Key Insights

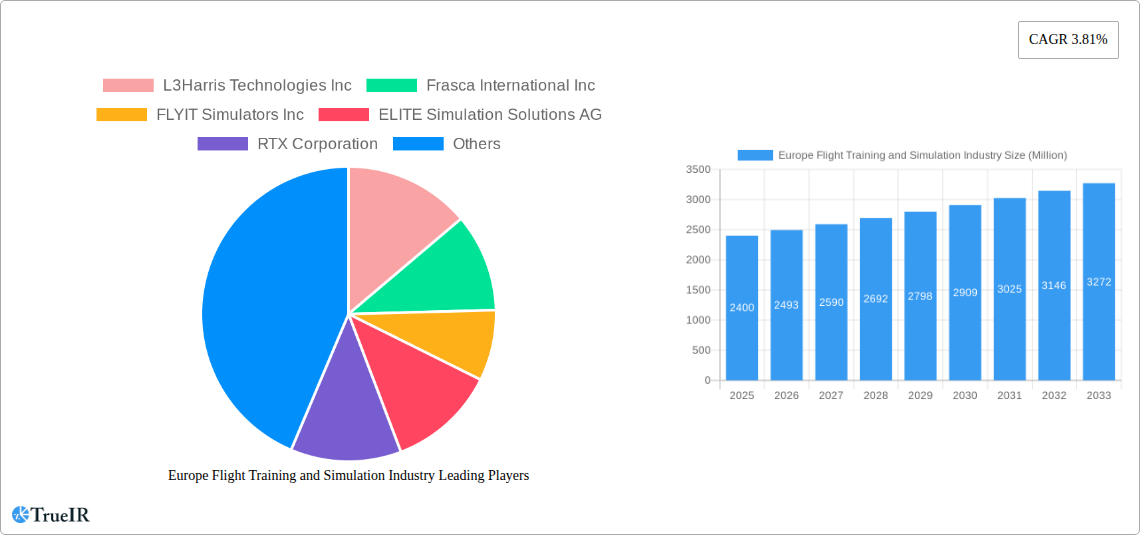

The European flight training and simulation market, valued at €2.4 billion in 2025, is projected to experience robust growth, driven by increasing air travel demand, stringent safety regulations, and the rising adoption of advanced simulation technologies. This growth, reflected in a Compound Annual Growth Rate (CAGR) of 3.81%, is expected to continue through 2033, propelled by several key factors. The expanding commercial aviation sector in Europe necessitates a larger pool of well-trained pilots, leading to increased investment in flight training programs. Furthermore, the integration of sophisticated full-flight simulators (FFS) and flight training devices (FTDs) offers more efficient and cost-effective training solutions compared to traditional methods. This shift towards technology-driven training is particularly evident in the significant growth of the FFS segment, fueled by its ability to replicate real-world flight conditions accurately. The market is segmented by training capability (rotorcraft and fixed-wing) and simulator type (FFS and FTD), with the fixed-wing segment dominating due to the higher number of commercial fixed-wing aircraft in operation. Key players like CAE Inc, L3Harris Technologies Inc, and Frasca International Inc are at the forefront of innovation, continuously developing and deploying advanced simulation technologies to meet the evolving training needs of the industry. The strong presence of these companies, along with other significant players in the market, indicates a competitive yet dynamic landscape.

Europe Flight Training and Simulation Industry Market Size (In Billion)

The geographical distribution of the market within Europe reveals a concentration in key countries like Germany, France, the United Kingdom, and Italy, driven by their robust aviation sectors and substantial investment in aviation infrastructure. However, growth is also expected in other European nations as the industry expands and regulatory standards become more unified. While challenges such as initial high investment costs associated with simulator procurement and ongoing maintenance might temporarily restrain growth, the long-term benefits of enhanced safety, efficiency, and cost savings outweigh these concerns, ensuring a positive outlook for the European flight training and simulation market. The market will likely witness further consolidation among industry players and increasing collaboration between training providers and simulator manufacturers to deliver comprehensive and advanced training solutions in the coming years.

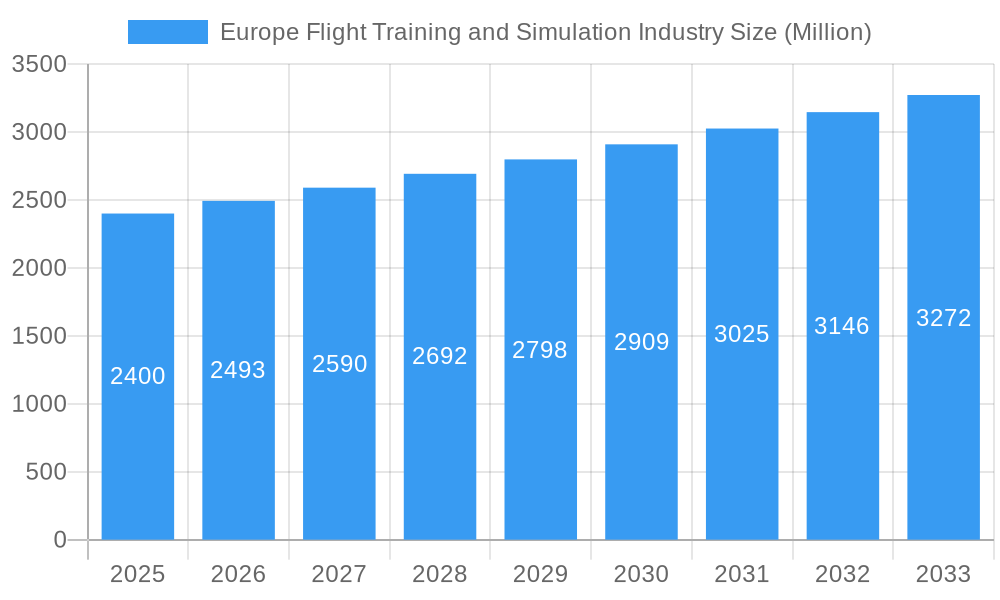

Europe Flight Training and Simulation Industry Company Market Share

Europe Flight Training and Simulation Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides an in-depth analysis of the European flight training and simulation industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a comprehensive study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report leverages extensive data analysis and expert insights to deliver a clear picture of market trends, opportunities, and challenges. The market is expected to reach xx Million by 2033, demonstrating robust growth potential.

Europe Flight Training and Simulation Industry Market Structure & Competitive Landscape

The European flight training and simulation market exhibits a moderately concentrated structure, with key players like CAE Inc, L3Harris Technologies Inc, and Boeing commanding significant market share. The industry is characterized by high barriers to entry due to substantial capital investment requirements for simulator development and certification. Innovation is driven by advancements in simulation technology, including the integration of artificial intelligence (AI), virtual reality (VR), and augmented reality (AR) to enhance training realism and effectiveness. Stringent regulatory frameworks, particularly from EASA (European Union Aviation Safety Agency), significantly impact market dynamics, influencing simulator design, certification processes, and training standards. Product substitutes, such as more traditional classroom training and less sophisticated simulation devices, are limited due to the growing demand for high-fidelity training for safety and operational efficiency. The end-user segment primarily comprises airlines, flight schools, military organizations, and pilot training academies. Recent years have witnessed a notable increase in mergers and acquisitions (M&A) activity, with xx Million in deal volume recorded between 2019-2024, reflecting industry consolidation and strategic expansion. The Herfindahl-Hirschman Index (HHI) for the market is estimated to be xx, indicating a moderately concentrated landscape.

- High Barriers to Entry: Significant capital investment, stringent certifications.

- Innovation Drivers: AI, VR/AR integration, advanced simulation software.

- Regulatory Impact: EASA regulations shape training standards and simulator design.

- End-User Segmentation: Airlines, flight schools, military, pilot training academies.

- M&A Activity: xx Million in deal volume (2019-2024), indicating industry consolidation.

Europe Flight Training and Simulation Industry Market Trends & Opportunities

The European flight training and simulation market is experiencing robust growth, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. The increasing demand for highly skilled pilots, driven by the expanding global aviation industry, is a major catalyst. Technological advancements, particularly in simulator fidelity and training methodologies, are enhancing training effectiveness and efficiency. Furthermore, the rising adoption of digital technologies is creating opportunities for innovative training solutions, such as cloud-based simulation platforms and personalized learning experiences. Airlines and flight schools are increasingly adopting full-flight simulators (FFS) and flight training devices (FTDs) to improve pilot proficiency and reduce training costs. The competitive landscape is becoming increasingly dynamic, with established players focusing on strategic partnerships and technological upgrades to maintain their market share. Market penetration rates for advanced simulation technologies are expected to increase significantly by 2033, reaching xx% for FFS and xx% for FTDs.

Dominant Markets & Segments in Europe Flight Training and Simulation Industry

The UK and Germany are currently the dominant markets within Europe, accounting for approximately xx% of the overall market share. Significant growth is also anticipated in France and other major aviation hubs. Within the training capability segment, fixed-wing training dominates, driven by a larger demand for commercial pilot training. However, the rotorcraft segment is also witnessing notable growth, stimulated by the rising popularity of helicopter services and defense applications. The full-flight simulator (FFS) segment holds the largest market share, with a strong preference for high-fidelity training among professional pilot training programs.

Key Growth Drivers:

- UK & Germany: Strong aviation infrastructure, established training institutions.

- Fixed-Wing Dominance: High demand for commercial pilot training.

- Rotorcraft Growth: Increasing helicopter services and defense applications.

- FFS Market Leadership: High-fidelity training needs among professional programs.

Detailed Analysis: The dominance of the UK and Germany is attributable to their established aviation sectors, robust regulatory frameworks, and a concentration of major airlines and flight schools. The growth in the rotorcraft segment is influenced by expanding emergency medical services (EMS), offshore oil and gas operations, and military aviation.

Europe Flight Training and Simulation Industry Product Analysis

The European flight training and simulation market showcases continuous innovation in simulator technology, resulting in increasingly realistic and immersive training environments. Recent advancements focus on improving visual fidelity, incorporating more sophisticated flight models, and enhancing haptic feedback to create more realistic pilot responses. The integration of AI and VR/AR is creating interactive training scenarios, thereby improving learning outcomes. The competitive advantage lies in the ability to provide high-fidelity simulations with cost-effective and flexible solutions tailored to the specific training needs of the end-users.

Key Drivers, Barriers & Challenges in Europe Flight Training and Simulation Industry

Key Drivers: The rising demand for skilled pilots, technological advancements in simulation technology, and government initiatives promoting aviation safety are driving the market. Specifically, increased air travel, the expansion of low-cost carriers, and growing military investment in aviation training are fueling growth.

Challenges: Regulatory hurdles, high capital investment requirements, and intense competition among established players pose significant challenges. Supply chain disruptions and the skilled labor shortage also affect market growth. The increased regulatory burden adds to the cost and complexity of bringing new simulators to the market, limiting entry of new players.

Growth Drivers in the Europe Flight Training and Simulation Industry Market

Increased air travel demand, technological advancements (AI, VR/AR), and government investments in aviation safety and training are key drivers. The rising need for highly skilled pilots further propels the market's growth.

Challenges Impacting Europe Flight Training and Simulation Industry Growth

Stringent regulatory approvals, high initial investment costs for simulators, and intense competition among established players impede growth. Furthermore, supply chain disruptions and skilled labor shortages present substantial obstacles.

Key Players Shaping the Europe Flight Training and Simulation Industry Market

Significant Europe Flight Training and Simulation Industry Industry Milestones

- 2021: CAE Inc. announces a significant investment in new generation flight simulators.

- 2022: L3Harris Technologies and Frasca International collaborate on a new training solution.

- 2023: Several new FTDs are certified by EASA, expanding training capacity. (Specific examples would need to be added here based on actual data)

Future Outlook for Europe Flight Training and Simulation Industry Market

The European flight training and simulation market is poised for continued growth, driven by technological advancements, the increasing demand for pilot training, and supportive regulatory frameworks. Strategic partnerships, innovation in training methodologies, and the expansion into new training markets will shape the future of the industry. Opportunities exist for companies specializing in immersive training environments, personalized learning experiences, and advanced simulation technologies. The market's potential remains significant, with further expansion expected across various segments.

Europe Flight Training and Simulation Industry Segmentation

-

1. Simulator Type

- 1.1. Full Flight Simulator (FFS)

- 1.2. Flight Training Devices (FTD)

-

2. Training Capability

- 2.1. Rotorcraft

- 2.2. Fixed-Wing

Europe Flight Training and Simulation Industry Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Poland

- 5. Spain

- 6. Italy

- 7. Rest of Europe

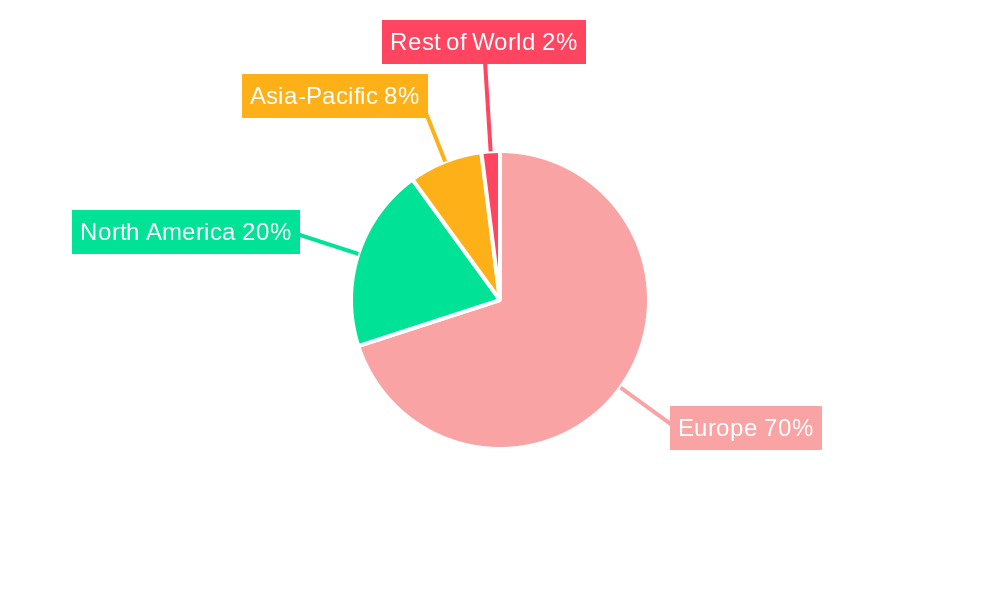

Europe Flight Training and Simulation Industry Regional Market Share

Geographic Coverage of Europe Flight Training and Simulation Industry

Europe Flight Training and Simulation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Fixed-wing to Dominate Market Share during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Flight Training and Simulation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Simulator Type

- 5.1.1. Full Flight Simulator (FFS)

- 5.1.2. Flight Training Devices (FTD)

- 5.2. Market Analysis, Insights and Forecast - by Training Capability

- 5.2.1. Rotorcraft

- 5.2.2. Fixed-Wing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Poland

- 5.3.5. Spain

- 5.3.6. Italy

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Simulator Type

- 6. United Kingdom Europe Flight Training and Simulation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Simulator Type

- 6.1.1. Full Flight Simulator (FFS)

- 6.1.2. Flight Training Devices (FTD)

- 6.2. Market Analysis, Insights and Forecast - by Training Capability

- 6.2.1. Rotorcraft

- 6.2.2. Fixed-Wing

- 6.1. Market Analysis, Insights and Forecast - by Simulator Type

- 7. France Europe Flight Training and Simulation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Simulator Type

- 7.1.1. Full Flight Simulator (FFS)

- 7.1.2. Flight Training Devices (FTD)

- 7.2. Market Analysis, Insights and Forecast - by Training Capability

- 7.2.1. Rotorcraft

- 7.2.2. Fixed-Wing

- 7.1. Market Analysis, Insights and Forecast - by Simulator Type

- 8. Germany Europe Flight Training and Simulation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Simulator Type

- 8.1.1. Full Flight Simulator (FFS)

- 8.1.2. Flight Training Devices (FTD)

- 8.2. Market Analysis, Insights and Forecast - by Training Capability

- 8.2.1. Rotorcraft

- 8.2.2. Fixed-Wing

- 8.1. Market Analysis, Insights and Forecast - by Simulator Type

- 9. Poland Europe Flight Training and Simulation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Simulator Type

- 9.1.1. Full Flight Simulator (FFS)

- 9.1.2. Flight Training Devices (FTD)

- 9.2. Market Analysis, Insights and Forecast - by Training Capability

- 9.2.1. Rotorcraft

- 9.2.2. Fixed-Wing

- 9.1. Market Analysis, Insights and Forecast - by Simulator Type

- 10. Spain Europe Flight Training and Simulation Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Simulator Type

- 10.1.1. Full Flight Simulator (FFS)

- 10.1.2. Flight Training Devices (FTD)

- 10.2. Market Analysis, Insights and Forecast - by Training Capability

- 10.2.1. Rotorcraft

- 10.2.2. Fixed-Wing

- 10.1. Market Analysis, Insights and Forecast - by Simulator Type

- 11. Italy Europe Flight Training and Simulation Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Simulator Type

- 11.1.1. Full Flight Simulator (FFS)

- 11.1.2. Flight Training Devices (FTD)

- 11.2. Market Analysis, Insights and Forecast - by Training Capability

- 11.2.1. Rotorcraft

- 11.2.2. Fixed-Wing

- 11.1. Market Analysis, Insights and Forecast - by Simulator Type

- 12. Rest of Europe Europe Flight Training and Simulation Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Simulator Type

- 12.1.1. Full Flight Simulator (FFS)

- 12.1.2. Flight Training Devices (FTD)

- 12.2. Market Analysis, Insights and Forecast - by Training Capability

- 12.2.1. Rotorcraft

- 12.2.2. Fixed-Wing

- 12.1. Market Analysis, Insights and Forecast - by Simulator Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 L3Harris Technologies Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Frasca International Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 FLYIT Simulators Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 ELITE Simulation Solutions AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 RTX Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ALSIM EMEA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 CAE Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Multi Pilot Simulations BV

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Thale

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 TRU Simulation + Training Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 FlightSafety International Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 The Boeing Company

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Europe Flight Training and Simulation Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Flight Training and Simulation Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 2: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Training Capability 2020 & 2033

- Table 3: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 5: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Training Capability 2020 & 2033

- Table 6: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 8: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Training Capability 2020 & 2033

- Table 9: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 11: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Training Capability 2020 & 2033

- Table 12: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 14: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Training Capability 2020 & 2033

- Table 15: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 17: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Training Capability 2020 & 2033

- Table 18: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 20: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Training Capability 2020 & 2033

- Table 21: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 23: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Training Capability 2020 & 2033

- Table 24: Europe Flight Training and Simulation Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Flight Training and Simulation Industry?

The projected CAGR is approximately 3.81%.

2. Which companies are prominent players in the Europe Flight Training and Simulation Industry?

Key companies in the market include L3Harris Technologies Inc, Frasca International Inc, FLYIT Simulators Inc, ELITE Simulation Solutions AG, RTX Corporation, ALSIM EMEA, CAE Inc, Multi Pilot Simulations BV, Thale, TRU Simulation + Training Inc, FlightSafety International Inc, The Boeing Company.

3. What are the main segments of the Europe Flight Training and Simulation Industry?

The market segments include Simulator Type, Training Capability.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Fixed-wing to Dominate Market Share during the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Flight Training and Simulation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Flight Training and Simulation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Flight Training and Simulation Industry?

To stay informed about further developments, trends, and reports in the Europe Flight Training and Simulation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence