Key Insights

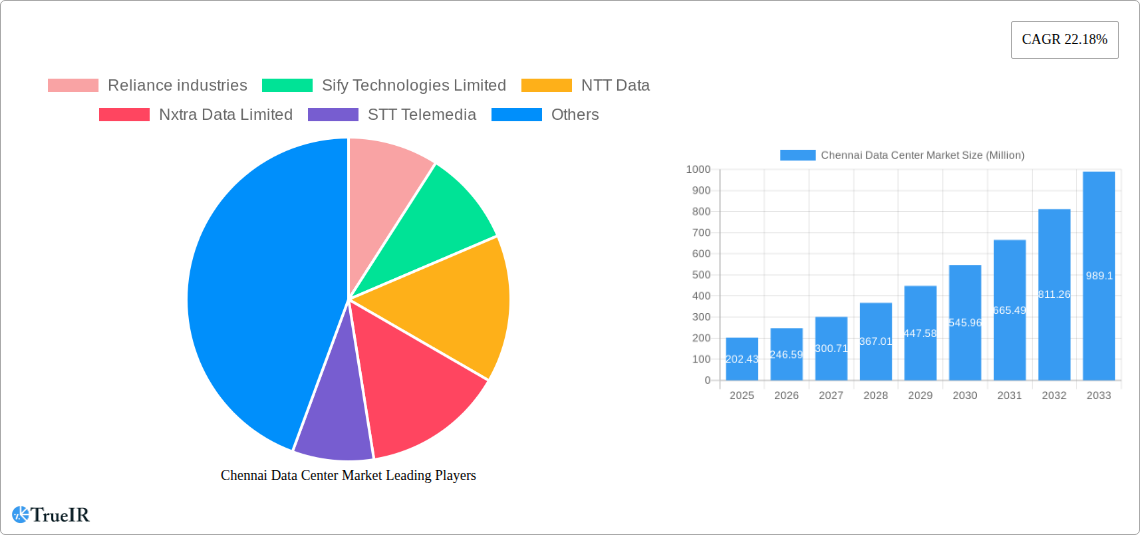

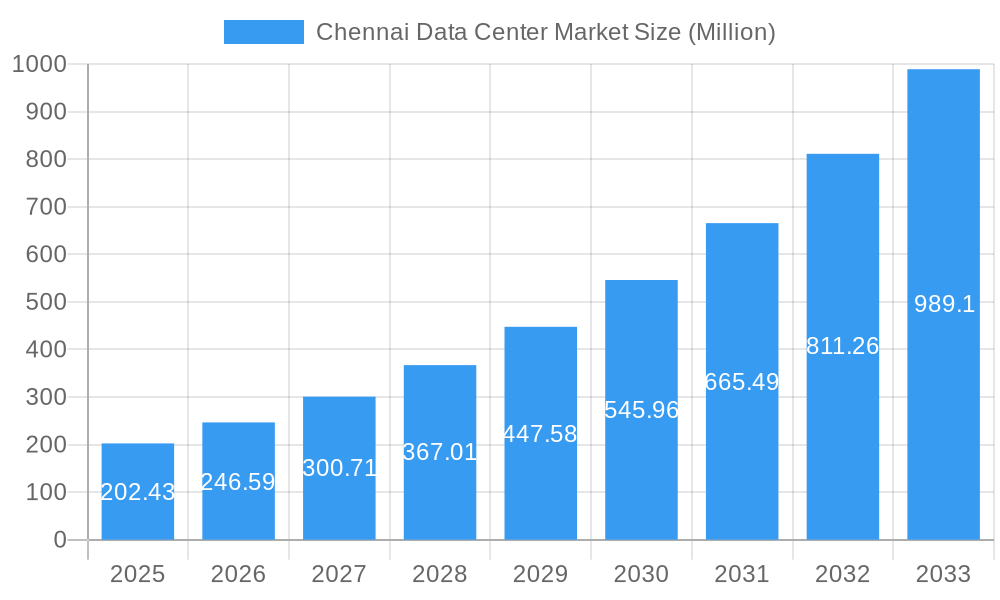

The Chennai Data Center Market is poised for exceptional growth, demonstrating a robust compound annual growth rate (CAGR) of 21.78%. Valued at an estimated $202.43 million in 2025, this surge is propelled by a confluence of strategic drivers, primarily the escalating demand for cloud services, the burgeoning digital transformation initiatives across industries, and the significant investments in hyper-scale data center development. Chennai's strategic coastal location, coupled with its status as a major IT hub and connectivity gateway, positions it as a prime destination for both domestic and international data center operators. The market's expansion is further fueled by the increasing need for advanced IT infrastructure to support Big Data analytics, Artificial Intelligence, and the Internet of Things (IoT) applications. These factors collectively contribute to a dynamic and rapidly evolving market landscape, promising substantial opportunities for stakeholders.

Chennai Data Center Market Market Size (In Million)

The market's trajectory is characterized by a strong uptake across various segments, indicating a well-rounded demand. While specific value units are in millions, the absorption trends reveal significant utilization across retail, wholesale, and hyperscale colocation types. Key end-users such as Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, and E-Commerce are driving this demand, underscoring the foundational role of data centers in modern digital economies. Emerging trends include the development of advanced cooling technologies, the integration of renewable energy sources to meet sustainability goals, and the increasing adoption of edge computing solutions to reduce latency. Despite these positive indicators, potential restraints might emerge from evolving regulatory landscapes concerning data privacy and sovereignty, as well as the ongoing challenges related to land acquisition and skilled workforce availability in certain critical infrastructure projects. Nonetheless, the overarching growth narrative for the Chennai Data Center Market remains exceptionally strong, driven by technological advancements and increasing digital dependency.

Chennai Data Center Market Company Market Share

This in-depth report provides an unparalleled analysis of the Chennai Data Center Market, a critical hub for digital infrastructure in India. Leveraging a comprehensive study period from 2019 to 2033, with a base year of 2025, this report offers precise insights into market dynamics, growth trajectories, and competitive landscapes. Delve into the market's structure, trends, dominant segments, and the strategic moves of key players. Understand the key drivers, challenges, and the future potential of Chennai's burgeoning data center ecosystem. This report is essential for investors, operators, and stakeholders looking to capitalize on the immense opportunities within this rapidly expanding market.

Chennai Data Center Market Market Structure & Competitive Landscape

The Chennai data center market exhibits a moderate to high concentration, driven by significant investments from global and domestic players. Innovation is predominantly fueled by advancements in power efficiency, cooling technologies, and cloud integration, with a focus on sustainability. Regulatory frameworks, while evolving, provide a stable operating environment, though evolving data localization policies necessitate adaptive strategies. Substitutes are limited in the context of physical data center infrastructure, with digital transformation and the increasing demand for high-speed connectivity being primary demand drivers. End-user segmentation reveals a strong reliance on Cloud & IT services, BFSI, and Telecom, with growing adoption across E-Commerce and Manufacturing. Mergers and acquisitions (M&A) activity is present, indicating a consolidation trend as larger entities acquire smaller players to expand capacity and market reach. For instance, the acquisition of land by CapitaLand for a 55 MW facility signals strategic expansion. While quantitative data on concentration ratios is dynamic, the presence of major players like Reliance Industries, Sify Technologies Limited, NTT Data, Nxtra Data Limited, STT Telemedia, and Adani suggests a competitive but structured market.

Chennai Data Center Market Market Trends & Opportunities

The Chennai data center market is poised for exponential growth, driven by robust demand for digital services, burgeoning cloud adoption, and the 'Digital India' initiative. The market size is projected to expand significantly, fueled by increasing data generation from mobile devices, IoT, and enterprise digitalization. Technological shifts are leaning towards hyperscale facilities, AI-driven operations, and advanced cooling solutions to manage power consumption efficiently. Consumer preferences are increasingly focused on low latency, high availability, and secure data storage, pushing operators to invest in cutting-edge infrastructure. Competitive dynamics are intensifying, with established players expanding their footprint and new entrants seeking strategic entry points. Opportunities lie in catering to the growing demand for edge data centers, specialized colocation services for specific industries like media and entertainment, and the development of green data centers with renewable energy integration. The strategic advantage of Chennai's coastal location with its underwater cable connectivity further enhances its appeal as a data center hub. The forecast period is expected to witness a compound annual growth rate (CAGR) of approximately 15-20%, with market penetration rates for advanced data center services expected to climb to over 70% by 2033.

Dominant Markets & Segments in Chennai Data Center Market

Within the Chennai data center market, the Massive and Mega DC size segments are dominating, driven by the insatiable demand from hyperscale cloud providers and large enterprises. These segments offer economies of scale and are crucial for supporting the extensive digital infrastructure required for global cloud services. Tier 3 and Tier 4 facilities are the most sought-after, reflecting the critical need for high availability, redundancy, and robust uptime guarantees essential for mission-critical applications. The Utilized absorption segment is experiencing rapid growth, particularly in Hyperscale colocation, which accounts for a significant portion of the deployed capacity.

Key growth drivers include:

- Infrastructure: Continuous expansion of submarine cable landing stations, enhancing international connectivity and attracting global cloud players.

- Policies: Government initiatives promoting digital transformation and data localization are fostering domestic demand and investment.

- Connectivity: Chennai's strategic location and well-established network infrastructure provide superior latency and bandwidth.

The Cloud & IT end-user segment is the largest consumer of data center services, followed closely by Telecom and BFSI. The increasing adoption of cloud computing for scalability and flexibility, coupled with the robust growth of India's telecommunications sector and the digital transformation within the financial services industry, are the primary forces driving this dominance. The E-Commerce and Manufacturing sectors are also showing significant growth in data center utilization as they embrace digital tools and online platforms. The non-utilized capacity, while present, is decreasing as demand outpaces supply, leading to competitive bidding and premium pricing for available space.

Chennai Data Center Market Product Analysis

The Chennai data center market is characterized by a strong emphasis on high-density computing, advanced cooling technologies, and robust power infrastructure. Product innovations are centered around modular designs for rapid deployment, liquid cooling solutions to manage increasing heat loads from high-performance computing, and advanced security features. Applications range from supporting AI/ML workloads and big data analytics to hosting mission-critical enterprise applications and providing low-latency services for gaming and streaming. Competitive advantages are derived from superior power redundancy, efficient energy management, strategic location with excellent connectivity, and comprehensive support services. The focus on building highly resilient and scalable facilities to meet the demands of hyperscale operators and enterprises is a key differentiator.

Key Drivers, Barriers & Challenges in Chennai Data Center Market

Key Drivers: The primary forces propelling the Chennai data center market include the rapid digital transformation across all industries, the exponential growth of data consumption, and supportive government initiatives like 'Digital India.' Technological advancements in AI, IoT, and 5G are necessitating increased data processing and storage capabilities. Economic growth in India and the increasing foreign direct investment in the IT sector also play a crucial role.

Barriers & Challenges: Key challenges include the escalating costs of land acquisition and power, particularly in prime locations. Supply chain disruptions for specialized equipment can lead to project delays. Regulatory complexities, though improving, can still pose hurdles for new developments. Intense competition among established players and new entrants can lead to price pressures. Power availability and grid stability are critical concerns that require continuous investment and innovative solutions. The management of environmental impact and the increasing demand for sustainable practices present a significant challenge.

Growth Drivers in the Chennai Data Center Market Market

The Chennai data center market is driven by several key factors. The surge in cloud adoption by enterprises seeking scalability and cost-efficiency is a significant catalyst. The expansion of the telecommunications sector, with the rollout of 5G technology, is creating a demand for localized processing and storage. Government policies promoting digital infrastructure and data localization further bolster growth. Technological advancements in AI, IoT, and big data analytics necessitate powerful and scalable data center solutions. Furthermore, Chennai's strategic location as a gateway to South India, with excellent subsea cable connectivity, makes it an attractive hub for both domestic and international players.

Challenges Impacting Chennai Data Center Market Growth

Despite robust growth, the Chennai data center market faces significant challenges. The escalating cost of electricity and the availability of a stable, high-capacity power supply remain critical concerns. Land acquisition for large-scale developments can be complex and expensive. Intense competition from both local and global players can lead to pricing pressures and impact profitability margins. Regulatory hurdles, particularly concerning environmental clearances and data privacy laws, require careful navigation. Furthermore, ensuring a consistent supply of skilled labor for operations and maintenance is an ongoing challenge. Supply chain vulnerabilities for specialized hardware can also impact construction timelines and operational readiness.

Key Players Shaping the Chennai Data Center Market Market

- Reliance Industries

- Sify Technologies Limited

- NTT Data

- Nxtra Data Limited

- STT Telemedia

- Adani

Significant Chennai Data Center Market Industry Milestones

- December 2022: CapitaLand acquired a 4.01-acre freehold plot in Ambattur, Chennai, to construct a 55 MW greenfield data center facility. The complex will accommodate 4,900 racks over seven stories and 420,000 square feet. Phase 1 of the project was expected to be completed by the end of 2025, serving cloud service providers, major corporations, and international technology firms.

- February 2023: Cyfuture announced the construction of a new data center in Tambaran, Chennai, with an initial capacity of 500 racks and plans for expansion. The company acquired a sizable site of almost 1 acre. This development highlights Chennai's significance due to its strategic position, underwater cable connectivity, and the presence of major corporations and IT firms.

Future Outlook for Chennai Data Center Market Market

The future outlook for the Chennai Data Center Market is exceptionally bright, driven by sustained demand for digital services and India's ongoing digital transformation. The market is expected to witness continued expansion, with significant investments in hyperscale facilities and edge computing. Strategic opportunities lie in developing more sustainable and power-efficient data centers, leveraging renewable energy sources to meet growing ESG mandates. The increasing adoption of AI, IoT, and 5G technologies will further accelerate the need for robust data infrastructure. Chennai is set to solidify its position as a premier data center hub in India, attracting both domestic and international capital and innovation. The market is poised for a period of significant growth, driven by technological advancements and an ever-increasing digital footprint.

Chennai Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. By Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. By End-User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End-User

-

3.1.1. By Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Chennai Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

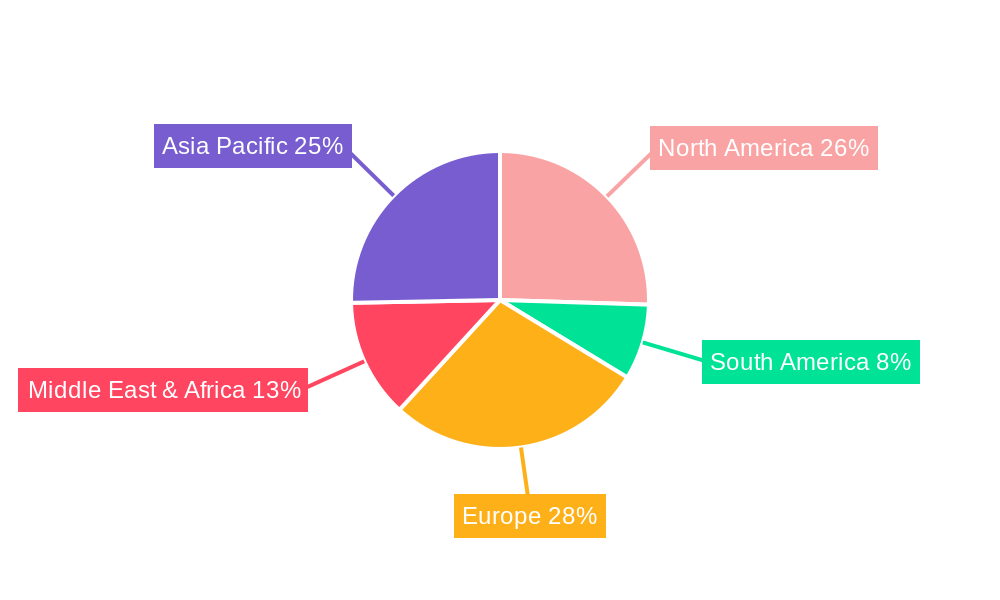

Chennai Data Center Market Regional Market Share

Geographic Coverage of Chennai Data Center Market

Chennai Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Reduction in Power Consumption With the Use of Silicon Photonics Based Transceivers; Growing Need for High-Speed Connectivity and High Data Transfer Capabilities Across Data Centers

- 3.3. Market Restrains

- 3.3.1. Risk of Thermal Effect

- 3.4. Market Trends

- 3.4.1. Government policies would advance the Investment of Data Centre

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chennai Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. By Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. By End-User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End-User

- 5.3.1.1. By Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Chennai Data Center Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.1.4. Massive

- 6.1.5. Mega

- 6.2. Market Analysis, Insights and Forecast - by Tier Type

- 6.2.1. Tier 1 & 2

- 6.2.2. Tier 3

- 6.2.3. Tier 4

- 6.3. Market Analysis, Insights and Forecast - by Absorption

- 6.3.1. Utilized

- 6.3.1.1. By Colocation Type

- 6.3.1.1.1. Retail

- 6.3.1.1.2. Wholesale

- 6.3.1.1.3. Hyperscale

- 6.3.1.2. By End-User

- 6.3.1.2.1. Cloud & IT

- 6.3.1.2.2. Telecom

- 6.3.1.2.3. Media & Entertainment

- 6.3.1.2.4. Government

- 6.3.1.2.5. BFSI

- 6.3.1.2.6. Manufacturing

- 6.3.1.2.7. E-Commerce

- 6.3.1.2.8. Other End-User

- 6.3.1.1. By Colocation Type

- 6.3.2. Non-Utilized

- 6.3.1. Utilized

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 7. South America Chennai Data Center Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.1.4. Massive

- 7.1.5. Mega

- 7.2. Market Analysis, Insights and Forecast - by Tier Type

- 7.2.1. Tier 1 & 2

- 7.2.2. Tier 3

- 7.2.3. Tier 4

- 7.3. Market Analysis, Insights and Forecast - by Absorption

- 7.3.1. Utilized

- 7.3.1.1. By Colocation Type

- 7.3.1.1.1. Retail

- 7.3.1.1.2. Wholesale

- 7.3.1.1.3. Hyperscale

- 7.3.1.2. By End-User

- 7.3.1.2.1. Cloud & IT

- 7.3.1.2.2. Telecom

- 7.3.1.2.3. Media & Entertainment

- 7.3.1.2.4. Government

- 7.3.1.2.5. BFSI

- 7.3.1.2.6. Manufacturing

- 7.3.1.2.7. E-Commerce

- 7.3.1.2.8. Other End-User

- 7.3.1.1. By Colocation Type

- 7.3.2. Non-Utilized

- 7.3.1. Utilized

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 8. Europe Chennai Data Center Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.1.4. Massive

- 8.1.5. Mega

- 8.2. Market Analysis, Insights and Forecast - by Tier Type

- 8.2.1. Tier 1 & 2

- 8.2.2. Tier 3

- 8.2.3. Tier 4

- 8.3. Market Analysis, Insights and Forecast - by Absorption

- 8.3.1. Utilized

- 8.3.1.1. By Colocation Type

- 8.3.1.1.1. Retail

- 8.3.1.1.2. Wholesale

- 8.3.1.1.3. Hyperscale

- 8.3.1.2. By End-User

- 8.3.1.2.1. Cloud & IT

- 8.3.1.2.2. Telecom

- 8.3.1.2.3. Media & Entertainment

- 8.3.1.2.4. Government

- 8.3.1.2.5. BFSI

- 8.3.1.2.6. Manufacturing

- 8.3.1.2.7. E-Commerce

- 8.3.1.2.8. Other End-User

- 8.3.1.1. By Colocation Type

- 8.3.2. Non-Utilized

- 8.3.1. Utilized

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 9. Middle East & Africa Chennai Data Center Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.1.4. Massive

- 9.1.5. Mega

- 9.2. Market Analysis, Insights and Forecast - by Tier Type

- 9.2.1. Tier 1 & 2

- 9.2.2. Tier 3

- 9.2.3. Tier 4

- 9.3. Market Analysis, Insights and Forecast - by Absorption

- 9.3.1. Utilized

- 9.3.1.1. By Colocation Type

- 9.3.1.1.1. Retail

- 9.3.1.1.2. Wholesale

- 9.3.1.1.3. Hyperscale

- 9.3.1.2. By End-User

- 9.3.1.2.1. Cloud & IT

- 9.3.1.2.2. Telecom

- 9.3.1.2.3. Media & Entertainment

- 9.3.1.2.4. Government

- 9.3.1.2.5. BFSI

- 9.3.1.2.6. Manufacturing

- 9.3.1.2.7. E-Commerce

- 9.3.1.2.8. Other End-User

- 9.3.1.1. By Colocation Type

- 9.3.2. Non-Utilized

- 9.3.1. Utilized

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 10. Asia Pacific Chennai Data Center Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.1.4. Massive

- 10.1.5. Mega

- 10.2. Market Analysis, Insights and Forecast - by Tier Type

- 10.2.1. Tier 1 & 2

- 10.2.2. Tier 3

- 10.2.3. Tier 4

- 10.3. Market Analysis, Insights and Forecast - by Absorption

- 10.3.1. Utilized

- 10.3.1.1. By Colocation Type

- 10.3.1.1.1. Retail

- 10.3.1.1.2. Wholesale

- 10.3.1.1.3. Hyperscale

- 10.3.1.2. By End-User

- 10.3.1.2.1. Cloud & IT

- 10.3.1.2.2. Telecom

- 10.3.1.2.3. Media & Entertainment

- 10.3.1.2.4. Government

- 10.3.1.2.5. BFSI

- 10.3.1.2.6. Manufacturing

- 10.3.1.2.7. E-Commerce

- 10.3.1.2.8. Other End-User

- 10.3.1.1. By Colocation Type

- 10.3.2. Non-Utilized

- 10.3.1. Utilized

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Reliance industries

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sify Technologies Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NTT Data

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nxtra Data Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 STT Telemedia

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Adani7 2 Market share analysis (In terms of MW)7 3 List of Companie

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Reliance industries

List of Figures

- Figure 1: Global Chennai Data Center Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Chennai Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 3: North America Chennai Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 4: North America Chennai Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 5: North America Chennai Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 6: North America Chennai Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 7: North America Chennai Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 8: North America Chennai Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Chennai Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Chennai Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 11: South America Chennai Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 12: South America Chennai Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 13: South America Chennai Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 14: South America Chennai Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 15: South America Chennai Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 16: South America Chennai Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Chennai Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Chennai Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 19: Europe Chennai Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 20: Europe Chennai Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 21: Europe Chennai Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 22: Europe Chennai Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 23: Europe Chennai Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 24: Europe Chennai Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Chennai Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Chennai Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 27: Middle East & Africa Chennai Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 28: Middle East & Africa Chennai Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 29: Middle East & Africa Chennai Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 30: Middle East & Africa Chennai Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 31: Middle East & Africa Chennai Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 32: Middle East & Africa Chennai Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa Chennai Data Center Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Chennai Data Center Market Revenue (undefined), by DC Size 2025 & 2033

- Figure 35: Asia Pacific Chennai Data Center Market Revenue Share (%), by DC Size 2025 & 2033

- Figure 36: Asia Pacific Chennai Data Center Market Revenue (undefined), by Tier Type 2025 & 2033

- Figure 37: Asia Pacific Chennai Data Center Market Revenue Share (%), by Tier Type 2025 & 2033

- Figure 38: Asia Pacific Chennai Data Center Market Revenue (undefined), by Absorption 2025 & 2033

- Figure 39: Asia Pacific Chennai Data Center Market Revenue Share (%), by Absorption 2025 & 2033

- Figure 40: Asia Pacific Chennai Data Center Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific Chennai Data Center Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chennai Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 2: Global Chennai Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 3: Global Chennai Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 4: Global Chennai Data Center Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Chennai Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 6: Global Chennai Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 7: Global Chennai Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 8: Global Chennai Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Chennai Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 13: Global Chennai Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 14: Global Chennai Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 15: Global Chennai Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Chennai Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 20: Global Chennai Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 21: Global Chennai Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 22: Global Chennai Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Chennai Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 33: Global Chennai Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 34: Global Chennai Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 35: Global Chennai Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global Chennai Data Center Market Revenue undefined Forecast, by DC Size 2020 & 2033

- Table 43: Global Chennai Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 44: Global Chennai Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 45: Global Chennai Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Chennai Data Center Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chennai Data Center Market?

The projected CAGR is approximately 21.78%.

2. Which companies are prominent players in the Chennai Data Center Market?

Key companies in the market include Reliance industries, Sify Technologies Limited, NTT Data, Nxtra Data Limited, STT Telemedia, Adani7 2 Market share analysis (In terms of MW)7 3 List of Companie.

3. What are the main segments of the Chennai Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Reduction in Power Consumption With the Use of Silicon Photonics Based Transceivers; Growing Need for High-Speed Connectivity and High Data Transfer Capabilities Across Data Centers.

6. What are the notable trends driving market growth?

Government policies would advance the Investment of Data Centre.

7. Are there any restraints impacting market growth?

Risk of Thermal Effect.

8. Can you provide examples of recent developments in the market?

December 2022: CapitaLand acquired land in Chennai, India, to construct a 55 MW data center. The disputed property is a 4.01-acre freehold plot in Chennai, India's Ambattur neighborhood. The 55 MW greenfield facility will be built by CapitaLand India Trust (CLINT) through its subsidiary, Minerva Veritas Data Centre Private Limited. The data center complex will be finished when it can accommodate 4,900 racks over seven stories and 420,000 square feet. Phase 1 of CLINT's project was expected to be completed by the end of 2025. The organization added that the facility would serve clients like cloud service providers, major corporations, and international technology firms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chennai Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chennai Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chennai Data Center Market?

To stay informed about further developments, trends, and reports in the Chennai Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence