Key Insights

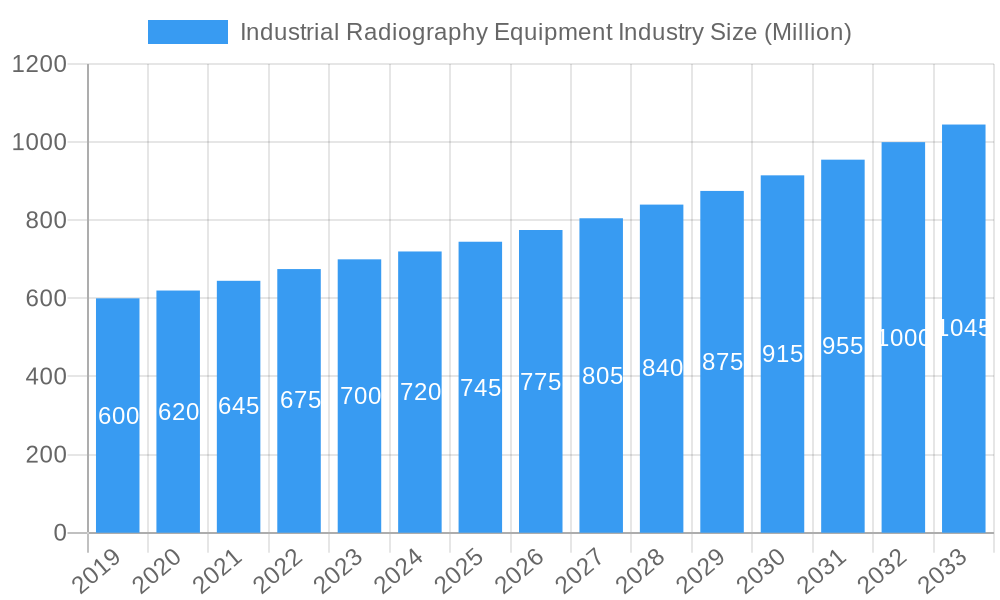

The Industrial Radiography Equipment market is set for substantial growth, propelled by escalating demand for non-destructive testing (NDT) across key sectors. Projected to reach a market size of $1.35 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 8.6%, the market demonstrates robust expansion. This growth is driven by the critical need for quality assurance and defect detection in aerospace & defense, petrochemical & gas, energy & power, and automotive industries. Technological advancements, including the increasing adoption of Direct Radiography (DR) and Computed Tomography (CT) for their superior image resolution and efficiency, are significant growth catalysts. These advanced technologies offer enhanced inspection speed and detailed insights, surpassing traditional methods and becoming essential for verifying the integrity of critical components.

Industrial Radiography Equipment Industry Market Size (In Billion)

Market dynamics are further influenced by emerging trends such as the integration of artificial intelligence (AI) and machine learning (ML) for automated defect analysis, alongside the development of portable and automated radiography systems for improved field inspections. While significant growth is anticipated, potential challenges include high initial investment costs for advanced equipment and the requirement for skilled technicians. However, continuous innovation from industry leaders and the increasing global emphasis on stringent safety regulations and product quality are expected to mitigate these challenges. The broad spectrum of applications, from pipeline weld inspection to aircraft component integrity verification, ensures sustained demand for industrial radiography equipment in both mature and emerging economies.

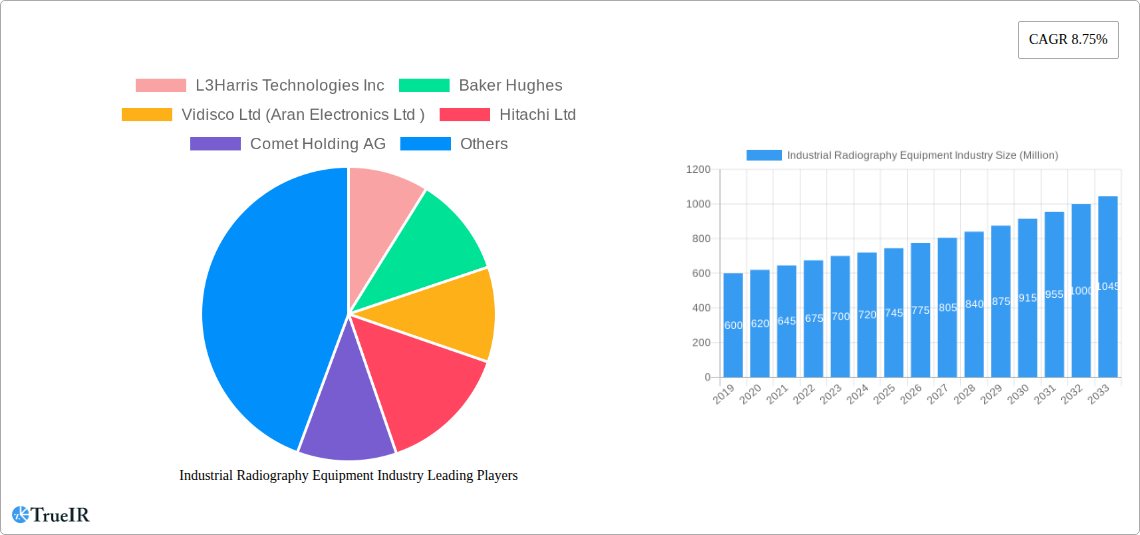

Industrial Radiography Equipment Industry Company Market Share

Industrial Radiography Equipment Industry Market Report: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the global Industrial Radiography Equipment Market. Leveraging high-volume keywords such as "industrial X-ray systems," "non-destructive testing (NDT) equipment," "computed tomography (CT) scanners," and "radiographic inspection solutions," this report is designed to enhance search rankings and engage a broad spectrum of industry professionals. Covering the period from 2019 to 2033, with a base year of 2025, this report offers unparalleled insights into market structure, trends, dominant segments, product innovations, key players, and future outlook.

Industrial Radiography Equipment Industry Market Structure & Competitive Landscape

The Industrial Radiography Equipment Industry exhibits a moderately consolidated market structure, with a few key players dominating a significant market share, estimated at approximately 60% in the base year 2025. Innovation drivers are primarily fueled by advancements in detector technology, image processing algorithms, and portability, leading to enhanced inspection speed and accuracy. Regulatory impacts, particularly stringent safety standards and quality control mandates across end-user industries, play a crucial role in shaping product development and market entry. Product substitutes, such as ultrasonic testing and eddy current testing, present a competitive challenge, though radiography's unique ability to detect internal flaws remains a core advantage. End-user segmentation reveals the Aerospace and Defense and Petrochemical and Gas sectors as primary consumers, driving demand for high-resolution and robust equipment. Merger and acquisition (M&A) trends, with an estimated volume of 15-20 significant transactions annually between 2019 and 2024, indicate strategic consolidation and expansion by leading companies seeking to broaden their product portfolios and geographic reach.

- Market Concentration: Moderate to High, with top 5 players holding an estimated 60% market share in 2025.

- Innovation Focus: Digitalization, miniaturization, automated inspection, and advanced software solutions.

- Regulatory Influence: Strong emphasis on safety, accuracy, and industry-specific compliance standards.

- Competitive Landscape: Characterized by product differentiation, technological superiority, and strong customer relationships.

- M&A Activity: Indicates a strategic drive for market consolidation and diversification.

Industrial Radiography Equipment Industry Market Trends & Opportunities

The global Industrial Radiography Equipment Market is projected to experience robust growth, driven by an escalating demand for non-destructive testing (NDT) solutions across a myriad of industries. The market size is anticipated to reach an estimated USD 2.5 Billion by the end of the forecast period in 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5% from the base year 2025. Technological shifts are a paramount trend, with a significant move away from traditional film radiography towards advanced digital solutions like Computed Radiography (CR) and Direct Radiography (DR), and increasingly, Computed Tomography (CT). These digital technologies offer superior image quality, reduced processing times, lower operational costs, and enhanced data management capabilities. Consumer preferences are increasingly leaning towards portable, user-friendly, and automated systems that can deliver real-time inspection results, thus minimizing downtime and improving overall operational efficiency. The competitive dynamics are intensifying, with established players investing heavily in research and development to introduce next-generation equipment that addresses emerging industrial needs, such as the inspection of complex composite materials and advanced alloys. Opportunities abound in the development of artificial intelligence (AI)-powered image analysis software, which promises to further revolutionize defect detection and interpretation, thereby improving inspection accuracy and reducing human error. The growing emphasis on asset integrity management and predictive maintenance in sectors like Petrochemical and Gas and Energy and Power further fuels the demand for sophisticated radiography equipment. Furthermore, the burgeoning adoption of advanced manufacturing techniques and the increasing complexity of manufactured components necessitate highly precise inspection methods, creating a sustained demand for cutting-edge radiography solutions. The expansion of infrastructure projects globally, particularly in developing economies, also presents a significant growth avenue for the industrial radiography equipment market.

Dominant Markets & Segments in Industrial Radiography Equipment Industry

The Industrial Radiography Equipment Industry is characterized by distinct regional dominance and segment penetration. Globally, Asia Pacific is emerging as the most dominant region, driven by rapid industrialization, significant investments in infrastructure development, and a burgeoning manufacturing sector in countries like China and India. The Manufacturing segment, encompassing automotive, electronics, and general manufacturing, represents a substantial portion of the market, accounting for an estimated 25% of global demand in the base year 2025. However, the Aerospace and Defense and Petrochemical and Gas industries hold significant sway due to the critical nature of their inspections and the high value of assets requiring rigorous quality control, collectively contributing an estimated 40% to the market.

Within the technology segmentation, Direct Radiography (DR) is rapidly gaining market share due to its efficiency and superior image quality compared to traditional methods, projected to account for approximately 35% of the market by 2025. Computed Radiography (CR) remains a strong contender, particularly in cost-sensitive applications. Computed Tomography (CT), while representing a smaller segment currently (around 15%), is experiencing the fastest growth rate, driven by its unparalleled ability to provide detailed 3D volumetric data, crucial for complex part inspection.

- Dominant Region: Asia Pacific, driven by manufacturing growth and infrastructure development.

- Key Growth Drivers in Asia Pacific:

- Increasing investments in advanced manufacturing.

- Government initiatives promoting industrial modernization.

- Expansion of automotive and electronics sectors.

- Dominant End-User Industries:

- Manufacturing: Essential for quality control of diverse products.

- Aerospace and Defense: Critical for ensuring the integrity of high-stress components.

- Petrochemical and Gas: Vital for pipeline inspection and asset integrity.

- Dominant Technology Segment (by market share): Direct Radiography (DR), offering faster acquisition and improved image quality.

- Fastest Growing Technology Segment: Computed Tomography (CT), enabling detailed 3D volumetric inspection.

- Key Growth Drivers in Technology Segments:

- Advancements in detector technology and software.

- Demand for higher resolution and faster inspection speeds.

- Increasing complexity of manufactured parts requiring advanced imaging.

Industrial Radiography Equipment Industry Product Analysis

The Industrial Radiography Equipment Industry is witnessing continuous product innovation focused on enhancing portability, resolution, and speed of inspection. Advancements in detector technology, including the development of highly sensitive and compact flat-panel detectors (FPDs), are enabling the creation of lighter and more versatile X-ray systems. Applications are expanding beyond traditional flaw detection to include detailed 3D metrology and quality assurance of complex geometries. Competitive advantages are increasingly derived from integrated software solutions that offer automated defect recognition, image enhancement, and comprehensive reporting capabilities, thereby streamlining the inspection workflow and improving accuracy.

Key Drivers, Barriers & Challenges in Industrial Radiography Equipment Industry

Key Drivers:

- Increasing demand for NDT: Driven by stringent quality control mandates across industries like aerospace, automotive, and petrochemical.

- Technological Advancements: Development of digital radiography, computed tomography, and AI-powered image analysis solutions.

- Focus on Asset Integrity and Safety: Ensuring the reliability and longevity of critical infrastructure and manufactured components.

- Growth in Emerging Economies: Rapid industrialization and infrastructure development in regions like Asia Pacific.

Barriers & Challenges:

- High initial investment cost: Advanced radiography equipment can be expensive, posing a barrier for smaller enterprises.

- Regulatory complexities: Adherence to diverse and evolving safety and quality standards across different regions and industries.

- Shortage of skilled workforce: The need for trained and certified NDT professionals to operate and interpret radiography equipment.

- Supply chain disruptions: Potential for delays in the availability of specialized components and raw materials.

Growth Drivers in the Industrial Radiography Equipment Industry Market

Several key factors are propelling the Industrial Radiography Equipment Market. Technological innovation stands as a primary driver, with continuous advancements in digital imaging, computed tomography, and automated inspection systems. The growing emphasis on safety, quality assurance, and asset integrity across critical sectors such as Aerospace and Defense, Petrochemical and Gas, and Energy and Power directly translates into increased demand for reliable NDT solutions. Economic factors, including global industrial growth and infrastructure development, particularly in emerging economies, further bolster market expansion. Furthermore, supportive government policies and regulations mandating stringent quality checks for manufactured goods and infrastructure projects act as significant catalysts for market growth. The rising adoption of Industry 4.0 principles, promoting smart manufacturing and predictive maintenance, also fuels the need for advanced inspection technologies like industrial radiography.

Challenges Impacting Industrial Radiography Equipment Industry Growth

Despite the promising growth trajectory, the Industrial Radiography Equipment Industry faces several challenges. Regulatory complexities and the need for compliance with evolving international safety and quality standards can be a significant hurdle for manufacturers and end-users alike. Supply chain issues, including the availability of specialized components and raw materials, can lead to production delays and increased costs. Competitive pressures are intensifying, with market players continuously striving for technological differentiation and cost-effectiveness. The high initial investment required for advanced radiography systems can also act as a restraint, particularly for small and medium-sized enterprises (SMEs). Moreover, the persistent shortage of skilled NDT technicians capable of operating and interpreting complex radiography equipment remains a persistent challenge, potentially limiting the full adoption of cutting-edge technologies.

Key Players Shaping the Industrial Radiography Equipment Industry Market

- L3Harris Technologies Inc

- Baker Hughes

- Vidisco Ltd (Aran Electronics Ltd)

- Hitachi Ltd

- Comet Holding AG

- Canon Medical Systems Corporation (Canon Inc)

- Rigaku Corporation (Carlyle Group)

- North Star Imaging Inc

- Carestream Health

- Carl Zeiss AG

- Evident Corporation (Bain Capital)

- Hamamatsu Photonics K K

- Durr NDT GmbH & Co Kg

- Teledyne Dalsa Inc (Teledyne Technologies)

- Fujifilm Corporation (Fujifilm Holdings Corporation)

- Nikon Metrology NV (Nikon Corporation)

Significant Industrial Radiography Equipment Industry Industry Milestones

- July 2023: Canon Inc. launched the Zexirai9 digital X-ray RF system, a multi-purpose fluoroscopic table with many new functions and a compact design. Zexirai9 is a new digital X-ray RF system equipped with Canon's flat panel detector (FPD) and a newly developed image processing technology; the system has been developed in consultation with medical staff, referring physicians, and engineers. This launch signifies Canon's commitment to advancing digital radiography with enhanced functionality and user-centric design, impacting the medical and potentially niche industrial imaging sectors.

- May 2023: Nikon Metrology announced the launch of its next-generation family of X-ray computed tomography (CT) inspection systems called VOXLS (VOlumemetricX-ray Leading Solutions). It is designed for diverse inspection needs across automotive, aerospace, and academia industries - and likely for use on composite structures - the VOXLS family includes the large-volume VOXLS 40 C 450 available now and four medium-sized models coming later this year. Such initiatives by the companies in the market are expected to complement the industrial radiography market during the forecast period, particularly in the high-growth CT segment.

Future Outlook for Industrial Radiography Equipment Industry Market

The future outlook for the Industrial Radiography Equipment Industry is exceptionally promising, poised for continued growth driven by an insatiable demand for advanced NDT solutions. Strategic opportunities lie in the ongoing digitalization of inspection processes, the integration of AI and machine learning for enhanced defect analysis, and the development of more portable and cost-effective radiography systems. The increasing complexity of manufactured components, coupled with stringent safety regulations across core end-user industries, will sustain robust demand. Furthermore, the expansion of infrastructure projects in developing nations and the growing adoption of smart manufacturing technologies present significant untapped market potential. Companies focusing on innovative product development, strategic partnerships, and expanding their global service networks are best positioned to capitalize on the evolving market landscape.

Industrial Radiography Equipment Industry Segmentation

-

1. Technology

- 1.1. Film Radiography

- 1.2. Computed Radiography

- 1.3. Direct Radiography

- 1.4. Computed Tomography

-

2. End-User Industry

- 2.1. Aerospace and Defense

- 2.2. Petrochemical and Gas

- 2.3. Energy and Power

- 2.4. Construction

- 2.5. Automotive and Transportation

- 2.6. Manufacturing

- 2.7. Other End-User Industries

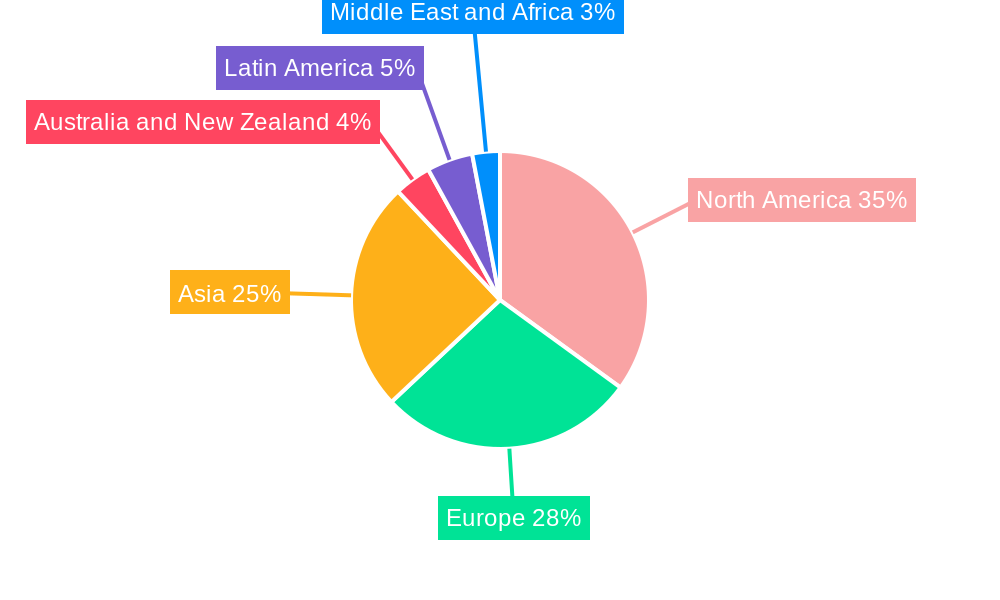

Industrial Radiography Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Industrial Radiography Equipment Industry Regional Market Share

Geographic Coverage of Industrial Radiography Equipment Industry

Industrial Radiography Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand From Automotive and Aerospace Industry; Augmented Accuracy of Inspection With the Integration of Advanced Software

- 3.3. Market Restrains

- 3.3.1 High Risk of Radiation Since it uses Gamma Rays

- 3.3.2 X-Rays; High Deployment Costs

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense to be the Largest End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Radiography Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Film Radiography

- 5.1.2. Computed Radiography

- 5.1.3. Direct Radiography

- 5.1.4. Computed Tomography

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Aerospace and Defense

- 5.2.2. Petrochemical and Gas

- 5.2.3. Energy and Power

- 5.2.4. Construction

- 5.2.5. Automotive and Transportation

- 5.2.6. Manufacturing

- 5.2.7. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Industrial Radiography Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Film Radiography

- 6.1.2. Computed Radiography

- 6.1.3. Direct Radiography

- 6.1.4. Computed Tomography

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Aerospace and Defense

- 6.2.2. Petrochemical and Gas

- 6.2.3. Energy and Power

- 6.2.4. Construction

- 6.2.5. Automotive and Transportation

- 6.2.6. Manufacturing

- 6.2.7. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Industrial Radiography Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Film Radiography

- 7.1.2. Computed Radiography

- 7.1.3. Direct Radiography

- 7.1.4. Computed Tomography

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Aerospace and Defense

- 7.2.2. Petrochemical and Gas

- 7.2.3. Energy and Power

- 7.2.4. Construction

- 7.2.5. Automotive and Transportation

- 7.2.6. Manufacturing

- 7.2.7. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Industrial Radiography Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Film Radiography

- 8.1.2. Computed Radiography

- 8.1.3. Direct Radiography

- 8.1.4. Computed Tomography

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Aerospace and Defense

- 8.2.2. Petrochemical and Gas

- 8.2.3. Energy and Power

- 8.2.4. Construction

- 8.2.5. Automotive and Transportation

- 8.2.6. Manufacturing

- 8.2.7. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Australia and New Zealand Industrial Radiography Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Film Radiography

- 9.1.2. Computed Radiography

- 9.1.3. Direct Radiography

- 9.1.4. Computed Tomography

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Aerospace and Defense

- 9.2.2. Petrochemical and Gas

- 9.2.3. Energy and Power

- 9.2.4. Construction

- 9.2.5. Automotive and Transportation

- 9.2.6. Manufacturing

- 9.2.7. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Latin America Industrial Radiography Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Film Radiography

- 10.1.2. Computed Radiography

- 10.1.3. Direct Radiography

- 10.1.4. Computed Tomography

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Aerospace and Defense

- 10.2.2. Petrochemical and Gas

- 10.2.3. Energy and Power

- 10.2.4. Construction

- 10.2.5. Automotive and Transportation

- 10.2.6. Manufacturing

- 10.2.7. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Middle East and Africa Industrial Radiography Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Film Radiography

- 11.1.2. Computed Radiography

- 11.1.3. Direct Radiography

- 11.1.4. Computed Tomography

- 11.2. Market Analysis, Insights and Forecast - by End-User Industry

- 11.2.1. Aerospace and Defense

- 11.2.2. Petrochemical and Gas

- 11.2.3. Energy and Power

- 11.2.4. Construction

- 11.2.5. Automotive and Transportation

- 11.2.6. Manufacturing

- 11.2.7. Other End-User Industries

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 L3Harris Technologies Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Baker Hughes

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Vidisco Ltd (Aran Electronics Ltd )

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Hitachi Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Comet Holding AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Canon Medical Systems Corporation (Canon Inc )

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Rigaku Corporation (Carlyle Group)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 North Star Imaging Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Carestream Health

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Carl Zeiss AG

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Evident Corporation (Bain Capital)

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Hamamatsu Photonics K K

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Durr NDT GmbH & Co Kg

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Teledyne Dalsa Inc (Teledyne Technologies)

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Fujifilm Corporation (Fujifilm Holdings Corporation)

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Nikon Metrology NV (Nikon Corporation)

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Industrial Radiography Equipment Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Industrial Radiography Equipment Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Industrial Radiography Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 4: North America Industrial Radiography Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 5: North America Industrial Radiography Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Industrial Radiography Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 7: North America Industrial Radiography Equipment Industry Revenue (billion), by End-User Industry 2025 & 2033

- Figure 8: North America Industrial Radiography Equipment Industry Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 9: North America Industrial Radiography Equipment Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 10: North America Industrial Radiography Equipment Industry Volume Share (%), by End-User Industry 2025 & 2033

- Figure 11: North America Industrial Radiography Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Industrial Radiography Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Industrial Radiography Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Industrial Radiography Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Industrial Radiography Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 16: Europe Industrial Radiography Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 17: Europe Industrial Radiography Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Europe Industrial Radiography Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 19: Europe Industrial Radiography Equipment Industry Revenue (billion), by End-User Industry 2025 & 2033

- Figure 20: Europe Industrial Radiography Equipment Industry Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 21: Europe Industrial Radiography Equipment Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 22: Europe Industrial Radiography Equipment Industry Volume Share (%), by End-User Industry 2025 & 2033

- Figure 23: Europe Industrial Radiography Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Industrial Radiography Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Industrial Radiography Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Industrial Radiography Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Industrial Radiography Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 28: Asia Industrial Radiography Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 29: Asia Industrial Radiography Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Asia Industrial Radiography Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 31: Asia Industrial Radiography Equipment Industry Revenue (billion), by End-User Industry 2025 & 2033

- Figure 32: Asia Industrial Radiography Equipment Industry Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 33: Asia Industrial Radiography Equipment Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 34: Asia Industrial Radiography Equipment Industry Volume Share (%), by End-User Industry 2025 & 2033

- Figure 35: Asia Industrial Radiography Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Industrial Radiography Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Industrial Radiography Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Industrial Radiography Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Industrial Radiography Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 40: Australia and New Zealand Industrial Radiography Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 41: Australia and New Zealand Industrial Radiography Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Australia and New Zealand Industrial Radiography Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 43: Australia and New Zealand Industrial Radiography Equipment Industry Revenue (billion), by End-User Industry 2025 & 2033

- Figure 44: Australia and New Zealand Industrial Radiography Equipment Industry Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 45: Australia and New Zealand Industrial Radiography Equipment Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 46: Australia and New Zealand Industrial Radiography Equipment Industry Volume Share (%), by End-User Industry 2025 & 2033

- Figure 47: Australia and New Zealand Industrial Radiography Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Industrial Radiography Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Industrial Radiography Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Industrial Radiography Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Industrial Radiography Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 52: Latin America Industrial Radiography Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 53: Latin America Industrial Radiography Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Latin America Industrial Radiography Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 55: Latin America Industrial Radiography Equipment Industry Revenue (billion), by End-User Industry 2025 & 2033

- Figure 56: Latin America Industrial Radiography Equipment Industry Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 57: Latin America Industrial Radiography Equipment Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 58: Latin America Industrial Radiography Equipment Industry Volume Share (%), by End-User Industry 2025 & 2033

- Figure 59: Latin America Industrial Radiography Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: Latin America Industrial Radiography Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Latin America Industrial Radiography Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Industrial Radiography Equipment Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Industrial Radiography Equipment Industry Revenue (billion), by Technology 2025 & 2033

- Figure 64: Middle East and Africa Industrial Radiography Equipment Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 65: Middle East and Africa Industrial Radiography Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 66: Middle East and Africa Industrial Radiography Equipment Industry Volume Share (%), by Technology 2025 & 2033

- Figure 67: Middle East and Africa Industrial Radiography Equipment Industry Revenue (billion), by End-User Industry 2025 & 2033

- Figure 68: Middle East and Africa Industrial Radiography Equipment Industry Volume (K Unit), by End-User Industry 2025 & 2033

- Figure 69: Middle East and Africa Industrial Radiography Equipment Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 70: Middle East and Africa Industrial Radiography Equipment Industry Volume Share (%), by End-User Industry 2025 & 2033

- Figure 71: Middle East and Africa Industrial Radiography Equipment Industry Revenue (billion), by Country 2025 & 2033

- Figure 72: Middle East and Africa Industrial Radiography Equipment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 73: Middle East and Africa Industrial Radiography Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Industrial Radiography Equipment Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 5: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 9: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 10: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 11: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 14: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 15: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 16: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 17: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 20: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 21: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 22: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 23: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 26: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 27: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 28: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 29: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 32: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 33: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 34: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 35: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 38: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 39: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 40: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 41: Global Industrial Radiography Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Industrial Radiography Equipment Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Radiography Equipment Industry?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Industrial Radiography Equipment Industry?

Key companies in the market include L3Harris Technologies Inc, Baker Hughes, Vidisco Ltd (Aran Electronics Ltd ), Hitachi Ltd, Comet Holding AG, Canon Medical Systems Corporation (Canon Inc ), Rigaku Corporation (Carlyle Group), North Star Imaging Inc, Carestream Health, Carl Zeiss AG, Evident Corporation (Bain Capital), Hamamatsu Photonics K K, Durr NDT GmbH & Co Kg, Teledyne Dalsa Inc (Teledyne Technologies), Fujifilm Corporation (Fujifilm Holdings Corporation), Nikon Metrology NV (Nikon Corporation).

3. What are the main segments of the Industrial Radiography Equipment Industry?

The market segments include Technology, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.35 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand From Automotive and Aerospace Industry; Augmented Accuracy of Inspection With the Integration of Advanced Software.

6. What are the notable trends driving market growth?

Aerospace and Defense to be the Largest End User.

7. Are there any restraints impacting market growth?

High Risk of Radiation Since it uses Gamma Rays. X-Rays; High Deployment Costs.

8. Can you provide examples of recent developments in the market?

July 2023: Canon Inc. launched the Zexirai9 digital X-ray RF system, a multi-purpose fluoroscopic table with many new functions and a compact design. Zexirai9 is a new digital X-ray RF system equipped with Canon's flat panel detector (FPD) and a newly developed image processing technology; the system has been developed in consultation with medical staff, referring physicians, and engineers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Radiography Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Radiography Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Radiography Equipment Industry?

To stay informed about further developments, trends, and reports in the Industrial Radiography Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence