Key Insights

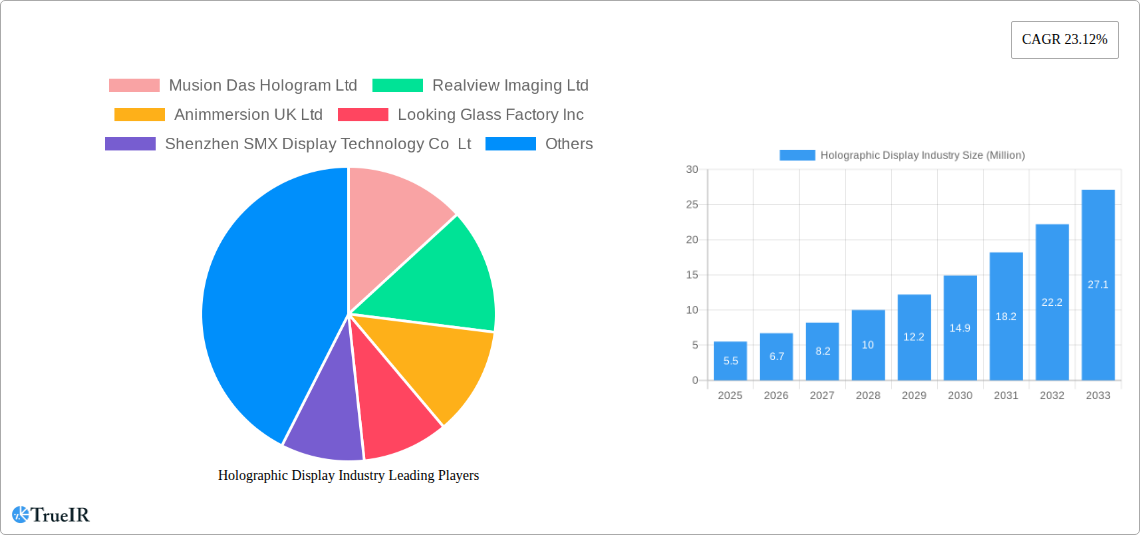

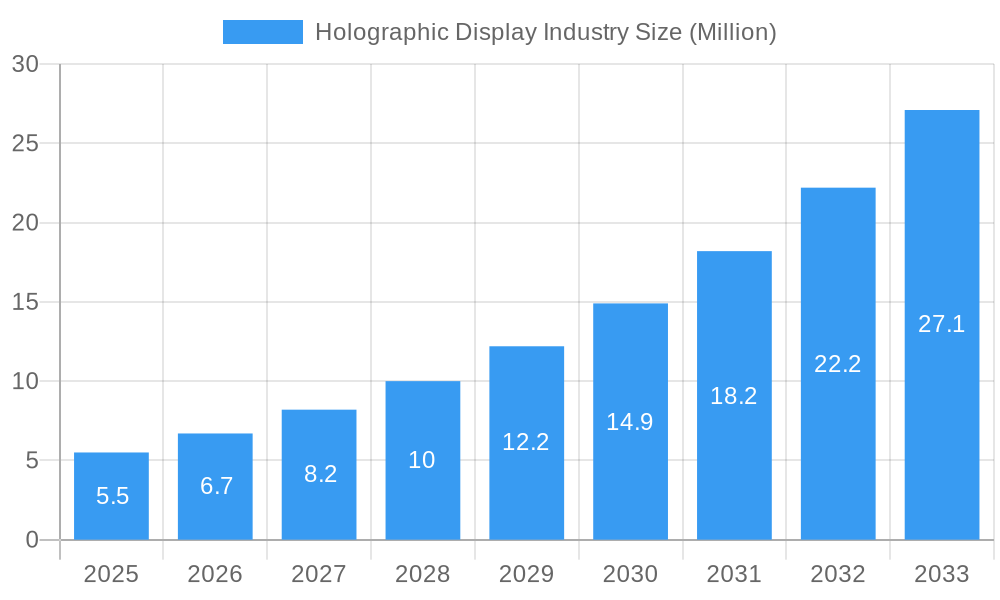

The global Holographic Display Industry is poised for remarkable expansion, with a current market size of $3.45 million and a projected CAGR of 23.12% from 2019 to 2033. This robust growth is primarily fueled by escalating demand across a multitude of end-user verticals, including consumer electronics, retail, media and entertainment, military and defense, healthcare, and automotive. The intrinsic ability of holographic displays to deliver immersive, interactive, and visually stunning experiences makes them increasingly indispensable in these sectors. Advancements in display technologies, coupled with a burgeoning interest in augmented reality (AR) and virtual reality (VR) applications, are significant drivers of this market. The convergence of digital content creation and sophisticated projection systems is unlocking new avenues for advertising, entertainment, education, and even complex medical visualizations. As the technology matures and becomes more accessible, its adoption rate is expected to accelerate significantly throughout the forecast period.

Holographic Display Industry Market Size (In Million)

Key trends shaping the Holographic Display Industry include the miniaturization of holographic projectors, the development of more energy-efficient display solutions, and the integration of AI for enhanced content personalization and interactivity. The increasing prevalence of 3D content creation and consumption is also a substantial tailwind. While the market enjoys strong growth potential, certain restraints exist, such as the initial high cost of some holographic solutions and the need for specialized content creation expertise. However, ongoing research and development are actively addressing these challenges, driving down costs and simplifying content production. The industry is characterized by innovation from prominent companies like Musion Das Hologram Ltd, Realview Imaging Ltd, and Kino-mo Limited (HYPERVSN), all contributing to the dynamic evolution of holographic display capabilities and market penetration. Regions like North America and Europe are anticipated to lead in adoption due to strong technological infrastructure and significant investment in advanced display solutions.

Holographic Display Industry Company Market Share

Here is a dynamic, SEO-optimized report description for the Holographic Display Industry, incorporating high-volume keywords and structured as requested.

Holographic Display Market: Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2025–2033

This comprehensive report delves into the burgeoning holographic display market, offering an in-depth analysis of its global structure, competitive landscape, and future trajectory. Spanning the historical period of 2019–2024 and projecting growth through the forecast period of 2025–2033, with a base year and estimated year of 2025, this study is essential for stakeholders seeking to understand and capitalize on this transformative technology. We explore market size, growth drivers, emerging trends, dominant segments, and the key players shaping the future of holographic displays.

Holographic Display Industry Market Structure & Competitive Landscape

The global holographic display market exhibits a moderately concentrated structure, with a blend of established technology giants and innovative startups driving competition. Key innovation drivers include advancements in display resolution, reduced latency, and increased interactivity, all crucial for broader adoption. Regulatory impacts, while nascent, are expected to focus on consumer safety and data privacy as holographic applications become more pervasive. Product substitutes, such as advanced LED screens and augmented reality overlays, pose a competitive threat, necessitating continuous technological leaps in holographic fidelity and immersion. The end-user segmentation, encompassing Consumer Electronics, Retail, Media and Entertainment, Military and Defense, Healthcare, and Automotive, reveals diverse application potentials and varying adoption rates. Mergers & Acquisitions (M&A) trends indicate strategic consolidation, with approximately 15-20 M&A deals projected between 2025-2030, aimed at acquiring core technologies and expanding market reach. Concentration ratios are estimated at around 45-55% for the top five players by 2025, reflecting ongoing competitive dynamics.

Holographic Display Industry Market Trends & Opportunities

The holographic display market is poised for significant expansion, with an estimated market size projected to reach over $60 Billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of approximately 28% from 2025 to 2033. This robust growth is fueled by rapid technological advancements, including improvements in light field displays, volumetric imaging, and interactive holographic interfaces. Consumer preferences are increasingly shifting towards more immersive and interactive visual experiences, creating fertile ground for holographic solutions in entertainment, gaming, and communication. The Media and Entertainment sector, in particular, is expected to witness unprecedented adoption, with holographic live events and interactive cinematic experiences becoming mainstream.

Furthermore, the automotive industry is embracing transparent holographic displays for enhanced driver information systems, promising a safer and more intuitive driving experience. In retail, holographic point-of-sale displays and virtual try-on solutions are set to revolutionize customer engagement and boost sales. The healthcare sector is exploring holographic imaging for surgical planning, medical training, and remote patient consultations, enhancing precision and accessibility. The market penetration rate for holographic displays in niche applications is expected to exceed 25% by 2030, driven by a growing understanding of their unique value proposition. Emerging trends also include the development of more portable and affordable holographic projectors, democratizing access to this advanced technology. Strategic partnerships and collaborative R&D efforts are crucial for overcoming technical hurdles and accelerating market acceptance, unlocking significant revenue opportunities for early adopters.

Dominant Markets & Segments in Holographic Display Industry

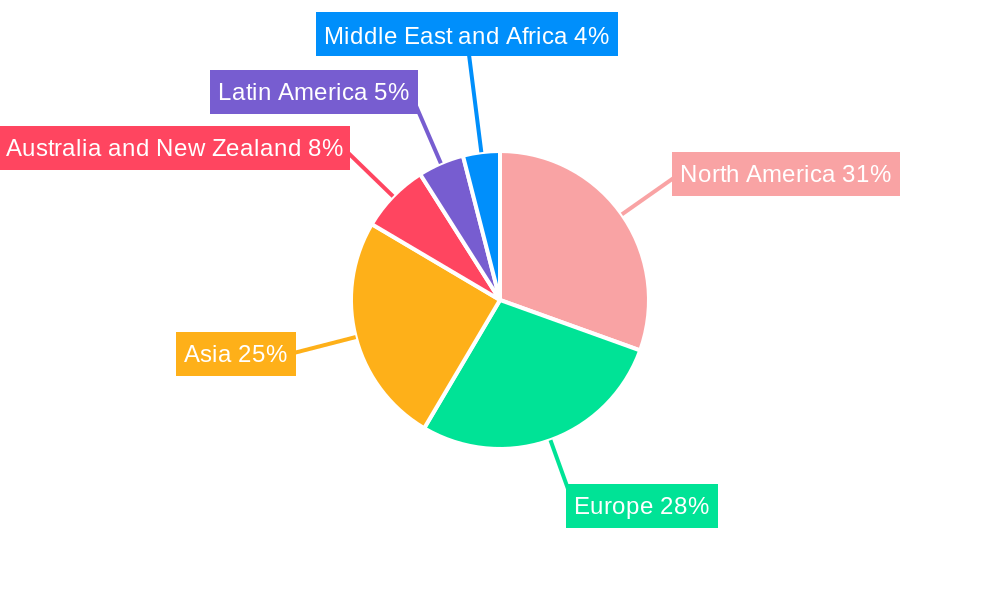

The Media and Entertainment segment is currently the dominant market within the holographic display industry, driven by its inherent demand for visually engaging and immersive content. The Consumer Electronics segment is rapidly emerging as a close second, with an increasing consumer appetite for innovative home entertainment and gaming solutions. North America currently leads as the dominant region, owing to significant investment in R&D and a strong consumer base for advanced technologies.

Media and Entertainment:

- Growth Drivers: Demand for live holographic concerts, interactive theme park attractions, and next-generation cinema experiences. Increased adoption of volumetric video capture and playback.

- Market Dominance: Early adoption by major entertainment studios and live event organizers. Development of specialized holographic content creation tools and platforms.

Consumer Electronics:

- Growth Drivers: Growing interest in holographic gaming consoles, immersive home theater systems, and holographic smart devices. Technological advancements leading to more compact and affordable consumer-grade holographic projectors.

- Market Dominance: Increasing product launches from major consumer electronics manufacturers, coupled with evolving consumer expectations for interactive and futuristic gadgets.

Automotive:

- Growth Drivers: Integration of transparent holographic displays for Heads-Up Displays (HUDs) and in-cabin information systems, enhancing driver safety and experience. The January 2024 introduction of transparent holographic displays by Hyundai Mobis for EVs signals a major push.

- Market Dominance: Significant investments by automotive OEMs and Tier-1 suppliers in developing and integrating holographic display technology into next-generation vehicles.

Military and Defense:

- Growth Drivers: Applications in simulation and training, battlefield visualization, and advanced targeting systems.

- Market Dominance: Government funding for advanced defense technologies and the need for high-fidelity, real-time holographic simulations.

Healthcare:

- Growth Drivers: Use in surgical planning, medical visualization, and remote diagnostic tools.

- Market Dominance: Growing recognition of holographic technology's potential to improve patient outcomes and streamline medical procedures.

Holographic Display Industry Product Analysis

Product innovations in the holographic display industry are centered on enhancing realism, interactivity, and portability. Advancements in light field technology and volumetric displays are enabling more convincing 3D imagery with wider viewing angles and greater depth perception. Interactive holographic interfaces, responding to gestures and voice commands, are expanding application possibilities across various sectors. Competitive advantages stem from superior image quality, reduced latency, energy efficiency, and the ability to integrate seamlessly with existing ecosystems. The development of transparent holographic displays, as seen in automotive applications, offers unique functionalities for heads-up displays and augmented reality integration.

Key Drivers, Barriers & Challenges in Holographic Display Industry

Key Drivers:

- Technological Advancements: Continuous improvements in display resolution, refresh rates, and computational power are making holographic displays more viable.

- Growing Demand for Immersive Experiences: Consumer and industry demand for more engaging and interactive visual content.

- Industry-Specific Applications: Emerging use cases in Media and Entertainment, Automotive, and Healthcare are creating significant market pull.

- Investment and Funding: Increased R&D investment from both private and public sectors.

Barriers & Challenges:

- High Development and Production Costs: Initial costs for developing and manufacturing advanced holographic displays remain substantial, limiting widespread adoption.

- Technical Limitations: Challenges persist in achieving true holographic realism, wide viewing angles without distortion, and high refresh rates for smooth motion.

- Content Creation Ecosystem: A lack of standardized content creation tools and a mature ecosystem for holographic content hinders broader application development.

- Consumer Awareness and Education: Many consumers are still unfamiliar with holographic technology and its potential benefits, requiring significant market education.

Growth Drivers in the Holographic Display Industry Market

Key growth drivers for the holographic display industry are deeply rooted in technological innovation, evolving consumer preferences, and strategic industry applications. The relentless pursuit of higher fidelity and more interactive holographic experiences, driven by advancements in light field technology and computational imaging, is a primary catalyst. Furthermore, the burgeoning demand for immersive entertainment, advanced automotive interfaces, and groundbreaking medical visualization tools provides significant market pull. Government initiatives and increased R&D funding in sectors like defense and healthcare also act as crucial growth enablers, fostering the development and adoption of sophisticated holographic solutions.

Challenges Impacting Holographic Display Industry Growth

The holographic display industry faces several significant challenges that could impede its growth trajectory. Foremost among these are the substantial costs associated with research, development, and manufacturing, which currently make widespread adoption prohibitive for many applications. Technical hurdles, including achieving true volumetric imaging with wide, distortion-free viewing angles and maintaining high refresh rates for seamless motion, continue to be areas requiring innovation. The nascent ecosystem for holographic content creation also presents a bottleneck, as the availability of compelling and easily producible holographic content is crucial for driving demand across various end-user verticals.

Key Players Shaping the Holographic Display Industry Market

- Musion Das Hologram Ltd

- Realview Imaging Ltd

- Animmersion UK Ltd

- Looking Glass Factory Inc

- Shenzhen SMX Display Technology Co Lt

- Kino-mo Limited (HYPERVSN)

- RealFiction Holding AB

- Provision Holding Inc

Significant Holographic Display Industry Industry Milestones

- Jan 2024: Hyundai Mobis unveiled its latest EV technology, featuring the world's first transparent display screen utilizing holographic technology, showcasing innovative display series for next-gen vehicles including a rollable and swivel display. This advancement simplifies driver information display for enhanced road safety.

- Jan 2024: ARHT Media Inc. announced a partnership with a global luxury retail brand to install ARHT Capsule hologram displays in five country headquarters across three continents. This collaboration will leverage ARHT's low-latency, high-fidelity live streaming technology for learning, sales, marketing, and special events.

Future Outlook for Holographic Display Industry Market

The future outlook for the holographic display market is exceptionally bright, fueled by accelerating technological advancements and expanding application horizons. Strategic opportunities lie in further miniaturization of devices, cost reduction through mass production, and the development of robust content creation platforms. The convergence of holographic technology with artificial intelligence and 5G networks promises to unlock unprecedented levels of interactivity and real-time performance, driving adoption across Consumer Electronics, Automotive, and Healthcare. The market is projected to witness significant growth catalysts, including the widespread integration of holographic interfaces into daily life and the emergence of entirely new holographic-based industries, solidifying its position as a transformative technology.

Holographic Display Industry Segmentation

-

1. End-user Verticals

- 1.1. Consumer Electronics

- 1.2. Retail

- 1.3. Media and Entertainment

- 1.4. Military and Defense

- 1.5. Healthcare

- 1.6. Automotive

- 1.7. Other End-user Verticals

Holographic Display Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Holographic Display Industry Regional Market Share

Geographic Coverage of Holographic Display Industry

Holographic Display Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investments in 3D Technology; Advancements in Screenless Displays

- 3.3. Market Restrains

- 3.3.1. High Cost of Assembling Holographic Display Devices; Presence of Substitute Display Products

- 3.4. Market Trends

- 3.4.1. Automotive Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Holographic Display Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.1.1. Consumer Electronics

- 5.1.2. Retail

- 5.1.3. Media and Entertainment

- 5.1.4. Military and Defense

- 5.1.5. Healthcare

- 5.1.6. Automotive

- 5.1.7. Other End-user Verticals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 6. North America Holographic Display Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 6.1.1. Consumer Electronics

- 6.1.2. Retail

- 6.1.3. Media and Entertainment

- 6.1.4. Military and Defense

- 6.1.5. Healthcare

- 6.1.6. Automotive

- 6.1.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 7. Europe Holographic Display Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 7.1.1. Consumer Electronics

- 7.1.2. Retail

- 7.1.3. Media and Entertainment

- 7.1.4. Military and Defense

- 7.1.5. Healthcare

- 7.1.6. Automotive

- 7.1.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 8. Asia Holographic Display Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 8.1.1. Consumer Electronics

- 8.1.2. Retail

- 8.1.3. Media and Entertainment

- 8.1.4. Military and Defense

- 8.1.5. Healthcare

- 8.1.6. Automotive

- 8.1.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 9. Australia and New Zealand Holographic Display Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 9.1.1. Consumer Electronics

- 9.1.2. Retail

- 9.1.3. Media and Entertainment

- 9.1.4. Military and Defense

- 9.1.5. Healthcare

- 9.1.6. Automotive

- 9.1.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 10. Latin America Holographic Display Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 10.1.1. Consumer Electronics

- 10.1.2. Retail

- 10.1.3. Media and Entertainment

- 10.1.4. Military and Defense

- 10.1.5. Healthcare

- 10.1.6. Automotive

- 10.1.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 11. Middle East and Africa Holographic Display Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 11.1.1. Consumer Electronics

- 11.1.2. Retail

- 11.1.3. Media and Entertainment

- 11.1.4. Military and Defense

- 11.1.5. Healthcare

- 11.1.6. Automotive

- 11.1.7. Other End-user Verticals

- 11.1. Market Analysis, Insights and Forecast - by End-user Verticals

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Musion Das Hologram Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Realview Imaging Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Animmersion UK Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Looking Glass Factory Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Shenzhen SMX Display Technology Co Lt

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Kino-mo Limited (HYPERVSN)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 RealFiction Holding AB

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Provision Holding Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Musion Das Hologram Ltd

List of Figures

- Figure 1: Global Holographic Display Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Holographic Display Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 3: North America Holographic Display Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 4: North America Holographic Display Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Holographic Display Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Holographic Display Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 7: Europe Holographic Display Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 8: Europe Holographic Display Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Holographic Display Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Holographic Display Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 11: Asia Holographic Display Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 12: Asia Holographic Display Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Holographic Display Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand Holographic Display Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 15: Australia and New Zealand Holographic Display Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 16: Australia and New Zealand Holographic Display Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand Holographic Display Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Holographic Display Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 19: Latin America Holographic Display Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 20: Latin America Holographic Display Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America Holographic Display Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Holographic Display Industry Revenue (Million), by End-user Verticals 2025 & 2033

- Figure 23: Middle East and Africa Holographic Display Industry Revenue Share (%), by End-user Verticals 2025 & 2033

- Figure 24: Middle East and Africa Holographic Display Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Holographic Display Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Holographic Display Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 2: Global Holographic Display Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Holographic Display Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 4: Global Holographic Display Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Holographic Display Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 6: Global Holographic Display Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Holographic Display Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 8: Global Holographic Display Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Holographic Display Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 10: Global Holographic Display Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Holographic Display Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 12: Global Holographic Display Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Holographic Display Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 14: Global Holographic Display Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Holographic Display Industry?

The projected CAGR is approximately 23.12%.

2. Which companies are prominent players in the Holographic Display Industry?

Key companies in the market include Musion Das Hologram Ltd, Realview Imaging Ltd, Animmersion UK Ltd, Looking Glass Factory Inc, Shenzhen SMX Display Technology Co Lt, Kino-mo Limited (HYPERVSN), RealFiction Holding AB, Provision Holding Inc.

3. What are the main segments of the Holographic Display Industry?

The market segments include End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments in 3D Technology; Advancements in Screenless Displays.

6. What are the notable trends driving market growth?

Automotive Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Cost of Assembling Holographic Display Devices; Presence of Substitute Display Products.

8. Can you provide examples of recent developments in the market?

Jan 2024: Hyundai Mobis, Hyundai’s largest supplier, unveiled its latest EV tech. It uses the first transparent display screen using holographic tech. The company revealed its “innovative display series” for next-gen vehicles, which included the “world’s first rollable display and swivel display.” Hyundai Mobis presented a transparent display that uses holographic elements. The display appears on a transparent panel, making it easier for drivers to keep their eyes on the road.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Holographic Display Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Holographic Display Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Holographic Display Industry?

To stay informed about further developments, trends, and reports in the Holographic Display Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence