Key Insights

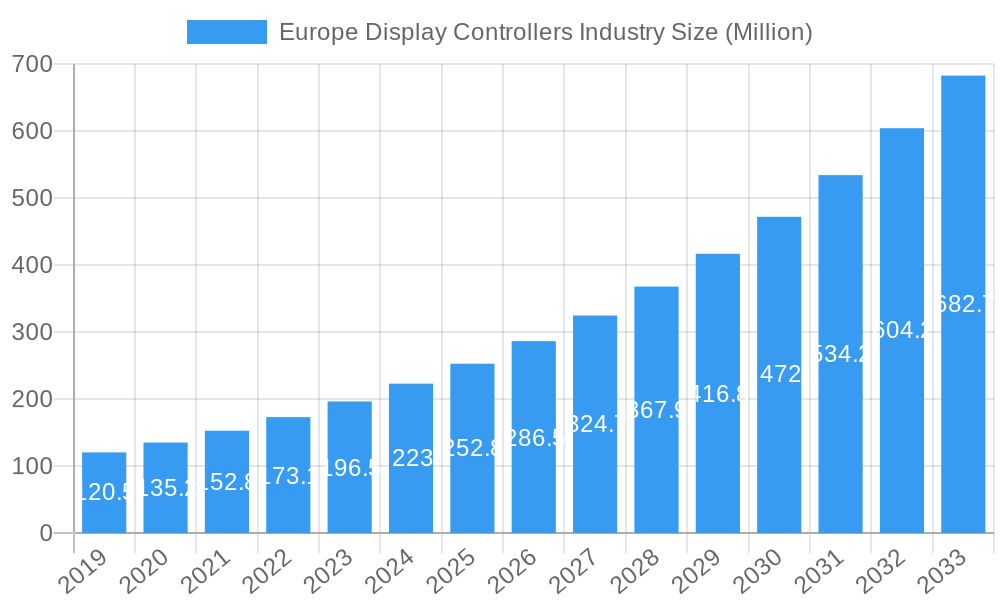

The European Display Controllers market is projected for substantial growth, expected to reach 35.6 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 9% through 2033. This growth is driven by the increasing demand for advanced display technologies across various industries. Key factors include the adoption of sophisticated interfaces in industrial automation, the integration of high-resolution displays in healthcare, and consumer demand for immersive electronic devices. The automotive sector's embrace of digital dashboards and infotainment, alongside the retail industry's shift to digital signage, also contribute significantly. Emerging trends like flexible, transparent, and energy-efficient displays will further shape market innovation.

Europe Display Controllers Industry Market Size (In Billion)

Challenges such as the high cost of advanced display controller technologies and complex integration processes may impact market pace. However, ongoing research and development efforts to reduce manufacturing costs and simplify integration are expected to mitigate these restraints. The market is segmented by type into Resistive and Capacitive display controllers, with Capacitive technology leading due to its superior touch sensitivity and multi-touch capabilities. Major end-user industries include Industrial, Healthcare, Consumer Electronics, Retail, Automotive, and BFSI. Key players like Semtech Corporation, Synaptics Incorporated, Samsung Electronics Co Ltd, and STMicroelectronics are innovating within Europe, with the United Kingdom, Germany, and France leading adoption.

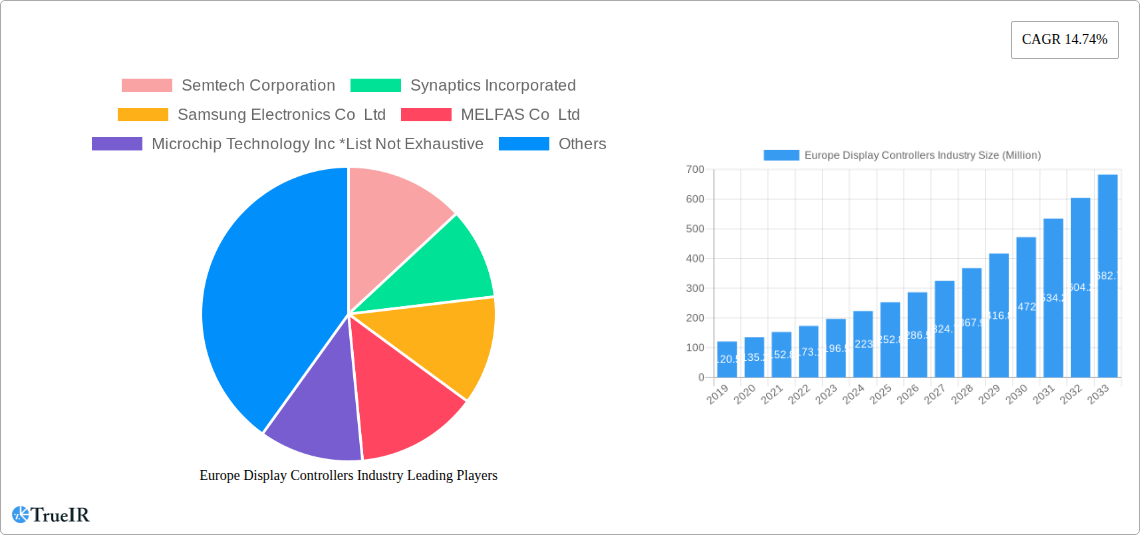

Europe Display Controllers Industry Company Market Share

Europe Display Controllers Industry Market Structure & Competitive Landscape

The Europe Display Controllers industry exhibits a dynamic market structure characterized by a mix of established multinational corporations and emerging specialized players. Market concentration is moderate, with leading companies like Samsung Electronics Co Ltd, Synaptics Incorporated, and STMicroelectronics holding significant market share, yet leaving room for niche innovation. Innovation drivers are primarily fueled by advancements in display technologies such as OLED, MicroLED, and flexible displays, alongside increasing demand for higher resolution, faster refresh rates, and enhanced power efficiency. Regulatory impacts are significant, with a growing emphasis on environmental standards, energy efficiency mandates, and data privacy in consumer electronics and automotive applications. Product substitutes are largely limited within the core display controller functionality, but the evolution of integrated display solutions and smart device ecosystems indirectly influences market demand. End-user segmentation is diverse, with the Industrial, Healthcare, Consumer Electronics, Retail, and Automotive sectors representing key growth areas, each with distinct technical requirements and adoption cycles. Mergers & Acquisitions (M&A) trends are active, with companies strategically acquiring technologies and market access to bolster their portfolios and expand their geographical reach. For instance, recent M&A activity has focused on acquiring companies with expertise in advanced driver-assistance systems (ADAS) integration and IoT display solutions. Concentration ratios are estimated to be around 65% for the top five players in the historical period, indicating a competitive yet consolidated landscape.

Europe Display Controllers Industry Market Trends & Opportunities

The Europe Display Controllers industry is projected for robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and expanding application horizons. The market size for display controllers in Europe is anticipated to reach XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This growth is underpinned by the escalating demand for sophisticated and immersive visual experiences across various end-user segments. In the Consumer Electronics sector, the proliferation of smart home devices, wearables, and advanced televisions continues to fuel demand for high-performance display controllers capable of supporting higher resolutions, wider color gamuts, and faster response times. The automotive industry presents a significant opportunity, with the increasing integration of digital cockpits, advanced driver-assistance systems (ADAS), and in-car infotainment systems necessitating sophisticated display controller solutions that can handle multiple displays, ensure safety-critical functionality, and offer enhanced user interfaces. Market penetration rates for advanced display controller solutions in the automotive sector are expected to climb from XX% in 2025 to XX% by 2033.

The Industrial segment is witnessing a surge in automation and the adoption of Industry 4.0 principles, leading to a greater reliance on intelligent displays for monitoring, control, and human-machine interaction (HMI) in factories, logistics, and energy management systems. Display controllers with robust connectivity options, real-time processing capabilities, and industrial-grade reliability are becoming increasingly vital. Healthcare applications are also expanding, with the demand for high-resolution medical imaging displays, patient monitoring systems, and surgical equipment driving the need for precise and reliable display control. The retail sector is embracing digital signage and interactive point-of-sale (POS) systems, creating opportunities for display controllers that can manage dynamic content, offer touch interactivity, and contribute to enhanced customer engagement.

Technological shifts are central to market evolution. The transition towards more energy-efficient display technologies, such as advanced OLED and Mini-LED backlighting, requires display controllers that can optimize power consumption without compromising performance. Furthermore, the development of integrated touch solutions and augmented reality (AR)/virtual reality (VR) interfaces is creating new demands for display controllers with advanced processing power and low latency. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on providing comprehensive solutions that encompass hardware, software, and integration services. Companies that can offer scalable, cost-effective, and feature-rich display controller solutions tailored to specific industry needs are poised to capture significant market share.

Dominant Markets & Segments in Europe Display Controllers Industry

The Europe Display Controllers industry is characterized by the dominance of specific regions and segments, driven by underlying economic, technological, and policy factors. Among the end-user segments, Consumer Electronics stands out as a leading market, propelled by the insatiable European consumer appetite for cutting-edge smart devices, high-definition televisions, and advanced gaming consoles. The strong purchasing power of consumers, coupled with a high adoption rate of new technologies, makes this segment a primary growth engine for display controllers. For instance, the market for display controllers in European consumer electronics is estimated to grow at a CAGR of XX% between 2025 and 2033, reaching an estimated value of XX Million.

The Automotive segment is rapidly emerging as another dominant force, driven by the transformative shift towards connected and autonomous vehicles. The increasing complexity of vehicle interiors, with multiple digital displays for infotainment, instrument clusters, and advanced driver-assistance systems (ADAS), creates a substantial demand for sophisticated and highly integrated display controllers. European automotive manufacturers are at the forefront of adopting these technologies, supported by stringent safety regulations and a focus on enhanced driving experience. Key growth drivers in this segment include the mandate for advanced safety features and the growing popularity of electric vehicles (EVs), which often feature larger and more integrated digital displays. The automotive segment is projected to witness a CAGR of XX% during the forecast period, reaching XX Million by 2033.

Within the Type segmentation, Capacitive display controllers are experiencing significant market dominance, particularly in touch-enabled applications across all end-user segments. Their superior responsiveness, multi-touch capabilities, and durability make them the preferred choice for smartphones, tablets, automotive infotainment systems, and industrial HMI. The market for capacitive display controllers is expected to grow at a CAGR of XX%, outperforming resistive counterparts.

The Industrial segment also represents a significant market for display controllers, driven by the ongoing digital transformation and the implementation of Industry 4.0 initiatives across Europe. The need for robust and reliable displays for factory automation, process control, and data visualization in manufacturing environments fuels demand for specialized industrial-grade display controllers. Government initiatives promoting industrial modernization and smart manufacturing further bolster this segment.

Policy-driven factors such as the EU's Green Deal and its emphasis on energy efficiency are indirectly influencing the dominance of certain display technologies and, consequently, display controllers. This encourages the adoption of power-efficient display solutions, benefiting controllers designed for such technologies. Infrastructure development, particularly in terms of 5G connectivity, is also a key enabler for advanced automotive and industrial applications that rely heavily on real-time data processing and display control.

Europe Display Controllers Industry Product Analysis

The Europe Display Controllers industry is defined by a continuous stream of product innovations focused on enhancing visual fidelity, interactivity, and system integration. Products are increasingly characterized by higher resolutions, improved color accuracy, and faster refresh rates, catering to the demand for more immersive and lifelike visual experiences. Advanced features such as variable refresh rate (VRR) support, HDR (High Dynamic Range) rendering, and sophisticated image processing algorithms are becoming standard in high-end display controllers. Competitive advantages are being built on the ability of these controllers to seamlessly integrate with emerging display technologies like OLED, MicroLED, and flexible displays, offering manufacturers greater design freedom and enabling novel form factors. Furthermore, the integration of advanced security features and robust power management capabilities is crucial for applications in the automotive and industrial sectors.

Key Drivers, Barriers & Challenges in Europe Display Controllers Industry

The Europe Display Controllers industry is propelled by a confluence of technological advancements and growing demand across diverse sectors. Key Drivers include the pervasive integration of digital displays in consumer electronics, the rapid evolution of the automotive sector towards digital cockpits and ADAS, and the increasing adoption of automation in industrial settings. Government initiatives promoting digitalization and smart manufacturing also act as significant catalysts. The demand for enhanced user experiences, characterized by higher resolution, better color reproduction, and faster response times, is a constant driver for innovation.

However, the industry faces considerable Barriers and Challenges. Supply chain disruptions, particularly concerning semiconductor components, can significantly impact production volumes and lead times. Regulatory hurdles, such as evolving environmental standards and data privacy regulations (e.g., GDPR), add complexity to product development and market entry. Intense competitive pressures from global players and the constant need for substantial R&D investment to keep pace with technological advancements also pose significant challenges. The cost sensitivity of certain market segments can also limit the adoption of premium display controller solutions.

Growth Drivers in the Europe Display Controllers Industry Market

Several pivotal factors are accelerating growth in the Europe Display Controllers Industry Market. The relentless march of technological innovation, particularly in display panel technology such as OLED and MicroLED, directly fuels the demand for sophisticated controllers capable of driving these advanced displays. Economic tailwinds, such as increasing disposable incomes in key European markets, translate into higher consumer spending on premium electronic devices that incorporate advanced display functionalities. Policy-driven support for digital transformation initiatives, including Industry 4.0 and the widespread adoption of electric and autonomous vehicles, provides a robust framework for market expansion. The growing emphasis on in-vehicle infotainment and safety systems, mandated by evolving automotive regulations, is a significant growth catalyst.

Challenges Impacting Europe Display Controllers Industry Growth

The growth trajectory of the Europe Display Controllers Industry is not without its impediments. Regulatory complexities, including stringent environmental compliance and evolving data security standards, necessitate ongoing adaptation and investment, potentially delaying product rollouts. Persistent supply chain issues, particularly the global shortage of critical semiconductor components, continue to pose a threat to production capacity and timely delivery. Competitive pressures from established and emerging players, coupled with the relentless pace of technological obsolescence, demand continuous innovation and significant research and development expenditure. The high cost of advanced display controller solutions can also act as a restraint in price-sensitive market segments, impacting broader market penetration.

Key Players Shaping the Europe Display Controllers Industry Market

- Semtech Corporation

- Synaptics Incorporated

- Samsung Electronics Co Ltd

- MELFAS Co Ltd

- Microchip Technology Inc

- STMicroelectronics

- NXP Semiconductors

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Analog Devices Inc

Significant Europe Display Controllers Industry Industry Milestones

- July 2021: REDMOND launched a full touch screen LED display stainless steel toaster. The countdown two-slice toaster includes digital technology and classic retro design with features such as cancel, reheat, and defrost functions.

Future Outlook for Europe Display Controllers Industry Market

The future outlook for the Europe Display Controllers industry is exceptionally promising, driven by sustained technological innovation and expanding market applications. The ongoing evolution of flexible displays, augmented reality interfaces, and the increasing demand for AI-powered visual analytics will present significant growth catalysts. Strategic opportunities lie in developing highly integrated, power-efficient, and secure display controller solutions tailored for the burgeoning automotive and industrial IoT markets. The market is expected to witness increased investment in advanced driver-assistance systems (ADAS) integration and smart infrastructure displays, further solidifying its growth trajectory.

Europe Display Controllers Industry Segmentation

-

1. Type

- 1.1. Resistive

- 1.2. Capacitive

-

2. End User

- 2.1. Industrial

- 2.2. Healthcare

- 2.3. Consumer Electronics

- 2.4. Retail

- 2.5. Automotive

- 2.6. BFSI

- 2.7. Other End Users

Europe Display Controllers Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

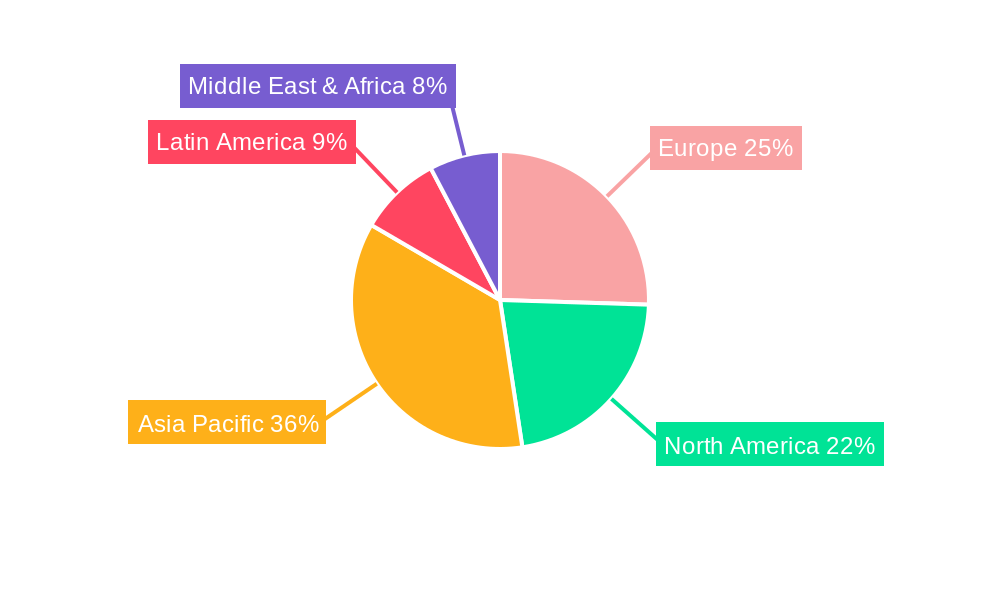

Europe Display Controllers Industry Regional Market Share

Geographic Coverage of Europe Display Controllers Industry

Europe Display Controllers Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Number of Smart Devices; Increasing Usage Across Various End-user Industries

- 3.3. Market Restrains

- 3.3.1. Complexities Associated with the Technology

- 3.4. Market Trends

- 3.4.1. Capacitive Touch Screens to Account for a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Display Controllers Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Resistive

- 5.1.2. Capacitive

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Industrial

- 5.2.2. Healthcare

- 5.2.3. Consumer Electronics

- 5.2.4. Retail

- 5.2.5. Automotive

- 5.2.6. BFSI

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Semtech Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Synaptics Incorporated

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MELFAS Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Microchip Technology Inc *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 STMicroelectronics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NXP Semiconductors

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Renesas Electronics Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Texas Instruments Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Analog Devices Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Semtech Corporation

List of Figures

- Figure 1: Europe Display Controllers Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Display Controllers Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Display Controllers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Display Controllers Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Europe Display Controllers Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Display Controllers Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Europe Display Controllers Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Europe Display Controllers Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Display Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Display Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Display Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Display Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Display Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Display Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Display Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Display Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Display Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Display Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Display Controllers Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Display Controllers Industry?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Europe Display Controllers Industry?

Key companies in the market include Semtech Corporation, Synaptics Incorporated, Samsung Electronics Co Ltd, MELFAS Co Ltd, Microchip Technology Inc *List Not Exhaustive, STMicroelectronics, NXP Semiconductors, Renesas Electronics Corporation, Texas Instruments Incorporated, Analog Devices Inc.

3. What are the main segments of the Europe Display Controllers Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Number of Smart Devices; Increasing Usage Across Various End-user Industries.

6. What are the notable trends driving market growth?

Capacitive Touch Screens to Account for a Significant Market Share.

7. Are there any restraints impacting market growth?

Complexities Associated with the Technology.

8. Can you provide examples of recent developments in the market?

July 2021 - REDMOND launched a full touch screen LED display stainless steel toaster. The countdown two-slice toaster includes digital technology and classic retro design with features such as cancel, reheat, and defrost functions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Display Controllers Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Display Controllers Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Display Controllers Industry?

To stay informed about further developments, trends, and reports in the Europe Display Controllers Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence