Key Insights

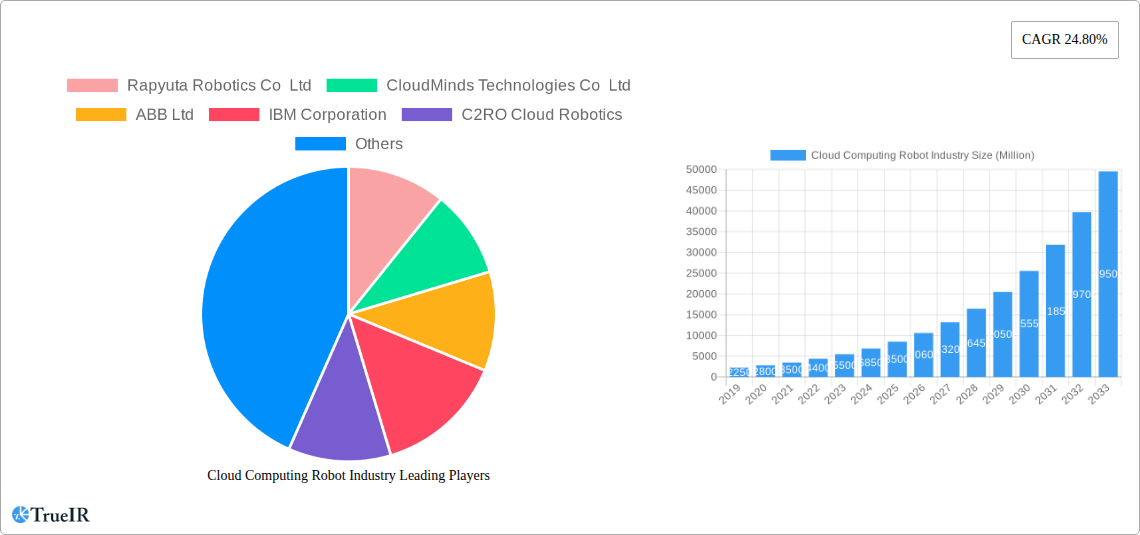

The Cloud Computing Robot industry is projected for substantial expansion. Anticipated to reach a market size of $2.78 billion by 2025, the sector is expected to grow at a Compound Annual Growth Rate (CAGR) of 24.8% through 2033. This robust growth is driven by escalating demand for automation across various sectors, propelled by advancements in artificial intelligence, the Internet of Things (IoT), and improved connectivity. The synergy of cloud computing and robotics enables unparalleled scalability, advanced data processing, and remote management, empowering robots to execute complex tasks with enhanced efficiency and intelligence. The software and service segments are predicted to spearhead this growth, providing the core intelligence and infrastructure for these sophisticated robotic systems. Industrial robot applications are a significant contributor, with service robots experiencing rapid integration in healthcare, retail, and logistics due to their adaptability and capacity for handling repetitive or hazardous tasks.

Cloud Computing Robot Industry Market Size (In Billion)

Key factors fueling this market momentum include the continuous drive for operational efficiency, cost optimization, and heightened productivity in industries such as manufacturing. The military and defense sector is also a notable adopter, utilizing cloud-enabled robots for surveillance, logistics, and hazardous operations. Additionally, the expanding retail and e-commerce landscape is increasingly leveraging robots for warehouse automation, inventory management, and customer engagement. In healthcare and life sciences, robotic solutions are being explored for surgical procedures, patient care, and laboratory automation. While the outlook is strong, potential challenges may arise from significant initial investment for advanced cloud robotics, data security and privacy concerns, and the requirement for skilled personnel. However, the substantial advantages of enhanced collaboration, real-time data analytics, and continuous software updates offered by cloud robotics are expected to mitigate these obstacles, fostering widespread adoption.

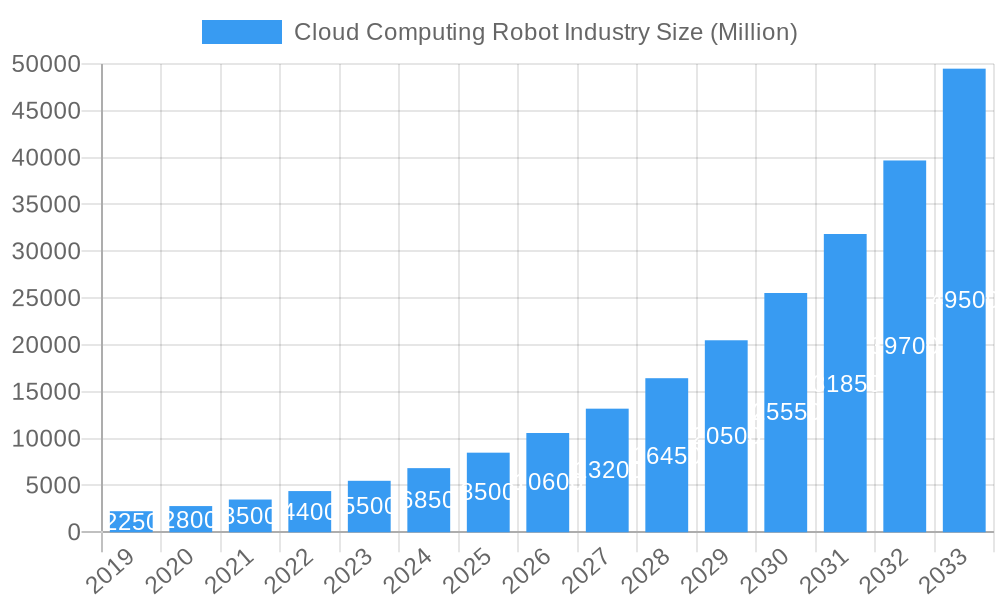

Cloud Computing Robot Industry Company Market Share

Cloud Computing Robot Industry Market: Revolutionizing Automation with Intelligent Connectivity

This comprehensive report delves into the dynamic cloud computing robot industry, a burgeoning sector poised to redefine automation across diverse applications. Leveraging advanced AI, IoT, and cloud infrastructure, this market is witnessing exponential growth, driven by the demand for enhanced operational efficiency, scalability, and data-driven decision-making. This analysis, spanning 2019–2033, with a base year of 2025 and a robust forecast period of 2025–2033, provides deep insights into market structure, trends, opportunities, dominant segments, and key players. We explore critical drivers, barriers, and transformative industry milestones, offering a panoramic view of the future of cloud robotics.

Cloud Computing Robot Industry Market Structure & Competitive Landscape

The cloud computing robot industry exhibits a moderately concentrated market structure, characterized by a blend of established technology giants and agile, specialized robotics firms. Innovation is a paramount driver, with companies heavily investing in AI algorithms, machine learning, and edge computing to enhance robotic autonomy and cloud integration. Regulatory impacts are evolving, with a focus on safety standards, data privacy, and ethical AI deployment. While direct product substitutes are limited due to the unique capabilities of cloud-connected robots, advancements in traditional automation and specialized software solutions present indirect competition. End-user segmentation is broad, encompassing industrial manufacturing, healthcare, logistics, and defense. Mergers and acquisitions (M&A) activity is increasing as larger players seek to acquire innovative technologies and expand their market reach. For instance, recent investments signal a consolidation trend, with strategic partnerships and acquisitions expected to shape the competitive landscape further. Quantifiable data, such as an estimated 15% concentration ratio amongst the top five players in 2025, underscores this trend.

Cloud Computing Robot Industry Market Trends & Opportunities

The cloud computing robot industry is experiencing a period of rapid expansion and transformation, fueled by a confluence of technological advancements and evolving market demands. The global market size is projected to reach an impressive USD 500 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% from 2025. This growth is underpinned by a significant shift towards intelligent automation, where robots are increasingly connected to cloud platforms for enhanced processing power, data analytics, and collaborative capabilities. Technological shifts, including the proliferation of 5G networks, advancements in computer vision, and sophisticated AI algorithms, are enabling robots to perform more complex tasks, adapt to dynamic environments, and operate with greater autonomy. Consumer preferences are leaning towards solutions that offer flexibility, scalability, and cost-effectiveness, all of which are hallmarks of cloud-based robotics. The ability to remotely manage, monitor, and update robot fleets via the cloud significantly reduces operational overheads and optimizes performance, making them highly attractive across various end-user industries.

Competitive dynamics are intensifying, with companies vying for market share through continuous innovation, strategic partnerships, and aggressive go-to-market strategies. The rise of service robots in sectors like healthcare and retail, coupled with the persistent demand for industrial robots in manufacturing, presents a dual growth avenue. Opportunities abound in developing specialized cloud robotics solutions for niche applications, addressing challenges in areas like hazardous environments, precision agriculture, and advanced logistics. The increasing adoption of robotic process automation (RPA) and the integration of robots with other IoT devices further expand the market's potential. As cloud infrastructure becomes more robust and accessible, the deployment of sophisticated robotic systems will become more democratized, fostering wider adoption and driving market penetration rates across emerging economies.

Dominant Markets & Segments in Cloud Computing Robot Industry

The cloud computing robot industry is characterized by distinct dominant markets and segments, each contributing significantly to overall growth.

Offering: Software:

- Market Dominance: Cloud-based robot operating systems, AI platforms, and analytics software are leading the charge. The ability to remotely deploy, manage, and update robot fleets through sophisticated software platforms is a primary growth driver.

- Growth Drivers: Advances in AI/ML for enhanced robot intelligence, robust cybersecurity for cloud platforms, and the development of intuitive user interfaces for seamless operation.

- Analysis: Software is the intellectual core of cloud robotics, enabling functionalities like predictive maintenance, swarm intelligence, and autonomous navigation. The demand for specialized software solutions tailored to specific industrial or service applications is particularly high.

Application: Industrial Robot:

- Market Dominance: Manufacturing continues to be a stronghold, with cloud-connected robots enhancing assembly lines, material handling, and quality control. The push for Industry 4.0 and smart factories is a major catalyst.

- Growth Drivers: Increased automation in complex manufacturing processes, need for precision and repeatability, integration with existing enterprise resource planning (ERP) systems.

- Analysis: Industrial robots, empowered by cloud connectivity, offer unprecedented levels of flexibility and efficiency. Remote monitoring and control allow for reduced downtime and optimized production schedules, making them indispensable for modern manufacturing.

End-user Industry: Manufacturing:

- Market Dominance: This sector represents the largest and most mature market for cloud computing robots, driven by the need for enhanced productivity, safety, and cost reduction.

- Growth Drivers: High adoption rates of automation technologies, government initiatives promoting advanced manufacturing, and the increasing complexity of production lines.

- Analysis: Manufacturers are leveraging cloud robotics to achieve greater agility in production, respond to market fluctuations, and improve product quality. The ability to analyze vast amounts of production data in the cloud provides actionable insights for continuous improvement.

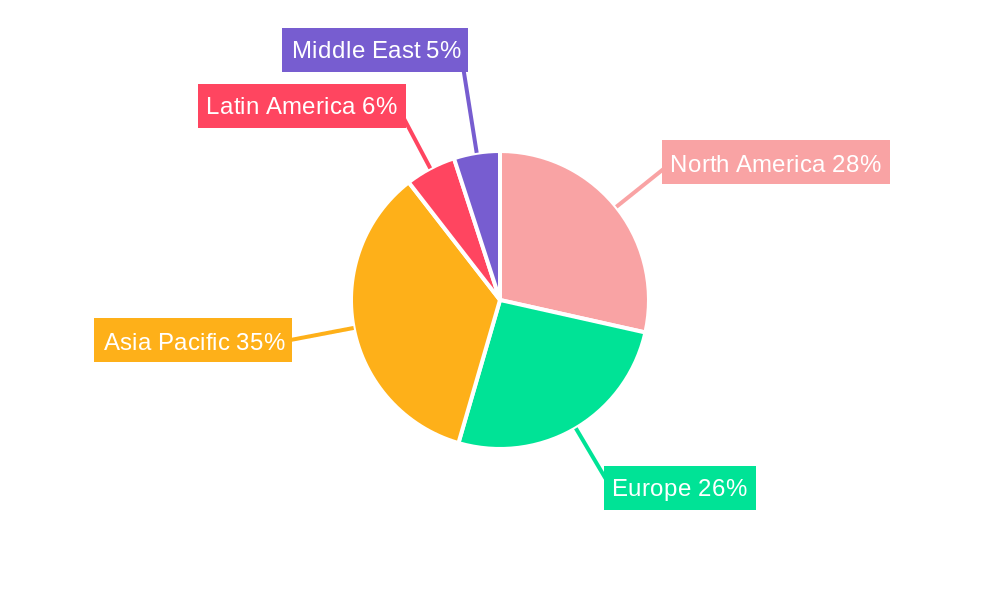

Region: North America currently leads in market share due to advanced technological infrastructure, significant R&D investments, and a high adoption rate of automation solutions in manufacturing and logistics.

Cloud Computing Robot Industry Product Analysis

Cloud computing robots integrate advanced hardware with intelligent cloud-based software, offering enhanced autonomy and collaborative capabilities. Product innovations focus on miniaturization, improved sensor technology for enhanced environmental perception, and advanced AI algorithms for complex decision-making. Competitive advantages stem from the scalability and accessibility provided by cloud platforms, enabling remote management, data analytics, and over-the-air updates. This synergy allows for the development of highly specialized robots tailored for diverse applications, from intricate surgical procedures in healthcare to complex logistics operations in e-commerce.

Key Drivers, Barriers & Challenges in Cloud Computing Robot Industry

Key Drivers:

- Technological Advancements: Rapid evolution of AI, ML, IoT, and 5G connectivity significantly enhances robotic capabilities and cloud integration.

- Demand for Automation: Growing need for increased efficiency, productivity, and cost reduction across industries fuels adoption.

- Scalability & Flexibility: Cloud platforms offer unparalleled scalability and flexibility, allowing businesses to adapt robot deployment to changing needs.

- Data-Driven Insights: Cloud analytics enable real-time monitoring, performance optimization, and predictive maintenance for robot fleets.

Barriers & Challenges:

- High Initial Investment: The upfront cost of sophisticated robotic hardware and cloud infrastructure can be a significant barrier for smaller enterprises.

- Cybersecurity Concerns: Protecting sensitive data and ensuring the integrity of robot operations against cyber threats is paramount.

- Integration Complexities: Seamless integration with existing IT systems and legacy infrastructure can be challenging.

- Skilled Workforce Shortage: A lack of trained professionals to design, operate, and maintain cloud robotics systems poses a constraint.

- Regulatory Hurdles: Evolving regulations regarding AI ethics, data privacy, and safety standards can create compliance challenges.

Growth Drivers in the Cloud Computing Robot Industry Market

The cloud computing robot industry is propelled by several powerful growth drivers. Technologically, the exponential advancement in Artificial Intelligence and Machine Learning allows robots to perform more sophisticated tasks and adapt to dynamic environments. The widespread adoption of the Internet of Things (IoT) facilitates seamless data exchange between robots and cloud platforms, enabling real-time monitoring and control. Economically, the constant drive for increased operational efficiency, reduced labor costs, and enhanced productivity across sectors like manufacturing and logistics directly fuels demand for robotic solutions. Furthermore, government initiatives and investments in Industry 4.0, smart cities, and advanced technology adoption create a supportive ecosystem. The inherent scalability and flexibility offered by cloud infrastructure make sophisticated robotics accessible and cost-effective for a broader range of businesses.

Challenges Impacting Cloud Computing Robot Industry Growth

Despite its promising trajectory, the cloud computing robot industry faces several significant challenges that can impact its growth. Regulatory complexities surrounding data privacy and security, especially with the increasing volume of sensitive data processed by cloud-connected robots, require careful navigation. Supply chain disruptions, as witnessed in recent global events, can impact the availability of crucial hardware components, leading to production delays and increased costs. Competitive pressures are intense, with established technology giants and agile startups vying for market share, leading to rapid price fluctuations and demanding innovation cycles. Furthermore, the high initial investment required for advanced robotic systems and cloud integration can be a substantial barrier for small and medium-sized enterprises (SMEs), limiting wider adoption. The need for a skilled workforce capable of designing, deploying, and maintaining these complex systems also presents a persistent challenge.

Key Players Shaping the Cloud Computing Robot Industry Market

- Rapyuta Robotics Co Ltd

- CloudMinds Technologies Co Ltd

- ABB Ltd

- IBM Corporation

- C2RO Cloud Robotics

- Tend AI Inc

- Google LLC

- V3 Smart Technologies PTE Ltd

- Hit Robot Group Co Ltd

- Microsoft Corporation

- inVia Robotics Inc

Significant Cloud Computing Robot Industry Industry Milestones

- August 2022: Zoho Corp. announced an INR 20 crore investment in Genrobotics, an Indian startup that develops robotics and AI-powered solutions for social issues such as hazardous working conditions. According to a business release, Zoho's investment would help Genrobotics in its objective to eliminate manual scavenging in India and offer safety and dignity to workers in the sanitation and oil and gas industries.

- June 2022: Hewlett Packard Enterprise unveiled a new 5G software solution that expands HPE's existing 5G portfolio with fully integrated automated management. The solution combines HPE 5G Automated Assurance and a further 5G feature for HPE Service Director, simplifying 5G network management and decreasing deployment risks via a zero-touch, closed-loop system. The new automation software monitors and orchestrates network activities, infrastructure, slices, and services, automatically resolving issues to ensure service continuity.

- April 2022: Foxconn Industrial Internet (FII) announced a USD 30 million investment in Agile Robots AG, a Munich and Beijing-based automation firm. It is the company's second strategic investment in Agile Robots.

Future Outlook for Cloud Computing Robot Industry Market

The cloud computing robot industry is poised for continued, robust growth, driven by an increasing demand for intelligent automation and enhanced operational efficiencies. Strategic opportunities lie in the development of specialized, industry-specific cloud robotics solutions and the integration of robots with emerging technologies like augmented reality (AR) for remote assistance and training. The expanding role of AI in enabling more sophisticated robot autonomy and predictive capabilities will further unlock market potential. As cloud infrastructure becomes more powerful and affordable, and as cybersecurity measures mature, the adoption of cloud-connected robots is expected to accelerate across a wider spectrum of industries, including agriculture, construction, and even consumer services, promising a future where robots are seamlessly integrated into our daily lives and work environments.

Cloud Computing Robot Industry Segmentation

-

1. Offering

- 1.1. Software

- 1.2. Service

-

2. Application

- 2.1. Industrial Robot

- 2.2. Service Robot

-

3. End-user Industry

- 3.1. Manufacturing

- 3.2. Military and Defense

- 3.3. Retail and E-commerce

- 3.4. Healthcare and Life Sciences

- 3.5. Other End-user Industries

Cloud Computing Robot Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Cloud Computing Robot Industry Regional Market Share

Geographic Coverage of Cloud Computing Robot Industry

Cloud Computing Robot Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prominence of Cloud Technology; Increasing Adoption of Robotics across Various End Users

- 3.3. Market Restrains

- 3.3.1. Security and Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Rising Demand for Industrial Robotics to Augment the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Computing Robot Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Software

- 5.1.2. Service

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial Robot

- 5.2.2. Service Robot

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Manufacturing

- 5.3.2. Military and Defense

- 5.3.3. Retail and E-commerce

- 5.3.4. Healthcare and Life Sciences

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Cloud Computing Robot Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Software

- 6.1.2. Service

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Industrial Robot

- 6.2.2. Service Robot

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Manufacturing

- 6.3.2. Military and Defense

- 6.3.3. Retail and E-commerce

- 6.3.4. Healthcare and Life Sciences

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Cloud Computing Robot Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Software

- 7.1.2. Service

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Industrial Robot

- 7.2.2. Service Robot

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Manufacturing

- 7.3.2. Military and Defense

- 7.3.3. Retail and E-commerce

- 7.3.4. Healthcare and Life Sciences

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Cloud Computing Robot Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Software

- 8.1.2. Service

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Industrial Robot

- 8.2.2. Service Robot

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Manufacturing

- 8.3.2. Military and Defense

- 8.3.3. Retail and E-commerce

- 8.3.4. Healthcare and Life Sciences

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Latin America Cloud Computing Robot Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Software

- 9.1.2. Service

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Industrial Robot

- 9.2.2. Service Robot

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Manufacturing

- 9.3.2. Military and Defense

- 9.3.3. Retail and E-commerce

- 9.3.4. Healthcare and Life Sciences

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Middle East Cloud Computing Robot Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Software

- 10.1.2. Service

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Industrial Robot

- 10.2.2. Service Robot

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Manufacturing

- 10.3.2. Military and Defense

- 10.3.3. Retail and E-commerce

- 10.3.4. Healthcare and Life Sciences

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rapyuta Robotics Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CloudMinds Technologies Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ABB Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 C2RO Cloud Robotics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tend AI Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Google LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 V3 Smart Technologies PTE Ltd*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hit Robot Group Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Microsoft Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 inVia Robotics Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Rapyuta Robotics Co Ltd

List of Figures

- Figure 1: Global Cloud Computing Robot Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cloud Computing Robot Industry Revenue (billion), by Offering 2025 & 2033

- Figure 3: North America Cloud Computing Robot Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 4: North America Cloud Computing Robot Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Cloud Computing Robot Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Cloud Computing Robot Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: North America Cloud Computing Robot Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Cloud Computing Robot Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Cloud Computing Robot Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Cloud Computing Robot Industry Revenue (billion), by Offering 2025 & 2033

- Figure 11: Europe Cloud Computing Robot Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 12: Europe Cloud Computing Robot Industry Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Cloud Computing Robot Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Cloud Computing Robot Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Europe Cloud Computing Robot Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Cloud Computing Robot Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Cloud Computing Robot Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Cloud Computing Robot Industry Revenue (billion), by Offering 2025 & 2033

- Figure 19: Asia Pacific Cloud Computing Robot Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 20: Asia Pacific Cloud Computing Robot Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Cloud Computing Robot Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Cloud Computing Robot Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Cloud Computing Robot Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Cloud Computing Robot Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Cloud Computing Robot Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Cloud Computing Robot Industry Revenue (billion), by Offering 2025 & 2033

- Figure 27: Latin America Cloud Computing Robot Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 28: Latin America Cloud Computing Robot Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Latin America Cloud Computing Robot Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Latin America Cloud Computing Robot Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: Latin America Cloud Computing Robot Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Cloud Computing Robot Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Cloud Computing Robot Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Cloud Computing Robot Industry Revenue (billion), by Offering 2025 & 2033

- Figure 35: Middle East Cloud Computing Robot Industry Revenue Share (%), by Offering 2025 & 2033

- Figure 36: Middle East Cloud Computing Robot Industry Revenue (billion), by Application 2025 & 2033

- Figure 37: Middle East Cloud Computing Robot Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East Cloud Computing Robot Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 39: Middle East Cloud Computing Robot Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East Cloud Computing Robot Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Cloud Computing Robot Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud Computing Robot Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 2: Global Cloud Computing Robot Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Cloud Computing Robot Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Cloud Computing Robot Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Cloud Computing Robot Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 6: Global Cloud Computing Robot Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Cloud Computing Robot Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Cloud Computing Robot Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Cloud Computing Robot Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 10: Global Cloud Computing Robot Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Cloud Computing Robot Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Cloud Computing Robot Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Cloud Computing Robot Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 14: Global Cloud Computing Robot Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Cloud Computing Robot Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Cloud Computing Robot Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Cloud Computing Robot Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 18: Global Cloud Computing Robot Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Cloud Computing Robot Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Cloud Computing Robot Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Cloud Computing Robot Industry Revenue billion Forecast, by Offering 2020 & 2033

- Table 22: Global Cloud Computing Robot Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global Cloud Computing Robot Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Cloud Computing Robot Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Computing Robot Industry?

The projected CAGR is approximately 24.8%.

2. Which companies are prominent players in the Cloud Computing Robot Industry?

Key companies in the market include Rapyuta Robotics Co Ltd, CloudMinds Technologies Co Ltd, ABB Ltd, IBM Corporation, C2RO Cloud Robotics, Tend AI Inc, Google LLC, V3 Smart Technologies PTE Ltd*List Not Exhaustive, Hit Robot Group Co Ltd, Microsoft Corporation, inVia Robotics Inc.

3. What are the main segments of the Cloud Computing Robot Industry?

The market segments include Offering, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prominence of Cloud Technology; Increasing Adoption of Robotics across Various End Users.

6. What are the notable trends driving market growth?

Rising Demand for Industrial Robotics to Augment the Market Growth.

7. Are there any restraints impacting market growth?

Security and Privacy Concerns.

8. Can you provide examples of recent developments in the market?

August 2022 - Zoho Corp. announced an INR 20 crore investment in Genrobotics, an Indian startup that develops robotics and AI-powered solutions for social issues such as hazardous working conditions. According to a business release, Zoho's investment would help Genrobotics in its objective to eliminate manual scavenging in India and offer safety and dignity to workers in the sanitation and oil and gas industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Computing Robot Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Computing Robot Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Computing Robot Industry?

To stay informed about further developments, trends, and reports in the Cloud Computing Robot Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence