Key Insights

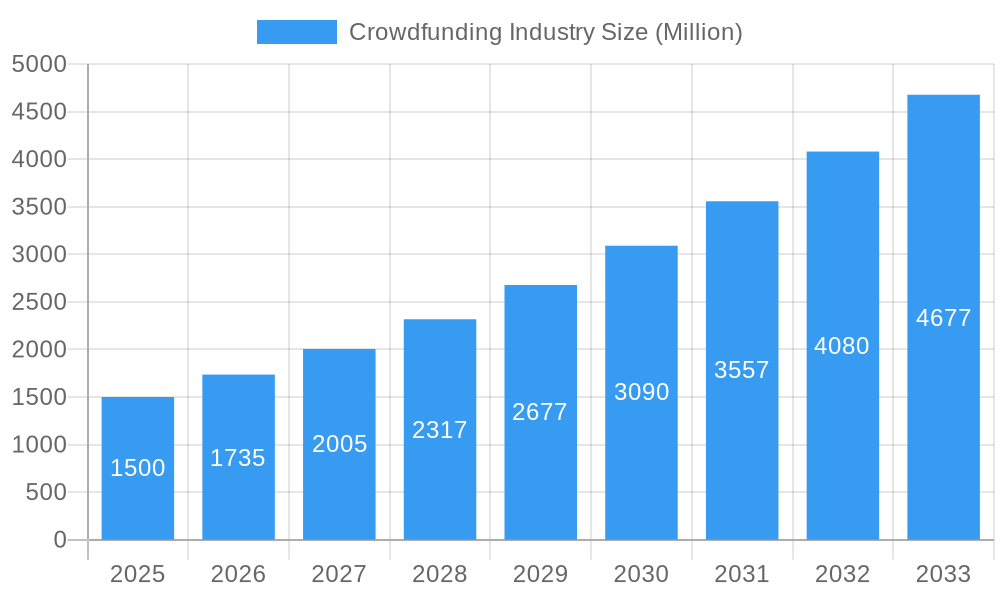

The global crowdfunding industry is poised for remarkable expansion, projected to reach $1.5 billion by 2025 and sustain a robust 15.70% CAGR through 2033. This significant growth is primarily fueled by the increasing adoption of innovative funding models across diverse sectors, including technology, cultural projects, and healthcare. Reward-based crowdfunding continues to dominate, enabling creators to pre-sell products and gain essential early traction. Simultaneously, equity crowdfunding is gaining momentum, offering investors direct stakes in promising startups and businesses, thereby democratizing access to venture capital. Donation-based crowdfunding remains a vital channel for charitable causes and social impact initiatives, demonstrating the multifaceted role of crowdfunding in empowering individuals and organizations alike.

Crowdfunding Industry Market Size (In Billion)

The industry's expansion is underpinned by several key drivers: enhanced internet penetration, the rise of digital payment systems, and a growing appetite for alternative investment avenues. As more individuals and businesses become comfortable with online fundraising platforms, the accessibility and reach of crowdfunding are amplified. Emerging trends such as the integration of blockchain technology for enhanced transparency and security, and specialized platforms catering to niche markets, are further shaping the landscape. While regulatory frameworks are evolving to ensure investor protection, they also contribute to the industry's maturity and long-term sustainability. The Asia Pacific region is expected to emerge as a significant growth engine, driven by a burgeoning startup ecosystem and increasing digital adoption.

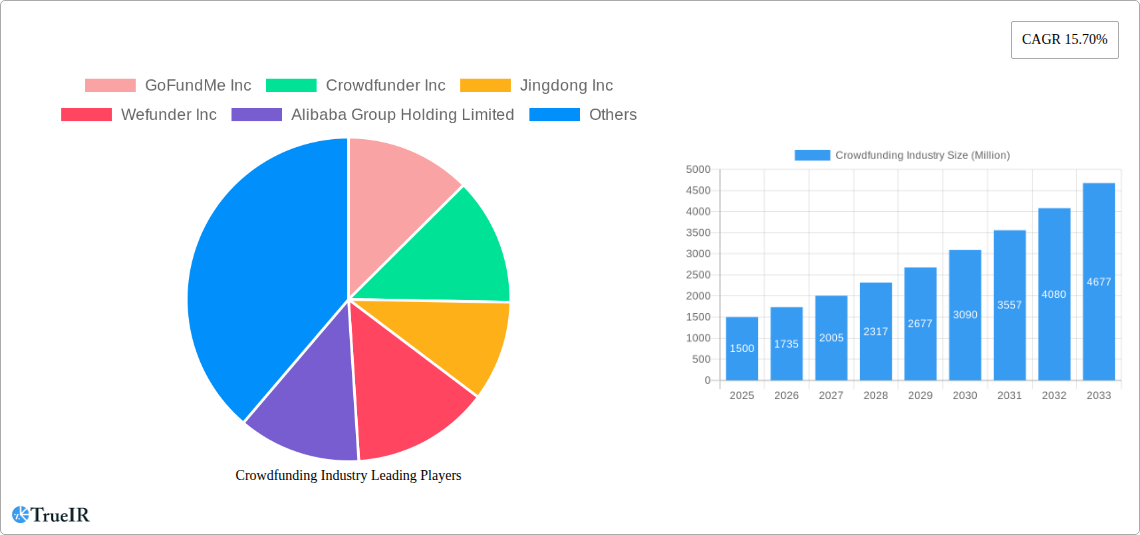

Crowdfunding Industry Company Market Share

Here is a dynamic, SEO-optimized report description for the Crowdfunding Industry:

Crowdfunding Industry Market Structure & Competitive Landscape

The crowdfunding industry is characterized by a moderately concentrated market structure, with leading players like GoFundMe Inc., Crowdfunder Inc., Jingdong Inc., Wefunder Inc., Alibaba Group Holding Limited, Owners Circle, Crowdcube Limited, Fundable LLC, Indiegogo Inc., Realcrowd Inc., GoGetFunding, Fundly, Suning com Co Ltd, and Kickstarter PBC commanding significant market share. Innovation is a key driver, spurred by advancements in financial technology (FinTech) and the increasing demand for alternative funding solutions. Regulatory landscapes are continuously evolving, influencing operational frameworks and investor protections across reward-based crowdfunding, equity crowdfunding, and donation-based models. While product substitutes exist in traditional financing avenues, the unique accessibility and community-driven nature of crowdfunding offer distinct advantages. End-user segmentation spans the cultural sector, technology, product development, healthcare, and other diverse applications, each with specific funding requirements. Merger and acquisition (M&A) activities are projected to see a XX% growth in volume over the forecast period (2025-2033), indicating a trend towards consolidation and strategic partnerships aimed at expanding service offerings and market reach. Concentration ratios are estimated to reach XX% by the base year 2025, highlighting the importance of scale in this dynamic sector.

Crowdfunding Industry Market Trends & Opportunities

The crowdfunding industry is poised for substantial growth, with projections indicating a robust compound annual growth rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is fueled by a confluence of technological advancements, shifting consumer and investor preferences, and evolving economic landscapes. The proliferation of digital platforms and mobile accessibility has democratized access to capital, enabling individuals and businesses to bypass traditional financial institutions. Market penetration rates are expected to climb significantly as awareness of crowdfunding's benefits, including speed, flexibility, and community engagement, continues to rise. Technological shifts, such as the integration of blockchain for enhanced transparency and security in equity crowdfunding, and the application of artificial intelligence (AI) for project vetting and investor matching, are creating new avenues for innovation and efficiency. Consumer preferences are leaning towards supporting businesses and causes that align with their values, a trend that crowdfunding platforms are adept at facilitating. The competitive dynamics within the industry are intensifying, with established players diversifying their offerings and new entrants focusing on niche markets and specialized funding models. Opportunities abound for platforms that can effectively leverage data analytics to personalize user experiences, streamline fundraising processes, and mitigate risks. The increasing global adoption of online payment systems and digital wallets further underpins the market's upward trajectory, making cross-border crowdfunding more feasible and attractive. As the digital economy matures, crowdfunding is set to become an indispensable tool for entrepreneurship, social impact initiatives, and creative endeavors, offering unparalleled opportunities for both funders and fundraisers. The market size is estimated to reach XXX Million by 2033, underscoring its significant economic impact and future potential.

Dominant Markets & Segments in Crowdfunding Industry

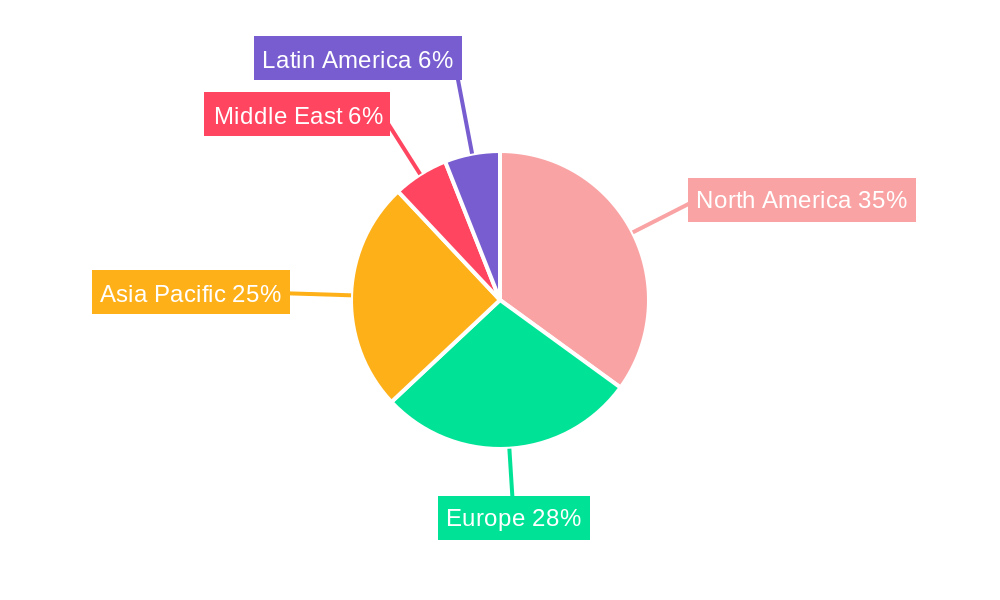

Leading Regions and Countries: North America, particularly the United States, continues to dominate the crowdfunding industry due to its well-established FinTech ecosystem, supportive regulatory environment for equity crowdfunding, and high internet penetration. European countries, especially the UK and Germany, are also significant players, driven by increasing adoption of alternative finance and supportive EU regulations. Asia-Pacific, led by China, is emerging as a rapidly growing market, propelled by e-commerce giants like Jingdong Inc. and Alibaba Group Holding Limited integrating crowdfunding features into their platforms.

Dominant Product Types:

- Equity Crowdfunding: This segment is experiencing the most significant growth, driven by increased investor confidence and regulatory clarity. It offers startups and SMEs direct access to capital from a broad base of investors in exchange for company shares. Key growth drivers include the demand for early-stage funding for innovative ventures and the potential for high returns for accredited investors.

- Reward-based Crowdfunding: Platforms like Kickstarter PBC and Indiegogo Inc. continue to be highly popular for product launches and creative projects. This type of crowdfunding allows creators to raise funds by offering non-financial rewards to backers. Growth drivers include the strong desire for unique products, the ability for creators to validate market demand, and the strong community engagement fostered.

- Donation and Other Product Types: Donation-based crowdfunding remains vital for charitable causes and social impact projects. The ease of participation and the altruistic motivation of donors contribute to its steady growth. "Other Product Types" can encompass debt crowdfunding and real estate crowdfunding, each catering to specific investment needs.

Dominant End-User Applications:

- Technology: This sector consistently leads in crowdfunding campaigns, seeking funding for software development, hardware innovation, and emerging technologies. The inherent risk and high growth potential associated with tech startups align well with the crowdfunding model.

- Product: The development and manufacturing of physical products, from consumer goods to innovative gadgets, are heavily reliant on crowdfunding for initial production runs and market entry.

- Cultural Sector: This encompasses film, music, art, and publishing, where crowdfunding has become an integral tool for artists and creators to bypass traditional gatekeepers and connect directly with their audience for project funding.

- Healthcare: Emerging as a significant growth area, healthcare crowdfunding supports medical research, innovative medical devices, and patient care initiatives, demonstrating the sector's expanding reach.

- Other End-User Applications: This broad category includes projects in education, sustainability, and social enterprises, showcasing the versatility and wide-ranging impact of crowdfunding.

Crowdfunding Industry Product Analysis

Crowdfunding platforms are continuously innovating their product offerings to cater to diverse funding needs and investor appetites. Reward-based crowdfunding, pioneered by platforms like Kickstarter PBC, excels in enabling creators to bring tangible products and creative projects to life by offering pre-orders and unique perks. Equity crowdfunding, championed by Wefunder Inc. and Crowdcube Limited, provides a vital pathway for startups and SMEs to raise significant capital from a wide investor base in exchange for ownership stakes. Donation and other product types, including specialized platforms for social causes and real estate, further broaden the market's appeal. Technological advancements, such as enhanced due diligence tools, AI-driven matchmaking for investors and projects, and blockchain integration for transparency, are enhancing the efficiency and security of these offerings. The competitive advantage lies in platform usability, fee structures, investor access, and the ability to foster robust communities around funded ventures, ensuring market fit and sustained growth.

Key Drivers, Barriers & Challenges in Crowdfunding Industry

Key Drivers: The crowdfunding industry is propelled by several critical factors. Technological advancements in FinTech, including user-friendly interfaces and secure online transaction systems, significantly lower barriers to entry for both fundraisers and investors. The increasing demand for alternative financing sources, driven by the limitations of traditional lending, opens up substantial opportunities. Growing investor appetite for early-stage and impact investments, coupled with a desire for greater financial inclusion, fuels market expansion. Supportive regulatory frameworks in key markets, such as those enabling equity crowdfunding, are vital catalysts for growth.

Barriers & Challenges: Despite its growth, the industry faces significant challenges. Regulatory complexities and evolving compliance requirements can pose hurdles, particularly for cross-border campaigns and equity offerings. Investor protection concerns and the risk of project failure can lead to skepticism and impact overall confidence, with estimated potential losses from failed projects reaching XX Million annually. Intense competition among platforms and from traditional funding sources necessitates continuous innovation and customer acquisition strategies. Supply chain issues and economic downturns can disrupt the execution of crowdfunded product-based projects, leading to delays or cancellations.

Growth Drivers in the Crowdfunding Industry Market

The crowdfunding industry is experiencing robust growth driven by a confluence of powerful factors. Technological innovations in digital payment systems and platform user experience are making participation more accessible than ever. The increasing global acceptance of alternative investment avenues, fueled by a desire for higher returns and direct engagement with promising ventures, is a significant economic driver. Furthermore, supportive regulatory initiatives in various regions are legitimizing and streamlining equity crowdfunding, opening up new capital streams for businesses. The growing trend of social impact investing and the desire to support mission-driven projects are also fueling the donation and social enterprise segments of the market.

Challenges Impacting Crowdfunding Industry Growth

While growth is evident, several challenges continue to impact the crowdfunding industry. Regulatory uncertainties and the patchwork of rules across different jurisdictions can create compliance complexities, particularly for international campaigns. Supply chain disruptions and unforeseen economic downturns can pose significant risks to the successful fulfillment of rewards and product delivery for reward-based crowdfunding. Intense competitive pressures from a growing number of platforms, as well as established financial institutions, necessitate continuous innovation and effective marketing strategies to attract both fundraisers and investors. Concerns regarding fraud and the potential for project failure also remain a barrier to broader investor adoption, impacting market confidence.

Key Players Shaping the Crowdfunding Industry Market

- GoFundMe Inc.

- Crowdfunder Inc.

- Jingdong Inc.

- Wefunder Inc.

- Alibaba Group Holding Limited

- Owners Circle

- Crowdcube Limited

- Fundable LLC

- Indiegogo Inc.

- Realcrowd Inc.

- GoGetFunding

- Fundly

- Suning com Co Ltd

- Kickstarter PBC

Significant Crowdfunding Industry Industry Milestones

- 2019: Increased regulatory clarity in several European countries boosts equity crowdfunding activity.

- 2020: The COVID-19 pandemic drives a surge in demand for online fundraising, particularly for causes and small businesses.

- 2021: Major FinTech companies begin integrating crowdfunding features into their existing financial services.

- 2022: Blockchain technology adoption accelerates in equity crowdfunding for enhanced transparency and security.

- 2023: Significant growth observed in specialized crowdfunding for impact investing and sustainable projects.

- 2024: Further diversification of product types, including decentralized finance (DeFi) integrations for crowdfunding.

Future Outlook for Crowdfunding Industry Market

The future outlook for the crowdfunding industry is exceptionally bright, driven by continued technological innovation and expanding global adoption. Strategic opportunities lie in leveraging AI for personalized investor-fundraiser matching and enhanced risk assessment, as well as integrating with evolving digital asset markets. The market potential for crowdfunding as a mainstream financing solution for startups, SMEs, and social enterprises is immense. As regulatory frameworks mature and investor confidence grows, platforms that offer a seamless, transparent, and secure fundraising experience are poised for significant expansion, further democratizing access to capital and fostering innovation worldwide.

Crowdfunding Industry Segmentation

-

1. Product Type

- 1.1. Reward-based Crowdfunding

- 1.2. Equity Crowdfunding

- 1.3. Donation and Other Product Types

-

2. End-User Application

- 2.1. Cultural Sector

- 2.2. Technology

- 2.3. Product

- 2.4. Healthcare

- 2.5. Other End-User Applications

Crowdfunding Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia pacific

- 4. Middle East

- 5. Latin America

Crowdfunding Industry Regional Market Share

Geographic Coverage of Crowdfunding Industry

Crowdfunding Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Use of Social Media as a Free of Cost Promotion Source; Increasing Investor Forward looking Strategic Behaviour and Social Interactions among Investors

- 3.3. Market Restrains

- 3.3.1. Time Consuming Process and Stringent Regulatory Compliance

- 3.4. Market Trends

- 3.4.1. Reward-Based Crowdfunding is Anticipated to Augment the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Crowdfunding Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Reward-based Crowdfunding

- 5.1.2. Equity Crowdfunding

- 5.1.3. Donation and Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Application

- 5.2.1. Cultural Sector

- 5.2.2. Technology

- 5.2.3. Product

- 5.2.4. Healthcare

- 5.2.5. Other End-User Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia pacific

- 5.3.4. Middle East

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Crowdfunding Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Reward-based Crowdfunding

- 6.1.2. Equity Crowdfunding

- 6.1.3. Donation and Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-User Application

- 6.2.1. Cultural Sector

- 6.2.2. Technology

- 6.2.3. Product

- 6.2.4. Healthcare

- 6.2.5. Other End-User Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Crowdfunding Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Reward-based Crowdfunding

- 7.1.2. Equity Crowdfunding

- 7.1.3. Donation and Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-User Application

- 7.2.1. Cultural Sector

- 7.2.2. Technology

- 7.2.3. Product

- 7.2.4. Healthcare

- 7.2.5. Other End-User Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia pacific Crowdfunding Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Reward-based Crowdfunding

- 8.1.2. Equity Crowdfunding

- 8.1.3. Donation and Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-User Application

- 8.2.1. Cultural Sector

- 8.2.2. Technology

- 8.2.3. Product

- 8.2.4. Healthcare

- 8.2.5. Other End-User Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East Crowdfunding Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Reward-based Crowdfunding

- 9.1.2. Equity Crowdfunding

- 9.1.3. Donation and Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-User Application

- 9.2.1. Cultural Sector

- 9.2.2. Technology

- 9.2.3. Product

- 9.2.4. Healthcare

- 9.2.5. Other End-User Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Crowdfunding Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Reward-based Crowdfunding

- 10.1.2. Equity Crowdfunding

- 10.1.3. Donation and Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-User Application

- 10.2.1. Cultural Sector

- 10.2.2. Technology

- 10.2.3. Product

- 10.2.4. Healthcare

- 10.2.5. Other End-User Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GoFundMe Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Crowdfunder Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jingdong Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wefunder Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alibaba Group Holding Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Owners Circle

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Crowdcube Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fundable LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Indiegogo Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Realcrowd Inc *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GoGetFunding

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Fundly

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Suning com Co Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Kickstarter PBC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 GoFundMe Inc

List of Figures

- Figure 1: Global Crowdfunding Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Crowdfunding Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Crowdfunding Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Crowdfunding Industry Revenue (Million), by End-User Application 2025 & 2033

- Figure 5: North America Crowdfunding Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 6: North America Crowdfunding Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Crowdfunding Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Crowdfunding Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Crowdfunding Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Crowdfunding Industry Revenue (Million), by End-User Application 2025 & 2033

- Figure 11: Europe Crowdfunding Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 12: Europe Crowdfunding Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Crowdfunding Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia pacific Crowdfunding Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia pacific Crowdfunding Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia pacific Crowdfunding Industry Revenue (Million), by End-User Application 2025 & 2033

- Figure 17: Asia pacific Crowdfunding Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 18: Asia pacific Crowdfunding Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia pacific Crowdfunding Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East Crowdfunding Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Middle East Crowdfunding Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East Crowdfunding Industry Revenue (Million), by End-User Application 2025 & 2033

- Figure 23: Middle East Crowdfunding Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 24: Middle East Crowdfunding Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East Crowdfunding Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Crowdfunding Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Latin America Crowdfunding Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Latin America Crowdfunding Industry Revenue (Million), by End-User Application 2025 & 2033

- Figure 29: Latin America Crowdfunding Industry Revenue Share (%), by End-User Application 2025 & 2033

- Figure 30: Latin America Crowdfunding Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Crowdfunding Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2020 & 2033

- Table 3: Global Crowdfunding Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2020 & 2033

- Table 6: Global Crowdfunding Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2020 & 2033

- Table 9: Global Crowdfunding Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2020 & 2033

- Table 12: Global Crowdfunding Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2020 & 2033

- Table 15: Global Crowdfunding Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2020 & 2033

- Table 18: Global Crowdfunding Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crowdfunding Industry?

The projected CAGR is approximately 15.70%.

2. Which companies are prominent players in the Crowdfunding Industry?

Key companies in the market include GoFundMe Inc, Crowdfunder Inc, Jingdong Inc, Wefunder Inc, Alibaba Group Holding Limited, Owners Circle, Crowdcube Limited, Fundable LLC, Indiegogo Inc, Realcrowd Inc *List Not Exhaustive, GoGetFunding, Fundly, Suning com Co Ltd, Kickstarter PBC.

3. What are the main segments of the Crowdfunding Industry?

The market segments include Product Type, End-User Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Use of Social Media as a Free of Cost Promotion Source; Increasing Investor Forward looking Strategic Behaviour and Social Interactions among Investors.

6. What are the notable trends driving market growth?

Reward-Based Crowdfunding is Anticipated to Augment the Growth of the Market.

7. Are there any restraints impacting market growth?

Time Consuming Process and Stringent Regulatory Compliance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Crowdfunding Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Crowdfunding Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Crowdfunding Industry?

To stay informed about further developments, trends, and reports in the Crowdfunding Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence