Key Insights

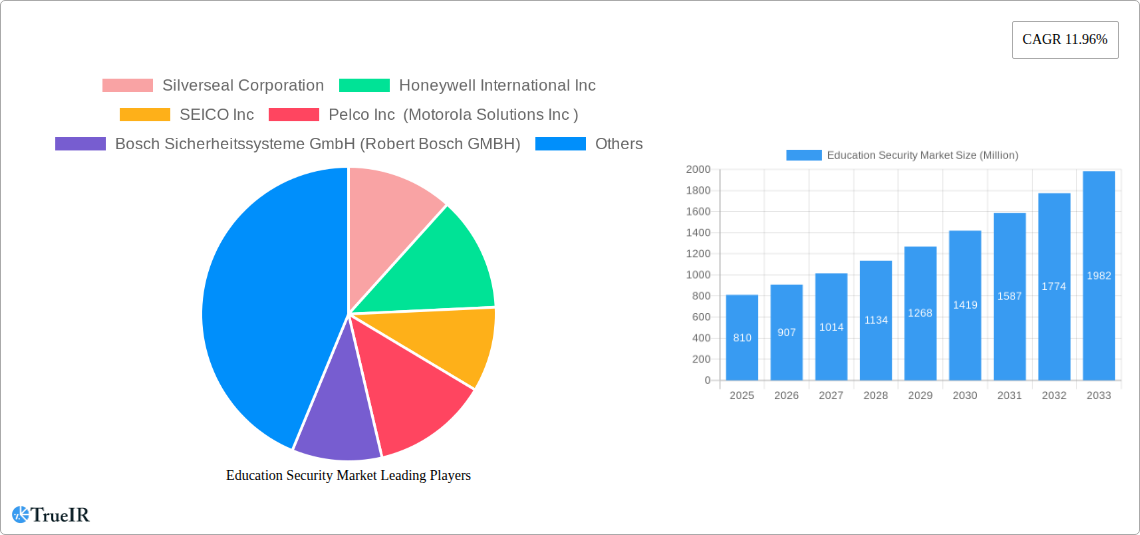

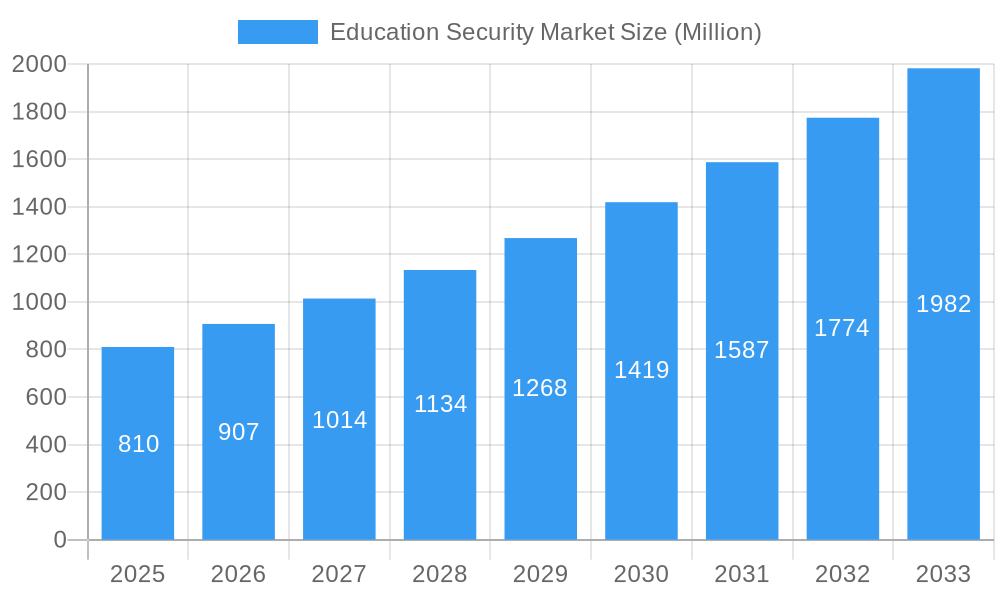

The global Education Security Market is poised for substantial growth, estimated to reach a significant valuation in the coming years. Driven by an increasing need to safeguard students, faculty, and valuable assets within educational institutions, the market is projected to expand at a robust Compound Annual Growth Rate (CAGR) of 11.96% over the forecast period. This upward trajectory is fueled by a confluence of factors, including rising concerns over school safety, the adoption of advanced security technologies, and evolving regulatory landscapes mandating enhanced security measures. Key market drivers include the escalating threat of active shooter incidents, the need for effective surveillance and access control in an era of increasing student populations, and the integration of smart technologies into campus security systems. The market encompasses a broad spectrum of services, with Guarding, Pre-Employment Screening, and Security Consulting expected to see consistent demand. Furthermore, the integration of Systems Integration & Management and Alarm Monitoring Services are becoming increasingly crucial for comprehensive campus security solutions. Educational facilities, from primary and secondary schools to higher education institutions, are actively investing in these security enhancements to create safer learning environments.

Education Security Market Market Size (In Million)

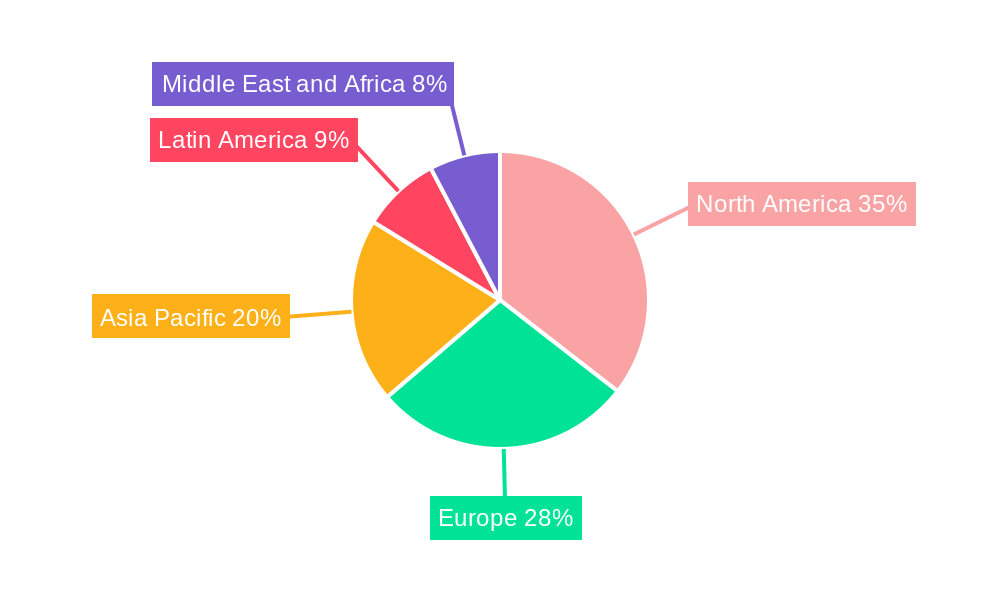

The market's expansion is further characterized by emerging trends such as the widespread adoption of Artificial Intelligence (AI) and Machine Learning (ML) for threat detection and predictive analysis, the increasing deployment of video surveillance systems with advanced analytics, and the growing preference for cloud-based security management platforms for scalability and remote accessibility. Biometric authentication, smart access control systems, and integrated emergency communication systems are also gaining traction. However, the market faces certain restraints, including budget constraints within educational institutions, particularly for smaller or underfunded schools, and concerns regarding data privacy and the ethical implications of extensive surveillance. Additionally, the technical expertise required for the installation and maintenance of sophisticated security systems can pose a challenge. Geographically, North America and Europe are anticipated to remain dominant markets due to their proactive approach to security and significant investments in educational infrastructure. The Asia Pacific region, however, is expected to exhibit the highest growth rate, driven by rapid infrastructure development and increasing security awareness.

Education Security Market Company Market Share

Education Security Market Report: Unlocking a Safer Future for Learning Institutions

This comprehensive Education Security Market report provides an in-depth analysis of the global landscape, forecasting significant growth driven by increasing security concerns and technological advancements in educational institutions. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report delves into market structure, trends, opportunities, dominant segments, product innovations, key players, and future outlook. Leveraging high-volume keywords such as "school security," "campus safety," "education technology security," "K-12 security," and "higher education security," this SEO-optimized report is designed for industry professionals seeking actionable insights and strategic guidance.

Education Security Market Market Structure & Competitive Landscape

The Education Security Market exhibits a moderately concentrated structure, with a mix of large multinational corporations and specialized security solution providers. Innovation is a key differentiator, with companies continuously developing advanced technologies like AI-powered surveillance, access control systems, and integrated security platforms. Regulatory frameworks surrounding student privacy, data security, and campus safety significantly influence market dynamics, driving demand for compliant and robust solutions. Product substitutes, while present in the form of standalone security devices, are increasingly being integrated into comprehensive solutions. The end-user segmentation spans primary and secondary facilities, higher education institutions, and other educational settings, each with unique security needs. Mergers and acquisitions (M&A) are an active trend, with major players consolidating their market share and expanding their service portfolios. Approximately 10-15% of the market has seen M&A activity in the historical period, indicating strategic consolidation. The competitive landscape is characterized by intense rivalry, focused on offering end-to-end security solutions that address the evolving threat landscape in educational environments.

Education Security Market Market Trends & Opportunities

The Education Security Market is poised for substantial expansion, projected to reach a global market size of approximately USD 15 Billion by 2033, with a Compound Annual Growth Rate (CAGR) of around 7.8% from 2025 to 2033. This impressive growth is fueled by a confluence of escalating security threats, increased awareness among educational institutions, and the relentless pace of technological innovation. The integration of Artificial Intelligence (AI) into security systems, particularly for video analytics, threat detection, and behavioral analysis, is a transformative trend. AI-powered solutions are enabling proactive rather than reactive security measures, identifying potential risks before they escalate. Furthermore, the rising adoption of cloud-based security management platforms is enhancing scalability, accessibility, and data management for educational institutions of all sizes. This shift towards intelligent, connected, and centralized security systems represents a significant opportunity for solution providers.

Consumer preferences are increasingly leaning towards comprehensive, integrated security solutions that offer a holistic approach to campus safety. This includes robust access control systems, advanced surveillance cameras with facial recognition capabilities, intrusion detection systems, and emergency communication platforms. The demand for solutions that can be seamlessly integrated with existing IT infrastructure is also a key trend, minimizing disruption and maximizing efficiency. The competitive dynamics are shaped by the ability of companies to offer customized solutions tailored to the specific needs and budget constraints of diverse educational institutions. Factors such as the rising incidence of school shootings, the growing threat of cyberattacks targeting educational data, and the need to ensure the well-being of both students and staff are compelling educational bodies to prioritize and invest in advanced security measures. The market penetration rate for advanced security technologies is expected to rise significantly, moving from approximately 45% in 2025 to an estimated 70% by 2033. Opportunities also lie in providing specialized security services, such as pre-employment screening for educators and staff, and comprehensive security consulting to help institutions develop effective safety protocols. The increasing global focus on mental health support within educational settings also presents an opportunity for integrated safety solutions that can facilitate communication and well-being checks.

Dominant Markets & Segments in Education Security Market

The Education Security Market is witnessing significant growth and dominance across various regions and segments, driven by distinct factors.

Leading Regions & Countries:

- North America: This region consistently leads the market, primarily due to high levels of awareness regarding school safety, substantial government funding for security initiatives, and the early adoption of advanced technologies. The United States, in particular, with its vast network of educational institutions and a proactive approach to addressing security concerns, represents a major market. The presence of leading security technology providers further bolsters its dominance.

- Europe: With a growing focus on student safety and data privacy regulations, Europe is emerging as a strong market. Countries like Germany, the UK, and France are investing in integrated security systems and smart campus solutions.

- Asia Pacific: This region presents the fastest-growing market for education security, propelled by rapid urbanization, increasing student populations, and government initiatives aimed at enhancing campus safety, especially in countries like China and India.

Dominant Segments:

Facilities: Primary & Secondary Facilities: This segment holds the largest market share. The heightened vulnerability of younger students and the increasing frequency of safety incidents in K-12 schools necessitate robust security measures. Key growth drivers include:

- Mandatory government regulations for school safety.

- Parental and community pressure for safer learning environments.

- Increased funding for school security upgrades.

- The growing need for access control and visitor management systems.

Services: Systems Integration & Management: This segment is experiencing rapid growth. Educational institutions are increasingly opting for integrated security solutions rather than disparate systems. This demand is driven by:

- The need for a unified security approach across campus.

- The complexity of managing multiple security subsystems.

- The desire for centralized monitoring and remote management capabilities.

- The growing adoption of IoT devices and smart campus technologies.

Facilities: Higher Education Facilities: Universities and colleges, with their larger campuses, diverse student populations, and critical research infrastructure, represent another significant segment. Growth here is fueled by:

- Concerns over campus-wide security and crime prevention.

- The need to protect valuable research data and intellectual property.

- The implementation of advanced access control for sensitive areas.

- The increasing use of AI-powered analytics for anomaly detection.

Services: Guarding: While traditional guarding services remain important, there is a growing trend towards integrating human security personnel with advanced technological solutions to create a more effective and efficient security posture.

Education Security Market Product Analysis

The Education Security Market is characterized by a wave of innovative products focused on enhancing campus safety and operational efficiency. Key advancements include AI-powered video analytics for real-time threat detection, facial recognition for access control and visitor management, and intelligent surveillance systems offering comprehensive situational awareness. Integrated security platforms are consolidating various functions, from access control and alarm monitoring to emergency communication and mass notification systems, providing a unified command center. Furthermore, the demand for cybersecurity solutions tailored to educational institutions is surging, protecting sensitive student data and preventing cyberattacks. Product innovations are driven by the need for scalable, user-friendly, and cost-effective solutions that can be deployed across diverse educational settings, from K-12 schools to large university campuses.

Key Drivers, Barriers & Challenges in Education Security Market

Key Drivers: The Education Security Market is propelled by a strong impetus from escalating security concerns and a heightened awareness of the need for robust safety measures in educational institutions. Government mandates and funding initiatives, aimed at enhancing campus safety and preventing incidents like school violence, are significant drivers. The increasing adoption of advanced technologies, such as AI-powered surveillance, biometrics, and integrated security platforms, offers proactive threat detection and response capabilities. Furthermore, the growing emphasis on creating a secure and conducive learning environment for students and staff is a fundamental catalyst for market growth.

Barriers & Challenges: Despite the growth trajectory, the market faces several hurdles. Budgetary constraints within educational institutions, particularly for public schools, can limit the adoption of comprehensive, high-cost security solutions. Regulatory complexities surrounding data privacy and the ethical use of surveillance technologies can also pose challenges. Supply chain disruptions and the availability of skilled personnel for installation and maintenance of advanced security systems can impact deployment timelines and costs. Intense competitive pressure among vendors also drives price wars, potentially impacting profitability.

Growth Drivers in the Education Security Market Market

The Education Security Market is experiencing robust growth, driven by several key factors. Technological advancements, particularly in AI, machine learning, and IoT, are enabling more sophisticated and proactive security solutions, such as intelligent video analytics for threat detection and behavior monitoring. Government initiatives and funding are crucial, with increased allocations for school safety grants and security infrastructure upgrades. The rising awareness among parents, educators, and administrators about potential security threats, including active shooter events and cyberattacks, is a significant driver. Furthermore, the trend towards smart campus development and the integration of various security systems into a unified platform enhances operational efficiency and provides comprehensive protection.

Challenges Impacting Education Security Market Growth

Several challenges are impacting the growth of the Education Security Market. Budgetary limitations in many educational institutions, especially public K-12 schools, often restrict investment in comprehensive security solutions. Navigating complex regulatory frameworks related to data privacy, student surveillance, and the ethical use of AI technologies can be a significant hurdle. Supply chain issues and the availability of skilled labor for the installation and maintenance of advanced security systems can lead to delays and increased costs. Moreover, intense competition among vendors can lead to price pressures, impacting profit margins for market players.

Key Players Shaping the Education Security Market Market

- Silverseal Corporation

- Honeywell International Inc

- SEICO Inc

- Pelco Inc (Motorola Solutions Inc)

- Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH)

- Cisco Systems Inc

- Genetec Inc

- Verkada Inc

- Securitas Technology (Securitas AB)

- Hangzhou Hikvision Digital Technology Co Ltd

- Kisi Incorporated

- AV Costar

- Axis Communications AB

- Siemens A

Significant Education Security Market Industry Milestones

- May 2024: Senator Wayne Fontana, D-District 42, announced USD 8,25,522 in School and Safety grants to enhance student and staff safety, security, and mental health support. This initiative directly fuels investment in educational security solutions.

- March 2024: Schools in Ontario could soon be equipped with more security cameras and more vape detectors. Premier Kathleen Wynne announced that USD 30 million would be spent on school safety in the province’s budget. Installing vape detectors and smoke detectors that detect vapor in places like washrooms will help keep students healthy and safe. This demonstrates a proactive approach to modernizing school safety infrastructure.

Future Outlook for Education Security Market Market

The Education Security Market is projected for sustained and robust growth in the coming years. Key growth catalysts include the continued evolution of AI and machine learning, leading to more predictive and intelligent security systems that can identify threats before they materialize. The increasing demand for integrated, end-to-end security solutions that encompass physical security, cybersecurity, and emergency management will drive market expansion. Strategic partnerships between technology providers and educational institutions, along with government support and funding, will further accelerate adoption. Opportunities lie in developing cost-effective, scalable, and user-friendly solutions tailored to the specific needs of diverse educational environments, ensuring a safe and secure learning experience for all. The market potential is significant, with an estimated reach of over USD 15 Billion by 2033.

Education Security Market Segmentation

-

1. Services

- 1.1. Guarding

- 1.2. Pre-Employment Screening

- 1.3. Security Consulting

- 1.4. Systems Integration & Management

- 1.5. Alarm Monitoring Services

- 1.6. Other Private Security Services

-

2. Facilities

- 2.1. Primary & Secondary Facilities

- 2.2. Higher Education Facilities

- 2.3. Other Educational Facilities

Education Security Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Education Security Market Regional Market Share

Geographic Coverage of Education Security Market

Education Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Real-time Surveillance; Growing Demand for Cost-effective security solutions and significant Infrastructure Developments

- 3.3. Market Restrains

- 3.3.1. The Security Solutions Procurement Costs and Privacy Concerns Related to Public Surveillance Impact the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Higher Education Facilities are Expected to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Education Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Guarding

- 5.1.2. Pre-Employment Screening

- 5.1.3. Security Consulting

- 5.1.4. Systems Integration & Management

- 5.1.5. Alarm Monitoring Services

- 5.1.6. Other Private Security Services

- 5.2. Market Analysis, Insights and Forecast - by Facilities

- 5.2.1. Primary & Secondary Facilities

- 5.2.2. Higher Education Facilities

- 5.2.3. Other Educational Facilities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Education Security Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Guarding

- 6.1.2. Pre-Employment Screening

- 6.1.3. Security Consulting

- 6.1.4. Systems Integration & Management

- 6.1.5. Alarm Monitoring Services

- 6.1.6. Other Private Security Services

- 6.2. Market Analysis, Insights and Forecast - by Facilities

- 6.2.1. Primary & Secondary Facilities

- 6.2.2. Higher Education Facilities

- 6.2.3. Other Educational Facilities

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. Europe Education Security Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Guarding

- 7.1.2. Pre-Employment Screening

- 7.1.3. Security Consulting

- 7.1.4. Systems Integration & Management

- 7.1.5. Alarm Monitoring Services

- 7.1.6. Other Private Security Services

- 7.2. Market Analysis, Insights and Forecast - by Facilities

- 7.2.1. Primary & Secondary Facilities

- 7.2.2. Higher Education Facilities

- 7.2.3. Other Educational Facilities

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Asia Pacific Education Security Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Guarding

- 8.1.2. Pre-Employment Screening

- 8.1.3. Security Consulting

- 8.1.4. Systems Integration & Management

- 8.1.5. Alarm Monitoring Services

- 8.1.6. Other Private Security Services

- 8.2. Market Analysis, Insights and Forecast - by Facilities

- 8.2.1. Primary & Secondary Facilities

- 8.2.2. Higher Education Facilities

- 8.2.3. Other Educational Facilities

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Latin America Education Security Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Guarding

- 9.1.2. Pre-Employment Screening

- 9.1.3. Security Consulting

- 9.1.4. Systems Integration & Management

- 9.1.5. Alarm Monitoring Services

- 9.1.6. Other Private Security Services

- 9.2. Market Analysis, Insights and Forecast - by Facilities

- 9.2.1. Primary & Secondary Facilities

- 9.2.2. Higher Education Facilities

- 9.2.3. Other Educational Facilities

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Middle East and Africa Education Security Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Guarding

- 10.1.2. Pre-Employment Screening

- 10.1.3. Security Consulting

- 10.1.4. Systems Integration & Management

- 10.1.5. Alarm Monitoring Services

- 10.1.6. Other Private Security Services

- 10.2. Market Analysis, Insights and Forecast - by Facilities

- 10.2.1. Primary & Secondary Facilities

- 10.2.2. Higher Education Facilities

- 10.2.3. Other Educational Facilities

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Silverseal Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SEICO Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pelco Inc (Motorola Solutions Inc )

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cisco Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Genetec Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Verkada Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Securitas Technology (Securitas AB)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hangzhou Hikvision Digital Technology Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kisi Incorporated

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AV Costar

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Axis Communications AB

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Siemens A

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Silverseal Corporation

List of Figures

- Figure 1: Global Education Security Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Education Security Market Revenue (Million), by Services 2025 & 2033

- Figure 3: North America Education Security Market Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America Education Security Market Revenue (Million), by Facilities 2025 & 2033

- Figure 5: North America Education Security Market Revenue Share (%), by Facilities 2025 & 2033

- Figure 6: North America Education Security Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Education Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Education Security Market Revenue (Million), by Services 2025 & 2033

- Figure 9: Europe Education Security Market Revenue Share (%), by Services 2025 & 2033

- Figure 10: Europe Education Security Market Revenue (Million), by Facilities 2025 & 2033

- Figure 11: Europe Education Security Market Revenue Share (%), by Facilities 2025 & 2033

- Figure 12: Europe Education Security Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Education Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Education Security Market Revenue (Million), by Services 2025 & 2033

- Figure 15: Asia Pacific Education Security Market Revenue Share (%), by Services 2025 & 2033

- Figure 16: Asia Pacific Education Security Market Revenue (Million), by Facilities 2025 & 2033

- Figure 17: Asia Pacific Education Security Market Revenue Share (%), by Facilities 2025 & 2033

- Figure 18: Asia Pacific Education Security Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Education Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Education Security Market Revenue (Million), by Services 2025 & 2033

- Figure 21: Latin America Education Security Market Revenue Share (%), by Services 2025 & 2033

- Figure 22: Latin America Education Security Market Revenue (Million), by Facilities 2025 & 2033

- Figure 23: Latin America Education Security Market Revenue Share (%), by Facilities 2025 & 2033

- Figure 24: Latin America Education Security Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Education Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Education Security Market Revenue (Million), by Services 2025 & 2033

- Figure 27: Middle East and Africa Education Security Market Revenue Share (%), by Services 2025 & 2033

- Figure 28: Middle East and Africa Education Security Market Revenue (Million), by Facilities 2025 & 2033

- Figure 29: Middle East and Africa Education Security Market Revenue Share (%), by Facilities 2025 & 2033

- Figure 30: Middle East and Africa Education Security Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Education Security Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Education Security Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global Education Security Market Revenue Million Forecast, by Facilities 2020 & 2033

- Table 3: Global Education Security Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Education Security Market Revenue Million Forecast, by Services 2020 & 2033

- Table 5: Global Education Security Market Revenue Million Forecast, by Facilities 2020 & 2033

- Table 6: Global Education Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Education Security Market Revenue Million Forecast, by Services 2020 & 2033

- Table 8: Global Education Security Market Revenue Million Forecast, by Facilities 2020 & 2033

- Table 9: Global Education Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Education Security Market Revenue Million Forecast, by Services 2020 & 2033

- Table 11: Global Education Security Market Revenue Million Forecast, by Facilities 2020 & 2033

- Table 12: Global Education Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Education Security Market Revenue Million Forecast, by Services 2020 & 2033

- Table 14: Global Education Security Market Revenue Million Forecast, by Facilities 2020 & 2033

- Table 15: Global Education Security Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Education Security Market Revenue Million Forecast, by Services 2020 & 2033

- Table 17: Global Education Security Market Revenue Million Forecast, by Facilities 2020 & 2033

- Table 18: Global Education Security Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Education Security Market?

The projected CAGR is approximately 11.96%.

2. Which companies are prominent players in the Education Security Market?

Key companies in the market include Silverseal Corporation, Honeywell International Inc, SEICO Inc, Pelco Inc (Motorola Solutions Inc ), Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH), Cisco Systems Inc, Genetec Inc, Verkada Inc, Securitas Technology (Securitas AB), Hangzhou Hikvision Digital Technology Co Ltd, Kisi Incorporated, AV Costar, Axis Communications AB, Siemens A.

3. What are the main segments of the Education Security Market?

The market segments include Services, Facilities.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Real-time Surveillance; Growing Demand for Cost-effective security solutions and significant Infrastructure Developments.

6. What are the notable trends driving market growth?

Higher Education Facilities are Expected to Witness Major Growth.

7. Are there any restraints impacting market growth?

The Security Solutions Procurement Costs and Privacy Concerns Related to Public Surveillance Impact the Growth of the Market.

8. Can you provide examples of recent developments in the market?

May 2024: Senator Wayne Fontana, D-District 42, announced USD 8,25,522 in School and Safety grants to enhance student and staff safety, security, and mental health support.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Education Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Education Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Education Security Market?

To stay informed about further developments, trends, and reports in the Education Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence