Key Insights

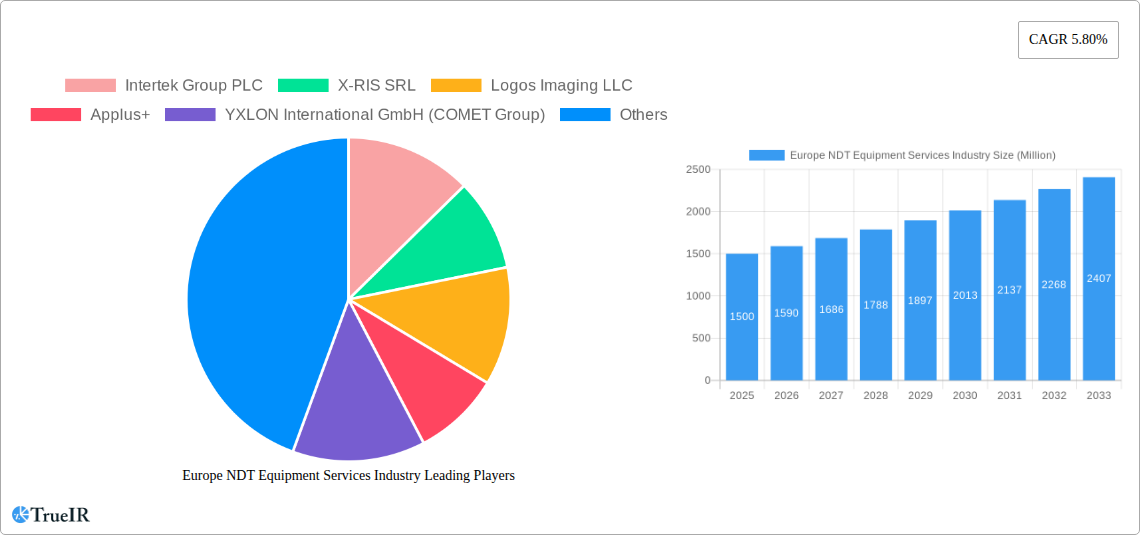

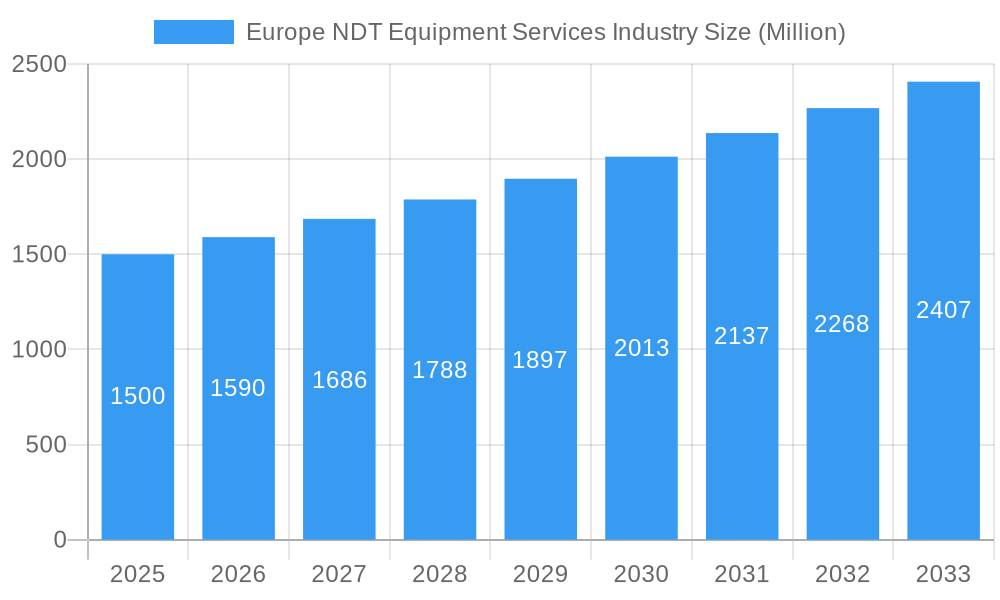

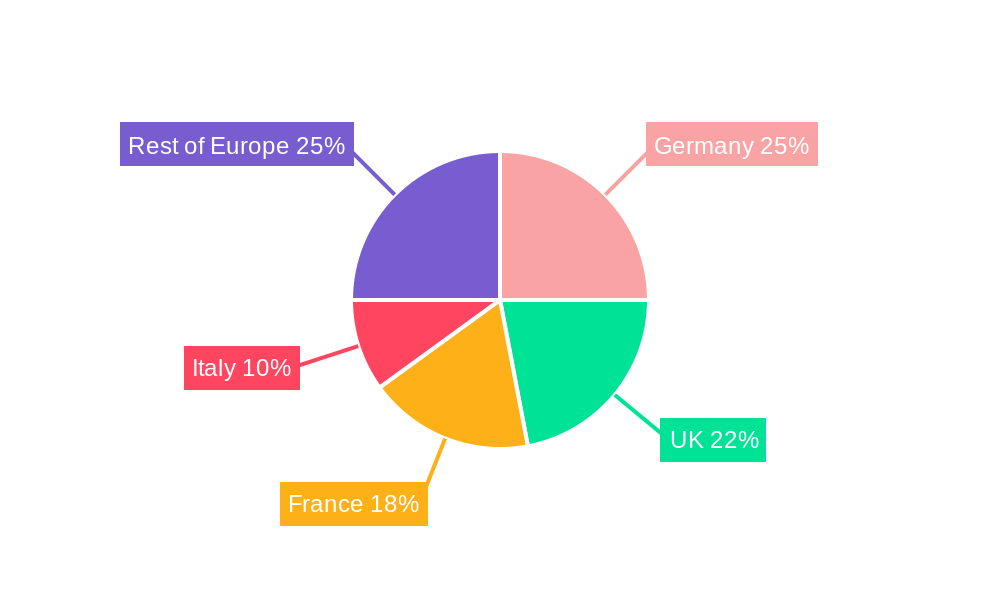

The European Non-Destructive Testing (NDT) equipment and services market is experiencing robust growth, driven by increasing demand across key sectors like oil and gas, aerospace, and automotive. A compound annual growth rate (CAGR) of 5.80% from 2019 to 2024 suggests a significant market expansion. This growth is fueled by stricter safety regulations, the need for improved infrastructure maintenance, and the rising adoption of advanced NDT technologies like radiography, ultrasonic testing, and phased array techniques. The market is segmented by equipment (e.g., portable X-ray systems, ultrasonic flaw detectors) and services (e.g., inspection, training, and certification). The significant presence of major players like Intertek, Applus+, and YXLON indicates a competitive landscape with established players and niche technology providers vying for market share. Germany, the UK, and France represent the largest national markets within Europe, reflecting their strong industrial base and regulatory frameworks. Future growth will likely be influenced by factors such as technological advancements in NDT, increased investment in infrastructure projects, and government initiatives promoting safety and quality control. While economic fluctuations and potential supply chain disruptions could pose challenges, the overall outlook for the European NDT market remains positive. The adoption of automation and digitalization within NDT processes, including data analytics and remote inspection capabilities, promises further market expansion in the coming years. The consistent demand for inspection and maintenance across existing infrastructure, coupled with large-scale infrastructure projects planned within the region, fuels the ongoing growth trajectory.

Europe NDT Equipment Services Industry Market Size (In Billion)

The competitive landscape is marked by a mix of multinational corporations and specialized service providers. The presence of numerous companies underscores the market's maturity and the diverse range of services offered. Future market dynamics will be shaped by the evolution of NDT technologies, the increasing demand for faster and more accurate inspection methods, and the continued focus on safety and compliance across various industries. The market is expected to witness increased adoption of advanced technologies that improve efficiency and reduce inspection time, further stimulating growth. The integration of artificial intelligence (AI) and machine learning (ML) within NDT processes holds immense potential to enhance the accuracy and automation of inspections. This would lead to a shift in the services segment, favoring providers with advanced technological capabilities and data analytics expertise. Geographical expansion within the European region will continue, with growing demand expected from countries beyond the major economies.

Europe NDT Equipment Services Industry Company Market Share

Europe NDT Equipment Services Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the European Non-Destructive Testing (NDT) equipment and services market, covering the period 2019-2033. It offers invaluable insights into market structure, competitive dynamics, growth drivers, and future opportunities, making it an essential resource for industry professionals, investors, and strategic decision-makers. The report leverages extensive data analysis and incorporates detailed forecasts to provide a clear understanding of this dynamic market.

Europe NDT Equipment Services Industry Market Structure & Competitive Landscape

The European NDT equipment and services market is moderately concentrated, with several major players and a multitude of smaller, specialized firms. The market structure is characterized by a mix of multinational corporations and regional specialists, each catering to specific niches within the NDT landscape. The top 10 players (Intertek Group PLC, X-RIS SRL, Logos Imaging LLC, Applus+, YXLON International GmbH, Teledyne ICM, Novo DR Ltd, SAS novup (VisioConsult), Zetec Inc, 3DX-RAY Ltd) account for an estimated xx% of the total market revenue in 2025.

Key Aspects of the Market Structure:

- High Barriers to Entry: Significant capital investment and expertise are required to enter the market.

- Innovation Drivers: Continuous advancements in testing technologies, automation, and data analysis are driving market growth.

- Regulatory Impacts: Stringent safety regulations and industry standards influence the adoption of NDT techniques and equipment.

- Product Substitutes: Limited direct substitutes exist, but cost-effective alternatives and technological improvements pose competitive pressures.

- End-User Segmentation: The market is segmented by diverse end-user industries including oil & gas, aerospace, automotive, and construction, each with specific NDT requirements.

- M&A Trends: Consolidation through mergers and acquisitions (M&A) is expected to continue, with larger players seeking to expand their market share and capabilities. Estimated M&A volume in the historical period (2019-2024) totaled approximately xx Million EUR.

Europe NDT Equipment Services Industry Market Trends & Opportunities

The European NDT equipment and services market is projected to witness robust growth during the forecast period (2025-2033), driven by several key factors. The market size is estimated at xx Million EUR in 2025, and is projected to reach xx Million EUR by 2033, exhibiting a CAGR of xx%. This growth is fueled by increasing infrastructure development, stringent safety regulations, rising demand for quality assurance and control across various industries, and the adoption of advanced NDT technologies. Technological shifts towards automation, AI-powered analysis, and improved data management systems are transforming industry practices. Consumer preferences are increasingly focused on faster, more accurate, and cost-effective NDT solutions.

The competitive landscape is characterized by both intense competition and opportunities for collaboration. Larger companies are investing in R&D to develop innovative solutions, while smaller companies are focusing on niche market segments. Market penetration rates for advanced technologies like phased array ultrasonic testing and digital radiography are steadily increasing.

Dominant Markets & Segments in Europe NDT Equipment Services Industry

The UK, Germany, and France represent the largest national markets within Europe, accounting for an estimated xx% of the total regional market in 2025. The Oil & Gas and Power & Energy sectors are the dominant end-user industries, driving a significant portion of the demand for NDT services and equipment. Ultrasonic testing and radiography remain the most widely used testing technologies, however, the adoption of other methods such as magnetic particle testing and liquid penetrant testing remains steady.

Key Growth Drivers:

- Robust infrastructure development projects: Extensive investments in infrastructure across Europe are stimulating demand for NDT services.

- Stringent safety regulations: Stricter regulations in multiple sectors necessitate comprehensive NDT procedures.

- Technological advancements: Ongoing improvements in NDT equipment and software enhance inspection efficiency and accuracy.

- Rising awareness of quality control: The increasing focus on quality assurance and control across various industries fuels market expansion.

Market Dominance Analysis:

The Oil & Gas sector's demand for NDT services is primarily driven by the need for regular inspections and maintenance of pipelines, refineries, and offshore platforms. Similarly, the Power & Energy sector relies heavily on NDT for ensuring the integrity of power plants and transmission lines. The UK's strong presence in both sectors contributes to its dominance as a leading national market. Germany benefits from a strong manufacturing base and robust automotive sector, driving demand for advanced NDT solutions. France's substantial nuclear power sector contributes considerably to its market share within the country.

Europe NDT Equipment Services Industry Product Analysis

The European NDT market offers a broad range of products and services, from traditional techniques like liquid penetrant testing to advanced technologies such as phased array ultrasonic testing (PAUT) and digital radiography (DR). Recent product innovations focus on enhancing portability, automation, and data analysis capabilities. Competitive advantages are derived from the combination of advanced technology, comprehensive service offerings, and strong customer relationships. Market fit is determined by factors like cost-effectiveness, ease of use, inspection speed, and data analysis features.

Key Drivers, Barriers & Challenges in Europe NDT Equipment Services Industry

Key Drivers:

Stringent regulatory compliance requirements for safety and quality across various industries are the primary drivers. Technological innovations, like automated systems and AI-driven data analysis, improve testing efficiency and accuracy, attracting higher demand. Growth in infrastructure projects, especially renewable energy and transportation, further fuels market expansion.

Challenges and Restraints:

High initial investment costs for advanced equipment can hinder adoption, especially amongst smaller companies. Supply chain disruptions, especially in the procurement of specialized components, impact production and delivery timelines. Skilled labor shortages present a challenge for businesses across Europe, impacting operational efficiency and market growth. Regulatory compliance across different European countries can create administrative hurdles for companies operating across borders. Intense competition among both established and emerging players creates pressure on profit margins.

Growth Drivers in the Europe NDT Equipment Services Industry Market

The market is propelled by growing demand for quality assurance and control across numerous sectors (Oil & Gas, Power Generation, Aerospace). Stricter safety regulations across Europe mandate enhanced inspection procedures. Technological advancements such as PAUT, DR, and advanced data analytics improve testing speed and accuracy.

Challenges Impacting Europe NDT Equipment Services Industry Growth

The market faces challenges including high equipment costs, skilled labor shortages, and regulatory complexities varying across different European nations. Supply chain disruptions related to component sourcing for specialized NDT equipment cause delays and increased costs. Competition from low-cost providers from outside Europe puts downward pressure on pricing.

Key Players Shaping the Europe NDT Equipment Services Industry Market

- Intertek Group PLC

- X-RIS SRL

- Logos Imaging LLC

- Applus+

- YXLON International GmbH (COMET Group)

- Teledyne ICM

- Novo DR Ltd

- SAS novup (VisioConsult)

- Zetec Inc

- 3DX-RAY Ltd (Image Scan Holdings Plc)

- Scanna MSC

- GE Measurement and Control

- Bureau Veritas

Significant Europe NDT Equipment Services Industry Industry Milestones

- 2020: Increased adoption of remote NDT inspection technologies due to pandemic restrictions.

- 2021: Several major players announced significant investments in R&D for AI-powered NDT solutions.

- 2022: New regulations on pipeline integrity inspection came into effect in several European countries.

- 2023: Several strategic mergers and acquisitions took place, consolidating the market landscape.

Future Outlook for Europe NDT Equipment Services Industry Market

The European NDT equipment and services market is poised for continued growth, driven by technological advancements, rising regulatory requirements, and increasing investments in infrastructure. Strategic opportunities exist for companies that can leverage digitalization, automation, and advanced data analytics to offer efficient and cost-effective solutions. The market's potential is significant, with further expansion expected across various sectors and countries.

Europe NDT Equipment Services Industry Segmentation

-

1. Type

- 1.1. Equipment

- 1.2. Services

-

2. Testing Technology

- 2.1. Radiography

- 2.2. Ultrasonic

- 2.3. Magnetic Particle

- 2.4. Liquid Penetrant

- 2.5. Visual Inspection

- 2.6. Other Technologies

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Power and Energy

- 3.3. Aerospace and Defense

- 3.4. Automotive and Transportation

- 3.5. Construction

- 3.6. Other End-user Industries

Europe NDT Equipment Services Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe NDT Equipment Services Industry Regional Market Share

Geographic Coverage of Europe NDT Equipment Services Industry

Europe NDT Equipment Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Stringent Regulations Mandating Safety Standards

- 3.3. Market Restrains

- 3.3.1. ; Lack of Skilled Personnel and Training Facilities

- 3.4. Market Trends

- 3.4.1. Increasing Investment in Aerospace and Defense

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe NDT Equipment Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Testing Technology

- 5.2.1. Radiography

- 5.2.2. Ultrasonic

- 5.2.3. Magnetic Particle

- 5.2.4. Liquid Penetrant

- 5.2.5. Visual Inspection

- 5.2.6. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Power and Energy

- 5.3.3. Aerospace and Defense

- 5.3.4. Automotive and Transportation

- 5.3.5. Construction

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intertek Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 X-RIS SRL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Logos Imaging LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Applus+

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 YXLON International GmbH (COMET Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teledyne ICM

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Novo DR Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAS novup (VisioConsult)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zetec Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 3DX-RAY Ltd (Image Scan Holdings Plc)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Scanna MSC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GE Measurement and Control

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Bureau Veritas*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Intertek Group PLC

List of Figures

- Figure 1: Europe NDT Equipment Services Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe NDT Equipment Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Testing Technology 2020 & 2033

- Table 3: Europe NDT Equipment Services Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Testing Technology 2020 & 2033

- Table 7: Europe NDT Equipment Services Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: France Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe NDT Equipment Services Industry?

The projected CAGR is approximately 7.97%.

2. Which companies are prominent players in the Europe NDT Equipment Services Industry?

Key companies in the market include Intertek Group PLC, X-RIS SRL, Logos Imaging LLC, Applus+, YXLON International GmbH (COMET Group), Teledyne ICM, Novo DR Ltd, SAS novup (VisioConsult), Zetec Inc, 3DX-RAY Ltd (Image Scan Holdings Plc), Scanna MSC, GE Measurement and Control, Bureau Veritas*List Not Exhaustive.

3. What are the main segments of the Europe NDT Equipment Services Industry?

The market segments include Type, Testing Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Stringent Regulations Mandating Safety Standards.

6. What are the notable trends driving market growth?

Increasing Investment in Aerospace and Defense.

7. Are there any restraints impacting market growth?

; Lack of Skilled Personnel and Training Facilities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe NDT Equipment Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe NDT Equipment Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe NDT Equipment Services Industry?

To stay informed about further developments, trends, and reports in the Europe NDT Equipment Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence