Key Insights

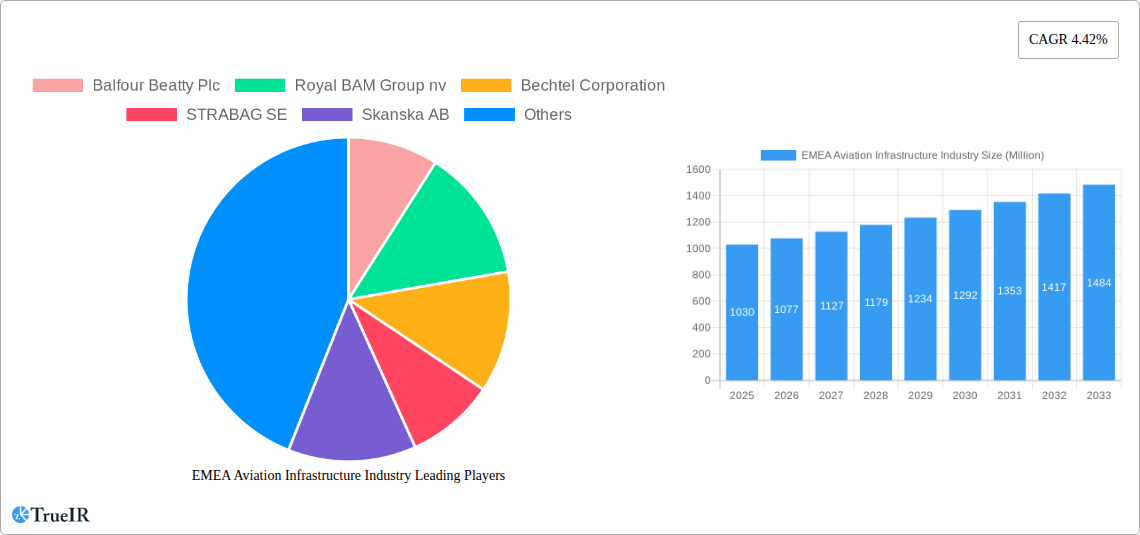

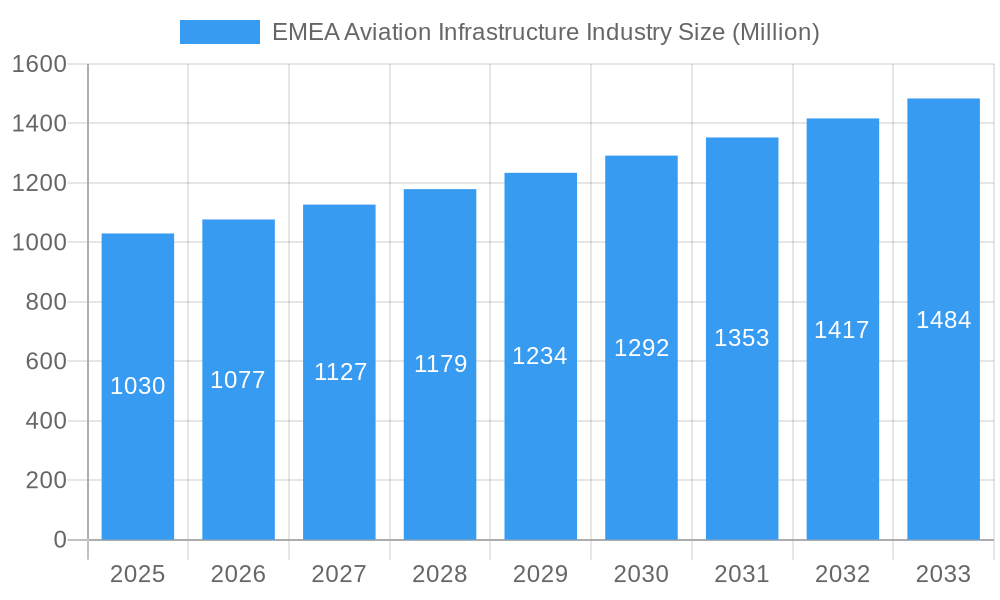

The EMEA (Europe, Middle East, and Africa) aviation infrastructure market, valued at $1.03 billion in 2025, is projected to experience robust growth, driven by increasing air passenger traffic, the expansion of existing airports, and the development of new aviation hubs across the region. A Compound Annual Growth Rate (CAGR) of 4.42% from 2025 to 2033 indicates a significant market expansion. Key drivers include government investments in infrastructure modernization, particularly in rapidly developing economies within the Middle East and Africa, the rising demand for enhanced passenger experience leading to airport expansion projects, and the increasing focus on sustainable aviation infrastructure. The market is segmented by airport type (commercial, military, general aviation) and infrastructure type (terminals, control towers, runways, aprons, hangars, etc.), offering diverse investment opportunities. While challenges exist, such as fluctuating oil prices impacting some projects and potential geopolitical instability in certain regions, the long-term outlook remains positive, fueled by sustained growth in air travel and the need for upgraded and expanded facilities to handle this increase in demand.

EMEA Aviation Infrastructure Industry Market Size (In Billion)

The major players in this market, including Balfour Beatty Plc, Royal BAM Group nv, and Bechtel Corporation, are well-positioned to capitalize on the growth opportunities. The regional breakdown reveals significant potential in both Europe (with key markets like the UK, Germany, and France) and the Middle East and Africa (with strong growth expected in Saudi Arabia, the UAE, and Turkey). The consistent investment in new technologies, such as improved air traffic management systems and sustainable building materials, will further fuel market growth. Growth in the general aviation segment is expected to be particularly strong, driven by the rise of business aviation and private air travel. Furthermore, the focus on improving airport security and implementing advanced technologies to enhance efficiency will continue to drive investment within the sector.

EMEA Aviation Infrastructure Industry Company Market Share

This comprehensive report provides an in-depth analysis of the EMEA Aviation Infrastructure Industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period extending to 2033, this report meticulously examines market trends, competitive landscapes, and future growth potential. The report leverages extensive market research and data analysis to provide a clear and concise overview of the industry's current state and future trajectory, covering key segments, dominant players, and significant milestones. Market values are expressed in Millions USD throughout.

EMEA Aviation Infrastructure Industry Market Structure & Competitive Landscape

The EMEA aviation infrastructure market is characterized by a moderately concentrated landscape, with several large multinational players dominating the sector. Concentration ratios, while varying across segments (e.g., higher for terminal construction than hangar construction), are estimated to be around xx% for the top 5 players in 2025. Key factors shaping the competitive landscape include:

- Market Concentration: The top 10 companies account for approximately xx% of total market revenue, reflecting a consolidated market structure.

- Innovation Drivers: Technological advancements such as Building Information Modeling (BIM), advanced materials, and sustainable construction practices are driving innovation.

- Regulatory Impacts: Stringent safety regulations, environmental standards (e.g., carbon emission reduction targets), and procurement processes influence market dynamics.

- Product Substitutes: Limited direct substitutes exist, but competition arises from alternative construction methods and material choices.

- End-User Segmentation: The market is segmented by airport type (commercial, military, general aviation) and infrastructure type (terminals, control towers, runways, aprons, hangars, etc.), each with unique characteristics and market dynamics.

- M&A Trends: Consolidation through mergers and acquisitions (M&A) is expected to continue, driven by the pursuit of economies of scale and geographic expansion. The estimated M&A volume for 2025 is around xx Million USD.

Several qualitative factors also influence the market structure. These include the availability of skilled labor, access to financing, and government policies promoting airport infrastructure development. The relative importance of these factors varies across different EMEA regions.

EMEA Aviation Infrastructure Industry Market Trends & Opportunities

The EMEA aviation infrastructure market is poised for significant growth throughout the forecast period (2025-2033). Driven by increasing air passenger traffic, expansion of existing airports, and the development of new infrastructure, the market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching a market size of xx Million USD by 2033. Several factors contribute to this growth, including:

- Rising Air Passenger Traffic: The consistent increase in air travel demand across EMEA necessitates expansion and modernization of existing airport infrastructure and the construction of new airports.

- Government Initiatives and Investments: Many EMEA governments are actively investing in airport infrastructure development to boost tourism, trade, and economic growth.

- Technological Advancements: The adoption of innovative construction technologies and materials leads to greater efficiency, reduced costs, and improved sustainability in airport construction projects.

- Growing Focus on Sustainability: The aviation industry's emphasis on environmental sustainability is pushing for the adoption of green construction technologies and sustainable materials in airport development.

- Increased Investment in Airport Security: Rising concerns about aviation security are driving investment in advanced security systems and technologies, contributing to market growth.

- Rise of Low-Cost Carriers: The proliferation of low-cost airlines has increased the demand for efficient and cost-effective airport infrastructure.

Market penetration rates vary significantly across different segments and regions, with commercial airport infrastructure showing higher penetration compared to general aviation. This disparity reflects the relative economic importance and demand across the segments.

Dominant Markets & Segments in EMEA Aviation Infrastructure Industry

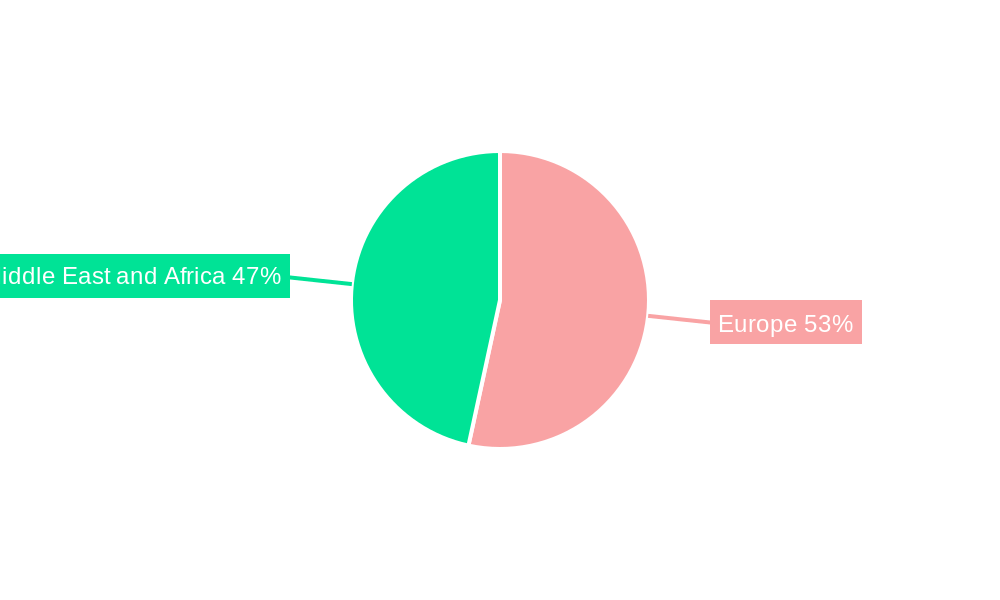

The Western European region is currently the dominant market for aviation infrastructure in EMEA, followed by Eastern Europe and the Middle East and Africa. Within this region, countries such as the UK, France, Germany, and Turkey exhibit high growth potential.

- Dominant Airport Types: Commercial airports dominate the market, driven by robust passenger traffic.

- Dominant Infrastructure Types: Terminals and taxiways/runways are the largest segments in terms of market value, due to their high construction costs and frequent upgrades.

Key Growth Drivers:

- Infrastructure Development: Significant government investments in airport infrastructure expansion and modernization are a major catalyst for growth.

- Economic Growth: Strong economic growth in several EMEA countries fuels investment in airport infrastructure.

- Tourism Growth: Increased tourism in several regions drives the demand for larger and more efficient airports.

- Supportive Government Policies: Policies aimed at improving air connectivity and facilitating foreign direct investment promote market expansion.

Detailed analysis of regional dominance reveals variations in market size, growth drivers, and competitive intensity across the EMEA region. Differences in regulatory frameworks, economic conditions, and government policies shape market characteristics in each sub-region.

EMEA Aviation Infrastructure Industry Product Analysis

The EMEA aviation infrastructure industry involves a wide range of products and services, including design, engineering, procurement, construction, and maintenance of airport infrastructure. Technological advancements are transforming the industry, with the adoption of sustainable building materials, automation in construction processes, and advanced security technologies improving efficiency and reducing environmental impact. These innovations are enhancing both the functional and aesthetic aspects of airport design, leading to increased passenger satisfaction and operational efficiency. The competitive advantage lies in offering innovative solutions, cost-effective construction, and sustainable practices to cater to the evolving needs of the aviation industry.

Key Drivers, Barriers & Challenges in EMEA Aviation Infrastructure Industry

Key Drivers:

The market is primarily driven by the increasing demand for air travel, government investments in airport infrastructure, and technological advancements. Examples include the significant investments being made in new airports, particularly in emerging markets. Technological advancements in building materials and construction methods also contribute to market growth. Favourable government policies supporting the aviation sector play a crucial role.

Key Challenges and Restraints:

Challenges include high construction costs, stringent regulatory requirements, supply chain disruptions (as seen in recent years with material shortages and labor constraints), and intense competition among contractors. These factors can result in project delays and cost overruns, creating significant challenges for market players. The quantification of the impact of these challenges is difficult but can be seen through project cost overruns and delays in project completion documented by industry bodies.

Growth Drivers in the EMEA Aviation Infrastructure Industry Market

Significant growth in air passenger traffic across EMEA, coupled with substantial government investment in infrastructure development and technological advancements in construction methods, are driving market expansion. The increasing focus on sustainable infrastructure and improving airport security measures also contributes.

Challenges Impacting EMEA Aviation Infrastructure Industry Growth

High construction and operating costs, coupled with supply chain disruptions and complex regulatory hurdles, pose challenges to market expansion. Competition from established players and the need to balance rapid infrastructure expansion with environmental sustainability concerns are also notable obstacles. These factors contribute to project delays and cost overruns, impacting the overall growth trajectory.

Key Players Shaping the EMEA Aviation Infrastructure Industry Market

- Balfour Beatty Plc

- Royal BAM Group nv

- Bechtel Corporation

- STRABAG SE

- Skanska AB

- VINCI Airports

- Limak Group of Companies

- ALEC Engineering & Contracting LL

- BIC Contracting LLC

- Bouygues Construction S A

- TAV Construction

- Eiffage S A

- Impresa Pizzarotti & C S p A

Significant EMEA Aviation Infrastructure Industry Industry Milestones

- May 2023: Poland announces plans for the Solidarity Hub (CPK) airport in Warsaw, a USD 870 million project expected to be operational by summer 2028. This signals significant investment and future growth in Eastern Europe.

- February 2023: The Airport Council of Europe allocates USD 440 million to upgrade Zvartnots International Airport, doubling its capacity. This highlights investment in existing infrastructure to meet growing demand.

Future Outlook for EMEA Aviation Infrastructure Industry Market

The EMEA aviation infrastructure market is projected to experience robust growth over the next decade, driven by sustained air passenger traffic growth, government initiatives, and technological innovation. Strategic opportunities exist for companies specializing in sustainable construction, airport security technologies, and efficient airport operations. The market's potential is significant, promising substantial returns for investors and market participants who can effectively navigate the challenges and capitalize on the growth drivers.

EMEA Aviation Infrastructure Industry Segmentation

-

1. Airport Type

- 1.1. Commercial Airport

- 1.2. Military Airport

- 1.3. General Aviation Airport

-

2. Infrastructure Type

- 2.1. Terminal

- 2.2. Control Tower

- 2.3. Taxiway and Runway

- 2.4. Apron

- 2.5. Hangar

- 2.6. Other Infrastructure Types

EMEA Aviation Infrastructure Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdon

- 1.2. Germany

- 1.3. France

- 1.4. Russia

- 1.5. Italy

- 1.6. Denmark

- 1.7. Rest of Europe

-

2. Middle East and Africa

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Egypt

- 2.4. Qatar

- 2.5. Turkey

- 2.6. South Africa

- 2.7. Rest of Middle East and Africa

EMEA Aviation Infrastructure Industry Regional Market Share

Geographic Coverage of EMEA Aviation Infrastructure Industry

EMEA Aviation Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Airport to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 5.1.1. Commercial Airport

- 5.1.2. Military Airport

- 5.1.3. General Aviation Airport

- 5.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.2.1. Terminal

- 5.2.2. Control Tower

- 5.2.3. Taxiway and Runway

- 5.2.4. Apron

- 5.2.5. Hangar

- 5.2.6. Other Infrastructure Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.3.2. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 6. Europe EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 6.1.1. Commercial Airport

- 6.1.2. Military Airport

- 6.1.3. General Aviation Airport

- 6.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.2.1. Terminal

- 6.2.2. Control Tower

- 6.2.3. Taxiway and Runway

- 6.2.4. Apron

- 6.2.5. Hangar

- 6.2.6. Other Infrastructure Types

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 7. Middle East and Africa EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 7.1.1. Commercial Airport

- 7.1.2. Military Airport

- 7.1.3. General Aviation Airport

- 7.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.2.1. Terminal

- 7.2.2. Control Tower

- 7.2.3. Taxiway and Runway

- 7.2.4. Apron

- 7.2.5. Hangar

- 7.2.6. Other Infrastructure Types

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Balfour Beatty Plc

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Royal BAM Group nv

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Bechtel Corporation

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 STRABAG SE

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Skanska AB

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 VINCI Airports

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Limak Group of Companies

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 ALEC Engineering & Contracting LL

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 BIC Contracting LLC

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Bouygues Construction S A

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 TAV Construction

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Eiffage S A

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Impresa Pizzarotti & C S p A

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.1 Balfour Beatty Plc

List of Figures

- Figure 1: Global EMEA Aviation Infrastructure Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 3: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 4: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 5: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 6: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 9: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 10: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 11: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 12: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 2: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 3: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 5: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 6: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdon EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Russia EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Italy EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Denmark EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 15: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 16: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Saudi Arabia EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Arab Emirates EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Egypt EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Qatar EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Turkey EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Africa EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the EMEA Aviation Infrastructure Industry?

The projected CAGR is approximately 4.42%.

2. Which companies are prominent players in the EMEA Aviation Infrastructure Industry?

Key companies in the market include Balfour Beatty Plc, Royal BAM Group nv, Bechtel Corporation, STRABAG SE, Skanska AB, VINCI Airports, Limak Group of Companies, ALEC Engineering & Contracting LL, BIC Contracting LLC, Bouygues Construction S A, TAV Construction, Eiffage S A, Impresa Pizzarotti & C S p A.

3. What are the main segments of the EMEA Aviation Infrastructure Industry?

The market segments include Airport Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.03 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Airport to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: Poland announced its plans to build a state-of-the-art airport in Warsaw. The Solidarity Hub, or CPK, which will serve as the Central and Eastern European main air transit hub, is scheduled to become operational in the summer of 2028. The CPK, with a price tag of around USD 870 million, is one of the costliest infrastructure projects currently being built in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "EMEA Aviation Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the EMEA Aviation Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the EMEA Aviation Infrastructure Industry?

To stay informed about further developments, trends, and reports in the EMEA Aviation Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence