Key Insights

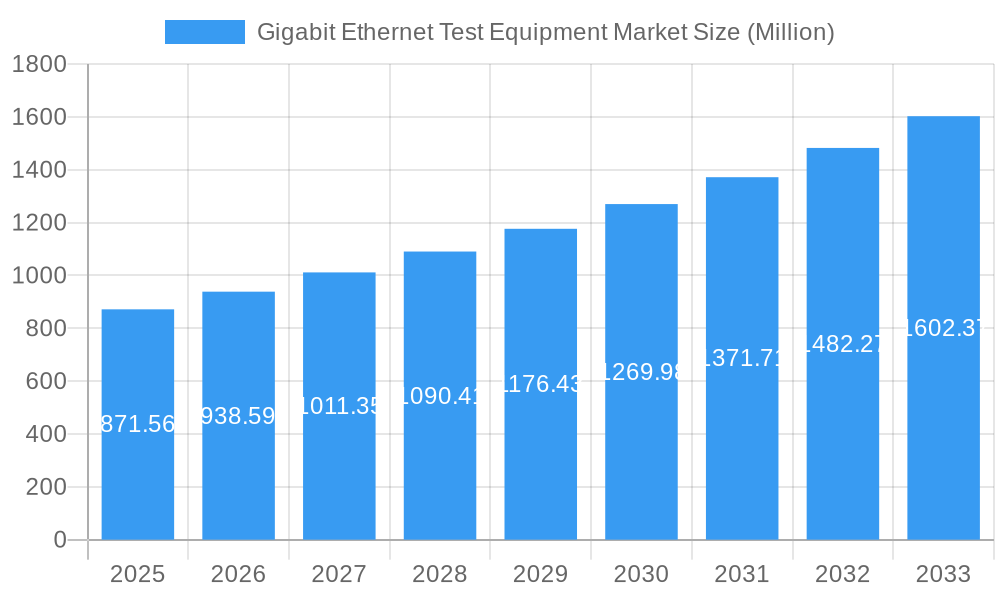

The Gigabit Ethernet Test Equipment Market is poised for robust expansion, projected to reach $871.56 million in 2025 and exhibit a compound annual growth rate (CAGR) of 7.8% through 2033. This significant growth is underpinned by the escalating demand for high-speed data transmission across various industries, driven by the proliferation of IoT devices, the increasing adoption of cloud computing, and the continuous evolution of telecommunication infrastructure. The burgeoning automotive sector, with its increasing reliance on in-vehicle network connectivity and advanced driver-assistance systems (ADAS), represents a pivotal driver. Similarly, the manufacturing industry's push towards Industry 4.0 and smart factories necessitates sophisticated network testing to ensure seamless automation and real-time data processing. The telecommunications sector, at the forefront of 5G deployment and fiber optic network upgrades, also significantly fuels the demand for advanced Gigabit Ethernet test solutions.

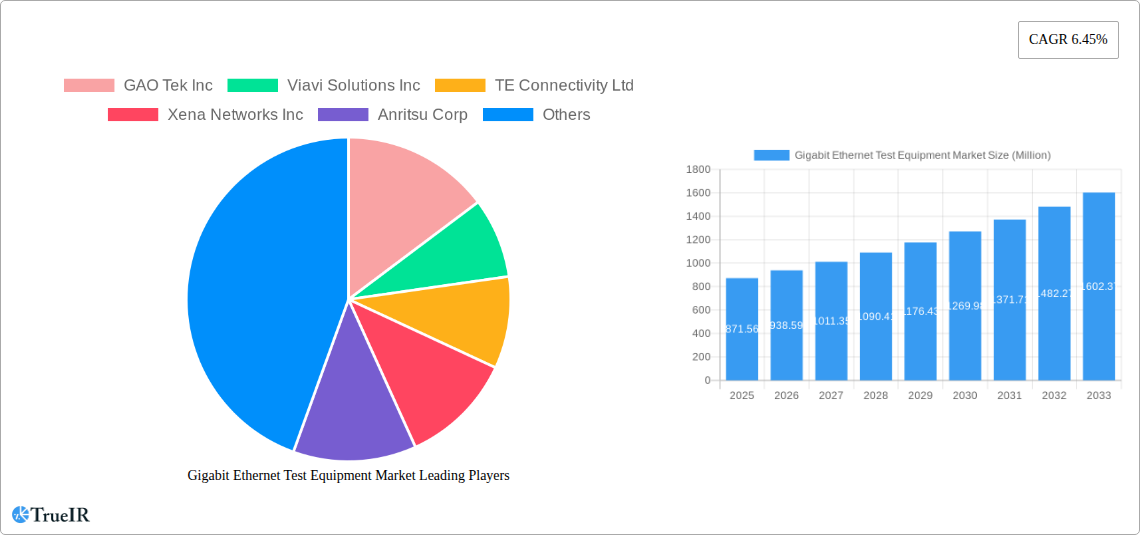

Gigabit Ethernet Test Equipment Market Market Size (In Million)

The market's trajectory is further shaped by key trends such as the growing adoption of higher Ethernet speeds like 10 GBE and 25/50 GBE to accommodate the ever-increasing bandwidth requirements. Advancements in test equipment technology, including the development of portable and cloud-based testing solutions, are enhancing efficiency and accessibility for end-users. However, the market faces certain restraints, including the high initial cost of sophisticated test equipment, which can pose a challenge for smaller enterprises. Additionally, the rapid pace of technological evolution in networking standards requires continuous investment in R&D for test equipment manufacturers to stay competitive. Despite these challenges, the sustained growth in data traffic and the critical need for reliable network performance across sectors like transportation and logistics, alongside other emerging end-user industries, will continue to propel the Gigabit Ethernet Test Equipment Market forward.

Gigabit Ethernet Test Equipment Market Company Market Share

This in-depth report provides a thorough analysis of the global Gigabit Ethernet (GE) Test Equipment Market, offering insights into market dynamics, growth trajectories, and competitive strategies. The study covers a comprehensive historical period from 2019 to 2024, with a base year of 2025, and projects future market trends from 2025 to 2033. We explore the critical role of GE test equipment in enabling high-speed network deployments across various industries, driven by increasing data traffic and the evolution of network infrastructure. This report is essential for stakeholders seeking to understand the market's intricacies, identify emerging opportunities, and navigate its challenges. The market size is estimated to be in the billions of dollars, with significant growth anticipated in the coming decade.

Gigabit Ethernet Test Equipment Market Market Structure & Competitive Landscape

The Gigabit Ethernet Test Equipment Market exhibits a moderately concentrated structure, characterized by the presence of both established multinational corporations and specialized niche players. Innovation drivers are primarily fueled by the relentless demand for higher bandwidth, lower latency, and improved network reliability, pushing manufacturers to develop sophisticated testing solutions for 1 GBE, 10 GBE, and the rapidly emerging 25/50 GBE segments. Regulatory impacts are minimal, with industry standards largely self-governed by organizations like IEEE. However, the increasing adoption of 5G, AI, and IoT is indirectly influencing the need for robust and advanced GE testing capabilities. Product substitutes are limited, as specialized GE test equipment offers unique functionalities not easily replicated by general-purpose network diagnostic tools.

- Market Concentration: The top five players are estimated to hold approximately 50-60% of the market share.

- Innovation Drivers:

- Demand for 800 Gigabit Ethernet (GE) and beyond.

- Testing of emerging transceiver technologies (e.g., QSFP-DD 800, OSFP 112).

- Development of portable and automated test solutions.

- Product Substitutes: Limited, with highly specialized nature of GE test equipment.

- End-User Segmentation: Telecommunications, Automotive, and Manufacturing represent key segments, each with distinct testing requirements.

- Mergers & Acquisitions (M&A): The market has witnessed a few strategic acquisitions in the past, aimed at portfolio expansion and technological integration. For instance, the acquisition of a specialized Ethernet testing company by a larger test and measurement firm in 2023. The volume of M&A deals is estimated to be around xx per year.

Gigabit Ethernet Test Equipment Market Market Trends & Opportunities

The Gigabit Ethernet Test Equipment Market is experiencing robust growth, driven by the exponential increase in data consumption, the proliferation of connected devices, and the ongoing digital transformation across industries. The market size is projected to reach several tens of billions of dollars by 2033, with a compound annual growth rate (CAGR) of approximately 8-10%. Technological shifts are paramount, with a significant transition from 1 GBE and 10 GBE to higher-speed interfaces like 25/50 GBE and even 100/200 GBE and beyond. This evolution is necessitated by the demands of 5G infrastructure deployment, data center upgrades, and the expansion of high-performance computing. Consumer preferences, though indirect, are influencing manufacturers to develop test equipment that supports faster and more reliable network connections, ultimately impacting end-user experiences. Competitive dynamics are intensifying, with companies focusing on R&D for next-generation testing solutions, offering integrated platforms, and expanding their service offerings.

The growing demand for ultra-high-speed networking in telecommunication networks, including the rollout of 5G and fiber-to-the-home (FTTH) initiatives, is a primary growth catalyst. Data centers are continuously upgrading their infrastructure to accommodate the ever-increasing data volumes generated by cloud computing, big data analytics, and artificial intelligence. This necessitates precise testing of Ethernet links up to 400 GBE and higher. The automotive industry is also a burgeoning segment, with the increasing adoption of advanced driver-assistance systems (ADAS) and in-vehicle infotainment requiring high-bandwidth, low-latency communication, thus driving the need for reliable GE test equipment. Furthermore, the manufacturing sector is embracing Industry 4.0, with smart factories relying heavily on interconnected industrial Ethernet networks for automation and control, creating significant opportunities for specialized test equipment. The transportation and logistics sector is also witnessing the integration of advanced communication technologies for real-time tracking and management, further fueling the demand.

Emerging opportunities lie in the development of AI-powered test automation solutions, cloud-based testing platforms, and modular, scalable test equipment that can adapt to future network upgrades. The increasing complexity of network architectures, including SDN and NFV, also presents opportunities for test equipment providers to offer solutions that can effectively test these dynamic environments. The development of standardized testing protocols for emerging technologies like Wi-Fi 7 and future Ethernet standards will also create new avenues for market growth. The market penetration rate for advanced GE test equipment is expected to rise significantly, particularly in developed economies and rapidly digitizing regions.

Dominant Markets & Segments in Gigabit Ethernet Test Equipment Market

The Gigabit Ethernet Test Equipment Market is segmented by type and end-user industry, with significant variations in growth and dominance across these categories.

Dominance by Type:

- 1 GBE: While historically dominant, the 1 GBE segment is gradually ceding ground to higher speeds but remains crucial for legacy systems, enterprise networks, and specific applications where extreme bandwidth is not a prerequisite. Its installed base ensures continued demand for maintenance and upgrade testing.

- 10 GBE: This segment currently holds a substantial market share due to its widespread adoption in data centers, enterprise networks, and backbone infrastructure. It represents a mature yet continuously relevant market, with ongoing demand for upgrades and new deployments.

- 25/50 GBE: This is the fastest-growing segment, driven by the increasing demand for higher throughput in data centers, cloud environments, and high-performance computing. The adoption of 25/50 GBE is directly linked to the evolution of server and storage technologies, as well as the need for faster interconnections. This segment is expected to witness significant market expansion over the forecast period, with its market share projected to surpass 10 GBE in the coming years. The development of IEEE 802.3 standards supporting these speeds is a key enabler.

Dominance by End-User Industry:

- Telecommunication: This sector is the largest and most significant contributor to the Gigabit Ethernet Test Equipment Market. The ongoing global rollout of 5G networks, expansion of fiber optic infrastructure for broadband access, and the increasing demand for high-speed data services necessitate extensive testing of network equipment and links. Service providers are investing heavily in upgrading their core and access networks, driving substantial demand for high-performance GE test equipment. The partnership between Bharti Airtel and Google, with Google's USD 1 Billion investment, exemplifies the massive digital transformation underway in India's telecommunication sector, directly impacting the need for advanced network testing solutions.

- Manufacturing: With the rise of Industry 4.0, smart factories, and industrial automation, the manufacturing sector is increasingly relying on robust and high-speed industrial Ethernet networks. Test equipment is crucial for ensuring the reliability and performance of these networks, which are critical for real-time control, data acquisition, and seamless communication between machines and systems.

- Automotive: The automotive industry is witnessing a rapid increase in in-vehicle network complexity. Advanced driver-assistance systems (ADAS), autonomous driving technologies, and in-car infotainment systems require high-bandwidth, low-latency Ethernet connections. Testing equipment is vital for validating these critical communication links, ensuring safety and performance.

- Transportation and Logistics: The integration of real-time tracking, fleet management systems, and smart logistics solutions is driving the adoption of advanced communication technologies, including Ethernet. This segment presents a growing opportunity for GE test equipment as these industries strive for greater efficiency and connectivity.

- Other End-user Industries: This category includes segments such as healthcare (telemedicine, medical imaging), education (e-learning, research networks), and government (smart cities, defense), all of which contribute to the overall demand for reliable and high-speed networking, thereby influencing the GE test equipment market.

The dominance of the telecommunication sector, coupled with the rapid growth of the 25/50 GBE segment, will shape the future landscape of the Gigabit Ethernet Test Equipment Market.

Gigabit Ethernet Test Equipment Market Product Analysis

The Gigabit Ethernet Test Equipment Market is characterized by continuous product innovation focused on enhancing speed, accuracy, portability, and automation. Manufacturers are developing advanced test solutions capable of validating network performance at speeds of 1 GBE, 10 GBE, 25/50 GBE, and even higher, such as 100 GBE and 400 GBE. Key product innovations include portable handheld testers for field deployment, high-density port testers for data centers, and sophisticated lab-based equipment for in-depth protocol analysis and stress testing. Competitive advantages are gained through the development of equipment that supports emerging standards, offers comprehensive troubleshooting capabilities, and integrates with network management systems. The demonstration of Keysight's optical and high-speed digital test solutions at the OFC Conference, supporting IEEE 802.3ck 112 Gigabits/second (112G) PAM4 electrical lanes for full line-rate 800 Gigabit Ethernet (GE) traffic, exemplifies the cutting-edge advancements in this sector. These innovations are crucial for ensuring the reliability and performance of next-generation networks.

Key Drivers, Barriers & Challenges in Gigabit Ethernet Test Equipment Market

The key drivers propelling the Gigabit Ethernet Test Equipment Market are multifaceted, including the insatiable demand for higher bandwidth fueled by cloud computing, big data, and video streaming. The widespread deployment of 5G networks and the expansion of fiber optic infrastructure are significant technological drivers. Economically, increased IT spending by enterprises and the ongoing digital transformation initiatives across industries create a strong impetus. Policy-driven factors, such as government initiatives promoting digital connectivity and infrastructure development, also contribute positively.

Conversely, the market faces several barriers and challenges. The high cost of advanced test equipment can be a restraint, particularly for smaller organizations or in price-sensitive markets. Rapid technological obsolescence requires continuous R&D investment, posing a challenge for manufacturers to keep pace. Supply chain disruptions, as evidenced by recent global events, can impact production and delivery timelines, leading to increased costs. Intense competitive pressures from established players and emerging entrants necessitate constant innovation and competitive pricing strategies. Regulatory hurdles, though minimal for GE standards themselves, can arise from differing regional compliance requirements or the need to certify equipment for critical infrastructure applications.

Growth Drivers in the Gigabit Ethernet Test Equipment Market Market

The growth of the Gigabit Ethernet Test Equipment Market is primarily driven by the relentless expansion of data traffic globally, necessitating continuous upgrades to network infrastructure. The widespread adoption of 5G technology and the ongoing build-out of fiber optic networks are critical growth enablers, demanding robust testing solutions for higher speeds and greater reliability. Furthermore, the digital transformation initiatives across various industries, including telecommunications, data centers, automotive, and manufacturing, are fueling the need for high-performance networking and, consequently, advanced test equipment. The increasing complexity of network architectures, such as Software-Defined Networking (SDN) and Network Functions Virtualization (NFV), also drives the demand for sophisticated testing tools. Government investments in digital infrastructure and connectivity further support market expansion.

Challenges Impacting Gigabit Ethernet Test Equipment Market Growth

Several challenges impact the growth of the Gigabit Ethernet Test Equipment Market. The high capital expenditure required for advanced, high-speed test equipment can be a significant barrier for some organizations. Rapid technological advancements lead to a short product lifecycle, necessitating continuous and substantial investment in research and development for manufacturers to remain competitive. Global supply chain vulnerabilities, prone to disruptions, can lead to increased lead times and production costs. Intense competition among market players often leads to price pressures, impacting profit margins. Moreover, ensuring compliance with evolving international standards and regional regulations adds another layer of complexity for manufacturers.

Key Players Shaping the Gigabit Ethernet Test Equipment Market Market

- GAO Tek Inc

- Viavi Solutions Inc

- TE Connectivity Ltd

- Xena Networks Inc

- Anritsu Corp

- IDEAL Industries Inc

- Exfo Inc

- Keysight Technologies Inc

- Spirent Communications PLC

- Aquantia Corp

Significant Gigabit Ethernet Test Equipment Market Industry Milestones

- March 2022: Keysight Demonstrated Optical and High-speed Digital Test Solutions at Optical Fiber Communications (OFC) Conference. This demonstration highlighted IEEE 802.3ck 112 Gigabits/second (112G) PAM4 electrical lanes support for full line-rate 800 Gigabit Ethernet (GE) traffic. The G800GE Ethernet test system showcased the performance of Octal Small Form Factor Pluggable (OSFP) 112 and Quad Small Form Factor Pluggable Double Density (QSFP-DD) 800 optical transceivers, focusing on bit error rate (BER) and forward error correction (FEC). This development is crucial for validating the performance of next-generation high-speed optical transceivers.

- January 2022: Bharti Airtel ("Airtel"), a leading Indian communications service provider, and Google announced a multi-year partnership to accelerate India's digital ecosystem growth. This collaboration aims to provide end-to-end products and address affordability, access, and digital inclusion. Google's investment of USD 1 Billion as part of its Google for India Digitization Fund underscores the massive investment in digital infrastructure, directly impacting the demand for robust networking and, consequently, advanced test equipment.

Future Outlook for Gigabit Ethernet Test Equipment Market Market

The future outlook for the Gigabit Ethernet Test Equipment Market is highly optimistic, driven by the persistent demand for faster, more reliable, and scalable network infrastructure. The ongoing evolution towards higher Ethernet speeds, including 400 GBE, 800 GBE, and beyond, will necessitate sophisticated testing solutions. The proliferation of 5G, the expansion of data centers, and the increasing adoption of technologies like AI, IoT, and edge computing will continue to be significant growth catalysts. Strategic opportunities lie in developing modular and adaptable test platforms, integrating artificial intelligence for automated testing, and offering cloud-based testing solutions. The market will also witness increased focus on power efficiency and miniaturization of test equipment. The continuous investment in digital transformation across key industries promises a sustained and robust growth trajectory for the Gigabit Ethernet Test Equipment Market in the coming years.

Gigabit Ethernet Test Equipment Market Segmentation

-

1. Type

- 1.1. 1 GBE

- 1.2. 10 GBE

- 1.3. 25/50 GBE

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Manufacturing

- 2.3. Telecommunication

- 2.4. Transportation and Logistics

- 2.5. Other End-user Industries

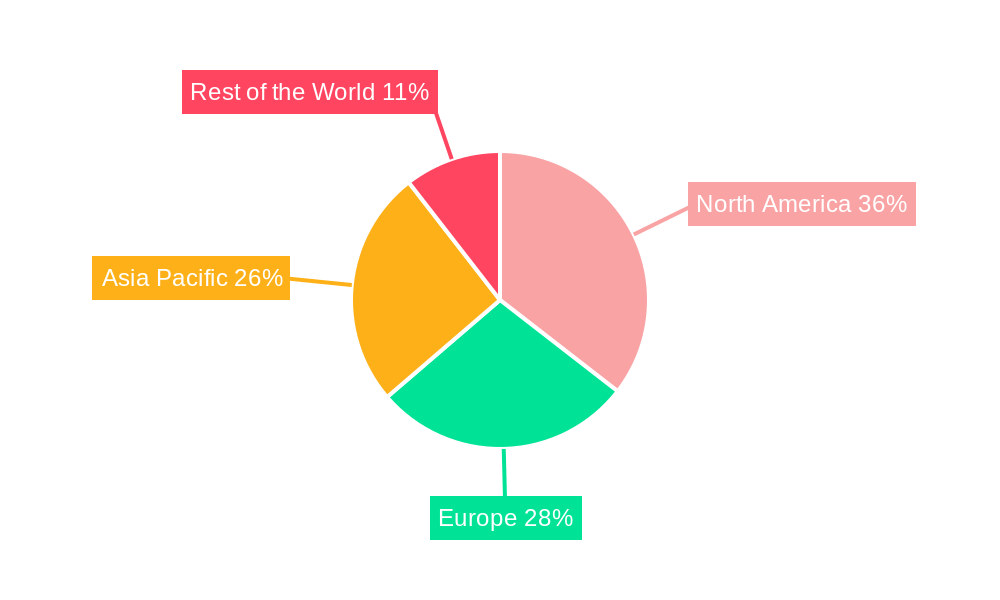

Gigabit Ethernet Test Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Gigabit Ethernet Test Equipment Market Regional Market Share

Geographic Coverage of Gigabit Ethernet Test Equipment Market

Gigabit Ethernet Test Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Ethernet in the Manufacturing Industries; Growth in Mobile Backhaul; Adoption of Cloud Services and Big Data

- 3.3. Market Restrains

- 3.3.1. Operational Challenges and High Levels of Competition Leading to Price Pressures for Manufacturers

- 3.4. Market Trends

- 3.4.1. Telecommunication Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gigabit Ethernet Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. 1 GBE

- 5.1.2. 10 GBE

- 5.1.3. 25/50 GBE

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Manufacturing

- 5.2.3. Telecommunication

- 5.2.4. Transportation and Logistics

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Gigabit Ethernet Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. 1 GBE

- 6.1.2. 10 GBE

- 6.1.3. 25/50 GBE

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Manufacturing

- 6.2.3. Telecommunication

- 6.2.4. Transportation and Logistics

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Gigabit Ethernet Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. 1 GBE

- 7.1.2. 10 GBE

- 7.1.3. 25/50 GBE

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Manufacturing

- 7.2.3. Telecommunication

- 7.2.4. Transportation and Logistics

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Gigabit Ethernet Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. 1 GBE

- 8.1.2. 10 GBE

- 8.1.3. 25/50 GBE

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Manufacturing

- 8.2.3. Telecommunication

- 8.2.4. Transportation and Logistics

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Gigabit Ethernet Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. 1 GBE

- 9.1.2. 10 GBE

- 9.1.3. 25/50 GBE

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Manufacturing

- 9.2.3. Telecommunication

- 9.2.4. Transportation and Logistics

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 GAO Tek Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Viavi Solutions Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 TE Connectivity Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Xena Networks Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Anritsu Corp

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IDEAL Industries Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Exfo Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Keysight Technologies Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Spirent Communications PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Aquantia Corp

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 GAO Tek Inc

List of Figures

- Figure 1: Global Gigabit Ethernet Test Equipment Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Gigabit Ethernet Test Equipment Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Gigabit Ethernet Test Equipment Market Revenue (undefined), by Type 2025 & 2033

- Figure 4: North America Gigabit Ethernet Test Equipment Market Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Gigabit Ethernet Test Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Gigabit Ethernet Test Equipment Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Gigabit Ethernet Test Equipment Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 8: North America Gigabit Ethernet Test Equipment Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 9: North America Gigabit Ethernet Test Equipment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Gigabit Ethernet Test Equipment Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: North America Gigabit Ethernet Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Gigabit Ethernet Test Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Gigabit Ethernet Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Gigabit Ethernet Test Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Gigabit Ethernet Test Equipment Market Revenue (undefined), by Type 2025 & 2033

- Figure 16: Europe Gigabit Ethernet Test Equipment Market Volume (K Unit), by Type 2025 & 2033

- Figure 17: Europe Gigabit Ethernet Test Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Gigabit Ethernet Test Equipment Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Gigabit Ethernet Test Equipment Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 20: Europe Gigabit Ethernet Test Equipment Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 21: Europe Gigabit Ethernet Test Equipment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Gigabit Ethernet Test Equipment Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Europe Gigabit Ethernet Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Gigabit Ethernet Test Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Gigabit Ethernet Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Gigabit Ethernet Test Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Gigabit Ethernet Test Equipment Market Revenue (undefined), by Type 2025 & 2033

- Figure 28: Asia Pacific Gigabit Ethernet Test Equipment Market Volume (K Unit), by Type 2025 & 2033

- Figure 29: Asia Pacific Gigabit Ethernet Test Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Gigabit Ethernet Test Equipment Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Gigabit Ethernet Test Equipment Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 32: Asia Pacific Gigabit Ethernet Test Equipment Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 33: Asia Pacific Gigabit Ethernet Test Equipment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Asia Pacific Gigabit Ethernet Test Equipment Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Asia Pacific Gigabit Ethernet Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Gigabit Ethernet Test Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Gigabit Ethernet Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Gigabit Ethernet Test Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Gigabit Ethernet Test Equipment Market Revenue (undefined), by Type 2025 & 2033

- Figure 40: Rest of the World Gigabit Ethernet Test Equipment Market Volume (K Unit), by Type 2025 & 2033

- Figure 41: Rest of the World Gigabit Ethernet Test Equipment Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Rest of the World Gigabit Ethernet Test Equipment Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Rest of the World Gigabit Ethernet Test Equipment Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 44: Rest of the World Gigabit Ethernet Test Equipment Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Rest of the World Gigabit Ethernet Test Equipment Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Rest of the World Gigabit Ethernet Test Equipment Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Rest of the World Gigabit Ethernet Test Equipment Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: Rest of the World Gigabit Ethernet Test Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Rest of the World Gigabit Ethernet Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Gigabit Ethernet Test Equipment Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Gigabit Ethernet Test Equipment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Gigabit Ethernet Test Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gigabit Ethernet Test Equipment Market?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Gigabit Ethernet Test Equipment Market?

Key companies in the market include GAO Tek Inc, Viavi Solutions Inc, TE Connectivity Ltd, Xena Networks Inc, Anritsu Corp, IDEAL Industries Inc, Exfo Inc, Keysight Technologies Inc, Spirent Communications PLC, Aquantia Corp.

3. What are the main segments of the Gigabit Ethernet Test Equipment Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Ethernet in the Manufacturing Industries; Growth in Mobile Backhaul; Adoption of Cloud Services and Big Data.

6. What are the notable trends driving market growth?

Telecommunication Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Operational Challenges and High Levels of Competition Leading to Price Pressures for Manufacturers.

8. Can you provide examples of recent developments in the market?

March 2022 - Keysight Demonstrated Optical and High-speed Digital Test Solutions at Optical Fiber Communications (OFC) Conference. IEEE 802.3ck 112 Gigabits/second (112G) PAM4 electrical lanes support full line-rate 800 Gigabit Ethernet (GE) traffic. The G800GE Ethernet test system will demonstrate the performance of Octal Small Form Factor Pluggable (OSFP) 112 and Quad Small Form Factor Pluggable Double Density (QSFP-DD) 800 optical transceivers in terms of bit error rate (BER) and forward error correction (FEC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gigabit Ethernet Test Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gigabit Ethernet Test Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gigabit Ethernet Test Equipment Market?

To stay informed about further developments, trends, and reports in the Gigabit Ethernet Test Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence