuous investment in robust security measures.

- Integration Complexity: Integrating payment gateways with existing business systems can be a technical challenge for some businesses.

- Competition: The highly competitive market landscape requires continuous innovation and competitive pricing strategies.

- Interoperability Issues: Ensuring seamless interoperability between different payment systems and networks remains a persistent challenge.

Growth Drivers in the Canada Payment Gateway Market Market

The Canada Payment Gateway Market is experiencing accelerated growth driven by several key factors. The robust expansion of e-commerce across all sectors, propelled by shifting consumer habits towards online purchasing, is a significant catalyst. Technological advancements, such as the increasing adoption of AI for fraud prevention and the proliferation of mobile payment solutions, are enhancing transaction security and convenience, thereby boosting adoption rates. Furthermore, government initiatives aimed at promoting digital payments and fostering financial inclusion are creating a more conducive environment for market players. The demand for seamless, real-time payment processing, particularly from the Retail, Travel, and BFSI sectors, continues to drive innovation and investment in payment gateway technologies. The focus on providing frictionless customer experiences is also a major growth stimulant.

Challenges Impacting Canada Payment Gateway Market Growth

Despite the positive growth trajectory, the Canada Payment Gateway Market faces several challenges. Navigating the complex and evolving landscape of regulatory compliance, including data privacy and security standards, poses a significant hurdle for businesses. The persistent threat of sophisticated cyberattacks and data breaches necessitates substantial and ongoing investment in cybersecurity infrastructure and protocols. Integrating new payment gateway solutions with legacy IT systems can be a technically demanding and time-consuming process for many businesses, particularly SMEs. The intense competition within the market also pressures providers to maintain competitive pricing while investing in innovation and security, impacting profit margins. Ensuring seamless interoperability between various payment networks and systems remains a critical challenge for achieving truly unified payment experiences.

Key Players Shaping the Canada Payment Gateway Market Market

- PayPal Holdings Inc

- Interac Corporation

- Stripe

- Block Inc

- Moneris Solutions

Significant Canada Payment Gateway Market Industry Milestones

- April 2024: Payments Canada, in partnership with tech giants IBM and CGI, announced plans to unveil its Real-Time Rail (RTR) system for swift digital payments by 2026. This initiative, after a decade of development, aims to enhance transaction oversight and security, enabling 24/7 real-time payments with rapid clearance and settlement.

- May 2024: Intellect Design Arena Ltd unveiled its Canada eMACH.ai Cloud, a comprehensive suite for Canadian banks and credit unions covering digital engagement, liquidity, virtual accounts, and core banking. Integrated with AI, these offerings empower financial institutions to customize and enhance their digital services, designed specifically for the Canadian market.

Future Outlook for Canada Payment Gateway Market Market

The future outlook for the Canada Payment Gateway Market is exceptionally promising, fueled by continued technological innovation and evolving consumer expectations. Growth catalysts include the increasing adoption of contactless payments, the expansion of Buy Now Pay Later (BNPL) services, and the growing demand for embedded finance solutions. The push towards real-time payments, as exemplified by initiatives like Payments Canada's RTR system, will further revolutionize transaction speeds and efficiency. Opportunities lie in developing more sophisticated AI-driven fraud prevention tools, enhancing cross-border payment capabilities, and providing personalized payment experiences tailored to specific industry needs. The market is poised for sustained growth as businesses of all sizes continue to prioritize secure, efficient, and customer-centric digital payment solutions to thrive in the evolving Canadian economy.

Canada Payment Gateway Market Segmentation

-

1. Type

- 1.1. Hosted

- 1.2. Non-Hosted

-

2. Enterprise

- 2.1. Small and Medium Enterprise (SME)

- 2.2. Large Enterprise

-

3. End User

- 3.1. Travel

- 3.2. Retail

- 3.3. BFSI

- 3.4. Media and Entertainment

- 3.5. Other End-users

Canada Payment Gateway Market Segmentation By Geography

- 1. Canada

Canada Payment Gateway Market Regional Market Share

Geographic Coverage of Canada Payment Gateway Market

Canada Payment Gateway Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail

- 3.3. Market Restrains

- 3.3.1. Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail

- 3.4. Market Trends

- 3.4.1. Increased Demand for Mobile-based Payments

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Payment Gateway Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hosted

- 5.1.2. Non-Hosted

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Small and Medium Enterprise (SME)

- 5.2.2. Large Enterprise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Travel

- 5.3.2. Retail

- 5.3.3. BFSI

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PayPal Holdings Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Interac Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stripe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Block Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Moneris Solutions*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 PayPal Holdings Inc

List of Figures

- Figure 1: Canada Payment Gateway Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Payment Gateway Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Payment Gateway Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Payment Gateway Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Canada Payment Gateway Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 4: Canada Payment Gateway Market Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 5: Canada Payment Gateway Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Canada Payment Gateway Market Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Canada Payment Gateway Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Canada Payment Gateway Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Canada Payment Gateway Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Canada Payment Gateway Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Canada Payment Gateway Market Revenue Million Forecast, by Enterprise 2020 & 2033

- Table 12: Canada Payment Gateway Market Volume Billion Forecast, by Enterprise 2020 & 2033

- Table 13: Canada Payment Gateway Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Canada Payment Gateway Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Canada Payment Gateway Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Canada Payment Gateway Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Payment Gateway Market?

The projected CAGR is approximately 22.04%.

2. Which companies are prominent players in the Canada Payment Gateway Market?

Key companies in the market include PayPal Holdings Inc, Interac Corporation, Stripe, Block Inc, Moneris Solutions*List Not Exhaustive.

3. What are the main segments of the Canada Payment Gateway Market?

The market segments include Type, Enterprise, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail.

6. What are the notable trends driving market growth?

Increased Demand for Mobile-based Payments.

7. Are there any restraints impacting market growth?

Increased E-commerce Sales and High Internet Penetration Rate; Increased Demand for Mobile-based Payments; Growing Adoption of Payment Gateways in Retail.

8. Can you provide examples of recent developments in the market?

April 2024: Payments Canada, in partnership with tech giants IBM and CGI, is set to unveil its Real-Time Rail (RTR) system for swift digital payments by 2026. This announcement comes after a decade-long journey marked by several delays since the initiative's inception. The RTR system is designed to enhance transaction oversight and security for Canadians, enabling real-time payments around the clock every day of the year, with swift clearance and settlement in mere seconds.May 2024: Intellect Design Arena Ltd, a versatile financial technology company catering to banks, credit unions, and insurance clients, has unveiled the Canada eMACH.ai Cloud tailored for banks and credit unions. This all-encompassing product suite covers areas such as digital engagement, liquidity, virtual accounts, and core banking (encompassing Payments and Deposits). With integrated AI, these offerings empower financial institutions to customize their digital services, meeting but surpassing customer expectations and driving growth. Furthermore, all products are fully operational or specifically designed for the Canadian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Payment Gateway Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Payment Gateway Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Payment Gateway Market?

To stay informed about further developments, trends, and reports in the Canada Payment Gateway Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence