Key Insights

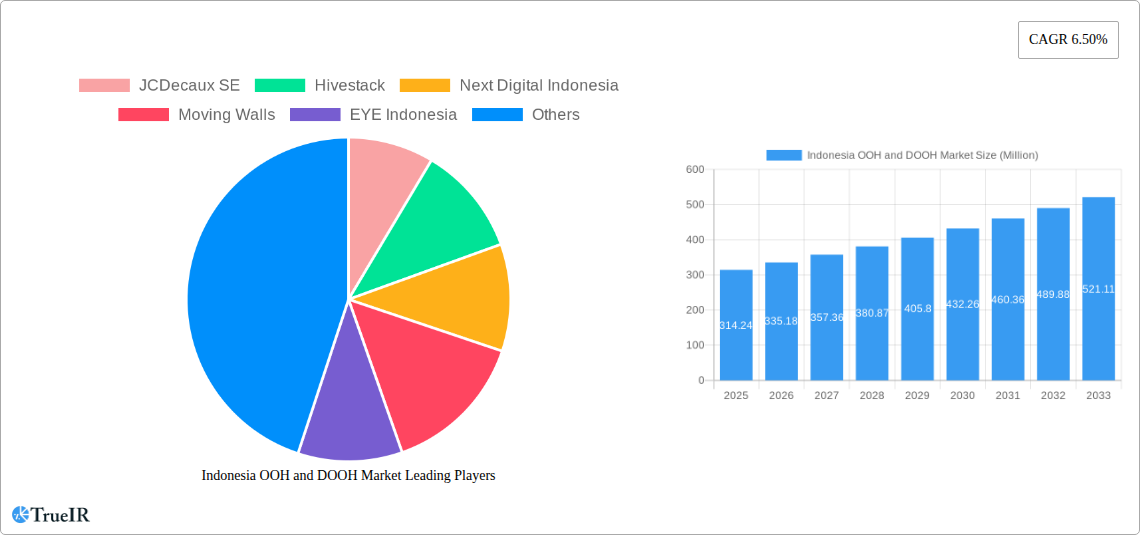

The Indonesian Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market is poised for significant expansion, currently valued at USD 314.24 million. This growth is propelled by a robust CAGR of 6.50% over the forecast period of 2025-2033. A primary driver for this upward trajectory is the increasing adoption of programmatic DOOH, allowing for more targeted and data-driven advertising campaigns. The inherent advantages of OOH, such as broad reach and high impact, are being amplified by the integration of digital technologies, offering enhanced engagement and measurable results for advertisers. Key segments like Digital OOH (LED Screens) and Transportation (Airports and Buses) are expected to witness substantial investment as brands seek to connect with consumers in high-traffic, dynamic environments. The retail and consumer goods sector, along with automotive, are leading the charge in leveraging OOH and DOOH for promotional activities and brand building.

Indonesia OOH and DOOH Market Market Size (In Million)

The market's potential is further underscored by ongoing trends such as the growing urbanization in Indonesia, leading to increased exposure to OOH media. Innovations in creative content, including interactive displays and augmented reality experiences, are also contributing to the market's dynamism. While the market enjoys strong growth, certain restraints may include the initial investment cost for advanced digital OOH infrastructure and the evolving regulatory landscape concerning outdoor advertising. However, the inherent ability of OOH and DOOH to complement digital marketing strategies, coupled with its cost-effectiveness in reaching mass audiences, positions it as a crucial component of integrated advertising plans for businesses across various end-user industries. The ongoing digital transformation across Indonesia is creating fertile ground for the continued evolution and dominance of the DOOH sector within the broader OOH landscape.

Indonesia OOH and DOOH Market Company Market Share

This report delivers an in-depth analysis of the dynamic Indonesian Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this comprehensive report examines market size, trends, opportunities, and the competitive landscape. Leveraging high-volume keywords such as "Indonesia OOH advertising," "Digital OOH Indonesia," "Programmatic OOH market," and "DOOH media Indonesia," this report is meticulously crafted for industry professionals, advertisers, media agencies, and investors seeking actionable insights into one of Southeast Asia's most rapidly evolving advertising sectors. Discover the strategies of leading players like JCDecaux SE, Hivestack, and Next Digital Indonesia as the market transitions towards programmatic innovation and data-driven campaigns.

Indonesia OOH and DOOH Market Market Structure & Competitive Landscape

The Indonesian OOH and DOOH market is characterized by a moderately concentrated structure, with a few dominant players alongside a significant number of regional and niche operators. Innovation is largely driven by the rapid adoption of digital technologies and programmatic buying, leading to increased efficiency and sophisticated targeting capabilities. Regulatory frameworks are evolving, with ongoing efforts to standardize digital advertising practices and ensure fair competition. Product substitutes include digital platforms and traditional media, but the unique reach and impact of OOH/DOOH continue to ensure its relevance. End-user segmentation reveals a strong reliance on sectors like Retail and Consumer Goods, Automotive, and BFSI for advertising spend. Merger and acquisition (M&A) activity is expected to increase as larger entities seek to consolidate market share and expand their digital OOH portfolios. For instance, an estimated 5-10 M&A deals in the OOH sector within the last two years indicate growing consolidation. Concentration ratios for the top three players in key metropolitan areas hover around 40-50%.

- Market Concentration: Moderate, with a blend of established global players and strong local entities.

- Innovation Drivers: Programmatic technology, data analytics, and digital screen adoption.

- Regulatory Impacts: Emerging standards for programmatic trading and digital ad formats.

- Product Substitutes: Digital streaming, social media, and traditional print media.

- End-User Segmentation: Dominance of Retail, Automotive, and BFSI sectors.

- M&A Trends: Increasing consolidation driven by the need for scale and technological integration.

Indonesia OOH and DOOH Market Market Trends & Opportunities

The Indonesian OOH and DOOH market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12-15% during the forecast period of 2025–2033. This robust expansion is fueled by increasing urbanization, a growing middle class with higher disposable incomes, and a surge in digital infrastructure development across the archipelago. The shift towards Digital Out-of-Home (DOOH) advertising is a defining trend, driven by its superior flexibility, dynamic content capabilities, and enhanced targeting options through programmatic buying. Programmatic OOH, in particular, presents a substantial opportunity for advertisers to reach specific audience segments with real-time optimized campaigns, a concept that gained significant traction with initiatives like Magnite's roadblock campaign in July 2024. The increasing penetration of smartphones and mobile data usage further empowers OOH and DOOH by enabling seamless integration with mobile marketing strategies, such as location-based services and QR code interactions.

Consumer preferences are also evolving, with audiences increasingly drawn to engaging and interactive advertising experiences. DOOH screens in high-traffic areas like malls, transportation hubs, and entertainment venues are proving highly effective in capturing attention. The rise of data analytics and AI is revolutionizing OOH, allowing for more precise audience measurement and campaign attribution. This move towards data-driven OOH advertising is a key opportunity for both media owners and advertisers to maximize ROI. Furthermore, the growing digital advertising spend in Indonesia, coupled with the inherent reach and impact of OOH, positions DOOH as a critical component of integrated marketing campaigns. Opportunities also lie in emerging formats and placements, such as smart city integrations and innovative street furniture advertising, which can provide hyper-local targeting and unique brand storytelling. The market penetration rate of DOOH is expected to climb from 30% in 2024 to over 55% by 2033, indicating a substantial shift in media allocation.

Dominant Markets & Segments in Indonesia OOH and DOOH Market

The Indonesian OOH and DOOH market exhibits distinct dominance across several segments, driven by infrastructure development, consumer behavior, and advertising spend patterns.

Type: Digital OOH (DOOH) is rapidly emerging as the dominant segment, surpassing Static (Traditional) OOH in terms of growth trajectory and advertiser interest. Within DOOH, LED Screens and Programmatic OOH are key growth drivers. The ability to display dynamic content, run real-time campaigns, and leverage data for targeting makes DOOH inherently more attractive for brands seeking to maximize impact and efficiency. Programmatic OOH, in particular, is witnessing accelerated adoption as it brings the precision and automation of digital advertising to the physical world. Indonesia's growing digital infrastructure and increasing programmatic media buying capabilities are key enablers for this segment's dominance.

- Key Growth Drivers for DOOH Dominance:

- Increasing availability of digital screens in prime urban locations.

- Advancements in programmatic OOH technology and platforms.

- Demand for dynamic content and real-time campaign optimization.

- Integration with mobile advertising for enhanced audience engagement.

Application: The Transportation (Transit) segment, encompassing airports and other transportation hubs like bus terminals and train stations, along with advertising on buses and other public transport, is a major driver of OOH and DOOH revenue. These locations offer high-density, captive audiences, making them ideal for widespread brand visibility. Airports, in particular, attract affluent travelers and business professionals, making them a premium advertising space. Billboards continue to hold significant sway, especially in high-visibility urban areas, offering broad reach. Street Furniture, such as bus shelters and kiosks, also plays a crucial role, providing localized and frequent exposure in urban environments.

- Key Growth Drivers for Transportation Dominance:

- Expansion and modernization of transportation infrastructure.

- High footfall and passenger volume in airports, train stations, and bus terminals.

- Unique advertising opportunities within transit vehicles and stations.

- Growing inter-city and international travel.

End-user Industry: The Retail and Consumer Goods sector is consistently the largest advertiser in the Indonesian OOH and DOOH market, driven by the need to reach broad consumer bases for product launches, promotions, and brand building. The Automotive industry is another significant contributor, utilizing OOH/DOOH for new vehicle launches and dealership promotions. The BFSI (Banking, Financial Services, and Insurance) sector is increasingly leveraging OOH/DOOH for brand awareness and service promotion, especially in urban centers. The Healthcare industry is also growing its OOH/DOOH spend, focusing on public health awareness campaigns and product promotion.

- Key Growth Drivers for Retail & Consumer Goods Dominance:

- Large consumer base and high purchasing power in urban centers.

- Need for mass reach and impulse purchase drivers.

- Frequent product launches and promotional activities.

- Brand building for everyday essentials and premium goods.

Indonesia OOH and DOOH Market Product Analysis

The Indonesian OOH and DOOH market is witnessing a rapid evolution of its product offerings, driven by technological advancements and evolving advertiser demands. Digital Out-of-Home (DOOH) encompasses a range of innovative products, from large-format LED screens in high-traffic urban locations to interactive digital displays integrated into street furniture and retail environments. Programmatic OOH is transforming traditional static billboards into data-driven, contextually relevant advertising spaces, allowing for hyper-targeted campaigns and dynamic content delivery. These DOOH products offer significant competitive advantages, including real-time campaign management, detailed audience measurement, and the ability to deliver personalized advertising experiences. Innovations like dynamic creative optimization and the integration of AI for audience analytics are enhancing the effectiveness and appeal of OOH and DOOH advertising.

Key Drivers, Barriers & Challenges in Indonesia OOH and DOOH Market

Key Drivers: The Indonesian OOH and DOOH market is propelled by robust economic growth, increasing urbanization, and a burgeoning middle class with higher disposable incomes. Technological advancements, particularly the widespread adoption of digital screens and programmatic buying platforms, are transforming the advertising landscape. Government initiatives aimed at improving urban infrastructure and promoting digital transformation also contribute significantly. The inherent strengths of OOH/DOOH, such as its ability to generate mass reach and impact, combined with growing mobile integration, further fuel market expansion. The increasing demand for measurable and data-driven advertising solutions also favors the growth of DOOH.

Barriers & Challenges: Despite the strong growth trajectory, the market faces several challenges. Regulatory complexities and evolving compliance standards can create hurdles for advertisers and media owners. The supply chain for digital hardware and installation can sometimes experience disruptions. Furthermore, competition from other digital advertising channels, while driving innovation, also necessitates continuous adaptation to maintain market share. Quantifiable impacts of these challenges can include increased operational costs due to import duties on digital hardware or delays in campaign deployment due to complex permit processes, potentially impacting campaign ROI by 5-10%.

Growth Drivers in the Indonesia OOH and DOOH Market Market

The growth of the Indonesia OOH and DOOH market is significantly driven by several factors. Economic Expansion and Urbanization are creating larger urban centers with higher consumer density, increasing the demand for advertising space. Technological Advancements in digital display technology and the proliferation of programmatic platforms are making DOOH more sophisticated and efficient. Increased Digital Penetration across Indonesia, including smartphone adoption and mobile internet usage, facilitates the integration of OOH/DOOH with digital campaigns, offering opportunities for richer consumer engagement. Government Support for smart city initiatives and digital infrastructure development also plays a crucial role in expanding OOH and DOOH opportunities.

Challenges Impacting Indonesia OOH and DOOH Market Growth

Several challenges are impacting the growth of the Indonesia OOH and DOOH market. Regulatory Hurdles and the evolving nature of digital advertising laws can create uncertainty and compliance burdens for businesses. Supply Chain Issues related to the procurement and maintenance of digital OOH hardware can lead to project delays and increased costs. Intense Competitive Pressure from other digital advertising channels, including social media and online video, requires continuous innovation and demonstrable ROI to retain advertising spend. Additionally, the need for standardization in programmatic trading and audience measurement remains a critical area for development to ensure market maturity and advertiser confidence.

Key Players Shaping the Indonesia OOH and DOOH Market Market

- JCDecaux SE

- Hivestack

- Next Digital Indonesia

- Moving Walls

- EYE Indonesia

- Plan B Media Public Company Limited

- VIOOH

- Vistar Media

- Jaris & K

- Pixel Group

Significant Indonesia OOH and DOOH Market Industry Milestones

- July 2024: Magnite, in collaboration with Dentsu Indonesia, successfully executed a programmatic roadblock campaign across leading Indonesian streaming platforms (Viu, Vidio, WeTV), achieving a 100% Share of Voice (SOV).

- July 2024: Nestlé Indonesia launched its limited-edition NESCAFÉ Biscuit Coffee, leveraging a strategic partnership with Magnite and Dentsu Indonesia to amplify reach on popular streaming platforms, recognizing their growing audience engagement.

- April 2024: inDrive, an Indonesian ride-hailing service, enhanced its marketing initiatives in Jakarta and other key cities by partnering with The Perfect Media for outdoor advertising.

- April 2024: inDrive also engaged in mall branding at Central Mall Bandar Lampung, targeting mall-goers with focused advertising.

Future Outlook for Indonesia OOH and DOOH Market Market

The future outlook for the Indonesia OOH and DOOH market is exceptionally bright, driven by sustained economic growth, rapid technological adoption, and evolving consumer behaviors. Programmatic DOOH is expected to become the dominant force, enabling highly targeted and data-driven campaigns with enhanced measurability. Opportunities will emerge from the integration of OOH/DOOH with mobile technologies for richer, interactive experiences and the expansion of digital screens into previously untapped locations. Smart city initiatives will further unlock new advertising avenues. As advertisers increasingly seek efficient, impactful, and measurable advertising solutions, the Indonesian OOH and DOOH market is well-positioned for continued robust expansion, projected to reach an estimated value of USD 2.5 Billion by 2033, with DOOH accounting for over 70% of the total market share.

Indonesia OOH and DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Other Digital OOH

-

2. Application

- 2.1. Billboard

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Other Transportation (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-based Media

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End-user Industries

Indonesia OOH and DOOH Market Segmentation By Geography

- 1. Indonesia

Indonesia OOH and DOOH Market Regional Market Share

Geographic Coverage of Indonesia OOH and DOOH Market

Indonesia OOH and DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines

- 3.4. Market Trends

- 3.4.1. Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia OOH and DOOH Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Other Digital OOH

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Billboard

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Other Transportation (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-based Media

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JCDecaux SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hivestack

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Next Digital Indonesia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Moving Walls

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 EYE Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Plan B Media Public Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 VIOOH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vistar Media

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jaris & K

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pixel Group*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JCDecaux SE

List of Figures

- Figure 1: Indonesia OOH and DOOH Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia OOH and DOOH Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Indonesia OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Indonesia OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Indonesia OOH and DOOH Market Volume Million Forecast, by Application 2020 & 2033

- Table 5: Indonesia OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Indonesia OOH and DOOH Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Indonesia OOH and DOOH Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Indonesia OOH and DOOH Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Indonesia OOH and DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Indonesia OOH and DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 11: Indonesia OOH and DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Indonesia OOH and DOOH Market Volume Million Forecast, by Application 2020 & 2033

- Table 13: Indonesia OOH and DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Indonesia OOH and DOOH Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Indonesia OOH and DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Indonesia OOH and DOOH Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia OOH and DOOH Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Indonesia OOH and DOOH Market?

Key companies in the market include JCDecaux SE, Hivestack, Next Digital Indonesia, Moving Walls, EYE Indonesia, Plan B Media Public Company Limited, VIOOH, Vistar Media, Jaris & K, Pixel Group*List Not Exhaustive.

3. What are the main segments of the Indonesia OOH and DOOH Market?

The market segments include Type, Application, End-user Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 314.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines.

6. What are the notable trends driving market growth?

Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects.

7. Are there any restraints impacting market growth?

Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines.

8. Can you provide examples of recent developments in the market?

July 2024: Magnite, in collaboration with Dentsu Indonesia, rolled out a programmatic roadblock campaign on Indonesia's top streaming platforms – Viu, Vidio, and WeTV. This strategic move secured Magnite a 100% share of voice (SOV), ensuring unparalleled brand exposure. Concurrently, Nestlé Indonesia unveiled its latest offering, the limited-edition NESCAFÉ Biscuit Coffee featuring Marie Regal Biscuit. Recognizing the surging popularity of streaming platforms, Nestlé Indonesia partnered with Magnite and Dentsu Indonesia to amplify its audience reach.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia OOH and DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia OOH and DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia OOH and DOOH Market?

To stay informed about further developments, trends, and reports in the Indonesia OOH and DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence