Key Insights

The Connected Logistics market is projected for significant expansion, with an estimated market size of 26.1 billion by 2025. This growth is driven by a robust Compound Annual Growth Rate (CAGR) of 13.3%. Key growth drivers include the widespread adoption of IoT for real-time tracking, advanced asset management software, and enhanced security solutions. Demand for seamless data management and streaming analytics is also a major catalyst, empowering businesses with deeper supply chain insights and improved decision-making. Emerging trends include the proliferation of smart devices across all transportation modes and the integration of connected logistics solutions across diverse industries like automotive, manufacturing, healthcare, and retail.

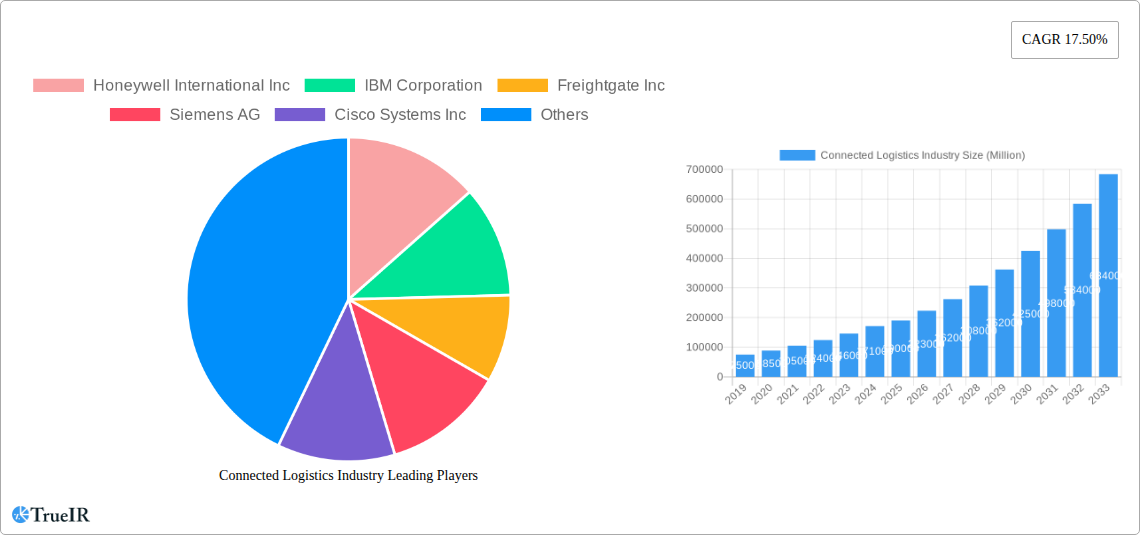

Connected Logistics Industry Market Size (In Billion)

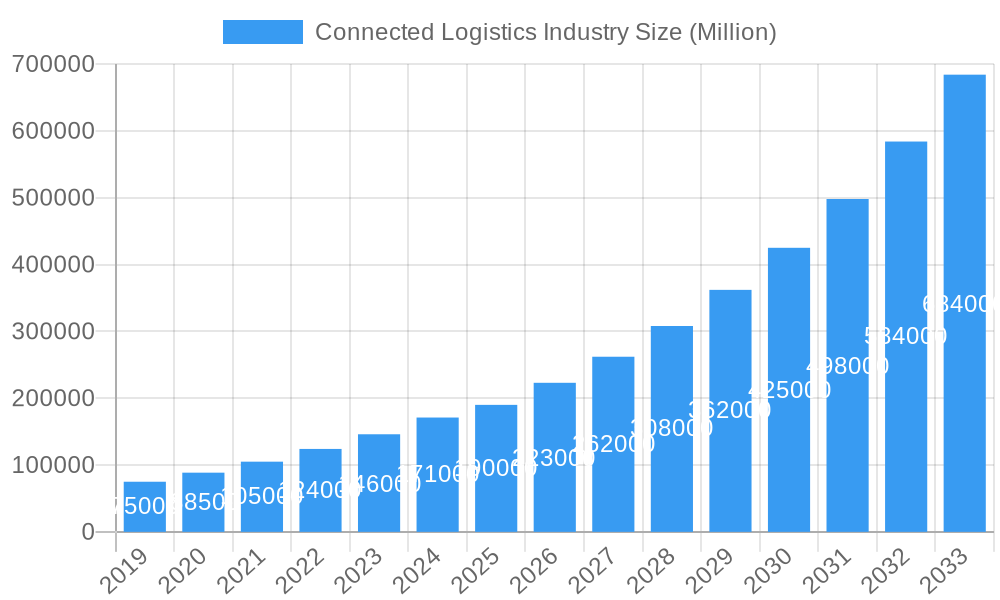

Market growth is further supported by a global focus on operational efficiency, cost reduction, and enhanced customer service within the supply chain. The implementation of sophisticated device, application, and connectivity management platforms is crucial for achieving these goals. While potential restraints such as high initial investment costs and data security concerns exist, the persistent need for supply chain visibility and resilience, alongside continuous technological advancements, ensures a dynamic market. Leading companies like Honeywell International Inc., IBM Corporation, Siemens AG, and Microsoft Corporation are driving innovation in this sector through comprehensive solutions. The market is anticipated to see ongoing consolidation and strategic alliances.

Connected Logistics Industry Company Market Share

This dynamic, SEO-optimized report description for the Connected Logistics Industry is ready for immediate use.

Connected Logistics Industry Market Analysis and Forecast (2019-2033)

This comprehensive report delves into the rapidly evolving Connected Logistics Industry, a sector revolutionizing global supply chains through the integration of IoT, AI, and advanced networking technologies. We provide an in-depth analysis of market dynamics, key players, emerging trends, and future projections, equipping stakeholders with critical insights for strategic decision-making. The study covers the historical period from 2019 to 2024, with a base year of 2025, and forecasts market performance through 2033. Leveraging high-volume keywords such as "supply chain optimization," "IoT logistics," "digital supply chain," "fleet management solutions," and "warehouse automation," this report targets industry professionals seeking to understand and capitalize on the transformative power of connected logistics.

Connected Logistics Industry Market Structure & Competitive Landscape

The Connected Logistics Industry exhibits a moderately concentrated market structure, driven by significant investments in technological innovation and the consolidation of key players. Innovation is primarily fueled by advancements in IoT sensors, AI-powered analytics, and cloud computing infrastructure, enabling real-time visibility and predictive capabilities across the supply chain. Regulatory impacts, while varied by region, are increasingly focused on data security, cross-border logistics efficiency, and environmental sustainability, influencing platform development and operational standards. Product substitutes, such as traditional non-connected logistics management systems, are rapidly becoming obsolete as the demand for enhanced efficiency, transparency, and resilience grows. End-user segmentation highlights a diverse range of industries adopting connected logistics, with Manufacturing, Automotive, and Retail leading the charge. Mergers and acquisitions (M&A) trends are prominent, reflecting a strategic imperative for companies to expand their technological capabilities and market reach. For instance, the acquisition of BluJay Solutions by E2open Parent Holdings, Inc. for approximately USD 1.7 billion in May 2020 signifies a major consolidation trend. The volume of such M&A activities is estimated to be in the range of tens of billions of dollars annually, indicating a dynamic and competitive landscape where strategic partnerships and acquisitions are pivotal for sustained growth. Concentration ratios, particularly within specialized segments like Warehouse IoT and Asset Management, are influenced by the dominance of a few large technology providers and logistics solution specialists.

Connected Logistics Industry Market Trends & Opportunities

The global Connected Logistics Industry is poised for extraordinary growth, with its market size projected to expand significantly from an estimated USD 50 Billion in 2025 to over USD 150 Billion by 2033. This robust expansion is underpinned by a Compound Annual Growth Rate (CAGR) exceeding 15%, reflecting the accelerating adoption of digital technologies across the entire logistics value chain. Key technological shifts are transforming operational paradigms, including the pervasive integration of the Internet of Things (IoT) for real-time tracking and monitoring of assets, vehicles, and inventory, coupled with the deployment of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, route optimization, and demand forecasting. These advancements are not only enhancing operational efficiency but also driving unprecedented levels of supply chain visibility and resilience. Consumer preferences are increasingly shifting towards faster, more transparent, and sustainable delivery options, creating a strong demand pull for connected logistics solutions that can meet these evolving expectations. Businesses are actively seeking ways to reduce lead times, minimize disruptions, and improve customer satisfaction, making connected logistics an indispensable tool. The competitive dynamics are intensifying, with established technology giants, specialized logistics software providers, and innovative startups vying for market share. Opportunities abound in areas such as the development of predictive maintenance solutions for fleets, the implementation of smart warehouse technologies that automate inventory management and order fulfillment, and the creation of secure, integrated data platforms that facilitate seamless information exchange between all supply chain partners. Furthermore, the growing emphasis on sustainability in logistics presents a significant avenue for growth, as connected technologies enable companies to optimize routes, reduce fuel consumption, and minimize their environmental footprint. The market penetration rates for advanced connected logistics solutions are still relatively low in many emerging economies, indicating substantial untapped potential for market expansion and innovation. The increasing digitalization of trade and commerce further propels the need for efficient, connected supply chains.

Dominant Markets & Segments in Connected Logistics Industry

The Connected Logistics Industry is experiencing significant dominance and growth across various segments, driven by specific technological enablers and end-user demands.

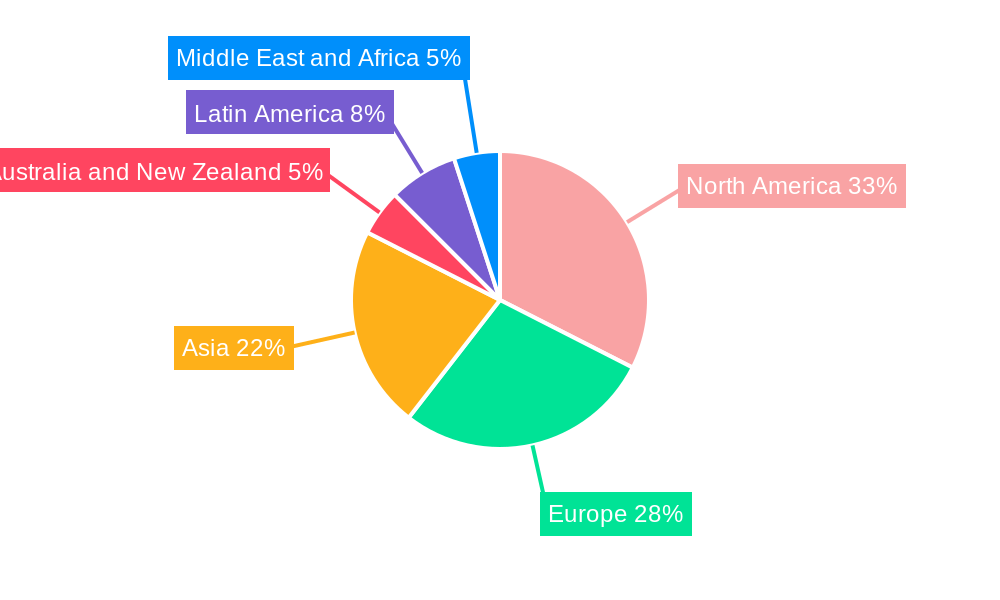

Dominant Regions and Countries:

- North America and Europe currently lead the market, characterized by mature digital infrastructures, high adoption rates of advanced technologies, and stringent regulatory frameworks that encourage innovation in supply chain efficiency and security. Within these regions, countries like the United States and Germany are at the forefront, boasting significant investments in logistics technology and a strong presence of key industry players.

- The Asia-Pacific region is emerging as a high-growth market, fueled by rapid industrialization, expanding e-commerce sectors, and increasing government initiatives to improve logistics infrastructure and connectivity.

Dominant Software Segments:

- Data Management: This segment is crucial, providing the backbone for collecting, storing, and analyzing vast amounts of data generated by connected devices. Its dominance is driven by the need for actionable insights into supply chain performance.

- Asset Management: Real-time tracking and monitoring of valuable assets, including vehicles, containers, and equipment, is a primary focus. Solutions in this area significantly reduce loss, optimize utilization, and enhance security.

- Warehouse IoT: The automation and optimization of warehouse operations through connected sensors, robotics, and intelligent systems are experiencing rapid growth. This segment is essential for improving inventory accuracy, reducing operational costs, and increasing throughput.

- Security: With the increasing interconnectedness of supply chains, robust security solutions for data, devices, and networks are paramount. This segment is critical for preventing breaches and ensuring the integrity of logistics operations.

Dominant Product Types:

- Connectivity Management: Ensuring reliable and secure communication channels for a multitude of devices is foundational. Platforms offering seamless connectivity solutions are in high demand.

- Device Management: The ability to deploy, monitor, update, and manage a large fleet of connected devices remotely is critical for scalability and operational efficiency.

Dominant Transportation Modes:

- Roadways: This mode consistently represents the largest segment due to the extensive reliance on road transportation for freight movement globally. Connected solutions enhance fleet management, route optimization, and driver safety.

- Airways: For time-sensitive and high-value cargo, connected solutions provide critical real-time tracking and security, ensuring efficient air freight operations.

Dominant End-user Industries:

- Manufacturing: This sector leverages connected logistics for inbound and outbound material flow optimization, inventory management, and ensuring the timely delivery of finished goods.

- Automotive: The automotive industry benefits from highly complex supply chains, making connected logistics essential for tracking components, managing Just-In-Time (JIT) deliveries, and optimizing finished vehicle distribution.

- Retail: Driven by e-commerce and consumer demand for fast, trackable deliveries, the retail sector is a major adopter of connected logistics solutions for inventory visibility, last-mile delivery optimization, and returns management.

- IT & Telecom: This industry relies on efficient and secure logistics for the movement of sensitive equipment and components, where real-time tracking and condition monitoring are vital.

Connected Logistics Industry Product Analysis

Product innovations in the Connected Logistics Industry are centered around enhancing visibility, efficiency, and predictive capabilities. Key advancements include the development of ultra-low power IoT sensors for extended asset tracking, AI-driven platforms for real-time route optimization and anomaly detection, and secure, blockchain-enabled solutions for transparent and tamper-proof supply chain transactions. These products offer competitive advantages by reducing operational costs, minimizing transit times, preventing cargo loss or damage, and providing unprecedented end-to-end supply chain visibility. The market fit is strong across all transportation modes and end-user industries, addressing critical pain points in modern logistics management.

Key Drivers, Barriers & Challenges in Connected Logistics Industry

Key Drivers: The Connected Logistics Industry is propelled by the escalating demand for real-time visibility and control over supply chains, driven by increasing global trade complexity and consumer expectations for faster deliveries. Technological advancements, particularly in IoT, AI, and cloud computing, are creating more sophisticated and affordable solutions. The pursuit of operational efficiency, cost reduction, and enhanced customer service by businesses across sectors like manufacturing, retail, and automotive are significant growth catalysts. Furthermore, increasing government initiatives and regulations promoting supply chain transparency and security are further accelerating adoption.

Key Barriers & Challenges: Despite strong growth, the industry faces significant barriers. High initial implementation costs for integrated IoT and software systems can be a deterrent, especially for small and medium-sized enterprises. Interoperability issues between different technology platforms and legacy systems create integration complexities. Data security and privacy concerns are paramount, given the sensitive nature of logistics data. Regulatory fragmentation across different regions can also pose challenges for global operations. Moreover, the shortage of skilled professionals capable of managing and analyzing complex connected logistics systems represents a substantial operational hurdle. Supply chain disruptions, such as those experienced globally, highlight vulnerabilities that require robust, albeit costly, solutions.

Growth Drivers in the Connected Logistics Industry Market

The growth of the Connected Logistics Industry is primarily driven by the imperative for enhanced supply chain visibility and efficiency. Technological advancements, including the proliferation of affordable IoT devices, sophisticated AI algorithms for predictive analytics, and robust cloud infrastructure, are key enablers. Economic factors such as the globalization of trade and the increasing demand for faster, more reliable delivery services are also significant drivers. Furthermore, supportive government policies aimed at modernizing infrastructure and promoting digital transformation in logistics create a favorable environment for growth. The increasing adoption of e-commerce and the need for seamless last-mile delivery solutions are also substantial growth catalysts.

Challenges Impacting Connected Logistics Industry Growth

Challenges impacting the Connected Logistics Industry growth include the substantial initial investment costs associated with implementing advanced IoT and AI solutions, which can be prohibitive for many businesses. Interoperability issues between disparate systems and the integration of new technologies with existing legacy infrastructure present significant technical hurdles. Data security and privacy concerns are paramount, as the increased flow of sensitive information necessitates robust cybersecurity measures to prevent breaches. Regulatory complexities and fragmentation across different geographical regions can hinder seamless global operations. Additionally, the scarcity of skilled talent proficient in managing and analyzing complex connected logistics ecosystems poses a considerable operational challenge.

Key Players Shaping the Connected Logistics Industry Market

- Honeywell International Inc

- IBM Corporation

- Freightgate Inc

- Siemens AG

- Cisco Systems Inc

- Microsoft Corporation

- Oracle Corporation

- Bosch Service Solutions GmbH

- Orbcomm Inc

- AT&T Inc

- HCL Technologies Limited

- SAP SE

- Intel Corporation

Significant Connected Logistics Industry Industry Milestones

- May 2020: E2open Parent Holdings, Inc., a leading network-based provider of a 100% cloud-based, mission-critical, end-to-end supply chain management platform, announced to acquire BluJay Solutions, a leading cloud-based logistics execution platform for approximately USD 1.7 billion. This acquisition significantly consolidated the market for cloud-based logistics platforms, enhancing E2open's comprehensive supply chain management capabilities.

- June 2021: Holisol Logistics, which provides end-to-end (E2E) supply chain management solutions, has raised USD 3 million in debt financing from Northern Arc Capital. Holisol provides E2E solutions due to customer demands for supply chain logistics. The proceeds shall be used for the company's growth and to increase demand. This funding highlights the growing investor confidence in the logistics sector and the demand for integrated supply chain solutions.

Future Outlook for Connected Logistics Industry Market

The future outlook for the Connected Logistics Industry is exceptionally bright, driven by sustained technological innovation and increasing global demand for efficient, transparent, and resilient supply chains. Strategic opportunities lie in the further integration of AI for predictive maintenance and autonomous logistics operations, the expansion of blockchain technology for enhanced security and traceability, and the development of more sustainable logistics solutions. The growing emphasis on the "smart city" concept and the evolution of hyper-personalized delivery services will also fuel market expansion. The industry is projected to witness continued M&A activity as companies seek to enhance their end-to-end offerings and achieve greater market penetration, particularly in emerging economies. This dynamic landscape presents significant potential for growth and transformation, making connected logistics a cornerstone of future global commerce.

Connected Logistics Industry Segmentation

-

1. Software

- 1.1. Asset Management

- 1.2. Warehouse IoT

- 1.3. Security

- 1.4. Data Management

- 1.5. Network Management

- 1.6. Streaming Analytics

-

2. Product Type

- 2.1. Device Management

- 2.2. Application Management

- 2.3. Connectivity Management

-

3. Transportation Mode

- 3.1. Roadways

- 3.2. Railways

- 3.3. Airways

- 3.4. Seaways

-

4. End-user Industry

- 4.1. Automotive

- 4.2. Manufacturing

- 4.3. Oil and Gas

- 4.4. IT & Telecom

- 4.5. Healthcare

- 4.6. IT and Telecommunication

- 4.7. Retail

- 4.8. Food and Beverage

- 4.9. Other End-user Industries

Connected Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Connected Logistics Industry Regional Market Share

Geographic Coverage of Connected Logistics Industry

Connected Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption on IoT in various Industries; Adoption of Sensor Based Technologies

- 3.3. Market Restrains

- 3.3.1. Lack of Uniform Government Regulations for Smart Technologies; Coronavirus Outbreak Influencing Electronic Industry

- 3.4. Market Trends

- 3.4.1. Increasing use of IoT and future technologies in different industries will drive the adoption of Connected Logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Connected Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Software

- 5.1.1. Asset Management

- 5.1.2. Warehouse IoT

- 5.1.3. Security

- 5.1.4. Data Management

- 5.1.5. Network Management

- 5.1.6. Streaming Analytics

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Device Management

- 5.2.2. Application Management

- 5.2.3. Connectivity Management

- 5.3. Market Analysis, Insights and Forecast - by Transportation Mode

- 5.3.1. Roadways

- 5.3.2. Railways

- 5.3.3. Airways

- 5.3.4. Seaways

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Automotive

- 5.4.2. Manufacturing

- 5.4.3. Oil and Gas

- 5.4.4. IT & Telecom

- 5.4.5. Healthcare

- 5.4.6. IT and Telecommunication

- 5.4.7. Retail

- 5.4.8. Food and Beverage

- 5.4.9. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia

- 5.5.4. Australia and New Zealand

- 5.5.5. Latin America

- 5.5.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Software

- 6. North America Connected Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Software

- 6.1.1. Asset Management

- 6.1.2. Warehouse IoT

- 6.1.3. Security

- 6.1.4. Data Management

- 6.1.5. Network Management

- 6.1.6. Streaming Analytics

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Device Management

- 6.2.2. Application Management

- 6.2.3. Connectivity Management

- 6.3. Market Analysis, Insights and Forecast - by Transportation Mode

- 6.3.1. Roadways

- 6.3.2. Railways

- 6.3.3. Airways

- 6.3.4. Seaways

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Automotive

- 6.4.2. Manufacturing

- 6.4.3. Oil and Gas

- 6.4.4. IT & Telecom

- 6.4.5. Healthcare

- 6.4.6. IT and Telecommunication

- 6.4.7. Retail

- 6.4.8. Food and Beverage

- 6.4.9. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Software

- 7. Europe Connected Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Software

- 7.1.1. Asset Management

- 7.1.2. Warehouse IoT

- 7.1.3. Security

- 7.1.4. Data Management

- 7.1.5. Network Management

- 7.1.6. Streaming Analytics

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Device Management

- 7.2.2. Application Management

- 7.2.3. Connectivity Management

- 7.3. Market Analysis, Insights and Forecast - by Transportation Mode

- 7.3.1. Roadways

- 7.3.2. Railways

- 7.3.3. Airways

- 7.3.4. Seaways

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Automotive

- 7.4.2. Manufacturing

- 7.4.3. Oil and Gas

- 7.4.4. IT & Telecom

- 7.4.5. Healthcare

- 7.4.6. IT and Telecommunication

- 7.4.7. Retail

- 7.4.8. Food and Beverage

- 7.4.9. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Software

- 8. Asia Connected Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Software

- 8.1.1. Asset Management

- 8.1.2. Warehouse IoT

- 8.1.3. Security

- 8.1.4. Data Management

- 8.1.5. Network Management

- 8.1.6. Streaming Analytics

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Device Management

- 8.2.2. Application Management

- 8.2.3. Connectivity Management

- 8.3. Market Analysis, Insights and Forecast - by Transportation Mode

- 8.3.1. Roadways

- 8.3.2. Railways

- 8.3.3. Airways

- 8.3.4. Seaways

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Automotive

- 8.4.2. Manufacturing

- 8.4.3. Oil and Gas

- 8.4.4. IT & Telecom

- 8.4.5. Healthcare

- 8.4.6. IT and Telecommunication

- 8.4.7. Retail

- 8.4.8. Food and Beverage

- 8.4.9. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Software

- 9. Australia and New Zealand Connected Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Software

- 9.1.1. Asset Management

- 9.1.2. Warehouse IoT

- 9.1.3. Security

- 9.1.4. Data Management

- 9.1.5. Network Management

- 9.1.6. Streaming Analytics

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Device Management

- 9.2.2. Application Management

- 9.2.3. Connectivity Management

- 9.3. Market Analysis, Insights and Forecast - by Transportation Mode

- 9.3.1. Roadways

- 9.3.2. Railways

- 9.3.3. Airways

- 9.3.4. Seaways

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Automotive

- 9.4.2. Manufacturing

- 9.4.3. Oil and Gas

- 9.4.4. IT & Telecom

- 9.4.5. Healthcare

- 9.4.6. IT and Telecommunication

- 9.4.7. Retail

- 9.4.8. Food and Beverage

- 9.4.9. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Software

- 10. Latin America Connected Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Software

- 10.1.1. Asset Management

- 10.1.2. Warehouse IoT

- 10.1.3. Security

- 10.1.4. Data Management

- 10.1.5. Network Management

- 10.1.6. Streaming Analytics

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Device Management

- 10.2.2. Application Management

- 10.2.3. Connectivity Management

- 10.3. Market Analysis, Insights and Forecast - by Transportation Mode

- 10.3.1. Roadways

- 10.3.2. Railways

- 10.3.3. Airways

- 10.3.4. Seaways

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. Automotive

- 10.4.2. Manufacturing

- 10.4.3. Oil and Gas

- 10.4.4. IT & Telecom

- 10.4.5. Healthcare

- 10.4.6. IT and Telecommunication

- 10.4.7. Retail

- 10.4.8. Food and Beverage

- 10.4.9. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Software

- 11. Middle East and Africa Connected Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Software

- 11.1.1. Asset Management

- 11.1.2. Warehouse IoT

- 11.1.3. Security

- 11.1.4. Data Management

- 11.1.5. Network Management

- 11.1.6. Streaming Analytics

- 11.2. Market Analysis, Insights and Forecast - by Product Type

- 11.2.1. Device Management

- 11.2.2. Application Management

- 11.2.3. Connectivity Management

- 11.3. Market Analysis, Insights and Forecast - by Transportation Mode

- 11.3.1. Roadways

- 11.3.2. Railways

- 11.3.3. Airways

- 11.3.4. Seaways

- 11.4. Market Analysis, Insights and Forecast - by End-user Industry

- 11.4.1. Automotive

- 11.4.2. Manufacturing

- 11.4.3. Oil and Gas

- 11.4.4. IT & Telecom

- 11.4.5. Healthcare

- 11.4.6. IT and Telecommunication

- 11.4.7. Retail

- 11.4.8. Food and Beverage

- 11.4.9. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Software

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Honeywell International Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 IBM Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Freightgate Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Siemens AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cisco Systems Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microsoft Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Oracle Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Bosch Service Solutions GmbH

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Orbcomm Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 AT&T Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 HCL Technologies Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 SAP SE

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Intel Corporation

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Connected Logistics Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Connected Logistics Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Connected Logistics Industry Revenue (billion), by Software 2025 & 2033

- Figure 4: North America Connected Logistics Industry Volume (K Unit), by Software 2025 & 2033

- Figure 5: North America Connected Logistics Industry Revenue Share (%), by Software 2025 & 2033

- Figure 6: North America Connected Logistics Industry Volume Share (%), by Software 2025 & 2033

- Figure 7: North America Connected Logistics Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 8: North America Connected Logistics Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 9: North America Connected Logistics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Connected Logistics Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 11: North America Connected Logistics Industry Revenue (billion), by Transportation Mode 2025 & 2033

- Figure 12: North America Connected Logistics Industry Volume (K Unit), by Transportation Mode 2025 & 2033

- Figure 13: North America Connected Logistics Industry Revenue Share (%), by Transportation Mode 2025 & 2033

- Figure 14: North America Connected Logistics Industry Volume Share (%), by Transportation Mode 2025 & 2033

- Figure 15: North America Connected Logistics Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 16: North America Connected Logistics Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 17: North America Connected Logistics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: North America Connected Logistics Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 19: North America Connected Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 20: North America Connected Logistics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 21: North America Connected Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Connected Logistics Industry Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Connected Logistics Industry Revenue (billion), by Software 2025 & 2033

- Figure 24: Europe Connected Logistics Industry Volume (K Unit), by Software 2025 & 2033

- Figure 25: Europe Connected Logistics Industry Revenue Share (%), by Software 2025 & 2033

- Figure 26: Europe Connected Logistics Industry Volume Share (%), by Software 2025 & 2033

- Figure 27: Europe Connected Logistics Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 28: Europe Connected Logistics Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 29: Europe Connected Logistics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Europe Connected Logistics Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Europe Connected Logistics Industry Revenue (billion), by Transportation Mode 2025 & 2033

- Figure 32: Europe Connected Logistics Industry Volume (K Unit), by Transportation Mode 2025 & 2033

- Figure 33: Europe Connected Logistics Industry Revenue Share (%), by Transportation Mode 2025 & 2033

- Figure 34: Europe Connected Logistics Industry Volume Share (%), by Transportation Mode 2025 & 2033

- Figure 35: Europe Connected Logistics Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 36: Europe Connected Logistics Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 37: Europe Connected Logistics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: Europe Connected Logistics Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 39: Europe Connected Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 40: Europe Connected Logistics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Europe Connected Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Connected Logistics Industry Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Connected Logistics Industry Revenue (billion), by Software 2025 & 2033

- Figure 44: Asia Connected Logistics Industry Volume (K Unit), by Software 2025 & 2033

- Figure 45: Asia Connected Logistics Industry Revenue Share (%), by Software 2025 & 2033

- Figure 46: Asia Connected Logistics Industry Volume Share (%), by Software 2025 & 2033

- Figure 47: Asia Connected Logistics Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 48: Asia Connected Logistics Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 49: Asia Connected Logistics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 50: Asia Connected Logistics Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 51: Asia Connected Logistics Industry Revenue (billion), by Transportation Mode 2025 & 2033

- Figure 52: Asia Connected Logistics Industry Volume (K Unit), by Transportation Mode 2025 & 2033

- Figure 53: Asia Connected Logistics Industry Revenue Share (%), by Transportation Mode 2025 & 2033

- Figure 54: Asia Connected Logistics Industry Volume Share (%), by Transportation Mode 2025 & 2033

- Figure 55: Asia Connected Logistics Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 56: Asia Connected Logistics Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 57: Asia Connected Logistics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Asia Connected Logistics Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Asia Connected Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Connected Logistics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Asia Connected Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Connected Logistics Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: Australia and New Zealand Connected Logistics Industry Revenue (billion), by Software 2025 & 2033

- Figure 64: Australia and New Zealand Connected Logistics Industry Volume (K Unit), by Software 2025 & 2033

- Figure 65: Australia and New Zealand Connected Logistics Industry Revenue Share (%), by Software 2025 & 2033

- Figure 66: Australia and New Zealand Connected Logistics Industry Volume Share (%), by Software 2025 & 2033

- Figure 67: Australia and New Zealand Connected Logistics Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 68: Australia and New Zealand Connected Logistics Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 69: Australia and New Zealand Connected Logistics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: Australia and New Zealand Connected Logistics Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 71: Australia and New Zealand Connected Logistics Industry Revenue (billion), by Transportation Mode 2025 & 2033

- Figure 72: Australia and New Zealand Connected Logistics Industry Volume (K Unit), by Transportation Mode 2025 & 2033

- Figure 73: Australia and New Zealand Connected Logistics Industry Revenue Share (%), by Transportation Mode 2025 & 2033

- Figure 74: Australia and New Zealand Connected Logistics Industry Volume Share (%), by Transportation Mode 2025 & 2033

- Figure 75: Australia and New Zealand Connected Logistics Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 76: Australia and New Zealand Connected Logistics Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 77: Australia and New Zealand Connected Logistics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Australia and New Zealand Connected Logistics Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Australia and New Zealand Connected Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: Australia and New Zealand Connected Logistics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Australia and New Zealand Connected Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Australia and New Zealand Connected Logistics Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: Latin America Connected Logistics Industry Revenue (billion), by Software 2025 & 2033

- Figure 84: Latin America Connected Logistics Industry Volume (K Unit), by Software 2025 & 2033

- Figure 85: Latin America Connected Logistics Industry Revenue Share (%), by Software 2025 & 2033

- Figure 86: Latin America Connected Logistics Industry Volume Share (%), by Software 2025 & 2033

- Figure 87: Latin America Connected Logistics Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 88: Latin America Connected Logistics Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 89: Latin America Connected Logistics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 90: Latin America Connected Logistics Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 91: Latin America Connected Logistics Industry Revenue (billion), by Transportation Mode 2025 & 2033

- Figure 92: Latin America Connected Logistics Industry Volume (K Unit), by Transportation Mode 2025 & 2033

- Figure 93: Latin America Connected Logistics Industry Revenue Share (%), by Transportation Mode 2025 & 2033

- Figure 94: Latin America Connected Logistics Industry Volume Share (%), by Transportation Mode 2025 & 2033

- Figure 95: Latin America Connected Logistics Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 96: Latin America Connected Logistics Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 97: Latin America Connected Logistics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 98: Latin America Connected Logistics Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 99: Latin America Connected Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 100: Latin America Connected Logistics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 101: Latin America Connected Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 102: Latin America Connected Logistics Industry Volume Share (%), by Country 2025 & 2033

- Figure 103: Middle East and Africa Connected Logistics Industry Revenue (billion), by Software 2025 & 2033

- Figure 104: Middle East and Africa Connected Logistics Industry Volume (K Unit), by Software 2025 & 2033

- Figure 105: Middle East and Africa Connected Logistics Industry Revenue Share (%), by Software 2025 & 2033

- Figure 106: Middle East and Africa Connected Logistics Industry Volume Share (%), by Software 2025 & 2033

- Figure 107: Middle East and Africa Connected Logistics Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 108: Middle East and Africa Connected Logistics Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 109: Middle East and Africa Connected Logistics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 110: Middle East and Africa Connected Logistics Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 111: Middle East and Africa Connected Logistics Industry Revenue (billion), by Transportation Mode 2025 & 2033

- Figure 112: Middle East and Africa Connected Logistics Industry Volume (K Unit), by Transportation Mode 2025 & 2033

- Figure 113: Middle East and Africa Connected Logistics Industry Revenue Share (%), by Transportation Mode 2025 & 2033

- Figure 114: Middle East and Africa Connected Logistics Industry Volume Share (%), by Transportation Mode 2025 & 2033

- Figure 115: Middle East and Africa Connected Logistics Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 116: Middle East and Africa Connected Logistics Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 117: Middle East and Africa Connected Logistics Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 118: Middle East and Africa Connected Logistics Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 119: Middle East and Africa Connected Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 120: Middle East and Africa Connected Logistics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 121: Middle East and Africa Connected Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 122: Middle East and Africa Connected Logistics Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Connected Logistics Industry Revenue billion Forecast, by Software 2020 & 2033

- Table 2: Global Connected Logistics Industry Volume K Unit Forecast, by Software 2020 & 2033

- Table 3: Global Connected Logistics Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: Global Connected Logistics Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 5: Global Connected Logistics Industry Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 6: Global Connected Logistics Industry Volume K Unit Forecast, by Transportation Mode 2020 & 2033

- Table 7: Global Connected Logistics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Connected Logistics Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Connected Logistics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Global Connected Logistics Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Global Connected Logistics Industry Revenue billion Forecast, by Software 2020 & 2033

- Table 12: Global Connected Logistics Industry Volume K Unit Forecast, by Software 2020 & 2033

- Table 13: Global Connected Logistics Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Connected Logistics Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 15: Global Connected Logistics Industry Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 16: Global Connected Logistics Industry Volume K Unit Forecast, by Transportation Mode 2020 & 2033

- Table 17: Global Connected Logistics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Connected Logistics Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Connected Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global Connected Logistics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: United States Connected Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: United States Connected Logistics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Canada Connected Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Canada Connected Logistics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Global Connected Logistics Industry Revenue billion Forecast, by Software 2020 & 2033

- Table 26: Global Connected Logistics Industry Volume K Unit Forecast, by Software 2020 & 2033

- Table 27: Global Connected Logistics Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 28: Global Connected Logistics Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 29: Global Connected Logistics Industry Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 30: Global Connected Logistics Industry Volume K Unit Forecast, by Transportation Mode 2020 & 2033

- Table 31: Global Connected Logistics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 32: Global Connected Logistics Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Connected Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: Global Connected Logistics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 35: United Kingdom Connected Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: United Kingdom Connected Logistics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Germany Connected Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Germany Connected Logistics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: France Connected Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: France Connected Logistics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Global Connected Logistics Industry Revenue billion Forecast, by Software 2020 & 2033

- Table 42: Global Connected Logistics Industry Volume K Unit Forecast, by Software 2020 & 2033

- Table 43: Global Connected Logistics Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 44: Global Connected Logistics Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 45: Global Connected Logistics Industry Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 46: Global Connected Logistics Industry Volume K Unit Forecast, by Transportation Mode 2020 & 2033

- Table 47: Global Connected Logistics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 48: Global Connected Logistics Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 49: Global Connected Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global Connected Logistics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Connected Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: China Connected Logistics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Connected Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Connected Logistics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Connected Logistics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: India Connected Logistics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Global Connected Logistics Industry Revenue billion Forecast, by Software 2020 & 2033

- Table 58: Global Connected Logistics Industry Volume K Unit Forecast, by Software 2020 & 2033

- Table 59: Global Connected Logistics Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 60: Global Connected Logistics Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 61: Global Connected Logistics Industry Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 62: Global Connected Logistics Industry Volume K Unit Forecast, by Transportation Mode 2020 & 2033

- Table 63: Global Connected Logistics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 64: Global Connected Logistics Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 65: Global Connected Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 66: Global Connected Logistics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 67: Global Connected Logistics Industry Revenue billion Forecast, by Software 2020 & 2033

- Table 68: Global Connected Logistics Industry Volume K Unit Forecast, by Software 2020 & 2033

- Table 69: Global Connected Logistics Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 70: Global Connected Logistics Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 71: Global Connected Logistics Industry Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 72: Global Connected Logistics Industry Volume K Unit Forecast, by Transportation Mode 2020 & 2033

- Table 73: Global Connected Logistics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 74: Global Connected Logistics Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 75: Global Connected Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 76: Global Connected Logistics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 77: Global Connected Logistics Industry Revenue billion Forecast, by Software 2020 & 2033

- Table 78: Global Connected Logistics Industry Volume K Unit Forecast, by Software 2020 & 2033

- Table 79: Global Connected Logistics Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 80: Global Connected Logistics Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 81: Global Connected Logistics Industry Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 82: Global Connected Logistics Industry Volume K Unit Forecast, by Transportation Mode 2020 & 2033

- Table 83: Global Connected Logistics Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 84: Global Connected Logistics Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 85: Global Connected Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 86: Global Connected Logistics Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Connected Logistics Industry?

The projected CAGR is approximately 13.3%.

2. Which companies are prominent players in the Connected Logistics Industry?

Key companies in the market include Honeywell International Inc, IBM Corporation, Freightgate Inc, Siemens AG, Cisco Systems Inc, Microsoft Corporation, Oracle Corporation, Bosch Service Solutions GmbH, Orbcomm Inc, AT&T Inc, HCL Technologies Limited, SAP SE, Intel Corporation.

3. What are the main segments of the Connected Logistics Industry?

The market segments include Software, Product Type, Transportation Mode, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption on IoT in various Industries; Adoption of Sensor Based Technologies.

6. What are the notable trends driving market growth?

Increasing use of IoT and future technologies in different industries will drive the adoption of Connected Logistics.

7. Are there any restraints impacting market growth?

Lack of Uniform Government Regulations for Smart Technologies; Coronavirus Outbreak Influencing Electronic Industry.

8. Can you provide examples of recent developments in the market?

May 2020 - E2open Parent Holdings, Inc., a leading network-based provider of a 100% cloud-based, mission-critical, end-to-end supply chain management platform, announced to acquire BluJay Solutions, a leading cloud-based logistics execution platform for approximately USD 1.7 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Connected Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Connected Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Connected Logistics Industry?

To stay informed about further developments, trends, and reports in the Connected Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence