Key Insights

The European Protective Footwear Market is projected for significant growth, reaching an estimated market size of $2.71 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.2% through 2033. This expansion is driven by increasingly stringent safety regulations across industries and a greater employer focus on worker well-being. The construction sector, a major market driver, continues to demand high-quality safety footwear due to ongoing infrastructure development and strict safety mandates. Likewise, manufacturing, mining, and oil & gas industries are prioritizing protective footwear to minimize workplace accidents and adhere to evolving occupational health and safety standards. The chemical and pharmaceutical sectors, with their inherent risks, also represent a substantial and expanding segment for specialized protective footwear. The transportation sector, including logistics and warehousing, further highlights the critical need for durable and protective footwear.

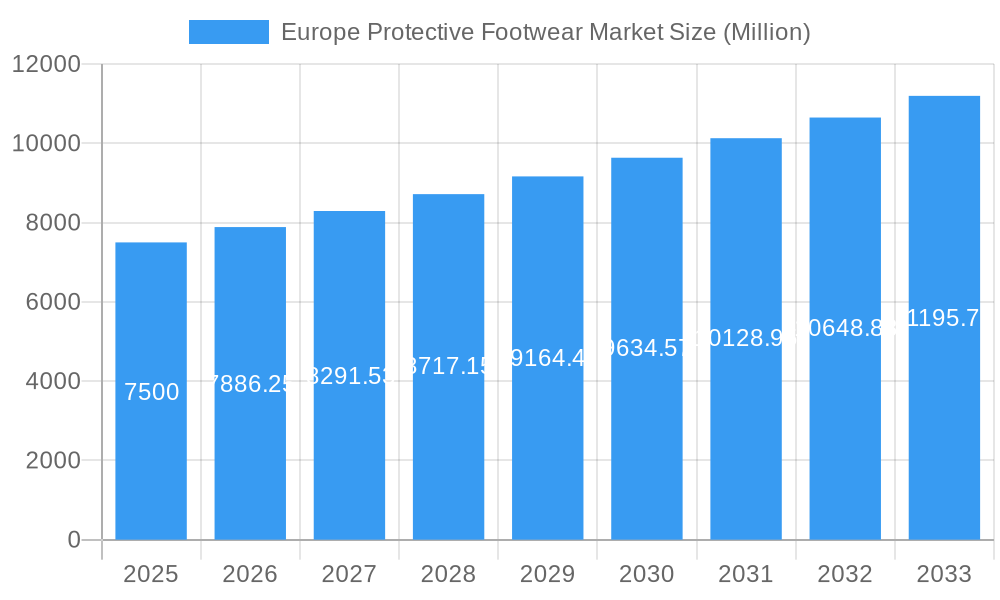

Europe Protective Footwear Market Market Size (In Billion)

Emerging trends such as the integration of advanced materials, including composite toes, puncture-resistant midsoles, and breathable, waterproof membranes, are enhancing both safety and comfort. Sustainability is also a growing factor, with manufacturers adopting eco-friendly materials and production methods. Market challenges include the high initial cost of advanced protective footwear, which can hinder adoption by smaller businesses, and the risk of counterfeit products impacting market integrity and safety standards. Key European markets, such as the United Kingdom, Germany, France, and Italy, offer significant opportunities due to their diverse industrial landscapes. Leading companies including Honeywell International Inc., VF Corporation, and Dunlop Protective Footwear are actively influencing the market through innovation and strategic growth initiatives. The forecast period indicates a continued positive trend, fueled by technological advancements and a sustained commitment to workplace safety across Europe.

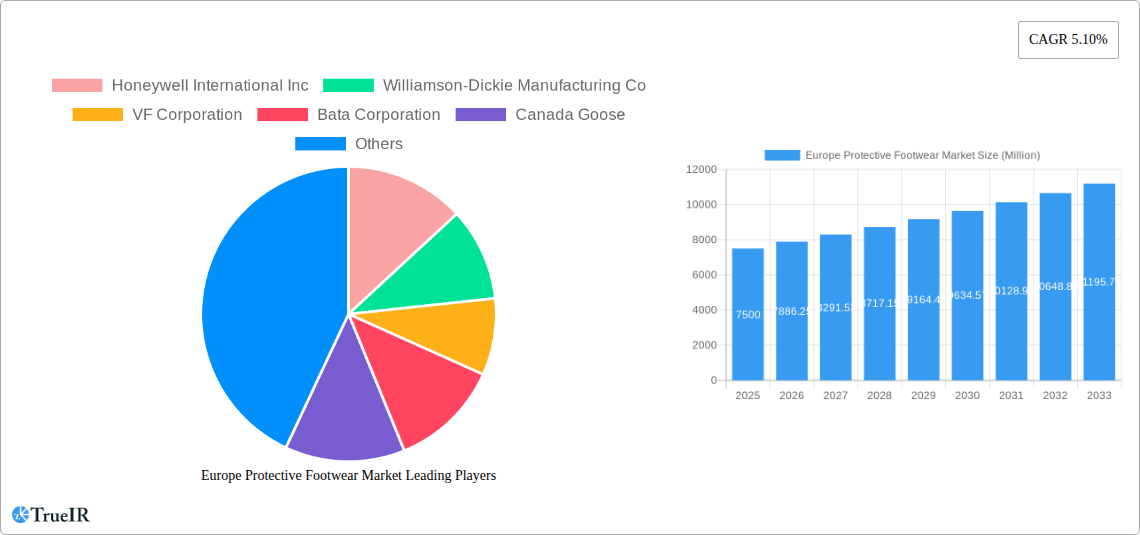

Europe Protective Footwear Market Company Market Share

This comprehensive report delivers a dynamic, SEO-optimized analysis of the Europe Protective Footwear Market, utilizing high-volume keywords to improve search visibility and captivate industry professionals. It offers a detailed overview of market dynamics, key trends, emerging opportunities, and prominent players from 2019 to 2033, with 2025 serving as the base year.

Europe Protective Footwear Market Market Structure & Competitive Landscape

The Europe Protective Footwear Market is characterized by a moderately concentrated competitive landscape, with a blend of established global manufacturers and regional specialists. Key innovation drivers include the relentless pursuit of enhanced safety features, improved wearer comfort through advanced materials and ergonomic designs, and compliance with increasingly stringent European safety standards and regulations. Regulatory impacts are significant, as standards like EN ISO 20345:2022 continuously shape product development and market entry strategies. The threat of product substitutes, while present in lower-risk applications, is mitigated in high-hazard environments by the essential protective functionalities of specialized safety footwear.

End-user segmentation plays a crucial role, with distinct demands arising from industries such as Construction, Manufacturing, Mining, Oil and Gas, Chemical, Pharmaceutical, and Transportation. Mergers and acquisitions (M&A) are strategic tools employed by leading players to expand market reach, acquire technological capabilities, and consolidate market share. While specific M&A volumes for the protective footwear sector are often embedded within broader corporate transactions, the trend indicates a drive towards consolidation and synergistic growth. Concentration ratios are expected to remain moderate to high in specialized segments, driven by the need for R&D investment and economies of scale.

Europe Protective Footwear Market Market Trends & Opportunities

The Europe Protective Footwear Market is poised for robust growth, driven by a confluence of economic, technological, and regulatory factors. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This expansion is fueled by a growing awareness of workplace safety across all industries, leading to increased adoption of personal protective equipment (PPE), including specialized footwear. Technological shifts are a primary trend, with manufacturers increasingly investing in research and development to integrate advanced materials like composite toe caps, breathable yet waterproof membranes, and anti-fatigue cushioning systems. Innovations in areas such as electro-static discharge (ESD) protection, metatarsal guards, and chemical-resistant soles are addressing the evolving safety needs of diverse industrial applications.

Consumer preferences are also evolving, with a greater emphasis on ergonomic design, lightweight construction, and aesthetic appeal, moving beyond purely functional considerations. This demand for comfort and style is pushing manufacturers to develop footwear that is not only protective but also suitable for extended wear and even casual use in some less hazardous professional settings. Competitive dynamics are intensifying, with companies differentiating themselves through product innovation, branding, customer service, and adherence to specific industry certifications. The market penetration rate of advanced protective footwear is expected to increase across all end-user segments as safety regulations become more comprehensive and enforcement is strengthened.

The drive towards sustainability is another significant trend, with an increasing demand for footwear made from recycled materials and produced through eco-friendly manufacturing processes. This presents an opportunity for companies to innovate and gain a competitive edge by offering sustainable protective footwear solutions. Furthermore, the digitalization of safety management systems is creating new opportunities for smart protective footwear equipped with sensors that can monitor wearer activity, detect potential hazards, and transmit data for improved safety protocols. The growth in e-commerce channels is also facilitating wider market access and enabling consumers to easily compare and purchase a broad range of protective footwear options. The increasing investment in infrastructure projects across Europe, particularly in construction and transportation, will continue to be a strong catalyst for the protective footwear market.

Dominant Markets & Segments in Europe Protective Footwear Market

The dominant region within the Europe Protective Footwear Market is expected to be Western Europe, driven by countries such as Germany, France, the United Kingdom, and the Netherlands. These nations have well-established industrial bases, stringent health and safety regulations, and a strong emphasis on worker protection across various sectors. Within this regional dominance, the Construction and Manufacturing segments are consistently the largest end-user industries, accounting for a significant portion of the overall market share.

Key Growth Drivers in Dominant Markets and Segments:

- Construction:

- Continued infrastructure development and urban renewal projects across key European economies.

- Strict enforcement of occupational health and safety directives mandating the use of safety footwear with features like steel toe caps, puncture-resistant soles, and slip resistance.

- Growth in residential and commercial building activities.

- Manufacturing:

- The presence of a diverse manufacturing base, including automotive, machinery, and general manufacturing, where risks of falling objects, sharp objects, and electrical hazards are prevalent.

- Increased automation in manufacturing processes, which can lead to new types of workplace hazards requiring specialized protective gear.

- Emphasis on worker productivity and comfort, driving demand for lighter and more ergonomic safety footwear.

The Rubber material segment is also a significant contributor, owing to its excellent resistance to chemicals, water, and extreme temperatures, making it ideal for applications in the Oil and Gas, Chemical, and Mining sectors. Plastic, particularly advanced polymers and composites, is gaining traction due to its lightweight properties and high impact resistance. Leather, a traditional material, continues to hold a strong position, especially in construction and manufacturing, for its durability and breathability.

Market Dominance Analysis:

Germany stands out as a leading country due to its robust industrial sector, particularly in manufacturing and automotive, coupled with a highly regulated safety environment. The country's commitment to worker safety translates into substantial demand for high-quality protective footwear. Similarly, the United Kingdom, with its significant construction and industrial sectors, also represents a major market. The Oil and Gas industry, while not the largest in terms of volume, commands a high-value segment due to the extreme conditions and specialized safety requirements associated with offshore exploration and onshore operations. The chemical and pharmaceutical industries also drive demand for footwear with specific resistance to corrosive substances and antistatic properties.

The Transportation sector, encompassing logistics and warehousing, is witnessing steady growth in demand for protective footwear, particularly with the rise of e-commerce and the need for efficient and safe material handling. The "Other End-user Industries" category encompasses niche but important sectors like agriculture, emergency services, and food processing, each with unique protective footwear needs. The overarching trend is a continuous upward trajectory for the protective footwear market, driven by proactive safety measures, technological advancements, and an unwavering commitment to safeguarding the workforce across Europe.

Europe Protective Footwear Market Product Analysis

Product innovations in the Europe Protective Footwear Market are increasingly focused on enhancing wearer comfort without compromising on protection. This includes the integration of advanced materials like composite toe caps and midsoles, offering robust impact and puncture resistance while significantly reducing weight compared to traditional steel components. Breathable yet waterproof membranes are becoming standard, ensuring dry and comfortable feet in diverse working conditions. Furthermore, ergonomic design principles are being applied to develop footwear with superior cushioning, arch support, and flexibility, reducing fatigue and improving productivity. Competitive advantages are being carved out through specialized features such as metatarsal guards for enhanced protection against severe foot injuries, advanced slip-resistant outsoles for superior traction on varied surfaces, and chemical-resistant materials tailored for specific industry hazards. The market fit is driven by strict adherence to EN ISO standards and a growing demand for footwear that aligns with sustainability goals.

Key Drivers, Barriers & Challenges in Europe Protective Footwear Market

Key Drivers, Barriers & Challenges in Europe Protective Footwear Market

Key Drivers:

- Stringent Safety Regulations: European Union directives and national health and safety laws mandate the use of protective footwear in high-risk environments, creating a consistent demand.

- Industrial Growth & Infrastructure Development: Expansion in construction, manufacturing, and transportation sectors directly fuels the need for safety footwear.

- Technological Advancements: Innovations in materials (e.g., composite toe caps, advanced polymers) and design lead to lighter, more comfortable, and more protective footwear, driving adoption.

- Increased Worker Awareness: Growing understanding of workplace hazards and the importance of PPE encourages higher compliance with safety standards.

- Focus on Comfort & Ergonomics: Demand for footwear that reduces fatigue and improves wearer well-being enhances market appeal.

Key Barriers & Challenges:

- High Manufacturing Costs: The need for specialized materials, rigorous testing, and compliance with safety standards can lead to higher production costs.

- Counterfeit Products: The presence of substandard or counterfeit protective footwear can undermine legitimate manufacturers and compromise worker safety.

- Supply Chain Disruptions: Global supply chain issues, geopolitical instability, and rising raw material prices can impact availability and cost.

- Economic Downturns: Recessions or economic slowdowns can lead to reduced investment in PPE and project cancellations, impacting demand.

- Resistance to Adoption in Certain Sectors: Despite regulations, some smaller businesses or certain sectors might still exhibit resistance to investing in premium protective footwear due to cost perceptions.

Growth Drivers in the Europe Protective Footwear Market Market

Key growth drivers in the Europe Protective Footwear Market are primarily shaped by an unwavering commitment to occupational safety and health. Stringent European Union directives and national labor laws continuously mandate the use of appropriate personal protective equipment, including safety footwear, across a wide array of industries. This regulatory push ensures a sustained demand for compliant products. Furthermore, significant investments in infrastructure development, urban regeneration projects, and the expansion of manufacturing capabilities across the continent are creating substantial opportunities. Technological innovation, such as the development of lighter, more durable, and ergonomically designed footwear using advanced composite materials and smart technologies, is not only improving protection but also enhancing wearer comfort, thus driving market penetration. The increasing awareness among both employers and employees regarding the long-term benefits of preventing workplace injuries, both in terms of human cost and economic efficiency, further propels the growth of this market.

Challenges Impacting Europe Protective Footwear Market Growth

Challenges impacting Europe Protective Footwear Market growth are multifaceted. Regulatory complexities, while driving demand, also present hurdles as manufacturers must continuously adapt to evolving standards and certification processes, which can be time-consuming and costly. Supply chain issues, exacerbated by global events, pose significant risks, leading to potential material shortages, increased raw material costs, and extended lead times, impacting product availability and pricing. Competitive pressures are intense, with both established global brands and niche manufacturers vying for market share, often leading to price sensitivity, particularly in less specialized segments. The economic climate also plays a crucial role; any significant economic downturn or recession can lead to reduced capital expenditure by businesses, potentially impacting the procurement of safety equipment. Furthermore, the ongoing challenge of ensuring consistent quality and preventing the influx of counterfeit products, which can compromise worker safety and damage brand reputation, remains a critical concern for the industry.

Key Players Shaping the Europe Protective Footwear Market Market

- Honeywell International Inc

- Williamson-Dickie Manufacturing Co

- VF Corporation

- Bata Corporation

- Canada Goose

- Uvex Group

- Dunlop Protective Footwear

- Rock Fall (UK) LTD

- Singer Safety Company

- Wolverine World Wide Inc

- Hilson Footwear Pvt Ltd

Significant Europe Protective Footwear Market Industry Milestones

- June 2022: MSA Safety Incorporated announced a new line of firefighter protective clothing (FPC) specifically designed to meet the needs of firefighters in Germany, the Netherlands, and across continental Europe, offering enhanced comfort and compatibility with MSA's advanced safety equipment and solutions.

Future Outlook for Europe Protective Footwear Market Market

The future outlook for the Europe Protective Footwear Market remains exceptionally positive, driven by sustained demand for high-performance safety solutions. Growth catalysts include the continued emphasis on stringent workplace safety regulations, coupled with a proactive approach from industries to invest in worker well-being. The increasing integration of smart technologies, such as sensors for real-time monitoring and data analytics, will create a new generation of intelligent protective footwear, offering enhanced safety management capabilities. Furthermore, the growing consumer demand for sustainable and ethically produced goods will push manufacturers to innovate with eco-friendly materials and manufacturing processes, opening up new market segments and brand differentiation opportunities. Strategic opportunities lie in expanding into emerging industrial sectors, developing specialized footwear for niche applications, and leveraging e-commerce platforms to reach a broader customer base. The market is set to benefit from ongoing infrastructure projects and a resilient industrial base across Europe.

Europe Protective Footwear Market Segmentation

-

1. Material

- 1.1. Leather

- 1.2. Rubber

- 1.3. Plastic

-

2. End-user

- 2.1. Construction

- 2.2. Manufacturing

- 2.3. Mining

- 2.4. Oil and Gas

- 2.5. Chemical

- 2.6. Pharmaceutical

- 2.7. Transportation

- 2.8. Other End-user Industries

Europe Protective Footwear Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

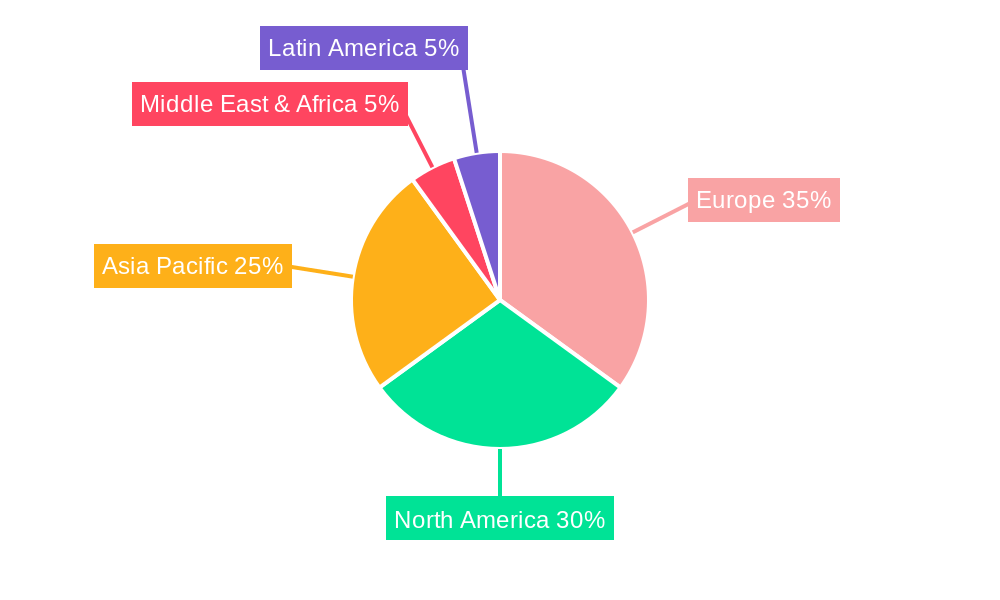

Europe Protective Footwear Market Regional Market Share

Geographic Coverage of Europe Protective Footwear Market

Europe Protective Footwear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Regulations for Labour Protection; Increasing Number of Industrial Accidents

- 3.3. Market Restrains

- 3.3.1. Rigid Regulations Imposed on Oil and Gas Drilling Activities

- 3.4. Market Trends

- 3.4.1. Construction Segment to Have a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Protective Footwear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Leather

- 5.1.2. Rubber

- 5.1.3. Plastic

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Construction

- 5.2.2. Manufacturing

- 5.2.3. Mining

- 5.2.4. Oil and Gas

- 5.2.5. Chemical

- 5.2.6. Pharmaceutical

- 5.2.7. Transportation

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Williamson-Dickie Manufacturing Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 VF Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bata Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Canada Goose

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Uvex Group*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dunlop Protective Footwear

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rock Fall (UK) LTD

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Singer Safety Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wolverine World Wide Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hilson Footwear Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Protective Footwear Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Protective Footwear Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Protective Footwear Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Europe Protective Footwear Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 3: Europe Protective Footwear Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Protective Footwear Market Revenue billion Forecast, by Material 2020 & 2033

- Table 5: Europe Protective Footwear Market Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Europe Protective Footwear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Protective Footwear Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Europe Protective Footwear Market?

Key companies in the market include Honeywell International Inc, Williamson-Dickie Manufacturing Co, VF Corporation, Bata Corporation, Canada Goose, Uvex Group*List Not Exhaustive, Dunlop Protective Footwear, Rock Fall (UK) LTD, Singer Safety Company, Wolverine World Wide Inc, Hilson Footwear Pvt Ltd.

3. What are the main segments of the Europe Protective Footwear Market?

The market segments include Material, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Regulations for Labour Protection; Increasing Number of Industrial Accidents.

6. What are the notable trends driving market growth?

Construction Segment to Have a Significant Growth.

7. Are there any restraints impacting market growth?

Rigid Regulations Imposed on Oil and Gas Drilling Activities.

8. Can you provide examples of recent developments in the market?

June 2022 - MSA Safety Incorporated announced a new line of firefighter protective clothing (FPC) specifically designed to meet the needs of firefighters in Germany, the Netherlands, and across continental Europe, offering enhanced comfort and compatibility with MSA's advanced safety equipment and solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Protective Footwear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Protective Footwear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Protective Footwear Market?

To stay informed about further developments, trends, and reports in the Europe Protective Footwear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence