Key Insights

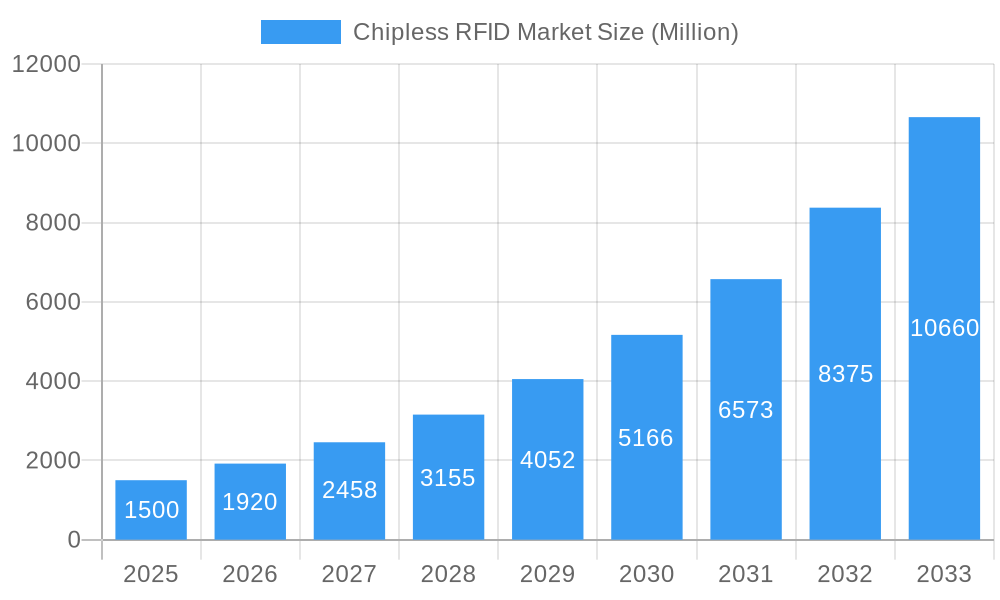

The global chipless RFID market is projected for significant expansion, driven by a robust Compound Annual Growth Rate (CAGR) of 8.5%. This growth is primarily fueled by the escalating demand for cost-effective and efficient inventory management across retail, healthcare, and logistics. The inherent advantages of chipless RFID, including lower costs, suitability for mass deployment, and enhanced durability in challenging environments, are attracting considerable investment. Advancements in passive chipless RFID technology, offering extended read ranges and improved data storage, further stimulate market growth. The market is segmented by product types (tags, readers, middleware) and applications (smart cards, smart tickets), with retail and logistics leading adoption. Key players like Avery Dennison and NXP Semiconductors, alongside emerging innovators, are shaping the competitive landscape. Geographic expansion, particularly in the Asia-Pacific region, is a notable contributor to market growth.

Chipless RFID Market Market Size (In Billion)

Despite this positive outlook, challenges such as the need for greater standardization and interoperability across chipless RFID systems persist. Security concerns and the requirement for robust authentication mechanisms to prevent counterfeiting and unauthorized access are also areas of focus. However, continuous advancements in security protocols and the development of more secure systems are actively addressing these issues. Overall, the chipless RFID market demonstrates strong growth potential, supported by increasing demand, technological innovation, and expanding applications. The market is poised for sustained expansion throughout the forecast period, driven by the ongoing need for efficient, cost-effective, and secure tracking and identification solutions.

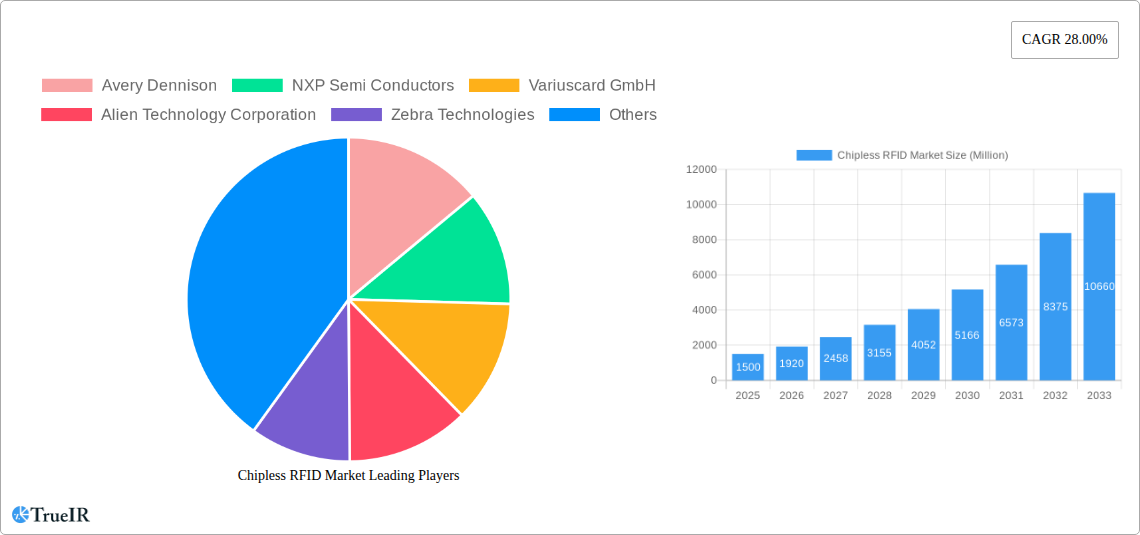

Chipless RFID Market Company Market Share

Chipless RFID Market: A Comprehensive Report Covering Market Size, Trends, and Future Outlook (2019-2033)

This dynamic report provides a detailed analysis of the Chipless RFID market, offering invaluable insights for businesses, investors, and researchers seeking to understand this rapidly evolving sector. The study period spans from 2019 to 2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The report leverages extensive market research and data analysis to present a comprehensive overview of market size, growth drivers, challenges, and future projections, all while incorporating high-volume keywords for optimal search engine visibility. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Chipless RFID Market Market Structure & Competitive Landscape

The Chipless RFID market exhibits a moderately concentrated structure, with key players such as Avery Dennison, NXP Semiconductors, Variuscard GmbH, Alien Technology Corporation, Zebra Technologies, and IDTRONIC GmbH holding significant market share. The market concentration ratio (CR4) is estimated at xx%, indicating a relatively competitive landscape. However, ongoing innovation and the development of new product features are driving consolidation. Regulatory compliance, particularly concerning data privacy and security, is a key factor impacting market dynamics. Product substitution, while limited currently due to the unique benefits of Chipless RFID technology, remains a potential threat.

The market is significantly segmented by end-user industries, including Retail, Healthcare, Logistics and Transportation, BFSI, and others. M&A activity within the Chipless RFID sector has been moderate in recent years, with xx major mergers and acquisitions recorded between 2019 and 2024. These activities have primarily focused on expanding product portfolios, strengthening supply chains, and gaining access to new technologies and markets. Future M&A activity is expected to increase as larger players seek to consolidate their positions in the market.

Chipless RFID Market Market Trends & Opportunities

The Chipless RFID market is experiencing robust growth, driven by several key trends. Increasing demand for contactless solutions across various sectors, particularly in retail and healthcare, is a major catalyst. The rising adoption of smart devices and the Internet of Things (IoT) is further fueling market expansion. Technological advancements, such as improved tag sensitivity and the development of energy harvesting solutions, are broadening the applications of Chipless RFID technology. The market penetration rate is currently estimated at xx% in the leading segments, with significant growth potential remaining untapped. Competitive dynamics are characterized by innovation-driven competition, with companies continuously striving to enhance product features and offer cost-effective solutions. This is leading to a decrease in average pricing, further boosting market accessibility and expansion.

Dominant Markets & Segments in Chipless RFID Market

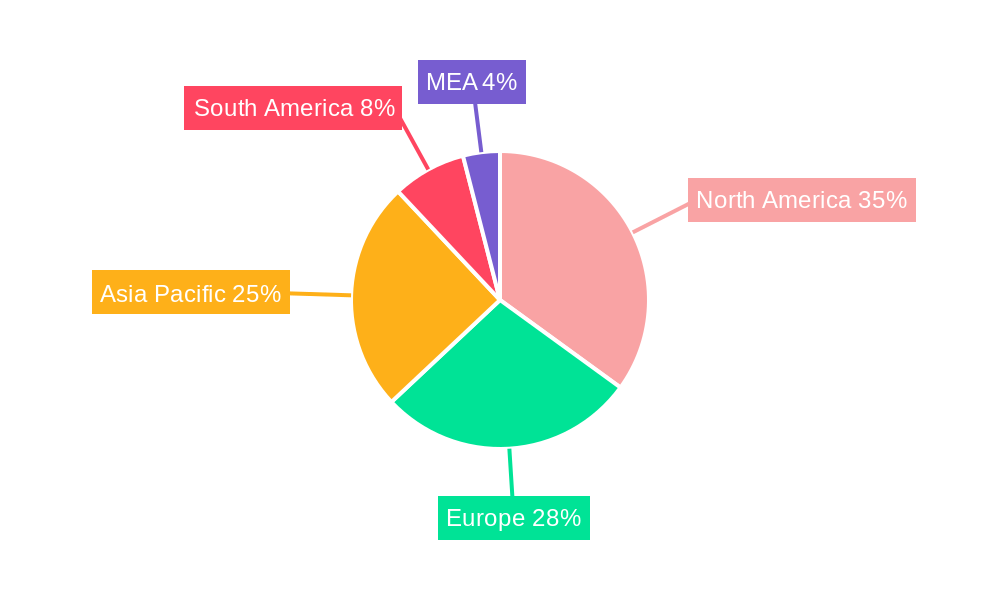

The North American region currently dominates the Chipless RFID market, primarily due to high technological adoption rates, well-established infrastructure, and stringent regulatory frameworks. However, the Asia-Pacific region is expected to witness the fastest growth during the forecast period, driven by increasing industrialization, a surge in e-commerce activities, and government initiatives promoting technological advancements.

- By Product Type: The Tag segment holds the largest market share, owing to its wide-ranging applications in various industries.

- By Application: Smart Cards and Smart Tickets are the most dominant applications, benefiting from their extensive use in access control, ticketing, and supply chain management.

- By End-user Industry: Retail and Logistics and Transportation segments are leading the way, driven by the growing need for efficient inventory management and asset tracking.

Key growth drivers for specific segments include:

- Retail: Increased demand for efficient inventory management and loss prevention.

- Healthcare: Rising need for patient identification and drug tracking.

- Logistics and Transportation: Growing demand for real-time asset tracking and supply chain visibility.

- BFSI: Increased emphasis on secure transactions and fraud prevention.

Chipless RFID Market Product Analysis

Recent innovations in Chipless RFID technology include advancements in material science, leading to more durable and cost-effective tags. Improved reader sensitivity ensures greater accuracy and longer read ranges, enhancing performance across diverse applications. The competitive advantage lies in offering superior performance, reliability, and cost-effectiveness while meeting the specific needs of individual industry segments. This includes customization options to cater to individual client needs and unique integration capabilities with existing systems.

Key Drivers, Barriers & Challenges in Chipless RFID Market

Key Drivers:

- Technological advancements: Continuous improvement in tag sensitivity, power efficiency, and read range.

- Economic factors: Cost reductions in tag manufacturing, making it more accessible.

- Regulatory support: Government initiatives promoting digitalization and automation across industries.

Challenges and Restraints:

- Supply chain disruptions: Volatility in raw material pricing and geopolitical uncertainties. This has resulted in a xx% increase in production costs over the past two years.

- Regulatory hurdles: Varying data privacy regulations across different regions create complexities.

- Competitive pressures: Intense competition from other RFID technologies and emerging technologies like Blockchain.

Growth Drivers in the Chipless RFID Market Market

The market is primarily driven by the increasing demand for efficient inventory management across various sectors, leading to increased deployment of Chipless RFID technology for real-time asset tracking and enhanced supply chain visibility. The rising popularity of contactless solutions, coupled with advancements in energy harvesting technologies for tags, are also major contributors to market growth. Furthermore, favorable regulatory frameworks and government support for digitalization in many regions are encouraging wider adoption.

Challenges Impacting Chipless RFID Market Growth

Significant challenges include the complexity and cost associated with integrating Chipless RFID systems into existing infrastructure and the interoperability issues among different RFID systems. Supply chain vulnerabilities and potential disruptions can lead to production delays and cost increases. Stringent regulatory compliance requirements for data security and privacy also pose a significant challenge, varying across different regions and impacting the cost of deployment.

Key Players Shaping the Chipless RFID Market Market

- Avery Dennison

- NXP Semiconductors

- Variuscard GmbH

- Alien Technology Corporation

- Zebra Technologies

- IDTRONIC GmbH

Significant Chipless RFID Market Industry Milestones

- 2021 Q3: Alien Technology launched a new generation of high-performance Chipless RFID tags.

- 2022 Q1: Avery Dennison acquired a smaller Chipless RFID technology company, expanding its product portfolio.

- 2023 Q4: New data privacy regulations in Europe impacted the market, leading to increased compliance costs.

Future Outlook for Chipless RFID Market Market

The Chipless RFID market is poised for significant growth in the coming years, driven by continued technological advancements, increasing adoption across various sectors, and favorable government policies promoting digitalization. The expansion into new applications, such as smart packaging and healthcare monitoring, will create new market opportunities. Strategic partnerships and collaborations among industry players will further accelerate market growth and innovation. Companies focusing on cost-effective solutions and seamless integration with existing infrastructure will gain a competitive edge.

Chipless RFID Market Segmentation

-

1. Product Type

- 1.1. Tag

- 1.2. Reader

- 1.3. Middleware

-

2. Application

- 2.1. Smart Cards

- 2.2. Smart Tickets

- 2.3. Other Applications

-

3. End-user Industry

- 3.1. Retail

- 3.2. Healthcare

- 3.3. Logistics and Transportation

- 3.4. BFSI

- 3.5. Other End-user Industries

Chipless RFID Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Chipless RFID Market Regional Market Share

Geographic Coverage of Chipless RFID Market

Chipless RFID Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Manufacturing Advantages of Chipless RFIDs; Rising Utilization of Access Control and Security Application

- 3.3. Market Restrains

- 3.3.1. ; High Initial Installation Cost and Device Interoperability

- 3.4. Market Trends

- 3.4.1. Healthcare Sector to Contribute Significantly to the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chipless RFID Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Tag

- 5.1.2. Reader

- 5.1.3. Middleware

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smart Cards

- 5.2.2. Smart Tickets

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Retail

- 5.3.2. Healthcare

- 5.3.3. Logistics and Transportation

- 5.3.4. BFSI

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Chipless RFID Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Tag

- 6.1.2. Reader

- 6.1.3. Middleware

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Smart Cards

- 6.2.2. Smart Tickets

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Retail

- 6.3.2. Healthcare

- 6.3.3. Logistics and Transportation

- 6.3.4. BFSI

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Chipless RFID Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Tag

- 7.1.2. Reader

- 7.1.3. Middleware

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Smart Cards

- 7.2.2. Smart Tickets

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Retail

- 7.3.2. Healthcare

- 7.3.3. Logistics and Transportation

- 7.3.4. BFSI

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Chipless RFID Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Tag

- 8.1.2. Reader

- 8.1.3. Middleware

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Smart Cards

- 8.2.2. Smart Tickets

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Retail

- 8.3.2. Healthcare

- 8.3.3. Logistics and Transportation

- 8.3.4. BFSI

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Chipless RFID Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Tag

- 9.1.2. Reader

- 9.1.3. Middleware

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Smart Cards

- 9.2.2. Smart Tickets

- 9.2.3. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Retail

- 9.3.2. Healthcare

- 9.3.3. Logistics and Transportation

- 9.3.4. BFSI

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Avery Dennison

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NXP Semi Conductors

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Variuscard GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Alien Technology Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Zebra Technologies

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IDTRONIC GmbH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Avery Dennison

List of Figures

- Figure 1: Global Chipless RFID Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Chipless RFID Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Chipless RFID Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Chipless RFID Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Chipless RFID Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Chipless RFID Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: North America Chipless RFID Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Chipless RFID Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Chipless RFID Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Chipless RFID Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Europe Chipless RFID Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Chipless RFID Market Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Chipless RFID Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Chipless RFID Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Europe Chipless RFID Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Chipless RFID Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Chipless RFID Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Chipless RFID Market Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Chipless RFID Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Chipless RFID Market Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Chipless RFID Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Chipless RFID Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Chipless RFID Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Chipless RFID Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Chipless RFID Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Chipless RFID Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Rest of the World Chipless RFID Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of the World Chipless RFID Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Rest of the World Chipless RFID Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of the World Chipless RFID Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: Rest of the World Chipless RFID Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Rest of the World Chipless RFID Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Chipless RFID Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chipless RFID Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Chipless RFID Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Chipless RFID Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Chipless RFID Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Chipless RFID Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Chipless RFID Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Chipless RFID Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Chipless RFID Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Chipless RFID Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global Chipless RFID Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Chipless RFID Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Chipless RFID Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Chipless RFID Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Chipless RFID Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Chipless RFID Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Chipless RFID Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Chipless RFID Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Chipless RFID Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Chipless RFID Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Chipless RFID Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chipless RFID Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Chipless RFID Market?

Key companies in the market include Avery Dennison, NXP Semi Conductors, Variuscard GmbH, Alien Technology Corporation, Zebra Technologies, IDTRONIC GmbH.

3. What are the main segments of the Chipless RFID Market?

The market segments include Product Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.58 billion as of 2022.

5. What are some drivers contributing to market growth?

; Manufacturing Advantages of Chipless RFIDs; Rising Utilization of Access Control and Security Application.

6. What are the notable trends driving market growth?

Healthcare Sector to Contribute Significantly to the Market Growth.

7. Are there any restraints impacting market growth?

; High Initial Installation Cost and Device Interoperability.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chipless RFID Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chipless RFID Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chipless RFID Market?

To stay informed about further developments, trends, and reports in the Chipless RFID Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence