Key Insights

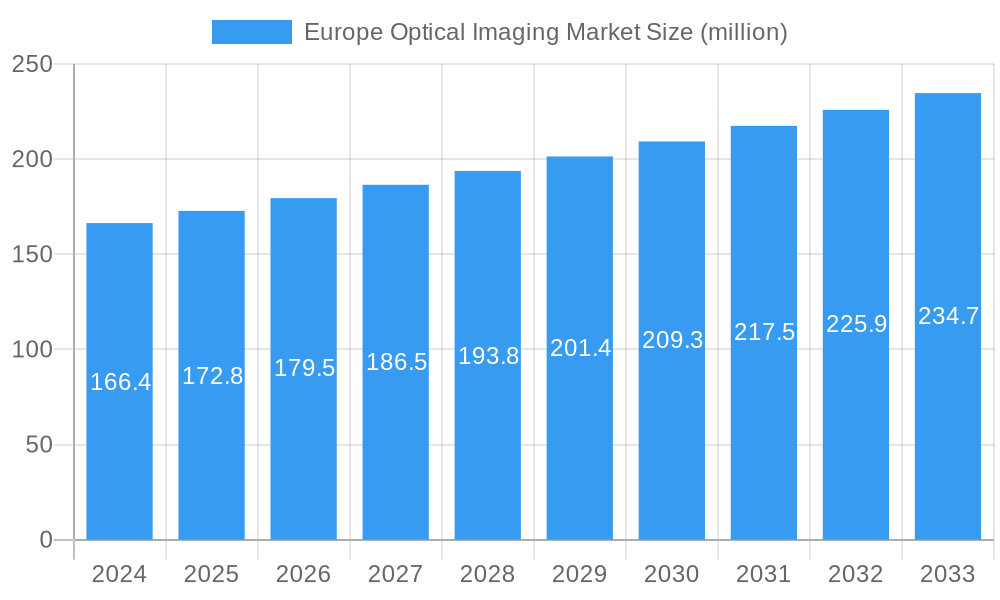

The European optical imaging market is poised for significant expansion, projected to reach $166.4 million in 2024, with a Compound Annual Growth Rate (CAGR) of 3.9% anticipated through 2033. This robust growth is fueled by advancements in imaging technologies such as Photoacoustic Tomography, Optical Coherence Tomography, and Hyperspectral Imaging, which are revolutionizing diagnostics and treatment across various medical disciplines. The increasing prevalence of chronic diseases like cancer, cardiovascular conditions, and neurological disorders is driving the demand for sophisticated imaging solutions that offer higher resolution, deeper tissue penetration, and non-invasive visualization capabilities. Furthermore, the growing emphasis on early disease detection and personalized medicine is accelerating the adoption of advanced optical imaging systems by healthcare providers, research institutions, and pharmaceutical companies.

Europe Optical Imaging Market Market Size (In Million)

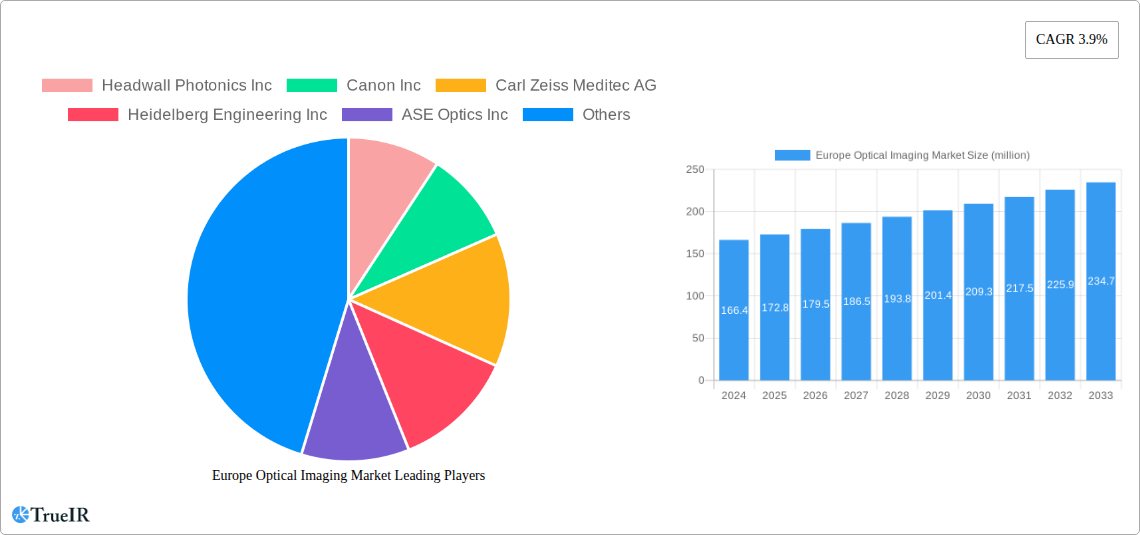

The market's expansion is further propelled by key trends including the integration of artificial intelligence and machine learning for enhanced image analysis, the development of portable and cost-effective imaging devices, and the increasing use of optical imaging in pathological and intraoperative settings for more precise surgical guidance and diagnosis. While the market enjoys strong growth drivers, potential restraints such as the high initial cost of advanced systems and the need for specialized training for their operation could pose challenges. However, the continuous innovation in product offerings, including advanced imaging systems, high-resolution cameras, and specialized optical imaging software, alongside a strong presence of key players like Canon Inc., Carl Zeiss Meditec AG, and Heidelberg Engineering Inc., ensures a dynamic and competitive landscape. Hospitals and clinics, alongside research and diagnostic laboratories, represent the dominant end-user segments, reflecting the critical role of optical imaging in both clinical practice and scientific discovery within Europe.

Europe Optical Imaging Market Company Market Share

This in-depth report provides a detailed analysis of the Europe Optical Imaging Market, covering market structure, trends, opportunities, dominant segments, product innovations, key drivers, barriers, and the competitive landscape. With a study period from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report offers critical insights for stakeholders seeking to understand and capitalize on the evolving dynamics of optical imaging across Europe. The market is projected to reach a valuation of XX million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

Europe Optical Imaging Market Market Structure & Competitive Landscape

The Europe Optical Imaging Market exhibits a moderately consolidated structure, characterized by the presence of both established multinational corporations and emerging specialized players. Innovation serves as a primary driver of market concentration, with companies continuously investing in research and development to introduce advanced technologies and applications. Regulatory impacts, particularly from entities like the European Medicines Agency (EMA) and national health authorities, significantly influence product approvals and market access, fostering a landscape where compliance and efficacy are paramount. Product substitutes, while present in some lower-end applications, are largely unable to replicate the precision and diagnostic capabilities offered by advanced optical imaging systems.

The end-user segmentation is diverse, with hospitals and clinics representing the largest segment due to the increasing adoption of optical imaging in diagnostic and therapeutic procedures. Research and diagnostic laboratories also play a crucial role, driving innovation and early adoption of new technologies. Mergers and acquisitions (M&A) trends are moderately active, with larger players strategically acquiring smaller, innovative companies to expand their product portfolios and technological capabilities. For instance, the period between 2019 and 2024 witnessed approximately XX significant M&A deals valued at over XX million, indicating a strategic consolidation phase. The competitive intensity is high, driven by the pursuit of technological superiority and a growing demand for minimally invasive diagnostic tools.

Europe Optical Imaging Market Market Trends & Opportunities

The Europe Optical Imaging Market is poised for significant expansion, driven by an confluence of technological advancements, increasing healthcare expenditure, and a growing emphasis on early disease detection and personalized medicine. The market size is projected to grow from an estimated XX million in 2025 to XX million by 2033, with a robust CAGR of XX%. Technological shifts are at the forefront of this growth, with innovations in areas like AI-powered image analysis, miniaturization of imaging devices, and the integration of multi-modal imaging techniques significantly enhancing diagnostic accuracy and efficiency. Optical Coherence Tomography (OCT) continues to dominate, particularly in ophthalmology, while Photoacoustic Tomography (PAT) and Hyperspectral Imaging are gaining traction for their ability to provide functional and molecular information.

Consumer preferences are increasingly leaning towards less invasive diagnostic procedures, fueling the demand for advanced optical imaging solutions. This shift is further supported by a rising awareness of the benefits of early disease detection in improving patient outcomes and reducing long-term healthcare costs. The competitive dynamics within the market are intensifying, with companies focusing on developing user-friendly interfaces, cloud-based data management solutions, and integrated platforms that streamline workflows for healthcare professionals. Opportunities abound for companies that can offer cost-effective, high-performance optical imaging systems tailored to specific clinical needs. The increasing prevalence of chronic diseases, such as cancer and cardiovascular disorders, further amplifies the market's potential, as optical imaging plays a vital role in their diagnosis, staging, and monitoring. The growing adoption of point-of-care diagnostics also presents a significant growth avenue for portable and user-friendly optical imaging devices.

Dominant Markets & Segments in Europe Optical Imaging Market

The Europe Optical Imaging Market is characterized by regional variations in adoption and technological preference. Ophthalmology currently stands as the most dominant application area, driven by the widespread use of Optical Coherence Tomography (OCT) for diagnosing and managing a spectrum of retinal diseases, including age-related macular degeneration, diabetic retinopathy, and glaucoma. Countries like Germany, the United Kingdom, and France are leading the market in terms of adoption and expenditure, owing to their advanced healthcare infrastructures, high disposable incomes, and a strong focus on research and development.

Technology:

- Optical Coherence Tomography (OCT): Continues to dominate due to its high resolution and non-invasive nature, particularly in ophthalmology and dermatology.

- Hyperspectral Imaging: Showing significant growth potential in oncology and pathology for its ability to differentiate tissue types and detect microscopic abnormalities.

- Near-Infrared Spectroscopy (NIRS): Gaining traction in cardiology and neurology for real-time physiological monitoring.

- Photoacoustic Tomography (PAT): Emerging as a powerful tool for deep tissue imaging, with increasing applications in oncology and drug discovery.

Product:

- Imaging Systems: The largest segment, encompassing a wide range of devices from compact handheld units to sophisticated laboratory-grade systems.

- Cameras: High-resolution, specialized optical cameras are crucial components driving innovation across various imaging modalities.

Application Areas:

- Ophthalmology: Remains the primary driver, accounting for an estimated XX% of the market share.

- Oncology: Experiencing rapid growth due to the demand for precise tumor detection and margin assessment.

- Cardiology: Growing adoption for non-invasive assessment of cardiac function and blood flow.

Application:

- Pathological Imaging: Essential for research and diagnostic laboratories to analyze tissue samples with cellular-level detail.

- Intraoperative Imaging: Increasingly utilized in surgical settings for real-time guidance and enhanced precision.

End-User Industry:

- Hospitals and Clinics: The largest end-user segment, driven by the integration of optical imaging into routine clinical practice.

- Research and Diagnostic Laboratories: Play a pivotal role in driving innovation and validating new technologies.

- Pharmaceutical Industry: Leverages optical imaging for preclinical research, drug development, and efficacy testing.

Policies supporting medical device innovation and the increasing burden of age-related and chronic diseases are significant growth drivers. The presence of leading market players with strong R&D capabilities further solidifies the dominance of these segments.

Europe Optical Imaging Market Product Analysis

Product innovation in the Europe Optical Imaging Market is primarily focused on enhancing resolution, speed, portability, and the integration of advanced analytical capabilities. Imaging Systems are evolving with higher magnification and multi-spectral capabilities, allowing for more detailed pathological imaging and intraoperative guidance. Optical Imaging Software is increasingly incorporating artificial intelligence (AI) and machine learning algorithms for automated image analysis, quantitative measurements, and predictive diagnostics, significantly improving diagnostic accuracy and efficiency. Cameras are becoming more sensitive and compact, enabling point-of-care applications and improved visualization in challenging environments. These advancements are crucial for addressing unmet needs in ophthalmology, oncology, cardiology, and dermatology, offering competitive advantages through superior diagnostic performance and improved patient outcomes.

Key Drivers, Barriers & Challenges in Europe Optical Imaging Market

Key Drivers:

The Europe Optical Imaging Market is propelled by several key factors. Technological advancements, particularly in areas like AI-driven image analysis and miniaturization of devices, are driving innovation and expanding application scope. The increasing prevalence of chronic diseases such as cancer and cardiovascular disorders necessitates early and accurate diagnosis, a role where optical imaging excels. Growing healthcare expenditure across European nations, coupled with a rising awareness of the benefits of minimally invasive diagnostic procedures, further fuels market growth. Government initiatives supporting medical research and device innovation also contribute significantly.

Key Barriers & Challenges:

Despite strong growth potential, the market faces several challenges. High initial investment costs for advanced optical imaging systems can be a barrier for smaller healthcare facilities. Stringent regulatory approval processes for new medical devices across different European countries can lead to extended market entry timelines. The need for specialized training and skilled personnel to operate and interpret complex optical imaging data also presents a hurdle. Supply chain disruptions and the reliance on components from global suppliers can impact production and availability. Furthermore, the emergence of alternative diagnostic technologies poses a competitive pressure, requiring continuous innovation to maintain market relevance.

Growth Drivers in the Europe Optical Imaging Market Market

The Europe Optical Imaging Market is experiencing robust growth driven by significant technological advancements, particularly in developing advanced imaging modalities and sophisticated analytical software. The increasing burden of chronic diseases, including cancer, ophthalmological conditions, and cardiovascular diseases, creates a sustained demand for precise and early diagnostic tools, a niche perfectly filled by optical imaging. Favorable reimbursement policies in many European countries for diagnostic procedures and a growing healthcare expenditure further bolster market expansion. Government initiatives promoting medical innovation and the adoption of cutting-edge healthcare technologies also act as crucial growth catalysts.

Challenges Impacting Europe Optical Imaging Market Growth

Several challenges are impacting the growth trajectory of the Europe Optical Imaging Market. The high cost associated with cutting-edge optical imaging systems can present a significant barrier to adoption for smaller healthcare providers and in resource-limited settings. The complex and varied regulatory landscape across European nations necessitates rigorous compliance procedures, potentially delaying product launches. The requirement for specialized training for healthcare professionals to effectively operate and interpret the sophisticated data generated by these systems can also be a limiting factor. Furthermore, competition from established diagnostic imaging modalities and the potential for supply chain disruptions in a globalized market add to the growth impediments.

Key Players Shaping the Europe Optical Imaging Market Market

- Headwall Photonics Inc

- Canon Inc

- Carl Zeiss Meditec AG

- Heidelberg Engineering Inc

- ASE Optics Inc

- Cytoviva Inc

- Agfa-Gevaert NV

- Topcon Corporation

- Optovue Inc

- Bioptigen Inc

- Perkinelmer Inc

- ChemImage Corporation

Significant Europe Optical Imaging Market Industry Milestones

- 2019: Launch of advanced AI-powered image analysis software for ophthalmology, significantly improving diagnostic speed and accuracy.

- 2020: Introduction of a compact, portable hyperspectral imaging device for early skin cancer detection, expanding its application in dermatology.

- 2021: Major acquisition of a specialized photoacoustic tomography technology company by a leading medical device manufacturer, indicating industry consolidation and strategic focus.

- 2022: Development of a novel intraoperative optical imaging system for neurosurgery, enhancing precision and reducing surgical risks.

- 2023: Regulatory approval of a new generation of OCT devices with enhanced resolution and speed, further solidifying its dominance in ophthalmology.

- 2024 (early): Strategic partnership formed between a leading optical imaging company and a major pharmaceutical firm to accelerate drug development through advanced imaging techniques.

Future Outlook for Europe Optical Imaging Market Market

The future outlook for the Europe Optical Imaging Market is exceptionally bright, characterized by sustained innovation and expanding applications. The market is poised to witness a surge in the integration of artificial intelligence and machine learning, leading to more autonomous and predictive diagnostic capabilities. Miniaturization and the development of cost-effective solutions will drive adoption in point-of-care settings and smaller clinics, democratizing access to advanced imaging. Growth will be particularly strong in oncology, cardiology, and neurology, as optical imaging continues to prove its value in early detection, precise staging, and minimally invasive interventions. Opportunities will also arise from the increasing demand for personalized medicine and the growing role of optical imaging in therapeutic drug monitoring and development.

Europe Optical Imaging Market Segmentation

-

1. Technology

- 1.1. Photoacoustic Tomography

- 1.2. Optical Coherence Tomography

- 1.3. Hyperspectral Imaging

- 1.4. Near-Infrared Spectroscopy

- 1.5. Others

-

2. Product

- 2.1. Imaging Systems

- 2.2. Illumination Systems

- 2.3. Optical Imaging Software

- 2.4. Cameras

- 2.5. Others

-

3. Application Areas

- 3.1. Ophthalmology

- 3.2. Oncology

- 3.3. Cardiology

- 3.4. Dermatology

- 3.5. Neurology

- 3.6. Others

-

4. Application

- 4.1. Pathological Imaging

- 4.2. Intraoperative Imaging

-

5. End-User Industry

- 5.1. Hospitals and Clinics

- 5.2. Research and Diagnostic Laboratories

- 5.3. Pharmaceutical Industry

- 5.4. Biotechnology Companies

- 5.5. Others

Europe Optical Imaging Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

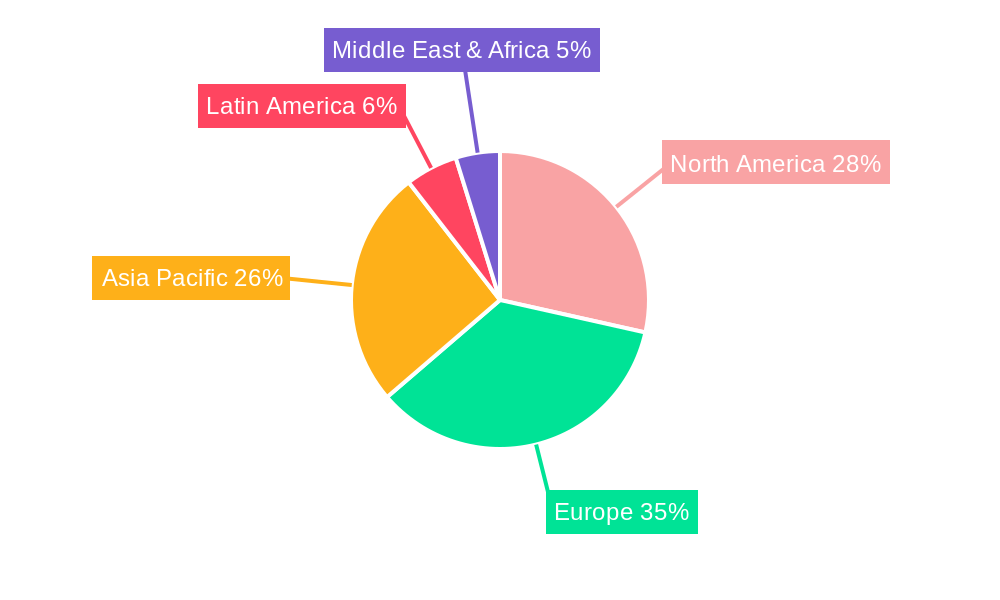

Europe Optical Imaging Market Regional Market Share

Geographic Coverage of Europe Optical Imaging Market

Europe Optical Imaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Demand for ophthalmology; Advancements in technology

- 3.3. Market Restrains

- 3.3.1. ; High Initial cost of the equipment

- 3.4. Market Trends

- 3.4.1. Ophthalmology Segment is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Optical Imaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Photoacoustic Tomography

- 5.1.2. Optical Coherence Tomography

- 5.1.3. Hyperspectral Imaging

- 5.1.4. Near-Infrared Spectroscopy

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Imaging Systems

- 5.2.2. Illumination Systems

- 5.2.3. Optical Imaging Software

- 5.2.4. Cameras

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Application Areas

- 5.3.1. Ophthalmology

- 5.3.2. Oncology

- 5.3.3. Cardiology

- 5.3.4. Dermatology

- 5.3.5. Neurology

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Pathological Imaging

- 5.4.2. Intraoperative Imaging

- 5.5. Market Analysis, Insights and Forecast - by End-User Industry

- 5.5.1. Hospitals and Clinics

- 5.5.2. Research and Diagnostic Laboratories

- 5.5.3. Pharmaceutical Industry

- 5.5.4. Biotechnology Companies

- 5.5.5. Others

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Headwall Photonics Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Canon Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Carl Zeiss Meditec AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Heidelberg Engineering Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ASE Optics Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cytoviva Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Agfa-Gevaert NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Topcon Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Optovue Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bioptigen Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Perkinelmer Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ChemImage Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Headwall Photonics Inc

List of Figures

- Figure 1: Europe Optical Imaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Optical Imaging Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Optical Imaging Market Revenue million Forecast, by Technology 2020 & 2033

- Table 2: Europe Optical Imaging Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Europe Optical Imaging Market Revenue million Forecast, by Product 2020 & 2033

- Table 4: Europe Optical Imaging Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 5: Europe Optical Imaging Market Revenue million Forecast, by Application Areas 2020 & 2033

- Table 6: Europe Optical Imaging Market Volume K Unit Forecast, by Application Areas 2020 & 2033

- Table 7: Europe Optical Imaging Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Europe Optical Imaging Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Europe Optical Imaging Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 10: Europe Optical Imaging Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 11: Europe Optical Imaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 12: Europe Optical Imaging Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 13: Europe Optical Imaging Market Revenue million Forecast, by Technology 2020 & 2033

- Table 14: Europe Optical Imaging Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 15: Europe Optical Imaging Market Revenue million Forecast, by Product 2020 & 2033

- Table 16: Europe Optical Imaging Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 17: Europe Optical Imaging Market Revenue million Forecast, by Application Areas 2020 & 2033

- Table 18: Europe Optical Imaging Market Volume K Unit Forecast, by Application Areas 2020 & 2033

- Table 19: Europe Optical Imaging Market Revenue million Forecast, by Application 2020 & 2033

- Table 20: Europe Optical Imaging Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Europe Optical Imaging Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 22: Europe Optical Imaging Market Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 23: Europe Optical Imaging Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Europe Optical Imaging Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: United Kingdom Europe Optical Imaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Europe Optical Imaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Germany Europe Optical Imaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Germany Europe Optical Imaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Europe Optical Imaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: France Europe Optical Imaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Europe Optical Imaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Italy Europe Optical Imaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Europe Optical Imaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Spain Europe Optical Imaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Netherlands Europe Optical Imaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Netherlands Europe Optical Imaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Belgium Europe Optical Imaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Belgium Europe Optical Imaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Sweden Europe Optical Imaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Sweden Europe Optical Imaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Norway Europe Optical Imaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Norway Europe Optical Imaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Poland Europe Optical Imaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: Poland Europe Optical Imaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Denmark Europe Optical Imaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Denmark Europe Optical Imaging Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Optical Imaging Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the Europe Optical Imaging Market?

Key companies in the market include Headwall Photonics Inc, Canon Inc, Carl Zeiss Meditec AG, Heidelberg Engineering Inc, ASE Optics Inc, Cytoviva Inc, Agfa-Gevaert NV, Topcon Corporation, Optovue Inc, Bioptigen Inc, Perkinelmer Inc , ChemImage Corporation.

3. What are the main segments of the Europe Optical Imaging Market?

The market segments include Technology, Product, Application Areas, Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 166.4 million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Demand for ophthalmology; Advancements in technology.

6. What are the notable trends driving market growth?

Ophthalmology Segment is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

; High Initial cost of the equipment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Optical Imaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Optical Imaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Optical Imaging Market?

To stay informed about further developments, trends, and reports in the Europe Optical Imaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence