Key Insights

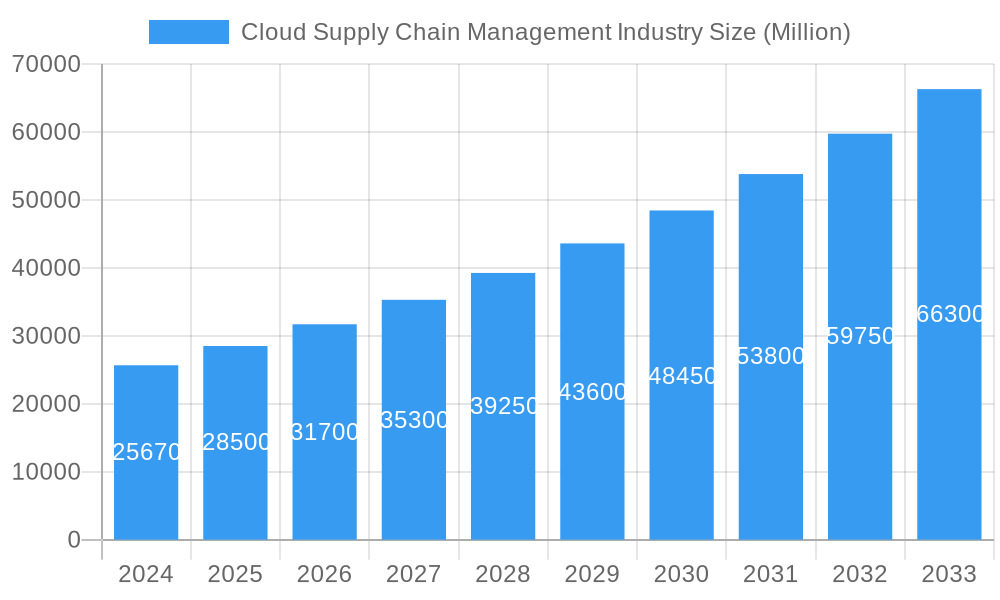

The global Cloud Supply Chain Management (SCM) market is poised for significant expansion, projected to reach an estimated $25.67 billion in 2024. This robust growth is propelled by a compelling Compound Annual Growth Rate (CAGR) of 11.4% anticipated over the forecast period of 2025-2033. A primary driver for this surge is the escalating demand for enhanced operational efficiency, cost optimization, and greater visibility across complex supply chains. Businesses are increasingly adopting cloud-based SCM solutions to leverage real-time data analytics, predictive capabilities, and collaborative tools, thereby mitigating risks associated with disruptions and improving responsiveness to market fluctuations. The shift towards digital transformation, coupled with the imperative for agile and resilient supply chain operations, is a fundamental catalyst. Furthermore, the growing adoption of advanced technologies like AI and IoT within SCM platforms is unlocking new efficiencies, enabling more sophisticated demand planning, inventory optimization, and logistics management. The need for streamlined product lifecycle management and efficient sales and operations planning further fuels this market's upward trajectory.

Cloud Supply Chain Management Industry Market Size (In Billion)

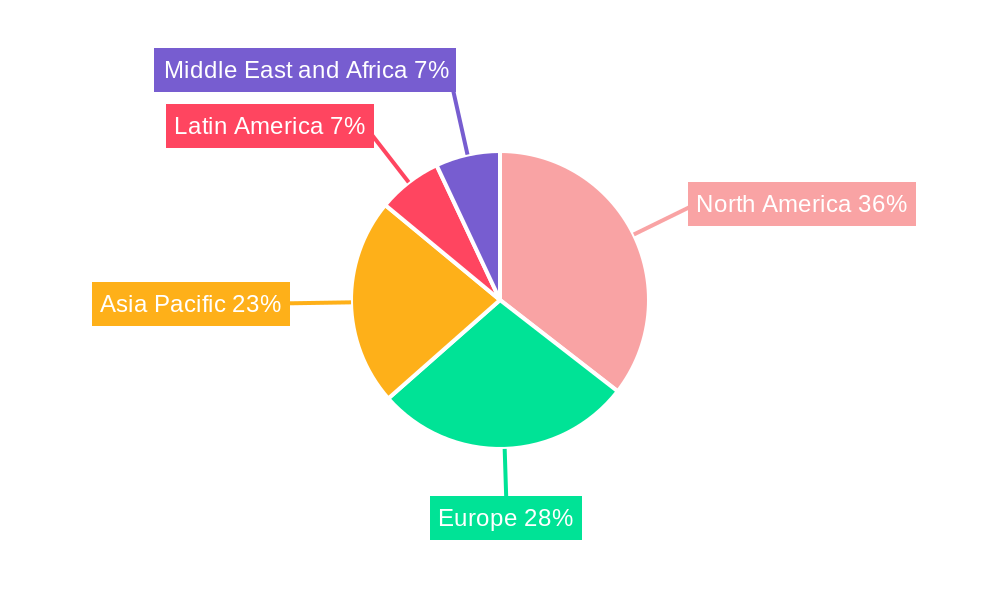

The market is segmented across various solution types, including Demand Planning and Forecasting, Inventory and Warehouse Management, Product Life-Cycle Management, Transportation & Logistics Management, and Sales and Operations Planning, with each segment contributing to the overall market value. Deployment types such as Hybrid Cloud, Public Cloud, and Private Cloud cater to diverse organizational needs, while the market encompasses both Large Enterprises and Small and Medium Enterprises. Key end-user industries driving this growth include Retail, Food & Beverage, Manufacturing, Automotive, Oil & Gas, and Healthcare, highlighting the pervasive impact of cloud SCM solutions across diverse economic sectors. North America is expected to lead in market share, followed by Europe and the Asia Pacific region, reflecting the mature adoption rates and ongoing digital initiatives in these areas. Despite the immense growth potential, certain restraints, such as data security concerns and the initial implementation costs, remain considerations, though they are increasingly being addressed through evolving cloud security protocols and scalable pricing models.

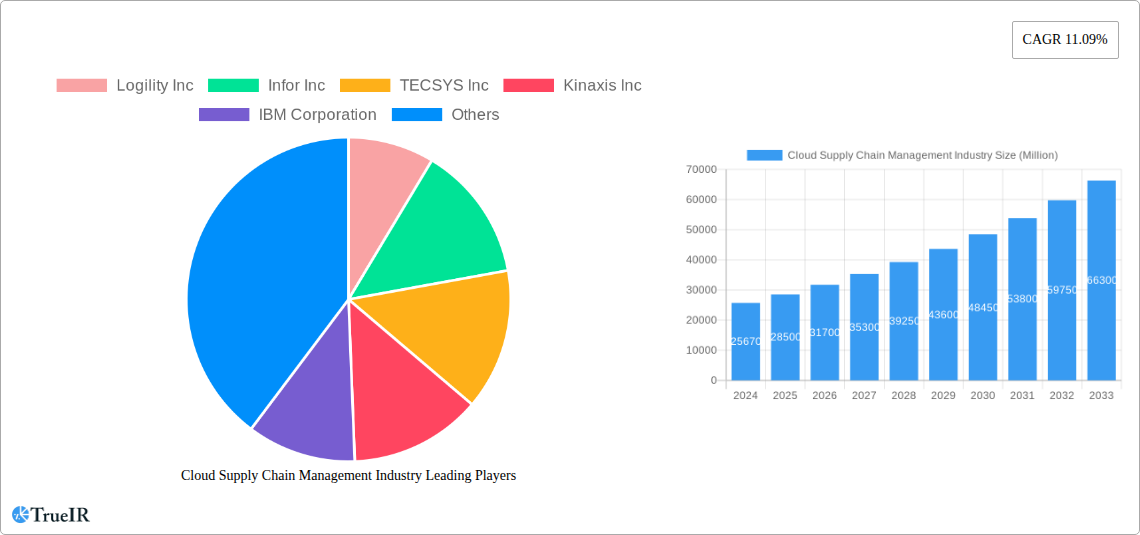

Cloud Supply Chain Management Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global Cloud Supply Chain Management (SCM) industry, providing critical insights into market dynamics, growth trajectories, and competitive landscapes from 2019 to 2033. Leveraging extensive data and expert analysis, this study is designed to empower stakeholders with the knowledge to navigate this rapidly evolving sector, driven by massive investments in digital transformation and the pursuit of resilient, agile supply chains.

The market is experiencing significant growth, projected to reach billions by the forecast period. This expansion is fueled by the increasing adoption of cloud-based solutions across all organizational sizes, from large enterprises to small and medium-sized businesses, across diverse end-user industries such as Retail, Food & Beverage, Manufacturing, Automotive, Oil & Gas, and Healthcare.

This report meticulously examines key market segments, including Demand Planning and Forecasting, Inventory and Warehouse Management, Product Life-Cycle Management, Transportation & Logistics Management, and Sales and Operations Planning, with a focus on their adoption across Hybrid Cloud, Public Cloud, and Private Cloud deployment models. Discover the pivotal role of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) in shaping the future of SCM.

Cloud Supply Chain Management Industry Market Structure & Competitive Landscape

The Cloud Supply Chain Management industry is characterized by a dynamic market structure with a moderate to high level of concentration, driven by significant investments and strategic collaborations. Innovation drivers are primarily technological advancements, including AI, ML, IoT, and big data analytics, enabling enhanced visibility, efficiency, and predictive capabilities across supply chains. Regulatory impacts, while evolving, are generally supportive of digital transformation and data security within cloud environments. Product substitutes are limited, as specialized cloud SCM solutions offer unparalleled integration and scalability compared to traditional on-premise systems. End-user segmentation reveals strong demand across Retail, Manufacturing, and Automotive sectors, with growing adoption in Food & Beverage and Healthcare. Mergers and acquisitions (M&A) trends are active, with an estimated volume of over 100 billion in deal value over the historical period, reflecting consolidation and strategic acquisitions to expand market share and technological offerings. Concentration ratios are influenced by key players who hold significant market share, with the top 5 companies estimated to account for over 70% of the market revenue.

- Market Concentration: Moderate to High, driven by strategic M&A and product development.

- Innovation Drivers: AI, ML, IoT, Big Data Analytics, Blockchain.

- Regulatory Impacts: Supportive of digital transformation and data security standards.

- Product Substitutes: Limited, with cloud solutions offering distinct advantages.

- End-User Segmentation: Strongest in Retail, Manufacturing, and Automotive; growing in Food & Beverage and Healthcare.

- M&A Trends: Active, with significant deal values and strategic acquisitions aiming for market expansion.

Cloud Supply Chain Management Industry Market Trends & Opportunities

The Cloud Supply Chain Management industry is poised for substantial growth, with the market size projected to exceed 500 billion by 2033. This robust expansion is fueled by an increasing CAGR of approximately 15% over the forecast period. Key trends driving this market include the imperative for enhanced supply chain visibility and resilience in response to global disruptions, the growing adoption of AI and ML for predictive analytics and automation, and the demand for integrated solutions that streamline operations from procurement to delivery. The shift towards sustainability and ethical sourcing further amplifies the need for sophisticated cloud SCM platforms that can track and manage environmental impact. Opportunities abound for providers offering specialized solutions for specific industries, such as cold chain management for Food & Beverage or track-and-trace capabilities for Pharmaceuticals. The increasing penetration of cloud SCM solutions among Small and Medium Enterprises (SMEs) presents a significant growth avenue, as these businesses seek cost-effective and scalable alternatives to traditional systems. Furthermore, the development of smart contracts and blockchain technology within cloud SCM platforms offers new avenues for secure and transparent transactions. The integration of IoT devices for real-time data collection is transforming inventory management and logistics, creating opportunities for data-driven decision-making. The ongoing digital transformation across all sectors is a foundational trend, creating a continuous demand for cloud-based SCM solutions that offer agility, scalability, and cost-efficiency. The competitive landscape is evolving, with a strong emphasis on providing comprehensive suite solutions that address the end-to-end supply chain needs of businesses. The rise of edge computing in conjunction with cloud SCM will further enable faster decision-making and localized optimization.

Dominant Markets & Segments in Cloud Supply Chain Management Industry

The Cloud Supply Chain Management industry is dominated by Large Enterprises in terms of revenue and adoption, with an estimated market share exceeding 60%. These organizations possess the resources and the complex operational needs that necessitate sophisticated cloud SCM solutions for global supply chain optimization. Within End-user Industries, the Retail sector is a leading segment, accounting for over 25% of the market share, driven by the need for efficient inventory management, demand forecasting, and omnichannel fulfillment. The Manufacturing sector follows closely, representing approximately 20% of the market, due to its intricate production processes and the demand for robust planning and execution capabilities.

The Public Cloud deployment model holds a dominant position, estimated at over 45% market share, owing to its scalability, cost-effectiveness, and ease of implementation. However, Hybrid Cloud solutions are experiencing significant growth, particularly among large enterprises with existing on-premise infrastructure, accounting for approximately 35% of the market.

In terms of Solutions, Inventory and Warehouse Management is a key growth driver, contributing over 20% to the market. This is closely followed by Transportation & Logistics Management, with a market share of around 18%, reflecting the globalized nature of supply chains and the need for efficient movement of goods. Demand Planning and Forecasting also plays a crucial role, representing approximately 17% of the market, as businesses strive to align supply with demand more accurately.

Key growth drivers for market dominance include:

- Infrastructure: Robust cloud infrastructure provided by major hyperscalers like AWS, Azure, and Google Cloud.

- Policies: Government initiatives promoting digital transformation and supply chain modernization.

- Technological Advancements: Continuous innovation in AI, ML, and IoT integration.

- Globalization: Increasing complexity of international supply chains demanding advanced management tools.

- E-commerce Growth: The explosive growth of online retail necessitates agile and responsive SCM.

The North America region is a dominant market, capturing over 35% of the global Cloud SCM market, due to early adoption of cloud technologies, a strong manufacturing base, and a highly developed retail sector. The United States, in particular, is a key contributor to this dominance.

Cloud Supply Chain Management Industry Product Analysis

Cloud Supply Chain Management solutions are continuously evolving with a strong emphasis on AI-driven predictive analytics, real-time visibility, and enhanced collaboration. Innovations include advanced demand forecasting algorithms that leverage vast datasets for greater accuracy, automated inventory optimization to minimize stockouts and excess inventory, and intelligent transportation management systems that dynamically reroute shipments. Product Life-Cycle Management (PLM) capabilities are being integrated to track products from design to end-of-life, ensuring compliance and sustainability. The competitive advantage lies in the ability of these cloud-native platforms to offer seamless integration, scalability, and continuous updates, enabling businesses to adapt swiftly to market changes and disruptions.

Key Drivers, Barriers & Challenges in Cloud Supply Chain Management Industry

Key Drivers: The Cloud SCM market is propelled by several key drivers. Technologically, the widespread adoption of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) enables unprecedented levels of automation, predictive analytics, and real-time visibility. Economically, the pursuit of operational efficiency, cost reduction through cloud elasticity, and the need for agility in response to market volatility are significant motivators. Policy-driven factors, such as government initiatives promoting digitalization and supply chain resilience, also contribute. For example, the increasing complexity of global trade and the need for transparent supply chains are driving investment.

Barriers & Challenges: Despite the growth, the industry faces several barriers and challenges. Supply chain issues, including labor shortages, geopolitical instability, and raw material availability, can impact the effectiveness of even the most advanced SCM systems. Regulatory hurdles, particularly concerning data privacy and cross-border data flow, can create complexities. Competitive pressures are intense, with a continuous need for innovation and differentiation. Quantifiable impacts include the potential for project delays due to unforeseen disruptions, estimated to add up to 10-15% to project costs in volatile periods. The cost of integration with legacy systems can also be a significant restraint, estimated to range from 5-20% of the total solution cost.

Growth Drivers in the Cloud Supply Chain Management Industry Market

The growth of the Cloud SCM market is significantly driven by the relentless pursuit of enhanced supply chain resilience and agility in an era of increasing global uncertainties. Technological advancements, particularly the integration of AI and ML, are empowering businesses with predictive capabilities, enabling proactive decision-making to mitigate risks and optimize operations. The economic imperative to reduce operational costs through cloud scalability and efficiency is another major growth catalyst. Furthermore, increasing government focus on digitized supply chains and sustainable practices is creating a favorable regulatory environment. The rise of e-commerce and its associated complexities in fulfillment and delivery also necessitates robust cloud SCM solutions.

Challenges Impacting Cloud Supply Chain Management Industry Growth

Several challenges impact the growth of the Cloud SCM industry. Regulatory complexities surrounding data privacy and security across different jurisdictions can hinder seamless global implementation. Persistent supply chain disruptions, including raw material shortages, transportation bottlenecks, and geopolitical tensions, can challenge the efficacy of SCM systems. Intense competitive pressures necessitate continuous innovation and significant investment in R&D, potentially straining resources for smaller players. The upfront cost of integration with existing legacy systems and the need for specialized skill sets to manage complex cloud environments also pose significant barriers to widespread adoption.

Key Players Shaping the Cloud Supply Chain Management Industry Market

- Logility Inc

- Infor Inc

- TECSYS Inc

- Kinaxis Inc

- IBM Corporation

- Manhattan Associates Inc

- JDA Software Group Inc

- Descartes Systems Group Inc

- Oracle Corporation

- HighJump Software Inc

- CloudLogix Inc

- SAP SE

Significant Cloud Supply Chain Management Industry Industry Milestones

- June 2022: XPO Logistics, based in Connecticut, collaborated with Google Cloud to improve how commodities flow through supply chains. In a multi-year partnership, XPO will make use of Google Cloud's artificial intelligence (AI), machine learning (ML), and data analytics capabilities to create supply chains that are quicker, more effective, and more visible.

- 2021: SAP SE launched SAP Integrated Business Planning for Supply Chain, enhancing its cloud SCM portfolio with advanced analytics and planning capabilities.

- 2020: Oracle Corporation expanded its Oracle SCM Cloud offerings, focusing on real-time visibility and collaboration tools to address supply chain disruptions.

- 2019: Kinaxis Inc. acquired QMS, a quality management system provider, to further integrate quality control into its cloud SCM platform.

Future Outlook for Cloud Supply Chain Management Industry Market

The future outlook for the Cloud Supply Chain Management industry is exceptionally bright, with sustained growth projected to exceed 500 billion by 2033. Strategic opportunities lie in the continued integration of advanced technologies like AI, ML, and blockchain to foster intelligent, autonomous supply chains. The increasing demand for sustainable and ethical supply chains will drive innovation in traceability and impact reporting. The expansion of cloud SCM adoption among SMEs and emerging markets presents significant untapped potential. Furthermore, the development of hyper-personalized supply chain solutions tailored to specific industry needs will be a key differentiator. The industry is poised to become increasingly vital in ensuring global economic stability and facilitating resilient, efficient, and transparent trade.

Cloud Supply Chain Management Industry Segmentation

-

1. Solution

- 1.1. Demand Planning and Forecasting

- 1.2. Inventory and Warehouse Management

- 1.3. Product Life-Cycle Management

- 1.4. Transportation & Logistics Management

- 1.5. Sales and Operations Planning

- 1.6. Other So

-

2. Deployment Type

- 2.1. Hybrid Cloud

- 2.2. Public Cloud

- 2.3. Private Cloud

-

3. Organization Size

- 3.1. Large Enterprises

- 3.2. Small and Medium Enterprises

-

4. End-user Industries

- 4.1. Retail

- 4.2. Food & Beverage

- 4.3. Manufacturing

- 4.4. Automotive

- 4.5. Oil & Gas

- 4.6. Healthcare

- 4.7. Other End-user Industries

Cloud Supply Chain Management Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Cloud Supply Chain Management Industry Regional Market Share

Geographic Coverage of Cloud Supply Chain Management Industry

Cloud Supply Chain Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Adoption of Cloud -based Solution for Demand Management by SMEs; Increasing Growth of E - commerce Sector Has Fueled the Adoption of Technological Solutions to Retain Customers

- 3.3. Market Restrains

- 3.3.1. Increasing Security and Privacy Concerns Among Enterprises

- 3.4. Market Trends

- 3.4.1. Retail Industry is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Demand Planning and Forecasting

- 5.1.2. Inventory and Warehouse Management

- 5.1.3. Product Life-Cycle Management

- 5.1.4. Transportation & Logistics Management

- 5.1.5. Sales and Operations Planning

- 5.1.6. Other So

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. Hybrid Cloud

- 5.2.2. Public Cloud

- 5.2.3. Private Cloud

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. Large Enterprises

- 5.3.2. Small and Medium Enterprises

- 5.4. Market Analysis, Insights and Forecast - by End-user Industries

- 5.4.1. Retail

- 5.4.2. Food & Beverage

- 5.4.3. Manufacturing

- 5.4.4. Automotive

- 5.4.5. Oil & Gas

- 5.4.6. Healthcare

- 5.4.7. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Demand Planning and Forecasting

- 6.1.2. Inventory and Warehouse Management

- 6.1.3. Product Life-Cycle Management

- 6.1.4. Transportation & Logistics Management

- 6.1.5. Sales and Operations Planning

- 6.1.6. Other So

- 6.2. Market Analysis, Insights and Forecast - by Deployment Type

- 6.2.1. Hybrid Cloud

- 6.2.2. Public Cloud

- 6.2.3. Private Cloud

- 6.3. Market Analysis, Insights and Forecast - by Organization Size

- 6.3.1. Large Enterprises

- 6.3.2. Small and Medium Enterprises

- 6.4. Market Analysis, Insights and Forecast - by End-user Industries

- 6.4.1. Retail

- 6.4.2. Food & Beverage

- 6.4.3. Manufacturing

- 6.4.4. Automotive

- 6.4.5. Oil & Gas

- 6.4.6. Healthcare

- 6.4.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Demand Planning and Forecasting

- 7.1.2. Inventory and Warehouse Management

- 7.1.3. Product Life-Cycle Management

- 7.1.4. Transportation & Logistics Management

- 7.1.5. Sales and Operations Planning

- 7.1.6. Other So

- 7.2. Market Analysis, Insights and Forecast - by Deployment Type

- 7.2.1. Hybrid Cloud

- 7.2.2. Public Cloud

- 7.2.3. Private Cloud

- 7.3. Market Analysis, Insights and Forecast - by Organization Size

- 7.3.1. Large Enterprises

- 7.3.2. Small and Medium Enterprises

- 7.4. Market Analysis, Insights and Forecast - by End-user Industries

- 7.4.1. Retail

- 7.4.2. Food & Beverage

- 7.4.3. Manufacturing

- 7.4.4. Automotive

- 7.4.5. Oil & Gas

- 7.4.6. Healthcare

- 7.4.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Demand Planning and Forecasting

- 8.1.2. Inventory and Warehouse Management

- 8.1.3. Product Life-Cycle Management

- 8.1.4. Transportation & Logistics Management

- 8.1.5. Sales and Operations Planning

- 8.1.6. Other So

- 8.2. Market Analysis, Insights and Forecast - by Deployment Type

- 8.2.1. Hybrid Cloud

- 8.2.2. Public Cloud

- 8.2.3. Private Cloud

- 8.3. Market Analysis, Insights and Forecast - by Organization Size

- 8.3.1. Large Enterprises

- 8.3.2. Small and Medium Enterprises

- 8.4. Market Analysis, Insights and Forecast - by End-user Industries

- 8.4.1. Retail

- 8.4.2. Food & Beverage

- 8.4.3. Manufacturing

- 8.4.4. Automotive

- 8.4.5. Oil & Gas

- 8.4.6. Healthcare

- 8.4.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Latin America Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Demand Planning and Forecasting

- 9.1.2. Inventory and Warehouse Management

- 9.1.3. Product Life-Cycle Management

- 9.1.4. Transportation & Logistics Management

- 9.1.5. Sales and Operations Planning

- 9.1.6. Other So

- 9.2. Market Analysis, Insights and Forecast - by Deployment Type

- 9.2.1. Hybrid Cloud

- 9.2.2. Public Cloud

- 9.2.3. Private Cloud

- 9.3. Market Analysis, Insights and Forecast - by Organization Size

- 9.3.1. Large Enterprises

- 9.3.2. Small and Medium Enterprises

- 9.4. Market Analysis, Insights and Forecast - by End-user Industries

- 9.4.1. Retail

- 9.4.2. Food & Beverage

- 9.4.3. Manufacturing

- 9.4.4. Automotive

- 9.4.5. Oil & Gas

- 9.4.6. Healthcare

- 9.4.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Middle East and Africa Cloud Supply Chain Management Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Demand Planning and Forecasting

- 10.1.2. Inventory and Warehouse Management

- 10.1.3. Product Life-Cycle Management

- 10.1.4. Transportation & Logistics Management

- 10.1.5. Sales and Operations Planning

- 10.1.6. Other So

- 10.2. Market Analysis, Insights and Forecast - by Deployment Type

- 10.2.1. Hybrid Cloud

- 10.2.2. Public Cloud

- 10.2.3. Private Cloud

- 10.3. Market Analysis, Insights and Forecast - by Organization Size

- 10.3.1. Large Enterprises

- 10.3.2. Small and Medium Enterprises

- 10.4. Market Analysis, Insights and Forecast - by End-user Industries

- 10.4.1. Retail

- 10.4.2. Food & Beverage

- 10.4.3. Manufacturing

- 10.4.4. Automotive

- 10.4.5. Oil & Gas

- 10.4.6. Healthcare

- 10.4.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Logility Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Infor Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TECSYS Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kinaxis Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IBM Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Manhattan Associates Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 JDA Software Group Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Descartes Systems Group Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oracle Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HighJump Software Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CloudLogix Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SAP SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Logility Inc

List of Figures

- Figure 1: Global Cloud Supply Chain Management Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Cloud Supply Chain Management Industry Revenue (undefined), by Solution 2025 & 2033

- Figure 3: North America Cloud Supply Chain Management Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 4: North America Cloud Supply Chain Management Industry Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 5: North America Cloud Supply Chain Management Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 6: North America Cloud Supply Chain Management Industry Revenue (undefined), by Organization Size 2025 & 2033

- Figure 7: North America Cloud Supply Chain Management Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 8: North America Cloud Supply Chain Management Industry Revenue (undefined), by End-user Industries 2025 & 2033

- Figure 9: North America Cloud Supply Chain Management Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 10: North America Cloud Supply Chain Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 11: North America Cloud Supply Chain Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Cloud Supply Chain Management Industry Revenue (undefined), by Solution 2025 & 2033

- Figure 13: Europe Cloud Supply Chain Management Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 14: Europe Cloud Supply Chain Management Industry Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 15: Europe Cloud Supply Chain Management Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 16: Europe Cloud Supply Chain Management Industry Revenue (undefined), by Organization Size 2025 & 2033

- Figure 17: Europe Cloud Supply Chain Management Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 18: Europe Cloud Supply Chain Management Industry Revenue (undefined), by End-user Industries 2025 & 2033

- Figure 19: Europe Cloud Supply Chain Management Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 20: Europe Cloud Supply Chain Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: Europe Cloud Supply Chain Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Cloud Supply Chain Management Industry Revenue (undefined), by Solution 2025 & 2033

- Figure 23: Asia Pacific Cloud Supply Chain Management Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 24: Asia Pacific Cloud Supply Chain Management Industry Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 25: Asia Pacific Cloud Supply Chain Management Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 26: Asia Pacific Cloud Supply Chain Management Industry Revenue (undefined), by Organization Size 2025 & 2033

- Figure 27: Asia Pacific Cloud Supply Chain Management Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 28: Asia Pacific Cloud Supply Chain Management Industry Revenue (undefined), by End-user Industries 2025 & 2033

- Figure 29: Asia Pacific Cloud Supply Chain Management Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 30: Asia Pacific Cloud Supply Chain Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Cloud Supply Chain Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Cloud Supply Chain Management Industry Revenue (undefined), by Solution 2025 & 2033

- Figure 33: Latin America Cloud Supply Chain Management Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 34: Latin America Cloud Supply Chain Management Industry Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 35: Latin America Cloud Supply Chain Management Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 36: Latin America Cloud Supply Chain Management Industry Revenue (undefined), by Organization Size 2025 & 2033

- Figure 37: Latin America Cloud Supply Chain Management Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 38: Latin America Cloud Supply Chain Management Industry Revenue (undefined), by End-user Industries 2025 & 2033

- Figure 39: Latin America Cloud Supply Chain Management Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 40: Latin America Cloud Supply Chain Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Latin America Cloud Supply Chain Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Cloud Supply Chain Management Industry Revenue (undefined), by Solution 2025 & 2033

- Figure 43: Middle East and Africa Cloud Supply Chain Management Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 44: Middle East and Africa Cloud Supply Chain Management Industry Revenue (undefined), by Deployment Type 2025 & 2033

- Figure 45: Middle East and Africa Cloud Supply Chain Management Industry Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 46: Middle East and Africa Cloud Supply Chain Management Industry Revenue (undefined), by Organization Size 2025 & 2033

- Figure 47: Middle East and Africa Cloud Supply Chain Management Industry Revenue Share (%), by Organization Size 2025 & 2033

- Figure 48: Middle East and Africa Cloud Supply Chain Management Industry Revenue (undefined), by End-user Industries 2025 & 2033

- Figure 49: Middle East and Africa Cloud Supply Chain Management Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 50: Middle East and Africa Cloud Supply Chain Management Industry Revenue (undefined), by Country 2025 & 2033

- Figure 51: Middle East and Africa Cloud Supply Chain Management Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Solution 2020 & 2033

- Table 2: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 3: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 4: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by End-user Industries 2020 & 2033

- Table 5: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Solution 2020 & 2033

- Table 7: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 8: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 9: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by End-user Industries 2020 & 2033

- Table 10: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Solution 2020 & 2033

- Table 12: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 13: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 14: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by End-user Industries 2020 & 2033

- Table 15: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Solution 2020 & 2033

- Table 17: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 18: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 19: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by End-user Industries 2020 & 2033

- Table 20: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Solution 2020 & 2033

- Table 22: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 23: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 24: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by End-user Industries 2020 & 2033

- Table 25: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Solution 2020 & 2033

- Table 27: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Deployment Type 2020 & 2033

- Table 28: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Organization Size 2020 & 2033

- Table 29: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by End-user Industries 2020 & 2033

- Table 30: Global Cloud Supply Chain Management Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Supply Chain Management Industry?

The projected CAGR is approximately 11.4%.

2. Which companies are prominent players in the Cloud Supply Chain Management Industry?

Key companies in the market include Logility Inc, Infor Inc, TECSYS Inc, Kinaxis Inc, IBM Corporation, Manhattan Associates Inc, JDA Software Group Inc, Descartes Systems Group Inc, Oracle Corporation, HighJump Software Inc, CloudLogix Inc, SAP SE.

3. What are the main segments of the Cloud Supply Chain Management Industry?

The market segments include Solution, Deployment Type, Organization Size, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rapid Adoption of Cloud -based Solution for Demand Management by SMEs; Increasing Growth of E - commerce Sector Has Fueled the Adoption of Technological Solutions to Retain Customers.

6. What are the notable trends driving market growth?

Retail Industry is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Increasing Security and Privacy Concerns Among Enterprises.

8. Can you provide examples of recent developments in the market?

In June 2022 - XPO Logistics, based in Connecticut, collaborated with Google Cloud to improve how commodities flow through supply chains. In a multi-year partnership, XPO will make use of Google Cloud's artificial intelligence (AI), machine learning (ML), and data analytics capabilities to create supply chains that are quicker, more effective, and more visible.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Supply Chain Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Supply Chain Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Supply Chain Management Industry?

To stay informed about further developments, trends, and reports in the Cloud Supply Chain Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence