Key Insights

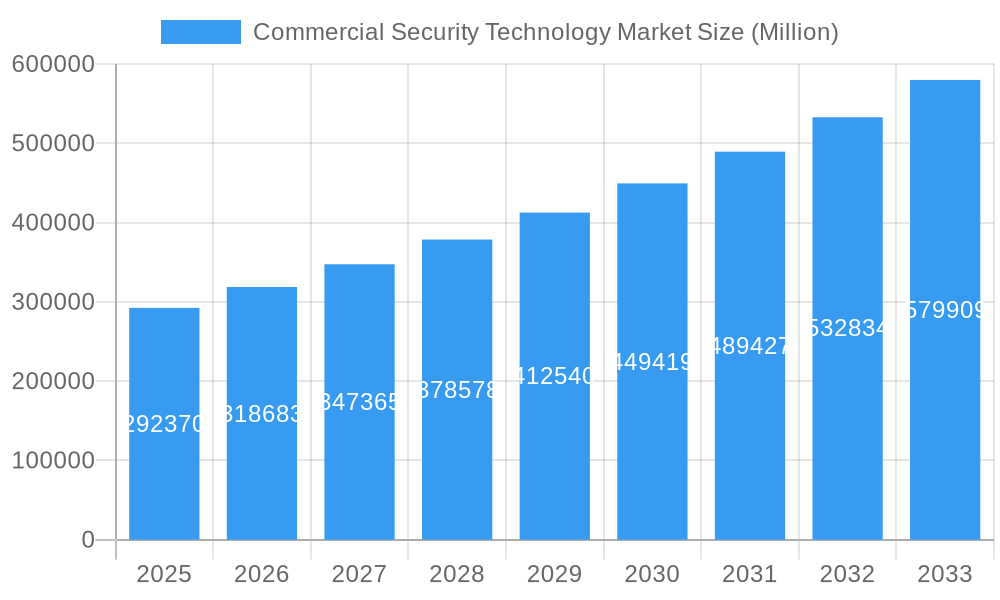

The global Commercial Security Technology Market is poised for substantial growth, projected to reach USD 292.37 billion by 2025, exhibiting a robust CAGR of 9% through 2033. This expansion is primarily fueled by escalating concerns over property and asset protection, coupled with the increasing adoption of advanced technologies like artificial intelligence, cloud computing, and the Internet of Things (IoT) within security solutions. Businesses are prioritizing integrated security systems that offer comprehensive protection, encompassing fire safety, advanced video surveillance capabilities for real-time monitoring and analytics, and sophisticated access control mechanisms to manage entry and prevent unauthorized access. The rising threat landscape, encompassing both physical and cyber-security breaches, further accentuates the demand for intelligent and interconnected security platforms.

Commercial Security Technology Market Market Size (In Billion)

Key trends shaping the market include the growing deployment of smart security devices that leverage AI for threat detection and predictive analysis, as well as the shift towards cloud-based security management systems, offering enhanced scalability, remote accessibility, and cost-effectiveness. The integration of biometric authentication, video analytics for crowd management and behavior analysis, and networked fire protection systems are becoming standard in modern commercial establishments. While market growth is strong, certain factors such as the high initial investment costs for sophisticated systems and the need for skilled personnel to manage and maintain these technologies can present challenges. Nevertheless, the continuous innovation by leading companies and the increasing realization of the long-term benefits of robust security infrastructure are expected to drive sustained market advancement.

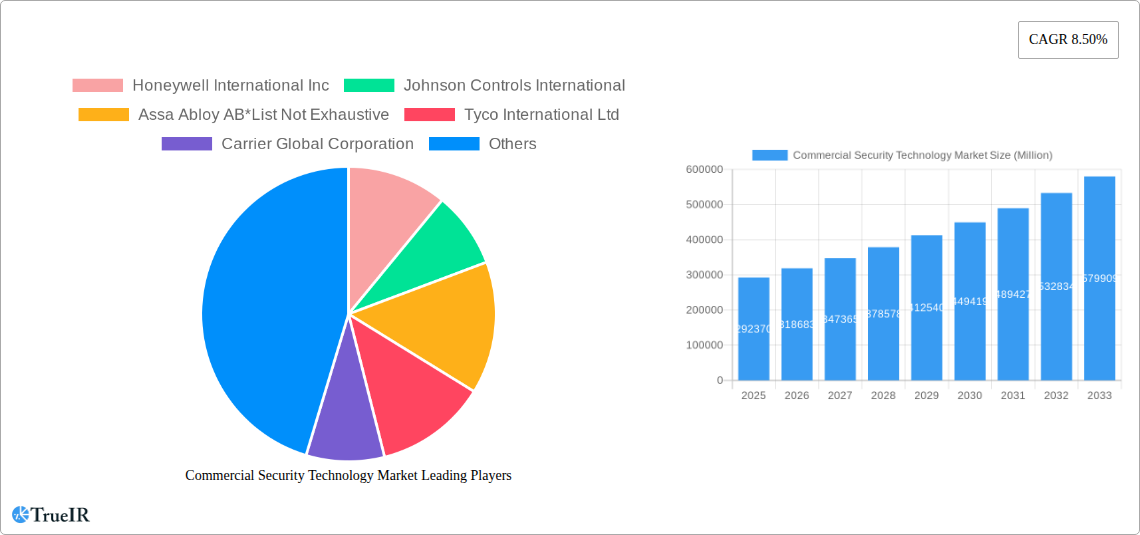

Commercial Security Technology Market Company Market Share

This in-depth market research report offers a comprehensive analysis of the global Commercial Security Technology Market. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report delves into the intricate dynamics, evolving trends, and significant opportunities within this critical industry. Discover the market's structure, competitive landscape, dominant segments, product innovations, key drivers, challenges, and the pivotal players shaping its future.

Commercial Security Technology Market Market Structure & Competitive Landscape

The Commercial Security Technology Market is characterized by a moderately consolidated structure, with leading players like Honeywell International Inc., Johnson Controls International, and Assa Abloy AB holding significant market share. While comprehensive concentration ratios are proprietary, industry analyses suggest a market concentration in the high double digits among the top five vendors. Innovation remains a primary driver, fueled by advancements in AI-powered video analytics, integrated access control solutions, and smart fire detection systems. Regulatory impacts, particularly evolving data privacy laws and cybersecurity mandates, are shaping product development and deployment strategies. Product substitutes, such as managed security services and cloud-based solutions, are increasingly challenging traditional hardware-centric models. End-user segmentation spans a wide array of sectors, including retail, healthcare, BFSI, manufacturing, and government, each with distinct security requirements. Mergers and acquisitions (M&A) are a consistent feature, reflecting the drive for market consolidation and expanded service offerings. Notably, the first half of 2022 saw several strategic acquisitions aimed at bolstering integration capabilities and expanding regional presence.

Commercial Security Technology Market Market Trends & Opportunities

The global Commercial Security Technology Market is projected to experience robust growth, with an estimated market size reaching hundreds of billions of dollars by 2033. A significant Compound Annual Growth Rate (CAGR) is anticipated, driven by increasing concerns over physical and cyber threats, coupled with a growing adoption of smart building technologies. Technological shifts are a major catalyst, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) revolutionizing video surveillance through advanced analytics like facial recognition, behavioral analysis, and anomaly detection. Internet of Things (IoT) connectivity is enabling seamless integration between various security systems, creating intelligent and responsive security ecosystems. Consumer preferences are evolving towards proactive, predictive, and automated security solutions that offer enhanced convenience and operational efficiency. The competitive dynamics are intensifying, with companies focusing on offering end-to-end security solutions, including installation, monitoring, and maintenance services. Opportunities abound in emerging markets, driven by infrastructure development and increased investment in public and private security. The demand for cloud-based security platforms is also on the rise, offering scalability, flexibility, and cost-effectiveness for businesses of all sizes. The convergence of physical and cybersecurity is another key trend, pushing for holistic security strategies that protect both digital assets and physical spaces.

Dominant Markets & Segments in Commercial Security Technology Market

The Commercial Security Technology Market exhibits dominance across several key segments and regions, each driven by unique factors.

Video Surveillance: This segment consistently holds a significant market share, propelled by increasing adoption of high-definition cameras, AI-powered analytics for real-time threat detection, and the growing need for operational monitoring in sectors like retail and manufacturing. Government mandates for public safety and infrastructure protection further fuel its growth. The market dominance is further solidified by the decreasing cost of advanced surveillance hardware and the rising demand for remote monitoring capabilities.

Access Control Systems: This segment is a vital component of commercial security, witnessing substantial growth due to the imperative for enhanced physical security, employee tracking, and secure data management. The proliferation of smart buildings, cloud-based access control solutions, and biometric authentication technologies are key growth drivers. Industries such as finance, healthcare, and government, which handle sensitive information and assets, are major contributors to this segment's dominance.

Fire Protection Systems: While often considered a distinct category, its integration with broader security platforms is increasingly common. Growth in this segment is driven by stringent building codes, increasing awareness of fire safety, and advancements in early detection and suppression technologies. The demand for integrated fire and security solutions, offering a unified approach to emergency response, contributes significantly to its market presence.

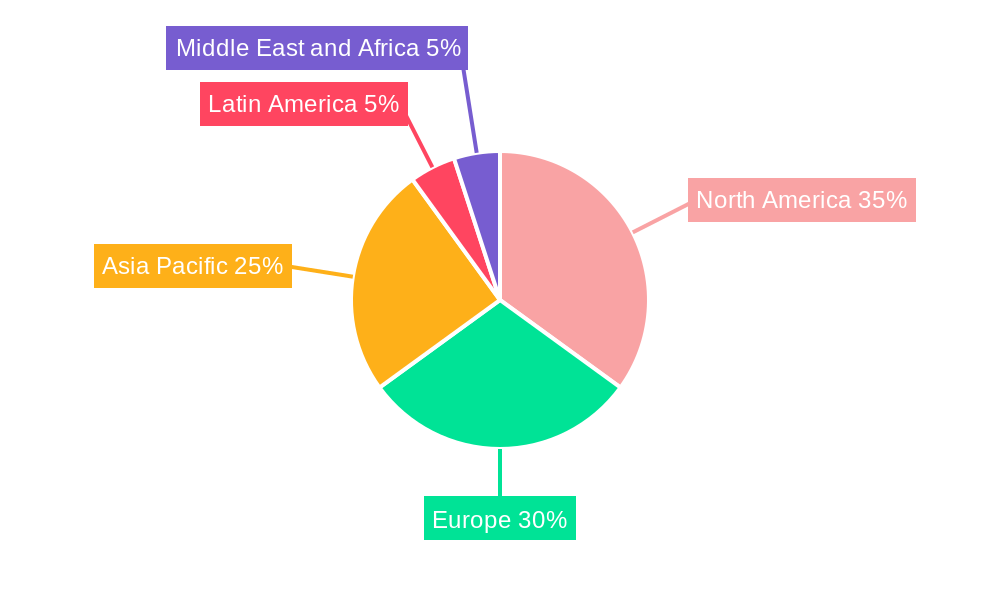

Regional Dominance: North America and Europe currently represent the largest markets due to advanced technological adoption, high security awareness, and significant investments in smart infrastructure. However, the Asia-Pacific region is emerging as a rapid growth market, driven by rapid urbanization, increasing industrialization, and government initiatives focused on enhancing public safety and security infrastructure.

Commercial Security Technology Market Product Analysis

Product innovation in the Commercial Security Technology Market is centered on intelligence and integration. AI-powered video analytics are revolutionizing surveillance by enabling predictive capabilities and automated threat detection. Access control systems are evolving beyond traditional keycards to include sophisticated biometric solutions and cloud-managed platforms offering enhanced flexibility and security. Fire protection systems are integrating with smart building management to provide a unified response to emergencies. These advancements offer competitive advantages by delivering enhanced efficiency, proactive threat mitigation, and comprehensive security management for businesses.

Key Drivers, Barriers & Challenges in Commercial Security Technology Market

Key Drivers:

- Rising security threats: Increased instances of crime, terrorism, and cyberattacks are driving demand for advanced security solutions.

- Technological advancements: AI, IoT, and cloud computing are enabling more sophisticated, integrated, and intelligent security systems.

- Government initiatives and regulations: Stricter safety standards and government investments in public security are boosting market growth.

- Growth of smart buildings: The increasing prevalence of interconnected buildings necessitates integrated security solutions.

Barriers & Challenges:

- High initial investment costs: Advanced security systems can require significant upfront capital, posing a barrier for small and medium-sized enterprises.

- Cybersecurity vulnerabilities: The interconnected nature of modern security systems makes them susceptible to cyberattacks, requiring robust protection measures.

- Lack of skilled professionals: A shortage of trained personnel for installation, maintenance, and operation of complex security technologies can hinder adoption.

- Data privacy concerns: The collection and storage of sensitive data through surveillance and access control systems raise privacy issues that need careful management.

Growth Drivers in the Commercial Security Technology Market Market

The Commercial Security Technology Market is propelled by a confluence of technological, economic, and regulatory factors. The pervasive threat landscape, encompassing both physical and cyber risks, acts as a primary catalyst, compelling businesses to invest in robust protection. Advancements in AI and IoT are enabling the development of intelligent, predictive, and automated security systems that offer enhanced effectiveness and operational efficiency. Government mandates, such as stricter building codes and data protection regulations, further incentivize the adoption of advanced security technologies. The rapid growth of smart cities and the increasing integration of technology in commercial infrastructure create a fertile ground for comprehensive security solutions. Economic growth in emerging markets is also contributing significantly, as businesses there increasingly prioritize security investments to safeguard assets and operations.

Challenges Impacting Commercial Security Technology Market Growth

Despite robust growth drivers, the Commercial Security Technology Market faces several significant challenges. The complex regulatory landscape, particularly concerning data privacy and surveillance laws across different jurisdictions, can create hurdles for global deployment. Supply chain disruptions, as evidenced in recent years, can impact the availability and cost of essential components, leading to project delays and increased expenses. Fierce competitive pressures from both established players and emerging technology startups necessitate continuous innovation and aggressive pricing strategies, potentially squeezing profit margins. Furthermore, the significant initial investment required for advanced security systems can be a barrier for many businesses, especially small and medium-sized enterprises. The ongoing threat of sophisticated cyberattacks targeting security infrastructure itself also poses a substantial risk, requiring constant vigilance and investment in cybersecurity measures.

Key Players Shaping the Commercial Security Technology Market Market

- Honeywell International Inc.

- Johnson Controls International

- Assa Abloy AB

- Tyco International Ltd

- Carrier Global Corporation

- UTC Fire & Security

- Hangzhou Hikvision Digital Technology Co Ltd

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

- Nortek Control

Significant Commercial Security Technology Market Industry Milestones

- January 2022: ADT Commercial acquired Edwards Electronic Systems, Inc., a premier fire, life safety, and security systems provider in North Carolina, USA, enhancing its integration capabilities and fire and life safety expertise in the Carolinas region.

- January 2022: American Alarm and Communications completed the acquisition of Phoenix Security Systems Inc. of Wilmington, Mass., expanding its security, access control, fire alarm, and video surveillance services for businesses and homes in the Boston metropolitan and south shore areas.

Future Outlook for Commercial Security Technology Market Market

The future of the Commercial Security Technology Market is characterized by continued innovation and expansion, driven by an increasing demand for integrated, intelligent, and proactive security solutions. Strategic opportunities lie in the further development and adoption of AI-powered analytics, cloud-based security platforms, and cybersecurity convergence. The growing emphasis on smart cities, IoT integration, and the need for robust protection against evolving threats will fuel market growth. Companies that can offer comprehensive, end-to-end solutions, coupled with exceptional customer service and ongoing technical support, are poised for significant success. Emerging markets, in particular, present substantial growth potential as infrastructure development and security awareness continue to rise. The market is expected to witness sustained double-digit growth in the coming years.

Commercial Security Technology Market Segmentation

-

1. Security Type

- 1.1. Fire Protection System

- 1.2. Video Surveillance

- 1.3. Access Control System

Commercial Security Technology Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Commercial Security Technology Market Regional Market Share

Geographic Coverage of Commercial Security Technology Market

Commercial Security Technology Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of IoT-based Security Systems; Rapid Implementation of Stringent Fire Protection Related Regulations

- 3.3. Market Restrains

- 3.3.1. High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Video Surveillance to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Security Technology Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Security Type

- 5.1.1. Fire Protection System

- 5.1.2. Video Surveillance

- 5.1.3. Access Control System

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Security Type

- 6. North America Commercial Security Technology Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Security Type

- 6.1.1. Fire Protection System

- 6.1.2. Video Surveillance

- 6.1.3. Access Control System

- 6.1. Market Analysis, Insights and Forecast - by Security Type

- 7. Europe Commercial Security Technology Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Security Type

- 7.1.1. Fire Protection System

- 7.1.2. Video Surveillance

- 7.1.3. Access Control System

- 7.1. Market Analysis, Insights and Forecast - by Security Type

- 8. Asia Pacific Commercial Security Technology Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Security Type

- 8.1.1. Fire Protection System

- 8.1.2. Video Surveillance

- 8.1.3. Access Control System

- 8.1. Market Analysis, Insights and Forecast - by Security Type

- 9. Latin America Commercial Security Technology Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Security Type

- 9.1.1. Fire Protection System

- 9.1.2. Video Surveillance

- 9.1.3. Access Control System

- 9.1. Market Analysis, Insights and Forecast - by Security Type

- 10. Middle East and Africa Commercial Security Technology Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Security Type

- 10.1.1. Fire Protection System

- 10.1.2. Video Surveillance

- 10.1.3. Access Control System

- 10.1. Market Analysis, Insights and Forecast - by Security Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Johnson Controls International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Assa Abloy AB*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tyco International Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Carrier Global Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 UTC Fire & Security

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hangzhou Hikvision Digital Technology Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bosch Sicherheitssysteme GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Axis Communications AB

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nortek Control

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Commercial Security Technology Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Commercial Security Technology Market Revenue (undefined), by Security Type 2025 & 2033

- Figure 3: North America Commercial Security Technology Market Revenue Share (%), by Security Type 2025 & 2033

- Figure 4: North America Commercial Security Technology Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Commercial Security Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Commercial Security Technology Market Revenue (undefined), by Security Type 2025 & 2033

- Figure 7: Europe Commercial Security Technology Market Revenue Share (%), by Security Type 2025 & 2033

- Figure 8: Europe Commercial Security Technology Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Commercial Security Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Commercial Security Technology Market Revenue (undefined), by Security Type 2025 & 2033

- Figure 11: Asia Pacific Commercial Security Technology Market Revenue Share (%), by Security Type 2025 & 2033

- Figure 12: Asia Pacific Commercial Security Technology Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Commercial Security Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Commercial Security Technology Market Revenue (undefined), by Security Type 2025 & 2033

- Figure 15: Latin America Commercial Security Technology Market Revenue Share (%), by Security Type 2025 & 2033

- Figure 16: Latin America Commercial Security Technology Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Latin America Commercial Security Technology Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Commercial Security Technology Market Revenue (undefined), by Security Type 2025 & 2033

- Figure 19: Middle East and Africa Commercial Security Technology Market Revenue Share (%), by Security Type 2025 & 2033

- Figure 20: Middle East and Africa Commercial Security Technology Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Middle East and Africa Commercial Security Technology Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Security Technology Market Revenue undefined Forecast, by Security Type 2020 & 2033

- Table 2: Global Commercial Security Technology Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Commercial Security Technology Market Revenue undefined Forecast, by Security Type 2020 & 2033

- Table 4: Global Commercial Security Technology Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Commercial Security Technology Market Revenue undefined Forecast, by Security Type 2020 & 2033

- Table 6: Global Commercial Security Technology Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Commercial Security Technology Market Revenue undefined Forecast, by Security Type 2020 & 2033

- Table 8: Global Commercial Security Technology Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Commercial Security Technology Market Revenue undefined Forecast, by Security Type 2020 & 2033

- Table 10: Global Commercial Security Technology Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global Commercial Security Technology Market Revenue undefined Forecast, by Security Type 2020 & 2033

- Table 12: Global Commercial Security Technology Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Security Technology Market?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Commercial Security Technology Market?

Key companies in the market include Honeywell International Inc, Johnson Controls International, Assa Abloy AB*List Not Exhaustive, Tyco International Ltd, Carrier Global Corporation, UTC Fire & Security, Hangzhou Hikvision Digital Technology Co Ltd, Bosch Sicherheitssysteme GmbH, Axis Communications AB, Nortek Control.

3. What are the main segments of the Commercial Security Technology Market?

The market segments include Security Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of IoT-based Security Systems; Rapid Implementation of Stringent Fire Protection Related Regulations.

6. What are the notable trends driving market growth?

Video Surveillance to Hold Major Share.

7. Are there any restraints impacting market growth?

High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

January 2022 - ADT Commercial has announced that it has acquired premier fire, life safety, and security systems provider Edwards Electronic Systems, Inc., based out of Clayton and Concord, North Carolina, USA. This acquisition further deepens the ADT Commercial organization's integration capabilities and fire and life safety expertise to serve the Carolinas region's mid-market, national, and large-scale commercial customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Security Technology Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Security Technology Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Security Technology Market?

To stay informed about further developments, trends, and reports in the Commercial Security Technology Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence