Key Insights

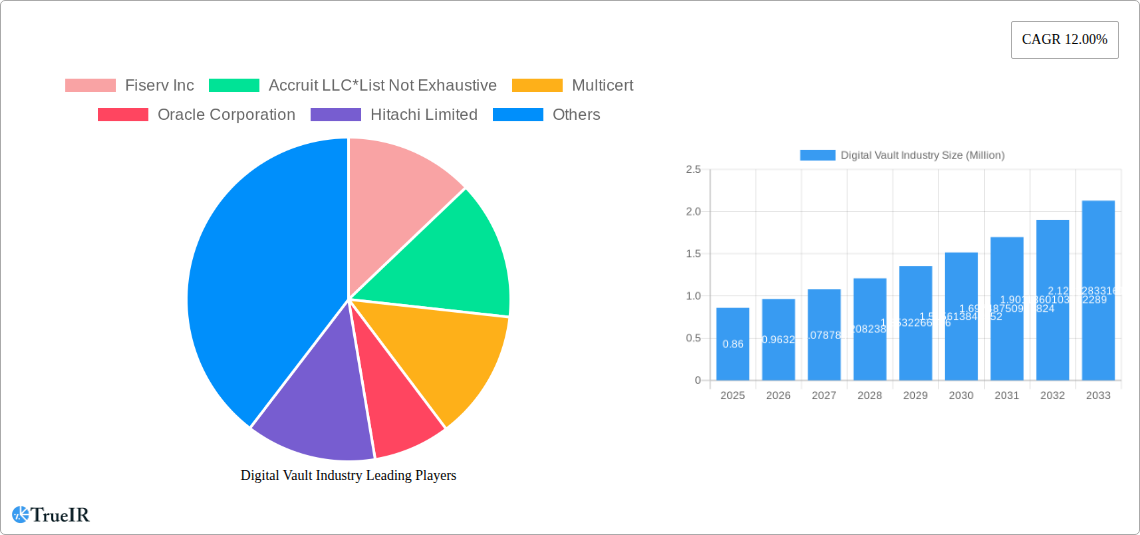

The global digital vault market is poised for significant expansion, driven by the escalating need for robust data security and regulatory compliance across industries. With an estimated market size of $0.86 million in the base year of 2025, the industry is projected to witness a remarkable Compound Annual Growth Rate (CAGR) of 12.00% throughout the forecast period of 2025-2033. This robust growth is primarily fueled by the increasing sophistication of cyber threats, the proliferation of sensitive digital assets, and the growing adoption of cloud-based solutions for enhanced accessibility and scalability. Key drivers include the imperative for secure storage of critical information such as financial records, intellectual property, and personal data, alongside stringent data protection regulations like GDPR and CCPA, which mandate robust security measures. The market's expansion is further supported by advancements in encryption technologies and the integration of AI and machine learning for proactive threat detection and prevention.

Digital Vault Industry Market Size (In Million)

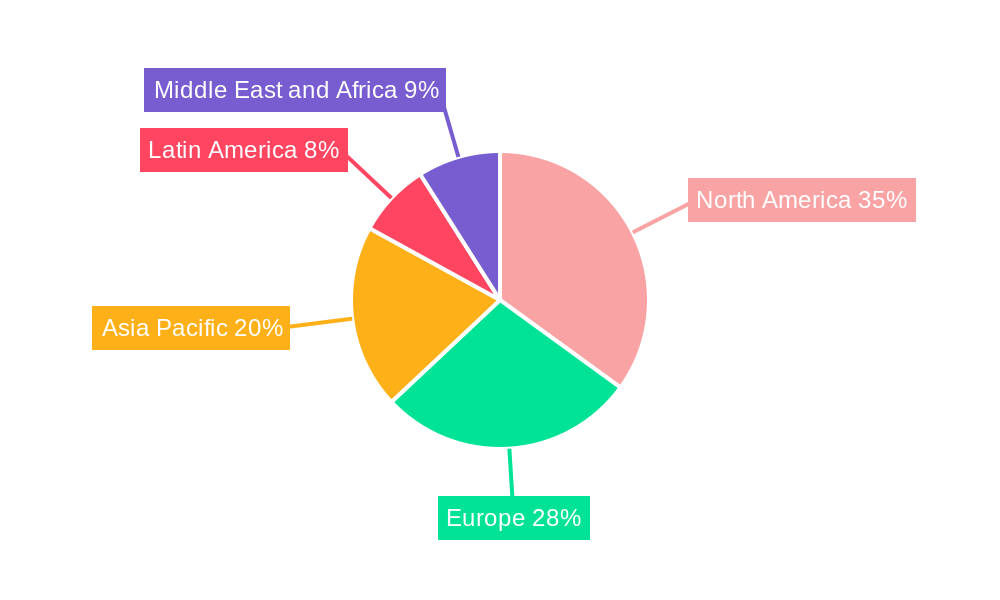

The digital vault market encompasses a diverse range of solutions and services, catering to various deployment models, including on-premise and cloud-based infrastructure. The solutions segment, focusing on software and platforms for secure storage and management, is expected to dominate, while the services segment, encompassing implementation, consulting, and support, will also experience substantial growth. Prominent end-user industries such as BFSI, IT and Telecommunication, and Government are leading the adoption due to the high volume of sensitive data they handle and the critical nature of their operations. Emerging markets in the Asia Pacific region are anticipated to present significant growth opportunities, driven by rapid digital transformation and increasing awareness of cybersecurity threats. Despite the promising outlook, challenges such as the high cost of implementation for advanced security features and the need for continuous adaptation to evolving cyberattack methodologies pose potential restraints to the market's full potential.

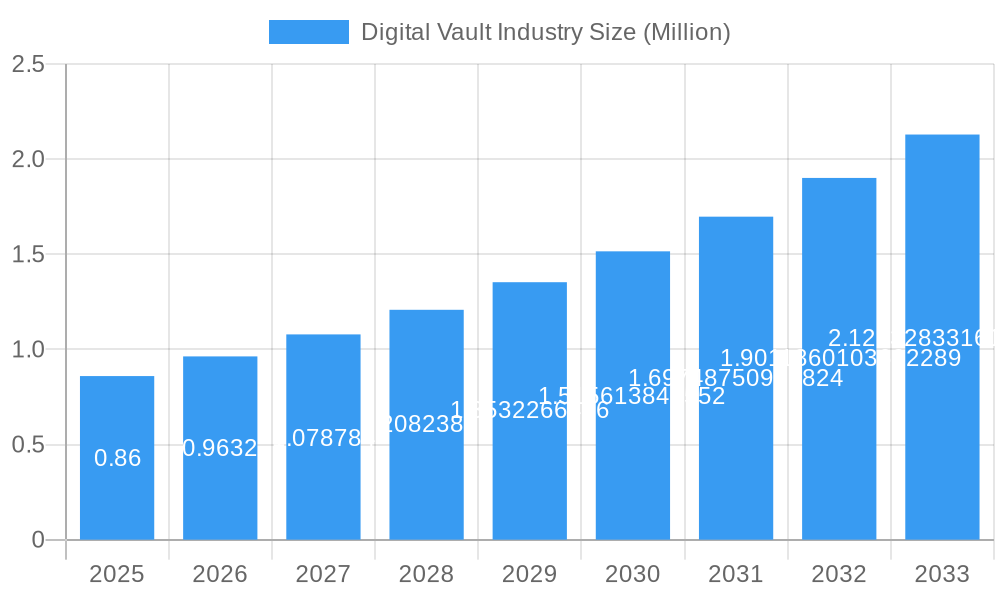

Digital Vault Industry Company Market Share

This in-depth Digital Vault Industry report offers a meticulous analysis of the global digital vault market, covering historical data from 2019 to 2024, a base year of 2025, and a comprehensive forecast period extending to 2033. Leveraging high-volume SEO keywords such as "digital vault solutions," "cloud storage security," "data protection services," and "BFSI cybersecurity," this report is engineered to rank highly in search results and provide invaluable insights to industry stakeholders.

Digital Vault Industry Market Structure & Competitive Landscape

The digital vault market exhibits a moderately concentrated structure, with key players investing heavily in innovation and strategic acquisitions to capture market share. Drivers of innovation include the escalating need for robust data security, compliance with stringent data privacy regulations, and the growing adoption of cloud-based solutions. Regulatory impacts, such as GDPR and CCPA, are significant, compelling companies to enhance their security protocols and offering compliant digital vault services. Product substitutes, while present in general cloud storage, lack the specialized security and access control features inherent in dedicated digital vaults. End-user segmentation reveals a strong preference within the BFSI, IT and Telecommunication, and Government sectors, driven by the sensitive nature of their data. Mergers and acquisitions (M&A) are a notable trend, with approximately XX M&A deals recorded during the historical period, indicating a consolidation phase and strategic expansion by larger entities. Concentration ratios are estimated to be around XX%, with the top five players holding a significant portion of the market. Qualitative insights suggest a growing emphasis on zero-trust architectures and advanced encryption techniques.

Digital Vault Industry Market Trends & Opportunities

The digital vault industry is experiencing robust growth, projected to reach a market size of [Insert Market Size Value] Million by 2025 and further expanding to [Insert Forecasted Market Size Value] Million by 2033, demonstrating a compelling Compound Annual Growth Rate (CAGR) of [Insert CAGR Value]%. This expansion is fueled by a confluence of transformative technological shifts, evolving consumer preferences for secure digital asset management, and intense competitive dynamics. The increasing volume and sensitivity of digital data generated across all sectors necessitate advanced security solutions, positioning digital vaults as critical infrastructure for data protection. Cloud adoption continues its upward trajectory, with an estimated [Insert Cloud Adoption Rate]% of digital vault solutions being deployed in cloud environments by 2025, offering scalability, accessibility, and cost-effectiveness. Conversely, on-premise deployments still hold a significant share, particularly within government and highly regulated industries where data sovereignty is paramount. Consumer preferences are shifting towards user-friendly interfaces and seamless integration with existing digital workflows, driving demand for intuitive digital vault solutions. The competitive landscape is characterized by continuous product development, with companies focusing on features like granular access controls, secure collaboration tools, and advanced threat detection. The market penetration rate for advanced digital vault solutions among enterprises is estimated at [Insert Market Penetration Rate]% in 2025, with significant room for growth. Opportunities abound for providers offering specialized solutions for niche markets, such as digital legacy management and intellectual property protection, alongside the continuous innovation in blockchain integration for enhanced data immutability and auditability. The rise of remote work further amplifies the need for secure off-site data storage and accessibility.

Dominant Markets & Segments in Digital Vault Industry

The digital vault market is currently dominated by Cloud deployments, accounting for an estimated [Insert Cloud Deployment Percentage]% of the market share in 2025. This dominance is driven by the inherent scalability, accessibility, and cost-efficiency of cloud infrastructure, aligning perfectly with the growing demand for flexible and secure data storage. The BFSI (Banking, Financial Services, and Insurance) sector emerges as the leading end-user segment, representing approximately [Insert BFSI Segment Percentage]% of the market in 2025. This is primarily attributed to the highly sensitive nature of financial data, stringent regulatory compliance requirements (e.g., PCI DSS, SOX), and the critical need for secure transaction records and customer information. IT and Telecommunication and Government sectors follow closely, with significant adoption driven by data security mandates and the protection of critical infrastructure.

- Deployment: Cloud

- Growth Drivers: Enhanced scalability, reduced infrastructure costs, remote accessibility, disaster recovery capabilities, seamless integration with other cloud services.

- Market Dominance Analysis: The cloud model offers a robust and adaptable solution for businesses of all sizes, facilitating rapid deployment and ongoing updates, crucial for keeping pace with evolving cyber threats.

- End-User: BFSI

- Growth Drivers: Regulatory compliance (e.g., FINRA, SEC), protection of sensitive customer data (account numbers, PII), secure storage of financial records and audit trails, fraud prevention.

- Market Dominance Analysis: Financial institutions are prime targets for cyberattacks, making secure digital vault solutions an indispensable component of their cybersecurity strategies to maintain trust and prevent significant financial and reputational damage.

- Type: Solutions

- Growth Drivers: Demand for comprehensive data protection suites, integrated security features, end-to-end encryption, robust access management controls.

- Market Dominance Analysis: The focus on integrated "solutions" over standalone "services" reflects a market trend towards holistic data security platforms that address multiple facets of data protection.

The IT and Telecommunication sector also presents substantial growth opportunities due to the vast amounts of data handled and the critical nature of network infrastructure. Government agencies, driven by national security concerns and the need to protect classified information, are also significant adopters, often favoring highly secure on-premise or hybrid cloud deployments.

Digital Vault Industry Product Analysis

Digital vault products are characterized by their advanced security architectures, featuring end-to-end encryption, multi-factor authentication, granular access controls, and comprehensive audit trails. Innovations are focused on enhancing user experience through intuitive interfaces, AI-powered threat detection, and seamless integration with enterprise workflows. Competitive advantages lie in features like secure collaboration, digital rights management, and robust compliance reporting capabilities. The market is witnessing the evolution of digital vaults beyond simple storage to comprehensive data governance platforms.

Key Drivers, Barriers & Challenges in Digital Vault Industry

Key Drivers: The primary forces propelling the digital vault industry include the escalating global cyber threats, stringent data privacy regulations (e.g., GDPR, CCPA), the increasing volume of sensitive digital data, and the growing adoption of cloud computing. Technological advancements in encryption and AI further bolster the market. Barriers & Challenges: Challenges impacting digital vault growth include the high initial investment costs for some advanced solutions, user resistance to adopting new technologies, the complexity of integrating digital vaults with legacy systems, and the persistent threat of sophisticated cyberattacks. Supply chain issues related to hardware components for on-premise solutions and evolving regulatory landscapes also pose hurdles.

Growth Drivers in the Digital Vault Industry Market

Key growth drivers in the digital vault industry are multifaceted. Technologically, advancements in artificial intelligence and machine learning are enabling more sophisticated threat detection and automated data management within vaults. Economically, the rising cost of data breaches and the potential for significant financial losses are compelling organizations to invest proactively in robust security measures. Regulatory mandates, such as data localization laws and enhanced privacy protections, are also acting as significant catalysts, pushing businesses to adopt compliant digital vault solutions. For instance, the increasing focus on protecting intellectual property and confidential business strategies is a direct driver for secure digital vault adoption.

Challenges Impacting Digital Vault Industry Growth

Despite the robust growth potential, several challenges impact the digital vault industry. Regulatory complexities across different jurisdictions can create compliance burdens for global providers. Supply chain issues, particularly for hardware components in on-premise deployments, can lead to delays and increased costs. Competitive pressures from established cloud storage providers offering basic security features also present a challenge, requiring digital vault vendors to clearly articulate their unique value proposition. Furthermore, the persistent evolution of cyber threats necessitates continuous investment in research and development to stay ahead of malicious actors.

Key Players Shaping the Digital Vault Industry Market

- Fiserv Inc

- Accruit LLC

- Multicert

- Oracle Corporation

- Hitachi Limited

- CyberArk Software Ltd

- IBM

- Keeper Security

Significant Digital Vault Industry Industry Milestones

- June 2022: Presidio released online and smartphone applications for its digital vault, addressing the "digital conundrum" of scattered critical information.

- April 2022: FutureVault partnered with Envestnet| Yodlee to enhance its digital vault solutions for financial services organizations.

Future Outlook for Digital Vault Industry Market

The digital vault industry is poised for continued substantial growth, driven by the persistent and evolving threat landscape, increasing data volumes, and stringent regulatory compliance demands. Strategic opportunities lie in developing specialized solutions for emerging markets like IoT data management and decentralized finance (DeFi), alongside enhancing AI-driven security features and user experience. The market potential is immense as organizations across all sectors increasingly recognize digital vaults as a cornerstone of their cybersecurity and data governance strategies.

Digital Vault Industry Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

-

2. Type

- 2.1. Solutions

- 2.2. Services

-

3. End-User

- 3.1. BFSI

- 3.2. IT and Telecommunication

- 3.3. Government

- 3.4. Other End-Users

Digital Vault Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Digital Vault Industry Regional Market Share

Geographic Coverage of Digital Vault Industry

Digital Vault Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Data Privacy and Secured File Sharing Concerns; Handling of Data Generated through Connected Devices

- 3.3. Market Restrains

- 3.3.1. Use of Physical Vault

- 3.4. Market Trends

- 3.4.1. Cloud-Based Digital Vaults to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Vault Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Solutions

- 5.2.2. Services

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. BFSI

- 5.3.2. IT and Telecommunication

- 5.3.3. Government

- 5.3.4. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Digital Vault Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Solutions

- 6.2.2. Services

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. BFSI

- 6.3.2. IT and Telecommunication

- 6.3.3. Government

- 6.3.4. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Digital Vault Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Solutions

- 7.2.2. Services

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. BFSI

- 7.3.2. IT and Telecommunication

- 7.3.3. Government

- 7.3.4. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Digital Vault Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Solutions

- 8.2.2. Services

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. BFSI

- 8.3.2. IT and Telecommunication

- 8.3.3. Government

- 8.3.4. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Latin America Digital Vault Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Solutions

- 9.2.2. Services

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. BFSI

- 9.3.2. IT and Telecommunication

- 9.3.3. Government

- 9.3.4. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Middle East and Africa Digital Vault Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Solutions

- 10.2.2. Services

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. BFSI

- 10.3.2. IT and Telecommunication

- 10.3.3. Government

- 10.3.4. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Fiserv Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Accruit LLC*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Multicert

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Oracle Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hitachi Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CyberArk Software Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IBM

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Keeper Security

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Fiserv Inc

List of Figures

- Figure 1: Global Digital Vault Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Digital Vault Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 3: North America Digital Vault Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Digital Vault Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: North America Digital Vault Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Digital Vault Industry Revenue (Million), by End-User 2025 & 2033

- Figure 7: North America Digital Vault Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Digital Vault Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Digital Vault Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Digital Vault Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 11: Europe Digital Vault Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Digital Vault Industry Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Digital Vault Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Digital Vault Industry Revenue (Million), by End-User 2025 & 2033

- Figure 15: Europe Digital Vault Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Digital Vault Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Digital Vault Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Digital Vault Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 19: Asia Pacific Digital Vault Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 20: Asia Pacific Digital Vault Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Asia Pacific Digital Vault Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Digital Vault Industry Revenue (Million), by End-User 2025 & 2033

- Figure 23: Asia Pacific Digital Vault Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Digital Vault Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Digital Vault Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Digital Vault Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Latin America Digital Vault Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Latin America Digital Vault Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: Latin America Digital Vault Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Latin America Digital Vault Industry Revenue (Million), by End-User 2025 & 2033

- Figure 31: Latin America Digital Vault Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Latin America Digital Vault Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Digital Vault Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Digital Vault Industry Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Middle East and Africa Digital Vault Industry Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Middle East and Africa Digital Vault Industry Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Digital Vault Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Digital Vault Industry Revenue (Million), by End-User 2025 & 2033

- Figure 39: Middle East and Africa Digital Vault Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East and Africa Digital Vault Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Digital Vault Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Vault Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 2: Global Digital Vault Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Digital Vault Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Digital Vault Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Digital Vault Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global Digital Vault Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Digital Vault Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global Digital Vault Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Digital Vault Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 10: Global Digital Vault Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Digital Vault Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Digital Vault Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Digital Vault Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global Digital Vault Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 15: Global Digital Vault Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 16: Global Digital Vault Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Digital Vault Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global Digital Vault Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Digital Vault Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 20: Global Digital Vault Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Digital Vault Industry Revenue Million Forecast, by Deployment 2020 & 2033

- Table 22: Global Digital Vault Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Digital Vault Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 24: Global Digital Vault Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Vault Industry?

The projected CAGR is approximately 12.00%.

2. Which companies are prominent players in the Digital Vault Industry?

Key companies in the market include Fiserv Inc, Accruit LLC*List Not Exhaustive, Multicert, Oracle Corporation, Hitachi Limited, CyberArk Software Ltd, IBM, Keeper Security.

3. What are the main segments of the Digital Vault Industry?

The market segments include Deployment, Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Data Privacy and Secured File Sharing Concerns; Handling of Data Generated through Connected Devices.

6. What are the notable trends driving market growth?

Cloud-Based Digital Vaults to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Use of Physical Vault.

8. Can you provide examples of recent developments in the market?

June 2022 - Presidio, a digital vault that allows users to safely store, organize, and share their most critical information, has released online and smartphone applications. Presidio tackles the "digital conundrum," wherein people's vital papers, digital assets, and private details are scattered throughout physical and online sites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Vault Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Vault Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Vault Industry?

To stay informed about further developments, trends, and reports in the Digital Vault Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence